- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

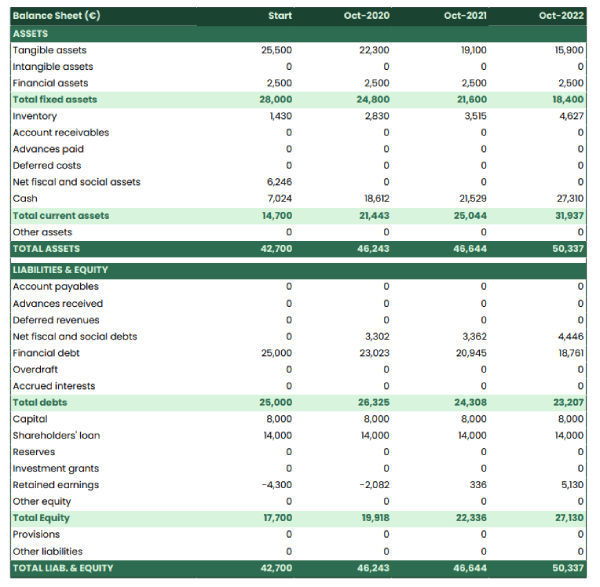

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

How to Write Your Business Plan to Secure Funding

Unlock funding for your business! Master the art of writing a funding-worthy business plan with our ultimate guide.

Introduction to Writing a Funding-Worthy Business Plan

When it comes to securing funding for your business, a well-written business plan plays a pivotal role. It serves as a roadmap that outlines your goals, strategies, and financial projections, giving potential investors or lenders a comprehensive understanding of your business. In this section, we will explore the importance of a well-written business plan and delve into the purpose it serves.

Importance of a Well-Written Business Plan

A well-crafted business plan is essential for multiple reasons. Firstly, it showcases your professionalism and commitment to your business idea. It demonstrates that you have thoroughly thought through every aspect of your venture and have a solid plan in place.

Additionally, a well-written business plan acts as a communication tool between you and potential investors or lenders. It allows you to effectively convey your business concept, market analysis, and financial projections, helping them understand the viability and potential of your business.

Moreover, a comprehensive business plan can help you identify any potential pitfalls or gaps in your strategy. By thoroughly analyzing your business model, market conditions, and financial projections, you can proactively address any weaknesses and make necessary adjustments.

Understanding the Purpose of a Business Plan

The purpose of a business plan extends beyond just securing funding. It serves as a strategic document that guides your business operations and helps you stay focused on your goals. Some key purposes of a business plan include:

- Attracting Investors and Lenders: A well-written business plan provides potential investors or lenders with the information they need to make an informed decision about whether to invest in your business or provide financial support. It showcases the potential return on investment and outlines the steps you will take to achieve success.

- Setting Clear Goals and Strategies: A business plan helps you define your short-term and long-term goals, as well as the strategies you will implement to achieve them. It provides a roadmap that keeps you on track and allows you to measure your progress along the way.

- Identifying Strengths and Weaknesses: By conducting a thorough market analysis and assessing your business's strengths and weaknesses, a business plan helps you identify areas where you excel and areas that require improvement. This enables you to develop strategies to leverage your strengths and mitigate any weaknesses.

- Guiding Financial Decision-Making: A business plan includes financial projections and analysis that help you make informed financial decisions. It provides a clear understanding of your revenue streams, costs, and potential profitability, enabling you to allocate resources effectively.

- Facilitating Collaboration and Communication: A business plan serves as a tool for collaboration and communication within your organization. It ensures that all team members are aligned with the business goals and strategies, fostering a cohesive and unified approach.

Understanding the importance and purpose of a well-written business plan is the first step towards creating a document that effectively communicates your vision and secures the funding you need. In the following sections, we will explore the key components, step-by-step guide, and best practices for crafting a funding-worthy business plan.

