How to Deduct Education, Classes, Workshops

Cameron McCool

Reviewed by

Judah Broussard, EA

March 1, 2022

This article is Tax Professional approved

The world of business moves quickly, and entrepreneurs need to work hard to keep up. Investing in your education through workshops, classes, and books are great ways to stay ahead of the curve and ensure you’re constantly growing.

Here’s what you can and can’t deduct.

I am the text that will be copied.

Heads up: this article is only relevant for U.S. businesses.

Understanding work-related education

Work-related education costs are fully deductible when they add value to your business and increase your expertise. In order to decide if your class or workshop qualifies, the IRS will look at whether the expense maintains or improves skills that are required in your current business.

Here are some examples of work-related education expenses:

- Classes that improve or maintain skills in your field

- Seminars and webinars that improve or maintain skills in your field

- Subscriptions to trade or professional publications that improve or maintain skills in your field

- Books tailored to your industry that improve or maintain skills in your field

- Workshops to increase or maintain your expertise and skills

- Transportation expenses to and from classes that improve or maintain skills in your field (note: no deduction is allowed for travel as a form of education in and of itself)

Note that if the class or workshop is local, you are able to deduct the cost of traveling from your place of work to the location of the class or workshop. If you’re required to travel in order to take a class, you can deduct travel expenses in the same way that you would deduct general business travel .

If you have employees working for your business, you can choose to offer an educational assistance program, with your business paying the cost of employee training and education. If you cover these costs, you can claim them as fringe benefits . In order to deduct these expenses, they need to be reasonably related to your business.

Also, note that the IRS says some educational expenses cannot be deducted and labels them personal education expenses. These educational expenses include those that are necessary to meet the minimum educational requirements and qualify you for your present employment, trade, or business.

Deduction limitations

Classes or workshops are deductible in many cases, but not if they qualify you for a new career or are simply outside the realm of your business. For example, taking law classes in the evening in order to become adept at contracts for your business is generally not a deductible expense. Although this new skill could very well improve your business, this skill improvement is not required of the business and not expressly required of law, or regulation.

Reporting work-related education costs

As with all tax claims, it’s key to report your expenses properly and back them up thoroughly with the right documentation (e.g. an invoice or receipt that proves the expense).

To report the costs of work-related education, classes, and workshops, record the expenses as professional development against self-employment income on Schedule C if filing as an unincorporated sole proprietor or a single-member LLC.

If filing as a partnership or multi-member LLC, capture these work-related education expenses on Form 1065 . If filing as a corporation, capture these expenses on Form 1120 .

Be sure to save all of the receipts for work-related education expenses you generate. This can help you track the smaller purchases that are easy to forget, in addition to acting as proof of your deductions.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

Deducting Education Expenses for Employees and Owners

- Taxes and Education Benefits

- Deducting Education Benefits

- Education for Self-employed

Where to Deduct Education Expenses on Your Business Tax Return

Many employers provide educational benefits for employees. Some of these benefits are for continuing education, to maintain professional licenses, or to gain new skills, credentials, or degrees to benefit both the employee and employer. Self-employed business owners also may be able to deduct education expenses.

Education expenses are legitimate business expenses. But there are still some qualifications that must be met before these expenses are fully deductible to your business.

This article looks at four questions:

- Which of these benefits are deductible as business expenses?

- Which of these benefits are taxable to employees?

- How do I report taxable benefits on an employee's W-2 form?

- How do I include deductible benefits in my business tax return?

Employee Taxes and Education Assistance Benefits

The IRS allows some fringe benefits to be excluded from employee pay and taxes. For all of these excluded benefits , including educational assistance, you don't have to withhold federal income tax and FICA tax for Social Security and Medicare (both the employee and employer portion). These excluded educational benefits aren't subject to federal unemployment (FUTA) tax .

In addition, to be excluded from employee pay, these benefits must meet certain conditions.

The exclusion is for education benefits you provide to employees up to $5,250 o benefits each year; anything over this amount is taxable to the employee. Educational expenses include books, tuition, and travel costs to and from school.

You must have a written Educational Assistance Program. The plan requirements include these restrictions:

- The plan cannot favor highly paid employees

- It can't provide more than 5% of benefits to shareholders or owners (or their spouses or dependents)

- Employees can't receive cash or other benefits instead of educational assistance

- You must give reasonable notice of the program to eligible employees

In addition,

- The educational benefit must relate to your business

- The business use must be substantiated with records, even if you reimburse in cash

You can include yourself (as a sole proprietor) or yourself and your partners who perform services for a partnership in your educational assistance program. You can also include these people in your educational assistance program:

- Current employees

- Former employees who retired, left on a disability, or were laid off

- A leased employee who has provided services to your business on a substantially full-time basis for at least a year if the services were performed under your primary direction or control

As of the 2018 tax year and into the future, education tuition costs are no longer deductible to individuals on Schedule A of their personal tax returns.

Education Benefits Deductible to Your Business

The cost of continuing education credits for employees is included as an expense of your business if it meets these restrictions:

The educational course must not

- Be needed to meet the minimum educational requirements of the current job

- Qualify the employee for a new (different) trade or business

As usual with the IRS, this issue is complicated. See the IRS Employer's Fringe Benefit Guide for more information about qualification, limitations, and restrictions.

