Subscribe Sign In Register

A CEO’s Guide for How to Build an Asset Management Firm

Fundamental global founder kyle cerminara left point72 in 2012 to start his own firm. here’s how he did it..

- Copy Link copied

Illustration by II

Click on Kyle Cerminara’s Twitter page and you’ll find an image of him and Warren Buffett smiling into the camera. Scroll down to his pinned tweet, and there’s another photo with Buffett — but this time, Cerminara is hunched over, with Buffett’s arm locked around his neck.

The caption: “When Warren Buffett puts you in a headlock at a football game...”

For Cerminara, founder and CEO of Fundamental Global, relationships with other investors and industry professionals are critical to his success, a point he made clear in a series of tweets last week. In the thread, Cerminara offered “some unsolicited advice on how to build a multi-billion dollar asset management firm (from someone who did it).”

His first tip: “You will likely not succeed if you do it all yourself.”

Cerminara started Fundamental Global in 2012 with help from Joe Moglia, the former chairman of the board at TD Ameritrade. Moglia is now the chairman of the firm.

“People try to do too much all at once,” Cerminara told Institutional Investor . “I really wanted to focus my time and effort on investing. We brought in an exciting financial advisors team.”

Looking to set his firm apart from other asset management firms, Cerminara decided to make its financial advisory team client-facing.

“A lot of asset management companies these days are buying exchange traded funds or indexing,” he said. “And, quite frankly, anybody can do index funds, so I didn’t understand why that was of value to people. I thought that we could create something using active management.”

To turn this vision into a reality, the firm built an advisory team in a 50/50 joint venture with a firm called Capital Wealth Advisors. Under this structure, advisors met face-to-face with clients and reviewed their risk-reward parameters and liquidity needs, Cerminara said.

“It really freed me up to really be able to invest the money,” he said.

Cerminara has an interesting pedigree: He started his career as an equity research analyst at T. Rowe Price, where he worked his way up to a portfolio management role before leaving in 2007 to work for celebrity hedge fund manager Steven Cohen . Cerminara worked with Cohen over the next five years, taking a brief hiatus in 2010 to run a portfolio for Tiger Management descendent Highside Capital Management.

There was nothing particularly special about 2012 that prompted him to start his own firm. It was just the right time in his career, Cerminara said. Together, he and Moglia built an investment team from the ground-up, pulling talent from their former firms.

“In 2012 when I was starting my own firm, [Moglia] decided to bet big on me,” Cerminara said. “He initially gave us $30 million of capital to manage and became a partner of the firm.”

In December 2020, FG divested its interest from Capital Wealth Advisors. By then, Cerminara said the firm was handling about $2 billion in assets under management. In 2021, Cerminara sold his stake in the asset manager. He now spends his time building public companies, including working as a sponsor for special purpose acquisition companies.

Cerminara said his relationships with his mentors, specifically Moglia and Cohen, “compounded over time,” producing a rolodex of investors and partners for him throughout his career.

“Networking is critical,” he said. “I think some people that are great investors can sometimes undervalue that.”

- Platform OUR PRODUCT & MODULES Connected CMMS Maintenance Management Service Management Vendor Management Connected Workplace Work Order Management Inspections Asset Management Connected Buildings Utility Tracking & Benchmarking Energy Analytics & BI Cloud based Optimization Fault Detection & Diagnostics Connected Refrigeration Refrigeration Energy Optimization Remote Multi-site Monitoring Refrigerant Leak Compliance PLATFORM OVERVIEW Facilio O&M Platform Facilio IoT Edge Integrations Schedule time with a solutions expert

- Solutions By Industry Commercial Portfolios A complete real estate O&M suite built to boost building value Corporate Facilities Maximize efficiency and make 'experience' the new dimenson of your enterprise FM Services Empower workforce, make data-backed decisions, and create more value to clients Retail Enhance the in-store customer experience, operational efficiency, and run energy efficient stores across your portfolio. By Outcome Data-driven Portfolio Operations Remove friction points and ensure insight-led operations across buildings and teams FM Visibility More than just a CaFM/CMMS - gain contextual insights on contracted services 360* Asset Lifecycle Visualise assets, track performance, and streamline lifecycle processes Continuous Sustainability Close the energy efficiency gap by embedding sustainability with operations Customer Success at Facilio

Quick Guides

Our collection of playbooks on data-driven building operations to fuel efficiency. Get all the insights you need to improve portfolio operations.

Facilio Blog

Noteworthy articles on all things building ops. Strategies and videos on how to improve maintenance, sustainability, and tenant retention.

What's New with Facilio

We're constantly working to improve your Facilio experience so you can fasttrack your property operations to success. Here's what's new!

- Partners Become a Partner Locate a Partner AWS

- Company About Futureproof Careers Customers Contact Us Events

Featured Asset Management

Creating a strategic asset management plan (samp) with five handy steps.

Manaswini Rao

An asset management strategy is a high-level, strategic plan that defines the framework for accomplishing asset management objectives in an organization. It includes asset acquisition, planning, and maintenance.

An effective asset management strategy helps asset managers optimize the value and performance of tangible and intangible assets throughout the asset lifecycle .

As a result, you can reduce asset downtime, save on repair costs, increase productivity, and boost profitability.

By the end of this article, you will learn how to develop a strategic asset management plan and ways to simplify it with a computerized maintenance management system (CMMS) .

Why is an asset management strategy important?

An asset management strategy helps you create a long-term asset maintenance plan which eases asset condition assessment and optimization.

The result is a better return on asset (ROA), improved decision-making, and efficient resource allocation.

- Improved decision-making: An asset management strategy equips you with critical asset information to inform decisions like asset shutdown, turnaround, and outage (STO) to repair or replacement to operating expense (OpEx) prioritization. So, you’re better able to combine financial and non-financial strategies for decision-making and meeting the asset management objectives of the organization.

- Reduced costs: An asset management strategy also puts checks in place to track under-used, duplicate, or overused assets. This knowledge of asset utilization drives your understanding of equipment health. For example, overused assets are more likely to experience breakdowns at frequent intervals and go through costly repairs. Linking preventive maintenance with an asset management strategy helps you ensure cost savings and reduce the total cost of ownership (TCO).

- Better resource allocation: An asset management strategy helps you identify which assets cause bottlenecks, those that need upgrades or replacements, and how you can use the assets at your disposal to reach facility goals and objectives with maximum efficiency.

- What is strategic asset management?

Strategic asset management (SAM) is a top-down equipment management framework for long-term maintenance and operation planning.

This approach prioritizes long-term physical asset investments while balancing capital and operational expenditure from a total expenditure (TOTEX) standpoint.

An SAM framework provides a holistic view of current asset needs and what you’ll need 5, 10, or 20+ years down the line.

This framework gives you the data you need to make asset decisions that align with the company’s goals, instead of relying on budget and guesswork to manage assets.

Read More: Integrate asset and energy management for real-time building performance

- What does an asset management strategy include?

SAM dives deep into the following areas to help you maximize the return on every dollar you spend.

Asset inventory

Understanding the assets you own, their state, energy utilization, useful life, and whereabouts helps you create a single source of truth for all decisions.

If you’ve been using pen-and-paper inventory or spreadsheets to assign unique ID numbers and maintain asset records, it’s time to migrate to an asset management system.

An infrastructure asset management system simplifies the upkeep of asset information. Plus, it helps you form a basis for maintenance planning, resource allocation, and continuous assessment.

Asset prioritization

Assessing assets and how critical they are for smooth business operations is vital to asset management success. To rank assets, you need to answer two questions:

- What are the chances of any asset experiencing failure?

- What are the consequences of asset failure?

Set parameters to define the probability and consequences of an asset's failure. This will allow you to establish risk tolerance levels and rank assets by criticality. Also, concentrate on the most critical assets to get the most out of your investment.

Maintenance plans

Create maintenance schedules for each asset based on manufacturer recommendations, location, condition, and impact on operations.

For example, production assets running infrequently will benefit from corrective maintenance , whereas highly critical assets need total productive maintenance to stay in good shape.

Life cycle management

Prioritize maintenance for assets based on risk, energy consumption, cost of replacement, or whichever factor matters most to you.

This eases day-to-day resource management and reliability engineering for assets. Additionally, it helps you figure out the capital budget for asset upkeep as per operation and maintenance (O&M) manuals .

Performance monitoring

Your SAMP should also include a reliability-centered maintenance process that monitors asset conditions.

ISO 55000, the international asset management standard, requires you to report on asset performance and the effectiveness of the asset management system.

The best way to meet this requirement is to leverage both reactive and proactive monitoring.

- Reactive monitoring uses periodic audits to spot existing nonconformities in an asset management system and find asset deterioration, or failures.

- Proactive monitoring incorporates procedures in your asset monitoring process to find what’s affecting asset performance and reliability.

You can also use leading and lagging metrics, like energy usage per unit or labor hours per unit, to understand what needs breakdown maintenance or how to reduce failure-centric deficiencies.

SAMP is essential to determine which goals are realistic, or if you’ll have sufficient funds to maintain assets for the desired level of service.

Maintaining an asset register with asset-related transactions also helps you tackle fixed asset depreciation and asset revaluation for fiscal reporting.

Risk management

Define a risk tolerance policy to measure safety and environmental risks to inform contingency plans to address specific risks.

These elements help you consistently meet service levels, manage utilities without service interruptions, and generate predictable revenues.

Is your CMMS doing enough to keep your assets in excellent shape?

Your legacy cmms is probably costing you time, productivity, and money..

- What are the pillars of an asset management strategy?

A good asset management strategy relies on five key pillars to boost asset productivity while minimizing asset costs.

- Asset classification involves registering and sorting assets systematically based on their properties and attributes for easy asset management.

- Centralized asset information means you have all important asset data in one place. Companies using spreadsheets to manage asset information often struggle with data redundancy. Using an enterprise asset management system improves your asset management efficiency.

- Asset indicators offer real-time insights into asset performance. Common maintenance KPIs include mean time to repair, mean time between failures, availability, and downtime. They tell you which assets are more reliable and which have the longest downtimes.

- Maintenance plan usually combines preventive, corrective, and predictive maintenance techniques.

You can leverage a CMMS to plan and automate key maintenance tasks like:

- Preventive maintenance scheduling

- Unplanned and planned maintenance management

- Work order management

- Asset inventory tracking

- Real-time asset performance monitoring

- Energy consumption tracking

- Maintenance reporting

- Asset calibration involves scheduling, planning, executing, and analyzing equipment calibrations. Consider setting and meeting due dates for internal and external calibrations.

Now that you know the what , let's focus on the how .

- 5 steps to develop an asset management strategy

As you build or refine your asset management strategy, use these steps to reduce expenses and maximize asset performance.

1. Review the organization’s structure

Start by understanding how your organization operates or makes investment decisions. Then, you can focus on creating asset management goals that align with business objectives. Consider presenting strategic ideas to management and staff to win their confidence and support.

2. Conduct an asset condition assessment

Periodic asset monitoring gives you crucial data on the condition of each asset in your facility. This data tells you if the asset needs preventive maintenance to reach its expected useful life.

3. Prepare and implement an asset management action plan

These asset management initiatives altogether help you create an action plan. This implementation plan must support the current business cycle.

4. Review and monitor your progress

With an asset management system, you can capture data about asset performance and use it to optimize investment decisions.

Progress monitoring also reveals critical areas that you should prioritize in the next enterprise asset management strategy planning cycle.

5. Get feedback from all stakeholders

Conduct panels and focus groups with staff to hear their thoughts on existing asset management processes. This feedback lets you develop more effective solutions to meet organizational expectations.

