Switch language:

What will Netflix do next?

The rise and rise of Netflix has stalled in 2022, but can the streaming company reinvent itself to fight off multiple headwinds?

- Share on Linkedin

- Share on Facebook

From November 2022, Netflix will introduce a cheaper ad-supported subscription option, a move that seemed improbable just a year ago. Netflix’s strong ethos for serving its customers included a frequently reiterated promise by founder Reed Hasting that the streaming giant would never include advertising. However, changing market conditions and a reversal of the company’s fortunes have called for drastic measures.

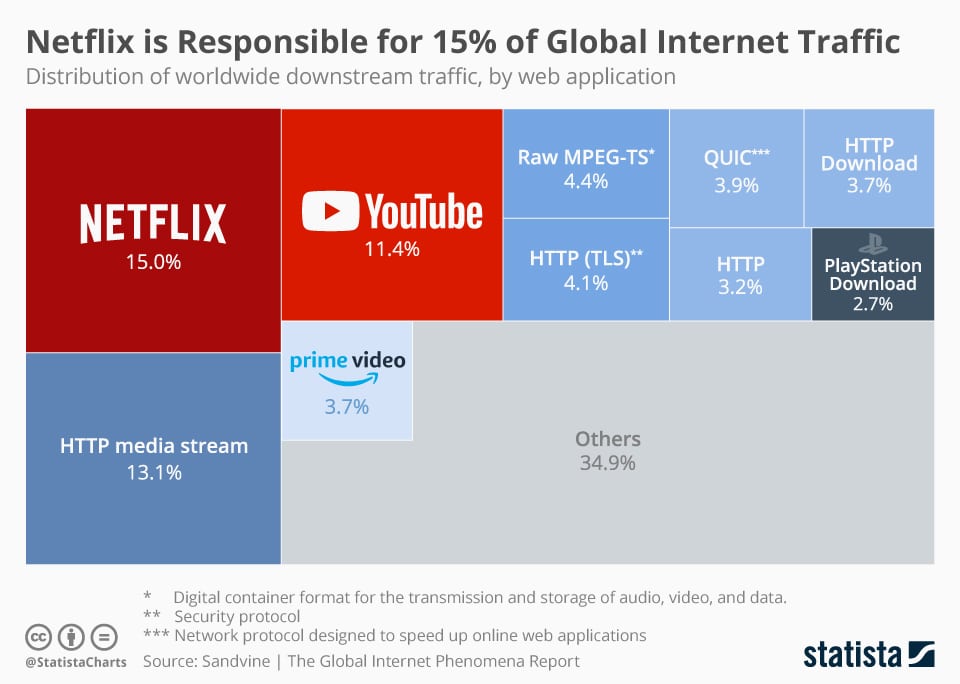

The rise and (potential) fall of Netflix serves as a cautionary tale for all Big Tech disruptors . The company’s staggering growth trajectory had at one time seemed unstoppable. Founded in 1997 by Hastings and Marc Randolph in Scotts Valley, California , Netflix started life as a DVD rental business. Today, the company is valued at $102bn, is reportedly responsible for around 10% of the world’s internet traffic and has revolutionised the business of television entertainment. However, after more than two decades of growth, 2022 saw the company’s subscriber growth slow for the first time and its domination of the television streaming industry called into question.

Go deeper with GlobalData

Corporate Governance Trends by Sector - Thematic Intelligence

Corporate governance trends in banking - thematic intelligence, premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

Netflix inc, gartner inc, bloomberg lp, sandvine corp, jpmorgan chase & co.

Netflix went public in 2002, at which time it was still mostly focused on DVD rentals, with revenues of around $150m. A strategic pivot in 2007 to the entertainment streaming business saw the company invest more than $40m in data centres as well as striking favourable deals for stacking rights to high-quality content (stacking rights are distribution rights to an entire library boxset). It was a gamble that would pay off. By the end of 2007, Netflix’s revenues had grown to a whopping $1.2bn. Early competitors Amazon Prime and Hulu simply couldn’t compete on the kind of high-quality franchise content Netflix had managed to negotiate as a first mover.

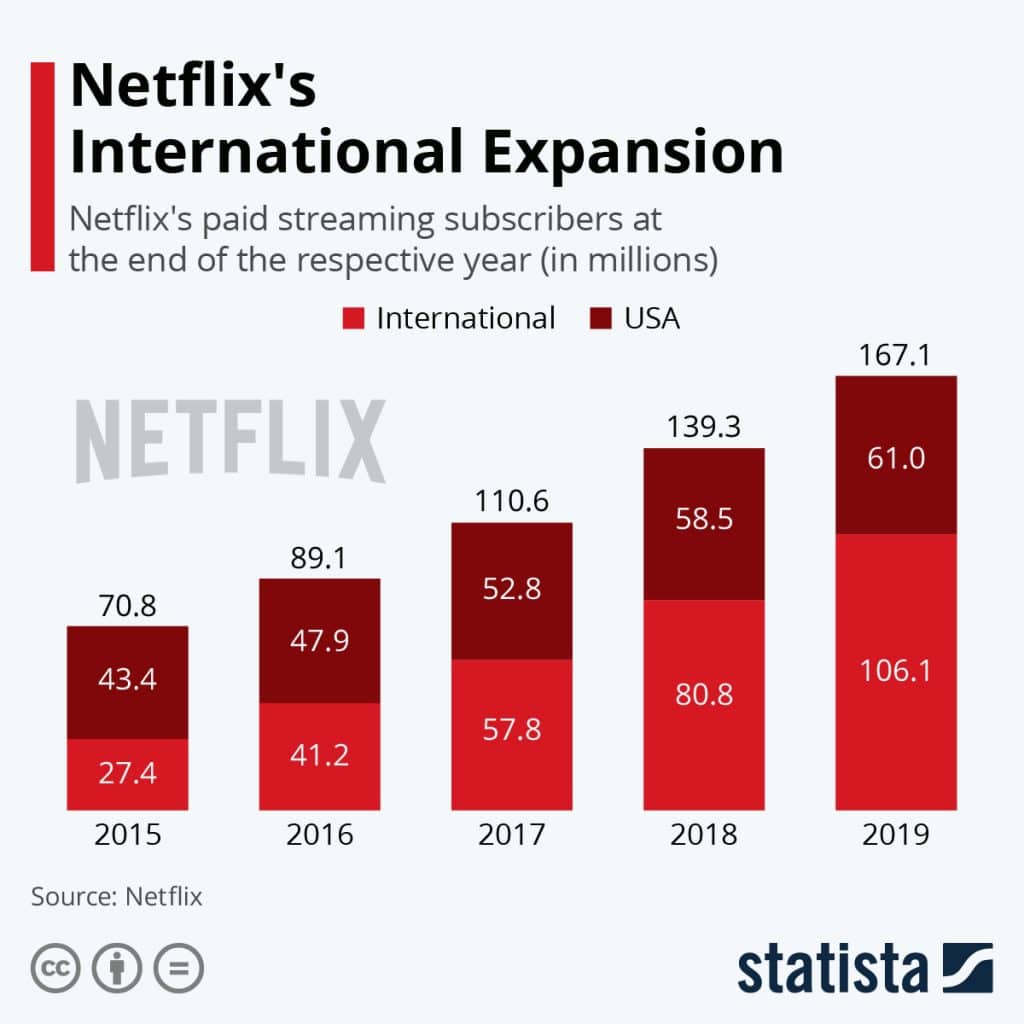

The growth years continued, with Netflix going global in 2016, expanding to 190 countries. The company led the market with growing subscription numbers in excess of 100 million and award-winning original content – a strategy it would continue to pursue by producing original content, starting with House of Cards in 2013 and more recently Stranger Things , Lupin and Squid Game .

Even a pandemic failed to halt the streaming giant’s runaway success. In fact, global lockdowns saw Netflix add 36 million subscribers in 2020, according to Statista. In 2021, Netflix had approximately 222 million paid memberships, achieved approximately $30bn in revenue, representing 19% year-on-year growth, and more than $6bn of operating income, representing 35% year-on-year growth. However, while the company had added 8.3 million subscribers in the last three months of 2021, bringing total subscriber growth for the year to 18.2 million, it was the lowest annual subscriber gain since 2016.

Has Netflix lost its edge?