Independent contractors working for your business can be treated as employees for the purpose of this benefit. That means they may also exclude allowable education benefit expense payments from income. Their income would be reported on Form 1099-NEC (starting in 2019 and going forward).

Education Benefits As Working Condition Fringe Benefits

Another way to provide employees with education benefits without having them be taxable to the employee is to provide working condition benefits. This policy is for businesses that don't have an educational assistance plan or who provide education assistance over $5,250 in a year.

Working condition benefits are given to employees to help them do their jobs, including job-related education benefits. Degree programs usually don't qualify, because the employee should already have the degree necessary to do the job. To qualify as a working condition fringe benefit:

- The education must be required by the employer or by law for the employee to keep his or her present salary, status, or job. The required education must serve a bona fide business purpose of the employer.

- The education maintains or improves skills needed in the job .

Education Expenses for Self-employed Business Owners

As noted above, self-employed business owners can deduct costs for their education, subject to certain limitations in the same way as individual taxpayers. You are self-employed if you own a business that is not a corporation (this includes ownership of an LLC or partnership as well as a sole proprietorship) .

To be deductible, you must be able to show that this education

- "Maintains or improves skills required in your present work."

- It is required by law or regulations for maintaining a license to practice, status, or job. For example, professionals can deduct costs for continuing education

Education expenses are not deductible if

- This education is needed to meet the minimum educational requirements of your present trade or business. For example, you can't deduct the cost of obtaining a license to practice if you don't already hold such a license.

- The education is part of a program of study that will qualify you for a new trade or business.

To deduct employee education expenses, use "Employee Benefit Programs" or similar line on your business tax return.

- For sole proprietors and single-member LLCs, show these expenses in the "Expenses" section of Schedule C .

- For partnerships and multiple-member LLCs, show these expenses in the "Deductions" section of Form 1065 .

- For corporations, show these expenses in the "Deductions" section of Form 1120.

For More Information on Deducting Educational Expenses

For more information, see IRS Publication 970: Tax Benefits for Education , Chapter 12, Business Deduction for Work-Related Education.

This article about which employee benefits are taxable might also be helpful.

Disclaimer: This article presents general information but tax regulations change and every business situation is unique. Discuss your situation with your tax professional or employee benefits consultant.

IRS. " Publication 15-B Employer's Tax Guide to Fringe Benefits ." Page 11. Accessed Sept. 2, 2020.

IRS. " Publication 15-B Employer's Tax Guide to Fringe Benefits ." Page 10. Accessed Sept. 2, 2020.

IRS. " Publication 15-B Employer's Tax Guide to Fringe Benefits ." Page 22. Accessed Sept. 2, 2020.

IRS. " Topic No. 513 Work-Related Education Expenses ." Accessed Sept. 2, 2020.

IRS. " Publication 535 Business Expenses ." Page 9. Accessed Sept. 2, 2020.

The Last Schedule C Guide You'll Ever Need

Sarah is an Enrolled Agent with the IRS and a former staff writer at Keeper. In 2022, she was named one of CPA Practice Advisor’s 20 Under 40 Top Influencers in the field of accounting. Her work has been featured in Business Insider, Money Under 30, Best Life, GOBankingRates, and Shopify. Sarah has spent nearly a decade in public accounting and has extensive experience offering strategic tax planning at the state and federal level. Her clients have come from a wide range of industries, including oil and gas, manufacturing, real estate, wholesale and retail, finance, and ecommerce, and she has handled tax returns for C corps, S corps, partnerships, nonprofits, and sole proprietorships. In her spare time, she is a devoted cat mom and enjoys hiking, painting, and overwatering her houseplants.

Everyone loves a good DIY fail. That is, until it happens to you. If you’re filing your self-employment taxes yourself this year, you’ll need a Schedule C guide you can trust. Look no further. Not to toot my own horn, but I’ve got all the Schedule C info you’ll ever need.

This article tackles the most common questions and provides a comprehensive roadmap for how to do it yourself.

What is a Schedule C?

Schedule C is a form used to report self-employment income on a personal return.

“Self-employment income” is how we describe all earned income derived from non-W-2 sources. This could be income from your small business, freelance work, or just extra cash earned through a side hustle. It’s usually paired with a Schedule SE (Form 1040), or self-employment tax form.

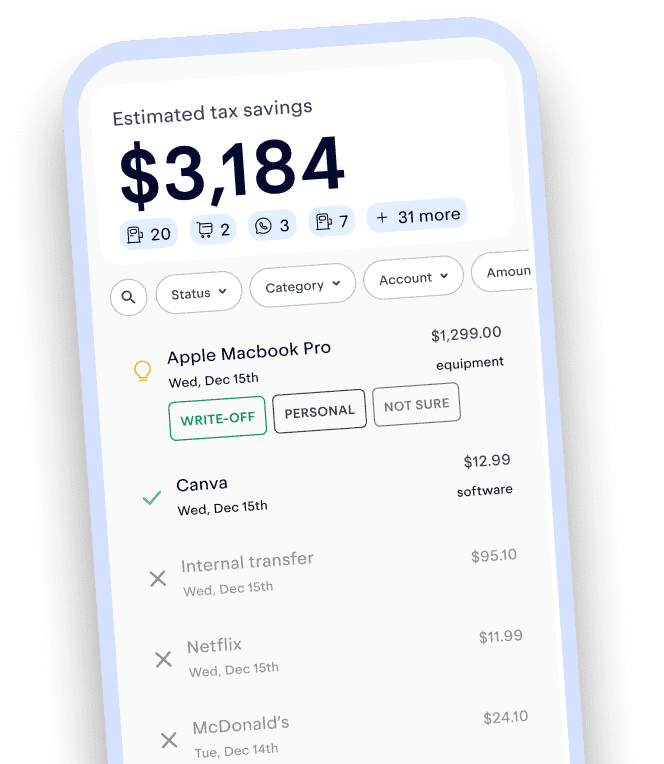

Schedule C is also where you report your business write-offs. Those are the work-related expenses you incurred during the year, like supplies, software costs, your cell phone bill , and more.

