- Book Solutions

- State Boards

India’s roadmap to renewable energy Essay

Essay – india’s roadmap to renewable energy.

India’s roadmap to renewable energy Essay: Climate change has become the global problem due to excessive carbon and other greenhouse gas emissions into air. It causes long-term change in weather patterns and climatic conditions which disrupts the natural ecological balance of our environment. India is facing climate change for prolonged use of excessive fossil fuels, deforestation, urbanisation, industrialisation which increase the level greenhouse gases. Greenhouse gas makes hole in the ozone layer of atmosphere which traps sun’s harmful ultraviolet rays from escaping. For the increased greenhouse gas emission we are facing climate change, sea level rise, extreme weather conditions, flood, and improper cycle of seasons etc. We need to take immediate action for reducing carbon emissions into the air and maintain the balance of environment. The effective process will be shifting to renewable energy resources in place of fossil fuels which is responsible for carbon emissions. India is spread heading to clean energy transitions and its promise to combat climate change. India has declared to reach non-fossil energy capacity to 500GW and meet the energy requirements with renewable energy by 2030. So, the actions of reducing carbon density from the environment will be discussed in this essay.

Efficiency of renewable energy resources:

From the beginning of electricity production, India is largely dependent on fossil fuel combustion like coal, petroleum and natural gases. Fossil fuels are the main source of carbon dioxide, nitrous oxide, methane and other greenhouse gases. Due to urbanisation huge percentage of forests has been destroyed so there is lack of trees to absorb carbon from the air. Energy consumption has also been increased with the high level population and their usage of different electronic appliances, vehicles etc. so, fossil fuels have been using abruptly in almost all purposes which threatens the presence of resources as it is limited. It takes millions of years to formulate fossil fuel after long natural procedure with plants and animals. So, once fossil fuels get finished we will be in danger for the lack of energy resources. In this scenario, adopting renewable energy is the wisest decision to call sustainability and conserve our environment.

Different renewable energy sources are solar energy, wind energy, hydroelectricity, biomass, geothermal energy etc. which do not impact the environment. We just need to invest once for installing renewable energy sources then it will meet our needs. People should move ahead in choosing electric vehicles, solar charged battery, and solar cookers etc. for reducing carbon footprints. It is our responsibility to be aware about renewable energy sources and use it wisely for protecting our environment which is in our hand.

Positive effects of renewable energy:

Renewable energy sources produce clean and green energy which does not affect the environment and create sustainability. Inclusion of renewable energy calls new technology too which opens new opportunity of employment. Installing renewable sources of energy will increase economic growth of a country as it provides vitality, sustainability and revenue generation. People will be assured about their constant power supply through renewable energy which will cut down the cost of other resources. Renewable energy will reduce carbon footprints form the environment shortly and give us pure, clean environment to breathe in.

Initiatives taken by the government:

The production linked incentive scheme is an excellent initiative by the government of India to boost manufacturing sector with large investment in electronics components, electronics value chain and semiconductor packaging. Pradhan mantra kisanurjasurakshaevamutthaanmahabhiyan is an initiative to provide financial security and water supply to farmers by installing solar energy capacity of 25,750 MW. With this initiative water pumps will be provided at doorsteps through solar energy. The ministry of new and renewable energy of India has also started online portals akshayurja portal and India renewable idea exchange portal in its official website for inviting energy conscious people to exchange their views and share ideas. They will learn the value of including renewable energy in lifestyle from the global community too.

Actions for the upcoming years:

India has the twin challenge to provide cleaner and sustainable energy among all citizens. The main focus is in manufacturing sector for installing solar panels under atmanirbharbharat scheme. This initiative will create multiple job opportunities for the youth of India where they will learn new skills too. The government will monitor the entire supply chain development along the improving manufacturing sector. The government has also targeted 20% blending of bio CNG in petrol for vehicles. Biomass energy is a considerable option to provide clean energy and reduce dependence on energy consumption. Hydrogen based fuel cells vehicles is another target by the government to change the landscape of renewable energy resources by including technology in it. The government has given stress over installing solar and wind energy grids in places for strengthening the sources of renewable energy everywhere. The government need to identify the ideal places for installing wind energy panel as it requires lots of space. The government has taken actions to support agricultural production by securing solar panel installation in different areas. Electric vehicles and hydrogen cells based vehicles are the suitable options in place of fuel run vehicles to reduce carbon footprint from the environment. So, people should opt for the alternative and sustainable options which will bring them long term benefits.

Conclusion:

India requires a proper road map to reach the clean energy goal within limited time period. For that purpose NITI Aayog has come into action with energy vision 2035 to convert energy sources into renewable within upcoming years. It is expected that India will largely replace fossil fuels with renewable energy resources by 2050. For that diverse energy options like hydrogen cells, wind energy, solar energy, biomass have already been started using by people. The government should start working effectively on improving infrastructure, capacity building, better integration power, technological advancement for near future. The government should invest more in all these areas to increase adaptability of renewable energy sources in India. India is looking forward to meet the goal of converting entire energy consumption in renewable resources.

For more updates follow our net explanations homepage

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

We have a strong team of experienced Teachers who are here to solve all your exam preparation doubts

Selina concise biology class 7 solution, rd sharma class 10 solution pdf chapter 2 polynomials, rd sharma class 10 solution chapter 1 real numbers, rd sharma class 9 solution chapter 1 number system.

Sign in to your account

Username or Email Address

Remember Me

How India’s renewable energy sector survived and thrived in a turbulent 2020

Image: REUTERS/Amit Dave

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Julia Pyper

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} India is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, decarbonizing energy.

- 2020 proved to be a decisive year for clean energy in India.

- Record-low solar tariffs and flexible clean power auctions have pushed India’s renewable energy growth, despite disruption from the pandemic.

- Power demand is expected to triple by 2040, leading many to ask if renewables can be developed fast enough to keep up?

Last March, the Indian government implemented one of the most stringent coronavirus lockdowns in the world. With just a few hours’ notice, all 1.3 billion people in the country were ordered to stay at home for several weeks. Ongoing restrictions to limit the spread of the virus crippled economic activity. Businesses closed. Workers fled from cities. And India’s clean energy transition was put on pause .

Looking back, however, 2020 proved to be a decisive year for clean energy in India.

Have you read?

6 of the world’s 10 most polluted cities are in india, this is how the populations of india and china have changed since 1800, it’s clean, powerful and available: are you ready for hydrogen energy.

Bids for new solar projects hit record lows last year, affirming that coal is no longer the cheapest source of electricity. The country awarded landmark supply contracts for flexible renewable power, an important step in addressing the limitations of intermittent wind and solar. Cheap renewables were favored on the grid last year, which caused coal use to fall as energy demand plummeted amid the economic slowdown. Stimulus measures for utilities, an extension to project commissioning deadlines, and domestic solar manufacturing initiatives also helped to bolster the outlook for renewables.

But while the renewable energy industry endured a turbulent 2020, coal remains the dominant player in India’s electricity mix. With power demand expected to triple by 2040 as India’s population continues to achieve upward mobility, fossil fuels are poised to see continued growth even as the clean energy market thrives.

Two burning questions for India — and the world — are how fast the use of renewables and related clean energy technologies can scale, and to what extent can they mitigate the increase in fossil fuel use. As the second-largest coal-producing and -consuming country on earth and the third-largest emitter of greenhouse gases, India’s transition from carbon-intensive resources is a critical front in the global climate change fight.

Challenges lie ahead, but there may be cause for optimism. As the country grapples with the intertwined issues of air pollution, water scarcity and energy security, along with energy access and affordability, experts say they’re starting to see a future for India where coal will no longer be king.

"Despite the pandemic, there has been a slew of challenges for coal mining and generation, and the government is becoming clearer that energy transition is on track even as the economic recovery continues to take shape,” said Aarti Khosla, founder and director of Climate Trends, a Delhi-based strategic communications initiative, and former communication lead for WWF India.

“The energy transition is gathering speed,” she said. “It's no more a question of if the transition will happen or not. It's only a question of what the pace of the transition will be.”

Modi: India on track to "exceed" its renewable targets

Speaking at the United Nations Climate Ambition Summit in mid-December, Prime Minister Narendra Modi declared that India is on track to reach, and ultimately exceed, its ambitious renewable energy targets.

“India has reduced its emission intensity by 21 percent over 2005 levels,” he said at the virtual event, which marked five years since the adoption of the Paris Agreement on Climate Change. “Our renewable energy capacity is the fourth largest in the world. It will reach 175 gigawatts before 2022.”