Key Components of a Funding-Worthy Business Plan

To create a business plan that attracts funding, it's essential to include key components that provide a comprehensive overview of your business. These components will help potential investors understand your business's potential and make informed decisions. Here are the key components you should include in your funding-worthy business plan:

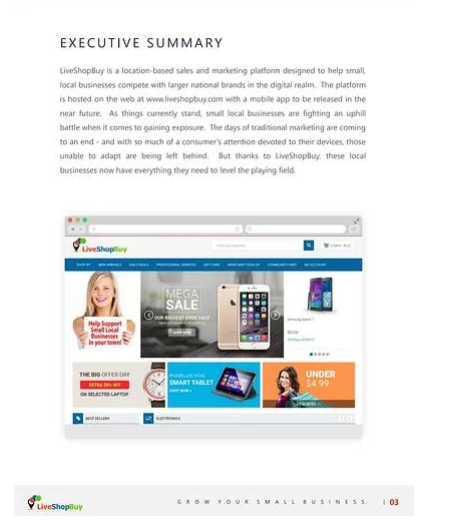

Executive Summary

The executive summary is a concise overview of your entire business plan. It should provide a clear and compelling summary of your business, highlighting its unique selling proposition, market opportunities, and financial projections. This section should be written in a way that captures the attention of potential investors and encourages them to read further.

Company Overview

The company overview section provides an introduction to your business. It should include details about your company's mission, vision, and values. Additionally, this section should highlight key information such as the legal structure of your business, its history, location, and any notable achievements or milestones.

Market Analysis

The market analysis section presents a thorough examination of your target market, industry trends, and competitors. It should showcase your understanding of the market dynamics, customer needs, and competitive landscape. Including market research, data, and relevant statistics can strengthen your analysis and demonstrate the market opportunity your business intends to tap into.

Product or Service Description

In this section, you should provide a detailed description of your product or service. Explain how it addresses a need or solves a problem in the market. Include information about its features, benefits, and any unique selling points. Use this section to showcase the value proposition of your offering and differentiate it from competitors.

Marketing and Sales Strategy

The marketing and sales strategy section outlines how you plan to promote and sell your product or service. It should include your target market segmentation, pricing strategy, distribution channels, and promotional activities. Demonstrating a well-thought-out marketing and sales strategy can instill confidence in investors regarding your ability to reach and attract customers.

Organizational Structure and Management

In this section, provide an overview of your organizational structure, including key personnel and their roles. Highlight the qualifications and experience of your management team, as well as any advisors or board members. Investors want to see that your team has the expertise and capabilities to execute your business plan successfully.

Financial Projections and Analysis

The financial projections and analysis section is crucial for illustrating the financial viability of your business. Include projected income statements, balance sheets, and cash flow statements for at least the next three years. Additionally, provide a detailed analysis of your financial assumptions and key performance indicators. It's important to present realistic and well-supported financial projections.

Funding Request and Use of Funds

In this section, clearly state the amount of funding you are seeking and how you intend to use it. Break down the allocation of funds, highlighting specific areas such as product development, marketing, operations, or expansion. Providing a detailed breakdown of the use of funds demonstrates your ability to effectively utilize the investment.

The appendix section serves as a supplemental section that includes any additional information that supports your business plan. This may include market research data, product samples, patents, licenses, permits, or any other relevant documents. The appendix provides investors with access to more detailed information without overwhelming the main body of the business plan.

By including these key components in your funding-worthy business plan, you can present a comprehensive overview of your business and increase your chances of securing the funding you need to bring your entrepreneurial vision to life.

Step-by-Step Guide to Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and attractive to potential investors is a crucial step in securing funding for your venture. To help you navigate this process, here is a step-by-step guide to writing a funding-worthy business plan.

Research and Gather Information

Before diving into the writing process, it's essential to conduct thorough research and gather all the necessary information. This includes understanding your industry, target market, competitors, and potential investors. Collecting data and market insights will provide a solid foundation for your business plan.

Define Your Business and Goals

Clearly define your business and outline your goals. Describe the nature of your business, the products or services you offer, and what sets you apart from your competitors. Additionally, establish both short-term and long-term goals for your business, focusing on specific, measurable, achievable, relevant, and time-bound (SMART) objectives.