Who needs to fill out Schedule C?

If you would describe yourself as one of the following, you should be using a Schedule C:

- Side hustler

- Sole proprietor

- Independent contractor

- Sole owner of an LLC

- Business owner with your spouse

In a nutshell, if you earn income that isn’t reported on a W-2, you don’t have a business partner, and your business isn’t incorporated (or treated as a corporation for tax purposes), Schedule C is for you.

Prior to 2019, the IRS offered some sole proprietors with very lean operations a simpler option called Schedule C-EZ. Unfortunately, it’s no longer available.

How many Schedule C forms do you need?

As a general rule, you should use one Schedule C for every business activity you’re involved in. For instance, if you DJ on the weekends and sell custom T-shirts on Etsy, those should be reported separately.

The reason is that certain write-offs are only available to certain industries, so if you mix together your different ventures on a single Schedule C, it’s much more likely that your return will get flagged and audited.

The goal is to keep all similar or related activities together. So for example, if you drive for both Uber and Doordash, you could combine those activities on a single Schedule C, since they both fall under the umbrella of driving services.

How to fill out your Schedule C, step by step

The best way to learn is with examples. So for our Schedule C walkthrough we’re going to look at how Bruce Banner — also known as The Hulk — would complete his tax form.

Step #1: Input your information

The first section of the Schedule C is reserved for your business information. We’re going to review this in detail below.

Name of proprietor

In most cases, this will be your personal name. If you have an LLC you’re registered under, you can use the business name here.

Social Security number

You’ll fill out either this box, or box D, never both.

If you haven’t registered for an employer tax ID number, use your Social Security. If you do have an employer tax ID number, leave the Social Security box blank.

The important thing is that the tax ID number listed here matches any 1099-NECs you receive.

Box A: Principal profession

This box describes the industry you work in. In the example above, Bruce Banner’s profession is working as an Avenger.

There’s really no right or wrong here, just pick a word that best describes what you do. That could be “dog walker,” “massage therapist,” or even something general, like “janitorial services.”

Box B: Code

This code helps the IRS identify your industry more precisely. The IRS uses a list of predetermined NAICS codes to pick from.

It’s not always easy to determine which code makes the most sense, but your best guess is fine. There’s no penalty for accidentally choosing the wrong thing.

In Dr. Banner’s case, it’s hard to find a code that adequately describes “superhero,” so he went with 812990 - “other personal services.”

Box C: Business name

This is optional, but it’s used to list your “doing business as” name. This helps the IRS tie records in the event that some of your 1099’s are issued under your personal name, and some under your DBA name.

When working on the team, Mr. Banner goes by Bruce, but his public-facing name is The Hulk, so he listed both to minimize confusion.

Box E: Business address

If you have a separate location for your business, list it here. If not, your personal address will do.

Box F: Accounting method

The majority of taxpayers use the cash method.

The other accounting methods won’t be applicable to most of you, but if you’re like Tony Stark and don’t like being kept in the dark, here’s where you can learn more .

Box G: Material participation

For the majority of taxpayers, this will be yes. The IRS needs to confirm that you were the person actually earning the income, because if you weren’t, there are additional rules for claiming business losses.

Box I & J: Filing 1099 forms

If you paid a contractor more than $600 you are required to send them a 1099-NEC. These boxes ask you to report whether that applies to you.

Note that if you mark “yes” to the first box, and “no” to the second, it’s likely the IRS will follow up, and you could get penalized for every unsent 1099.

{email_capture}

Step #2: Fill out your income and cost of goods sold

Part 1 of Schedule C is where you record your total income and the cost of your sales.

Box 1: Gross receipts

Remember all those 1099-NECs and 1099-Ks you’ve been saving? This is where they go. Tally up your income for the year using your 1099s and bank statements and input the total in box one.

Box 2: Returns

This is used to report any returns or refunds you had to give during the year. Typically it’s used by people selling physical products, but any refunds can be put here.

Box 4: Cost of goods sold

Cost of goods sold (COGS) refers to the costs directly related to creating a product. For example, if you sell artwork, your COGS would be things like canvases and paint.

To determine what amount should go on line 4 of the Schedule C, you have to fill out Part III on Page 2.

Line 33 asks you to choose an inventory method. For most taxpayers, this will be “cost.”

Line 34 asks if you’ve made any changes to how you track or value inventory. The answer will be “no” for most people.