India’s total installed capacity of renewable energy, not including hydropower, currently stands at 90 gigawatts. According to a year-end review by the Ministry of New and Renewable Energy, another 49.59 gigawatts of renewable energy capacity is under installation, and an additional 27.41 gigawatts of capacity has been tendered. This puts the total capacity of renewable energy projects already commissioned or in the pipeline at nearly 167 gigawatts.

Modi recently announced that he expects the country’s clean energy capacity to reach 220 megawatts by 2022 — besting the country’s 175-gigawatt target. India has an even more ambitious target of 450 gigawatts of renewable energy capacity by 2030. By that year, the government wants to meet half of the country's power demand with renewable energy resources.

“India is not only on track to achieve Paris targets but to exceed them beyond your expectations,” Modi said at the climate summit last month.

While leadership reaffirmed the country’s lofty goals, the pace of renewable energy deployment in India slowed significantly in 2020. Solar installations in the first nine months of the year totaled 1.73 gigawatts, marking a 68 percent decline from the same period in 2019, according to Mercom India Research . Wind installations also fell dramatically .

Still, India’s renewables industry weathered the market turbulence. Central and state governments took steps to support the domestic clean energy sector last year, which have put low-carbon energy resources in a position to see continued growth and claim a greater share of India’s coal-heavy power system.

Record-low solar bids and "must-run" status

One key action the Modi government took to bolster clean energy in 2020 was to grant wind and solar projects “must-run” status, which means that their power cannot be curtailed except in conditions that would compromise grid stability. Renewables were insulated from the decline in electricity demand as a result, while coal plants took a major hit.

During the 2019/2020 fiscal year, the average coal-fired power plant ran just 55.5 percent of the time, according to the Institute for Energy Economics and Financial Analysis (IEEFA) . In April 2020, the average Indian coal-fired power plant operated at just 40 percent capacity utilization, creating inefficiencies and ultimately increasing the cost of production.

In addition to granting renewables must-run status through the pandemic, the government launched multiple tenders for new renewable energy projects to meet India’s future energy demand. Not only did the auctions continue but the country also saw a series of record-low solar bids.

Last month, a 500-megawatt solar auction held by utility Gujarat Urja Vikas Nigam Limited set a new record for the lowest price in India of INR 1.99 ($0.0269) per kilowatt-hour.

The latest auction results narrowly beat a record set just a few weeks prior. In late November, state-owned Solar Energy Corporation of India announced the outcome of a 1.07-gigawatt solar auction in Rajasthan that attracted bids of INR 2 ($0.0270) per kilowatt-hour from Saudi Arabia-based Aljomaih Energy and Water Co. and Sembcorp Energy’s India arm Green Infra Wind Energy Ltd.

These recent historic bids are 15 percent lower than the previous Indian record of INR 2.36 ($0.032) per kilowatt-hour, submitted by Spanish developer Solarpack in an auction held earlier in the year. In addition, developers set a new record for solar-wind hybrid projects, quoting a price of INR 2.41 ($0.0326) per kilowatt-hour.

“Solar is now by far the lowest-cost source of new energy in India,” said Tim Buckley, director of energy finance studies for Australia and South Asia for IEEFA. Solar is helping to meet the country’s objective of making power affordable to low-income residents, he said. But that is far from the only benefit.

“India's economy is going to see its energy consumption double over the next decade or two, and they want to enhance energy security, which means they want to ideally use domestic energy supplies,” said Buckley. “They also have a massive air pollution problem, so they want to reduce the air pollution issues. They have a massive water security issue, too…so they want to use energy sources that are least taxing on their water supply. Solar ticks every one of those boxes.”

“And...it doesn't emit carbon dioxide or methane,” he added. “So there's an ancillary benefit that it helps solve the world's climate crisis.”

The combination of low-cost financing and expected solar module cost declines are among the key factors driving down solar prices in India today. Delivering on this year’s record-low solar bids will be a challenge; it will require developers to deploy the latest technology and accurately estimate costs for every project component.

But while the recent bid prices set a tough standard for the Indian solar industry, IEEFA analysts say that it demonstrates investor confidence in the sector and opportunities for continued cost reductions as the country strives to create a more sustainable and domestic-based energy system.

A boost for domestic solar manufacturing

In a testament to India's growing demand for low-cost and locally manufactured power, Indian power minister R.K. Singh announced last fall that the country would boost its domestic solar manufacturing base to reduce reliance on solar cells and modules imported from China. He also announced that renewables would replace the generating capacity from 29 coal plants slated to retire in the coming years.

State-owned enterprise Coal India — the largest coal-producing company in the world — announced that it will enter the solar value-chain business and launch a new renewable energy vertical. The company received board approval to establish an integrated solar wafer manufacturing facility in December. There are also reports that other state-owned companies could be required to establish a domestic polysilicon supply chain.

In November, Prime Minister Modi announced that the government will offer new incentives for Indian-made solar modules, which follows an announcement that solar modules have been included in a production-linked incentive scheme to help make domestic players more competitive abroad.

A lifeline for renewable projects and utilities

In addition to the measures above, the Indian government extended commissioning deadlines for wind and solar projects already under development, taking into account that developers couldn’t get their workers and equipment to their construction sites amid the lockdowns.

“They gave a blanket five-month extension to all projects, which was really essential,” said Sumant Sinha, chairman and managing director of ReNew Power, India's largest clean energy company.

Another significant step the government took to benefit the clean energy sector was to give power distribution companies (discoms) a roughly $13 billion liquidity injection as part of a stimulus package to shore up the Indian economy. The country’s discoms, which have long suffered from financial woes , fell deeper into debt due to weak power demand caused by the COVID-19 pandemic.

Because discoms purchase the power from renewable energy projects, the financial health of the utility sector is critical to keeping India’s clean energy transition moving forward. Analysts note that utility bailouts also benefit thermal power plants . But according to Sinha, the stimulus funding was critical to ensuring that renewable energy generators continued to get paid on time.

“All of these steps have really been very positive,” said Sinha, who recently published the book Fossil Free focusing on the drivers of India’s clean energy transition and path ahead. “I think they indicate that the Indian government is very serious about supporting the growth of renewable energy and they are willing to do whatever is required to push the agenda forward on that front.”

Landmark auctions for flexible renewable energy

As the share of renewables on India’s power grid continues to grow, so too does the demand for new technologies to balance better integrate these intermittent resources.

In January 2020, the Solar Energy Corporation of India (SECI) announced the results of its first peak power tender , requiring developers to couple wind and solar with energy storage to meet grid needs at times of peak demand. At 1.2 gigawatts, the auction represented one of the largest renewables-plus-storage tenders in the world. Greenko Group and ReNew Power ultimately won 900 megawatts and 300 megawatts of capacity, respectively.

SECI also held the country’s first tender for " around-the-clock " clean power last year, which requires developers to bundle solar with wind, hydropower or energy storage to provide an 80 percent plant load factor over the course of the year. ReNew Power was the sole winner in the around-the-clock auction, which was criticized for having terms that were both too tough and too lenient in turn.

These auctions mark a new era in India's energy transition. The government is seeking these new kinds of bids with a view to "making renewable energy more acceptable into the grid and enabling India’s discoms to buy more renewable energy," said Sinha. But he acknowledged that it’s still early days for the next wave of cleantech products and services in India.

There is only one utility-scale energy storage project deployed in India today: a 10-megawatt-hour pilot project owned by Tata Power Delhi Distributed Limited. ReNew’s peak power and around-the-clock projects will be the next battery installations to come online, and they’re still a year and a half out.

“The government is introducing all of these storage-based tenders [because] they are experimenting to ensure that...the storage ecosystem develops in India,” Sinha said.

The International Energy Agency forecasts that India will eventually become the largest market for utility-scale battery storage worldwide. But right now, the government is grappling with what the ecosystem for energy storage in India should look like, including the mix of standalone battery projects versus renewable energy hybrid systems and requirements for ancillary services.

"Over the last decade, India’s government had the luxury of focusing mostly on adding solar and wind energy capacity as fast as possible. Now it must walk, chew gum and much more," Varun Sivaram, senior research scholar at the Columbia University Center on Global Energy Policy, wrote in a recent analysis for the Aspen Institute .

"The next phase will require deep structural reforms to create a cleaner, more flexible and more efficient power system," he continued. "But given the impressive progress to date on deploying renewable energy and the willingness of the government to constantly experiment with new policy approaches, there is reason for optimism about India’s energy future."

Travel to India for portions of this story was supported by SED Fund , which supports a range of activities related to sustainability. All content is editorially independent, with no influence or input from the philanthropy. The views expressed in this article do not necessarily reflect the views of SED Fund or any of its affiliates.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Geographies in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Global South leaders: 'It’s time for the Global North to walk the talk and collaborate'

Pooja Chhabria

April 29, 2024

How can Japan navigate digital transformation ahead of a ‘2025 digital cliff’?

Naoko Tochibayashi and Naoko Kutty

April 25, 2024

What is desertification and why is it important to understand?

Andrea Willige

April 23, 2024

$400 billion debt burden: Emerging economies face climate action crisis

Libby George

April 19, 2024

How Bengaluru's tree-lovers are leading an environmental restoration movement

Apurv Chhavi

April 18, 2024

The World Bank: How the development bank confronts today's crises

Efrem Garlando

April 16, 2024

- Open access

- Published: 07 January 2020

Renewable energy for sustainable development in India: current status, future prospects, challenges, employment, and investment opportunities

- Charles Rajesh Kumar. J ORCID: orcid.org/0000-0003-2354-6463 1 &

- M. A. Majid 1

Energy, Sustainability and Society volume 10 , Article number: 2 ( 2020 ) Cite this article

421k Accesses

258 Citations

83 Altmetric

Metrics details

The primary objective for deploying renewable energy in India is to advance economic development, improve energy security, improve access to energy, and mitigate climate change. Sustainable development is possible by use of sustainable energy and by ensuring access to affordable, reliable, sustainable, and modern energy for citizens. Strong government support and the increasingly opportune economic situation have pushed India to be one of the top leaders in the world’s most attractive renewable energy markets. The government has designed policies, programs, and a liberal environment to attract foreign investments to ramp up the country in the renewable energy market at a rapid rate. It is anticipated that the renewable energy sector can create a large number of domestic jobs over the following years. This paper aims to present significant achievements, prospects, projections, generation of electricity, as well as challenges and investment and employment opportunities due to the development of renewable energy in India. In this review, we have identified the various obstacles faced by the renewable sector. The recommendations based on the review outcomes will provide useful information for policymakers, innovators, project developers, investors, industries, associated stakeholders and departments, researchers, and scientists.

Introduction

The sources of electricity production such as coal, oil, and natural gas have contributed to one-third of global greenhouse gas emissions. It is essential to raise the standard of living by providing cleaner and more reliable electricity [ 1 ]. India has an increasing energy demand to fulfill the economic development plans that are being implemented. The provision of increasing quanta of energy is a vital pre-requisite for the economic growth of a country [ 2 ]. The National Electricity Plan [NEP] [ 3 ] framed by the Ministry of Power (MoP) has developed a 10-year detailed action plan with the objective to provide electricity across the country, and has prepared a further plan to ensure that power is supplied to the citizens efficiently and at a reasonable cost. According to the World Resource Institute Report 2017 [ 4 , 5 ], India is responsible for nearly 6.65% of total global carbon emissions, ranked fourth next to China (26.83%), the USA (14.36%), and the EU (9.66%). Climate change might also change the ecological balance in the world. Intended Nationally Determined Contributions (INDCs) have been submitted to the United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement. The latter has hoped to achieve the goal of limiting the rise in global temperature to well below 2 °C [ 6 , 7 ]. According to a World Energy Council [ 8 ] prediction, global electricity demand will peak in 2030. India is one of the largest coal consumers in the world and imports costly fossil fuel [ 8 ]. Close to 74% of the energy demand is supplied by coal and oil. According to a report from the Center for monitoring Indian economy, the country imported 171 million tons of coal in 2013–2014, 215 million tons in 2014–2015, 207 million tons in 2015–2016, 195 million tons in 2016–2017, and 213 million tons in 2017–2018 [ 9 ]. Therefore, there is an urgent need to find alternate sources for generating electricity.

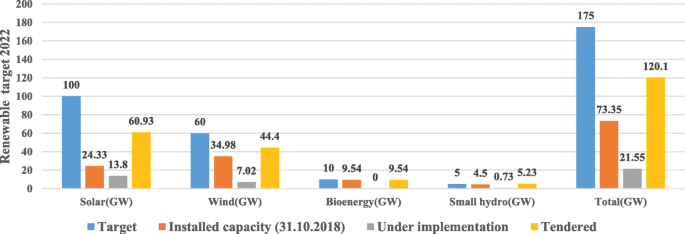

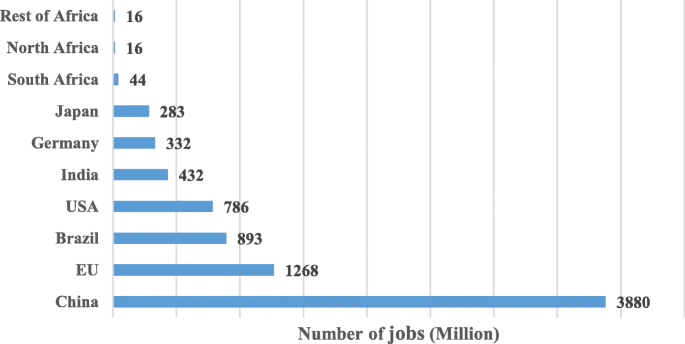

In this way, the country will have a rapid and global transition to renewable energy technologies to achieve sustainable growth and avoid catastrophic climate change. Renewable energy sources play a vital role in securing sustainable energy with lower emissions [ 10 ]. It is already accepted that renewable energy technologies might significantly cover the electricity demand and reduce emissions. In recent years, the country has developed a sustainable path for its energy supply. Awareness of saving energy has been promoted among citizens to increase the use of solar, wind, biomass, waste, and hydropower energies. It is evident that clean energy is less harmful and often cheaper. India is aiming to attain 175 GW of renewable energy which would consist of 100 GW from solar energy, 10 GW from bio-power, 60 GW from wind power, and 5 GW from small hydropower plants by the year 2022 [ 11 ]. Investors have promised to achieve more than 270 GW, which is significantly above the ambitious targets. The promises are as follows: 58 GW by foreign companies, 191 GW by private companies, 18 GW by private sectors, and 5 GW by the Indian Railways [ 12 ]. Recent estimates show that in 2047, solar potential will be more than 750 GW and wind potential will be 410 GW [ 13 , 14 ]. To reach the ambitious targets of generating 175 GW of renewable energy by 2022, it is essential that the government creates 330,000 new jobs and livelihood opportunities [ 15 , 16 ].

A mixture of push policies and pull mechanisms, accompanied by particular strategies should promote the development of renewable energy technologies. Advancement in technology, proper regulatory policies [ 17 ], tax deduction, and attempts in efficiency enhancement due to research and development (R&D) [ 18 ] are some of the pathways to conservation of energy and environment that should guarantee that renewable resource bases are used in a cost-effective and quick manner. Hence, strategies to promote investment opportunities in the renewable energy sector along with jobs for the unskilled workers, technicians, and contractors are discussed. This article also manifests technological and financial initiatives [ 19 ], policy and regulatory framework, as well as training and educational initiatives [ 20 , 21 ] launched by the government for the growth and development of renewable energy sources. The development of renewable technology has encountered explicit obstacles, and thus, there is a need to discuss these barriers. Additionally, it is also vital to discover possible solutions to overcome these barriers, and hence, proper recommendations have been suggested for the steady growth of renewable power [ 22 , 23 , 24 ]. Given the enormous potential of renewables in the country, coherent policy measures and an investor-friendly administration might be the key drivers for India to become a global leader in clean and green energy.

Projection of global primary energy consumption

An energy source is a necessary element of socio-economic development. The increasing economic growth of developing nations in the last decades has caused an accelerated increase in energy consumption. This trend is anticipated to grow [ 25 ]. A prediction of future power consumption is essential for the investigation of adequate environmental and economic policies [ 26 ]. Likewise, an outlook to future power consumption helps to determine future investments in renewable energy. Energy supply and security have not only increased the essential issues for the development of human society but also for their global political and economic patterns [ 27 ]. Hence, international comparisons are helpful to identify past, present, and future power consumption.

Table 1 shows the primary energy consumption of the world, based on the BP Energy Outlook 2018 reports. In 2016, India’s overall energy consumption was 724 million tons of oil equivalent (Mtoe) and is expected to rise to 1921 Mtoe by 2040 with an average growth rate of 4.2% per annum. Energy consumption of various major countries comprises commercially traded fuels and modern renewables used to produce power. In 2016, India was the fourth largest energy consumer in the world after China, the USA, and the Organization for economic co-operation and development (OECD) in Europe [ 29 ].

The projected estimation of global energy consumption demonstrates that energy consumption in India is continuously increasing and retains its position even in 2035/2040 [ 28 ]. The increase in India’s energy consumption will push the country’s share of global energy demand to 11% by 2040 from 5% in 2016. Emerging economies such as China, India, or Brazil have experienced a process of rapid industrialization, have increased their share in the global economy, and are exporting enormous volumes of manufactured products to developed countries. This shift of economic activities among nations has also had consequences concerning the country’s energy use [ 30 ].

Projected primary energy consumption in India

The size and growth of a country’s population significantly affects the demand for energy. With 1.368 billion citizens, India is ranked second, of the most populous countries as of January 2019 [ 31 ]. The yearly growth rate is 1.18% and represents almost 17.74% of the world’s population. The country is expected to have more than 1.383 billion, 1.512 billion, 1.605 billion, 1.658 billion people by the end of 2020, 2030, 2040, and 2050, respectively. Each year, India adds a higher number of people to the world than any other nation and the specific population of some of the states in India is equal to the population of many countries.

The growth of India’s energy consumption will be the fastest among all significant economies by 2040, with coal meeting most of this demand followed by renewable energy. Renewables became the second most significant source of domestic power production, overtaking gas and then oil, by 2020. The demand for renewables in India will have a tremendous growth of 256 Mtoe in 2040 from 17 Mtoe in 2016, with an annual increase of 12%, as shown in Table 2 .

Table 3 shows the primary energy consumption of renewables for the BRIC countries (Brazil, Russia, India, and China) from 2016 to 2040. India consumed around 17 Mtoe of renewable energy in 2016, and this will be 256 Mtoe in 2040. It is probable that India’s energy consumption will grow fastest among all major economies by 2040, with coal contributing most in meeting this demand followed by renewables. The percentage share of renewable consumption in 2016 was 2% and is predicted to increase by 13% by 2040.

How renewable energy sources contribute to the energy demand in India

Even though India has achieved a fast and remarkable economic growth, energy is still scarce. Strong economic growth in India is escalating the demand for energy, and more energy sources are required to cover this demand. At the same time, due to the increasing population and environmental deterioration, the country faces the challenge of sustainable development. The gap between demand and supply of power is expected to rise in the future [ 32 ]. Table 4 presents the power supply status of the country from 2009–2010 to 2018–2019 (until October 2018). In 2018, the energy demand was 1,212,134 GWh, and the availability was 1,203,567 GWh, i.e., a deficit of − 0.7% [ 33 ].

According to the Load generation and Balance Report (2016–2017) of the Central Electricity Authority of India (CEA), the electrical energy demand for 2021–2022 is anticipated to be at least 1915 terawatt hours (TWh), with a peak electric demand of 298 GW [ 34 ]. Increasing urbanization and rising income levels are responsible for an increased demand for electrical appliances, i.e., an increased demand for electricity in the residential sector. The increased demand in materials for buildings, transportation, capital goods, and infrastructure is driving the industrial demand for electricity. An increased mechanization and the shift to groundwater irrigation across the country is pushing the pumping and tractor demand in the agriculture sector, and hence the large diesel and electricity demand. The penetration of electric vehicles and the fuel switch to electric and induction cook stoves will drive the electricity demand in the other sectors shown in Table 5 .

According to the International Renewable Energy Agency (IRENA), a quarter of India’s energy demand can be met with renewable energy. The country could potentially increase its share of renewable power generation to over one-third by 2030 [ 35 ].

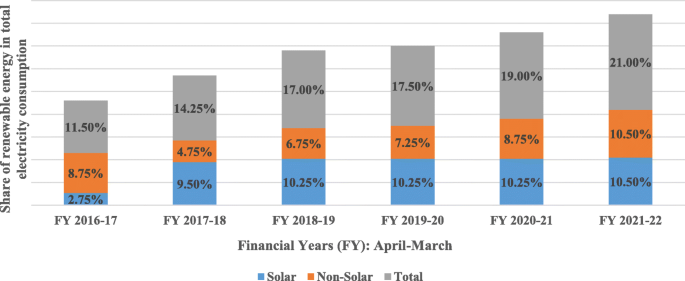

Table 6 presents the estimated contribution of renewable energy sources to the total energy demand. MoP along with CEA in its draft national electricity plan for 2016 anticipated that with 175 GW of installed capacity of renewable power by 2022, the expected electricity generation would be 327 billion units (BUs), which would contribute to 1611 BU energy requirements. This indicates that 20.3% of the energy requirements would be fulfilled by renewable energy by 2022 and 24.2% by 2027 [ 36 ]. Figure 1 shows the ambitious new target for the share of renewable energy in India’s electricity consumption set by MoP. As per the order of revised RPO (Renewable Purchase Obligations, legal act of June 2018), the country has a target of a 21% share of renewable energy in its total electricity consumption by March 2022. In 2014, the same goal was at 15% and increased to 21% by 2018. It is India’s goal to reach 40% renewable sources by 2030.

Target share of renewable energy in India’s power consumption

Estimated renewable energy potential in India

The estimated potential of wind power in the country during 1995 [ 37 ] was found to be 20,000 MW (20 GW), solar energy was 5 × 10 15 kWh/pa, bioenergy was 17,000 MW, bagasse cogeneration was 8000 MW, and small hydropower was 10,000 MW. For 2006, the renewable potential was estimated as 85,000 MW with wind 4500 MW, solar 35 MW, biomass/bioenergy 25,000 MW, and small hydropower of 15,000 MW [ 38 ]. According to the annual report of the Ministry of New and Renewable Energy (MNRE) for 2017–2018, the estimated potential of wind power was 302.251 GW (at 100-m mast height), of small hydropower 19.749 GW, biomass power 17.536 GW, bagasse cogeneration 5 GW, waste to energy (WTE) 2.554 GW, and solar 748.990 GW. The estimated total renewable potential amounted to 1096.080 GW [ 39 ] assuming 3% wasteland, which is shown in Table 7 . India is a tropical country and receives significant radiation, and hence the solar potential is very high [ 40 , 41 , 42 ].

Gross installed capacity of renewable energy in India

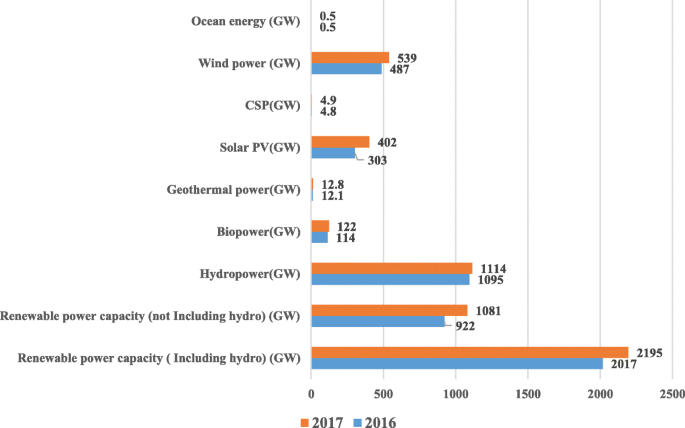

As of June 2018 reports, the country intends to reach 225 GW of renewable power capacity by 2022 exceeding the target of 175 GW pledged during the Paris Agreement. The sector is the fourth most attractive renewable energy market in the world. As in October 2018, India ranked fifth in installed renewable energy capacity [ 43 ].

Gross installed capacity of renewable energy—according to region

Table 8 lists the cumulative installed capacity of both conventional and renewable energy sources. The cumulative installed capacity of renewable sources as on the 31 st of December 2018 was 74081.66 MW. Renewable energy (small hydropower, wind, biomass, WTE, solar) accounted for an approximate 21% share of the cumulative installed power capacity, and the remaining 78.791% originated from other conventional sources (coal, gas diesel, nuclear, and large hydropower) [ 44 ]. The best regions for renewable energy are the southern states that have the highest solar irradiance and wind in the country. When renewable energy alone is considered for analysis, the Southern region covers 49.121% of the cumulative installed renewable capacity, followed by the Western region (29.742%), the Northern region (18.890%), the Eastern region (1.836%), the North-Easter region 0.394%, and the Islands (0.017%). As far as conventional energy is concerned, the Western region with 33.452% ranks first and is followed by the Northern region with 28.484%, the Southern region (24.967%), the Eastern region (11.716%), the Northern-Eastern (1.366%), and the Islands (0.015%).