Creating, enforcing, and m0nitoring the effectiveness of your strategic asset management plan is simple with a CMMS software .

Leverage a CMMS to streamline and automate 360° asset lifecycle management

A CMMS centralizes asset maintenance and performance data so you can easily track asset utilization, improve ROA, and stay compliant.

Modern maintenance management software like Facilio’s Connected CMMS also use IoT and machine learning to understand asset health and performance, and proactively maintain them to keep them performing at their peak, and prolong useful life.

Further, it simplifies asset condition assessment and digitizes compliance to realize improved asset value. It also gives data-driven insights for optimizing performance, health, and energy efficiency for different assets.

Overtime, using machine learning algorithms, it understands the faults and failures an asset is prone to, and determines failure modes to help you proactively tend to its maintenance needs.

The mockup shows how, by analyzing root cause of failure and automatically creating work orders, Facilio helps you eliminate unplanned equipment downtimes.

If you’d like to learn more about how Facilio’s Connected CMMS can help your organization switch from reactive to proactive maintenance, and keep your assets healthy and productive, our product experts are only a click away!

- Keeping your assets humming along is simple with Facilio.

- Is your CMMS doing enough to keep your assets in excellent shape?

Gain 360° visibility into portfolio-wide O&M

We are Hiring!

© 2024 Facilio.Inc | All rights reserved

connect with us

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Asset Management Business Plan Templates with Examples and Samples

Siranjeev Santhanam

A partnership between an asset manager and his client based on trust, commitment, and responsibility can allow both parties to gain rich rewards and optimize available market resources.

Asset management is managing a customer’s money and maximizing earning potential through investments. This can be done through various avenues, ranging from stocks to property, funds, and other investment channels. Asset management figures perform this service for clients, allowing them to raise their net worth over time through investments, creating better spending opportunities, and making more informed decisions on behalf of their clients.

Do you have real estate management on your mind? Click here to read our blog on the top ten real estate management templates!

Asset management is a time-tested way to bolster one’s wealth and achieve better financial prospects. However, making a successful business out of this is more complicated than it sounds. It takes years of experience in the financial domain, coupled with significant hours of labor and some extensive resources, for an asset management firm to gain the kind of reputation that makes it worth people’s time.

In this blog, we will delve into a business plan meant for asset management. We will discuss all the leading segments of the template, giving readers a nice, good look at all the major areas of the slides. Let’s begin!

Table of Contents

- Executive Summary

- Company Overview

- Industry Analysis

- Customer Analysis

- Growth Potential Analysis

- Porter’s Five Forces Analysis

- Go-to-market Analysis

- Operational Plan

- Financial Assumptions

- Graphical Representation of Financials

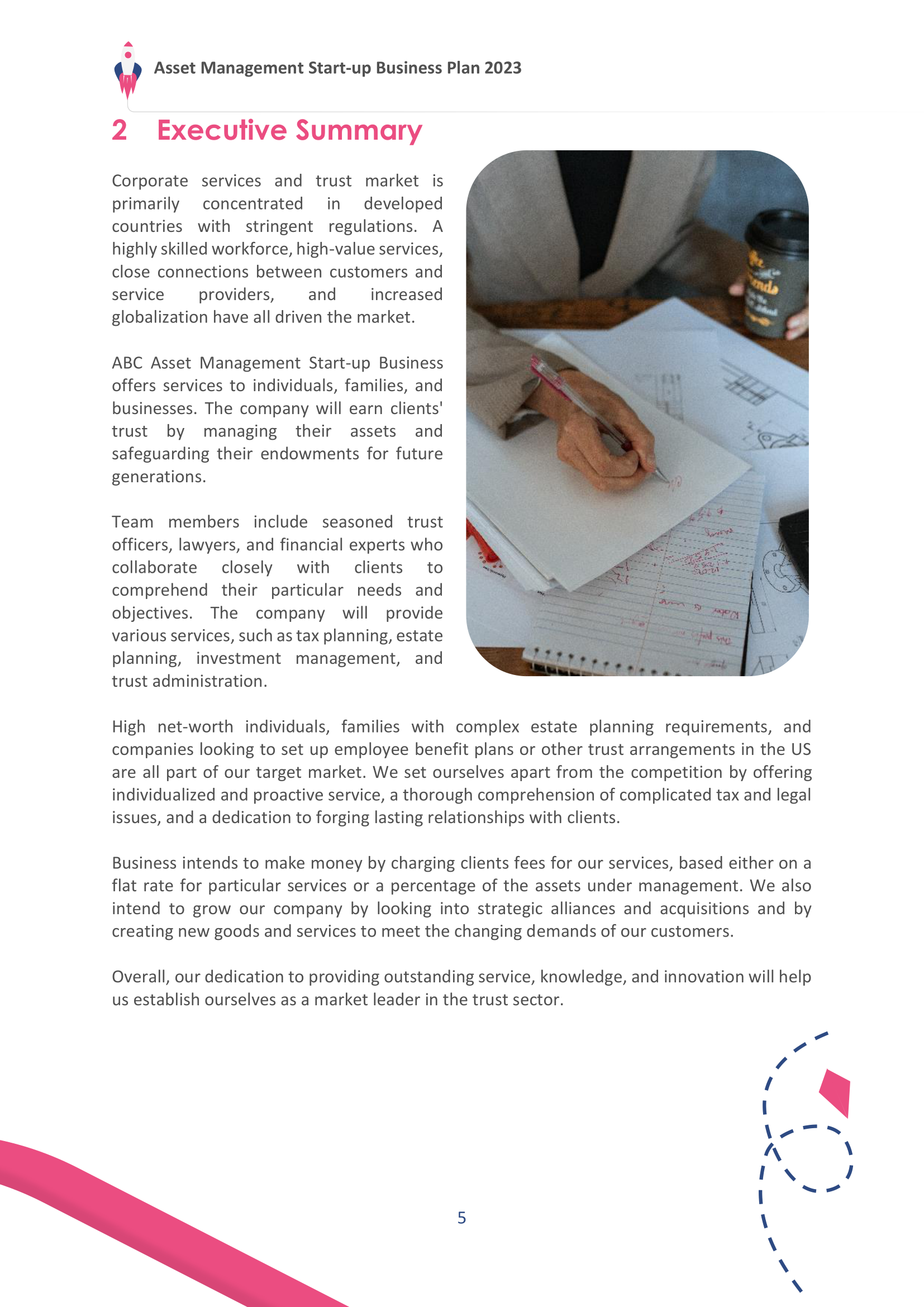

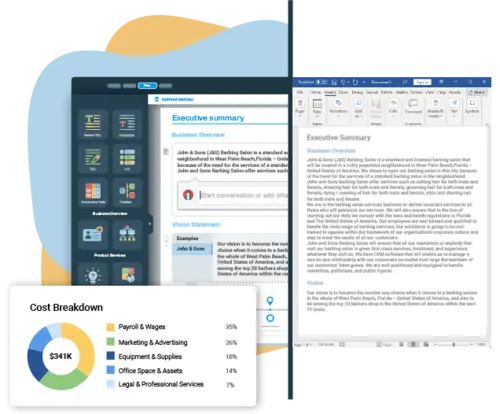

1) Executive summary

Our executive summary section provides you with a well-crafted and comprehensive template that empowers you to curate your asset management brand, supplying the details in a more attractive way. Integrated into the segment are some core subsections that serve to make your executive summary more engaging and impactful. These include “ about the business,” where you can present data and statistics to support your brand image and demonstrate your competitive advantage, and the quick pitch , which helps to consolidate the value proposition and convey the unique selling point of the business. Also present are the subheadings, products and services offered , key success factors , start-up business summary , and more.

Download now

Are you struggling to get ahead in financial asset management? Allow us to present you with some well-curated templates that can make a difference. Click here to read our other blog covering financial asset management templates now.

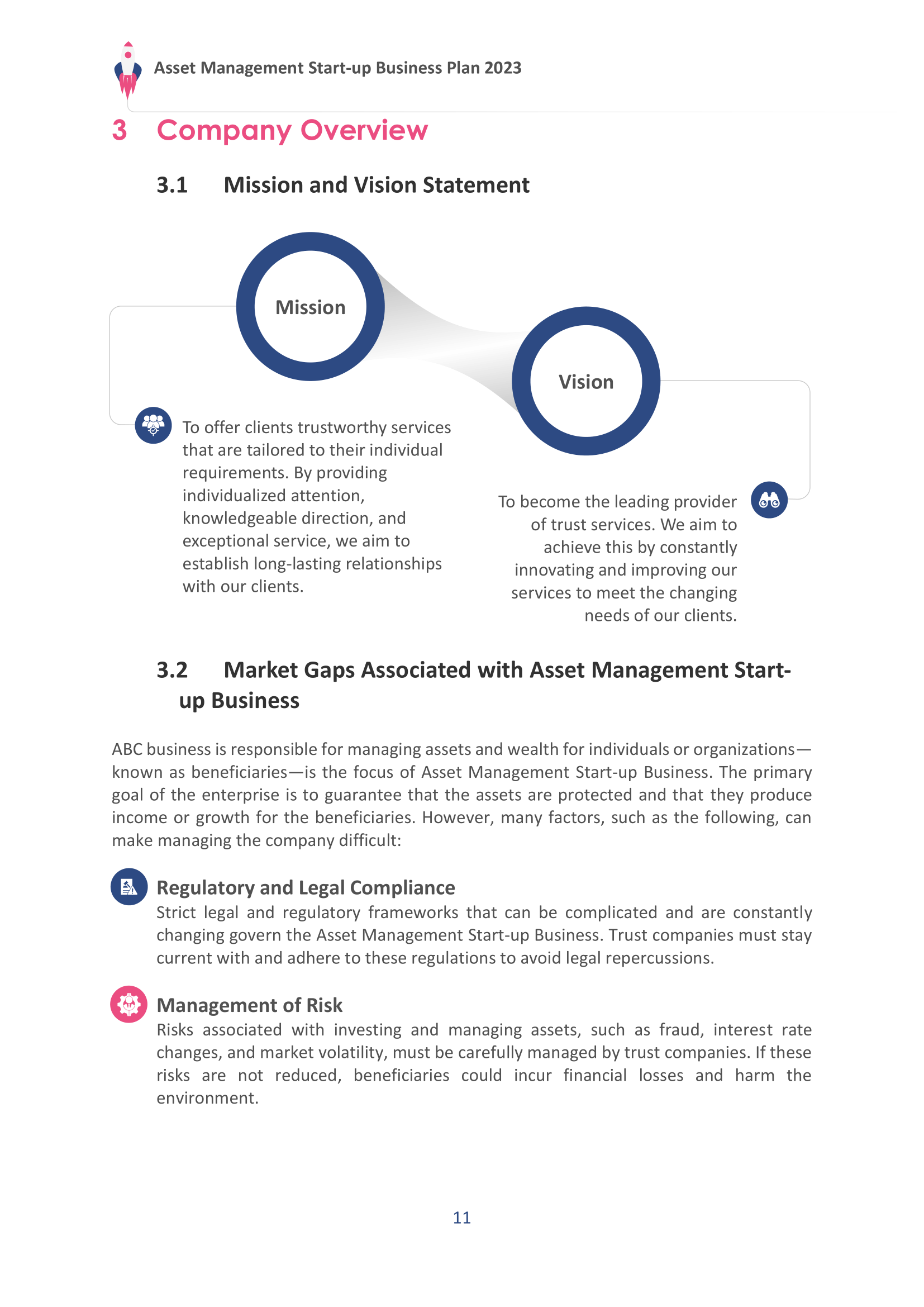

2) Company Overview

With our company overview section, you can introduce your company, underline its core work culture, expand on its history and etiquette, and much more. With the aid of this segment, you can build bridges with the audience, giving them avenues to connect with your business and understand your operations and principles. This subheading is tailor-made to suit the needs of the asset management market, presenting all vital information and reliable data in a digestible manner. Create a more authentic and presentable image of yourself, enabling partners, clients, and any specific audience to trust your business with this segment. The subheadings in the template slides include the mission and vision statement and market gaps associated with asset management start-up business .

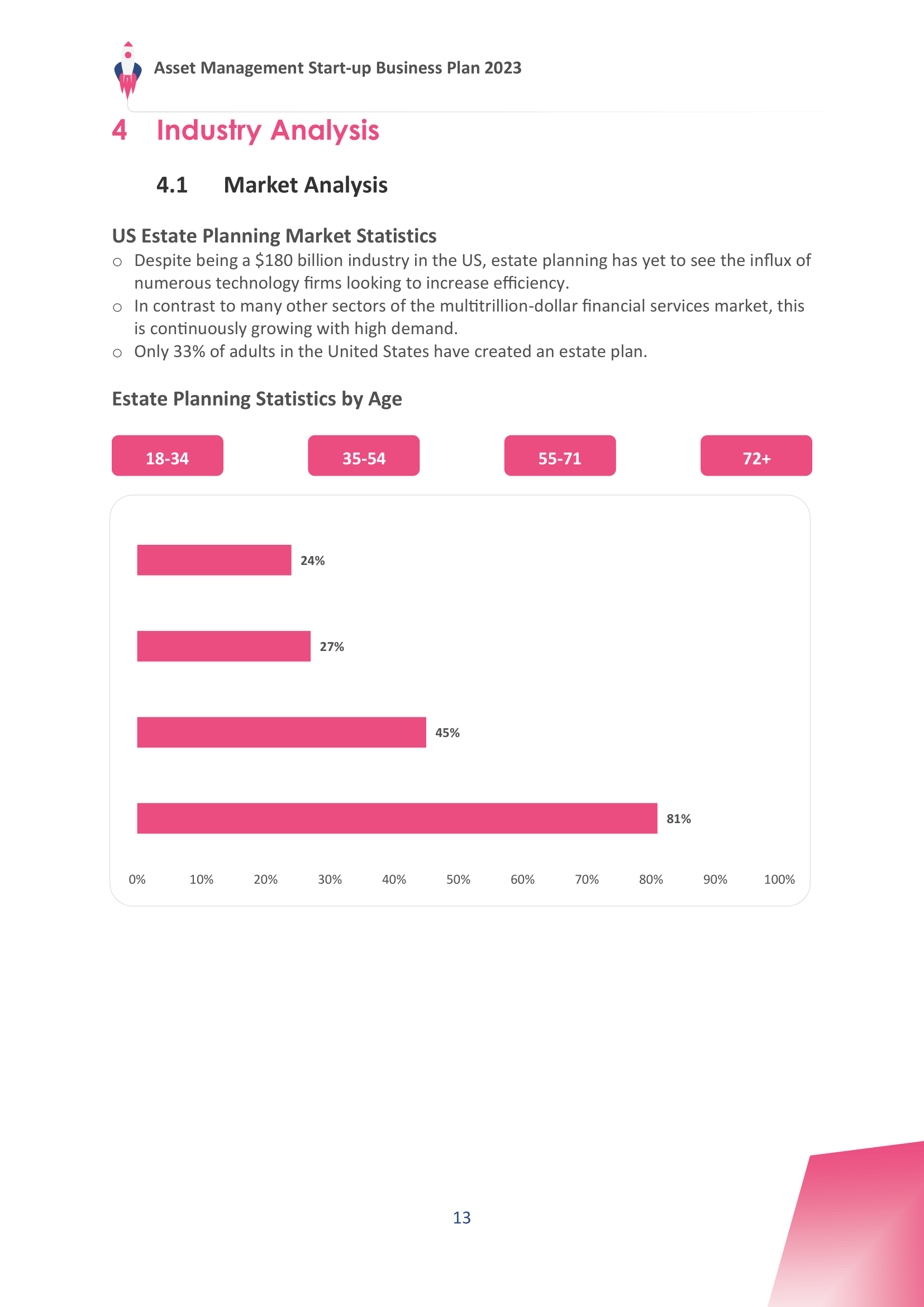

3) Industry Analysis

An industry analysis assists a business in knowing all of the multifaceted and intricate dynamics within a specific industry. Use our industry analysis segment to understand the trends, challenges, and opportunities that shape the asset management business and boost your position in the market. Create a more profound and richer knowledge of the industry as you seek reliable partnerships and attract funding from the right sources within the industry. Some key subheadings included in this document section are market analysis , market trends analysis , growth drivers , and geopolitical analysis .

4) Customer Analysis

Use the power of practical customer analysis to identify and understand all the essential needs of your target market, honing your business caliber to serve their personal preferences. Customize the internal dynamics of your asset management business to channel existing demands in the market. Our well-organized customer analysis section can be a fine ally in getting you all the support you need from within the core demographics that make the market. The subheadings featured within this template area are target market, buyer persona, and market sizing . Use the tools of this template to sync your business capabilities with the existing customer base and generate more revenue.

5) Growth Potential Analysis

The first part of this segment is the SWOT analysis . This framework gives businesses a data-driven strategic approach to assess the strengths, weaknesses, opportunities, and threats enveloping their business. Our well-structured SWOT analysis section can enable a more thorough internal evaluation of your asset management business, enabling you to create more effective responses to the changing market situations.

6) Porter’s Five Forces Analysis

Porter’s Five Forces Analysis can be a crucial tool in evaluating the competitive environment of a business. It features five key forces that help to establish the overall productivity and lucrative nature of the industry. The five forces here are – competition within the industry, potential new entrants in the same industry, the power of suppliers, the power of customers, and lastly, the threat of substitute products or services. Use these strategic methodologies to build a more competitive asset management business where you expand your market dominance and raise profitability.

7) Go-to-Market Analysis

A marketing plan is vital to any effective business process, and our template assists you in implementing the multi-layered steps that make marketing more productive. This segment has been divided into smaller, more important segments that can build a more efficient marketing characteristic for your asset management business. Some key elements that are featured within the slides of this template include promotional strategies, go-to-market strategies, sales strategies and pricing strategies . Fully explore the intricacies of marketing and gain a competitive edge on this front by applying the tools offered by this template.

8) Operational Plan

The operational plan of this template has been segmented into two major components – the service selling plan and the operational strategies of the year. Together, they make for a consolidated and structured method that any start-up in the asset management space can use to hone its effectiveness and develop better operations. The template comes ready-made with content that firms in this space can use to advance their operations, with internal points such as ‘asset management magazines,’ ‘campaigns to support online sales,’ ‘target market appropriate media,’ and more.

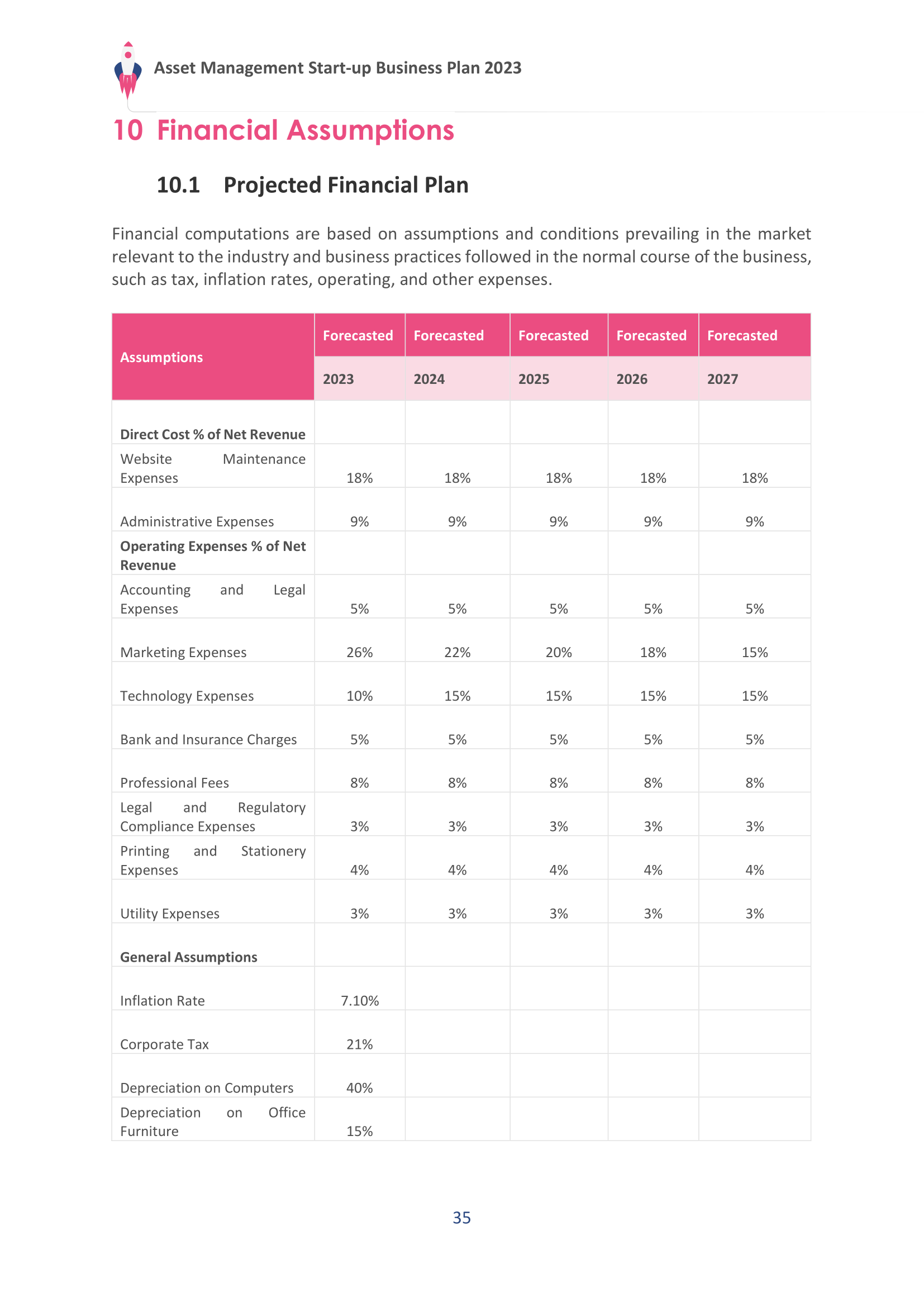

9) Financial Assumptions

Use the financial segment of our template to create a more integrated and cohesive account of your financial situation, building better commerce systems within the business. This segment has been split into some primary subheadings, all of which feature their own unique characteristics. Examples to be mentioned among the subsegments of the template include a projected financial plan , projected model and sales forecast , profit and loss statement, projected cash flow statement, projected balance sheet, and DCF valuation .

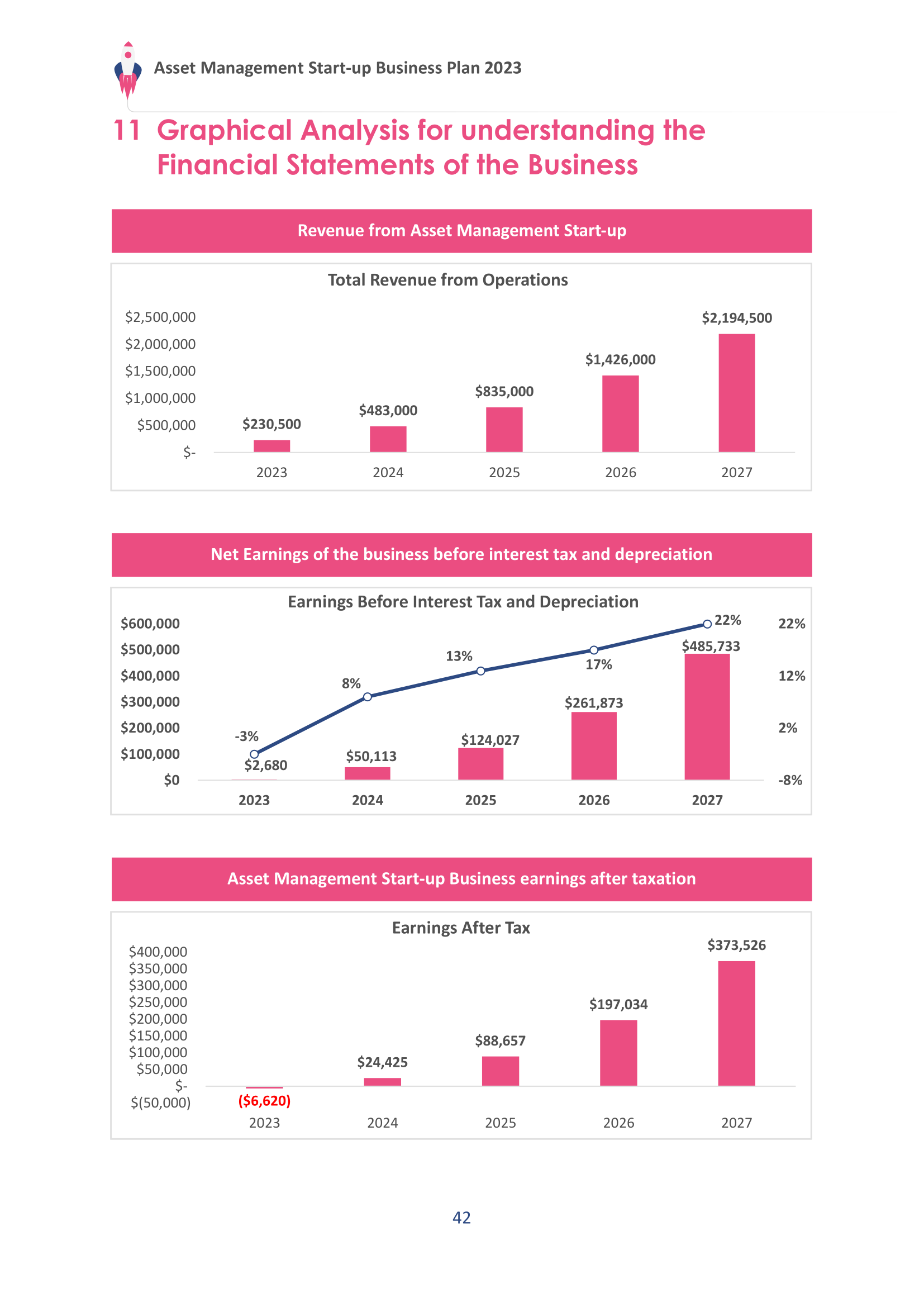

10) Graphical Analysis

Use this section to highlight key financial data in a visually appealing and understandable way, and use charts and graphs to enhance the experience. Craft a more stimulating and well-received account of your internal financial situation, outlining the trends, patterns, and connections between the commercial variables. Some key graphs featured as part of the segment include revenue from asset management start-ups, net earnings of business before tax and depreciation, asset management start-up business earnings after tax, gross profit from asset management start-up businesses, and many more.

Within the pages of this template are more exhaustive and comprehensive features that can aid you in creating better opportunities for yourself within the asset management market. This blog provides you with a brief gist of the main segments of the business plan, and once you get your hands on it, you can access a more complete version of it. Fully utilize the internal details of our business plan ppt templates to make a more thorough and intensive structure for your asset management business, avoiding all of the hazards and pitfalls as you get to the top.

Related posts:

- Top 10 Law Firm Business Plan Templates with Samples and Examples (Editable Word Doc, Excel, and PDF Included)

- Must-have Advertising Agency Business Plan Templates with Examples and Samples

- Top 10 Car Wash Business Plan Templates with Examples and Samples (Editable Word Doc, Excel and PDF Included)

- Top 10 Jewelry Business Plan Templates with Examples and Samples (Editable Word Doc, Excel and PDF Included)

Liked this blog? Please recommend us

Top 10 Capability Deck Templates with Examples and Samples

Top 10 Lease Proposal Templates with Examples and Samples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

How to Develop and Write an Asset Management Strategy

An asset management strategy is a document that outlines where your current asset management efforts stand, assesses changes that need to be made within the next 3–5 years, and outlines the high-level actions you need to take to get there.

This guide will e xplain the difference between an asset management policy and a strategy and share the information you will need to write your strategy with real-life examples.

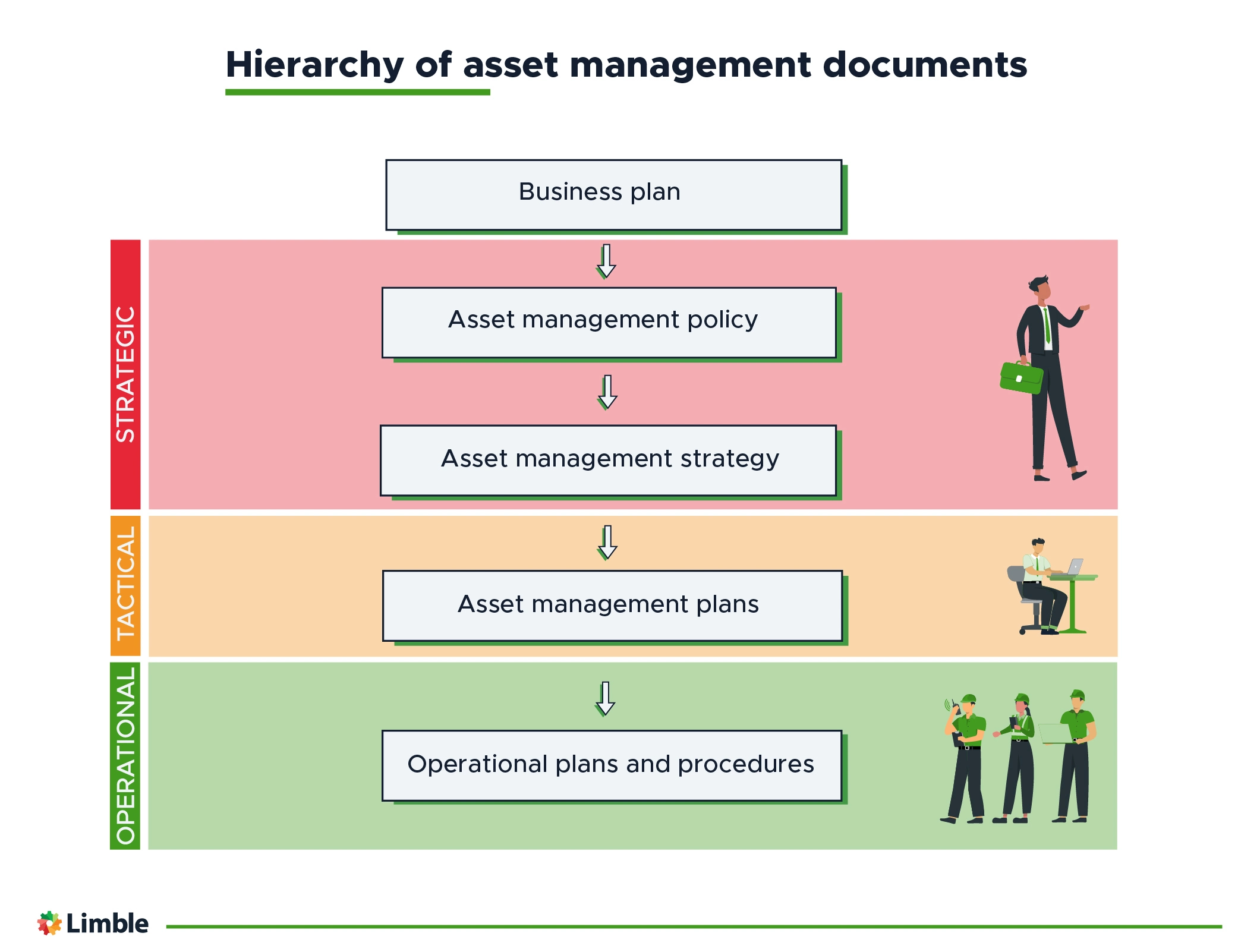

Where does the asset management strategy sit in the document hierarchy?

Businesses use an asset management strategy to describe the high-level goals they need to achieve in order to meet the company’s asset ownership, use, and care requirements. The document usually includes a business case showing the potential benefits the company can achieve by following the outlined strategy.

The image below illustrates where the asset management strategy sits in the asset management document hierarchy.

Here are quick explanations to help differentiate between a policy, strategy, and plan:

- Asset Management Policy : The policy outlines the company’s objectives and requirements for asset ownership, use, and care. It provides guiding principles for asset management, including applicability, responsibility, high-level procedures, and a clear statement of the company’s overall approach to maintenance.

- Asset Management Strategy: A strategy document takes the company objectives and requirements from the policy, and turns them into specific focus areas for the next three to five years. It outlines the current state of asset management within the company and its goals for improvement. It often includes a business case that predicts potential benefits of pursuing the strategy.

- Asset Management Plans : A plan takes the high-level aspirations and goals in the strategy document and turns them into shorter-term, actionable tasks. One strategy document will result in many plans, usually one for each department or business unit.

Now that we know its purpose, let’s see what it takes to create a proper asset management strategy.

The Essential Guide to CMMS

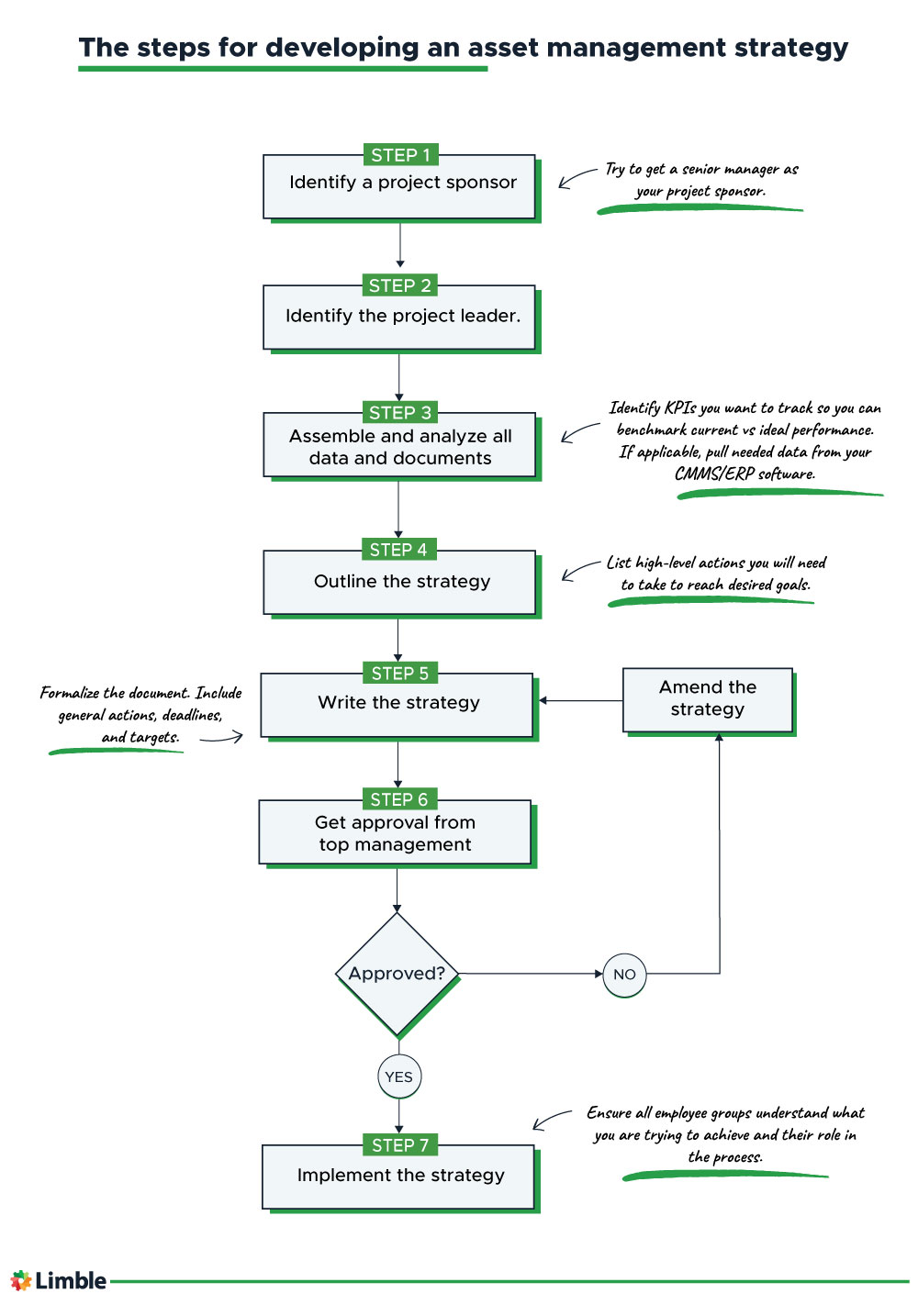

The steps for developing your asset management strategy

There are clearly many details and considerations that go into creating an effective asset management strategy. So how does an organization create one?

By taking the following steps, you’ll end up with an asset management strategy that captures all the necessary details, fits the needs of your company, and sets the stage for effective asset management that supports your business plan.

Step #1: Identify a project sponsor

Creating an intricate, strategic approach to improving your asset management processes is a waste of time if nobody acknowledges or follows the guidelines.

Appointing a senior manager as a project sponsor provides several benefits:

- Their involvement gives authority to the strategy production and provides line of sight to its impact across departments.

- Active involvement by the sponsor removes organizational roadblocks and helps with work prioritization — which keeps the strategy on track.

- A member of senior management will facilitate buy-in and decision-making from other leaders and ensure accountability for the strategy.

Step #2: Identify the project leader

The project leader manages the development of the asset management strategy. In this role, they are responsible for:

- Ensuring the process gets completed within time and budget constraints.

- Liaising with the project sponsor to brief them on progress.

- Considering all relevant data and other company information necessary for a thorough and thoughtful outcome.

In a small company, the project leader may also perform the data collection and writing of the strategy document. Larger companies may use a small team, which the project leader will manage.

Step #3: Assemble and analyze all data and documents

This is a time-intensive step that often requires data from multiple departments including engineering, maintenance, finance, procurement, and production.

You will analyze this data to evaluate the effectiveness of your current asset management strategy and how well it meets business objectives. We will discuss more details of data analysis in a later section.

Data collection and analysis is considerably easier if your company uses a centralized database like an asset management software, a computerized maintenance management system (CMMS) , or an enterprise resource planning system (ERP).

Step #4: Outline the strategy

After analyzing the data, you should have clear insights into your current asset management practices, their effectiveness, and their efficiency. The data will point you to:

- Current activities and processes that deliver less than desirable results.

- High-level changes and initiatives to include in your strategy to work toward improvement.

- Potential benefits of pursuing those high-level changes and shifts in strategy.

During this process, the project sponsor will be a key resource providing guidance, insight, and support from management and other departments.

Step #5: Write the strategy

At this stage, you should have all the necessary pieces to formalize the strategy.

The writing process should present a narrative explaining the current state of asset management in your company and the benefits of making a change. It should also outline general actions, deadlines, and targets.

This can sound a little abstract. In the following sections, we will look at a few real-life examples, show you how to structure the document, and review what to include.

Step #6: Get approval from top management

Top management must review and accept the proposed language for your new asset management strategy to ensure it aligns with business objectives. Approval from decision-makers means it is ready for implementation and employees will be held accountable for carrying it out.

Enter the document into your quality system for revision and amendment control. Any major changes should require resubmission for further approval.

Step #7: Implement the strategy

Sending out the document and expecting compliance will not work. There is an education component to implementation. Ensure all employee groups are trained and fully understand the goal of the strategy and their role in achieving it.

While they might have helped you gather data in previous steps, this is probably the first time they’re seeing the final strategy. They need to buy into the final product and believe it will be an improvement if you want it to be fully embraced and followed.

The data collection process

The data you collect in step four will be used for a gap analysis. This analysis will show the “gap” between how efficient your assets are today, and how efficient they could be at their best. It will also shed light on the operational and capital costs they incur.

There are two components to consider for the gap analysis: current performance and theoretical maximum efficiency.

Benchmarking current performance

Find out what key performance indicators (KPI) your production team uses to measure their efficiency and effectiveness. Examples include equipment downtime (or uptime) and setup time.

Many of these measures will be in percentages. However, we recommend translating them into actual, data-driven outputs — whether the numbers of products, frequency of stock turns, or the count of non-conforming products.

Remember, raw data is easier to relate to!

Identifying theoretical maximums

What could your plant achieve if everything ran like clockwork?

To answer that question, gather original equipment manufacturer data or the asset performance results from similar plants that are an example of best practice.

For example, if the KPI you are using is OEE (overall equipment effectiveness) , an often-quoted best OEE rating for a pure manufacturing plant is 85%. That would require equipment availability, performance, and quality metrics to be in the mid to high 90-percent range.

If your OEE rate is 68%, you know the performance management gap you need to close through asset strategy management.

Capturing operational and capital costs

By capturing data on the cost of your current performance, you have a baseline against which you can compare future costs. Comparing these over time will show you the financial impact of the changes you implemented as part of your updated strategy.

Consider operational budgets — like engineering, maintenance, and spares turnover. Capital costs for asset replacements may also be important, as poor asset life cycles or frequent modifications require more capital spending, and thus can reduce profitability.

Revenues, cost savings, and operating costs will be key to measuring production efficiency.

Developing your asset management strategy

With the gap analysis done, you must define the strategies that will close the gap between current and desired performance. These will become the basis for your strategy document.

Articulate an operational vision

Define a clear production goal for the business. It should be a stretch goal with measurable targets on a five to ten-year horizon.

For example, you may choose to:

- Reduce maintenance costs by V%

- Improve cycle time by W%

- Increase production capacity to X units

- Increase equipment reliability to 93%

- Move the factory to total productive maintenance (TPM)

Define the required high-level actions

Identify the broad practices the organization must change or implement to achieve the goals. These action plans should span three to five years due to the impact on employee workload, the available resources, and the budget.

Stay away from operational details and optimization . Leave that to the people writing the asset management plans .

Establish a business case

The effect of the changes on costs and production will have to be explained in order to justify the strategy. The business case you present should lay out the financial and operational justification and the expected change in key performance indicators .

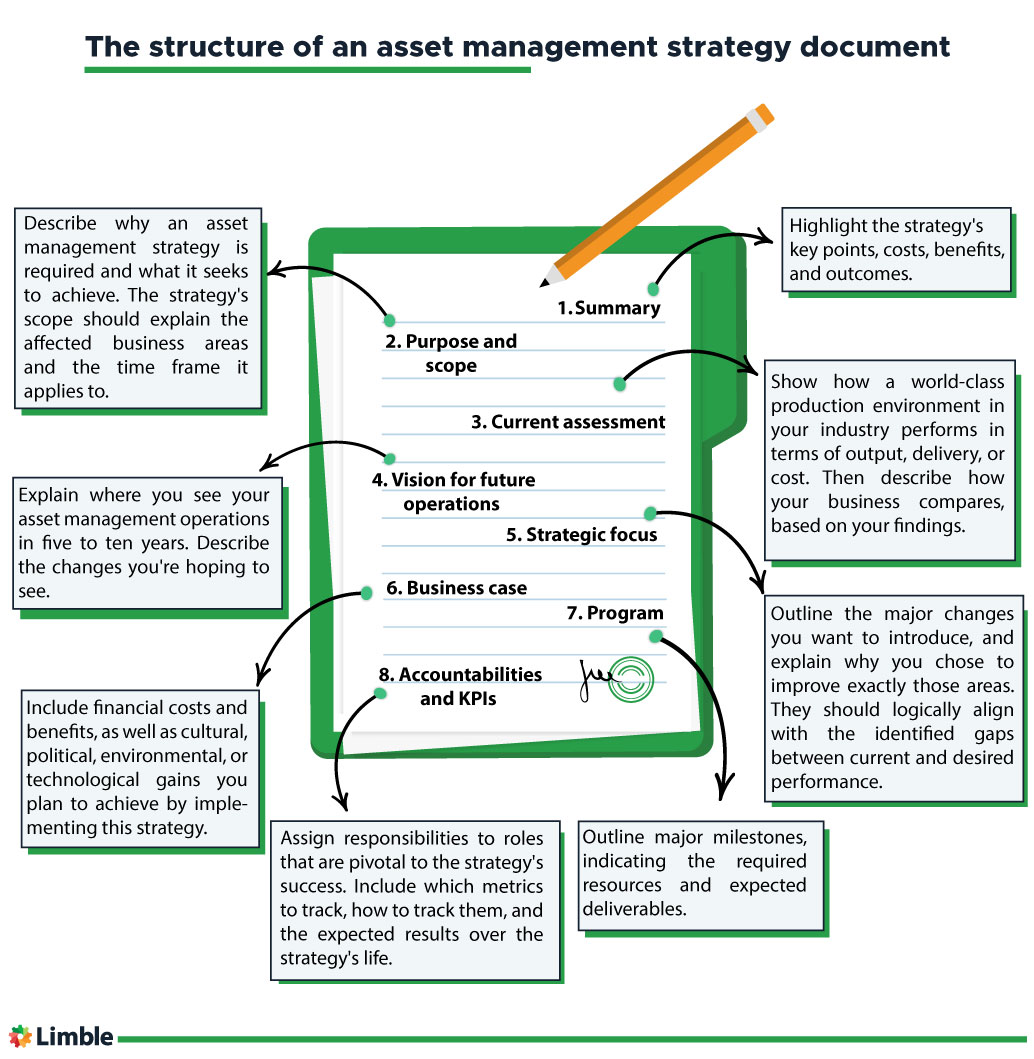

Structuring your asset management strategy document

While the layout of such documents varies widely across industries and countries, the following list provides a basic key components that you may want to include in yours.

The summary should come first in the document to allow senior management to review the document’s findings without wading through all the details. It must be concise, highlighting the strategy’s key points, costs, benefits, and outcomes.

2. Purpose and scope

Describing the purpose and scope in-depth establishes strategic alignment with business needs.

Describe why an asset management strategy is required and what it seeks to achieve. The strategy’s scope should explain the affected business areas and the time period — in years — to which the document applies.

3. Current assessment

This chapter summarizes the outcomes of the data analysis. Show how a world-class production environment in your industry performs in terms of output, delivery, or cost. Then describe how your business compares, based on your findings.

Cover maintenance and reliability comparisons, including:

- Overall equipment effectiveness (OEE) rates

- Reliability performance

- Cost per unit produced

This chapter should also clarify why effective asset management is important, why changes are required, and how far the business has to go to achieve best-in-class operations.

4. Vision for future operations

When crafting the vision, describe what the business could look like in five or ten years. Be sure to focus on more than just production and maintenance metrics. Illustrate:

- How the company culture may have changed

- What the organizational structure may have evolved into

- How roles and responsibilities will have altered

- Any physical changes or modifications that may have occurred to the structure of the business.

Avoid making unbelievable statements.

If your business is in the third or fourth quartile for industry benchmarks, promising world-class performance in three years undermines the document and the analysis that supports it. You’ll struggle to gain buy-in, and your strategy is likely to fail.

What creates support are realistic, continuous improvement targets, and a real business case that acknowledges the difficulty of the journey .

5. Strategic focus

Outline the key areas the organization needs to focus on over the timeframe covered by the strategy document. You had hundreds of areas for improvement to choose from. Yet, you selected only six to eight of them. Explain why.

Having clarified the focus, describe the expected outcomes. These must logically align with and help close the gaps between actual and theoretical performance.

Finally, outline the processes to follow.

For example, assume you have identified OEE as one focus area. Explain that the targets for improvement are equipment availability and performance, and the processes to be implemented will include reliability-centered maintenance and root cause analysis techniques .

6. Business case

This is the part of the document where you’ll need to make assumptions about the year-over-year improvements, the costs required to implement the changes, and the resulting benefits.

Remember to include financial costs and benefits, as well as cultural, political, environmental, or technological gains.

The business case is a justification for the strategy based on what the company expects to earn from improved production efficiency .

This section is your project plan. It outlines major milestones and timelines, indicating the required resources and the expected deliverables. It becomes the guideline for managers tasked with writing asset management plans.

8. Responsibilities and KPIs

The company’s asset management strategy will affect a wide cross-section of the organization. Therefore, the stakeholders and roles that are pivotal to the plan’s success must have clearly defined responsibilities.

It should also include key metrics, describing what will be measured, how to calculate KPIs, and the results expected over the strategy’s life.

Examples of public asset management strategies

Most privately owned companies do not publish their asset management strategies, given the confidential information they contain. But many public entities like councils or government organizations must publish theirs.

Here are three examples, along with some notes on what they do right.

- South Australian Government : This asset management strategy works at the right level, without dipping into unnecessary detail. It describes areas of focus and gives guidance on things to consider when individual agencies formulate their plans. Great examples are the life-cycle costing and asset register chapters on page nine.

- Eastleigh Borough Council : This council’s strategy has a good example of a forward plan , describing key strategic objectives.

- Kent County Council : This comprehensive plan has a good introduction, context, and purpose section. The vision and mission descriptions are first-class, and the strategy breakdown into thematic chapters is a great example of clear communication.

Start sooner rather than later

An asset management strategy drives improvements by comparing actual with ideal performance. By highlighting this performance gap and identifying priorities, best practices, and problem areas, the strategy sets goalposts for maintenance and other middle managers.

It provides a clear case for change and sets expectations on timelines and results, providing a map for the organization to follow in the next three to five years.

When done well, it supports constant incremental improvement for businesses that are intent on maintaining competitiveness through best-practice asset utilization.

To learn more about asset management and maintenance, keep browsing the Limble blog .

Subscribe to the Limble Blog

Request a demo.

See us at Cultivate’24 | July 13-16 | Columbus, OH

- Inventory Management

- Order Management

- Freight Management

- Truck Driver App

- Dock Door Scheduling

- Reporting and Analytics

- Asset Management

- Human Resources

Argos Software and Services

ABECAS Insight software and services are built and delivered around a core base of tools.

- ABECAS Insight

- Implementation

- Support & Consulting

Argos Software Industries

We offer both industry-specific and general software modules to meet a wide variety of business requirements, all built atop a financial accounting core.

- 3rd Party Logistics (3PL)

- Nursery, Greenhouse, & Growers

- Warehousing

- Asset-Based Trucking

- Cold Storage

Integration

- Shipping Integration

- EDI Integration

- API Integration

Argos Software Resources

Don’t miss our recent updates. Subscribe to Warehouse Best Practices.

- Trade Shows & Events

- White Papers

About Argos Software

It’s the best software for running a small-to-medium sized business or a division of a larger company where the focus is on understanding and controlling costs as a path to increased profitability.

- Our History

Recent Blogs

Top Cannabis Software Features to Optimize Your Business for Growth

By Christen Thomas | 2024-05-06T23:00:24+00:00 April 16, 2024 |

The Essential Guide to Business Asset Management

By Christen Thomas | 2024-05-07T01:19:13+00:00 April 3, 2024 |

Warehouse Slotting: A Comprehensive Guide to Maximizing Efficiency

By Christen Thomas | 2024-05-07T01:23:08+00:00 February 28, 2024 |

- Search for:

Christen Thomas

April 3, 2024

In today’s rapidly evolving business landscape, the efficient management of both physical and infrastructure assets stands as a cornerstone of operational success. Business asset management, a discipline that extends beyond the financial management of stocks and bonds, encompasses the strategic oversight of all valuable resources within an organization. This broad spectrum includes everything from tangible machinery and facilities to intangible assets like software and intellectual property. Effective management of these assets is crucial, not only for safeguarding them but also for optimizing their use to drive business growth and performance.

The significance of both physical asset management and infrastructure asset management cannot be overstated. As businesses across various sectors grow and integrate advanced technologies, the assets they rely upon become increasingly sophisticated and interconnected. This complex web of assets presents a challenge: ensuring they contribute positively to the bottom line through a comprehensive strategy that goes beyond mere inventory or maintenance. It involves creating a robust system where assets are monitored and managed from procurement through to disposal, thus ensuring they deliver maximum possible value throughout their lifecycle.

This guide aims to provide professionals across all industries with the insights and strategies necessary to excel in asset management. By adopting a holistic approach to the management of both tangible and intangible assets, organizations can unlock new levels of efficiency, sustainability, and competitive advantage. Whether you are in logistics, manufacturing, tech, or any field in between, mastering the principles of asset management is key to navigating the complexities of today’s business environment and securing a prosperous future.

Understanding the Basics of Asset Management

What is asset management.

At its core, asset management is the holistic approach to overseeing every asset within an organization to maximize value and minimize costs and risks. These include both physical or tangible fixed assets and non-physical, or intangible assets. This practice differs significantly from personal or financial asset management, focusing instead on the tangible and intangible assets that drive business operations forward. It involves a strategic blend of procurement, utilization, maintenance, and disposal to ensure each asset’s optimal performance and contribution to the business goals.

Types of Assets

A thorough understanding of the various types of assets under management is essential for developing and implementing effective asset management strategies. Generally, assets can be categorized into three broad groups: physical and infrastructure assets, intangible assets, and digital assets. Here’s a closer look at each category:

- Machinery and Equipment: Essential for manufacturing processes, maintenance work, and more.

- Vehicles and Fleets: Used for transportation, logistics, and delivery services.

- Buildings and Facilities: Encompasses office spaces, warehouses, and manufacturing facilities.

- Infrastructure: This subcategory includes the vital systems and structures that support a company’s operations, such as power grids, water and sewage systems, and communication networks. Infrastructure assets are crucial for both public services and private sector operations, requiring comprehensive management and strategic planning to ensure their reliability and efficiency.

- Software Licenses and Patents: Protect and provide exclusive rights to use innovative technologies and processes.

- Trademarks and Brand Recognition: Crucial for marketing, customer recognition, and establishing a reputable brand identity.

- Intellectual Property: Encompasses proprietary research, designs, and creative work. Managing these assets involves legal protections, licensing agreements, and strategic deployment to safeguard and leverage their value.

- Data and Information: Customer databases, analytical reports, and operational data that drive decision-making and strategic planning.

- Digital Content: Marketing materials, digital products, and online content that require management for copyright, distribution, and monetization.

By recognizing the diverse nature of assets, businesses can tailor their asset management strategies to address the unique challenges and opportunities each type of asset presents. Effective asset management ensures that physical, infrastructure, intangible, and digital assets are not only protected but also optimally utilized to contribute to business growth and sustainability.

Core Components of Effective Asset Management

Asset inventory and documentation.

One of the first steps toward achieving effective asset management is establishing a comprehensive asset inventory and maintaining detailed documentation. This process involves creating a systematic record of every asset owned by the business, including both tangible or fixed assets, and intangible assets. For tangible assets, this would encompass details such as serial numbers, purchase dates, costs, and current locations. For intangible assets, it includes licenses, patents, and copyrights, along with their acquisition dates and values.

The importance of maintaining this inventory cannot be understated. It serves as the backbone of any asset management strategy, enabling businesses to track the status and performance of their assets throughout their lifecycle. Additionally, well-kept documentation aids in compliance with regulatory standards, financial reporting, and strategic planning. It also simplifies the process of asset verification, valuation, and insurance.

Asset Tracking

In today’s digital age, the methodologies for tracking physical and digital assets have evolved significantly. Beyond traditional barcode systems and RFID tags, businesses now leverage GPS trackers, IoT sensors, and cloud-based software platforms for real-time asset monitoring. These technologies provide instant visibility into the location, condition, and performance of assets, facilitating proactive management.

Real-time asset tracking allows businesses to respond swiftly to changes in asset status, reducing downtime and preventing losses due to theft or misplacement. Moreover, integrating this data with asset management software can automate maintenance schedules, update asset records, and inform decision-making processes. For digital assets, software solutions can monitor usage, ensure compliance with licensing agreements, and protect intellectual property rights.

Lifecycle Management

Understanding and managing the lifecycle of an asset is central to maximizing its value and efficiency. Lifecycle management, whether for physical or infrastructure assets, or intangible assets, encompasses the stages from asset acquisition, through its operational use, to its eventual disposal or renewal. By strategically managing each phase, businesses can extend asset life, optimize their use, and ensure their assets remain a source of value rather than a cost burden.

- Acquisition: Making informed decisions about which assets to acquire, considering not only the purchase price but also the total cost of ownership, including maintenance, operation, and potential resale value.

- Operation: Ensuring assets are utilized effectively, maintaining them in good working order, and making adjustments as business needs change.

- Maintenance: Implementing scheduled maintenance and adopting predictive maintenance strategies to prevent failures and extend asset lifespan.

- Disposal or Renewal: Deciding when it’s more cost-effective to retire an asset and replace it, considering its residual value, the cost of continued maintenance, and the benefits of newer technology.

Maintenance Scheduling and Management

Regular maintenance is critical to extending the lifespan of assets, ensuring they perform efficiently and reducing the likelihood of unexpected breakdowns. Advanced techniques in maintenance scheduling, such as predictive maintenance, leverage data analytics and IoT sensors to anticipate failures before they occur, scheduling interventions only when necessary.

Choosing between in-house and outsourced maintenance involves weighing the cost and expertise associated with each option. While in-house teams provide control and rapid response, outsourced partners can offer specialized skills and scalability. Whichever choice is made, it’s essential to integrate maintenance activities into the broader asset management strategy, ensuring they contribute to overall business objectives and asset performance optimization.

In these sections, we’ve outlined the foundation of effective asset management, focusing on inventory documentation, tracking technologies, lifecycle strategies, and maintenance practices. As we move forward, we’ll explore additional aspects that contribute to a holistic asset management approach, including financial management, technological advancements, and strategic practices for risk management and compliance.

Depreciation Tracking and Financial Management

Depreciation tracking is a crucial component of managing fixed assets, allowing companies to understand the diminishing value of their tangible assets over time. This process is not just about compliance with accounting standards; it’s a strategic tool that informs decisions on asset maintenance, replacement, and disposal. By accurately tracking depreciation , businesses can ensure they’re making informed investment decisions, optimizing their tax benefits, and maintaining accurate financial records.

Financial management in asset management extends beyond depreciation tracking. It encompasses the total cost of ownership (TCO) analysis, investment planning, and the alignment of asset acquisition with financial goals and capabilities. Effective financial management ensures that assets are not only contributing to operational efficiency but also aligning with the company’s broader financial strategy, including budgeting, forecasting, and liquidity management.

Technology in Asset Management

In the realm of asset management, technology plays a pivotal role in enhancing the visibility, efficiency, and control of assets across various industries. The adoption of cloud-based software solutions marks a significant advancement, offering businesses the ability to centralize asset information, streamline processes, and facilitate real-time decision-making. These platforms are designed for scalability and provide remote access, ensuring that businesses can manage their assets effectively, regardless of their size or geographic distribution.

Moreover, the integration of Remote Access Technology (RAT) and other mobile solutions into asset management systems has revolutionized how field personnel, such as drivers and sales teams, interact with assets in real-time. This connectivity ensures that data is consistently updated and accessible, enhancing the responsiveness and agility of businesses in managing their assets.

For instance, systems like Argos Software utilize these technologies to offer comprehensive asset management solutions. By integrating e-mail and file export capabilities, along with the automatic generation and distribution of reports and documents, such platforms ensure seamless communication and efficiency. The ability to define alerts and receive automatic notifications helps businesses stay ahead of potential issues, enabling proactive management of assets.

Additionally, the integration of various external tools and services, including RF and handheld devices, further extends the capabilities of asset management systems. This interoperability allows for the efficient tracking and management of assets, reducing errors and improving overall operational efficiency.

The technology landscape in asset management continues to evolve, driven by the need for greater efficiency, accuracy, and control. As businesses strive to optimize their asset management practices, the adoption of advanced technological solutions remains a critical strategy for achieving operational excellence and competitive advantage.

Strategic Asset Management Practices

Risk management.

Identifying and mitigating risks associated with asset utilization and ownership is paramount in asset management. This includes physical risks to tangible and infrastructure assets, such as damage or theft, and operational risks, such as downtime due to unexpected failures. Effective risk management involves regular risk assessments, the implementation of preventive measures, and the development of contingency plans to ensure business continuity.

Policy and Compliance

Ensuring that asset management practices meet industry regulations and standards is critical for legal compliance and operational excellence. This encompasses everything from environmental regulations and safety standards to financial reporting requirements. Developing clear policies and procedures for asset management not only helps in meeting these requirements but also in standardizing practices across the organization, enhancing efficiency and accountability.

Performance Monitoring and Optimization

Monitoring the performance of assets and seeking ways to optimize their utilization is essential for maximizing return on investment. This involves regularly reviewing asset utilization rates, maintenance costs, and overall contribution to business goals. Performance data can inform strategic decisions on asset reallocation, upgrades, or divestment, ensuring that the asset portfolio remains aligned with changing business needs and market conditions.

Sustainability and Asset Management

Integrating sustainability into asset management practices is increasingly recognized as a key driver of long-term value creation. This includes considering the environmental impact of assets throughout their lifecycle, from acquisition to disposal. Sustainable asset management practices can reduce waste, lower energy consumption, and minimize the carbon footprint of operations, contributing to a company’s social responsibility goals and improving its reputation among consumers and investors.

The comprehensive approach outlined in these sections, from financial management and technology adoption to strategic practices and sustainability, forms the foundation of effective business asset management . As businesses continue to navigate a dynamic operational landscape, the principles and practices discussed here will be pivotal in leveraging assets as strategic tools for growth and competitive advantage.

Implementation and Best Practices

Implementing a robust asset management system requires careful planning, consistent execution, and continuous improvement. Here are key strategies and best practices to ensure the successful deployment and management of an effective asset management framework.

Assessing Your Current Asset Management Maturity

Understanding your organization’s current level of asset management maturity is crucial before embarking on any improvement initiative. This involves evaluating existing processes, technologies, and practices against industry standards or best practices. Tools like maturity models can help identify gaps in areas such as documentation, tracking, maintenance, and financial management, providing a clear roadmap for advancement.

Developing an Asset Management Plan

A strategic asset management plan (AMP) outlines how an organization’s assets will be managed to achieve its overall strategic plan. This plan should include:

- Goals and objectives for asset management.

- Roles and responsibilities within the asset management team.

- Standards and practices for asset acquisition, maintenance, and disposal.

- Strategies for risk management, compliance, and performance optimization.

- A technology roadmap for implementing or upgrading asset management tools and systems.

Change Management

Successfully implementing a new or revised asset management strategy often requires changes to organizational culture, processes, and technology. Effective change management strategies can facilitate this transition, ensuring buy-in from all stakeholders. Communicate the benefits of effective asset management clearly and consistently, provide training to relevant teams, and involve key stakeholders in the planning and implementation process to foster a culture of continuous improvement.

Training and Development

Investing in training and development is essential for building asset management competence within the organization. This includes both technical training on asset management tools and systems, and broader educational initiatives on best practices and principles. Regular training sessions can help ensure that staff are up to date with the latest asset management strategies, technologies, and regulatory requirements.

Leveraging Data and Analytics

In the era of big data, leveraging data analytics is a powerful strategy for optimizing asset management. Data collected from IoT devices, asset management software, and other sources can provide valuable insights into asset performance, maintenance needs, and utilization patterns. Analytics can help identify trends, predict failures, and inform strategic decision-making, enabling organizations to move from reactive to proactive asset management.

Choosing the Right Asset Management Software

Selecting the right asset management software is pivotal to enhancing operational efficiency and achieving strategic asset management goals. Key features to look for include:

- Compatibility with existing systems and technologies.

- Scalability to accommodate business growth.

- Real-time tracking and reporting capabilities.

- Customizable dashboards and reports.

- Support for predictive maintenance and analytics.

Challenges and Solutions in Asset Management

Common challenges.

Asset management teams often face challenges such as data silos, outdated systems, and resistance to change. These obstacles can hinder the effective tracking, management, and optimization of assets.

Solutions and Workarounds

To overcome these challenges, businesses can:

- Implement integrated asset management solutions to break down data silos.

- Regularly review and update asset management technologies and processes.

- Foster a culture of innovation and continuous improvement through training and change management practices.

The Future of Asset Management

Emerging trends.

Technological advancements such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and blockchain could further revolutionize asset management. These technologies offer potential new ways to track, manage, and optimize assets, driving efficiency and value creation.

Preparing for the Future

Staying ahead of emerging trends requires a proactive approach. Organizations should:

- Keep abreast of technological developments and industry best practices.

- Invest in technology and skills development.

- Experiment with new technologies on a small scale before full implementation.

Argos Software: Your Strategic Asset Management Solution

As businesses navigate the complexities of asset management, the need for a comprehensive, adaptable solution has never been more apparent. Argos Software, with its rich history of innovation and dedication to efficiency, presents a robust platform designed to streamline asset management across various industries. Our suite of features is not just a testament to our expertise but a reflection of our commitment to transforming the way businesses manage their assets.

Tailored Solutions Across Industries

Argos Software is engineered to cater to the unique challenges and dynamics of multiple sectors, including 3PL providers, agribusiness, transportation, and more. Each solution is meticulously designed with industry-specific functionalities to enhance operational efficiency and strategic decision-making.

- For 3PL Providers : Argos offers an end-to-end warehouse management solution, embracing advanced features like value-add transactions and storage billing, crucial for the complex demands of a 3PL environment.

- In Agribusiness : From seedling cultivation to stock management and shipping, Argos software provides comprehensive visibility and control, ensuring the seeds of hard work bear fruits of efficiency and productivity.

- Transportation and Freight Management : With features like advanced route optimization and real-time shipment tracking, Argos software is the ultimate tool for efficient logistics management.

Comprehensive Asset Management Features

Our Asset Management suite is a testament to our comprehensive approach, offering:

- Real-Time Asset Tracking and Visibility: Ensure every asset is precisely where it needs to be, when it needs to be there, with our advanced tracking solutions.

- Lifecycle Management: From procurement to disposal, maximize ROI with strategic insights into each asset’s journey.

- Maintenance Scheduling: Automate and optimize maintenance schedules to keep assets in peak condition, reducing unexpected breakdowns and extending asset lifespan.

- Depreciation Tracking: Stay ahead of financial planning with accurate, up-to-date depreciation records, aiding in strategic asset investment decisions.

- Customizable Dashboards and Reporting: Gain a holistic view of your asset portfolio with tailored operational insights, driving informed decision-making.

Why Choose Argos?

Choosing Argos Software means more than just accessing a top-tier asset management solution; it means partnering with a team that understands the nuances of your industry and the challenges you face. Our flexible, modular system allows you to tailor the software to your specific needs, ensuring that you only pay for what you need. Argos is committed to continuous improvement and innovation, ensuring our solutions evolve with your business.

In the ever-evolving world of business, effective asset management is not just a necessity but a strategic advantage. With Argos Software , businesses have a partner poised to elevate their asset management strategy, harnessing technology, industry expertise, and a commitment to excellence. As we look towards the future, Argos remains dedicated to empowering businesses with the solutions they need to manage their assets intelligently, efficiently, and profitably. Join us on this journey to redefine asset management and unlock the full potential of your business operations.

Request a Demo

Discover how Argos Software can transform your asset management practices, streamline your operations, and drive your business forward. Contact us today to request a demo and explore a partnership that grows with you, offering the tools and insights needed to excel in today’s competitive landscape.

Recent Blog

In today's rapidly evolving business landscape, the efficient management of both physical and infrastructure assets [...]

Struggling with warehouse organization? ‘Warehouse slotting’ might be your answer. It’s not just about orderly [...]

Mastering Business Intelligence Reporting: A Manager’s Guide

Discover how to effectively utilize business intelligence reporting to drive informed decision-making and improve organizational [...]

Table of Contents

Subscribe to Email For Updates

Argos’ ABECAS Insight is all-in-one business management software that’s flexible and modular, offering the functionality of an enterprise (ERP) solution at a fraction of the cost. ABECAS Insight is ideally suited for companies in 3PL, transportation, agriculture, field service, and utility industries, and for small- and medium-sized businesses selling to other companies (B2B).

8770 West Bryn Mawr Ave, Suite 1300 Chicago, IL 60631

+1-888-253-5353 +1-559-227-1000

© 2024 Argos Software. All rights reserved

Privacy Policy | Terms and Conditions | Cookie Policy

Asset Intelligence and Management

- EZOfficeInventory

Physical asset management software for total visibility and efficiency

EZO AssetSonar

Automated IT asset management for hardware and software

Maintenance operations management solution for equipment and facilities

Equipment rental software to manage your business

EZOfficeInventory Blogs Asset Management Plan

5 Top Ways to Efficiently Implement an Asset Management Plan

- May 10, 2024

- Rida Fatima

Creating a sound asset management plan is the core of smooth business operations. It provides a blueprint for organizations to achieve excellence in managing assets effortlessly – by defining criteria to handle asset-related emergencies.

Businesses usually have a variety of assets to maintain, necessitating a strategic asset-tracking approach. These plans include effectively using assets, improving their lifecycle, and maximizing their utility. Asset management plans can be best achieved when implemented with cloud-based systems. 90% of organizations use cloud-based systems to manage their assets and almost 48% plan on adopting one eventually.

This blog takes you through the basics of the asset management plan, and how it can be implemented using an asset management system.

What is an asset management plan (AMP)?

An asset management plan is a structured process outlining how an organization can manage assets throughout their lifecycle. It covers the broader asset infrastructure of your organization and provides an integrated approach to operating and maintaining assets.

Asset management plans are used widely by government agencies, healthcare organizations, and construction companies to mitigate risks. The aim is to streamline organizational management efforts while achieving performance goals and establishing asset control . These plans help organizations optimize their asset use and maintain optimal stock levels.

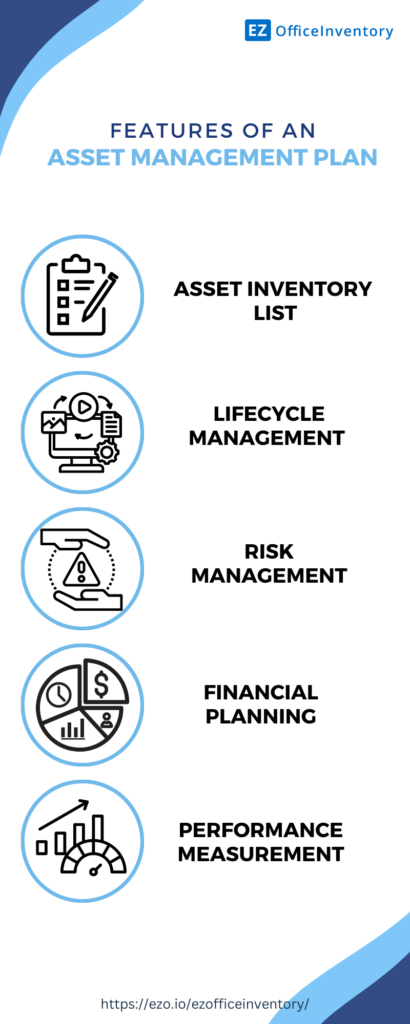

Core features of an asset management plan

There are some core features of an asset management plan that help organizations manage different types of assets, including:

1. Asset inventory list

It serves as a list of all the items managed by your organization, including backup assets, consumable inventory, and usable equipment. Having this repository helps organizations organize their assets and plan future steps accordingly.

2. Lifecycle management

Asset lifecycle management involves planning how the asset will be managed throughout its life, from its acquisition to disposal. The approach is designed to strategically manage assets to optimize their procurement, maintenance, and disposal.

3. Risk management

Involves identifying, assessing, and mitigating risks associated with acquiring, and maintaining assets. An asset plan lists potential risks that can impact the functionality of assets and steps to rectify or avoid them over time. By addressing risks beforehand, organizations can prevent financial losses and reduce the likelihood of asset failures.

4. Financial planning

Creating a financial plan to manage budgets and allocate resources for efficient asset management forms the foundation of business operations. It involves laying out a detailed plan to allocate funds for resources that are required the most as per business/project needs.

5. Performance measurement

Setting Key Performance Indicators (KPIs) to measure business performance helps determine if you have achieved your goals. The asset plan is targeted toward achieving these KPIs and identifying and analyzing the areas that need improvement. This stage helps optimize asset utilization and deploy unused assets to maximize operational efficiency.

How does an asset management plan increase business productivity?

An asset management plan helps yield the maximum benefit from assets and utilize them to their fullest potential. With strategic asset management planning in line with the system you use, you can increase asset reliability and performance.

Creating an asset plan is a sustainable strategy for extending the lifecycle of assets and addressing issues to avoid unforeseen events. Here’s how you can leverage an asset management plan for effective asset use:

1. Efficient resource management

Effective resource management can be best achieved by keeping in mind the asset needs of your business. An asset plan provides a framework of how, when, and in what capacity the current assets are being used, so the procurement team can acquire new ones in advance. This helps in handling budgets and forecasting asset-related expenses.

The following table provides a breakdown of how a strategic asset management plan helps businesses manage and allocate resources well (including both inventory and assets) throughout their life:

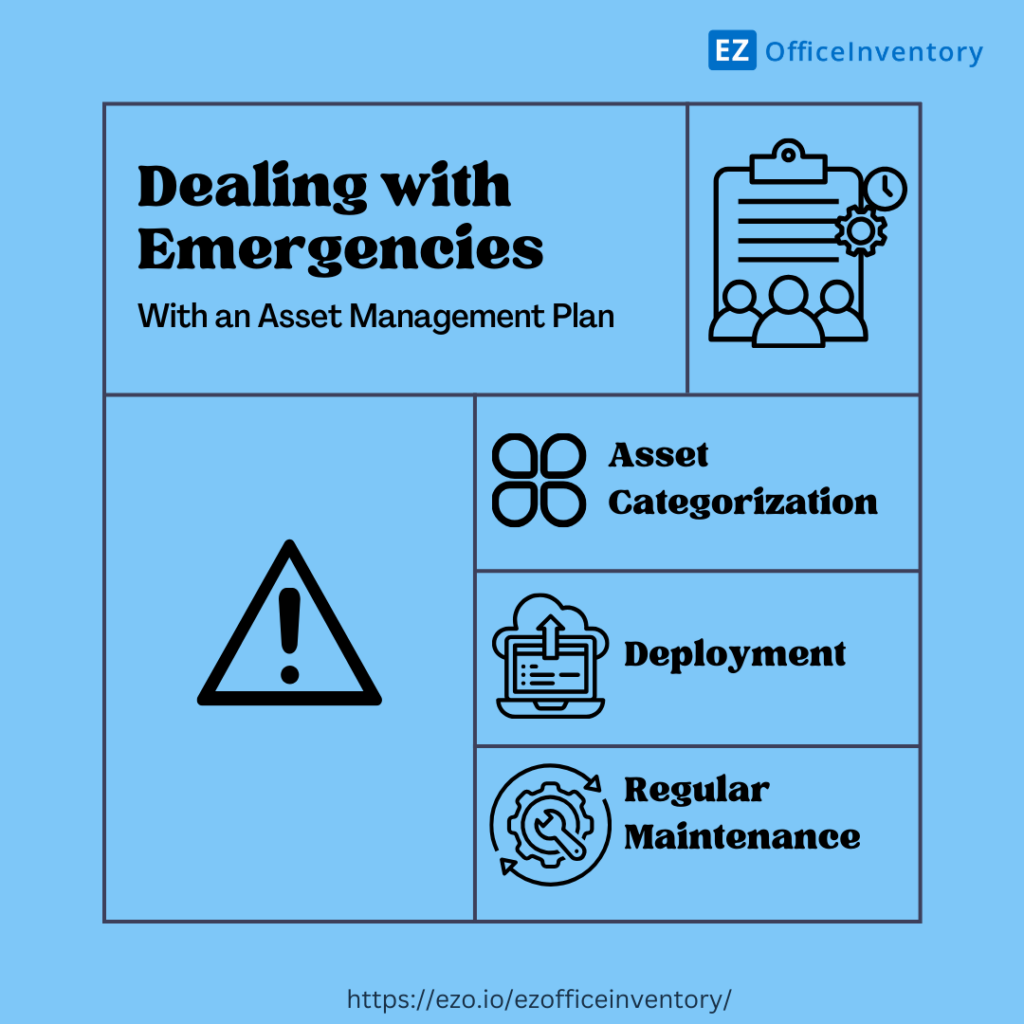

2. Improved response to emergencies

Effective resource management and categorization are essential for simplifying work processes and implementing faster administrative workflows. Achieving these motives is heavily dependent on accurate records management, which is possible only when an effective asset management plan is in place.

A plan enables your team to cross-check your organization’s management objectives with current performance to establish a baseline for benchmarking. By outlining clear implementation steps in your plan, you can prepare your team to achieve asset management objectives faster and more effectively.

Well-planned implementation steps help improve response time to emergencies – for instance, sudden asset breakdown. In such a situation, you can count on your asset management plan and respond wisely and quickly by following a pre-established safety plan. So, be prepared beforehand to avoid mishaps with an asset management plan!

3. Enhanced compliance management

An asset management strategy enables your team to comply with safety standards. This includes maintaining an asset on time, following safety protocols while using an asset, and training the staff to use an asset well. A sound plan highlights how an asset is to be treated, and what its long-term utilization plan and objectives are.

An asset’s maximum capacity can be achieved by creating a compliance checklist. Following a checklist as part of your asset plan helps achieve asset management compliance . This way you stay on top of rules and regulations that in turn increase the safety of assets (and their users), and help achieve the end-purpose of the assets.

4. Reduced asset downtime

According to recent studies , equipment downtimes cost an estimated $50 billion annually. To ensure your organization does not suffer the consequences of downtimes, your plan can incorporate preventative maintenance, with regular audits to analyze assets’ condition and make timely arrangements to avoid downtimes.

One way to implement proactive maintenance is by scheduling maintenance events in advance. This can be achieved by checking the assets’ availability calendar and choosing a day for maintenance when the asset is not being used for other tasks. This helps achieve consistency in service delivery and efficient operations by minimizing downtime.

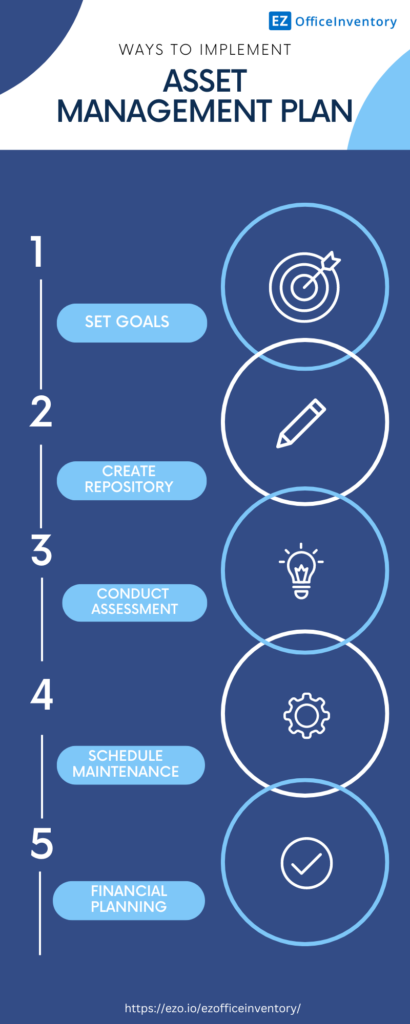

5 ways to implement an asset management plan

A detailed asset plan soon translates into successful strategic asset management once implemented using the right steps. Successful implementation of an asset management plan is straightforward and requires following a few steps, including:

Step 1: Set strategic objectives

To create a plan that aligns with your organizational goals, it is important to set SMART goals – specific, measurable, achievable, relevant and time-bound. These goals must align with your organization’s overall vision to maintain sustainability in the longer run.

SMART objectives direct major organizational operations towards higher efficiency, increased productivity and improved ROI. The objectives can include a variety of short term and long term goals, but need to be realistic with a specific timeline defined. These asset management goals help improve the overall asset monitoring processes and establish a benchmark for regular performance check.

For example, for a construction company, achieving goals with the help of an asset management plan looks like this: