Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

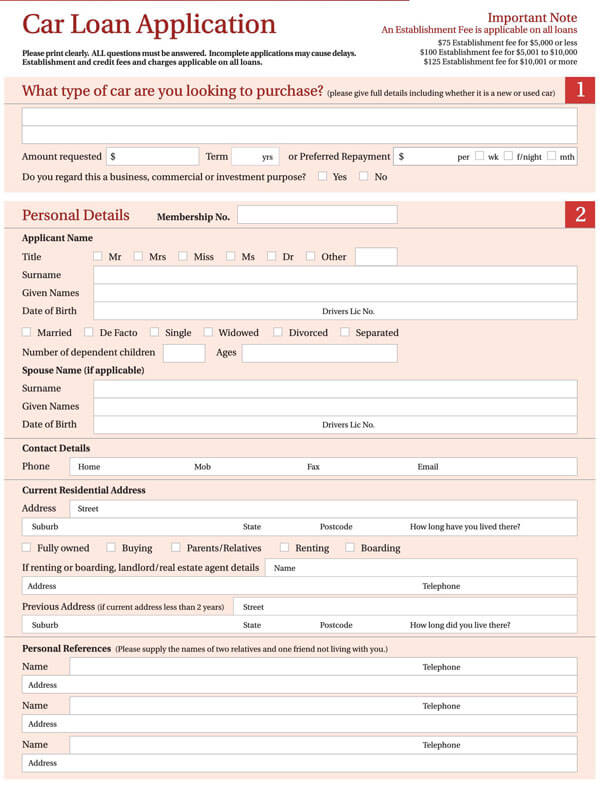

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

All Formats

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

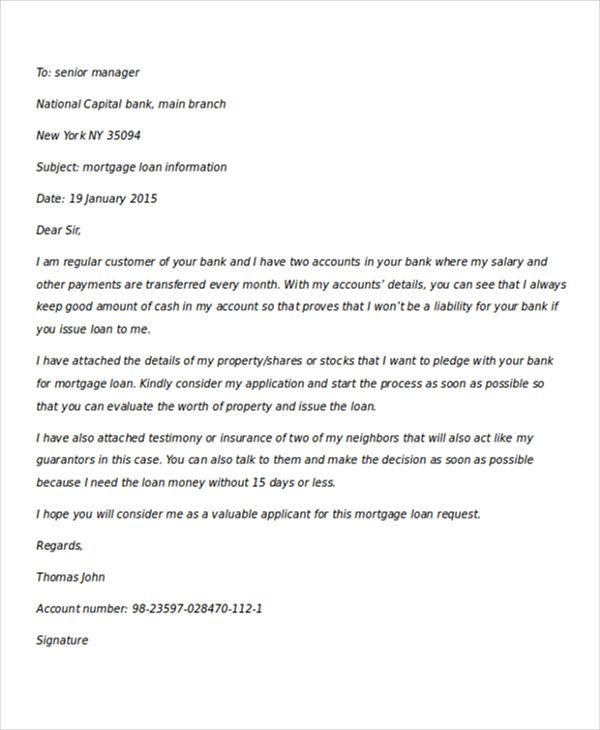

Formal Loan Purpose Application Letter to Senior Manager

Formal Event Management Small Business Letter

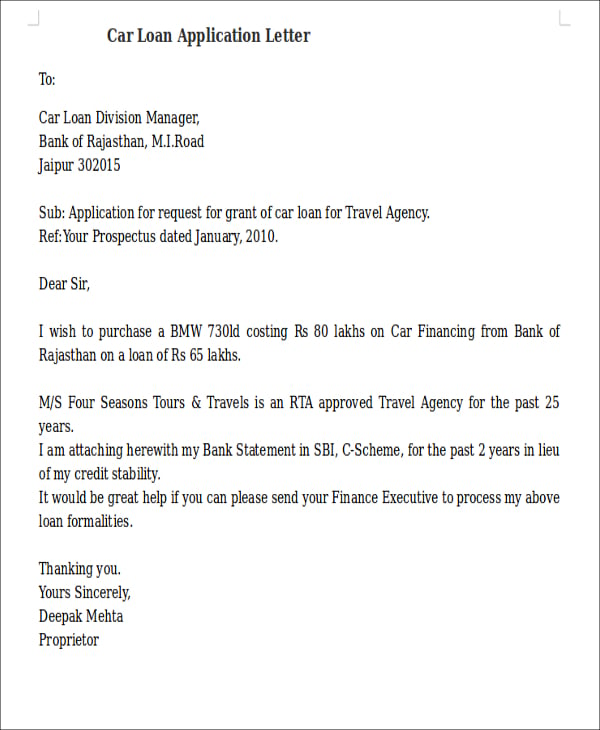

Sample Vehicle Application Letter Example

Agricultural Office Vehicle Application Letter Template

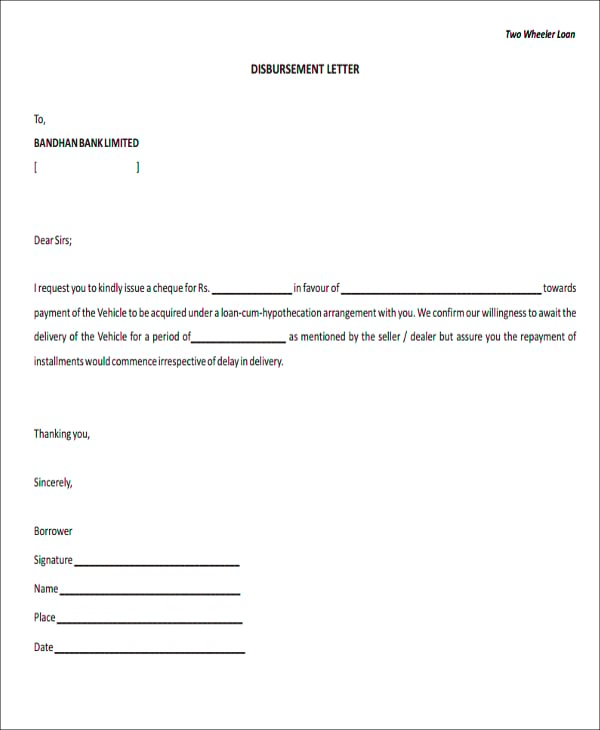

Sample Foreclosure Disbursement Apllication Form Letter

Example Work Travel Agency Letter

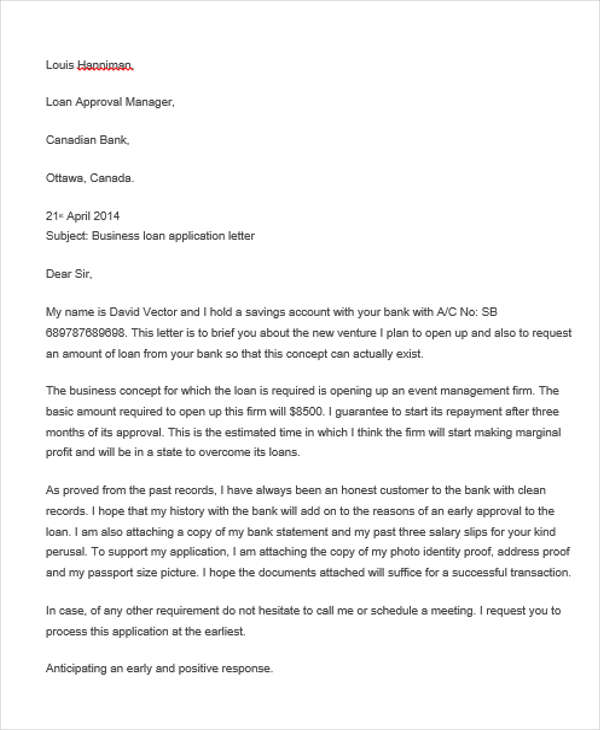

Application Letter to Canadian Bank for Loan

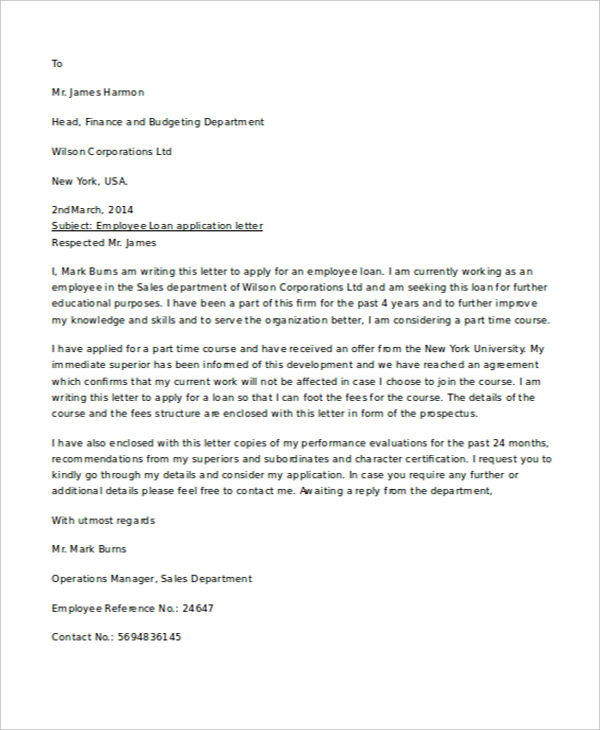

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

Mortgage Loan Application Letter with Boss Recommendation

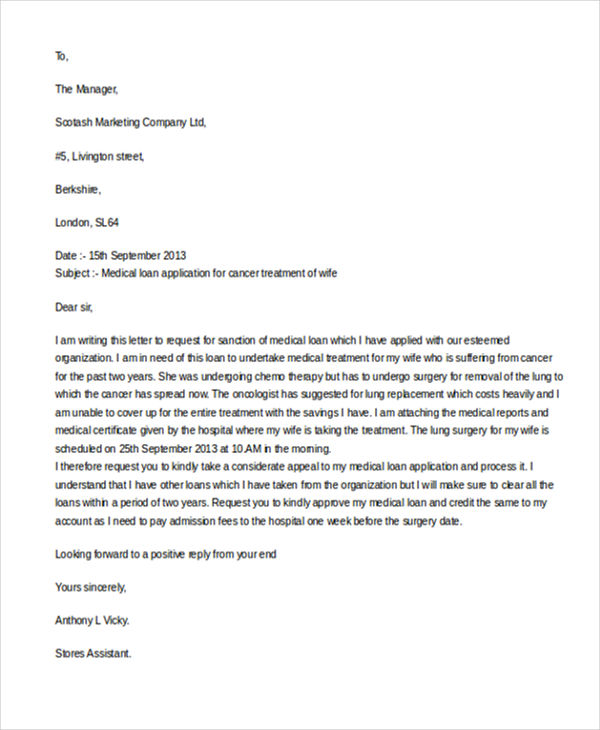

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

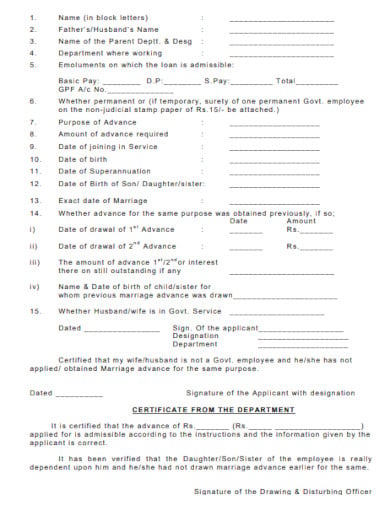

Loan Application Letter for Wedding/Marriage Template

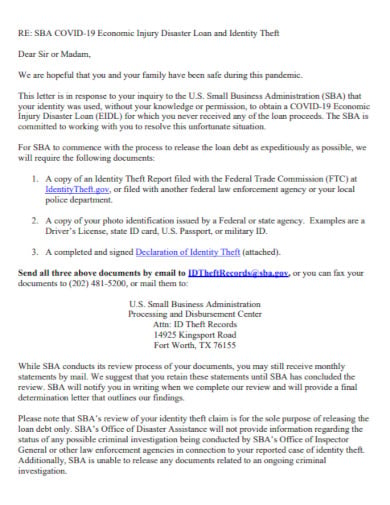

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Loan application letter template, loan requisition letter, sample loan application letter template, simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

- Search Search Please fill out this field.

How to Write a Loan Letter to Your Bank

How a Letter to the Bank Might Get Your Loan Approved

Why Write a Letter to Your Bank?

- Letter for a Mortgage Application

Parts of a Loan Letter to a Bank

Sample outline for a loan letter.

Maskot / Getty Images

Sometimes getting a loan is as easy as filling out an application. But as dollar amounts increase or the situation gets more complicated, lenders may want reassurance. They could even ask you to explain why your loan is a good idea.

If your bank wants more than the basic information that goes on an application, a letter to the bank could be in order. Some banks specifically request letters, while others might appreciate any extra steps you take to try and win the loan.

Learn how a loan letter can improve your application and what you should include in one.

When you write a loan letter to accompany your application, you have the chance to explain exactly why the lender should approve your request. It gives you an opportunity to:

- Add commentary on topics that do not appear in a standard application

- Explain your financial situation thoroughly

- Lay out your plan for using and repaying the loan

- Address any weak spots in your application or finances

Loan letters can be particularly beneficial for small businesses, which often need capital to grow but may not meet the strict requirements laid out by bank loan applications.

Like a cover letter for a job application, a loan letter is your chance to make your case on your terms.

Loan Letter for a Mortgage Application

If you are applying for a mortgage and your application has some weak spots or unexplained elements, writing a loan letter can increase your chances of approval or of receiving a lower interest rate.

You may need to write a letter to accompany your mortgage application if you have:

- Multiple names on your credit report

- Negative entries in your credit report

- Gaps in employment

- Atypical sources of incomes, such as a small business or freelance work

- A recent change in jobs

- Unusual activity in your bank account

- Former delinquencies or bankruptcies

A loan letter gives you a chance to explain these things and address any concerns they may create for the bank.

When writing a letter to accompany your loan application, you need to both keep things brief and provide sufficient detail to make a convincing argument.

Even while keeping things concise, however, there is still specific information you will want to include.

Who and What

Tell the bank a little bit about yourself. If you're applying for a business loan , be sure to include information about the whole team, including the number of employees and how long you've been in business.

Highlight any strengths, designations, or credentials you've earned, as well as successes in your past. Don't go overboard: just pick just a few of the most impressive and relevant things that come to mind.

Lay out the specific amount that you are requesting for your loan. But sure to include the timeframe, such as $100,000 to be repaid over five years.

Explain exactly how you will use the funds. Your lender needs to know that the money will be put to good use.

For example, if you have been turning away business because you didn't previously have capacity, let your lender know about this unmet demand and your ability to satisfy it.

Demonstrate that you have done some market research and know how the loan will impact your business or personal finances .

Your lender needs to know how you’ll fund the repayment. Will you repay a personal loan from your salary or a business loan from increased revenues?

Be specific about how and why your earnings will increase as a result of the loan.

Your lender will notice if you have bad credit or insufficient income to repay the loan. When you address those issues directly, you signal that you're a serious borrower who understands what's at stake.

Be polite and formal in your language, addressing your letter to the loan officer or specialist that you are working with and ending with "Sincerely" or "Regards." Be sure to include your full legal name, address, and contact information.

Like a cover letter for a resumé, aim to keep your loan letter no longer than one page.

Sample for a Small Business Loan Letter

- Overview : “ACME Enterprises specializes in… and has been in business since 2007...”

- Reason : “I’m writing to request a loan for $100,000…”

- Professional information : “ACME Enterprises was founded by Jane Doe, who has over 10 years of industry experience. The marketing team is led by John Jones, who previously helped grow XYZ Corporation…”

- How funds will be used : “Our goal is to increase the number of daily service visits by purchasing an additional vehicle and related equipment. The total cost of these investments is…”

- Benefit : “Currently we are unable to respond to 30% of requests for service, which results in customers calling our competitors or switching products. We will be able to profitably respond to all of those calls with the additional equipment…”

- Basic financial information : “ACME Enterprises currently operates at a profit. Revenue from the previous year was $X, and net income was $Y…”

- Concerns : Anything else that shows you’ve done your homework and deserve the loan.

- Closing : “Please see the enclosed business plan, and feel free to contact me with any questions you have at…”

You will also need to submit a business plan with your loan application. Think of your introductory letter as an abbreviated version of the business plan.

Sample for a Mortgage Loan Letter

- Personal information : “My spouse and I have recently submitted a mortgage application at XYZ Bank, our full names and contact information are...”

- Basic financial information : “You will see in our application that our joint income for the last ten years has ranged from $X to $Y..."

- Concerns : “I’m writing to explain my irregular income and why this will not impact my ability to repay the mortgage I have applied for…”

- Explanation : "Since 2011, I have been self-employed. My business is ABC Enterprises, which provides freelance ABC services for clients such as... My business has made an annual income of no less than $XX for the last ten years, out of which my personal salary has increased from $X to $Y. In the enclosed business plan, you will see that due to These Market Factors I expect demand to continue increasing as I expand my services..."

- Closing : “Thank you for your time and attention, and feel free to contact me with any questions you have at…”

The lending decision ultimately depends on the financials, such as your credit scores , income, collateral , and ability to repay the amount you borrow. But a loan letter can improve your chances by explaining your situation and the impact the loan will have on those factors.

How To Write A Letter Of Application For A Loan

Advertisement

Are you asking “how do I write a letter of loan request for a company?” or wondering “how to write an application letter for a loan in a microfinance bank?” Search no further, this guide is specially made for you to get the financial help you need, using our free loan application letter sample.

When requesting a loan from a bank, lender, or other financial institution, a letter of application is frequently required. You must include this letter in your loan application. If you describe your company’s background and current financial situation, as well as how you intend to use the loan funds and how you will repay them, the bank is more likely to approve your loan application.

Let’s take a look at the components of a loan application letter, explain how to write one, and walk you through writing a sample letter of your own. A formal letter of application for a loan is delivered to the lender at the time the loan is requested. Why you require the loan should be stated in the letter, as how you intend to spend the funds, and how you intend to pay back the loan.

A crucial step in the loan application process is the application letter. The lender will have the opportunity to find out more about you and how you’re doing financially. You can increase your chances of having a loan approved by writing a strong application letter.

Tips for creating a strong loan application letter:

- Be succinct and clear.

Lenders shouldn’t have to read through a lot of extraneous details in order to understand your loan request.

- Be precise.

Describe your reasons for needing the loan, the amount you require, and your intended use for the funds.

- Be sensible.

Asking for more money than you need is improper. Tailoring your cloth according to your size is one proverb that should be strictly applied when applying for a loan.

- Be truthful.

Don’t misrepresent anything or make any false claims and before sending your letter, carefully proofread it.

Here is an example of an application letter for a loan:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

To Whom It May Concern

I am writing to apply for a loan in the amount of #50,000 from your bank. I have been a customer of your bank for 5 years and have always been satisfied with your services.

I am requesting this loan to consolidate my credit card debt. I have been carrying a balance on my credit cards for the past few years and I am now paying over 20% interest on my debt. I am hoping to refinance my debt with a lower interest rate and save money on my monthly payments.

I am currently employed as a software engineer at XYZ. I have been with this company for 3 years and have a good performance record. I have a solid credit history and am a member of the National Institute of Finance Management.

A copy of my most recent pay stub, a credit report, and a letter from my employer attesting to my employment and salary are all enclosed. I would appreciate the chance to go over my loan application with you in more detail. I appreciate your consideration and time.

[Your Name ]

The first step in obtaining the financial assistance you require is to prepare an efficient and extensively reported loan proposal, which calls for knowledge of how to write a loan application letter. While an enterprise loan requires a strong credit history and receivables, personal loan approval is primarily based on your credit score and prudent financial planning.

Related posts:

- Loanspot Africa Loan Application Requirements And How To Apply

- How To Use GTBank Loan Code

- How To Apply For a Loan Using The Branch Loan App

- How To Use The Renmoney Ussd Code

- Loans For Unemployed In Nigeria

- How To Use Palmcredit Ussd Code

- Types Of Lapo Loans You Can Get

- How To Apply For Loan On Bg Loan App

- How To Apply For A Loan Using 9money

- Specta Loan: Requirements And How To Apply

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

How to Write a Loan Application Letter in Nigeria

Do you find it difficult to write a loan application letter or you are clueless about how to go about the process?

No need to fret, you have come to the right page for a solution.

It is not surprising that a lot of Nigerians apply for loans in various financial organisations ranging from commercial banks, and microfinance banks, and that online loan apps are on the increase in Nigeria.

Due to the current economic hardship coupled with debts incurred by some Nigerians, to settle their debts, they simply look forward to applying for a loan as a solution to their problems.

Nigerians apply for loans for different reasons and purposes. Some for their businesses, education, to pay off debt while some apply for loans to “japa”.

If you’re looking to apply for a loan here in Nigeria, in simple steps, I’ll guide and put you through how to write a loan application letter in Nigeria.

Table of Contents

Applying For a Loan in Nigeria

Firstly, you need to have a plan, ask yourself the question “what do I need this money for?”

Will the business you’re planning to venture into be productive enough to pay back the loan you’re applying for in the bank?

If you don’t have a plan, at the end of the day, when you write the application for a loan, you often find it difficult to pay back the loan.

This is why some of these loan sharks make public the loan defaulters personal details on social media platforms creating public embarrassment to the defaulters and the people close to them.

Steps in Applying for a Loan

The major thing you should look out for as you’re about to apply for a loan in Nigeria is the financial institution you want to go for.

Put in mind their interest rates, the loan duration (how long will it take for you to pay off?).

Read properly the T&Cs, and read it line by line before you append your signature.

Lots of Nigerians applying for loans make the mistake of not going through the terms and conditions thoroughly, you definitely don’t want to make this mistake to avoid “had I known?”

Don’t be too eager, I repeat, don’t be too eager.

Just recently someone told me something I want you to pick from, she said “one of the policies in giving loans is not to give a loan to a customer that is too eager, the one who never lets you rest”.

Read also: How to get loans without a salary account or collateral.

How to Write a Loan Application Letter

Writing a loan application letter in Nigeria is quite simple as you can refer to the letters you wrote while in school.

Your loan application letter should be well detailed and concise, not verbose.

There are two things to consider here, are you applying for personal use or for your company?

If it is a personal loan, it is simple, all you have to do is to walk into any bank of your choice to make some findings.

Make sure you get a clean sheet of paper (A4 Paper), your identity card (work id is included), a letter of introduction from your working place if you’re an employee of an organisation.

I’ll list out in bullet points what should be included in your loan application letter so you won’t make any mistakes or leave any information out of your loan application letter.

NOTE: You’re writing a formal letter, not an informal letter.

- The bank’s address (include the branch manager if you’re addressing the letter to him/her. This should be on the left side of your A4 paper.

- Your address should be on the right side of your letter.

- Under the address to the bank, “Dear Ma/Sir” should be written.

- Heading: You should provide heading to your loan application letter. See more details in the samples below.

- Body of your letter: You should explain in detail the reason and the duration.

Read also: Top banks in Nigeria for entrepreneurs.

Samples of a Loan Application Letter

Below are samples of loan application letters for an individual/personal use:

To the Branch Manager,

United Bank for Africa,

Lebanon Dugbe,

23rd April 2009.

40, Boladuro Street,

Challenge Ibadan,

Dear Ma/Sir,

LOAN REQUEST

I (your name), with the account number (×××××××××) wish to request for a loan in your business office.

I look forward to hearing from you soon.

Thanks in advance.

Yours faithfully,

(Signature)

(Phone number).

Applying for a loan in the name of your company? Ensure you have a great turnover with the bank to get a good loan.

The letter for loan application should be on your company’s letterhead. You can’t apply for a loan in Nigeria as a company on a plain sheet of paper.

XYZ CONSULTING FIRM LTD.

+234***********, 40 Boladuro Street Challenge Ibadan. Oyo State.

To the Branch Manager,

No 40 Boladuro Street,

Dear Sir/Ma,

Our company (name), with the account number (×××××××××) wishes to request for a loan in your business office to get some equipment for our business.

Sponsor your business on Insight.ng for a wider reach of your target audience.

Applying For a Loan on Your Mobile Phone

Do you know you can pick up your phone and apply for that loan you’ve been searching for?

Simply visit the Play Store/Apple store app, there are lots of applications offering loan services.

From Okash to New Credit, Fairmoney, 9ja Cash, Soko Loan and a host of others.

It is not surprising that some Nigerians prefer to apply for a loan using these mobile applications than walking into the bank.

Everyone wants comfort and a very easy experience.

Once you download the application of your choice, you click on the register button (all your information would be recorded together with your bank verification number).

While some Nigerians don’t like to apply for a loan from these Loan apps, due to the embarrassment/disgrace they put people through if they fail to make payment after the payback day, some apply for the loan and pay back in due time.

Read also: Top 10 best loan apps in Nigeria.

Conclusion

I hope you’ve learnt a thing or two from this article on how to write a loan application letter in Nigeria.

Whenever you’re in a fix or there’s something really urgent you need money to settle, you can simply visit any bank branch to make enquiries on the type of loan product they have to offer, or make use of online apps.

If you found this useful, subscribe to our newsletter for more insightful posts.

About Author

Latest entries

Angela Ajani

Give her books and you've made her day. Ajani Angela is a graduate of History and International Studies from Bowen University, currently pursuing her Masters Degree in Peace and Conflict Studies at the University of Ibadan. Angela loves to read and meet new people. Her interests are not limited to just education; she also loves to offer advice to people going through a lot. Angela loves to hear from readers. You can email her at [email protected] .

Expertnaire Tutorial: How to Start Making Millions in Expertnaire in Nigeria

How to write news stories: path to becoming a successful journalist in nigeria, related posts, effective strategies for managing cash flow in a..., the role of board of directors in a..., a guide to understanding intellectual property rights for..., the impact of government policies on nigerian businesses, top 17 prosperous business opportunities to consider in..., robotic process automation (rpa) in nigerian businesses, leave a comment.

Save my name, email, and website in this browser for the next time I comment.

- [email protected]

- Call (866) 670-7483

- Business Loans

- Posted on December 12, 2022

- Kortney Murray

A business loan application process often requires numerous documents, one of which is a request letter. This letter is a significant part of your application as it is written to request financial assistance from the financial institution.

In most loan application cases, the success of your application process hinges on your ability to craft a convincing and professional business loan request letter. However, to do this, you need to know what the letter entails, the necessary information to include, and, of course, how to write one.

To help you with your application process, below we have compiled everything you need to know about writing a request letter for a business loan.

What Is A Business Loan Request Letter?

During your loan application process, whether you are getting a business loan for your beauty salon or trucking company, your lender or financial institution will request information from you. This information is to help the lender or institution trust you enough to know that you will be able to pay back their loan.

Many times, the request for this information comes in the form of a business loan request letter. A request letter is a formal letter or a document that is written to request anything from an official. It can be seen as a way of asking for a favor from officials.

In this case, a business loan request letter is a letter to the bank or lending institution that supports your business loan request. During the loan request review process, the bank underwriter will pay attention to the content of your business loan request letter to see if you deserve to get your loan approved.

In essence, your loan request letter is the difference between your loan being approved or refused. A loan request letter usually commits elements such as the loan amount requested, detailed planned use of money if disbursed, reasons why you think you should receive the funds, and a detailed description of how you plan to repay the loan.

The loan request letter is usually requested when asking for financial help in the form of a loan. This can be when you’re applying for a loan from a conventional financial institution or bank lender, or when you’re requesting a loan from the SBA ( Small Business Administration ).

In both cases, you are trying to demonstrate to the lender that your business can repay the borrowed amount, and you have a plan for using the loan when disbursed. Although loan request letters are usually a part of loan application processes, they do not necessarily need to be a part of every loan application process.

Some situations require loan letters, and some can do without them. Some situations that do not require loan request letters are:

- Situations where you require a loan from specific lenders whose only concerns are your bank statement

- Situations where you request a business line of credit and the only requirements are recent business financial statements

- Situations where you request equipment financing and the equipment will be the collateral you need.

Regardless, writing a request letter for a business loan is an essential step to securing your loan. However, simply writing a letter is not enough. It is crucial to write an excellently detailed loan request letter that passes your message across quickly to the money lender.

What You Need To Know About Writing A Loan Request Letter