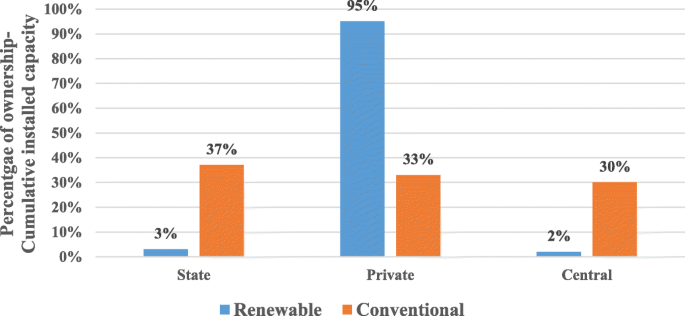

Gross installed capacity of renewable energy—according to ownership

State government, central government, and private players drive the Indian energy sector. The private sector leads the way in renewable energy investment. Table 9 shows the installed gross renewable energy and conventional energy capacity (percentage)—ownership wise. It is evident from Fig. 2 that 95% of the installed renewable capacity derives from private companies, 2% from the central government, and 3% from the state government. The top private companies in the field of non-conventional energy generation are Tata Power Solar, Suzlon, and ReNew Power. Tata Power Solar System Limited are the most significant integrated solar power players in the country, Suzlon realizes wind energy projects, and ReNew Power Ventures operate with solar and wind power.

Gross renewable energy installed capacity (percentage)—Ownership wise as per the 31.12.2018 [ 43 ]

Gross installed capacity of renewable energy—state wise

Table 10 shows the installed capacity of cumulative renewable energy (state wise), out of the total installed capacity of 74,081.66 MW, where Karnataka ranks first with 12,953.24 MW (17.485%), Tamilnadu second with 11,934.38 MW (16%), Maharashtra third with 9283.78 MW (12.532%), Gujarat fourth with 10.641 MW (10.641%), and Rajasthan fifth with 7573.86 MW (10.224%). These five states cover almost 66.991% of the installed capacity of total renewable. Other prominent states are Andhra Pradesh (9.829%), Madhya Pradesh (5.819%), Telangana (5.137%), and Uttar Pradesh (3.879%). These nine states cover almost 91.655%.

Gross installed capacity of renewable energy—according to source

Under union budget of India 2018–2019, INR 3762 crore (USD 581.09 million), was allotted for grid-interactive renewable power schemes and projects. As per the 31.12.2018, the installed capacity of total renewable power (excluding large hydropower) in the country amounted to 74.08166 GW. Around 9.363 GW of solar energy, 1.766 GW of wind, 0.105 GW of small hydropower (SHP), and biomass power of 8.7 GW capacity were added in 2017–2018. Table 11 shows the installed capacity of renewable energy over the last 10 years until the 31.12.2018. Wind energy continues to dominate the countries renewable energy industry, accounting for over 47% of cumulative installed renewable capacity (35,138.15 MW), followed by solar power of 34% (25,212.26 MW), biomass power/cogeneration of 12% (9075.5 MW), and small hydropower of 6% (4517.45 MW). In the renewable energy country attractiveness index (RECAI) of 2018, India ranked in fourth position. The installed renewable energy production capacity has grown at an accelerated pace over the preceding few years, posting a CAGR of 19.78% between 2014 and 2018 [ 45 ] .

Estimation of the installed capacity of renewable energy

Table 12 gives the share of installed cumulative renewable energy capacity, in comparison with the installed conventional energy capacity. In 2022 and 2032, the installed renewable energy capacity will account for 32% and 35%, respectively [ 46 , 47 ]. The most significant renewable capacity expansion program in the world is being taken up by India. The government is preparing to boost the percentage of clean energy through a tremendous push in renewables, as discussed in the subsequent sections.

Gross electricity generation from renewable energy in India

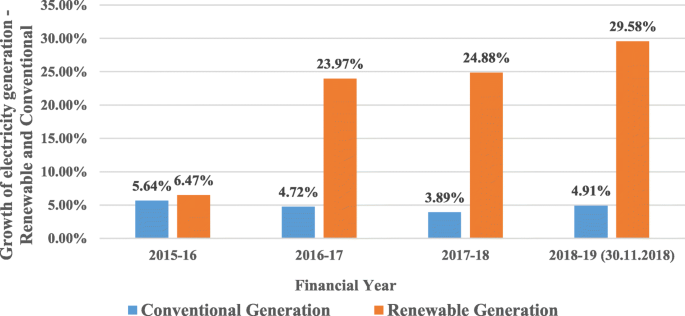

The overall generation (including the generation from grid-connected renewable sources) in the country has grown exponentially. Between 2014–2015 and 2015–2016, it achieved 1110.458 BU and 1173.603 BU, respectively. The same was recorded with 1241.689 BU and 1306.614 BU during 2015–2016 and 1306.614 BU from 2016–2017 and 2017–2018, respectively. Figure 3 indicates that the annual renewable power production increased faster than the conventional power production. The rise accounted for 6.47% in 2015–2016 and 24.88% in 2017–2018, respectively. Table 13 compares the energy generation from traditional sources with that from renewable sources. Remarkably, the energy generation from conventional sources reached 811.143 BU and from renewable sources 9.860 BU in 2010 compared to 1.206.306 BU and 88.945 BU in 2017, respectively [ 48 ]. It is observed that the price of electricity production using renewable technologies is higher than that for conventional generation technologies, but is likely to fall with increasing experience in the techniques involved [ 49 ].

The annual growth in power generation as per the 30th of November 2018

Gross electricity generation from renewable energy—according to regions

Table 14 shows the gross electricity generation from renewable energy-region wise. It is noted that the highest renewable energy generation derives from the southern region, followed by the western part. As of November 2018, 50.33% of energy generation was obtained from the southern area and 29.37%, 18.05%, 2%, and 0.24% from Western, Northern, North-Eastern Areas, and the Island, respectively.

Gross electricity generation from renewable energy—according to states

Table 15 shows the gross electricity generation from renewable energy—region-wise. It is observed that the highest renewable energy generation was achieved from Karnataka (16.57%), Tamilnadu (15.82%), Andhra Pradesh (11.92%), and Gujarat (10.87%) as per November 2018. While adding four years from 2015–2016 to 2018–2019 Tamilnadu [ 50 ] remains in the first position followed by Karnataka, Maharashtra, Gujarat and Andhra Pradesh.

Gross electricity generation from renewable energy—according to sources

Table 16 shows the gross electricity generation from renewable energy—source-wise. It can be concluded from the table that the wind-based energy generation as per 2017–2018 is most prominent with 51.71%, followed by solar energy (25.40%), Bagasse (11.63%), small hydropower (7.55%), biomass (3.34%), and WTE (0.35%). There has been a constant increase in the generation of all renewable sources from 2014–2015 to date. Wind energy, as always, was the highest contributor to the total renewable power production. The percentage of solar energy produced in the overall renewable power production comes next to wind and is typically reduced during the monsoon months. The definite improvement in wind energy production can be associated with a “good” monsoon. Cyclonic action during these months also facilitates high-speed winds. Monsoon winds play a significant part in the uptick in wind power production, especially in the southern states of the country.

Estimation of gross electricity generation from renewable energy

Table 17 shows an estimation of gross electricity generation from renewable energy based on the 2015 report of the National Institution for Transforming India (NITI Aayog) [ 51 ]. It is predicted that the share of renewable power will be 10.2% by 2022, but renewable power technologies contributed a record of 13.4% to the cumulative power production in India as of the 31st of August 2018. The power ministry report shows that India generated 122.10 TWh and out of the total electricity produced, renewables generated 16.30 TWh as on the 31st of August 2018. According to the India Brand Equity Foundation report, it is anticipated that by the year 2040, around 49% of total electricity will be produced using renewable energy.

Current achievements in renewable energy 2017–2018

India cares for the planet and has taken a groundbreaking journey in renewable energy through the last 4 years [ 52 , 53 ]. A dedicated ministry along with financial and technical institutions have helped India in the promotion of renewable energy and diversification of its energy mix. The country is engaged in expanding the use of clean energy sources and has already undertaken several large-scale sustainable energy projects to ensure a massive growth of green energy.

1. India doubled its renewable power capacity in the last 4 years. The cumulative renewable power capacity in 2013–2014 reached 35,500 MW and rose to 70,000 MW in 2017–2018.

2. India stands in the fourth and sixth position regarding the cumulative installed capacity in the wind and solar sector, respectively. Furthermore, its cumulative installed renewable capacity stands in fifth position globally as of the 31st of December 2018.

3. As said above, the cumulative renewable energy capacity target for 2022 is given as 175 GW. For 2017–2018, the cumulative installed capacity amounted to 70 GW, the capacity under implementation is 15 GW and the tendered capacity was 25 GW. The target, the installed capacity, the capacity under implementation, and the tendered capacity are shown in Fig. 4 .

4. There is tremendous growth in solar power. The cumulative installed solar capacity increased by more than eight times in the last 4 years from 2.630 GW (2013–2014) to 22 GW (2017–2018). As of the 31st of December 2018, the installed capacity amounted to 25.2122 GW.

5. The renewable electricity generated in 2017–2018 was 101839 BUs.

6. The country published competitive bidding guidelines for the production of renewable power. It also discovered the lowest tariff and transparent bidding method and resulted in a notable decrease in per unit cost of renewable energy.

7. In 21 states, there are 41 solar parks with a cumulative capacity of more than 26,144 MW that have already been approved by the MNRE. The Kurnool solar park was set up with 1000 MW; and with 2000 MW the largest solar park of Pavagada (Karnataka) is currently under installation.

8. The target for solar power (ground mounted) for 2018–2019 is given as 10 GW, and solar power (Rooftop) as 1 GW.

9. MNRE doubled the target for solar parks (projects of 500 MW or more) from 20 to 40 GW.

10. The cumulative installed capacity of wind power increased by 1.6 times in the last 4 years. In 2013–2014, it amounted to 21 GW, from 2017 to 2018 it amounted to 34 GW, and as of 31st of December 2018, it reached 35.138 GW. This shows that achievements were completed in wind power use.

11. An offshore wind policy was announced. Thirty-four companies (most significant global and domestic wind power players) competed in the “expression of interest” (EoI) floated on the plan to set up India’s first mega offshore wind farm with a capacity of 1 GW.

12. 682 MW small hydropower projects were installed during the last 4 years along with 600 watermills (mechanical applications) and 132 projects still under development.

13. MNRE is implementing green energy corridors to expand the transmission system. 9400 km of green energy corridors are completed or under implementation. The cost spent on it was INR 10141 crore (101,410 Million INR = 1425.01 USD). Furthermore, the total capacity of 19,000 MVA substations is now planned to be complete by March 2020.

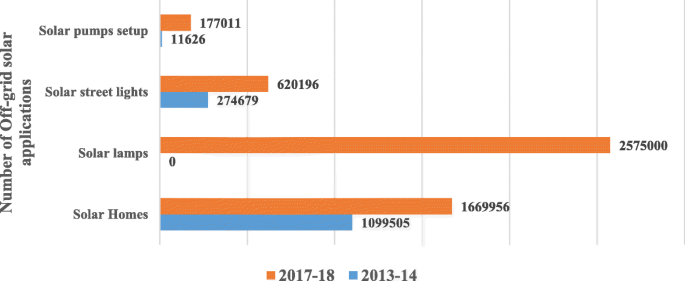

14. MNRE is setting up solar pumps (off-grid application), where 90% of pumps have been set up as of today and between 2014–2015 and 2017–2018. Solar street lights were more than doubled. Solar home lighting systems have been improved by around 1.5 times. More than 2,575,000 solar lamps have been distributed to students. The details are illustrated in Fig. 5 .

15. From 2014–2015 to 2017–2018, more than 2.5 lakh (0.25 million) biogas plants were set up for cooking in rural homes to enable families by providing them access to clean fuel.

16. New policy initiatives revised the tariff policy mandating purchase and generation obligations (RPO and RGO). Four wind and solar inter-state transmission were waived; charges were planned, the RPO trajectory for 2022 and renewable energy policy was finalized.

17. Expressions of interest (EoI) were invited for installing solar photovoltaic manufacturing capacities associated with the guaranteed off-take of 20 GW. EoI indicated 10 GW floating solar energy plants.

18. Policy for the solar-wind hybrid was announced. Tender for setting up 2 GW solar-wind hybrid systems in existing projects was invited.

19. To facilitate R&D in renewable power technology, a National lab policy on testing, standardization, and certification was announced by the MNRE.

20. The Surya Mitra program was conducted to train college graduates in the installation, commissioning, operations, and management of solar panels. The International Solar Alliance (ISA) headquarters in India (Gurgaon) will be a new commencement for solar energy improvement in India.

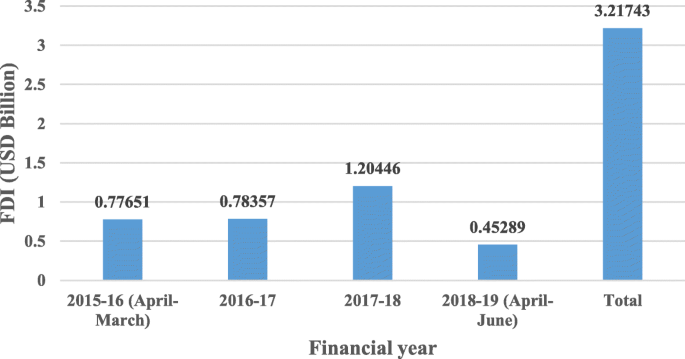

21. The renewable sector has become considerably more attractive for foreign and domestic investors, and the country expects to attract up to USD 80 billion in the next 4 years from 2018–2019 to 2021–2022.

22. The solar power capacity expanded by more than eight times from 2.63 GW in 2013–2014 to 22 GW in 2017–2018.

23. A bidding for 115 GW renewable energy projects up to March 2020 was announced.

24. The Bureau of Indian Standards (BIS) acting for system/components of solar PV was established.

25. To recognize and encourage innovative ideas in renewable energy sectors, the Government provides prizes and awards. Creative ideas/concepts should lead to prototype development. The Name of the award is “Abhinav Soch-Nayi Sambhawanaye,” which means Innovative ideas—New possibilities.

Renewable energy target, installed capacity, under implementation and tendered [ 52 ]

Off-grid solar applications [ 52 ]

Solar energy

Under the National Solar Mission, the MNRE has updated the objective of grid-connected solar power projects from 20 GW by the year 2021–2022 to 100 GW by the year 2021–2022. In 2008–2009, it reached just 6 MW. The “Made in India” initiative to promote domestic manufacturing supported this great height in solar installation capacity. Currently, India has the fifth highest solar installed capacity worldwide. By the 31st of December 2018, solar energy had achieved 25,212.26 MW against the target of 2022, and a further 22.8 GW of capacity has been tendered out or is under current implementation. MNRE is preparing to bid out the remaining solar energy capacity every year for the periods 2018–2019 and 2019–2020 so that bidding may contribute with 100 GW capacity additions by March 2020. In this way, 2 years for the completion of projects would remain. Tariffs will be determined through the competitive bidding process (reverse e-auction) to bring down tariffs significantly. The lowest solar tariff was identified to be INR 2.44 per kWh in July 2018. In 2010, solar tariffs amounted to INR 18 per kWh. Over 100,000 lakh (10,000 million) acres of land had been classified for several planned solar parks, out of which over 75,000 acres had been obtained. As of November 2018, 47 solar parks of a total capacity of 26,694 MW were established. The aggregate capacity of 4195 MW of solar projects has been commissioned inside various solar parks (floating solar power). Table 18 shows the capacity addition compared to the target. It indicates that capacity addition increased exponentially.

Wind energy

As of the 31st of December 2018, the total installed capacity of India amounted to 35,138.15 MW compared to a target of 60 GW by 2022. India is currently in fourth position in the world for installed capacity of wind power. Moreover, around 9.4 GW capacity has been tendered out or is under current implementation. The MNRE is preparing to bid out for A 10 GW wind energy capacity every year for 2018–2019 and 2019–2020, so that bidding will allow for 60 GW capacity additions by March 2020, giving the remaining two years for the accomplishment of the projects. The gross wind energy potential of the country now reaches 302 GW at a 100 m above-ground level. The tariff administration has been changed from feed-in-tariff (FiT) to the bidding method for capacity addition. On the 8th of December 2017, the ministry published guidelines for a tariff-based competitive bidding rule for the acquisition of energy from grid-connected wind energy projects. The developed transparent process of bidding lowered the tariff for wind power to its lowest level ever. The development of the wind industry has risen in a robust ecosystem ensuring project execution abilities and a manufacturing base. State-of-the-art technologies are now available for the production of wind turbines. All the major global players in wind power have their presence in India. More than 12 different companies manufacture more than 24 various models of wind turbines in India. India exports wind turbines and components to the USA, Europe, Australia, Brazil, and other Asian countries. Around 70–80% of the domestic production has been accomplished with strong domestic manufacturing companies. Table 19 lists the capacity addition compared to the target for the capacity addition. Furthermore, electricity generation from the wind-based capacity has improved, even though there was a slowdown of new capacity in the first half of 2018–2019 and 2017–2018.

The national energy storage mission—2018

The country is working toward a National Energy Storage Mission. A draft of the National Energy Storage Mission was proposed in February 2018 and initiated to develop a comprehensive policy and regulatory framework. During the last 4 years, projects included in R&D worth INR 115.8 million (USD 1.66 million) in the domain of energy storage have been launched, and a corpus of INR 48.2 million (USD 0.7 million) has been issued. India’s energy storage mission will provide an opportunity for globally competitive battery manufacturing. By increasing the battery manufacturing expertise and scaling up its national production capacity, the country can make a substantial economic contribution in this crucial sector. The mission aims to identify the cumulative battery requirements, total market size, imports, and domestic manufacturing. Table 20 presents the economic opportunity from battery manufacturing given by the National Institution for Transforming India, also called NITI Aayog, which provides relevant technical advice to central and state governments while designing strategic and long-term policies and programs for the Indian government.

Small hydropower—3-year action agenda—2017

Hydro projects are classified as large hydro, small hydro (2 to 25 MW), micro-hydro (up to 100 kW), and mini-hydropower (100 kW to 2 MW) projects. Whereas the estimated potential of SHP is 20 GW, the 2022 target for India in SHP is 5 GW. As of the 31st of December 2018, the country has achieved 4.5 GW and this production is constantly increasing. The objective, which was planned to be accomplished through infrastructure project grants and tariff support, was included in the NITI Aayog’s 3-year action agenda (2017–2018 to 2019–2020), which was published on the 1st of August 2017. MNRE is providing central financial assistance (CFA) to set up small/micro hydro projects both in the public and private sector. For the identification of new potential locations, surveys and comprehensive project reports are elaborated, and financial support for the renovation and modernization of old projects is provided. The Ministry has established a dedicated completely automatic supervisory control and data acquisition (SCADA)—based on a hydraulic turbine R&D laboratory at the Alternate Hydro Energy Center (AHEC) at IIT Roorkee. The establishment cost for the lab was INR 40 crore (400 million INR, 95.62 Million USD), and the laboratory will serve as a design and validation facility. It investigates hydro turbines and other hydro-mechanical devices adhering to national and international standards [ 54 , 55 ]. Table 21 shows the target and achievements from 2007–2008 to 2018–2019.

National policy regarding biofuels—2018

Modernization has generated an opportunity for a stable change in the use of bioenergy in India. MNRE amended the current policy for biomass in May 2018. The policy presents CFA for projects using biomass such as agriculture-based industrial residues, wood produced through energy plantations, bagasse, crop residues, wood waste generated from industrial operations, and weeds. Under the policy, CFA will be provided to the projects at the rate of INR 2.5 million (USD 35,477.7) per MW for bagasse cogeneration and INR 5 million (USD 70,955.5) per MW for non-bagasse cogeneration. The MNRE also announced a memorandum in November 2018 considering the continuation of the concessional customs duty certificate (CCDC) to set up projects for the production of energy using non-conventional materials such as bio-waste, agricultural, forestry, poultry litter, agro-industrial, industrial, municipal, and urban wastes. The government recently established the National policy on biofuels in August 2018. The MNRE invited an expression of interest (EOI) to estimate the potential of biomass energy and bagasse cogeneration in the country. A program to encourage the promotion of biomass-based cogeneration in sugar mills and other industries was also launched in May 2018. Table 22 shows how the biomass power target and achievements are expected to reach 10 GW of the target of 2022 before the end of 2019.

The new national biogas and organic manure program (NNBOMP)—2018

The National biogas and manure management programme (NBMMP) was launched in 2012–2013. The primary objective was to provide clean gaseous fuel for cooking, where the remaining slurry was organic bio-manure which is rich in nitrogen, phosphorus, and potassium. Further, 47.5 lakh (4.75 million) cumulative biogas plants were completed in 2014, and increased to 49.8 lakh (4.98 million). During 2017–2018, the target was to establish 1.10 lakh biogas plants (1.10 million), but resulted in 0.15 lakh (0.015 million). In this way, the cost of refilling the gas cylinders with liquefied petroleum gas (LPG) was greatly reduced. Likewise, tons of wood/trees were protected from being axed, as wood is traditionally used as a fuel in rural and semi-urban households. Biogas is a viable alternative to traditional cooking fuels. The scheme generated employment for almost 300 skilled laborers for setting up the biogas plants. By 30th of May 2018, the Ministry had issued guidelines for the implementation of the NNBOMP during the period 2017–2018 to 2019–2020 [ 56 ].

The off-grid and decentralized solar photovoltaic application program—2018

The program deals with the energy demand through the deployment of solar lanterns, solar streetlights, solar home lights, and solar pumps. The plan intended to reach 118 MWp of off-grid PV capacity by 2020. The sanctioning target proposed outlay was 50 MWp by 2017–2018 and 68 MWp by 2019–2020. The total estimated cost amounted to INR 1895 crore (18950 Million INR, 265.547 million USD), and the ministry wanted to support 637 crores (6370 million INR, 89.263 million USD) by its central finance assistance. Solar power plants with a 25 KWp size were promoted in those areas where grid power does not reach households or is not reliable. Public service institutions, schools, panchayats, hostels, as well as police stations will benefit from this scheme. Solar study lamps were also included as a component in the program. Thirty percent of financial assistance was provided to solar power plants. Every student should bear 15% of the lamp cost, and the ministry wanted to support the remaining 85%. As of October 2018, lantern and lamps of more than 40 Lakhs (4 million), home lights of 16.72 lakhs (1.672 million) number, street lights of 6.40 lakhs (0.64 million), solar pumps of 1.96 lakhs (0.196 million), and 187.99 MWp stand-alone devices had been installed [ 57 , 58 ].

Major government initiatives for renewable energy

Technological initiatives.

The Technology Development and Innovation Policy (TDIP) released on the 6th of October 2017 was endeavored to promote research, development, and demonstration (RD&D) in the renewable energy sector [ 59 ]. RD&D intended to evaluate resources, progress in technology, commercialization, and the presentation of renewable energy technologies across the country. It aimed to produce renewable power devices and systems domestically. The evaluation of standards and resources, processes, materials, components, products, services, and sub-systems was carried out through RD&D. A development of the market, efficiency improvements, cost reductions, and a promotion of commercialization (scalability and bankability) were achieved through RD&D. Likewise, the percentage of renewable energy in the total electricity mix made it self-sustainable, industrially competitive, and profitable through RD&D. RD&D also supported technology development and demonstration in wind, solar, wind-solar hybrid, biofuel, biogas, hydrogen fuel cells, and geothermal energies. RD&D supported the R&D units of educational institutions, industries, and non-government organizations (NGOs). Sharing expertise, information, as well as institutional mechanisms for collaboration was realized by use of the technology development program (TDP). The various people involved in this program were policymakers, industrial innovators, associated stakeholders and departments, researchers, and scientists. Renowned R&D centers in India are the National Institute of Solar Energy (NISE), Gurgaon, the National Institute of Bio-Energy (NIBE), Kapurthala, and the National Institute of Wind Energy (NIWE), Chennai. The TDP strategy encouraged the exploration of innovative approaches and possibilities to obtain long-term targets. Likewise, it efficiently supported the transformation of knowledge into technology through a well-established monitoring system for the development of renewable technology that meets the electricity needs of India. The research center of excellence approved the TDI projects, which were funded to strengthen R&D. Funds were provided for conducting training and workshops. The MNRE is now preparing a database of R&D accomplishments in the renewable energy sector.

The Impacting Research Innovation and Technology (IMPRINT) program seeks to develop engineering and technology (prototype/process development) on a national scale. IMPRINT is steered by the Indian Institute of Technologies (IITs) and Indian Institute of science (IISCs). The expansion covers all areas of engineering and technology including renewable technology. The ministry of human resource development (MHRD) finances up to 50% of the total cost of the project. The remaining costs of the project are financed by the ministry (MNRE) via the RD&D program for renewable projects. Currently (2018–2019), five projects are under implementation in the area of solar thermal systems, storage for SPV, biofuel, and hydrogen and fuel cells which are funded by the MNRE (36.9 million INR, 0.518426 Million USD) and IMPRINT. Development of domestic technology and quality control are promoted through lab policies that were published on the 7th of December 2017. Lab policies were implemented to test, standardize, and certify renewable energy products and projects. They supported the improvement of the reliability and quality of the projects. Furthermore, Indian test labs are strengthened in line with international standards and practices through well-established lab policies. From 2015, the MNRE has provided “The New and Renewable Energy Young Scientist’s Award” to researchers/scientists who demonstrate exceptional accomplishments in renewable R&D.

Financial initiatives

One hundred percent financial assistance is granted by the MNRE to the government and NGOs and 50% financial support to the industry. The policy framework was developed to guide the identification of the project, the formulation, monitoring appraisal, approval, and financing. Between 2012 and 2017, a 4467.8 million INR, 62.52 Million USD) support was granted by the MNRE. The MNRE wanted to double the budget for technology development efforts in renewable energy for the current three-year plan period. Table 23 shows that the government is spending more and more for the development of the renewable energy sector. Financial support was provided to R&D projects. Exceptional consideration was given to projects that worked under extreme and hazardous conditions. Furthermore, financial support was applied to organizing awareness programs, demonstrations, training, workshops, surveys, assessment studies, etc. Innovative approaches will be rewarded with cash prizes. The winners will be presented with a support mechanism for transforming their ideas and prototypes into marketable commodities such as start-ups for entrepreneur development. Innovative projects will be financed via start-up support mechanisms, which will include an investment contract with investors. The MNRE provides funds to proposals for investigating policies and performance analyses related to renewable energy.

Technology validation and demonstration projects and other innovative projects with regard to renewables received a financial assistance of 50% of the project cost. The CFA applied to partnerships with industry and private institutions including engineering colleges. Private academic institutions, accredited by a government accreditation body, were also eligible to receive a 50% support. The concerned industries and institutions should meet the remaining 50% expenditure. The MNRE allocated an INR 3762.50 crore (INR 37625 million, 528.634 million USD) for the grid interactive renewable sources and an INR 1036.50 crore (INR 10365 million, 145.629 million USD) for off-grid/distributed and decentralized renewable power for the year 2018–2019 [ 60 ]. The MNRE asked the Reserve Bank of India (RBI), attempting to build renewable power projects under “priority sector lending” (priority lending should be done for renewable energy projects and without any limit) and to eliminate the obstacles in the financing of renewable energy projects. In July 2018, the Ministry of Finance announced that it would impose a 25% safeguard duty on solar panels and modules imported from China and Malaysia for 1 year. The quantum of tax might be reduced to 20% for the next 6 months, and 15% for the following 6 months.

Policy and regulatory framework initiatives

The regulatory interventions for the development of renewable energy sources are (a) tariff determination, (b) defining RPO, (c) promoting grid connectivity, and (d) promoting the expansion of the market.

Tariff policy amendments—2018

On the 30th of May 2018, the MoP released draft amendments to the tariff policy. The objective of these policies was to promote electricity generation from renewables. MoP in consultation with MNRE announced the long-term trajectory for RPO, which is represented in Table 24 . The State Electricity Regulatory Commission (SERC) achieved a favorable and neutral/off-putting effect in the growth of the renewable power sector through their RPO regulations in consultation with the MNRE. On the 25th of May 2018, the MNRE created an RPO compliance cell to reach India’s solar and wind power goals. Due to the absence of implementation of RPO regulations, several states in India did not meet their specified RPO objectives. The cell will operate along with the Central Electricity Regulatory Commission (CERC) and SERCs to obtain monthly statements on RPO compliance. It will also take up non-compliance associated concerns with the relevant officials.

Repowering policy—2016

On the 09th of August 2016, India announced a “repowering policy” for wind energy projects. An about 27 GW turnaround was possible according to the policy. This policy supports the replacing of aging wind turbines with more modern and powerful units (fewer, larger, taller) to raise the level of electricity generation. This policy seeks to create a simplified framework and to promote an optimized use of wind power resources. It is mandatory because the up to the year 2000 installed wind turbines were below 500 kW in sites where high wind potential might be achieved. It will be possible to obtain 3000 MW from the same location once replacements are in place. The policy was initially applied for the one MW installed capacity of wind turbines, and the MNRE will extend the repowering policy to other projects in the future based on experience. Repowering projects were implemented by the respective state nodal agencies/organizations that were involved in wind energy promotion in their states. The policy provided an exception from the Power Purchase Agreement (PPA) for wind farms/turbines undergoing repowering because they could not fulfill the requirements according to the PPA during repowering. The repowering projects may avail accelerated depreciation (AD) benefit or generation-based incentive (GBI) due to the conditions appropriate to new wind energy projects [ 61 ].

The wind-solar hybrid policy—2018

On the 14th of May 2018, the MNRE announced a national wind-solar hybrid policy. This policy supported new projects (large grid-connected wind-solar photovoltaic hybrid systems) and the hybridization of the already available projects. These projects tried to achieve an optimal and efficient use of transmission infrastructure and land. Better grid stability was achieved and the variability in renewable power generation was reduced. The best part of the policy intervention was that which supported the hybridization of existing plants. The tariff-based transparent bidding process was included in the policy. Regulatory authorities should formulate the necessary standards and regulations for hybrid systems. The policy also highlighted a battery storage in hybrid projects for output optimization and variability reduction [ 62 ].

The national offshore wind energy policy—2015

The National Offshore Wind Policy was released in October 2015. On the 19th of June 2018, the MNRE announced a medium-term target of 5 GW by 2022 and a long-term target of 30 GW by 2030. The MNRE called expressions of Interest (EoI) for the first 1 GW of offshore wind (the last date was 08.06.2018). The EoI site is located in Pipavav port at the Gulf of Khambhat at a distance of 23 km facilitating offshore wind (FOWIND) where the consortium deployed light detection and ranging (LiDAR) in November 2017). Pipavav port is situated off the coast of Gujarat. The MNRE had planned to install more such equipment in the states of Tamil Nadu and Gujarat. On the 14 th of December 2018, the MNRE, through the National Institute of Wind Energy (NIWE), called tender for offshore environmental impact assessment studies at intended LIDAR points at the Gulf of Mannar, off the coast of Tamil Nadu for offshore wind measurement. The timeline for initiatives was to firstly add 500 MW by 2022, 2 to 2.5 GW by 2027, and eventually reaching 5 GW between 2028 and 2032. Even though the installation of large wind power turbines in open seas is a challenging task, the government has endeavored to promote this offshore sector. Offshore wind energy would add its contribution to the already existing renewable energy mix for India [ 63 ] .

The feed-in tariff policy—2018

On the 28th of January 2016, the revised tariff policy was notified following the Electricity Act. On the 30th May 2018, the amendment in tariff policy was released. The intentions of this tariff policy are (a) an inexpensive and competitive electricity rate for the consumers; (b) to attract investment and financial viability; (c) to ensure that the perceptions of regulatory risks decrease through predictability, consistency, and transparency of policy measures; (d) development in quality of supply, increased operational efficiency, and improved competition; (e) increase the production of electricity from wind, solar, biomass, and small hydro; (f) peaking reserves that are acceptable in quantity or consistently good in quality or performance of grid operation where variable renewable energy source integration is provided through the promotion of hydroelectric power generation, including pumped storage projects (PSP); (g) to achieve better consumer services through efficient and reliable electricity infrastructure; (h) to supply sufficient and uninterrupted electricity to every level of consumers; and (i) to create adequate capacity, reserves in the production, transmission, and distribution that is sufficient for the reliability of supply of power to customers [ 64 ].

Training and educational initiatives