Conduct a Comprehensive Market Analysis

Perform a comprehensive market analysis to gain insights into your target market, customer demographics, and industry trends. Identify your target audience's needs, preferences, and purchasing behavior. Analyze your competitors to understand their strengths, weaknesses, and market positioning. Presenting this information in tables can help organize and present the data effectively.

Market Analysis Factors Data

Target Market Size

Customer Demographics

Industry Trends

Competitor Analysis

Develop a Strong Marketing and Sales Strategy

Outline a robust marketing and sales strategy that highlights how you plan to reach and attract customers. Define your unique selling proposition (USP) and outline your pricing strategy, distribution channels, and promotional activities. This section should demonstrate your understanding of your target market and how you plan to position your business in the competitive landscape.

Outline Your Organizational Structure and Management

Describe your organizational structure and management team. Provide an overview of key personnel, their roles, and their qualifications. Highlight any relevant industry experience, expertise, or accomplishments that make your team well-equipped to execute the business plan successfully. A clear and concise organizational chart can help visualize the structure.

Create Financial Projections and Analysis

Develop financial projections that estimate your business's future revenue, expenses, and profitability. Include a projected income statement, balance sheet, and cash flow statement. Use realistic assumptions based on your market research and industry benchmarks. Additionally, conduct a comprehensive financial analysis that evaluates the financial health and viability of your business.

Craft a Compelling Executive Summary

The executive summary is a concise overview of your entire business plan and should entice readers to continue reading. Summarize the key elements of your plan, including your business concept, market opportunity, competitive advantage, and financial projections. Craft a compelling and engaging executive summary that captures the attention of potential investors.

Polish and Revise Your Business Plan

Once you have completed the initial draft of your business plan, take the time to polish and revise it. Review the content for clarity, coherence, and accuracy. Ensure that your plan flows logically and presents a compelling case for investment. Proofread for grammar and spelling errors. Consider seeking feedback from trusted advisors or professionals to refine your plan further.

By following this step-by-step guide, you can create a comprehensive and compelling business plan that increases your chances of securing funding for your venture. Remember to tailor your plan to the specific needs and preferences of your target audience, providing them with all the necessary information to make an informed investment decision.

Tips and Best Practices for Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and effective in securing funding requires careful attention to detail and adherence to best practices. Here are some tips to help you create a funding-worthy business plan:

Keep it Clear and Concise

When writing your business plan, it's essential to communicate your ideas clearly and concisely. Avoid using unnecessary jargon or technical terms that may confuse your readers. Use straightforward language and structure your content in a logical manner. Remember, clarity and simplicity are key to ensuring that your business plan is easily understood by potential investors.

Tailor Your Plan to the Target Audience

Each business plan should be tailored to the specific needs and expectations of the target audience. Consider the preferences and priorities of potential investors or lenders and customize your plan accordingly. For example, venture capitalists may be more interested in growth potential and return on investment, while traditional lenders may focus on cash flow and collateral. Understanding your audience will allow you to highlight the aspects of your business that are most relevant to them.

Support Claims with Data and Research

To instill confidence in your business plan, it's important to back up your claims with data and research. Provide market research, industry trends, and competitive analysis to support your assertions about the viability and potential of your business. Including relevant statistics, market projections, and customer surveys can help validate your assumptions and demonstrate that your business plan is grounded in reality.

Seek Professional Help if Needed

Writing a funding-worthy business plan can be a complex and time-consuming task. If you are unsure about certain aspects or need assistance in crafting a compelling plan, consider seeking professional help. Business consultants, accountants, or industry experts can provide valuable insights and guidance to ensure that your business plan is comprehensive, accurate, and persuasive.

Remember, a well-written business plan is not only a tool for securing funding but also a roadmap for the success of your business. By following these tips and best practices, you can increase your chances of creating a business plan that effectively communicates your vision and attracts the attention of potential investors or lenders.

Q: What is a funding-worthy business plan?

A: A funding-worthy business plan is a comprehensive document that outlines your business concept, market opportunity, competitive advantage, financial projections, and other key components to attract potential investors or lenders.

Q: What are the key components of a funding-worthy business plan?