Fast-forward to the company’s 2022 second quarter earnings report in April and Netflix’s track record hit an inflection point, with the streaming giant losing subscribers for the first time after what had been a decade-long ascension. Markets reacted swiftly with a 60% drop in the company’s stock value, wiping out more than $54.4bn from the company’s market capitalisation.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

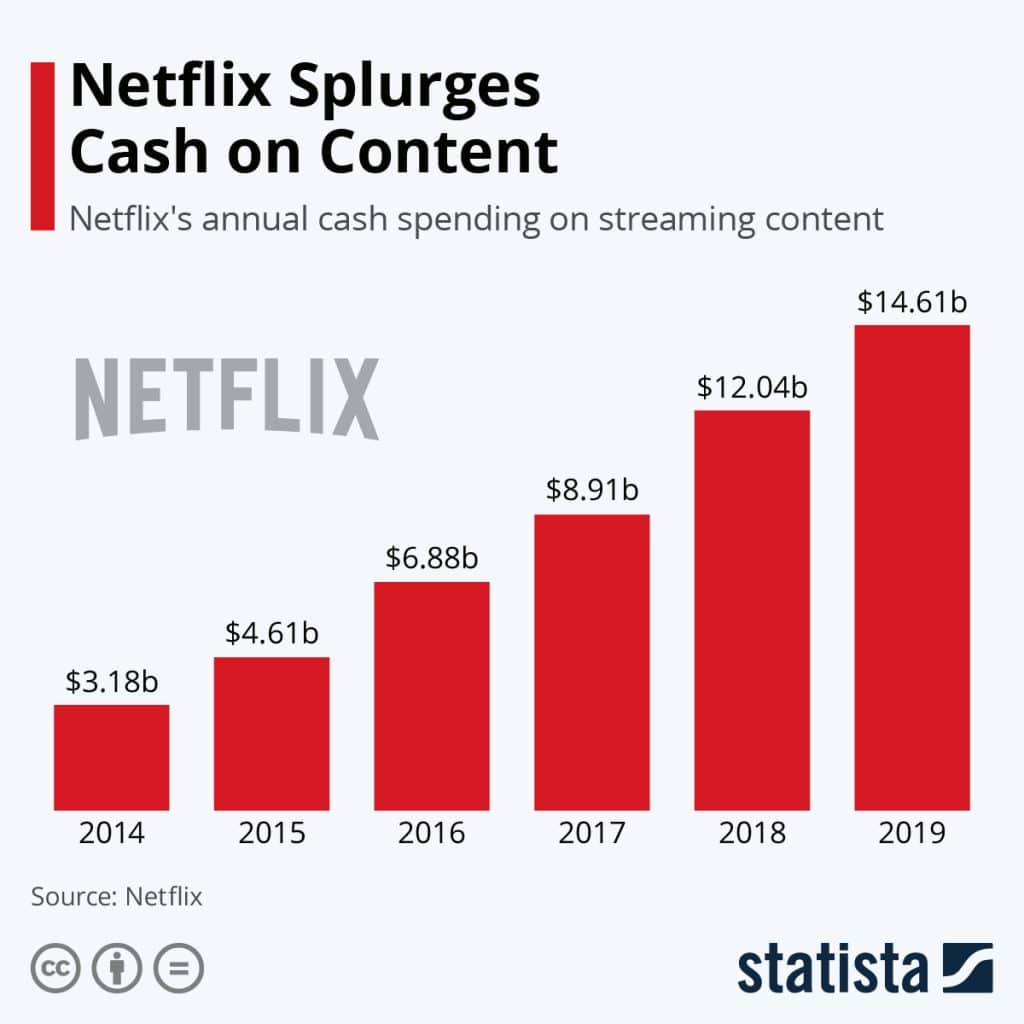

The hitherto undisputed winner of the so-called streaming wars, Netflix has seen its clear lead diminishing to competitors including Disney Plus, Amazon Prime and Apple TV. The streaming wars have long depended on the notion that ‘content is king’, thereby ensuring the massive growth in subscriber numbers that has made Netflix the market leader. In this regard, Netflix established itself much like any other television entertainment studio that preceded television streaming, with award-winning original content and franchised content such as Breaking Bad , for example.

However, the streaming wars are no longer being fought simply over content. A number of challenges threaten Netflix’s market dominance. The company puts its change in fortune down to factors including Russia’s invasion of Ukraine and the company’s subsequent exit from Russia, increasing market competition, revenue loss from subscriber password-sharing and a global cost of living crisis. However, other, equally pertinent, factors include the cost and unrelenting requirement of producing high-quality content, malcontent internet service providers (ISPs) struggling to accommodate Netflix-originated internet traffic volumes, as well as straightforward market saturation.

Will Netflix with ads save the company?

In October 2022, JP Morgan analyst Doug Anmuth issued a note predicting that Netflix’s move to incorporate an ad-supported product offering could drive the growth of an additional 7.5 million new subscribers to its existing subscriber base in 2023 within its North American markets, rising further to 22 million subscribers by 2026. And markets certainly seem to echo Anmuth’s optimism as Netflix stock rose 19% from July to October 2022 after the move was announced.

While consolidated revenues for 2021 increased 19% compared with 2020, paid net membership additions (essentially growth in subscriptions) in 2021 decreased by 50% compared with 2020. Despite slowing subscription growth, Netflix’s services continued to grow globally, with more than 90% of paid net membership additions in 2021 coming from outside North America.

GlobalData thematic research service director David George says that the company’s path to growth lies in developing markets. He sees the move to introduce advertising and a push into developing markets as a hybrid growth model. “While advertising is not a geographic shift, I think it is about stabilising the subscriber base while looking to grow in developing markets,” says George.

He expects to see a rationalisation of subscriber revenues due to the cost of living crisis in Western markets but points out that some entertainment streams have proved relatively recession-proof historically. In markets such as Africa and India, Netflix is launching low-cost or free products for a long-term growth strategy. “We are talking years, rather than months, for those subscribers to upgrade to some kind of paid model,” says George, adding that developing markets will always hold this challenge. “You can have five million subscribers in India, but they are all paying a dollar a month instead of nine,” he says.

Another challenge that George highlights is the business environment where content is so broadly distributed by so many different channels. He even goes as far as to say that Netflix’s dominance was simply a question of semantics.

“The definition of content delivery is now so incredibly broad,” says George. “The amount of video that is consumed on YouTube or TikTok, for, example is enormous. It is about how you define your market. If we are defining Netflix as a paid-for streaming service, then it is, of course, a big player, but if you define the content market as ‘where do people spend their time watching video content’, then Netflix is nowhere near the big players – and I think that is the challenge the company faces.”

Netflix is also deploying other strategies to mitigate subscriber losses. Subscriber password-sharing is said to cost the company billions of dollars. The company estimates that in addition to its 220 million paying households, an additional 100 million households are sharing passwords. To recoup these losses, the company is said to be trialling a new feature in Chile, Costa Rica and Peru that charges those who share passwords in separate households.

Netflix and FDI

Netflix’s global presence across 60 countries included approximately 11,300 full-time employees as of 31 December 2021. Of these, 8,600 (76%) were located in the US and Canada, 1,400 (12%) in Europe, the Middle East, and Africa (EMEA), 400 (4%) in Latin America and 900 (8%) in Asia-Pacific. The company also has fluctuating numbers of part-time content production employees. In 2021, the US and Canada region accounted for 43.7% of the company’s revenue, followed by EMEA with 32.7%, Latin America with 12% and Asia-Pacific with 11%.

Investment Monitor’s FDI Projects Database shows that Netflix’s new foreign direct investment projects outnumbered FDI expansion projects between 2019 and 2021, which indicates that the company is actively expanding overseas and into new markets.

Investment overseas was more heavily weighted in Europe than other regions, despite a significant push towards South Korea (which is no coincidence as Netflix’s 2021 South Korean original series Squid Game is believed to have delivered $891m of 'impact value', according to leaked internal data reported by Bloomberg ). Building on the success of Squid Game , Netflix is planning a reality show based on the series. The Squid Game impact can be seen in Netflix's second-quarter earnings for 2022, showing the strongest revenue growth in Asia-Pacific with an increase of 23% on the previous year, compared with 8.6% revenue growth across all regions.

Netflix continues to make acquisitions a part of its growth strategy. In March 2022, the company announced the purchase of Finnish gaming software company Next Games and US-based Boss Flight Entertainment in a continued push to enter the cloud gaming market. However, the news of Netflix's gaming acquisitions comes on the heels of Google’s announcement in February 2022 of its in-house gaming development studio Google Stadia – not a bullish sign for cloud gaming overall. In July 2022, Netflix announced plans to acquire Australian animation studio Animal Logic to support the company’s original animated film content – continuing the focus on its core strength of high-quality content delivery.

Peering agreements threaten Netflix's bottom line

A potential major roadblock to Netflix’s bottom line, one which may hamper the company’s growth aspirations, involves its symbiotic relationship with the ISPs streaming its content. Although the internet may appear to be a singular pipeline for the world’s internet traffic, it is actually made up of a complex web of local networks, connecting networks and larger ISPs. These networks agree to allow traffic to pass between them through what are known as ‘peering agreements'. This works well until a company such as Netflix comes along with 9.39% of all global downstream traffic in 2022, according to Sandvine 's 2022 Global Internet Phenomena Report.

Even accounting for a decrease (Sandvine's same report in 2019 found that Netflix took up 11.4 % of the total global downstream traffic), the volume of Netflix’s internet traffic means that peering agreements may prove a challenge in the short to medium term in Asia, Europe and the US, according to Hosuk Lee Makiyama, director of think tank the European Centre for International Political Economy and senior fellow at London School of Economics. “Network owners want to get paid for the traffic Netflix generates, which could easily kill its profits,” he says.

An ongoing landmark legal case in South Korea continues between Netflix and South Korean internet provider SK Broadband. Netflix is arguing for settlement-free peering to run its content over SK Broadband, whereas the internet service provider is demanding compensation. Investment Monitor’s FDI Projects Database registered three projects on behalf of Netflix in South Korea across 2021 and the first half of 2022, demonstrating significant expansion into the region and making peering agreements a critical challenge to its growth in the country.

Similarly contentious, the EU is exploring a mandatory tax for content providers such as Netflix to address what some view as an inequity created by the fact that ISPs cannot charge consumers based on the volume of content they view. Even the Federal Communications Commission in the US is looking at ways to compensate broadband network operators via some kind of fee, says Lee Makiyama. “That means lots more overheads for Netflix having to place servers everywhere to avoid the costs or otherwise just accepting the fees,” he adds.

Broadband providers essentially ‘own’ the end user at the platform level with customer contracts. It is an ‘all-you-can-eat’ model, according to Gartner analyst Phil Dawson. “But this is a shifting model," he adds. "What’s interesting is that content – business or social – has changed the relationship with the content provider, which means who owns the content now outweighs the delivery of the content. We are going from the all-you-can-eat model to the true utility model of how much we have used.”

In this respect, Netflix has become a real threat to the telecoms sector and the pushback may present significant challenges for the company. Content providers are increasingly at the mercy of ISPs – who owns the end point is becoming more important, adds Dawson. Netflix has responded to the situation by issuing the following statement: “We fight for free interconnection, where neither side charges the other, as we think Netflix and consumers are best served by strong network neutrality.” The company added: "We don't intend to try to collect a percentage of broadband revenue from ISPs, despite the fact that we are a substantial portion of what consumers do with their internet connection, and that this payment would parallel the payments to basic cable networks." What might have historically appeared a rapid ascension and wholesale disruption of television entertainment was, in actual fact, a combination of market opportunism and a long-term outlook that took account of both the evolution in technology and consumer habits. After all, Netflix had been operating for two decades before it became an 'overnight success' in 2007. It was a company that once seized the zeitgeist and changed the TV entertainment landscape forever – what remains to be seen is whether it can transform itself again, this time against the backdrop of a market in flux.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

What 2024 holds for the renewable energy market

Ai in business 2024: what can we expect, what does the economic crime act mean for foreign investors to the uk, biden versus trump ii: what will the us 2024 election mean for apparel, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Investment Monitor In Brief

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Netflix sets itself nicely for 2023 and beyond.

The streaming wars continue to rage on, with Netflix (NASDAQ:NFLX) at the forefront. As the market leader in streaming services, Netflix still wants to expand its reach so that it can continue to dominate the industry amidst new waves of competition. With a vast library of content, exclusive deals with content creators and producers and more, Netflix sets the standard for streaming services.

Despite subscriber losses in the first part of 2022, Netflix has once again proven its resilience against the competition by exceeding expectations in its fourth quarter earnings. While its earnings fell short of analysts' predictions, Netflix's fourth-quarter 2022 financial results were still impressive. The company surpassed revenue, operating profit and membership growth expectations.

NFLX 15-Year Financial Data

The intrinsic value of NFLX

Peter Lynch Chart of NFLX

Apart from these operating results, Netflix also announced a major leadership change. The streaming giant's longtime CEO and founder are stepping away from this role and will take on the title of executive chairman.

The stock price is up 15% since the start of 2023, leading to a price-earnings ratio of approximately 34. Throughout its history, Netflix's shares have been much more expensive than this, but that was due to continuous growth that has now been interrupted.

NFLX Data by GuruFocus

Still, Netflix has big plans for the future and is laying out an impressive strategy to get back to double-digit growth. With its aggressive plans and strong content library, it seems hard to think there will be a sustained downturn for Netflix shares in my opinion.

Netflix delivers another healthy quarter

Netflix stock gained about 8.5% after its latest earnings report showed that despite missing analysts' predictions on earnings revenue was as expected and subscriptions exceeded expectations.

Earnings per share were only $0.12 instead of the anticipated $0.45, and revenue was clocked at $7.85 billion. Netflix added 7.66 million paid customers in the fourth quarter, more than the 4.57 million Wall Street predicted.

This quarter marks the inclusion of Netflix's ad-supported service in the earnings results. The launch of this lower-priced option was in November, but there is no information yet on how many users have chosen this plan.

During its pre-recorded earnings call, Netflix reported similar engagement from its new subscribers who have opted for the ad-tier plans as it has seen with regular customers. The company stated that there hadn't been many people switching plans. Thus, the more expensive premium models are still being subscribed to. This indicates that many customers are content with the costlier version and not choosing the cheaper ad-supported model.

In terms of year-over-year comparisons for the fourth quarter, results were mixed. The year-over-year revenue increase was less than 2%. The operating profit margin declined to 7% and the net profit dropped by 91%. However, Netflix saw a considerable improvement in its financial health, generating $332 million in positive free cash flow compared to the $569 million in cash flow losses from the previous year. Overall, the strong subscriber number led to the tapering of negative sentiment.

For full-year 2022, Netflix acquired an impressive $31.6 billion in revenue, a 6% increase from the previous year. On the other hand, the operating profit margin dropped 310 basis points compared to 2021. In addition, earnings per share fell 11% to $9.95. Despite this, Netflix generated a positive free cash flow of $1.6 billion in 2022, which is a huge improvement compared to the cash flow loss of around $132 million it reported in 2021.

Looking ahead, Netflix is forecasting steady, healthy returns. In the short term, Netflix expects modest revenue and subscriber growth in the first quarter of 2023. However, its long-term goal is to get back to double-digit revenue growth, increase its profit margin and expand its free cash flow. For 2023, the target is to achieve $3 billion or more in positive free cash flow - a growth rate of approximately 100%.

All in all, Netflix had a highly successful quarterly earnings report, further creating favorable sentiment amongst investors. Over the past six months, the stock has seen an impressive growth of more than 55% on recovery from the epic fall in its valuation caused by the first-ever net subscriber loss. The outlook appears favorable, as the market is showing increasing strength, inflation is slowing and the Federal Reserve has become more moderate in its approach.

Change at the top will not hurt much

Reed Hastings, the founder of Netflix, has decided to step down as co-CEO but will continue to serve as chairman of the company. Ted Sarandos will stay on as co-CEO, and Greg Peters, formerly Chief Operating Officer, will fill the other co-CEO position vacated by Hastings. Peters additionally has been invited to the company's board.

In a recent tweet, Hastings stated his intent to stay as executive chairman of the company for "many years." This news comes when Netflix attempts different strategies to draw more subscribers and maintain its position in a tough market.

Further significant changes have also been made at the top of the Netflix hierarchy, with Bela Bajaria now taking on the role of Chief Content Officer and Scott Stuber assuming charge as Chairman of Netflix Film. Bajaria formerly served as the global head of television, while Stuber was the head of the global film.

Netflix had a strong showing in the fourth quarter. This was a major positive for investors concerned about slowing growth due to increasing competition from other streaming services.

In addition, Netflix is projecting healthy returns. Coming out of earnings season, it is in a great position. Its focus is shifting towards the classic television model, which involves creating plenty of content, advertising it and striving to achieve success with its audience. All this should keep both subscribers and advertisers happy for the foreseeable future.

This article first appeared on GuruFocus .

Netflix’s co-CEO discussed the road map to make the ‘very, very small’ mobile games business a growth engine with a ‘material impact’ on its $30 billion business

What game is Netflix playing with games?

The streaming giant has largely kept quiet about its long-term plans for video games, which it began offering free to subscribers in 2021. On Wednesday, Netflix executives shed a bit more light on its plans, indicating that the company is not simply in mobile gaming as a side hustle to help prevent subscriber churn, but wants to develop gaming into a marquee part of its service that can lift the overall business.

“We believe that we can build games into a strong content category,” co-CEO Greg Peters said during the company’s earnings call on Wednesday. “Our current scale—and frankly, our current investment—are both very, very, very small relative to our overall content spend and engagement.”

“So now our job is to incrementally scale to a place where games have a material impact on the business,” he added. “We want to really grow our engagement by many multiples of where it is today over the next handful of years.”

There’s certainly room to grow. According to a recent study by data intelligence firm Apptopia cited by Investors Business Daily , a meager 1% of Netflix’s 238 million worldwide subscribers engaged with its games every day. On Wednesday Netflix said its total paid subscribers grew to 247 million in the third quarter, while revenue of $8.5 billion increased roughly 8% year-over-year, sending shares in the company up more than 10%.

Netflix doesn’t break out performance metrics or financial information for its games business, so it’s unclear how much money the company is spending on the effort or the impact it’s having on profit margins—though Peters noted that Netflix doesn’t need to spend money to acquire users for its games, thus avoiding a major expense that its competitors are saddled with.

And while the company has said in the past that it has no current plans to generate revenue from the games business through direct monetization, Netflix executives appear to view gaming as a legitimate growth driver—a feature that not only gives existing subscribers one more reason to be happy with a service whose monthly price Netflix just increased again, but that also compels new consumers to sign up for a subscription.

“Games engagement right now on our service drives core business metrics in a way which is incremental to movies and series,” Peters said on Wednesday.

Netflix is focusing on video game ‘title selection’ and awareness

With Netflix’s array of intellectual property, the gaming business isn’t a bad place to be. The global games market will generate $188 billion this year, half of which comes from mobile, according to a report by gaming data company Newzoo. Industry revenues are expected to rise to $212 billion in 2026.

Some of Netflix’s competitors are already in the market. Warner Bros. Discovery , which operates the Max streaming platform, publishes the Harry Potter–themed Hogwarts Legacy and the Lego game series for the Star Wars, Marvel, and Harry Potter franchises. The company doesn’t disclose gaming revenues, but some titles have proven lucrative. Hogwarts Legacy reportedly cost $150 million to make, and it earned $850 million in the first two weeks after launch, according to the company. Apple and Google , which also own streaming platforms, have mobile games businesses as well.

As of March, Netflix had released 55 games with 70 more in the works. It has acquired a series of development studios to support its vision, and it recently began testing cloud gaming in the U.S.

Many of Netflix’s games are based on some of its most popular movies and TV shows, including Stranger Things, Love Is Blind, and Queen’s Gambit , and in the coming months it will roll out games based on the series Money Heist and Virgin River.

Ted Sarandos, Netflix’s other co-CEO, touted such games as a “great experience for the super fan to get themselves in the universe in between seasons of a show.”

But there are growing signs that the goal is more ambitious than simple off-season loyalty. A Grand Theft Auto game for Netflix has been discussed , according to a recent Wall Street Journal report.

On Wednesday’s call with investors, co-CEO Peters cited “title selection” as a key driver of its future gaming growth, as Netflix leans on its vast troves of user data to offer more of the kind of games that resonate with users. Better product features in the games will also help, Peters said. And he suggested that Netflix will put more effort behind promoting its games.

“We have to do it by gradually improving consumer awareness, which is what we’ve seen as when we launched other content categories,” he said, likening games to some of the other entertainment offerings that Netflix has added to its catalog. “You can think about unscripted or you can think about film, that broadly lifts overall engagement metrics as consumers learn that we’re a place to go to, to find games.”

Latest in Tech

Social media users are ‘blocking out’ celebrities on TikTok, Instagram and X over inaction around Israel-Hamas war

TikTok is footing the bill for a new lawsuit filed by creators challenging a ban

Boeing could face criminal charges after violating a deal negotiated in secret with regulators

Key player in on-again, off-again ouster of OpenAI CEO Sam Altman is leaving the company

Crewmember mistakenly caused the ship’s engine to stall hours before a blackout led to the Baltimore Bridge collapse

GM-owned Cruise reached a more than $8M settlement with pedestrian who was dragged by robo taxi

Most popular.

The collapsed Baltimore bridge will be demolished soon, and the crew of the ship that’s trapped underneath will be onboard when the explosives go off

The housing crisis in the U.S. is flipped upside down in Japan, where each home that’s occupied could be next to an empty one by 2033

TV chef Gordon Ramsay spends an extra $7.6 million on staff as U.K. restaurant empire losses triple

After selling his startup for a life-changing $3.7 billion, Jyoti Bansal launched a VC firm and two high-value startups. Why?

Consumers were deprived of rare bourbons, including Pappy Van Winkle’s 23-year-old whiskey, by alcohol overseers

Ex-Peloton director says disclosing pregnancy killed job prospects: ‘100% of the companies I told went from scheduling interviews to declining to bring me in for a final round’

Inflation, Passwords and TikTok: The Real Threats to the Future of Netflix and Streaming

T he pandemic sparked a boom for video streaming services like Netflix, Disney+, and Peacock. In 2020 and 2021, Netflix added 54.6 million subscribers , many of them in the frightening, isolating six months after the world locked down and people sought entertainment in the safety of their homes. Now, that unprecedented wave of growth may be hitting its limits, as the company lost subscribers for the first time in its history, cut around 25 people from its marketing staff, and has begun piloting ways to crack down on sharing passwords .

Netflix’s losses weren’t simply theirs to bear. In the aftermath of Netflix’s results, other streaming services have taken a hit—Disney, Paramount, and Warner Bros. Discovery, all of which run streaming services, saw their stock price drop as well. The same week that Netflix cut some of its marketing team, CNN+, the news service’s foray into streaming, shuttered.

It all raises the question: Was the pandemic peak streaming, and we’re now on a perpetual downward slope? On the heels of its April 19 letter to shareholders—where Netflix said it lost 200,000 subscribers instead of growing by millions as expected—the company lost $60 billion in market capitalization in just over a week. Netflix says it already expects to lose a further two million subscribers in the second quarter of 2022.

“In 2020, people were locked at home and you couldn’t do anything but watch TV,” says Maria Rua Aguete, senior director of media and entertainment at London-based consultancy Omdia, which regularly analyzes the state of the streaming market. “It’s only natural to go down after a boom.”

The next question, then, is how streaming services will find their new normal, as user demographics change and the cost of basic needs continues to rise.

Streaming is competing with YouTube and TikTok

It’s not just that pandemic viewing habits may be reverting. For one thing, viewers may be overwhelmed and exhausted by the plethora of services available, according to a Nielsen study—which found nearly half of users felt that way, even if they generally like the ability to watch streaming video.

“The number of video streaming services in the U.S. has reached a ceiling,” says Rua Aguete.

At the same time, there’s a potential generational shift.

“If there is a reckoning coming, it’s because all emerging data suggests millennials and Gen Z are not only less interested in streaming TV and film than the previous generation, they are also consuming more content on YouTube and TikTok,” says Andrew A. Rosen, founder of streaming service analyst PARQOR, and a former Viacom executive.

This issue was also noticed by consulting firm Deloitte , in its 2022 digital media trends survey. And for the first time, the most avid users of Netflix are likely to be those aged 24 to 44 in some markets , rather than those aged 18 to 24, according to research firm Ampere.

The cost of living is going up

If Netflix broadens some of its account-sharing restrictions, it may be particularly hard on younger people who are used to sharing Netflix passwords . But it’s not just younger generations—cost of living increases are squeezing users of all ages.

“With gas and electricity bills going up massively, you almost worry about switching the TV on at all,” says Emma Heath, 52, of Northampton, England, who recently cancelled Netflix, along with her satellite TV. United States inflation has hit a 40-year high , while the U.K. is doing little better, with inflation at a 30-year peak .

Rua Aguete says: “Inflation is going up, the cost of living is going up. If in 2020, we took six or seven services, do we need them all now?”

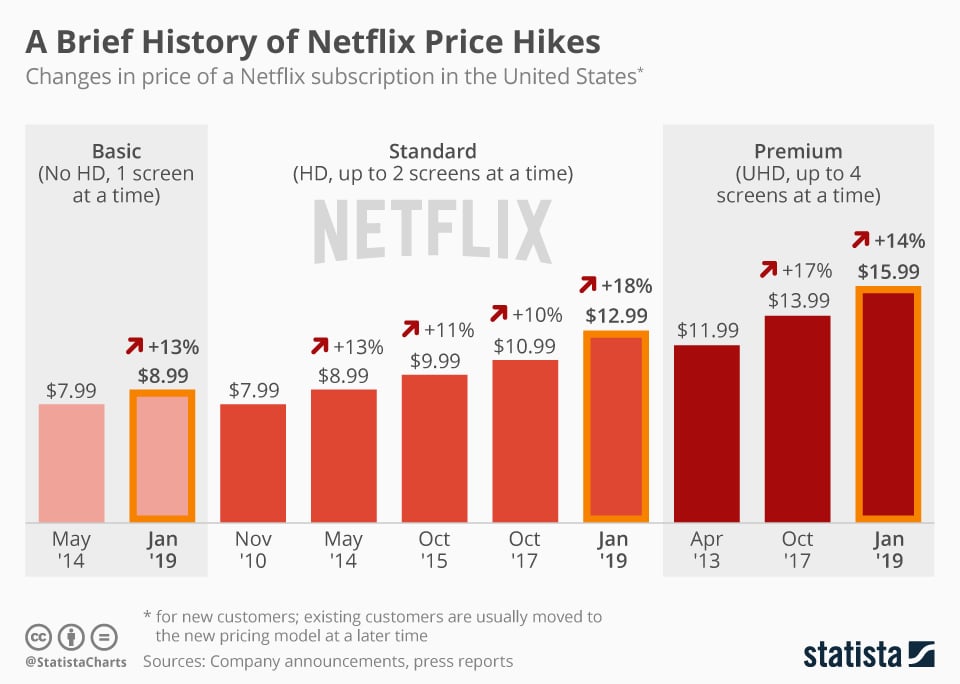

As consumers grapple with higher costs for basics like food and fuel, services like Netflix are hiking prices. In January, Netflix told U.S. consumers that its standard two-screen service would rise to $15.49—the second price increase in two years . A similar increase in the U.K. followed shortly thereafter. Nearly four in 10 U.K. households say they plan to cancel a paid streaming video service, according to research by Kantar .

These factors may add up to troubling news for streaming services trying to stand out among the crowd. Netflix rose to prominence by doing just that—with original hit shows like Orange Is The New Black , delivered ad-free. But now, Rosen says, the landscape has changed.

“To date, Netflix has driven a tightly constructed narrative around a subscription model only, and the objective of ‘we want to entertain the world’,” says Rosen. “Until the past two quarters, it has defied market concerns for its billions in debt that funded the content spending to pursue that objective.”

Netflix could not be reached for comment.

What’s next for Netflix and streaming

Netflix has said it’s looking at an ad-supported tier that would cost less. “Think of us as quite open to offering even lower prices with advertising as a consumer choice,” Netflix co-founder Reed Hastings said on a conference call with analysts after the results were announced, though there was no formal indication in the shareholder’s letter that the company would be pursuing an ad-supported model.

Should it decide to do so, Netflix would be following in the footsteps of many competitors who have introduced similar lower price points for consumers worried about cash. It’s not all bad news, either: according to Omdia’s analysis, Hulu and Peacock have each managed to increase and maintain their average revenue per user by introducing a half-price, ad-supported option.

Still, Rua Aguete doesn’t believe Netflix is losing its prominent place in the industry any time soon. In the Asia-Pacific region, Netflix posted subscriber gains that helped offset losses in the United States, Canada, and Europe. While the company’s first quarter results were disappointing, and may signal the tide turning, they weren’t necessarily terminal. “It’s challenging times,” says Rua Aguete. “Things are not fantastic around the world, but yes, there is still growth in some countries.”

More Must-Reads From TIME

- Putin’s Enemies Are Struggling to Unite

- Women Say They Were Pressured Into Long-Term Birth Control

- What Student Photojournalists Saw at the Campus Protests

- Scientists Are Finding Out Just How Toxic Your Stuff Is

- Boredom Makes Us Human

- John Mulaney Has What Late Night Needs

- The 100 Most Influential People of 2024

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at [email protected]

Netflix’s Future:

Netflix Plans to Offer Video Games in Push Beyond Films, TV

- Company hires veteran of Facebook and EA to lead gaming effort

- Service will add games to streaming platform in the next year

Netflix Inc. , marking its first big move beyond TV shows and films, is planning an expansion into video games and has hired a former Electronic Arts Inc. and Facebook Inc. executive to lead the effort.

Mike Verdu will join Netflix as vice president of game development, reporting to Chief Operating Officer Greg Peters , the company said on Wednesday. Verdu was previously Facebook’s vice president in charge of working with developers to bring games and other content to Oculus virtual-reality headsets.

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The Best Way for Netflix to Keep Growing

- Andrei Hagiu

Allowing third-party content could lead to new forms of revenue and new subscribers.

Netflix’s model has been undeniably successful to date. However, fighting the blockbuster content-acquisition and creation battle is becoming ever more expensive, and it involves an increasing number of combatants. Furthermore, the growth of Netflix’s subscriber base is slowing down. Netflix can and should become a platform. Why? Its big subscriber base (130 million worldwide) and content-delivery infrastructure are potentially very attractive to many third parties, including video content providers, developers of cloud gaming, and marketers. How would it become a platform? Simply by allowing these third parties to sell their products or services within Netflix’s service but outside Netflix’s subscription, on terms controlled by the third parties.

Netflix has a lot to gain by becoming a multisided platform.

- Andrei Hagiu is an associate professor of information systems at Boston University’s Questrom School of Business. theplatformguy

Partner Center

- Search 54198

- Search 30561

- Search 19261

Netflix Business Model (2023) | How does Netflix make money

Last Updated: Feb 3, 2023

Company: Netflix, Inc. Co-CEO: Ted Sarandos & Greg Peters Year founded: 1997 Headquarter: Los Gatos, USA Type: Public Ticker Symbol: NFLX (NASDAQ) Market Cap (Feb 2023): $ 162.95 Billion Annual Revenue(FY22): $ 31.6 Billion Profit |Net income (FY22): $ 4.49 Billion

Products & Services: Netflix Official Website | Monthly Subscription Plans | Video Recommendation-Algorithm System Offerings Streaming Options Domestic (featured tool) | International Streaming Options and Features Competitors: Amazon Prime Video | HULU | YouTube | Direct TV | Sony PlayStation’s Vue | HBO | Sling TV | HotStar | Disney + | Apple TV+

Table of Contents

Introduction to Netflix, Inc.

Netflix, Inc . happens to be one of the most successful entertainment mass-media-companies of all times. Netflix, Inc. originally began its inception in 1998 by providing services to customers through means of mailing out physical copies of movies, shows, video games and other forms of media through standard mailing system.

Through its successful startup and the rapid changes that technology introduced over time, Netflix converted its business model . They went from physical copies handouts to allowing customers streaming their favorite contents from the comfort of their own convenience.

Today, the platform has advanced to streaming technologies that have elevated and improved Netflix’s overall business structure and revenue. The platform provides its viewers the ability to stream and watch a variety of TV shows, movies, documentaries and much more, through means of using a software application.

Since Netflix converted to streaming, it is the world’s ninth-largest internet company by revenue , ranging its presence at a global scale. The following is a compilation that comprises specifications of Netflix’s business canvas model and its core operations.

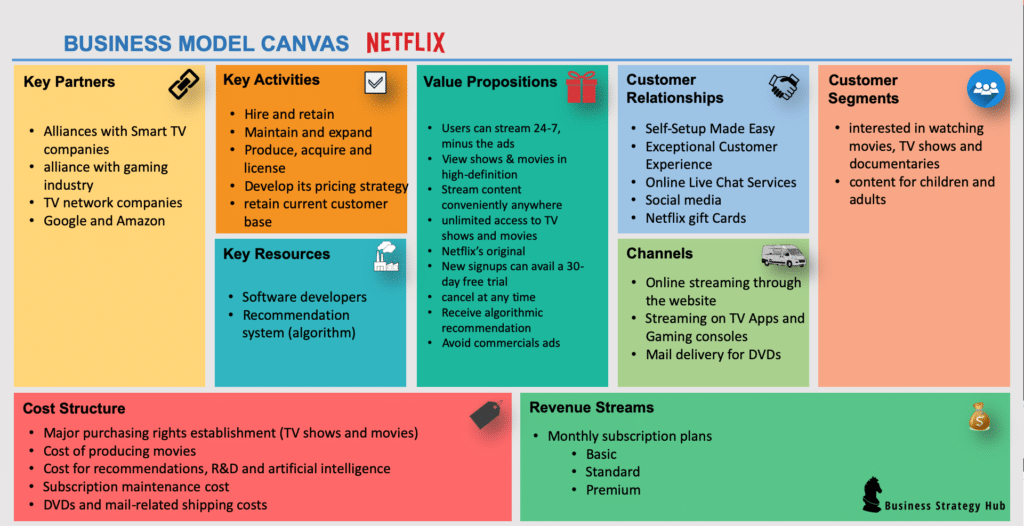

Business Model Canvas of Netflix

1. Netflix’s Key Partners

Netflix has built more than 35+ partners across the media business. Netflix today has millions of different types of genres for subscribers to select from and enjoy watching.

- Built alliances with Smart TV companies like LG and Sony for new emerging markets and several other aspects.

- Netflix has set an alliance with Wii , X-Box , PlayStation and many other brands in the gaming industry. Netflix built partnerships to provide and cater its “ gamer-clients ” with an entertainment video game.

- Netflix joined forces and partnered with Dish, Tivo and other TV network companies.

- Netflix crucial phase of converting the business from mail-in-system to streaming, Netflix established a partnership with Apple , Android, and Microsoft .

- Finally, Netflix joined the network and big data providers like Google and Amazon . (Amazon was accompanied to promote Netflix listings and subscription options)

- Netflix recently partnered with Samsung to further integrate its streaming service with Galaxy smartphones. In exchange, Samsung users will benefit from Netflix’s original shows and special bonus content.

- To expand in West Africa more aggressively, Netflix partnered with Nigerian filmmaker Mo Abudu , the owner of Ebony Life TV. This partnership will enable Netflix to create new content targeting consumers in West African nations.

2. Netflix’s Value Propositions

Netflix strategizes methods and aims to provide the best customer experience by deploying valuable propositions.

Here are a few of what Netflix idolizes:

- Users can stream 24-7, minus the ads !

- View shows & movies in high-definition

- Stream content conveniently anywhere without going to a DVD store or theatre

- Get unlimited access to TV shows and movies

- Access to exclusive Netflix’s original movies or shows

- New signups can avail a 30-day free trial ( 1 month free of services )

- Contract-oriented but can cancel at any time !

- Access locally-produced and culturally-relevant content

- Receive algorithmic recommendation for new items to watch

- Avoid commercials ads- Some people like looking at commercials and other advertisements and some people avoid them.

- At Netflix, users have the flexibility to either turn on notifications and suggestions or keep them switched off.

- Netflix “ user profiles ” gives leverage for users to personalize their user account and preferences. The User profiles allow the “admin-user” to modify, allow or ever restrict certain users

- Sharing accounts options is one of the rarest features a movie platform can provide. Sharing accounts feature on Netflix allows spouses, friends or even groups to share an account with specific filters and preferences already set.

- Netflix solves the issues with theaters and mainstream media that frustrated most consumers. The company promises to solve the problems of its target with four simple words – Watch Anywhere. Cancel Anytime .

3. Netflix’s Key Activities

- Hire and retain software and tech geeks

- Maintain and expand its platform on the website, Mobile apps, TV apps.

- Produce, acquire and license Netflix’s original content to expand its video library

- Develop its pricing strategy and subscription model to ensure affordability and new customer acquisition.

- Develop a roadmap to enter into the new market .

- Ensure great user recommendation to retain current customer base.

- Build and secure a partnership with Studios and content production house

- Negotiate the deals with Studios, Content providers and Movie production houses

- Comply with the laws (laws as per to State or Region/country), maintaining compliance to censorship , specifically for minors and children. Netflix has always promoted and operated within the boundaries of censorship.

- Supporting disadvantaged communities and other ideological issues that are important to its customers.

- Building local communities and economies that support the development of its local original content .

4. Netflix’s Customer Segments

- The Netflix platform is designed to offer a vast collection of different types of genres for subscribers to select from. Their collection (movies or shows) are designed appropriately for

- Everyone, who is interested in watching movies, TV shows and documentaries – and honestly who isn’t?

- Although Netflix offers content for children and adults alike, Netflix aims to promote Family-friendly , educational and entertaining content to help capture the better interests of families.

5. Netflix’s Customer Relationships

Self-setup made easy.

- Netflix platform was originally designed to ensure that it is simple and easy to use.

- Developers of the Website ensured to associate elements and themes that serves and promotes friendliness and provides a self-setup

Exceptional Customer Experience

- Netflix provides customer services through means of the website portal, email inquiries and users have the option to reach a representative directly, by telephone and live chat.

Online Live Chat Services

- Users have the option to opt-in to a live chat session with a Netflix representative.

- Users can directly chat with a Netflix representative to ask questions and support related inquiries.

- Request for discounts and other special promotional deals that they may qualify or offer such user or subscriber.

Social media

- Channeling major advertisements, deals, and other promotional deals through Social media channels and other relative platforms to help gain the high attraction of customer and new sign up users conversions.

- Social media is also used to inform and update individuals that operate or are familiar with the Netflix platform. Such platforms may include Facebook , LinkedIn , Instagram, Twitter , Snapchat etc.

Netflix gift Cards

- Part of the subscription plan, all users will be geared to receive special promotional discounts and other gift cards to avail.

6. Netflix’s Key Resources

Software developers.

- Software developers at Netflix are at constant innovation

- Design and enhance to help create a better customer-user experience

Recommendation system (algorithm)

- Artificial intelligence and selection preference sequence technology helps developers design and build the recommendation algorithm system for its users.

- Some data are based on “new releases,” or internal data that identifies user watch selection and the most viewed.

- Provides users with relative results based off of frequent searches

7. Netflix’s Channels

Through Netflix’s channeling sequence, users and interested users can access Netflix platform from one or more of the following;

- Online streaming through the website

- Streaming through Mobile apps

- Streaming on TV Apps and Gaming consoles

- Mail delivery for DVDs

8. Netflix’s Cost Structure

- Major purchasing rights establishment (TV shows and movies)

- Cost of producing movies

- Cost for providing personalized recommendations, R&D and artificial intelligence

- Subscription maintenance cost

- Paid-Connection deal with Internet Service Provider (ISP) such as Comcast to stream Netflix data at high speed.

- Infrastructure (data centers) cost of streaming content

- DVDs and mail-related shipping costs

- Employee salary distribution (customer service, Engineers, etc.)

9. Netflix’s Revenue Streams

It wasn’t until 2007, when Netflix launched “streaming” services through Netflix subscription plans , that it attained significant revenue streams and additional revenues.

- Monthly subscriptions fees with three different price options In US market (Basic – $8.99/month, Standard – $12.99/ month & Premium – $15.99/ month)

- Netflix has established a global presence with international streaming to expand its customer base.

- Upselling opportunities – Upgrade from Basic to Premium Plan etc.

- Money-making movie studio with Netflix original shows like fuller house, house of cards, etc.

How does Netflix Make Money?

Netflix was a platform which started as only offering an extensive collection of movies, shows and dramas (925 listings) through the mail-in-delivery system . It wasn’t till 2007 when Netflix has decided to convert their business structure from mail-in-system to streaming content based on subscriptions. Before launching online streaming in 2007, Netflix revenue on average summed at annually at around $997 million .

Subscription-based Business Model

- Netflix has over 230 million members from over 190 countries (as of Dec 2022)

- In fiscal year 2022, Netflix generated $31.6 billion annual revenue from both the United States and international regions.

Important partnerships

- One of the most influential tactics implemented was its ability to build alliances with a wide range of movie producers, filmmakers , writer, and animators to receive content and legally broadcasting the contents required aligning licenses.

- To make the Netflix platform and its streaming possible, setting the partnership between Internet Service provider was also crucially important.

Technology ( Monolithic architecture )

- Technology platforms allowed “streaming” accessibility to become convenient and unique and during their conversion year in 2007, not a lot of media companies offered such, which made the platform greatly attractive.

During the early year in 2000, Blockbuster was offered to purchase Netflix and all of its assets for only $50 million .

As of feb 2023, Netflix is worth $163 Billion in market cap value. Perhaps, it isn’t really about what a company sells, rather, it’s about how a company sells or promotes its products.

Through Netflix’s powerful technological tactics, innovating the accessibilities has helped to increase customer/user experience positively. Netflix implemented in several areas that helped to capture the global market.

References & more information

- Netflix Annual Report

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

A management consultant and entrepreneur. S.K. Gupta understands how to create and implement business strategies. He is passionate about analyzing and writing about businesses.

11 comments

Cancel reply.

Informative article, exactly what I needed.

Informative article!

Thanks Umar, Happy reading !

Disney+ next?:)

really a good one

Thanks Luca !

Yes, artical was very informative. Thank you.

Kirby – Thank you for the great feedback, really appreciate it. Happy reading !!!

excellent insight

Great article! Where can I find the list of sources you used? Thank you!

The Primary source of the article is Netflix’s Annual report – you can find the link in the reference section. And for secondary sources, links are embedded within the article.

You may also like

How Does Snapchat Make Money?

Company: Snapchat CEO: Evan Spiegel Year founded: 2011 Headquarter: Santa Monica, California, USA Number of Employees (Dec 2018): 2884 Public or Private: Public Ticker Symbol: SNAP Market Cap (April...

20 Most Unique Business Models

Every company follows a certain business model. The growth and success of a company are based on the business model it follows. Therefore, it is essential for a business model to be diverse and adaptable. However, there...

Paytm Business Model (2022)| How does Paytm make money

Last updated: Oct 29, 2021 Company: Paytm CEO: Varun Sridhar Founder: Vijay Shekhar Sharma Year founded: 2010 Headquarter: Noida, Uttar Pradesh, India Valuation (2020): $19 Billion Annual...

Zomato Business Model | How does Zomato make money?

Company: Zomato Founder & CEO: Steve Easterbrook Year founded: 2008 Headquarter: Gurgaon, Haryana, India. Number of Employees (2019): 5000+ Type: Private Monthly Active Users (2019): 70Million+...

Walmart Business Model | How does Walmart Make Money ?

Company: Walmart Inc. (NYSE: WMT) Founders: Sam Walton Year founded: 1962 CEO: Doug McMillan Headquarter: Bentonville, Arkansas Number of Employees (2023): 2.1 million Type: Public Market Capitalization (July...

ALDI Business Model | How Does ALDI make money?

Grocery stores are a staple of the American economy and raked in over $848.4 billion in sales last year alone. Interestingly, this sector is domineered by international supermarket chains, like ALDI, instead of...

Disney’s Business Model | How does Disney make money?

Disney is a world-renowned brand and requires no introduction. This company is an indispensable part of an individual’s life through its TV programs, theme parks, movies, games, and music. However, it is interesting to...

How Does Turnitin Work & Make Money

Last updated: May 30, 2020 Company: Turnitin CEO: Chris Caren Founders: John Barrie Year founded: 1998 Headquarter: Oakland, California, USA Employees: Est. 417 Type: Private Annual...

Amazon Business Model | How does Amazon make money

Last updated: Feb 13, 2021 Company : Amazon CEO : Andrew Jassy Year founded : 1994 Headquarter : Seattle, Washington United States Business world has never been the same since the inception of...

How Does Zillow Make Money?

Company: Zillow Group Founders: Rich Barton & Lloyd Frink (former Microsoft executives) CEO: Spencer Rascoff Year founded: 2006 Headquarter: Seattle, Washington Industry: Online real estate marketplace Number...

Recent Posts

- Who Owns Westin Hotels & Resorts?

- Who Owns Truist Bank?

- Who Owns Alfa Romeo?

- Who Owns Burt’s Bees?

- Top 15 Ruggable Competitors and Alternatives

- Top 15 Ticketmaster Competitors and Alternatives

- Who owns Kidz Bop?

- Top 20 Zapier Competitors and Alternatives

- Top 15 Boxabl Competitors and Alternatives

- Who Owns High Noon?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Netflix Business Strategy

Netflix’s business strategy revolves around content acquisition, including licensing agreements and original production, coupled with a personalized user experience and global expansion. They leverage advanced streaming technology, cloud infrastructure, and data analytics to optimize content delivery. Their strategy focuses on offering a wide variety of high-quality entertainment to a global audience through a user-friendly platform.

More on Netflix Business Model

- Netflix Business Model

Binge-Watching

Coopetition

Platform Expansion Theory

Netflix SWOT Analysis

Is Netflix Profitable

Who Owns Netflix?

Netflix Employees

Netflix Subscribers

Netflix Revenue

Netflix Yearly Average Revenue

Netflix Average Monthly Revenue Breakdown

Netflix Revenue By Country

Netflix Subscribers Per Region

Disney vs. Netflix

Read Also: Netflix Business Model , Netflix Content Strategy , Netflix SWOT Analysis , Coopetition , Is Netflix Profitable .

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Amazon Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Uber Business Model

'ZDNET Recommends': What exactly does it mean?

ZDNET's recommendations are based on many hours of testing, research, and comparison shopping. We gather data from the best available sources, including vendor and retailer listings as well as other relevant and independent reviews sites. And we pore over customer reviews to find out what matters to real people who already own and use the products and services we’re assessing.

When you click through from our site to a retailer and buy a product or service, we may earn affiliate commissions. This helps support our work, but does not affect what we cover or how, and it does not affect the price you pay. Neither ZDNET nor the author are compensated for these independent reviews. Indeed, we follow strict guidelines that ensure our editorial content is never influenced by advertisers.

ZDNET's editorial team writes on behalf of you, our reader. Our goal is to deliver the most accurate information and the most knowledgeable advice possible in order to help you make smarter buying decisions on tech gear and a wide array of products and services. Our editors thoroughly review and fact-check every article to ensure that our content meets the highest standards. If we have made an error or published misleading information, we will correct or clarify the article. If you see inaccuracies in our content, please report the mistake via this form .

Netflix is phasing out its most popular plan. Here's what you need to know

If you're a Netflix customer, there's a good chance your subscription will be changing soon. The company announced yesterday in a letter to shareholders that its most popular plan-- $11.99 a month for no ads -- is going away for good.

US customers haven't been able to sign up for the plan since last summer , instead having to choose a more expensive plan if they wanted to go commercial-free. But now existing subscribers are getting cut off too.

Also: The best live TV streaming services of 2024

The changes will start, the company said, in the UK and Canada, and would happen sometime in the second quarter. Netflix didn't say what countries would be next, or when they would be cut off, only that it would be "taking it from there."

When the changes take effect, the only remaining plans are the ad-supported $7/month plan , the standard ad-free plan at $15.50/month , and premium, which adds 4K streaming , spatial audio, offline content, and two extra members outside the household, for $23 a month .

So for customers currently on the basic $11.99 a month plan, this is essentially a 30% price increase.

If you want to add an extra person outside the house to any of those plans, it's another $8.

Also: 6 ways to save money on TV streaming without losing the shows you love

The move comes as Netflix subscriptions are soaring in the wake of last year's password-sharing crackdown . While many people predicted this would be the beginning of the end for the streaming giant, new subscriptions soared .

While streaming without ads has been a staple of the service for many years, it seems people are actually becoming okay with sitting through some advertisements, as the company notes that the ad-supported plan accounts for 40% of all new Netflix signups and the number of subscribers for ad-supported tiers grew nearly 70% quarter-over-quarter.

The best VPN for streaming: Expert tested

Comcast unveils contract-free internet plans, starting at $30 a month - is there a catch, the best live tv streaming services for cord cutters: expert tested.

How much is Netflix in 2024? A breakdown of the monthly prices for every subscription plan

With a vast library of TV shows, movies, and original programming, Netflix is one of our picks for the best streaming services you can sign up for. But like its competitors, the price of Netflix varies depending on which subscription tier and features you choose.

Netflix pricing starts at $7 a month, but following a Netflix price hike in October 2023, you now have to pay $23 a month to get the best video quality without ads. And due to Netflix's recent crackdown on password sharing , it now costs an additional $8 a month to add an extra user to your account in the US. The fee will only apply to users who live outside of an account holder's household.

To help you decide which Netflix plan is right for you, we've put together a guide detailing how much Netflix charges for each of its membership tiers, along with details on each plan's features.

How much Netflix costs a month

In the US, Netflix currently offers three streaming plans: Standard with Ads, Standard, and Premium, ranging from $7 to $23 monthly.

It also costs more to add another user to a subscription plan. Standard and Premium subscriptions are the only plans that offer extra member additions. Standard allows one extra member slot for $8 a month. Premium offers up to two extra member slots for $8 each monthly.

Here's a breakdown of Netflix prices for each plan.

- Main content

More From Forbes

Building future leaders: proactive strategies for talent development.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Stephen Nalley is the Founder & CEO of Black Briar Advisors .

In the rapidly evolving modern workplace, the ability to identify and cultivate talent within an organization is not just an advantage; it's a necessity. I believe companies that excel in recognizing and nurturing potential leaders are more likely to innovate, adapt and thrive. At my firm, we've seen firsthand how recognizing and nurturing potential leaders fosters innovation and adaptability. By investing in our team's growth, we not only enhance individual careers but also drive our company's success, ensuring we stay ahead in a competitive market.

Guiding promising employees into leadership roles requires a strategic approach—one that involves early identification, tailored development programs and continuous support. Here are some strategies and examples to consider.

Implementing Comprehensive Talent Identification Programs

Organizations should start with robust talent identification programs that go beyond traditional performance evaluations. These programs can include assessments that measure not just current performance but also potential, including leadership competencies like emotional intelligence, decision-making capabilities, and the ability to inspire and motivate others.

Example: A tech company might use 360-degree feedback mechanisms to gather insights about employees from peers, subordinates and supervisors. Coupled with leadership potential assessments, this approach can provide a well-rounded view of which employees have the attributes that align with the company’s leadership criteria.

Northern Lights Could Show Up Yet Again Tonight Here s An Updated Aurora Borealis Forecast

Michael cohen testifies: ex-trump fixer confirms he called trump ‘cheeto-dusted cartoon villain’ in fiery cross-examination, ios 17 5 apple issues update now warning to all iphone users, creating tailored development plans.

Once potential leaders are identified, the next step is to create development plans that are tailored to the individual's strengths, weaknesses and career aspirations. This can include a mix of on-the-job training, mentorship programs and formal education such as leadership courses or workshops.

Example: If you discover an employee who excels in strategic thinking but needs improvement in public speaking, you can then tailor a development plan that includes public speaking workshops, leadership role shadowing and leading smaller project teams as a way to build these skills in a supportive environment.

Fostering A Culture Of Continuous Learning

A culture that values and encourages continuous learning is essential for nurturing future leaders. Organizations should provide ample opportunities for employees to learn and grow, both in their areas of expertise and in general leadership skills. At Black Briar Advisors, we support continuous learning by funding certifications and offering access to online classes. This empowers our team to advance their expertise and leadership skills. Additionally, we host regular learning workshops to encourage a culture of growth and innovation.

Example: An international consulting firm could establish a "leadership library" filled with resources on leadership development, offer subscriptions to relevant online courses, and organize regular leadership seminars led by external experts or in-house leaders.

Establishing Mentoring And Coaching Relationships

Mentorship and coaching are crucial for personal and professional growth. Pairing promising employees with experienced leaders within the organization can provide them with valuable insights, guidance and feedback.

Example: My firm will sometimes implement a mentorship program where high-potential employees are paired with senior executives. These relationships involve regular meetings to discuss career development, challenges and strategies for effective leadership within the organization.

Providing Leadership Opportunities

Practical experience is often the best teacher. Giving promising employees the chance to lead projects or initiatives allows them to develop and showcase their leadership skills.

Example: A software development company could allow an employee showing leadership potential to lead a critical software release, giving them full responsibility for the project's success under the supervision of a department head or team lead. Experiences like these can be instrumental in developing project management, team leadership and stakeholder communication skills.

Encouraging Cross-Functional Collaboration

Exposure to different parts of the business can provide employees with a broader perspective and deeper understanding of the organization's challenges and opportunities. Encouraging cross-functional collaboration and roles can help in developing versatile leaders.

Example: A manufacturing company might create cross-functional teams tasked with improving the efficiency of the production line, including employees from operations, finance and human resources. Leading such a team can help potential leaders understand various aspects of the business and develop holistic problem-solving skills.

Offering Support And Recognition

Recognizing and supporting emerging leaders is critical to their development. Regular feedback, recognition of achievements and support in overcoming challenges can reinforce their growth path and motivation.

Example: My firm has an annual "Emerging Leaders" award that recognizes individuals who have demonstrated significant growth and potential in leadership roles. We have found that this not only provides recognition but also motivates others within the organization to strive for excellence.

Stepping promising employees up into leadership roles is a strategic imperative that requires a thoughtful and multifaceted approach. By identifying talent early, creating tailored development opportunities, fostering a culture of learning, establishing mentoring relationships, providing practical leadership experiences, encouraging cross-functional collaboration and offering ongoing support and recognition, organizations can build a strong pipeline of future leaders. These proactive strategies can help companies ensure their leadership ranks are always rejuvenated, keeping the organization resilient and forward-moving in an ever-changing business environment.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

Money blog: Burberry suffers big profits fall; Vinted forced to apologise to sellers

Taylor Swift is coming to the UK - and bringing her massive economic influence with her. Read this and all the latest consumer and personal finance news in the Money blog - and watch Business Live With Ian King by pressing play below.

Wednesday 15 May 2024 11:31, UK

Please use Chrome browser for a more accessible video player

- Burberry suffers massive profits fall as figures 'leave a lot to be desired'

- Vinted forced to apologise to sellers for payment issues

- Taylor Swift to bring nearly £1bn boost to economy

- Michelin-star chef reveals his top Cheap Eats in London - including an unbeatable sub sandwich

Essential reads

- The 'fast food' trend hitting Michelin starred restaurants

- Basically... What is PIP - and what could government changes mean?

- How to make sure your car passes its MOT

- 'Loud budgeting': The money-saving trend that has nothing to do with giving up your daily coffee

- Money Problem: My workplace wants to pay us by the minute - what can I do?

- Best of the Money blog - an archive

The chairman and chief executive of JP Morgan has told Sky News he is confident the UK economy will be in safe hands "whoever wins" the election.

Jamie Dimon told Sky's Wilfred Frost that he had met with both Rishi Sunak and Sir Keir Starmer and liked that they were both "pro-business".

"Growing the economy is a good thing, and that should benefit everybody," he said.

"Everyone I heard in the Labour and Conservative government are talking about growing the economy, technology, research and development, simplifying regulations and making it easier for people to start and grow businesses.

"Those policies work."

Asked if he was confident the UK economy would be in safe hands no matter who won the election, he replied: "Yeah, I certainly hope so, and we would help whoever wins."

Mr Dimon also said the world "had been through a difficult and weird time".

On the UK specifically, he said: "It's a great country and partner and friend of America."

He said he was "optimistic" about the UK, and said the government should keep investing in "education, work skills and technology".

By James Sillars , business news reporter

A solid start to the day for the FTSE 100 despite one of its well known constituents posting a big drop in profits.

The index rose by 0.5% in early dealing to stand at 8,469.

Leading the gainers were industrial and mining stocks.

Among the big names reporting its progress this morning was Burberry.

Its annual results to the end of March showed a 34% fall in operating profits as demand for luxury slowed in the second half.

The company's chief executive, who is in the process of taking the firm more upmarket, said he expected the current year to remain challenging but with a pick-up in sales weighted to the final six months.

Burberry, nevertheless, awarded a 61p per share dividend which was flat on the previous financial year.

Its shares were down by more than 3%.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said: "Burberry's latest figures leave a lot to be desired, amid slowing demand for luxury... Not only does this highlight the extent of consumer caution across the globe, it also puts a spotlight on some Burberry-specific issues.

"Refreshing the store estate is all well and good, but only if those costs and charges can be recouped by selling the clothes they hold. While Burberry's brand repositioning has come a long way, it’s not yet sharp enough to slice through to the core of the even more resilient end of the luxury market."

She added: "Slowing trends are being seen across the board in the sector, so these weaker results aren't a total bolt from the blue. The question now will be how quickly demand picks up, and that of course is in the hands of the economy... Burberry faces challenges, but it remains a strong heritage brand, with a lot of the right strategic ideas."

Taylor Swift's Eras Tour has been predicted to provide a £997m boost to the UK economy.

Fans are expected to fork out an average of £848 to see the star on one of her 15 tour dates.

That's according to data from Barclays, which has added up the total spending of the Swifties lucky enough to get a ticket.

After tickets, fans will spend the most on accommodation at around £121, with other notable costs including £111 on travel and £56 on an outfit.

Those visiting London, Liverpool, Edinburgh and Cardiff for the concert are expected to spend £79 each on official merchandise, as well as £59 on a pre-show meal.

The average amount spent on an Eras Tour ticket is £206, yet for 14% of fans, including those who purchased VIP ticket packages with premium seating and exclusive merchandise, the total exceeds £400.

Dr Peter Brooks, chief behavioural scientist at Barclays, said fans of "cultural icons" like Swift have a "powerful" spending power.

"Whoever came up with the phrase 'money can't buy happiness' clearly wasn't a Swiftie," he said.

"When it comes to cultural icons like Taylor Swift - like we saw with Elvis and Beatlemania in the 50s and 60s - supporters have such a strong connection to the artist and to the rest of the fandom that the desire to spend becomes even more powerful.

"For non-fans, £848 may seem like an enormous amount to splash out on a concert - but for Eras Tour ticketholders, every pound they spend is an investment in the memories they'll create."

Every Wednesday we get Michelin chefs to pick their favourite Cheap Eats where they live and when they cook at home. This week we speak to Andy Beynon, chef patron of Behind in London - which was awarded a Michelin star after being open for just 20 days.

Hi Andy, c an you tell us your favourite places in London where you can get a meal for two for less than £40?

I love Lahore Kebab House in Whitechapel. It's family run and I've been going there for about 15 years. I used to go with my dad - we'd get a couple of lagers from the shop next door, then tuck into lamb chops, tarka daal, the Peshwari naan, which is always cooked fresh on the tandoor, and all the dips on the menu.

You can't beat a "That Spicy D" from Dom's Subs . There's just something about that burnt chilli mayo and schiacciata piccante. It's my favourite lunch to have on the go, and totally worth the mess.

Umut 2000 in Dalston is my go-to for a kebab fix. They also do this amazing chargrilled lamb mince on a bed of tomato sauce with yoghurt and clarified butter. So good.

What's your go-to cheap meal at home?

I don't cook at home often, but when I do it's usually a big pot of spicy daal. It's super easy to make and keeps well in the fridge or the freezer. My secret ingredient for making the perfect daal is condensed milk - simply add a spoonful at the end to balance all of the spice.

We've spoken to lots of top chefs and bloggers - check out their cheap eats from around the country here...

Vinted has apologised for a tech issue that has left its sellers facing long delays to withdraw their cash.

Users have been complaining over the past few weeks about their balance not updating quickly enough after being told they had been paid...

We reached out to platform about the issue - it said its payment service provider Mangopay was aware of the problem and was "in the process of resolving" affected cases.

It said a "very small number" of Vinted members have experienced an issue with funds being received by banks after payouts had been initiated.