Economic Synopses

A simple evaluation of two decades of inflation targeting: lessons for the new monetary policy strategy.

Since the mid-1990s, the Federal Reserve System has either implicitly or explicitly had an annual inflation target (IT) of around 2 percent. The Federal Open Market Committee's (FOMC's) preferred inflation measure to meet this target is core personal consumption expenditures (PCE), which explicitly excludes the prices on food and fuel to mitigate short-term volatility in the index. There has been a debate about using the core measure of inflation instead of the headline measure, which includes all PCE categories, 1 but for the purpose of this analysis we focus primarily on the core measure. In addition to its target inflation rate, the Fed seeks to achieve "full employment" or the lowest level of unemployment possible. The combination of its inflation and employment mandates is known as the Fed's "dual mandate."

In August 2020 at the Jackson Hole conference, Fed Chair Jerome Powell announced a revision to the Fed's monetary policy framework 2 by stating the Fed would seek an average inflation target (AIT) of 2 percent over the long run. Under this new approach to monetary policy, the FOMC is communicating that it will begin to tolerate short-run inflation exceeding the target rate if it means the long-run inflation rate will average 2 percent. This is a very notable revision to monetary policy as it implies that recent rate hikes, such as those of 2018, are less likely to happen under the new framework. The rationale for the revision, as indicated by senior Fed officials, included concerns that inflation shortfalls in recent years were economically sub-optimal and damaged Fed credibility.

The revision of the framework provides the opportunity to ask how successful the Fed has been at achieving its dual mandate during the era of pure inflation targeting. To provide a simple illustration of the Fed's success rate concerning monetary policy, the figure depicts the bivariate distribution of core PCE inflation and the unemployment rate using monthly data from January 1995 to August 2020.

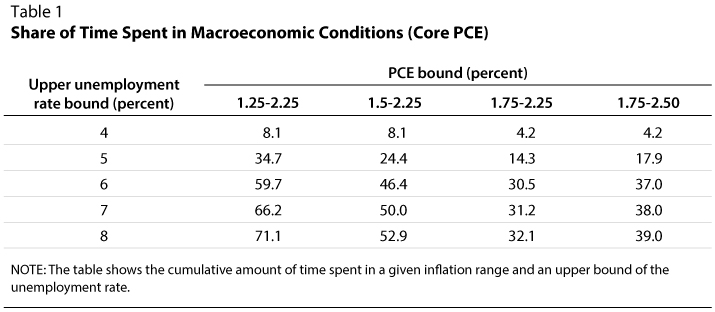

The left panel of the figure plots in 3D the bivariate distribution of these two measures, whereas the right panel plots a bird's eye view of the distribution. The bright colors represent pairs of outcomes that have been realized more frequently in the data, whereas darker colors represent less likely outcomes. The z -axis or vertical axis in the left panel represents the probability density of a given unemployment and inflation combination—in other words, the amount of time the U.S. was in that state of the economy. We also give this information in tabular form in Table 1, where we indicate the cumulative amount of time in our sample spent in a given range of inflation and unemployment rate measures.

So how has the Fed performed over the past 25 years? Judging by these baseline metrics, it appears to have done a reasonably good job maintaining its dual mandate. The concept of an "optimal" level of full employment is not well defined, so we abstract away from this definition and simply consider periods where the unemployment rate was under 6 percent as periods with high levels of employment. For 30.5 percent of the time, core PCE inflation has been between the narrow range around its target of 1.75 to 2.25 percent, and unemployment has been under 6 percent.

One might think that these bounds are too narrow and that during recessions or crises, one expects to observe inflation and unemployment outcomes outside the bounds. Expanding the range for inflation by reducing the lower bound to 1.5 percent increases the amount of time in that range to 46.4 percent. Surprisingly, increasing the unemployment rate bound to 8 percent to include periods of economic recovery or moderate recessionary periods only increases the share of time to 52.9 percent. In light of this evidence, one can argue that for approximately half the time in this recent era of monetary policy, the FOMC has been well within a reasonable range of its dual mandate.

The remainder of time unaccounted for in Table 1 and the analysis is concentrated in periods of high unemployment. Inflation for over two-thirds of this period moves in the range of 1.5 to 2.25 percent. However, this period has also been characterized by extremely large shocks to employment, including the Great Recession and the COVID-19 pandemic, causing the dual mandate to fail for periods of time.

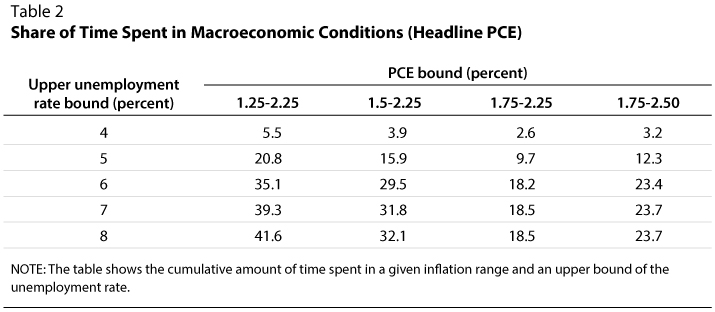

An alternative version of this analysis is presented in Table 2, where we substitute the headline PCE measure for core inflation. Using the more volatile measure unsurprisingly implies that the Fed was significantly less effective in anchoring inflation during this period. In the case of using headline inflation, the economy was in a state with less than 8 percent unemployment and with inflation between 1.5 and 2.25 percent only 32 percent of the time. As referenced earlier, there are pros and cons to selecting a less-volatile measure such as core PCE, and this can have large implications for evaluating the effectiveness of Fed policy during this period.

One has to bear in mind that the nature of this analysis is simple in execution, as it only evaluated the connection of the statistical properties of these two economic variables. To some extent, the high concentration in certain areas might be interpreted as a connection between both variables; but in order to move from a statistical relationship to a causal connection, it is necessary to bring economic theory into the picture.

Under the view of traditional monetarists, inflation is caused by a continuous increase in the supply of money with limited effects in labor markets and unemployment. The view of Keynesians is that inflation is generated in part by the relative strength of the labor market and that prices rise together with some lag caused by higher wages. Under this view, the central bank has the ability to exploit this connection, often referred to as the Phillips Curve, and influence the real economy through the trade-off between inflation and unemployment. Both of these views, in terms of the FOMC's ability to affect the variables, face some challenges. Recent work by Stock and Watson (2019) decomposes inflation rates into separate components. They find that the FOMC does not have the ability to influence all components of inflation and that many of the more unresponsive factors to monetary policy are weighted prominently in the Fed's preferred core measure of PCE. Related works by McLeay and Tenreyro (2020), Hazell et al. (2020), and Bharadwaj and Dvorkin (2020) document the flat Phillips phenomena and provide empirical and theoretical reasons for the recent flatness, calling into question the relative trade-off between the Fed's two measures in its dual mandate.

So far, the FOMC has done a reasonably good job, in a statistical sense, of keeping unemployment low and prices stable in the era of inflation targeting outside of large recessionary events, including the dot-com bubble, the Great Recession, and the COVID-19 pandemic. To what extent do these empirical distributions and theories about the employment-inflation trade-off matter for the new monetary policy strategy? It could affect the new monetary policy framework as it will seek to shift the bivariate distribution of inflation and unemployment up the y -axis (right panel of figure) to tolerate inflation above the explicit target of 2 percent. The credibility of the target made this a very unlikely outcome in the past, but the new guidance could deliver more inflation outcomes above the current inflation target. To what degree the FOMC can accomplish this remains an open question.

1 See Federal Reserve Bank of St. Louis President Jim Bullard's discussion of the pros and cons of various inflation measures at https://www.stlouisfed.org/publications/regional-economist/april-2011/headline-vs-core-inflation-a-look-at-some-issues .

2 See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200827a.htm .

Bharadwaj, Asha and Dvorkin, Maximiliano A. "The Case of the Reappearing Phillips Curve: A Discussion of Recent Findings." Federal Reserve Bank of St. Louis Review , 2020, 102 (3), pp. 313-37; https://doi.org/10.20955/r.102.313-37 .

Hazell, Jonathan; Herreño, Juan; Nakamura, Emi and Steinsson, Jón. "The Slope of the Phillips Curve: Evidence from U.S. States." NBER Working Paper Series, No. 28005, October 2020; https://doi.org/10.3386/w28005 .

McLeay, Michael and Tenreyro, Silvana. "Optimal Inflation and the Identification of the Phillips Curve." NBER Macroeconomics Annual 2019 , 2020, Vol. 34; https://doi.org/10.1086/707181 .

Stock, James H. and Watson, Mark W. "Slack and Cyclically Sensitive Inflation." NBER Working Paper Series, No. 25987, June 2019; https://doi.org/10.3386/w25987 .

© 2021, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Cite this article

Subscribe to Our Newsletter

Stay current with brief essays, scholarly articles, data news, and other information about the economy from the Research Division of the St. Louis Fed.

SUBSCRIBE TO THE RESEARCH DIVISION NEWSLETTER

Research division.

- Legal and Privacy

One Federal Reserve Bank Plaza St. Louis, MO 63102

Information for Visitors

The Effect of Inflation Targeting on Foreign Direct Investment Flows to Developing Countries

- UNDERGRADUATE PAPER

- Published: 19 December 2018

- Volume 46 , pages 459–470, ( 2018 )

Cite this article

- Iuliia Vasileva 1

969 Accesses

4 Citations

Explore all metrics

Due to the many benefits that come with foreign direct investment (FDI), such as greater economic growth and technology spillovers, developing countries strive to attract this type of investment. Although the amount of FDI in developing countries has increased greatly over the past several years, not all developing countries have been successful at attracting it. A credible monetary policy, such as inflation targeting (IT), might make countries that implement it more attractive destinations for FDI flows due to the reliable macroeconomic environment created. This paper estimates the effect of IT on FDI flows to developing countries using a difference-in-differences approach and panel data for 71 countries for the period 1985 to 2013. This paper also looks at the difference between targeting and non-targeting countries in terms of FDI inflows during times of high instability. The results indicate that the adoption of IT leads to increased FDI flows to developing countries overall and, most importantly, during times of distress.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Foreign Direct Investments and Economic Growth in Central and Eastern Europe: A Panel-Based Analysis

Foreign direct investment and economic growth nexus in the presence of domestic institutions: a regional comparative analysis

Sami Ullah, Kishwar Ali & Muhammad Ehsan

Impact of Foreign Direct Investment on Economic Growth in Eastern Africa

FDI is a cross-border investment associated with a person or an enterprise in one economy having ownership of 10% or more of the shares in an enterprise in another economy (IMF 2009 ). It represents the largest component of equity-related cross-border capital flows.

Tapsoba ( 2012 ), Valli and Masih ( 2014 ), Mason and Vracheva ( 2017 ), and Khan ( 2016 ) also study the effect of IT on FDI but they use a different estimation strategy.

I followed the World Economic Outlook’s (WEO) classification of emerging and developing economies (IMF 2017 ).

FDI flows were defined as capital transaction credits less debits between direct investors and their foreign affiliates recorded during the reference period, typically a year (UNCTAD 2017 ).

Although not reported in this paper, population was also used instead of GDP to account for the size of the country and the financial development index from IMF to account for financial development of countries instead of the credit to GDP ratio (Svirydzenka 2016 ). The results remained quantitatively and qualitatively similar to those in Table 1 .

Azangue, A. F. (2012). Coping with the recent financial crisis, did inflation targeting make any difference? Technical report. Available at https://halshs.archives-ouvertes.fr/halshs-00826277/document . Accessed 10 April 2018.

Bernanke, B. S. (2011). The effects of the Great Recession on central bank doctrine and practice: a speech at the Federal Reserve Bank of Boston 56th Economic Conference, Boston, Massachusetts, Oct. 18, 2011. Technical report. Available at https://www.federalreserve.gov/newsevents/speech/bernanke20111018a.htm . Accessed 10 April 2018.

Chinn, M. D., & Ito, H. (2006). What matters for financial development? Capital controls, institutions, and interactions. Journal of Development Economics, 81 (1), 163–192.

Article Google Scholar

Chinn, M. D. and Ito, H. (2016). A de jure measure of financial openness. Dataset. Available at http://web.pdx.edu/~ito/Chinn-Ito_website.htm . Date last accessed: 10 April 2018.

Feng, Y. (2017). Determinants of foreign direct investment (FDI). Oxford research encyclopedia of politics. Available at http://politics.oxfordre.com/view/10.1093/acrefore/9780190228637. 001.0001/acrefore-9780190228637-e-559?result=59&rskey=C6w0GY . Accessed 10 April 2018.

Goncalves, C., & Salles, J. M. (2008). Inflation targeting in emerging economies: What do the data say? Journal of Development Economics, 85 (1–2), 312–318.

Gurtner, B. (2010). The financial and economic crisis and developing countries. International Development Policy, 1 , 189–213.

Google Scholar

Hammond, G. (2012). State of the art of inflation targeting . Centre for Central Banking Studies, Bank of England. Available at https://econpapers.repec.org/bookchap/ccbhbooks/29.htm . Accessed 10 April 2018.

Ilzetzki, E., Reinhart, C. M., and Rogoff, K. S. (2017). Exchange arrangements entering the 21st century: Which anchor will hold? Working Paper 23134, National Bureau of Economic Research. Available at http://www.carmenreinhart.com/data/browse-by-topic/topics/11/ . Date last accessed: 10 April 2018.

IMF (2004). Classification of exchange rate arrangements and monetary policy frameworks. International Monetary Fund. Available at https://www.imf.org/external/np/mfd/er/2004/eng/0604.htm . Accessed 10 April 2018.

IMF (2009). Balance of payments and international investment position manual. International Monetary Fund, 6th edition. Available at https://www.imf.org/external/pubs/ft/bop/2007/bopman6.htm . Accessed 10 April 2018.

IMF (2017). Seeking sustainable growth: Short-term recovery, long-term challenges. World Economic Outlook . Available at https://www.imf.org/en/Publications/WEO/Issues/2017/09/19/world-economic-outlook-october-2017 . Accessed 10 April 2018.

IMF, World Economic Outlook (1985–2013). Available at https://www.imf.org/external/datamapper/PCPIPCH@WEO/OEMDC/ . Accessed 10 April 2018.

Kaminsky, G. L., Reinhart, C. M., & Vegh, C. A. (2004). When it rains, it pours: Procyclical capital flows and macroeconomic policies. NBER Macroeconomics Annual, 19 , 11–53.

Khan, N. (2016). Three essays on the macroeconomic impact of inflation targeting. (Doctoral Thesis). University of Ottawa. Available at https://ruor.uottawa.ca/bitstream/10393/35212/1/Khan_Najib_2016_thesis.pdf . Accessed 10 April 2018.

Kiat, J. (2008). The effect of exchange rate and inflation on foreign direct investment and its relationship with economic growth in South Africa. An unpublished MBA Thesis. Available at http://upetd.up.ac.za/thesis/subnitted/etd . Accessed 10 April 2018.

Laeven, L. and Valencia, F. (2012). Systemic banking crises database: An update. IMF Working Paper, International Monetary Fund. Available at https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Systemic-Banking-Crises-Database-An-Update-26015 . Date last accessed: 10 April 2018.

Mason, R., & Vracheva, V. (2017). The impact of inflation targeting on attracting foreign direct investment. Journal of Applied Business and Economics, 19 (4), 79–94.

National Bank of Georgia (NBG). (2018). Monetary policy strategy of the National Bank of Georgia. Available at https://www.nbg.gov.ge/index.php?m=628 . Accessed 1 December 2018.

OECD (2002). Foreign direct Investment for Development: Maximizing benefits, minimizing costs. Organization for Economic co-operation and Development. Available at https://www.oecd.org/investment/investmentfordevelopment/1959815.pdf . Accessed 10 April 2018.

Political Risk Services Group. (1985-2013). International Country Risk Guide. Data Source for political risk index, democratic accountability, ethnic tensions, religious tensions, law and order, corruption, external conflict, bureaucracy quality, internal conflict, governmental stability, and socioeconomic conditions. Available at https://epub.prsgroup.com/available-data . Accessed 10 April 2018.

Roger, S. (2010). Inflation targeting turns 20. Finance and Development, 47 (1), 46–49 Available at https://www.imf.org/external/pubs/ft/fandd/2010/03/roger.htm . Accessed 10 April 2018.

Seref Akin, M. (2009). How is the market size relevant as a determinant of FDI in developing countries? A research on population and the cohort size. International Symposium on Sustainable Development, pages 425–429. Available at https://www.researchgate.net/publication/267822860_How_Is_the_Market_Size_Relevant_as_a_Determinant_of_FDI_in_Developing_Countries_A_Research_on_Population_and_the_Cohort_Size . Accessed 10 April 2018.

Strat, V. A., Davidescu, A., and Paul, A. M. (2015). FDI and the unemployment - a causality analysis for the latest EU members. Procedia Economics and Finance, 23(Supplement C):635–643. 2nd Global Conference on Business, Economics, Management and Tourism. Available at https://core.ac.uk/download/pdf/81183232.pdf . Accessed 10 April 2018.

Svirydzenka, K. (2016). Introducing a new broad-based index of financial development. IMF Working Paper. Available at https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Introducing-a-New-Broad-based-Index-of-Financial-Development-43621 . Date last accessed: 10 April 2018.

Tapsoba, R. (2010). Does inflation targeting improve fiscal discipline? An empirical investigation. In Technical report Available at https://halshs.archives-ouvertes.fr/halshs-00553329/document . Accessed 10 April 2018.

Tapsoba, R. (2012). Does inflation targeting matter for attracting foreign direct investment into developing countries? Working papers 201203, CERDI. Available at https://halshs.archives-ouvertes.fr/halshs-00667203/document . Accessed 10 April 2018.

Ullah, I., Shah, M., and Khan, F. U. (2014). Domestic investment, foreign direct investment, and economic growth nexus: A case of Pakistan. Economics research international. Available at https://www.hindawi.com/journals/ecri/2014/592719/, 1, 5. Accessed 10 April 2018.

UNCTAD (1985–2013). World Investment Report. Available at http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740 . Accessed 10 April 2018.

UNCTAD (2017). World investment report 2017, investment and the digital economy. United Nations Publication. Available at https://unctad.org/en/PublicationsLibrary/wir2017_en.pdf . Accessed 10 April 2018.

Valli, M. and Masih, M. (2014). Is there any causality between inflation and FDI in an inflation targeting regime? Evidence from South Africa. MPRA Paper 60246, University Library of Munich, Germany. Available at https://mpra.ub.uni-muenchen.de/60246/1/MPRA_paper_60246.pdf . Accessed 10 April 2018.

Williams, J. (2014). Inflation targeting and the global financial crisis: Successes and challenges. Conference on fourteen years of inflation targeting in South Africa and the challenge of a changing mandate. Available at https://www.frbsf.org/our-district/files/SARB-2014-Williams_Web_PDF-final.pdf . Accessed 10 April 2018.

World Bank (1985-2013). World development indicators. Available at http://databank.worldbank.org/data/source/world-development-indicators . Date last accessed: 10 April 2018.

Download references

Author information

Authors and affiliations.

Double Major in Economics and International Affairs, with concentration in Financial Policy & Analysis, Lafayette College, Easton, PA, USA

Iuliia Vasileva

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Iuliia Vasileva .

Additional information

Iuliia Vasileva was the winner of the Best Undergraduate Paper Award Competition at the 86 th International Atlantic Economic Conference in New York, October 11-14, 2018.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

(DOCX 19 kb)

Rights and permissions

Reprints and permissions

About this article

Vasileva, I. The Effect of Inflation Targeting on Foreign Direct Investment Flows to Developing Countries. Atl Econ J 46 , 459–470 (2018). https://doi.org/10.1007/s11293-018-9594-6

Download citation

Published : 19 December 2018

Issue Date : 31 December 2018

DOI : https://doi.org/10.1007/s11293-018-9594-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Inflation targeting

- Developing countries

- Economic crises

- Find a journal

- Publish with us

- Track your research

- Architecture and Design

- Asian and Pacific Studies

- Business and Economics

- Classical and Ancient Near Eastern Studies

- Computer Sciences

- Cultural Studies

- Engineering

- General Interest

- Geosciences

- Industrial Chemistry

- Islamic and Middle Eastern Studies

- Jewish Studies

- Library and Information Science, Book Studies

- Life Sciences

- Linguistics and Semiotics

- Literary Studies

- Materials Sciences

- Mathematics

- Social Sciences

- Sports and Recreation

- Theology and Religion

- Publish your article

- The role of authors

- Promoting your article

- Abstracting & indexing

- Publishing Ethics

- Why publish with De Gruyter

- How to publish with De Gruyter

- Our book series

- Our subject areas

- Your digital product at De Gruyter

- Contribute to our reference works

- Product information

- Tools & resources

- Product Information

- Promotional Materials

- Orders and Inquiries

- FAQ for Library Suppliers and Book Sellers

- Repository Policy

- Free access policy

- Open Access agreements

- Database portals

- For Authors

- Customer service

- People + Culture

- Journal Management

- How to join us

- Working at De Gruyter

- Mission & Vision

- De Gruyter Foundation

- De Gruyter Ebound

- Our Responsibility

- Partner publishers

Your purchase has been completed. Your documents are now available to view.

Inflation Targeting

Lessons from the international experience.

- Ben S. Bernanke , Thomas Laubach , Frederic S. Mishkin and Adam S. Posen

- X / Twitter

Please login or register with De Gruyter to order this product.

- Language: English

- Publisher: Princeton University Press

- Copyright year: 1998

- Audience: Professional and scholarly;College/higher education;

- Main content: 392

- Keywords: Inflation ; Inflation targeting ; Monetary policy ; Central bank ; Exchange rate ; Long run and short run ; Deutsche Bundesbank ; Interest rate ; Inflationary bias ; Tight Monetary Policy ; Indexation ; Disinflation ; Retail price index ; Sacrifice Ratio ; Convertibility plan ; Core inflation ; Plaza Accord ; Rogernomics ; Money illusion ; Phillips curve ; Quantitative easing ; Headline inflation ; Monetary authority ; Supply shock ; Discretionary policy ; Real versus nominal value (economics) ; Rediscount ; Comparative advantage ; Output gap ; Stabilization policy ; Black Wednesday ; Speculative attack ; Export subsidy ; Devaluation ; Government bond ; Substitution bias ; Financial fragility ; Purchasing power ; Real interest rate ; Repurchase agreement ; Debt deflation ; Price Change ; Policy ; Fiscal policy ; Recession ; Monetary reform ; Real wages ; Market Indicators ; Currency ; Economics ; Public expenditure ; Quantity theory of money ; Overnight rate ; Interest Cost ; Tax ; Purchasing power parity ; European Exchange Rate Mechanism ; Economic recovery ; Unemployment ; Debt overhang ; Labour market flexibility ; Credit (finance) ; Currency intervention ; Real gross domestic product ; Liberalization ; RPIX ; Bond Yield ; And Interest ; Economic indicator ; Global recession

- Published: June 5, 2018

- ISBN: 9780691187396

AU Community Access Only

Reason: Restricted to American University users. To access this content, please connect to the secure campus network (includes the AU VPN).

Three essays on the impact of inflation targeting in developing and emerging countries

The objective of this dissertation is to estimate the effects of adopting inflation targeting (IT) on inflation and economic growth in developing countries. From an econometric perspective, the main shortcoming of most studies on IT effects is selection bias: the choice of implementing IT is intrinsically endogenous, in which case traditional regression techniques may yield biased estimates. To address this issue, each essay applies a novel methodology borrowed from the impact evaluation literature that has seldom been used in the monetary field.The first essay implements the synthetic control method to compare the macroeconomic trajectory of individual inflation targeters with that of a combination of comparison economies. Most of the results regarding inflation are unusable due to the sui generis nature of this series in developing countries. Evidence on the impact of IT on output is more insightful, albeit mixed. In Chile, Ghana, and Peru, real GDP is higher than that of their respective synthetic controls after the adoption of IT. However, the opposite is found in other countries, such as Mexico and Guatemala, and inconclusive results are found for various other countries.The second essay seeks to estimate IT effects by using a combination of entropy balancing, a weighting scheme designed to improve covariate balance between IT and non-IT countries, and fixed effects. This identification strategy helps to address potential endogeneity issues while keeping the benefits of the temporal nature of the dataset. While the evidence on the gains in terms of inflation reduction is mixed, we find that IT adoption tends to reduce output growth.The third essay aims to assess the impact of IT by using an endogenous treatment effect approach. This methodology enables us to jointly estimate the probability of implementing IT and the outcome equation, thereby addressing endogeneity issues. The analysis of the results confirms the existence of an output-inflation tradeoff under IT.Overall, the results of these estimates suggest caution in the application of IT policies. Especially, monetary authorities should recognize that there could potentially be output costs of any gains in reduced inflation and adjust the implementation of IT policies accordingly.

Usage metrics

Digitala Vetenskapliga Arkivet

- CSV all metadata

- CSV all metadata version 2

- modern-language-association-8th-edition

- Other style

- Other locale

Fromlet, Pia

Abstract [en].

Essay 1: This paper evaluates inflation targeting for ten countries. Assuming that the inflation targeting central bank's only concern is inflation around the target, expectations of the future deviation from the target given information about the deviation from the target today should be equal to zero. Testing this hypothesis, I find that data for the United Kingdom, Canada, Australia, Korea, the Czech Republic, and Chile are consistent with the central bank behaving as a strict inflation targeter. Korea has behaved most in line with a strict inflation targeter. In an extended approach lagged output gap is added as an information variable. In the extended case the null hypothesis of central banks behaving as a strict inflation targeter can be rejected for seven countries.

Essay 2: The monetary policy of five industrialized countries which have had explicit inflation targets for more than 15 years is studied. Considering the case of discretionary policy as well as commitment, I estimate two first-order conditions. The results support the theory of flexible inflation targeting under discretion for the United Kingdom. For New Zealand, the results under discretion suggests that monetary policymakers have been leaning with the wind rather than against the wind. The central banks of Canada, Sweden, and Australia have behaved in line with the theory of flexible inflation targeting under commitment.

Essay 3: This paper studies the effects on export prices (in the currency of the exporter) of shocks to the exchange rate, the exporting firms' costs and foreign prices. The theoretical analysis is done with alternative assumptions regarding the currency in which prices are set and the desired markup. Then, a VAR framework is used to analyze which theory predicts actual outcome the best. The results indicate that export prices respond strongly to exchange rate shocks and the effects seem to be in line with the theory of producer currency pricing and pricing to market. Wage shocks have insignificant effects.

Place, publisher, year, edition, pages

Keywords [en], national category, research subject, identifiers, public defence, akram, farooq, phd, supervisors, gottfries, nils, professor, westermark, andreas, docent, open access in diva, search in diva, by author/editor, by organisation, on the subject, search outside of diva, altmetric score.

The Fed may have no choice but to tip the US into recession, economist says

- The Fed might have to self-induce a recession if it wants to reach its target inflation rate, a BMO strategist said.

- Ian Lyngen told Bloomberg TV that the Fed might find its current monetary policy to not be restrictive enough.

- Markets have given up hope for a rate cut in June following the recent CPI print.

The latest inflation report not only sent bond yields soaring and stocks plunging , it may also have put the US back on track for a recession, one economist told Bloomberg TV on Thursday. The catch: such a downturn would be one self-induced by the Federal Reserve.

"If we continue to get inflation prints at these levels, the [Federal Reserve] is going to find itself backed into a corner where they need to cause a recession if they're going to hold that 2% inflation target," Ian Lyngen, BMO Capital Markets head of US rates strategy, said.

His comments follow after March's consumer price index came in hotter-than-expected on Wednesday, increasing 3.5% on an annual basis, against 3.4% year-over-year forecasts. The rate was higher than both January and February prints.

Related stories

This has essentially crushed market bets on a quick interest rate pivot from the Fed, with futures markets no longer counting on June as the starting point for easing. Instead, a majority of investors are eyeing September as more likely, according to the CME FedWatch Tool — though odds are below 50%.

The recession risk from the Fed may come as the central bank realizes that its current fed funds rate of 5.25% to 5.50% isn't restrictive enough to clamp down on inflation, Lyngen said.

This echoes recent warnings that others have put out, that the Fed could be pressured to pursue a rate hike.

Frances Donald, who also took part in the Bloomberg interview, agreed, noting that recession risk is increasing as the Fed loses data support to cut in the near term.

"Now that we're back to an environment where we're losing those embedded rate cuts, we actually have to increase the chance of something bad happening here," the chief economist at Manulife Investment Management warned, adding: "They may have to stay higher until something breaks. That's the problem."

Some have suggested that it's time for the Fed to instead adjust its inflation target rate to 3%, and in doing so ease these risks.

Leading economist Mohamed El-Erian is among this cohort, recently warning that interest rate policy will have to remain unchanged for years if the Fed wants to reach 2% inflation.

Watch: What Happens If The US Hits The Debt Ceiling And Defaults

- Main content

Advertisement

Supported by

Inflation Was Hotter Than Expected in March, Unwelcome News for the Fed

The surprisingly stubborn reading raised doubts about when — and even whether — the Federal Reserve will be able to start cutting interest rates this year.

- Share full article

+3.8% excluding

food and energy

+3.5% in March

By Jeanna Smialek

A closely watched measure of inflation remained stronger than expected in March, worrying news for Federal Reserve officials who have become increasingly concerned that their progress on lowering price increases might be stalling.

The surprisingly stubborn inflation reading raised doubts among economists about when — and even whether — the Fed will be able to start cutting interest rates this year.

The Consumer Price Index climbed 3.8 percent on an annual basis after stripping out food and fuel prices, which economists do in order to get a better sense of the underlying inflation trend. That “core” index was stronger than the 3.7 percent increase economists had expected, and unchanged from 3.8 percent in February. The monthly reading was also stronger than what economists had forecast.

Counting in food and fuel, the inflation measure climbed 3.5 percent in March from a year earlier, up from 3.2 percent in February and faster than what economists anticipated. A rise in gas prices contributed to that inflation number.

This week’s inflation figures come at a critical juncture for the Fed. Central bankers have been hoping to confirm that warmer-than-expected inflation figures at the start of the year were just a seasonal quirk, not evidence that inflation is getting stuck well above the 2 percent target. Wednesday’s report offers little comfort that the quick early 2024 readings have not lasted.

“It is what it is: It’s a stronger-than-expected number, and it’s showing that those price pressures are strong across goods and services,” said Blerina Uruci, chief U.S. economist at T. Rowe Price. “It’s problematic for the Fed. I don’t see how they can justify a June cut with this strong data.”

Policymakers have made it clear in recent months that they want to see further evidence that inflation is cooling before they cut interest rates. Fed officials raised borrowing costs to 5.3 percent in 2022 and mid-2023, which they think is high enough to meaningfully weigh on the economy. Central bankers forecast in March that they would cut interest rates three times this year.

But Fed officials do not want to cut rates before they are confident inflation is on track to return to normal. Lowering borrowing costs too early or too much would risk allowing price increases to pick back up. And if households and businesses come to expect inflation to remain slightly higher, officials worry that could make it even harder to stamp out down the road.

That threat of lingering inflation has become a more serious concern for policymakers since the start of the year. Inflation flatlined in January and February after months of steady declines, raising some alarm at the Fed and among forecasters. Going into the year, investors expected the Fed to cut rates sharply in 2024 — perhaps five or six times, to about 4 percent — but have steadily dialed back those expectations .

Stocks dropped sharply after the inflation release as investors further pared back their expectations for lower rates. Following the report, market pricing suggested that many investors now expect just one or two cuts his year.

The S&P 500 and the tech-heavy Nasdaq composite each closed nearly 1 percent lower on Wednesday. The Russell 2000 index, which tracks smaller companies, was down nearly 3 percent.

Investors would like to see lower interest rates, which tend to bolster prices for assets like stocks. But the Fed might struggle to explain why it is cutting rates at the current moment: Not only is inflation showing signs of getting stuck well above the central bank’s target, but the economy is growing at a fairly rapid pace and employers are hiring at a robust clip.

In short, the Fed’s policies do not appear to have pushed America to the brink of a recession — and in fact, there are signs that they may not be having as much of an effect as policymakers had expected when it comes to growth.

While the Fed officially targets Personal Consumption Expenditures inflation , a separate measure, the Consumer Price Index report released on Wednesday comes out earlier and includes data that feeds into the other metric. That makes it a closely watched signal of how price pressures are shaping up.

The inflation report’s details offered little reason to dismiss the gauge’s continued stubbornness as a fluke. They showed that housing inflation remains firm, auto insurance costs picked up at a rapid pace and apparel prices climbed.

Monthly changes in March

Motor vehicle insurance

Gasoline (all types)

Motor vehicle repair

Hospital services

Meats, poultry, fish, eggs

Electricity

All items excl. food and energy

Tobacco products

Rent of primary residence

Nonalcoholic beverages

Food away from home

Medical care commodities

Fruits, vegetables

Alcoholic beverages

Physicians’ services

Piped utility gas service

Dairy products

New vehicles

Airline fares

Cereals, bakery products

Used cars, trucks

Motor vehicle maintenance and repair

Meats, poultry, fish and eggs

All items excluding food and energy

Tobacco and smoking products

Nonalcoholic beverages and materials

Fruits and vegetables

Dairy and related products

Cereals and bakery products

Used cars and trucks

In a development that is likely to be especially notable for Fed officials, a measure of services inflation contributed to the pickup in annual inflation. Policymakers watch those prices closely, because they can reflect the strength of the underlying economy and because they tend to persist over time.

The question, increasingly, is whether Fed officials can cut interest rates at all this year in a world where inflation appears to be flatlining.

Ms. Uruci said that with every month inflation stays stubborn, the Fed may need to see more convincing evidence — and a more sustained return to deceleration — to feel confident that price increases are genuinely coming under control.

Kathy Bostjancic, Nationwide’s chief economist, predicted that rate cuts could now be delayed to this autumn, if they happen in 2024 at all.

“We now think September, if they start to cut rates, is more likely than July,” Ms. Bostjancic said. The new report “shakes the confidence that inflation is on this downward trend.”

If the Fed does not cut rates soon, the election could make the start of reductions more politically fraught. Central bankers are independent of the White House and typically insist that they do not make policy with an eye on the political calendar.

Still, cutting in the months just before the election could put policymakers under a partisan spotlight : Former President Donald J. Trump, the presumptive Republican nominee, has already painted possible rate cuts as a political ploy to help Democrats. Lower rates tend to help incumbents, since they bolster the economy.

But the current economic moment is a politically complicated one.

Consumers dislike rapidly rising prices, and inflation has been dogging President Biden’s approval ratings for months. That said, consumers have become less concerned about them in recent months as the pace of inflation has come down from its peak in 2022.

At the same time, some Americans are chafing against high interest rates, the medicine the Fed uses to cure rapid inflation because they make it more expensive to borrow to buy a house or make other large purchases.

Mr. Biden has struck a concerned tone about high prices and tough housing affordability conditions in recent months, while pinning at least some of the blame for recent rapid inflation on corporations.

He reiterated that message on Wednesday, while saying that he still expects to see rate cuts this year. Mr. Biden’s comments amounted to a forecast rather than a prescription, but they were unusual coming from a White House that usually avoids talking about Fed policy out of respect for the central bank’s independence.

“We have dramatically reduced inflation down from 9 percent to close to 3 percent,” Mr. Biden also noted.

Jeanna Smialek covers the Federal Reserve and the economy for The Times from Washington. More about Jeanna Smialek

Bank of Canada lifts 2024 growth forecast, sees inflation hitting target in 2025

- Medium Text

Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here.

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Japan's annual core consumer price growth is expected to have slowed slightly, a Reuters poll showed, but persistent cost-push pressures kept inflation at or above the central bank's 2% target for two years and remained a drag on household consumption.

Markets Chevron

Stocks muted, gold at new peak as markets weigh Fed cut timing

Asian equities were in a subdued mood on Friday as investors pondered the path for Federal Reserve interest rate cuts amid a murky U.S. inflation outlook.

IMAGES

COMMENTS

This doctoral thesis contains three essays on the macroeconomic impact of inflation targeting. 1. Inflation-targeting regime, as a framework for monetary policy conduct, has been adopted by central banks in thirty countries. Some of these countries enjoy high incomes while others have middle incomes.

The combination of its inflation and employment mandates is known as the Fed's "dual mandate." In August 2020 at the Jackson Hole conference, Fed Chair Jerome Powell announced a revision to the Fed's monetary policy framework 2 by stating the Fed would seek an average inflation target (AIT) of 2 percent over the long run. Under this new ...

Thesis for: MComm Economics; ... objective of this dissertation is to study whether the reduction in inflation and inflation variability experienced by inflation targeting countries is due to the ...

1.1 The Definition of Inflation Targeting Inflation targeting is characterized by the public announcement of official target ranges or quantitative targets for the inflation rate at one or more time horizons and by explicit acknowledgement that low and stable inflation is the long run primary objective of the monetary policy. According to ...

countries can be classified as inflation targeters (Roger 2010), including nine industrial countries and seventeen emerging market and developing economies. In the MENA region, Turkey adopted IT in 2006, while Egypt, Tunisia and Morocco intend to move toward a fully fledged inflation targeting regime in the foreseeable future.

This study employs the panel vector autoregressive (PVAR) model to examine the spillover effect of US unconventional monetary policy on inflation and non-inflation targeting emerging markets post credit crunch and during COVID-19 from 2000Q1 to 2020Q4. Unlike other analyses, this paper adds to the existing body of knowledge by employing a dummy variable to represent the United States ...

A credible monetary policy, such as inflation targeting (IT), might make countries that implement it more attractive destinations for FDI flows due to the reliable macroeconomic environment created. ... Three essays on the macroeconomic impact of inflation targeting. (Doctoral Thesis). University of Ottawa. Available at https://ruor.uottawa.ca ...

This is the reason why inflation targeting countries have so much success in keeping inflation low (see, e.g. Böhm et al., Citation 2012). Due to these reasons, the Czech Republic has one of the lowest average inflation of all the selected countries (see Table 2 ), while transmission effects from inflation and inflation uncertainty to GDP are ...

This doctoral thesis contains three essays on the macroeconomic impact of inflation targeting: (1) Inflation-targeting regime, as a framework for monetary policy conduct, has been adopted by ...

Clear, balanced, and authoritative, Inflation Targeting is a groundbreaking study that will have a major impact on the debate over the right monetary strategy for the coming decades. As a unique comparative study of what central banks actually do in different countries around the world, this book will also be invaluable to anyone interested in ...

DOI 10.3386/w9981. Issue Date September 2003. The paper begins by tracing the origins of the case for inflation targeting in postwar US monetary history. It describes five aspects of inflation targeting practiced implicitly by the Greenspan Fed. It argues that (1) low long run inflation should be an explicit priority for monetary policy, (2) as ...

Essays on Inflation Targeting D165562 THAN THAN SOE A Dissertation Submitted to ... Inflation targeting (IT) regime has become a popular monetary policy framework across countries. Since the early 1990's, advanced countries have adopted an IT regime while developing countries have adopted an IT regime since the late 1990's. As of 2013, fourteen

This thesis is concerned with the role of Inflation Targeting (IT) and Fiscal Rules (FRs), as well as of their interactions, on macroeconomic environment. After laying the conceptual and empirical ...

This paper deals with the relationship between inflation targeting and exchange rates. I address three specific issues: first, I analyze the effectiveness of nominal exchange rates as shock absorbers in countries with inflation targeting. This issue is closely related to the magnitude of the "pass-through" coefficient.

inflation variance, used as a proxy for inflation uncertainty. An analysis of previous work and related economic theory is posed. A GARCH methodology is implemented to measure inflation volatility, utilizing a variable to measure the presence of inflation targeting in relation to inflation variance. Also, a study of the impact of inflation ...

THESIS APPROVAL INFLATION TARGETING IN MONGOLIA: A VAR MODEL ANALYSIS by Anujin Nergui A Thesis Submitted in Partial Fulfillment of the Requirements ... inflation targeting works better in limiting the variability of CPI inflation, output gap, and exchange rate in a small open economy. Carare and Stone, (2005) classified countries that define ...

Inflation targeting in principle helps redress this asymmetry by making inflation--rather than employment, output, or some other criterion--the primary goal of monetary policy. It also forces the central bank to look ahead, giving it the opportunity to tighten policies before inflationary pressures become intense.

this thesis materially, logistically and through word of advice or otherwise. Firstly, I would like to thank God Almighty for protecting and guiding me throughout the ... inflation targeting does affect inflation behaviour which then lays a foundation for economic growth. There is an indirect relationship between inflation targeting and

Master's Thesis The Impact of Inflation Targeting on Inflation Volatility by SALIMOV Muhammad 51218628 July 2020 Master's Thesis Presented to Ritsumeikan Asia Pacific University In Partial Fulfillment of the Requirements for the Degree of Master of Science in International Cooperation Policy. i

The objective of this dissertation is to estimate the effects of adopting inflation targeting (IT) on inflation and economic growth in developing countries. From an econometric perspective, the main shortcoming of most studies on IT effects is selection bias: the choice of implementing IT is intrinsically endogenous, in which case traditional regression techniques may yield biased estimates ...

2013 (English) Doctoral thesis, comprehensive summary (Other academic) Abstract [en] Essay 1: This paper evaluates inflation targeting for ten countries. Assuming that the inflation targeting central bank's only concern is inflation around the target, expectations of the future deviation from the target given information about the deviation from the target today should be equal to zero.

A synthesis of the three essays suggest that the authorities have not succeeded in convincing price and wage setters that IT can credibily maintain inflation within the target band, hence inflation and inflation volatility persists. Moreover the success of inflation targeting is hinged

The U.S. economy is in better balance, which will allow inflation to continue on a gradual path to the Fed's 2% annual-rate target, New York Fed President John Williams said Thursday. "I ...

Investors went into 2024 expecting the Federal Reserve to cut rates sharply. Stubborn inflation and quick growth call that into question. Note: Average monthly effective Fed funds rate based on ...

Thesis PDF Available. ... Gill Hammond, 2012, State of the Art Inflation Targeting CEPR, 2013, Is Inflation Targeting Dead FED, Frederic S. Mishkin, April 2007, Speech: Monetary Policy and the ...

The ranks of Federal Reserve officials saying there is no rush to cut interest rates continue to grow, with still-too-hot-for-comfort U.S. inflation a rising concern at home and casting a shadow ...

The recession risk from the Fed may come as the central bank realizes that its current fed funds rate of 5.25% to 5.50% isn't restrictive enough to clamp down on inflation, Lyngen said.

The surprisingly stubborn reading raised doubts about when — and even whether — the Federal Reserve will be able to start cutting interest rates this year. 10 Inflation 8 +3.8% excluding food ...

Inflation has been falling in recent months but at 2.8%, it is still above the bank's 2% target. The bank said higher gasoline prices would keep it at around 3% in the second quarter before it ...

Higher gasoline prices are expected to keep overall inflation close to 3% in the second quarter of 2024 before it eases to below 2.5% in the second half of the year and returns to the 2% target ...