How to calculate cost of goods

Traditionally, COGS is calculated using the following formula:

Starting inventory + (purchases + labor +materials) - ending inventory

So for example, say you have $300 worth of unsold artwork at the start of the year. During the year, you purchase supplies to make an additional $400 worth of artwork. At the end of the year, you have $500 of unsold artwork. In that case, your cost of goods would be $200. (300 + 400 - 500 = 200)

The idea is to not write off the cost of anything that hasn’t been sold yet. Box 6: Other income

This is where you can report miscellaneous income related to your business. For example, let’s say you’re ready to upgrade your computer, and you decide to sell your old one for some pocket cash. That income would be reported here, since it’s only tangentially related to your business.

Step #3: Fill out your business expenses

For this next step, we’re going to look in-depth at Dr. Banner’s business expenses on Part II of his Schedule C:

Box 8: Advertising

As you can imagine, it’s not always easy for The Hulk to get good press, so Dr. Banner ran several social media campaigns to improve his public image.

In addition, he hired a firm to make Hulk T-shirts, action figures, and other merchandise. All of those costs are included in Box 8.

Naturally, Dr. Banner had a team of S.H.I.E.L.D’s top bookkeepers keeping track of these expenses for him.

While our bookkeepers don’t carry Vibranium weapons, the Keeper team can help you track your advertising costs during the year directly in our app.

{upsell_block}

Box 9: Car and truck expenses

Auto expenses are ubiquitous in many industries. Box 9 of the Schedule C is where you record either your actual car expenses or your business mileage deduction .

Regardless of the method you choose, you’ll have to report some additional information about your car.

If you plan to claim depreciation on your vehicle , you’re required to use Form 4562 to disclose your car details.

If you’re not claiming depreciation — either because you’re claiming mileage, your vehicle is leased, or it’s already been fully depreciated — you can use Part IV of the Schedule C to list your car details.

If you have multiple autos, you can attach as many copies of Part IV on Page 2 as you need.

Use Box 44 to list out your mileage details for the year. If you’re claiming actual expenses, you can leave Box 44 blank. However, Boxes 45-47a/b must be completed for either method.

For your mileage deduction, “written evidence” refers to a mileage log. For actual expenses, your business records will do. (The summary of expenses on the Keeper app is sufficient).

Box 10: Commissions and fees

As a member of S.H.I.E.L.D, Dr. Banner is required to pay a 5% fee on his gross sales for their services.

This commission arrangement is similar to what many hair stylists and estheticians have with the beauty salons that they operate out of. These payments can be listed here.

Box 11: Contract labor

This field is for payments made to workers who perform services for you, but aren’t your employees. If you work as a DJ and hire a friend to help set up your equipment, that's contract labor.

Our friend Dr. Banner regularly contracts mechanics, translators, and local guides for his work. Since he usually pays them more than $600, he also files 1099-NEC forms for them.

Box 12: Depletion

This box is really only used by one specific sector: those in the oil and gas industry , or anyone mining natural resources. Most taxpayers can skip it.

Box 13: Depreciation

Most major purchases can’t be expensed all at once. Things like machinery, equipment, cars, and so on, must be reported as a fixed asset on Form 4562 and gradually depreciated over their useful lives.

For more on how this works, check out our guide to computer write-offs , which covers depreciation in depth!

The current year depreciation is reported here.

Box 14: Employee benefits program

Anyone who has W-2 employees and offers them benefits like health or disability insurance , childcare, or group-term life insurance can report those costs here.

Box 15: Insurance

As you can imagine, when your catchphrase is “SMASH,” liability insurance is a must. Box 15 of the Schedule C is where all non-health insurance premiums are reported.

Box 16a: Interest

Do you have a mortgage for an office building or warehouse? If so, use this for the interest payments that are reported on Form 1098 by your bank at the end of the year.

Box 16b: Interest

This line reports interest paid on all other channels, such as credit cards and loans.

Box 17 : Legal and professional services

This is used to report payments to attorneys , accountants, and any other advisory service. Note that any attorney you pay more than $600 needs to be issued a 1099-NEC.

Box 18: Office expense

Office expenses cover a wide variety of purchases. The obvious ones are printers, paper products, computers and accessories , software, and office furniture. In general, this is a catch-all account for basic overhead expenses.

There is one important exception – office rent isn’t included here. You’ll report that in Box 20b.

Box 19: Pension and profit sharing

If you have W-2 employees that you provide retirement plan options to, this is where you record those costs, including your employer contributions.

Box 20a: Rent or lease machinery and equipment

Little-known fact: While some of The Hulk’s equipment is provided by S.H.I.E.L.D, much of it is leased from Stark Industries. Costs for renting equipment go here.

Box 20b: Other business property

This is where you record office rent or lease costs.

Box 21: Repairs and maintenance

This category can include anything from computer repairs to plumbing fees.

As you’d expect, this is a big category for Dr. Banner, whose sheer size and mode of movement results in regular damages to his equipment.

Box 22: Supplies

Another great catch-all category, supplies can include anything you need to complete a job. Think of it as “cost of goods sold” for service providers.

To give an example, if you work as a manicurist, the nail polish you purchase could be included under supplies. If you side-hustle as a dog walker, this is where you’d report treats or whistles.

Box 23: Taxes and licenses

Use this box to report sales tax, franchise taxes, property taxes on business assets, and payroll taxes (if you have employees). You can also report any business licenses you were required to pay for to operate in your state.

Box 24a: Travel

Business-related travel costs such as airfare, hotels, train tickets, and rental cars go here.

Note that Dr. Banner has left this box blank, even though he travels a lot for work during the year.

Why? Because he’s been floating around in space, so he doesn't have a designated “tax home”: a place that he routinely conducts business from. As such, he’s considered a “ transient worker ” for tax purposes and is explicitly disallowed from claiming travel expenses.

Box 24b: Meals

For a brief, glorious period from 2021 to 2022, taxpayers were allowed to claim 100% of their work-related meal costs . Typically, these are now limited to 50% in most cases. As of 2023 and for the foreseeable future, meals are 50% tax-deductible.

Box 25: Utilities

Typically, utilities can only be claimed if you own, rent, or lease an office space, since your home office utilities will be reported elsewhere.

Box 26: Wages

If you have employees, this is where you’ll report their wages.

Important note: this amount should match the total on your W-3 for the year. If you just report your employee’s take-home pay, you’ll understate your write-off and potentially miss out on a larger Qualified Business Income Deduction.

Box 27a: Other expenses

If you can’t figure out where to record an expense on lines 8-26, line 27 gives you the opportunity to list out alternative categories.

On page 2 of the Schedule C, under Part V, you can write custom expenses and their values. The total will carry to line 27 on page 1.

As you can see above, Dr Banner has some unusual business expenses that don’t fit in any of the other categories.

Because of the unique nature of his superpower, his modified garments are a good example of clothing that is specifically designed for work.

And while hypnotherapy is usually personal, it’s an essential cost for creating a safe work environment and improving his job performance.

A similar exception is made for pro athletes, who are allowed to write off the costs of physical therapy and massages. Am I the only one who can’t forget Michael Phelps’s cupping marks ?

{write_off_block}

Step #4: Calculate your net profit

Congratulations — you’re down to the final lap. All that remains is calculating your net profit or loss and factoring in your home office deduction.

Box 29: Tentative profit

Add up all of the expenses in lines 8-27b, and enter the total in Box 28. From there, subtract your total expenses from your gross income on line 7.

Voilà! Your tentative profit.

Box 30: Business use of home

You have two options when writing off your home office: the simplified method and the actual method. To learn more about each option and how to calculate them, check out our comprehensive home office guide .

If you’re claiming the actual method, you need to complete Form 8829 and attach it to your return.

Dr. Banner has elected the simplified method, so he included his home and office square footage on lines a and b. If he were to take the actual method, he could leave those lines blank.

However, since Dr. Banner spent the last few years in space, he actually doesn’t have a strong case to take the home office deduction.

Claiming the simplified method is the most conservative approach that will raise the least amount of scrutiny from the IRS. That’s a good thing, because nobody wants to be in the room when The Hulk learns he’s being audited.

Box 31: Net profit

The very last step is to subtract your home office deduction from your tentative profit to determine your actual net income.

This amount will carry to Schedule 1 of your 1040 and line 2 of Schedule SE to calculate self-employment taxes .

Box 32: Investment risk

This section prompts you to categorize the income as either “at risk” or “not at risk.”

It’s another way of asking, “what do you stand to lose?” In other words, if your business goes under, would you be personally on the hook for paying the outstanding debts?

For most taxpayers, the answer is going to be “all investment is at risk.”

You made it to the end — congratulations!

I hope you feel ready to file on your own.

Sarah York, EA

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

Join #1 A.I. tax service for freelancers

- Calculate Taxes

- How FlyFin works

- Quarterly Taxes

- Get Started

⏳ File 2023 taxes and minimize IRS late fees now! File taxes now →

How To Deduct Education Expenses?

If you’re self-employed and decide to further your education to benefit your business, you can write off your education expenses. To be eligible to claim the education expenses tax deduction , you must prove that the education:

- Maintains or improves skills required in your trade or business

- It is required by law or regulations, for keeping your license to practice, or job.

In other words, If you undergo a course or take classes to get certifications in your field or to enhance your business knowledge, you can typically write off those costs.

However, there are certain education expenses that you cannot deduct especially if your motive to pursue the course or program is to:

- Meet the minimum requirements of your present trade or business

- Qualify you for a new trade or business

This is true even if the education maintains or improves skills currently required in your business.

But if you happen to be eligible for the Education Expenses Tax Deduction, then you can deduct the costs of “ qualifying work-related education ,” which includes tuition, books, supplies, lab fees, transportation to and from classes, and anything else related to your education. It also covers other tax benefits, such as the American opportunity credit and the lifetime learning credit.

However, you can't claim this deduction as well as the tuition and fees deduction for the same expense, nor can you claim this deduction as well as an education credit for the same expense. With the qualifying work-related education, you can also claim a student loan interest deduction.

Now, when it comes to claiming a business deduction for work-related education, you must:

- Be working.

- Itemize your deductions on Schedule A (Form 1040 or 1040NR) if you are an employee.

- File Schedule C (Form 1040), Schedule C-EZ (Form 1040), or Schedule F (Form 1040) if you are self-employed.

- Have expenses for education that meet the requirements discussed under Qualifying Work-Related Education, below.

Additionally, education expenses incurred during a temporary absence from your work may also be considered tax-deductible. However, after your temporary absence, you must return to the same field of work. Generally, absence from work for one year or less is considered temporary.