A: The key components of a funding-worthy business plan include an executive summary, company overview, market analysis, product or service description, marketing and sales strategy, organizational structure and management, financial projections and analysis, funding request and use of funds, and appendix.

Q: How long should my business plan be?

A: While there is no strict rule on the length of a business plan, it's generally recommended to keep it concise and focused. A typical business plan can range from 15 to 30 pages. However, the most important thing is to provide all the necessary information in a clear and compelling manner.

Q: Do I need professional help to write my business plan?

A: While you can certainly write your own business plan with careful research and attention to detail, seeking professional help can provide valuable insights and guidance. Business consultants, accountants or industry experts can offer specialized knowledge that can enhance the quality of your business plan.

Q: How often should I update my business plan?

A: Your business plan should be viewed as a living document that evolves over time. It's recommended to review and update your plan regularly to reflect changes in your industry or market conditions. You may need to update it annually or even more frequently if significant changes occur in your business operations or financial performance.

By addressing these frequently asked questions about writing a funding-worthy business plan in your document or during presentations with investors or lenders can demonstrate that you have thoroughly thought through the planning process.

As an entrepreneur seeking funding for your business, a well-crafted and comprehensive business plan is essential. By following the step-by-step guide outlined in this article, you can create a funding-worthy business plan that effectively communicates your vision, market opportunity, competitive advantage, and financial projections to potential investors or lenders. Remember to tailor your plan to the specific needs and expectations of your target audience, keep it clear and concise, support claims with data and research, and seek professional help if needed. With a compelling business plan in hand, you'll be one step closer to turning your entrepreneurial dreams into reality.

https://blog.hubspot.com/sales/how-to-write-business-proposal

https://www.etu.org.za/toolbox/docs/finances/proposal.html

https://www.mybusiness.com.au/how-we-help/grow-your-business/increasing-sales/how-to-write-a-funding-proposal

Related Blog Post

Best Construction and Heavy Equipment Financing Loans

April 12, 2024

Discover the best construction and heavy equipment financing loans. Fuel your success with the right financial support.

Heavy Equipment Financing

Boost productivity with heavy equipment financing! Maximize efficiency and unlock long-term cost savings for your business operations.

Considerations in Forming a Limited Partnership

Discover key considerations for forming a limited partnership. From liability distribution to tax implications, make informed decisions.

What Is A Limited Partnership?

Unveiling the secret: What exactly is a limited partnership? Discover the definition, formation, and advantages of this business structure.

Top Line vs. Bottom Line in Business: What's the Difference?

Unraveling the difference between top line and bottom line in business. Understand the impact on success. Learn more!

The Bottom Line and What it Means

Unveiling the essence and importance of the bottom line in business. Discover its significance, strategies for improvement, and industry.

DBA Registration Guide

Master the art of DBA registration - your guide to legitimizing your business, building brand identity, and legal protection.

What is a DBA and When to File One For Your Business

Uncover the power of a DBA for your business! From legal implications to brand identity, learn when to file and unlock new opportunities.

Business Structure: How to Choose the Right One

Unlock business success with the best legal structure! Explore sole proprietorships, partnerships, LLCs, and corporations to make the right.

Guide to Business Structures

Your ultimate guide to choosing the right business structure - navigate the pros and cons of sole proprietorship and partnership, LLC.

Alternative Forms of Business Organizations

April 11, 2024

Discover alternative business organizations and find your perfect fit! Uncover the pros and cons of partnerships, corporations, and more.

.jpeg)

Financing Options for Small Businesses

Discover the best financing options for small businesses. From traditional bank loans to crowdfunding and more, achieve your business goals

Non-Bank Small Business Financing Options

Discover non-bank small business financing options and power your business to new heights! Unveil the secrets of alternative financing today

Best Business Loans With No Credit Check Of 2024

Discover the top business loans of 2024 with no credit check. Unleash your potential and secure funding for your business today!

Capital Expenditures vs. Revenue Expenditures

Boost your financial IQ with a clear understanding of capital expenditure and revenue. Discover the crucial difference for smarter decision.

Gains and Losses vs. Revenue and Expenses

Gain insights into gains and losses vs. revenue and expenses. Master financial terms for better financial performance!

Revenue vs. Sales: What's the Difference?

Unraveling the distinction between revenue and sales: What's the difference? Discover the impact on business success and strategies.

Revenue vs. Profit: What's the difference?

Unlock the difference between revenue and profit! Master financial understanding for informed decisions. Revenue vs. profit.

Commercial Truck Insurance Coverage

Discover optimal commercial truck insurance coverage! From liability to cargo insurance, find the perfect protection for your business.

Commercial Truck Insurance

Demystifying commercial truck insurance: Discover the coverage you need to stay protected on the road.

What Is Equity in Business & How Do You Calculate It?

Discover what equity in business is and how to calculate it! Gain insights into maintaining equity balance and its impact on financial.

.jpg)

How Do You Calculate a Company's Equity?

Unraveling the mystery: Learn how to calculate a company's equity and decode its financial health.

Best Semi Truck Financing Options of 2024

Discover the top semi truck financing options of 2024! Accelerate your success with the right financing for your business.

First Time Buyer Commercial Truck Loans

Breaking barriers with first time buyer commercial truck loans. Navigate the loan process and secure your dream truck!

How To Get Zero Down Semi Truck Financing

Unlock the path to successful semi truck financing with zero down options! Discover how to get the best deals for your business.

Learn How To Get Zero Down Semi Truck Financing

April 5, 2024

Unlock the path to semi truck financing success with zero worries. Learn how to get zero down financing today!

Best Equipment Financing Options Of 2024

Discover the best equipment financing options of 2024! Explore traditional bank loans, equipment leasing, online lenders, and government.

What is an Equipment Loan and How Does It Work?

Unlock the secrets of equipment loans! Discover the process, benefits, and tips for success. Get the guide now!

Car Depreciation for Taxes

Maximize tax savings with car depreciation strategies! Learn how to optimize deductions and navigate IRS guidelines.

How To Claim Vehicle Depreciation from the IRS

Unlock savings and maximize your tax benefits with our step-by-step guide to claiming vehicle depreciation from the IRS.

How Much Does An Accountant Cost In 2024?

April 1, 2024

Cracking the code on accountant costs in 2024! Discover the average price range and tips for finding an accountant within your budget.

Best Loans for Bad Credit in March 2024

Discover the game-changing loans for bad credit in March 2024. Find the best options to unlock your financial freedom!

List of Vehicles that Qualify for Section 179 in 2024

Discover the vehicles that qualify for Section 179 in 2024. Drive your business forward with tax savings!

Guide to Small Business Loans for Veterans

Unlocking opportunities with small business loans for veterans. Navigate the world of financing and government support for veteran.

Section 179 Deduction: How It Works

Maximize your business savings with the Section 179 deduction. Discover its benefits, eligibility, and common misconceptions.

Minority Small Business Grants

Unlock financial opportunities for minority small businesses with grants. Discover eligibility, application process, and valuable resources.

What Is A DBA? Everything You Need to Know

Unlock the secrets of DBA! Discover what a DBA is, why you need it, and how to choose the perfect one for your business.

How Do Gross Profit and Gross Margin Differ?

Unraveling the finance puzzle: Discover the distinction between gross profit and gross margin for insightful financial analysis.

Commercial Semi Truck Insurance

Protect your commercial semi truck with insurance. Ensure compliance, financial security, and peace of mind. Get covered today!

National Business Capital

Unlock the keys to success with national business capital. Explore financing options and drive growth for your business today.

Calculating Cost Of Goods Sold

Master the art of calculating cost of goods sold! Discover the components, methods, and importance of accurate COGS calculation.

What to know about Form 4562

Unlock the secrets of Form 4562! Discover what you need to know about this essential tax form.

What Is a Write-Off?

Unveiling the magic of write-offs: Discover how to turn expenses into savings with this guide on personal and business write-offs.

What is Microcredit? How Does it Work?

Unveiling the power of microcredit: How it works and its impact on poverty and entrepreneurship

Revenue vs. Income: What's the Difference?

Unveiling the contrast: Revenue vs. Income. Understand the difference and its impact on financial decisions.

What Is Commercial Insurance?

Unveiling the mysteries of commercial insurance. Discover what it is, its importance, and how to find the right coverage.

Break Even Point (BEP)

Unveiling the Break Even Point (BEP): Achieve financial stability and make informed business decisions with this essential guide!

What Is Bonus Depreciation?

Unveil the secrets of bonus depreciation and maximize your tax deductions. Discover how it differs from regular depreciation and its impact

What Are Small Business Grants and How to Get Them

Unlock funding opportunities for your small business! Discover the secrets of small business grants and how to secure them for success.

Small-Business Grants: Where to Find Free Funding

Unlock the power of free grants and programs for small businesses. Discover funding options and tips for success in securing your dream.

The Basics of Financing a Business

March 30, 2024

Master the art of financing a business with essential basics. Explore debt, equity, bootstrapping, and government funding options.

Types and Sources of Financing for Start-up Businesses

Discover the types and sources of financing for start-up businesses. Crack the code to secure the funds you need for success!

Buying an Existing Business? How to Finance Your Purchase

Discover financing strategies for buying an existing business. From traditional loans to angel investors, unlock the keys to success!

4 Deadly Small Business Mistakes You Must Avoid

Avoid these deadly small business mistakes! Learn how to manage finances, market effectively, listen to customers, and plan for success.

12 Common Financial Mistakes Business Owners Make

Avoid these 12 financial mistakes! Take control of your business's financial future with expert strategies and tips.

Feasibility Analysis for New Businesses

Discover the power of feasibility analysis for new businesses. Minimize risks, make informed decisions, and increase your chances of success

How To Start A Business In 11 Steps (2024 Guide)

Master the art of starting a business in 11 steps! Your ultimate 2024 guide to entrepreneurial success.

9 Documents to Show Investors for Funding

Unlock funding success with these 9 key documents! From business plans to legal docs, impress investors and secure your future.

40 Proven Ways to Fund Your Small Business

Discover 40 proven ways to fund your small business and break through barriers to success. Explore traditional, alternative, and creative fu

Backd Review: High Limit Business Funding

Unlock growth with High Limit Funding: A comprehensive backd review. Discover larger capital, expansion opportunities, and more.

Torro Business Funding Reviews 2024

Discover the 2024 Torro Business Funding reviews! Get insights into the funding landscape and evaluate your options.

Torro Funding Group

Unleash your business potential with Torro Funding Group. Discover flexible financing options and competitive rates to fuel your growth.

Fixed vs. Variable Interest Rates: What's the Difference?

Decoding the difference between fixed and variable interest rates: Make informed financial decisions with our expert guidance.

The Pros and Cons of Fixed-Rate Loans

Discover the pros and cons of fixed-rate loans. Make informed financial decisions with a closer look at stability and flexibility.

The Benefits of Fixed-Rate Loans

Discover the benefits of fixed-rate loans! Enjoy stability, predictability, and peace of mind. No more interest rate surprises!

.jpg)

The Best Ways to Borrow Money

Discover the best ways to borrow money! From traditional bank loans to borrowing from family and friends, find the perfect option for your n

Best Low Interest Personal Loans in March 2024

Discover the best low interest personal loans in March 2024 and march towards financial stability today!

How to Qualify for Low-Interest Personal Loans

Unlock low-interest personal loans! Discover the factors that affect eligibility and learn how to qualify like a pro.

Interest Rates for Small Business Loans in 2024

Unleash the potential of small business loans with 2024 interest rates. Stay ahead of the game and navigate the lending landscape effectivel

SBA Loan Interest Rates 2024

Discover the SBA loan interest rates for 2024. Navigate the financial landscape and secure the best rates for your business success.

A Guide to Finding Angel Investors for Start-Ups

March 22, 2024

Unlock the secrets to attracting angel investors for startups. From crafting pitches to building relationships, this guide has you covered.