Any program or course you pursue to meet the minimum educational requirements for your present trade or business is not qualifying work-related education. Once you have met the minimum educational requirements for your job, your employer or the law may require you to get more education. This additional education qualifies as work-related education if all three of the following requirements are met:

- It is required for you to keep your present salary, status, or job.

- The requirement serves the business purpose of your employer.

- The education is not part of a program that will qualify you for a new trade or business.

Now, when it comes to you getting more education than your employer or the law requires, the additional education can be qualified work-related education only if it maintains or improves skills required in your present work.

Aside from the above-mentioned expenses, there are some other expenses that you can deduct:

Online web development course

As a freelancer, you may be required to prepare branding and marketing assets for a client. You may be required to acquire certain skills in order to add another skill set to your services. That’s considered work-related education and can lower the amount of taxes owed!

Real estate license renewal

In industries such as real estate, you may be required to get your license or certification periodically renewed. All fees related to the preparation for those renewals are tax-deductible. These expenses can also be claimed as a tax deduction for educators.

However, there are certain expenses that you can’t deduct such as:

- Traveling to gain experience to improve your skill or education. For example, a Japanese teacher who takes a trip to Japan to improve her knowledge of the Japanese language can’t deduct her travel expenses.

- Vacation expense or annual leave you took to attend classes

- Expenses for sports, games, hobbies or non-credit courses do not qualify for the education expense tax deduction for freelancers or tuition and fees deduction, except when the course or activity is part of the student’s degree program.

As a self-employed individual, you can deduct tuition and other educational costs of the self-employment income you report on Schedule C. Your deductions will not only lower the income subject to income tax, but also self-employment tax.

Here are the steps needed to deduct your tuition costs:

- To deduct your education expenses, ensure that your education qualifies as a work-related expense.

- To calculate your expenses, consider your travel costs and add them to the list of deductions. You can claim the costs of traveling, lodging, and some food expenses.

- Reduce the number of your deductible expenses by any tax-free payments you received to pay for the costs. If you paid for tuition with some educational policy/benefits, that portion of your tuition will not be considered tax deductible.

- Report all your total deductible expenses on Schedule C. Most of your educational bills shall fall under the "other expenses" section at the end of the form. Enter any transportation or meal deductions in Section II of the form.

Aside from the educational expenses, you can also seek a deduction for your student loan interest. Generally, any taxpayer who pays interest on student loans can take a tax deduction.

To calculate your student loan interest deduction, you need to file a Form 1040, 1040-SR, or 1040-NR, you can use the Student Loan Interest Deduction worksheet on page 94 of your tax return. If you file Form 2555 or 4563, you’ll use Worksheet 4.1 to calculate your student loan interest deduction. You can find that worksheet in IRS Publication 970, Tax Breaks for Education .

If the task of filing your taxes seems complicated, you can make use of any online income tax deduction calculator however, they may not provide you with the appropriate education-related deductions. Determining the exact freelance business expenses can be a difficult task, but, with an expense tracker like FlyFin, you can track all the education-related deductions as the A.I. will simply scan through your expenses and provide you with different categories of deductions that may apply to you. FlyFin ’s team of expert CPAs can help you uncover industry-specific tax deductions that you may not even be aware of. If you’re unsure about an expense, the CPAs can help guide you through it. The advanced income tax deduction calculator can help you maximize your savings.

Q. Who can claim an education credit?

A. There are different requirements for each credit, but the common criteria comprises of the following:

- You, your dependent, or a third party pays qualified education expenses for higher education.

- An eligible student must be enrolled at an eligible educational institution.

- The eligible student is yourself, your spouse, or a dependent you list on your tax return.

Q. Are room & board a part of the qualified educational expenses?

A. The cost of room and board qualifies only to the extent that it is not more than the greater of:

- The allowance for room and board, as determined by the eligible educational institution, was included in the cost of attendance (for federal financial aid purposes) for a particular academic period and the living arrangement of the student, or

- The actual amount charged if the student is residing in housing owned or operated by the eligible educational institution.

Q. What are some examples of student loans that are eligible for the student loan interest deduction?

A. Some examples of college loans that are eligible for the student loan interest deduction include:

- Subsidized Federal Stafford Loan

- Unsubsidized Federal Stafford Loan

- Federal Perkins Loan

- Federal Grad PLUS Loan

- Federal Parent PLUS Loan

- Federal Consolidation Loan

- State Education Loans

- Private Student Loans

Q. Who is eligible to claim the student loan interest deduction?

A. Anyone who owes student loan debt can claim the deduction. However, in order to qualify, you must meet the following conditions:

- You paid interest on a qualified student loan in the current tax year

- You're legally obligated to pay interest on a qualified student loan

- Your filing status isn't married filing separately

- Your MAGI is less than a specified amount which is set annually

FlyFin CPA Team

With a combined 150 years of experience, FlyFin's CPA tax team includes tax CPAs, IRS Enrolled Agents and other tax professionals, offering users the most comprehensive tax advice and preparation.

Read Similar Blogs

How do tax write-offs work for business flyfin a.i..

Tax Deductions for Pet Groomers and Pet Sitters

When are taxes due in 2023, can a child earn money and still qualify for benefits as a dependent.

Don’t miss IRS deadlines and pay 100%+ in penalties

Add IRS deadlines to your calendar for timely reminders

Training and Education Tax Deduction

If you take classes or training courses to further your professional education you may be eligible to deduct your tuition, related course materials and certain travel costs. There are a number requirements you must meet to be able to deduct your education expenses (see our diagram), however, the most important points for sole proprietors to take note of are that your training and education cannot qualify you for a different trade or business, they cannot be for the purpose of meeting minimum educational requirements, and they must maintain or improve the skills required in your field. Sole proprietors can deduct qualifying education expenses on their Schedule C or E. Employees may be eligible to deduct unreimbursed training and education expenses on their Schedule A, subject to the 2% limit.

PROFESSIONAL SERVICES

Caroline has a bookkeeping and accounting business, however, she wants to be able to advise her clients on legal matters as well. Caroline decided to enroll in law courses at a local college and take the BAR exam. Since Caroline is a good accountant, she knew before she started her law endeavor that her education expenses would not be deductible on her Schedule C because the courses would qualify her for a new trade or business (law).

REAL ESTATE AGENT

Apollo is a self employed real estate agent who has been in the business for over 20 years. The state requires him to complete 20 hours of continuing education courses every 12 months to maintain his license. Last year he spent $350 to meet his CPE requirements. Since he already had met the minimum educational requirements of his profession (original license), the course he took was to maintain and improve his real estate skills and it did not qualify him for a new trade or business, the full $350 would be deductible on line 27a of his Schedule C.

AUTHOR / SPEAKER

Sarah Gomez has a masters in english and has been a freelance writer for the past 6 years. Her articles and books are targeted towards a younger demographic so she regularly participates in training courses to stay current on how to communicate with young readers. She spends approximately $1,900 every year on these courses, all of which would be deductible on her Schedule C since these courses improve the skills required in her business.

Paul has been a law clerk for five years and wants to start his own practice. He quits his job, studies for, and passes the BAR, which cost him approximately $5,000 after test fees and prep classes. At the end of the year Paul has his business up and running, however, his accountant advises him not to deduct the $5,000 of training and education expenses on his Schedule C since those costs were incurred so Paul could meet the minimum educational requirements for his business.

AIRBNB HOST

Virginia has a day job but regularly rents her house out on Airbnb and absolutely loves it. Last fall she decided to enroll in a $300 hospitality class at her local community college so she could refine her hosting skills. Since the class is not a minimum requirement of her "profession" (rental activities) and it will improve her trade knowledge, the $300 course would be generally be deductible on line 19 of her Schedule E.

HOW TO TAKE THE EDUCATION TAX CREDIT

- To be eligible for this deduction your education may not be for the purpose of meeting a minimum requirement or qualifying you for a different trade or business, however, it must serve a business purpose and improve or maintain your skills.

- You can not take this deduction if the education and training you took was to help you return to your business or profession.

- In addition to the cost of tuition, deductible educational expenses may include transportation, meals and lodging (subject to business travel rules), and certain administrative fees, to name a few. If you are deducting your transportation costs for a temporary / short-term course (less than one year) you may deduct travel from your home. If you are participating in a long-term course you may only be able to deduct your transportation costs between work and school.

- If you are receiving a grant, tax-free scholarship or any other tax benefit related to your qualifying education you generally cannot deduct your educational costs.

- If you are an employee and your employer does not reimburse you for qualifying education expenses (similar to requirements for self employed individual) you may be able to deduct unreimbursed training costs on line 21 of your Schedule A (if you itemize), subject to the 2% of AGI limit (i.e. certain miscellaneous itemized deductions cannot exceed 2% of your adjusted gross income).

Schedule C Checklist

This list may not cover all the income and expenses for your particular business. If you are not sure of the deductibility of an expense, provide the documentation anyway and we will make the determination.

**PLEASE NOTE** All payments totaling $600 or more to any vendor must be provided and a 1099 will be issued if necessary. A W-9 should be received from each vendor, indicating name, address, and Tax ID number.

- Sign in to Community

- Discuss your taxes

- News & Announcements

- Help Videos

- Event Calendar

- Life Event Hubs

- Champions Program

- Community Basics

Find answers to your questions

Work on your taxes

- Community home

- Discussions

- Deductions & credits

What category to put expenses in?

Do you have a turbotax online account.

We'll help you get started or pick up where you left off.

- Mark as New

- Subscribe to RSS Feed

- Report Inappropriate Content

- TurboTax Home & Biz Mac

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

View solution in original post

Still have questions?

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

2 member llc with one ein

taxquestion222

Returning Member

Selling a Rental Property

1 Car 2 businesses - standard mileage or actual expenses

lettersnumbersdashesaunderscores

head of household

Did the information on this page answer your question?

Thank you for helping us improve the TurboTax Community!

Sign in to turbotax.

and start working on your taxes

File your taxes, your way

Get expert help or do it yourself.

Access additional help, including our tax experts

Post your question.

to receive guidance from our tax experts and community.

Connect with an expert

Real experts - to help or even do your taxes for you.

You are leaving TurboTax.

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.

IMAGES

VIDEO

COMMENTS

To determine if your work-related expenses are deductible, see Are my work-related education expenses deductible? Reporting the education expense. Self-employed individuals include education expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) or Schedule F (Form 1040), Profit or Loss From Farming.

Expenses to learn a new trade or job or to qualify for a new career aren't deductible. Deduct your educational expenses and bank fees as Other Miscellaneous expenses. Type in schedule c in the search box, top right of your screen. Click on the first category Jump to schedule c link. Follow the prompts and online instructions. Arrive at the Your ...

Job-related education expenses. If you're an employee, you can deduct the cost of education that: You can't deduct education expenses if the course: To deduct these, itemize deductions on Schedule A. Your deductions must be more than the 2% of adjusted gross income (AGI) threshold for miscellaneous deductions.

To report the costs of work-related education, classes, and workshops, record the expenses as professional development against self-employment income on Schedule C if filing as an unincorporated sole proprietor or a single-member LLC. If filing as a partnership or multi-member LLC, capture these work-related education expenses on Form 1065.

The cost of continuing education credits for employees is included as an expense of your business if it meets these restrictions: ... For sole proprietors and single-member LLCs, show these expenses in the "Expenses" section of Schedule C. For partnerships and multiple-member LLCs, show these expenses in the "Deductions" section of Form 1065.

1 Best answer. RichardK. New Member. Continuing education to maintain or improve your business is an ordinary and necessary business expense and is deductible along with your other business expenses on Schedule C, Business Income and Expenses. View solution in original post.

Also, use Schedule C to report (a) wages and expenses you had as a statutory employee; (b) income and deductions of certain qualified joint ventures; and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C.

I checked the Schedule C and Expense Categories in QuickBooks Self-Employed.article that you linked and it seems to me that something like continuing education would be a category under the "Contract & professional fees" heading. The Schedule C article described several types of consultation fees as fitting under that grouping.

Step #1: Input your information. The first section of the Schedule C is reserved for your business information. We're going to review this in detail below. Name of proprietor. In most cases, this will be your personal name. If you have an LLC you're registered under, you can use the business name here. . .

May I claim my job-related education expenses as an itemized deduction or an education credit on my tax return? My employer paid me additional compensation to cover my graduate school tuition and included it on my W-2 as wages. The program improves skills needed in my current field of employment but doesn't qualify me for a new trade or business.

Thanks for asking about this, vertigo2896. In QuickBooks Self-Employed (QBSE), we're not able to provide which category to use for a specific transaction like professional education/training expenses. Also, it would be best to consult an accountant or accounting professional so you'll be guided accordingly on how to handle this type of situation.

Up to $5,250 per year can be provided to an employee as reimbursement for educational expenses as part of an employee benefit plan. Tuition, fees, books, supplies, and equipment are considered reimbursable "educational expenses." The tax law does not require the education to be related to the job, or part of a degree program, although some ...

File Schedule C (Form 1040), Schedule C-EZ (Form 1040), or Schedule F (Form 1040) if you are self-employed. Have expenses for education that meet the requirements discussed under Qualifying Work-Related Education, below. Additionally, education expenses incurred during a temporary absence from your work may also be considered tax-deductible.

Sole proprietors can deduct qualifying education expenses on their Schedule C or E. Employees may be eligible to deduct unreimbursed training and education expenses on their Schedule A, subject to the 2% limit. ... The state requires him to complete 20 hours of continuing education courses every 12 months to maintain his license. Last year he ...

Can i deduct my education expenses in schedule C? June 1, 2019 11:44 AM. Yes, if it meets the qualifications to be work-related education. See the additional information below provided by TurboTax MichaelL1.

Maintain accurate records and hold onto receipts in case the IRS asks you to support or prove your claim for a continuing medical education tax deduction. Once you've tracked your eligible work-related education expenses, you can deduct them from your total business income on a Schedule C (Form 1040) or Schedule F (Form 1040).

Schedule C Checklist. This list may not cover all the income and expenses for your particular business. If you are not sure of the deductibility of an expense, provide the documentation anyway and we will make the determination. ... Continuing Education: Taxes: Delivery & Freight: Payroll: Depreciation: Property: Dues & Subscriptions: State ...

If you're self-employed, you use a Schedule C form to report your self-employed income and expenses. It's also known as Form 1040. Each time you categorize a transaction, QuickBooks Self-Employed matches it to a line on your Schedule C. Here's more info on Schedule C categories. We'll also show you how Schedule C categories show up your ...

There are 17 unique categories for entering business expenses in the TurboTax Home and Business program for a Schedule C ( in addition to the vehicle, home office & assets sections). If you have a particular expense that does not fit in the other 16 categories listed use Other Miscellaneous Expenses at the bottom of the list.

identify the types of business expenses that are reported in Parts II, IV, and V of Schedule C. correctly apply the rules for determining the deductible amount when given examples of business-related expenses. determine whether a given taxpayer is eligible to claim a home office deduction and correctly calculate the available deduction.

1 Best answer. To be deductible, your expenses must be for education that either maintains or improves your job skills, or is required by your employer or by law to keep your salary, status or job. Expenses to learn a new trade or job or to qualify for a new career aren't deductible. If you are self employed and your education expenses ...

They are deducted as job related expenses (Sch A) if you are paid through W-2 for your services. If you are paid as both, you would allocate the cost between two types June 6, 2019 2:03 AM

I am a web developer and would like to know what Schedule C categories to put the following expense items in: 1. Software License for software and plugins used to create client websites. 2. Fees for domain registration. 3. Expenses for online training courses. 4. Books and Magazine subscriptions.