How to Raise Venture Capital (the Right Way) in 2024

March 23, 2024

Master the art of raising venture capital in 2024! From crafting a compelling pitch to closing the deal.

What Is the Easiest Loan to Get Approved For?

Discover the easiest loan to get approved for! Uncover the factors that can pave your path to financial assistance effortlessly.

5 Fast Facts about Freedom Cash Lenders

Unlock financial freedom with Freedom Cash Lenders! Discover 5 fast facts about tailored loan options and easy applications.

How Long Will You Have to Pay Back Your Business Loan?

Crack the payback puzzle! Discover how long it takes to settle your business loan and master loan repayment duration.

How Do Small Business Loans Work?

Discover the ins and outs of small business loans. How do they work? Uncover the process, types, and tips for success.

Average Small-Business Loan Amount

Discover the average small-business loan amount and learn how to determine the right funding for your business success.

8 Sources of Start-Up Financing for Your Business

Discover 8 key sources of start-up financing for your business! From personal savings to venture capitalists, we've got you covered.

13 Ways to Get Funding for a Business

Discover 13 proven methods to secure funding for your business. From traditional options like bank loans to alternative sources like crowdfu

8 Steps to Securing Funding for Your New Business

Conquer the funding challenge with 8 essential steps! Learn how to secure funding for your new business and achieve financial success.

How to Buy a Business With an SBA Loan

March 21, 2024

Unlock the path to business ownership with an SBA loan. Discover how to buy a business and thrive!

Advantages and Disadvantages of Bank Loans

Unlock the secrets of bank loans! Discover the advantages and disadvantages for your financial journey.

Banks' Funding Costs and Lending Rates

Uncover the truth behind banks' funding costs and lending rates. Explore the factors that influence rates and their impact on borrowers and

How To Get A Small Business Loan in California?

Unlock your business potential with a comprehensive guide to getting a small business loan in California. Expert tips and important steps re

10 Small Business Loans in California You Can Apply For

Discover the top 10 small business loans in California that can accelerate your path to success! Apply now and fuel your business growth.

Best Banks for Business Loans

Discover the best banks for business loans and fuel your entrepreneurial dreams with ease. Unveiling the top contenders for your financial s

Types of Bad Credit Business Loans

Discover the types of bad credit business loans and unlock your potential for financial growth. Explore secured, unsecured, and more!

Small Business Loans for Low Credit Scores and Bad Credit

Unlocking small business loans with bad credit! Discover strategies, alternative options, and success tips to break barriers and thrive.

4 Best No Credit Check Business Loans of 2024

Discover the 4 best no credit check business loans of 2024! Get the funds you need without the hassle of credit checks.

.jpg)

5 Best Easy Business Loans for 2024

Discover the 9 best easy business loans for 2024 and power your business expansion to new heights. Get the funding you need today!

Net Earnings

March 13, 2024

Unlock business success: Analyze net earnings to evaluate financial performance and profitability.

Auto Repair Loans

Unlock the power of auto repair loans. Get immediate funds for vehicle maintenance and preserve your wheels' value. Find the right provider

Best Small Business Financing Options for Women

Discover the best small business financing options for women entrepreneurs. Unlock opportunities for financial empowerment and equality.

Consider for Your Business Needs

Master your business needs with key considerations for success. Analyze, adapt, and achieve your goals!

Gross Sales vs. Net Sales

Master the numbers game! Unravel the difference between gross sales and net sales for informed business decisions.

Gross Sales

March 12, 2024

Unveiling the good, bad, and ugly of gross sales data. Gain insights, overcome limitations, and analyze effectively.

Unravel the significance of net sales in business. Explore components, calculations, and strategies to boost revenue.

How to Start a Small Business at Home

Unlock your potential and start a successful small business at home. Discover the secrets to building a thriving venture from the comfort of

How to Start a Business in 15 Steps

Master the art of starting a business in 15 steps! From developing your idea to marketing your brand, we've got you covered.

Average Business Loan Interest Rates in 2024

Discover the projected average business loan interest rates in 2024. Navigate financial waters with confidence and secure favorable rates fo

.png)

Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway