Buyside Hustle

Investment Banking, Private Equity, Hedge Fund Career Advice

Don’t Get Left Behind

Stay up to date with real advice and have new posts emailed to you. Promise we will never send spam.

By Buyside Hustle Leave a Comment

Best Private Equity Case Study Guide + Excel Model + Example

The most important part of the private equity interview is the case study round. After meeting a few people and going through a number of interviews, you will most likely get hit with a case study where you have to analyze whether a company is a good leveraged buyout target or not.

Your performance during the private equity case study round will determine whether or not you will get an offer. It is the most important part of the interview process, so you need to make sure you are well prepared and create a work product that sets you apart from the other candidates you are competing against.

Private Equity Case Study Example + Full LBO Excel Model

Private Equity Case Study Example + Model

It’s hard to know how to complete a full private equity case study if you don’t actually have experience working in private equity. With just an investment banking background or someone who is straight out of undergrad, you just don’t have the experience to understand how to structure and write a good case study.

Make sure you get access to a full private equity case study that was used in a real interview. You can use this as a reference on how to write your response and build the LBO model with all the key outputs.

Get access here before reading on. It becomes much easier to build a proper LBO model and complete a case study when you can refer to one that is already fully completed.

The case study was written by a private equity professional and includes a:

- Real Private Equity Case Study Example and Response

- Full Detailed LBO Excel Model

How is a Private Equity Case Study Structured

The private equity interview process is a lot more structured relative to hedge fund interviews. Most interviews happen during “on-cycle” recruiting your first six months in investment banking right out of undergrad. This is the best time to land an offer as you have dozens upon dozens of firms that are fighting to get the top talent to work at their firms. People will land offers after a matter of days after answering the basic private equity interview questions because of all this competition.

Unlike hedge fund case studies , private equity case studies are a bit different as it depends on if you are interviewing during the rush of on-cycle recruiting where firms fight for talent. You can expect the case study to be structured in either three ways:

- LBO Modeling Test

If you are going through the crazy all-out blitz of private equity interviews during on-cycle recruiting, you will like get either of the first two types of case studies, the modeling test and/or the paper LBO.

For an interview that is done outside of this period and at most of the smaller middle-market funds, you may get a longer take-home case study that is more comprehensive. It really just depends on the firm and how they conduct interviews.

1. LBO Modeling Test

The LBO modeling test is used in person during on-cycle recruiting very frequently. Usually when on-cycle interviews start, you’ll get invited along with other candidates to do a modeling test over the course of a few hours, then proceed with the usual interviews either before or after.

There is no reason why anyone can’t pass the modeling test. All it takes is practice after practice, just like how you’d get good at anything else. Back when I was an investment banking analyst, the only way I would learn how to do anything was by looking at previous models done by prior analysts saved on the shared drive and recreating those models from scratch over and over again. It’s the best way to learn how to get good at any type of Excel model – looking at precedent then recreating from scratch.

Wall Street Prep was another tool I used back during my investment banking analyst days. There is a course that was specifically created for Private Equity interviews and LBO modeling that teaches you everything you need to know. It was the best resource I was able to find to get prepared for private equity interviews and teaches you how to complete a full LBO model step-by-step from start to finish.

Start preparing today and sign up for the course below if you really want to break into private equity. I promise you will have a very low chance of landing a private equity offer if you do not know the basics of how to build an LBO.

Get 15% off if you use the coupon code in the link below:

Private Equity Masterclass: Step-By-Step Online Course

A Complete LBO and PE Training Program. Whether you’re preparing for an LBO Modeling test or you want to learn to build an LBO model and become a better PE professional, this course has you covered.

Special Offer: Get 15% Off On Wall Street Prep’s Private Equity Course

2. Paper LBO

The paper LBO is used during interviews to make sure you have spent the time to learn the basics of how an LBO works. Usually, you are given a set of assumptions, a pen/paper and asked to work through a paper LBO live during the interview without the help of a computer or calculator.

You need to be able to walk through how to:

- Calculate the purchase price

- Calculate sources and uses

- Build a simple income statement and projections

- Build to levered free cash flow

- Calculate the exit value, IRR and multiple on invested capital

The Wall Street Prep course above walks through how to do all this in detail and provides a few paper LBOs that you can use for practice.

3. Private Equity Take-Home Case Study + Written Memo

Now the full-blown take-home case study is the hardest and most in-depth analysis a private equity firm can ask of you during interviews. Outside of on-cycle recruiting, this is the most common type of case study that is given. Most firms will give you a week to work on it independently at home.

This case study round is the most important part of the interview. If you do not have a well-written case study with a good backup model that you can present to the interviewer, you will not get an offer.

The majority of case studies will ask either two questions:

- Look into XYZ company and tell us whether it’s a good LBO target

- Find an attractive LBO target and give us your thoughts

To answer the first question, you need to screen a universe of public companies and find one that could be an attractive target. You need to find a business that has the following characteristics:

- Growing market dynamics – markets that have structural tailwinds is a good place to start

- Strong competitive advantages – study Porter’s Five Forces if you haven’t already

- Stable recurring cash flows – business is going to be levered up in a buyout so it needs to have positive EBITDA and stable cash flows to pay off interest payments

- Low working capital / capex needs

Quickly eliminate all companies in your screen that have:

- Negative EBITDA

- High capex needs (capex is >75% of EBITDA)

- High valuation (EV/EBITDA is > 15x)

You can quickly eliminate companies in your screen that have negative EBITDA or high capex needs. Once you’ve found your target company (or if already given one), then you can start working on the actual meat of the case study.

Steps to Finish a Private Equity Case Study

This guide will walk you through all the steps required to complete a case study, from start to finish. You will learn everything from what documents you need to download, to how to build the LBO/model with all the key outputs, to how to actual write a good memorandum/presentation, to all the common mistakes to avoid.

- Download and organize all documents in one folder

- Research the industry to understand trends and key metrics

- Read the filings and take notes

- Input financials in Excel and build the LBO model

- Work on the presentation / memo

1. Download and organize all documents in one folder

You want to have everything in one folder that you can quickly access. Key websites to use for company filings are:

- www.sec.gov/edgar/searchedgar/companysearch.html – for direct access to filings

- www.Bamsec.com – access to filings in an organized fashion

- You want to save down (at the very least) the latest 10K and the prior four 10Qs, last four transcripts, earnings releases, investor presentations and supplements

- Other sources if you have access to them: Bloomberg, CapIQ, FactSet

- Sell-side research – sell-side research is how you gauge market expectations and quickly understand the business. Most initiating coverage reports will give a good overview of the company, its strengths, weaknesses and competitive landscape. Ask around for others to send you research if you don’t have direct access

- Other write-ups online – read all of the articles on Seeking Alpha and look at ValueInvestorsClub.com. Research on Seeking Alpha is usually very bad, but there may be articles that do a good job summarizing any fundamental pressures / tailwinds

2. Research the industry to understand trends and key metrics

If you have access to sell-side research, then go through the latest industry analysis for your target company or initiating coverage reports. When a sellside research firm initiates coverage, they write up a very in-depth review of the company. These reports provide a very good summary of a company and the industry it’s in with all relevant metrics.

If you don’t have access to sell-side research, then go through prior investor presentations of the company or any of its peers. There should be an industry/market overview and benchmarking metrics vs. peers in these presentations.

If you do not understand what is happening in the industry that the company is in, you will not know if there are any big headwinds or tailwinds that are directly impacting the company. A lot of private equity LBOs focus on growth and consolidation within an industry, so you need a good understanding of the market and what the growth opportunities are.

3. Read the filings and take notes

Create a new word document to copy and paste anything notable that you read. You can create sections in your notes for company overview, revenue / cost drivers, fixed versus variable costs, industry tailwinds/headwinds, key questions for items you don’t understand or need to follow-up with management on, etc.

The most important part of every 10K/10Q is the management’s discussion and analysis section (MD&A). This is where the company talks in detail about how the business has performed over the quarter/year relative to prior year’s performance. You should focus on the sections of the MD&A that talk about the revenue and cost drivers. Make a table in Excel and copy and paste commentary every quarter on what impacted revenue growth and margins (COGS and SG&A). Once you lay it all out in Excel, the fundamental picture of the Company becomes clearer and you can see what has had a major impact on recent results.

The most important thing you should read are the transcripts and investor presentations. Management usually gets into more detail on the overall strategy and key tailwinds / headwinds of the business. Additionally, you can gauge what the sell-side is most focused on in the Q&A section at the end of every transcript.

Lastly, read the risk section of the latest 10K to note what the Company finds to be the biggest risks to its overall performance. Pay close attention to the top few items listed here as you want to see what the structural/secular challenges are to the business.

4. Input financials in Excel and build the LBO model

Since private equity interviews can start very quickly after you start your first job in investment banking, most do not know how to properly build an LBO model. Every single private equity firm builds an LBO when looking at any investment. If you want to work in private equity, you need to make sure you spend time understanding an LBO, how it works and how to build one in your sleep.

Like I mentioned before, sign up for Wall Street Prep if you don’t know how to build an LBO. It’s the best resource available to learn how to build a LBO model and provides step-by-step instructions using a real public company example.

5. Work on a presentation or write a memo

Once you have done all the research and finished the modeling, you need to create outputs in a presentation or word doc format. The interviewer may specify what kind of output they prefer, but if not than do what you most comfortable with.

This presentation/memo will be what your interviewer will focus on, so the outputs need to be nicely formatted just like how you create outputs in investment banking. Formatting may not seem that important to you, but showing that you can present analysis in a clean, formatted manner without errors is what will set you apart from your peers.

Continue reading below to learn everything you need to know on what to include in this presentation or memo.

Private Equity Case Study Presentation / Memo

Background and company overview.

If you had to screen to find a company, briefly summarize the criteria you used to choose your company. List the financial metrics and any other factors you used when making the decision.

Then you need to summarize what that company does in around five sentences. If you were provided the company to analyze, the interviewer already knows what the company does so no need to go that much in depth as you can describe more in person if asked. Make sure to describe how the company makes money (a revenue breakdown), where they make money (what markets drive the most revenue), who their customers are (customer concentration), etc.

This is the easiest section as you can open up the latest 10K and within the first few pages there is a business description section that outlines what the company does. You should also check the latest investor presentations (if available) and sell-side research initiating coverage reports as they usually give good overviews of the company.

You need to make sure you yourself understands what the company does and what the revenue and cost drivers are. Anybody can copy the business descriptions written by the Company and sell-side research. You should make sure you know the company well enough to be able to talk about it without looking at your notes.

Investment Thesis/Highlights

Here you list out the top reasons why a company is a good leverage buyout target or not. The most common investment highlights discussed in a potential target can be:

- Attractive market dynamics due to XYZ reasons – could be due to fragmented market / consolidation opportunities, growing market dynamics, geographic expansion lack of competition, etc.

- Multiple ways to win – private equity firms love businesses that don’t just rely on one avenue of growth, so point out all the different ways value can be created either through revenue growth, expense rationalization, multiple expansion, etc.

- Recurring revenues – leverage buyout targets need to have steady cash flows since the business is going to be levered up in an acquisition and so cash flows need to be steady to support high recurring interest payments on the debt. Revenues need to be stable, recurring and non-cyclical in nature.

- Asset-light business – Also, PE firms like businesses that are asset-light (low capital expenditures or working capital requirements) and have low variable costs (little need to increase the expense base to grow revenues, also known as operating leverage).

- Valuation – if a company is underappreciated in the public markets and trades at a low valuation relative to peers, then returns can be very high if you can somehow grow/fix the business and make it more attractive at exit in the future. High LBO returns come from both growing cash flows and multiple expansion. Usually, you want to assume the same exit multiple (the multiple you sell the business for) in your model compared to your entry multiple (the multiple you purchased the business for). Purchasing a business at a high multiple and selling it at a lower multiple in the future will lead to significantly lower returns and can be a big risky.

Like I mentioned earlier, make sure you understand Porter’s Five Forces to understand the main competitive advantages/disadvantages a business can have.

Recommendation to Investment Committee

Summarize whether or not you think the company you chose to analyze (or were provided) is a good LBO target or not. Everything depends on the purchase price, so if you mention that it is not a good LBO target then make sure to describe why and at what price do you think makes the deal attractive.

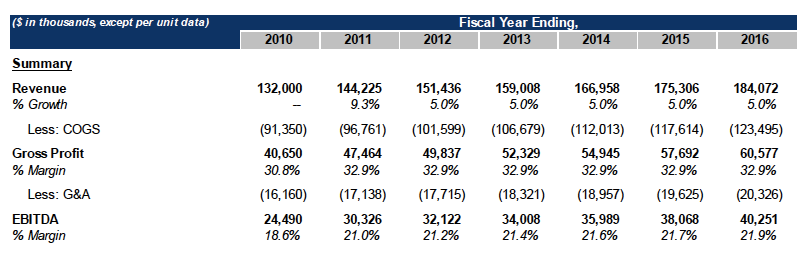

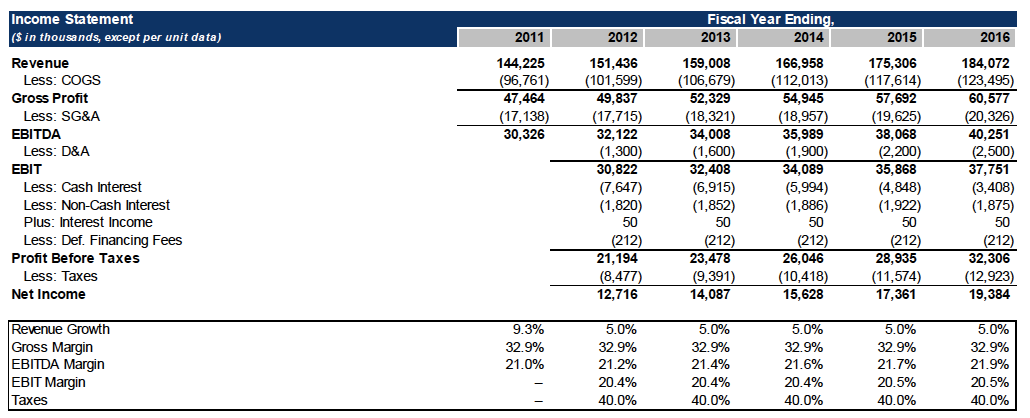

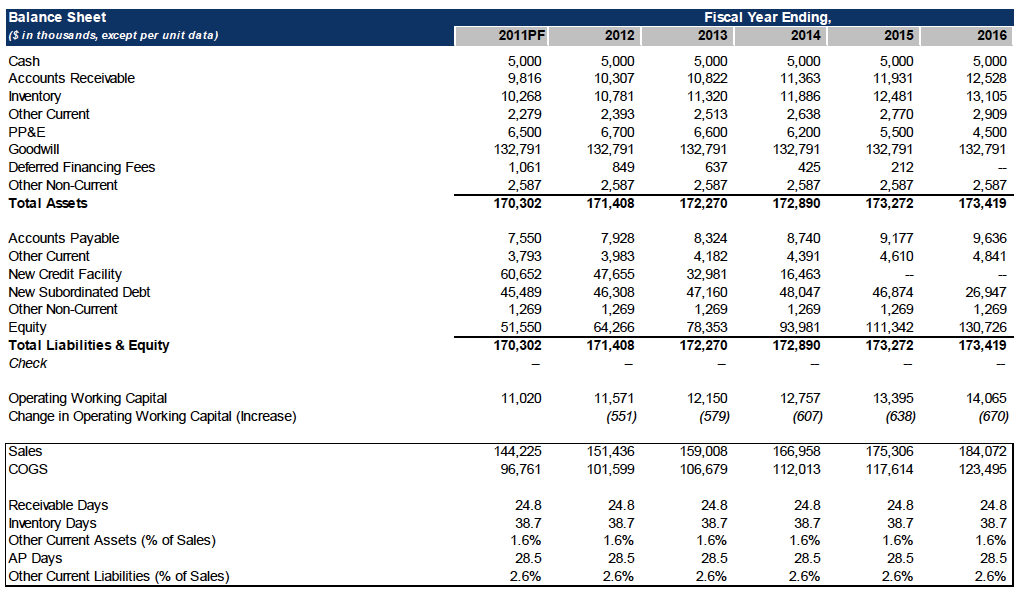

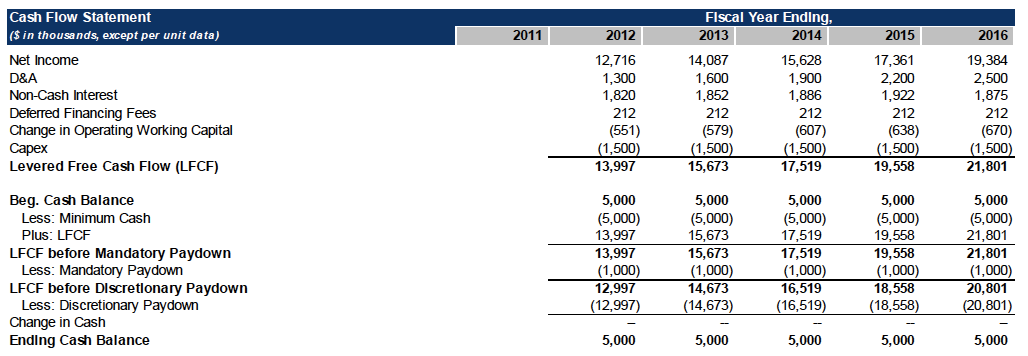

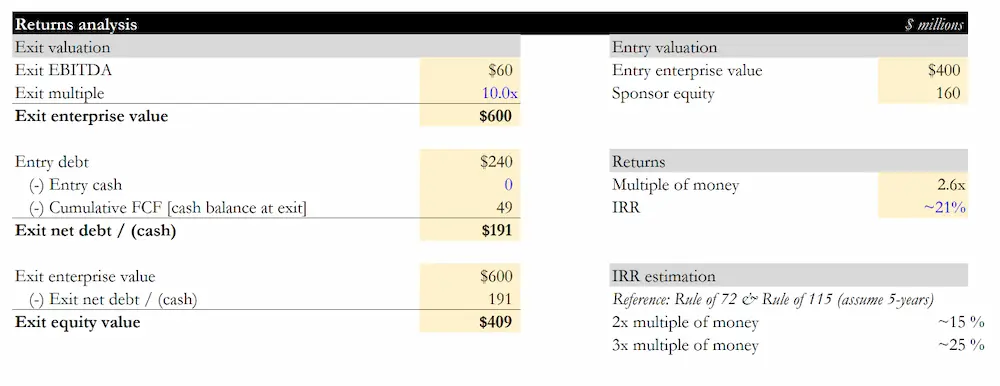

Financials/Return Summary

Your LBO model should have summary outputs that describe how attractive the deal looks from a financial perspective. At minimum, you need to show:

- Returns at various prices

- Sources and uses

- Pro forma capitalization

- Sensitivity table on returns, showing IRR/MOIC at various premiums and exit multiples

- 5-year levered free cash flow bridge

- Main model assumptions

The private equity case study example shows you all of these outputs and more, which you can replicate for your model.

Here you talk about the main risk factors and any potential unexpected events that would cause the firm to lose money on its investment. Look in the Risk Factors section of the 10K or sellide research to understand what the main risks are to the business. Analyze the most important risk factors to see if they have any merit and the potential implications to your analysis if the risk factor is realized. Examples of risks include technology disruption, realization of synergies / other cost savings initiatives, commodity price changes, wage or cost inflation in general, cyclicality/seasonality, changes to regulations, etc.

Outstanding Diligence Questions

Depending on the company, there may or may not be very detailed information on the company in public filings. Usually the bigger the market capitalization, the better the disclosures are.

You want to show the interviewer a list of diligence items you would still want to ask from the company to better understand the business. These questions should be around unit economics, profitability by segment/region, strategic plan over the next five years, cost structure plans/initiatives, etc.

Model Output/Exhibits

Either in a separate PDF or in the exhibits, you want to have a full output of the entire LBO model. At most private equity firms, associates print out the full model to discuss key assumptions with others on the deal team and to make sure everything is working properly. Make sure your Excel is nicely formatted and is already in print format.

The model should have all the outputs described above as well as full detailed 3-statement financials, revenue build and the levered free cash flow waterfall.I know this seems like a lot of work, but it’s the minimum that you need to do for a take home private equity case study.

General Tips and Common Mistakes to Avoid

Get Access to a Real Private Equity Case Study Example + Excel Model

If you need an example case study used in an real interview, then get instant access to one in the link below. You can use this as a reference as you complete a case study to make sure you are building the LBO model correctly, having all the key outputs, and learning how to put it all together in a written memo.

Check your model for errors

One of the worst things you can do is send a model that has a huge bust that changes all the outputs and return metrics. It’s the quickest way to get axed during the interview process, so make sure you spend time going through each cell of your model after completion to make sure there are no errors.

Spend time properly formatting the case study

Being able to cleanly present your analysis is a very important skill in private equity. Most firms create decks and go to investment committee to present a deal, so you need to show that you can format properly and present financials in a clean manner.

There are a ton of people applying for the same job as you are, so you need to figure out a way to differentiate yourself. If you were previously or currently an investment banker, then you should have no problem properly formatting the Excel model and the memorandum.

Understand the firm’s investment style

Every private equity firm has their own approach to making investments. Make sure that you understand the types of investments the firm likes to make and the key qualities to look for.

Then if given a case study, point out these key qualities. It’s good to show that you can analyze investments in a similar manner as the private equity firm you are interviewing at if possible.

Prepare for the most common private equity interview questions

Private equity is one of the most sought career paths and one of the Best Paying Jobs in Finance and Wall Street . There are so many young, smart, Ivy League educated investment bankers trying to break into private equity, so you must make sure you stand apart from the crowd in both your case study and when answering the most common private equity interview questions .

Don’t lie or try to bullshit if asked a question you do not know the answer to

The problem with a lot of smart people in this industry is that they are reluctant to say “I don’t know” and tend to talk as if they know what they are talking about. Interviewers will easily see through the bull shit as they likely know the company well and have heard others talk about the company.

Be a “straight shooter.” Be honest if you do not know the answer to a question and say you will follow-up with the interviewer. That said, you should know the company and industry inside out before presenting the case study and be confident when you speak about facts that you know are true.

Memorize key metrics

When discussing the case study in person with the interviewer, make sure you are an expert in the company and can answer questions on the spot without having to reference your written case study. Key metrics you should know off the top of your head include EBITDA, capex, interest, margins, market cap, total enterprise value, leverage, valuation metrics, valuation metrics versus peers, IRR/MOIC, etc.

Recent Posts

- Will Home Prices Go Down? Get Ready for a Downturn

- Complete List Of Finance Firms In Miami Florida

- Reality Of Working At A Hedge Fund – An Insider’s Guide

- Safest Cash Investments Ranked – Maximize Returns Today

- Work-Life Balance In Finance Ranked – Best to Worst

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

How to prepare for the case study in a private equity interview

If you're interviewing for a job in a private equity firm , then you will almost certainly come across a case study. Be warned: recruiters say this is the hardest part of the private equity interview process and how you handle it will decide whether you land the job.

“The case study is the most decisive part of the interview process because it’s the closest you get to doing the job," says Gail McManus of Private Equity Recruitment. It's purpose is to make you answer one question: 'Would you invest in this company?'

In most cases, you'll be given a 'Confidential Information Memorandum' (CIM) relating to a company the private equity fund could invest in. You'll be expected to a) value the company, and b) put together an investment proposal - or not. Often, you'll be allowed to take the CIM away to prepare your proposal at home.

“The case study is still the most decisive element of the recruitment process because it’s the closest you get to actually doing the job. Candidates can win or lose based on how they perform on case study. People who are OK in the interview can land the job by showing the quality of their thinking, ” says McManus. “You need to show that you can think, and think like an investor.”

"The end decision [on whether to invest] is not important," says one private equity professional who's been through the process. "The important thing is to show your thinking/logic behind answer."

Preparing for a PE case study has distinctive challenges for consultants and bankers. If you're a consultant, you need to, "make a big effort to mix your strategic toolkit with financial analysis. You need to prove that you can go from a strategic conclusion to a finance conclusion," says one PE professional. Make sure you're totally familiar with the way an LBO model works.

If you're a banker, you need to, "make a big effort to develop your strategic thinking," says the same PE associate. The fund you're interviewing with will want to see that you can think like an investor, not just a financier. "Reaching financial conclusions is not enough. You need to argue why certain industry is good, and why you have a competitive advantage or not. Things can look good on paper, but things can change from a day to another. As a PE investor, hence as a case solver, you need to highlight and discuss risks, and whether you are ready or not to underwrite them."

Kadeem Houson, partner at KEA consultants, which specialises in hiring junior to mid-level PE professionals, says: “If you’re a banker you’re expected to have great technical skills so you need to demonstrate you can think commercially about the numbers you plugged in. Conversely, a consultant who is good at blue sky thinking might be pressed more on their understanding of the model. Neither is better or worse – just be conscious of your blank spots.”

A good business versus a good investment

For McManus, one of the most important things to consider when looking at the case study is to understand the difference between a good business and a good investment. The difference between a good business and a good investment is the price. So you might have a great business but if you have to pay hugely for it it might not be a great business. Conversely you can have a so-so business but if you get it a good price it might make a great investment. “

McManus says as well as understanding the difference between a good business and a good investment, it’s important to focus on where the added value lies. This has become a critical element for private equity firms to consider as competition for assets has become even more fierce, given the amount of dry powder that funds now have at their disposal through a wide array of funds. “Because of the competition for transactions generally you have to overpay to win a deal. So in the case study it’s really important you think about where the value creation opportunity lies in this business and what the exit would be,” says McManus.

She advises candidates to be brave and state a specific price, provided you can demonstrate how you’ve arrived at your answer.

Another private equity professional says you shouldn't go out on a limb, though, and you should appear cautious: "Keep all assumptions conservative at all times so as not to raise difficult questions. Always highlight risks, downsides as well as upsides."

Research the fund – find the angle

One private equity professional says that understanding why an investment might suit a particular firm could prove to be a plus. Prior to the case study, check whether the fund favours a particular industry sector, so that when it comes to the case study, you can add that to the investment thesis. “This enables you to showcase you have read up on the firm’s strategy/unique characteristics Something that would make it more likely for the fund you’re interviewing with winning the deal in what’s a very competitive market, said the PE source, who said this knowledge made him stand out.

However, the primary purpose of the case study is to test the quality of your thinking - it is not to test you on your knowledge of the fund. “Knowing about the fund will tick an extra box, but the case study is about focusing on the three most critical things that will drive the investment decision,” says McManus.

You need to think through these questions and issues:

We spoke to another private equity professional who's helpfully prepared a checklist of points to think about when you're faced with the case study. "It's a cheat sheet for some of my friends," he says.

When you're faced with a case study, he says you need to think in terms of: the industry, the company, the revenues, the costs, the competition, growth prospects, due dliligence, and the transaction itself.

The questions from his checklist are below. There's some overlap, but they're about as thorough as you can get.

When you're considering the industry, you need to think about:

- What the company does. What are its key products and markets? What's the main source of demand for its products?

- What are the key drivers in that industry?

- Who are the market participants? How intense is the competition?

- Is the industry cyclical? Where are we in the cycle?

- Which outside factors might influence the industry (eg. government, climate, terrorism)?

When you're considering the company, you need to think about:

- Its position in the industry

- Its growth profile

- Its operational leverage (cost structure)

- Its margins (are they sustainable/improvable)?

- Its fixed costs from capex and R&D

- Its working capital requirements

- Its management

- The minimum amount of cash needed to run the business

When you're considering the revenues, you need to think about:

- What's driving them

- Where the growth is coming from

- How diverse the revenues are

- How stable the revenues are (are they cyclical?)

- How much of the revenues are coming from associates and joint ventures

- What's the working capital requirement? - How long before revenues are booked and received?

When you're considering the costs, you need to think about:

- The diversity of suppliers

- The operational gearing (What's the fixed cost vs. the variable cost?)

- The exposure to commodity prices

- The capex/R&D requirements

- The pension funding

- The labour force (is it unionized?)

- The ability of the company to pass on price increases to customers

- The selling, general and administrative expenses (SG&A). - Can they be reduced?

When you're considering the competition, you need to think about:

- Industry concentration

- Buyer power

- Supplier power

- Brand power

- Economies of scale/network economies/minimum efficient scale

- Substitutes

- Input access

When you're considering the growth prospects, you need to think about:

- Scalability

- Change of asset usage (Leasehold vs. freehold, could manufacturing take place in China?)

- Disposals

- How to achieve efficiencies

- Limitations of current management

When you're considering the due diligence, you need to think about:

- Change of control clauses

- Environmental and legal liabilities

- The power of pension schemes and unions

- The effectiveness of IT and operations systems

When you're considering the transaction, you need to think about:

- Your LBO model

- The basis for your valuation (have you used a Sum of The Parts (SOTP) valuation or another method - why?)

- The company's ability to raise debt

- The exit opportunities from the investment

- The synergies with other companies in the PE fund's portfolio

- The best timing for the transaction

BUT: keep things simple.

While this checklist is important as an input and a way to approach the task, w hen it comes to presenting the information, quality beats quantity. McManus says: “The main reason why people aren’t successful in case studies is that they say too much. What you’ve got to focus on is what’s critical, what makes a difference. It’s not about quantity, it’s about quality of thinking. If you do 30 strengths and weaknesses it might only be three that matter. It’s not the analysis that matters, but what’s important from that analysis. What’s critical to the investment thesis. Most firms tend to use the same case study so they can start to see what a good answer looks like.”

Houson agrees that picking out the most important elements in the case study are more important than spending too much time on an elaborate model. “You don’t necessarily need to demonstrate such technical prowess when it comes to building the model. But you need to be comfortable about being challenged around the business case. Frankly it’s better to go for a simple answer which sparks a really interesting conversation rather than something that is purely judged from a technical standpoint. The model is meant to inform the discussion, not be the discussion itself.”

Softer factors such as interpersonal skills are also important because if the case study is the closest thing you’ll get to doing the job, then it’s also a measure of how you might behave in a live situation. McManus says: “This is what it will be like having a conversation at 11am with your boss having been given the information memorandum the day before. Not only are the interviewers looking at how you approach the case study, but they’re also looking at whether they want to have this conversation with you every Tuesday morning at 11am.”

The exercise usually takes around four hours if you include the modelling aspect, so there is time pressure. “Top tips are to practice how to think in a way that is simple, but fit for purpose. Think about how to work quickly. The ability to work under pressure is still important,” says Houson.

But some firms will allow you do complete the CIM over the weekend. In that case on one private equity professional says you should get someone who already works in PE to check it over for you. He also advises getting friends who've been through case study interviews before to put you through some mock questions on your presentation.

But McManus says this can lead to spending too much time and favours the shorter method. “It’s fairer and you can illustrate the quality of your thinking over a short space of time.”

The case study is conducted online, and because of Covid, so too are many of the follow-up discussions, so it’s worth thinking about how to present yourself on zoom or Teams. “Although a lot of these case studies over the last couple of years have been done remotely, in many ways that’s even more reason to try to bring out a bit of engagement and personality with the people you’re talking to."

“ There’s never a right or wrong answer. Rather it’s showing your thinking and they like to have that discussion with you. It’s the nearest you get to doing the job. And that cuts both ways – if you don’t like the case study, you won't like doing the job. “

Contact: [email protected] in the first instance. Whatsapp/Signal/Telegram also available (Telegram: @SarahButcher)

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.

Photo by Adam Kring on Unsplash

Sign up to Morning Coffee!

The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits.

Boost your career

"My daughter is very unhappy with her Goldman Sachs bonus"

Edward Ruff, 40 year-old Citigroup MD accused of shouting at juniors, had a rough start

Reflections of a banking MD: "20 years of 70-90 hour weeks; six million air miles"

Goldman Sachs' potential next CEO has 5 children & a wife who's best friends with Gwyneth

Multiple banks cutting jobs after 'lowest bonuses for a decade'

Citigroup made another major JPMorgan hire without anyone noticing

Deutsche Bank hired a new head of credit trading from Morgan Stanley

Evercore is still hiring but it's paying slightly better now, too

Bank of Singapore fired up to 40 people for medical insurance claims

Citi’s cheap happy junior bankers in Malaga are not so grateful

Related articles

How to move from banking to private equity, by a former associate at Goldman Sachs

The banks with the best and worst working hours

Private equity pay: where the money has been made

If you want to work from home, these are the jobs to avoid as a graduate

S T R E E T OF W A L L S

Lbo modeling test example.

When interviewing for a junior private equity position, a candidate must prepare for in-office modeling tests on potential private equity investment opportunities—especially LBO scenarios. In this module, we will walk through an example of an in-office LBO modeling test. In-office case studies and modeling tests can occur at various stages of an interview process, and additional interviews with other members of the private equity team could occur on the same day. Therefore, you should strive to be able to do these studies effectively and efficiently without draining yourself so much that you can’t quickly rebound and move on to the next interview. Make sure to take your time and build every formula correctly, since this process is not a race. There are many complex formulas in this test, so make sure you understand every calculation.

This type of LBO test will not be mastered in a day or even a week. You must therefore begin practicing this technique in advance of meeting with headhunters. Repeated practice, checking for errors and difficulties and learning how to correct them, all the while enhancing your understanding of how an LBO works, is the key to success.

- Investment Scenario Overview

Given Information (Parameters and Assumptions)

Step 1: income statement projections, step 2: transaction summary, step 3: pro forma balance sheet.

- Step 4: Full Income Statement Projections

Step 5: Balance Sheet Projections

Step 6: cash flow statement projections, step 7: depreciation schedule, step 8: debt schedule, step 9: returns calculations.

Below we provide the given information from a real-life LBO test that was given to a pre-MBA associate candidate at a large PE firm. We will use it as an example of how to build an LBO model from scratch during the interview. Remember that candidates will receive a laptop and a printout with key information regarding the transaction to complete this assignment.

ABC Company, Inc.

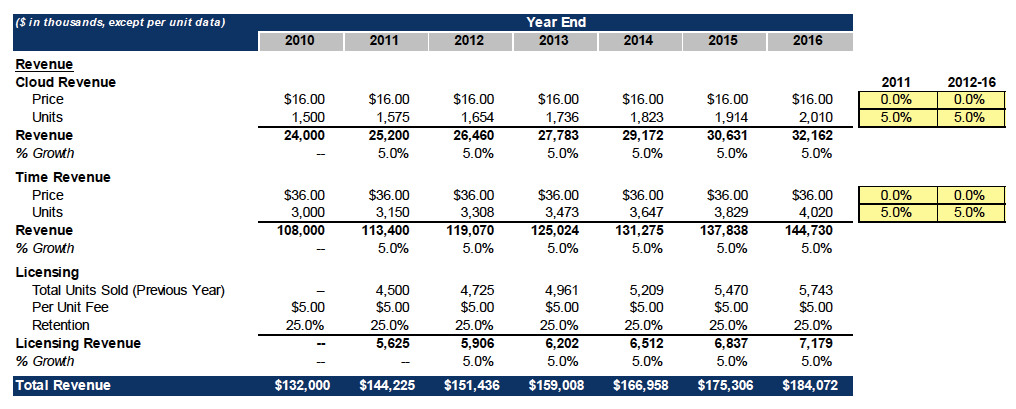

Scenario Overview and Revenue Assumptions:

ABC Company, Inc. is a developer of software applications for smartphone devices. The company sells two products for the various smartphones. The first is a software application called Cloud that tracks weather data. The second application, Time, acts as a calendar that keeps track of a user’s schedule. ABC Company prices Cloud at $16.00 and Time at $36.00 per software license. ABC Company sold 1.5 million copies of Cloud and 3 million copies of Time in 2010. That was the first year ABC Company generated any revenue.

Each software application requires the payment of a $5.00 renewal fee every year. ABC Company renews approximately 25% of the licenses it sold in the prior year; this renewal fee acts as a source of recurring revenue. To simplify, assume that renewals happen for only one additional year and that the recurring revenue stream is based on the prior year’s new licenses. Note that ABC Company does not incur any additional costs for renewals.

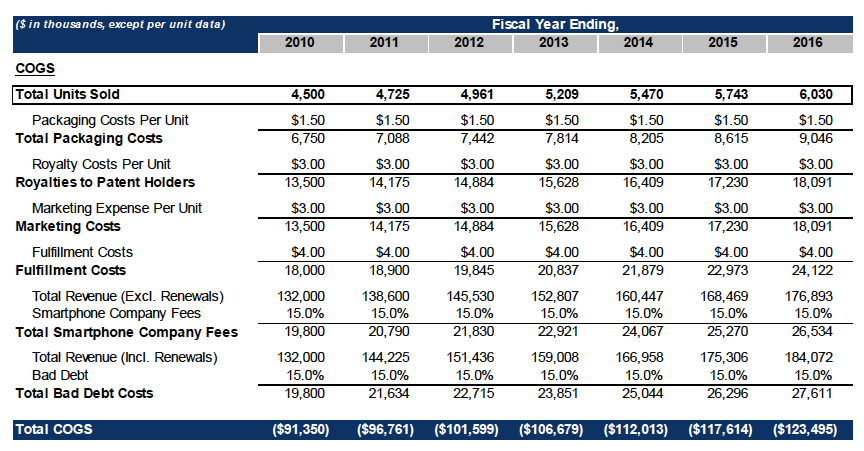

COGS assumptions (assume constant throughout the projection period):

- Packaging costs = $1.50 per unit

- Royalties to technology patent owners = $3.00 per unit

- Marketing expense = $3.00 per unit

- Fulfillment expense = $4.00 per unit

- Fees to smartphone companies = 15% of sale price (does not include renewal fees)

- ABC Company incurs a 15% bad debt allowance on total revenues (consider this as part of cost of sales, wherein ABC Company is unable to collect from customers’ credit card companies).

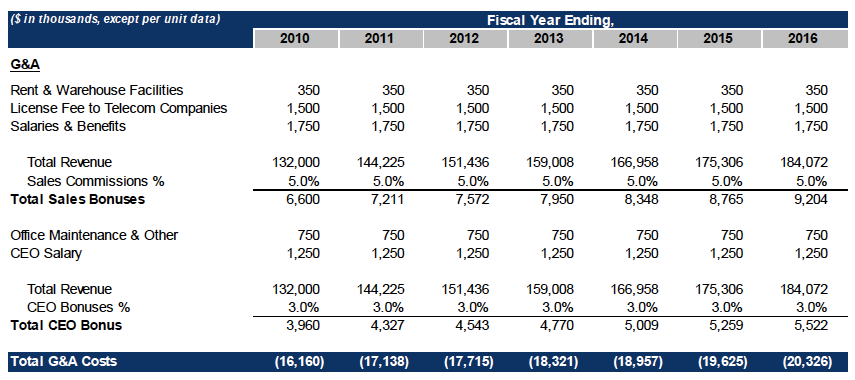

G&A and other assumptions (assume constant throughout the projection period):

- Rent of development property and warehouse facilities = $350,000 annually

- License fee to telecom internet providers = $1.5 million annually

- Salaries and benefits = $1.75 million annually

- Sales commissions = 5% of all sales including renewals

- Offices and other administrative costs = $750,000 annually

- CEO salary and bonus = $1.25 million annually + 3% of all sales including renewals

- Federal tax rate = 35% and state tax rate = 5% on EBT

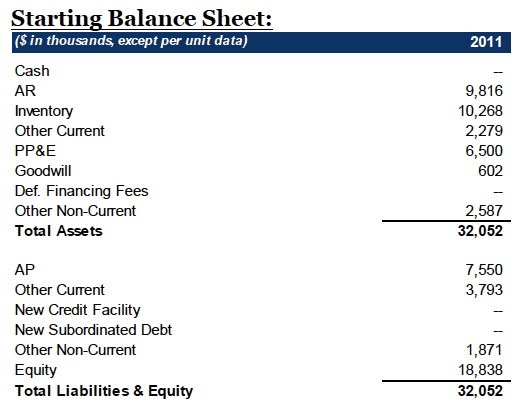

Starting Balance Sheet:

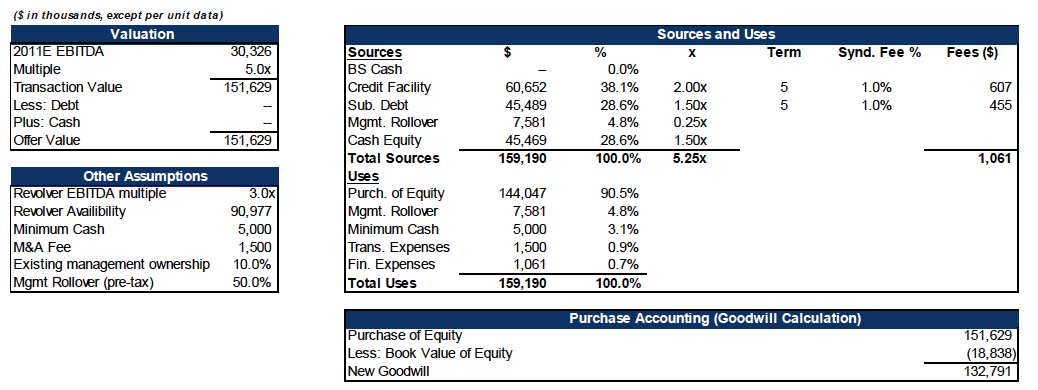

Investment Assumptions:

Due to the depressed macroeconomic and investing environment, the PE fund is able to acquire ABC Company for the inexpensive purchase price of 5.0x 2011 EBITDA (assuming a cash-free debt-free deal), which will be paid in cash. The transaction is expected to close at the end of 2011.

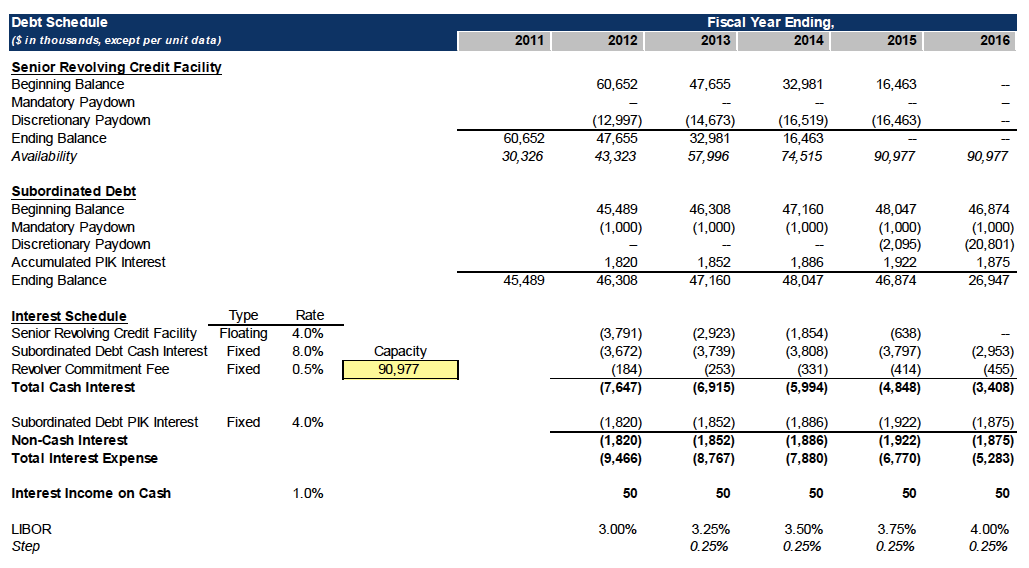

- Senior Revolving Credit Facility: 3.0x (2.0x funded at close) 2011 EBITDA, LIBOR + 400bps, 2017 maturity, commitment fee of 0.50% for any available revolver capacity. RCF is available to help fund operating cash requirements of the business (only as needed).

- Subordinated Debt: 1.5x 2011 EBITDA, 12% annual interest (8% cash, 4% PIK interest), 2017 maturity, $1 million required amortization per year. (Hint: add the PIK interest once you have a fully functioning model that balances.)

- Assume that existing management expects to roll-over 50% of its pre-tax exit proceeds from the transaction. Existing management’s ownership pre-LBO is 10%.

- Assume a minimum cash balance (Day 1 Cash) of $5 million (this needs to be funded by the financial sponsor as the transaction is a cash-free / debt-free deal).

- Assume that all remaining funding comes from the financial sponsor.

- Assume that all cash beyond the minimum cash balance of $5 million and the required amortization of each tranche is swept by creditors in order of priority (i.e. 100% cash flow sweep).

- Assume that LIBOR for 2012 is 3.00% and is expected to increase by 25bps each year.

- The M&A fee for the transaction is $1.5 million. Assume that the M&A fee cannot be expensed (amortized) by ABC and will be paid out of the sponsor equity contribution upon close.

- In addition, there is a financing syndication fee of 1% on all debt instruments used. This fee will be amortized on a five-year, straight-line schedule.

- Assume New Goodwill equals Purchase Equity Value less Book Value of Equity.

- Assume Interest Income on average cash balances is 1%.

Hint: The first forecast year for the model will be 2012. However, you will need to build out the income statement for 2010 and 2011 to forecast the financial statements for years 2012 through 2016.

- Build an integrated three-statement LBO model including all necessary schedules (see below).

- Build a Sources and Uses table.

- Make adjustments to the closing balance sheet of ABC Company post-acquisition.

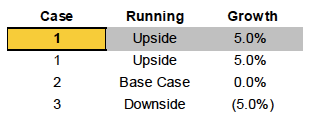

- Build an annual operating forecast for ABC Company with the following scenarios (using 2010 as the first year for the revenue forecast; note that 2010 EBITDA should be approximately $25 million). Assume that in 2011 there is 5% growth in units sold (both Cloud and Time units).

- Upside Case: 5% annual growth in units sold (both Cloud and Time units)

- Conservative Case: 0% annual growth in units sold (both Cloud and Time units)

- Downside Case: 5% annual decline in units sold (both Cloud and Time units)

- Build a Working Capital schedule using Accounts Receivable Days, Accounts Payable Days, Inventory Days, and other assets and liabilities as a percentage of Revenue. Assume working capital metrics stay constant throughout the projection period and assume 365 days per year.

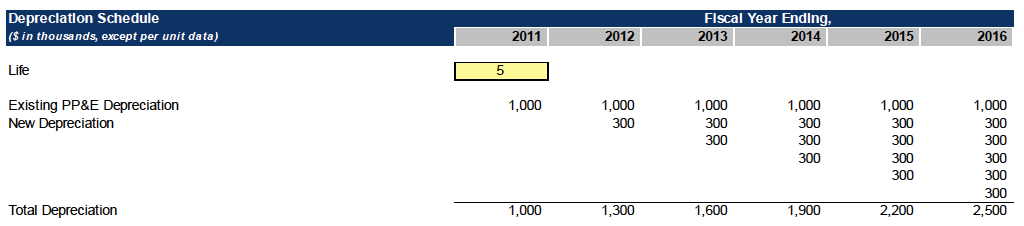

- Build a Depreciation Schedule that assumes that existing PP&E depreciates by $1 million per year, and that new capital expenditures of $1.5 million per year depreciate on a five-year, straight-line basis.

- Build a Debt schedule showing the capital structure described earlier. Use average balances for calculating Interest Expense (except for PIK interest—assume that PIK interest is calculated based on the beginning year Subordinated Debt balance and not the average over the year).

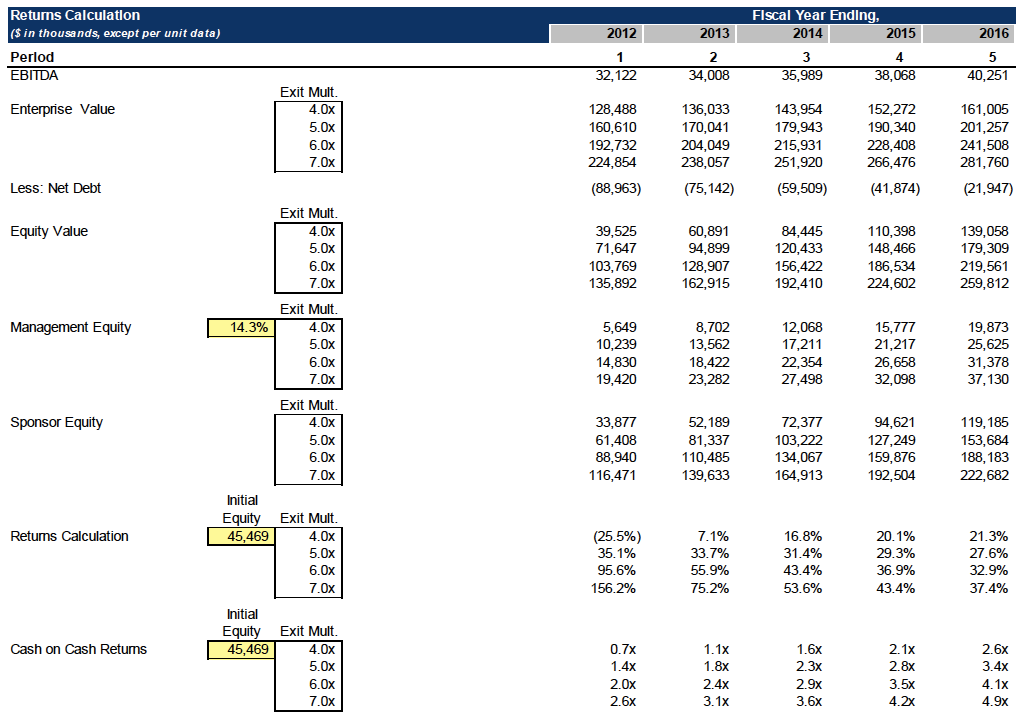

- Create an Exit Returns schedule (including both cash-on-cash and IRR) showing the returns to the PE firm equity based on all possible year-end exit points from 2012 to 2016, with exit EBITDA multiples ranging from 4.0x to 7.0x.

- Display the results of all of these calculations using the “Upside Case.”

Note that the above description incorporates all of the information, assumptions and assignments that were given in this LBO in-person test example.

As part of the first step, build out the core operating Income Statement line items for years 2010 through 2016.

- Make a distinction between 2011 assumptions and 2012-2016 assumptions

- Take the provided assumptions and make the revenue and cost build based upon them.

- OFFSET is a simple Excel formula that is used commonly to interchange scenarios, especially if the model becomes very complex. It simply reads the value in a cell that is located an appropriate number of rows/columns away, based on the parameters given to the function. Thus, for example, =OFFSET(A1, 3, 1) will read the value in cell B4 (3 rows and 1 column after A1).

Next, build the costs related to Revenue based upon the information given in the case.

Then, build the G&A expenses from the given information.

Finally, build a simple summary schedule for the above projections.

As part of the second step, build out the transaction summary section which will consist of the Purchase Price Calculation, Sources and Uses, and the Goodwill calculation.

- This model assumes a debt-free/cash-free balance sheet pre-transaction for simplification. Without debt or cash, the transaction value is simply equal to the offer price for the equity (before fees and minimum cash—discussed below).

- The funding for this model is fairly simple: the funded credit facility is 2.0x 2011E EBITDA, the subordinated debt is 1.5x, and the remaining portion is the equity funding, which is a combination of management rollover equity and sponsor (PE firm) equity. (Note that the 5.0x 2011E EBITDA is the offer value for the equity before the M&A and financing fees and the minimum cash balance, not after. After fees/cash, it ends up being 5.25x.)

- The management rollover is simply half of the management team’s proceeds from selling the company. Since management owned 10% of the company before the transaction, it constitutes 5% of the offer price for the original equity.

- The sponsor equity is the “plug” in this calculation. In other words, it is the amount that is solved for once all other amounts are known (offer price + minimum cash + fees – debt instruments – management rollover equity).

- The total equity (including management rollover) represents about 30-35% of the funding for the deal, which is about right for a typical LBO transaction.

- Goodwill is simply the excess paid for the original equity (offer price – book value of equity).

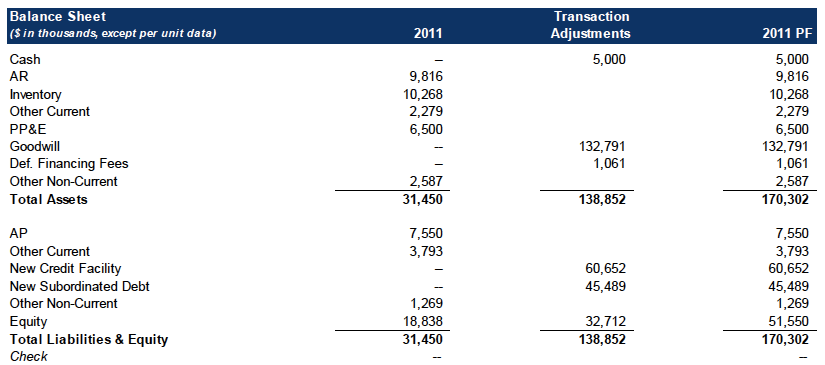

As a next step, build out the Pro Forma Balance Sheet using the given 2011 balance sheet. To do this, you need to incorporate all the transaction and financing-related adjustments needed to produce the Pro Forma Balance Sheet. Each adjustment is discussed in detail below.

- Since this is a cash-free and debt-free deal to start, there are no Pro Forma adjustments for the cancelling or refinancing of debt.

- Cash increases by $5 million upon close because the sponsor is funding the minimum cash balance (minimum cash that is assumed to be needed to run the business).

- The New Goodwill is simply the purchase value of the equity (not including fees) less the original book value of the equity.

- The adjustment for Debt Financing Fees reflects the cost of issuing the new debt instruments to buy the company. This fee is considered an asset, and is capitalized and amortized over 5 years.

- The Debt-related adjustments reflect the new debt instruments for the new capital structure.

- The Equity adjustment reflects the fact that the original equity is effectively wiped out in the transaction—the “adjustment” amount shown here is simply the difference between the new equity value and the old one. The new equity value will equal the amount of the total equity funding for the transaction (sponsor plus management’s rollover) less the M&A fee, which is accounted for as an off balance-sheet cost.

- VERY IMPORTANT: This stage of the LBO model development (once Pro Forma adjustments have been made to reflect the impact of the transaction on the balance sheet) is a very good time to check to make sure that everything in the model so far balances and reflects the given assumptions. This includes old and new assets equaling old and new liabilities plus equity; new sources of capital equaling the transaction value, which equals the offer price for the original equity (adjusting for cash, old debt and fees), etc.

Step 4: Full Income Statement

Next, build the full Income Statement projections all the way down to Net Income. Note that a few line items (especially Interest Expense!) will be calculated in later steps. Once the Cash Flow section and other schedules are built, link all the final line items to complete the integrated financials.

- You can link the Revenue, COGS and SG&A calculations to the operating model (built in Step 1) to get to EBITDA.

- D&A will be linked to the Depreciation Schedule that you will need to build (schedule of the Depreciation of the existing PP&E and new Capital Expenditures made over the projection period).

- Interest Expense and Interest Income will be linked to the Debt Schedule that you will need to build. There will be a natural circular reference because of the cash flow sweep feature of the LBO model, combined with the fact that Interest Expense is dependent upon Cash balances. This is usually one of the last things you should build in an LBO model.

- The amortization of Deferred Financing Fees is fairly straightforward: it uses a straight-line, 5 year amortization of the fees described in the case write-up and computed in Step 2.

- The tax rates apply to EBT after all of these expenses have been subtracted out. They are given in the case write-up.

Next, forecast the Balance Sheet from 2011 to 2016. Note that we start with the 2011 Pro Forma Balance Sheet from Step 3 , not the original Balance Sheet.

- Laying out the Balance Sheet is similar to laying out the Income Statement—you’ll have to set up the framework for some line items and leave the formulas blank at first, as they will be calculated in the other schedules you will create.

- Cash remains at $5 million throughout the life of the model, as we’re assuming a 100% cash flow sweep and that the minimum cash balance is $5 million. (Cash would only start to increase if we project out long enough that all outstanding Debt is paid off.)

- Accounts Receivable (AR): Calculate AR days (AR ÷ Total Revenue × 365) for 2011 and keep it constant throughout the projection period.

- Inventory: Calculate Inventory days (Inventory ÷ COGS × 365) for 2011 and keep it constant throughout the projection period.

- Other Current Assets: Keep this line item as a constant percentage of revenue throughout the projection period.

- Accounts Payable (AP): Calculate AP days (AP ÷ COGS × 365) for 2011 and keep it constant throughout the projection period.

- Other Current Liabilities: Keep this line item as a constant percentage of revenue throughout the projection period.

- Total Deferred Financing Fees are computed based upon the Debt balances and percentage assumptions given in the model. Deferred financing fees are then amortized, straight-line, over 5 years.

- The Credit Facility and Subordinated Debt line items will link to your Debt schedule. Their balances will decrease over time as a function of the cash available for Debt paydown (since the case write-up specifies a 100% cash sweep function).

- Equity (specifically Retained Earnings) will increase each year by the same amount as Net Income, because there are no dividends being declared. If dividends were to be added into the model, you would calculate ending Retained Earnings as Beginning Retained Earnings + Net Income – Dividends Declared.

- As discussed earlier, the balance sheet has the pleasing feature that if it balances, the model is probably operating correctly! Now is another good time to make sure everything balances before proceeding.

Next, forecast the Cash Flow Statement as requested in the Exercises section.

- Start with Net Income and add back non-cash expenses from the Income Statement, such as D&A, Non-Cash Interest (PIK), and Deferred Financing Fees.

- Next, subtract uses of Cash that are not reflected in the Income Statement. These include the increase in Operating Working Capital (which you calculated using your balance sheet) and Capital Expenditures (which is calculated here or, alternatively, could be calculated in the Depreciation Schedule to be built shortly).

- Next, calculate the change in cash, which will be interconnected with the Debt schedule. In this case, the model is assuming a 100% cash flow sweep (after mandatory debt amortization payments), so cash should not change after the 2011PF Balance Sheet amount of $5 million.

- Even though the amount is not changing, the Cash line item should link back to the Balance Sheet. This is because the model could later be used to relax the assumption that 100% of excess cash is swept to pay down Debt. If it’s less than 100%, Cash would accumulate, and that would need to tie in to the other financial statements.

Next, forecast the Depreciation schedule as requested in the Exercises section.

- The original PP&E is depreciated $1 million annually, as stated in the assumptions.

- New Depreciation is calculated based on the annual investment in Capital Expenditures over the projection period. This new Depreciation is created using a waterfall (see above): each year new Capital Expenditures occur and need to be depreciated; each year, Capital Expenditures from previous projection years in the model may have to be partially depreciated in that year. The sum of all of the component Depreciation line items (one row for each year, plus the Depreciation on the original PP&E) gives the total Depreciation Expense for the year.

Note that this model is less complex than it could be. Given that Capital Expenditures do not change each year, and that each new Capital Expenditure is depreciated according to the same simple schedule, the numbers and calculations are fairly straightforward. Here, we’re simply assuming that new Capital Expenditures are expensed evenly over a 5 year period (using straight-line depreciation), as specified in the case write-up.

Next, forecast the Debt Paydown and Interest Expenses for each year via the Debt Schedule, as requested in the Exercises section.

- WARNING: Be very careful about changing formulas once you have built the iterative calculation. If you do so and introduce an error, it could bust your entire model if you’re not careful. This is because the error will travel all the way through the iterative calculations and end up everywhere! If you run into this problem, break the circular reference entirely (by deleting it), reconstruct the calculations for the first forecast year (2012), and then copy and paste them across the columns, one year at a time (2013, then 2014, etc.). Many PE professionals have spent late nights in the office trying to recover from an accidental error introduced into a circular LBO model formula!

- The non-discretionary portion is the required amortization payments made on debt (in this case, there is only required pay-down for subordinated debt).

- The discretionary portion is the sweep portion of the remaining LFCF less required amortization. Since we’re assuming a 100% cash flow sweep, all of the LFCF is used to pay down debt—first the Senior Credit Facility, then the Subordinated Debt. The cash flow sweep and required payments will help you calculate the beginning and ending balances of both of the debt tranches.

- Also note that we need to include a fee for the availability of the unused portion of the RCF, even if the business never uses it—this is a typical, annual commitment fee arrangement for revolving credit facilities.

- The interest rate on the debt is a floating rate (this means an interest rate that is dependent on LIBOR, according to the assumptions provided). We need to calculate interest based on this rate times the average S/RCF balance over the year.

- The 8% cash interest is calculated based upon the average of the debt balance, just like with the S/RCF.

- However, the 4% PIK (non-cash) interest will accrue based upon the beginning debt balance, not the average.

- Because of this difference (and the fact that one source of interest uses cash and the other does not), we need to make sure we’re using separate line items for the two types of Interest Expense.

- We also need to be aware of the mandatory amortization payment of $1 million per year, provided in the assumptions. This amount will get paid down out of LFCF no matter what.

- Interest Income on Cash is fairly easy to calculate—it is the Cash interest rate (1%) times the average balance throughout the year. This amount will increase Cash.

- Total Interest needs to be linked to the Income Statement.

- Non-Cash Interest needs to be added back to Net Income in the Statement of Cash Flows to assist in deriving LFCF (it’s a non-cash expense).

- Any LFCF that is not used to pay down Debt needs to link to the Cash line item of the Balance Sheet. (In this model none will, but you should include this measure in case the model is later used to either relax the 100% cash sweep assumption, or to project financials beyond the point at which all debt has been paid off).

- All Debt balances paid down by LFCF need to link to the Debt line items on the Balance Sheet.

In the final step of the LBO test, build out the Returns calculation required in the Exercises section.

- For each year, we simply take EBITDA multiplied by a range of purchase multiples to get to a total Exit Value for the company (Transaction Enterprise Value, or TEV).

- Next, we subtract out Net Debt (which is dependent on the 3-statement model you just created) to get to Equity Value.

- Next, we calculate the portion of the Equity Value that belongs to the management and the sponsor by using the initial equity breakdown for each party.

LBO Case Study: Conclusion and Final Comments

We hope that this case study provides some insight into all of the considerations that need to be made in building a realistic LBO model based on a case study in a Private Equity interview, and that the 9-step breakdown helps you simplify the task into easy-to-replicate and easy-to-execute steps.

No one becomes an expert LBO modeler overnight, so the key to doing well in this portion of the process is practice, practice, and more practice. With enough sample LBO cases, you should be able to master the steps needed to confidently build a fully functioning, professional LBO model on interview day.

Good luck with the modeling case and with the interviews!

Paper LBO: A Step-By-Step Guide with Interview Examples

Preparing for private equity or growth equity interviews is quite an undertaking. Whether it’s your first interview or your tenth, there’s a lot you need to prepare.

Preparing for that first one is especially tricky, though, because you’re facing your first paper LBO exercise.

The paper LBO requires knowledge of the ins-and-outs of a leveraged buyout model, as well as strong analytical skills, knowledge of the deal, and a quick mind for mental math.

Once you know how to do it, be sure to practice – you don’t want to have the additional challenge of feeling pressured while you think.

In this article, we’ll cover what a Paper LBO model is, how to prepare, and example prompts so you can go into it feeling extremely confident.

What is a paper LBO?

At its most basic level, a paper LBO highly is a simplified LBO model that uses certain simplifying assumptions that allow you to either calculate using pen and paper (or verbally). It allows you to estimate returns for a deal quickly without a full model.

The paper LBO is not actually used much “on the job” but it is often asked for during private equity interviews (and even growth equity interviews).

In an interview situation, the interviewer will commonly ask the candidate to pencil out a paper LBO for a company or deal they’ve worked on in their previous job. In other cases, the interviewer might present a new company and supply the candidate with assumptions and financial metrics to use.

Because the paper LBO simplifies the math, usually you can complete a paper LBO using paper & pen, or verbally in an interview. Sometimes interviewers will lead you along with questions, as you complete the Paper LBO live on the fly.

Usually the paper LBO exercise will last 5-20 minutes during an interview.

Paper LBO in Interviews

Paper LBO calculations are mostly for private equity interviews , although they can show up in growth equity interviews as well.

The Paper LBO assesses many key skills for private equity and growth equity jobs and internships :

First, it’s an excellent way to quickly assess your knowledge of the mechanics of LBO modeling.

It’s also a great way for an interviewer to assess your communication and quantitative skills. Can you make quick calculations on the fly? Can you sift through financial metrics in your head and calculate orally with confidence?

Additionally, the Paper LBO allows the interviewer to dig into a deal on your resume by asking you to sketch out a Paper LBO for the deal. This allows in-depth follow up questions.

Finally, because usually the Paper LBO is requested for a company/deal you’ve worked on, it tests your level of preparation for the interviews, because in order to complete it successfully you need to remember or memorize key financial metrics for the company and deal.

Paper LBO vs full LBO model

The paper LBO you might encounter in an interview is a highly simplified version of a full leveraged buyout model.

Here are a couple key ways that paper LBO models differ from full LBO models:

- Instead of building a full 3-statement model, simply focus on projecting Revenue, EBITDA, and free cash flow every year (memorize these for the entire projection period for all your deals!)

- Since you are memorizing financial numbers for Revenue, EBITDA, and FCF, it’s OK to use figures that are rounded to the nearest $5 million

- Often, you’ll assume growth in metrics over the projection period is linear, allowing you to memorize the year 0 and year 5 metric values (and assume linear growth between them)

- No need to build out balance sheet or debt schedule; you’ll capture their impact by simply projecting FCF

Sometimes interviewers will throw in a complicating factor or two, but the calculations are all designed to be completed without a computer in less than ~20 minutes.

Step-by-step process for Paper LBO

In many ways, completing a paper LBO is the same as completing any other financial model.

For any model, you can remember the ASBICIR process. This stands for the following steps:

- A ssumptions – gather all your operating and entry assumptions (incl. pro forma valuation and debt figures); start with the purchase price and debt/equity financing split.

- S ources and uses – using the assumptions, fill out your sources and uses, which shows where the cash flows to and from in the acquisition transaction. Ultimately, this will get you to your “Sponsor Equity” which is the investment amount upon which you should base your IRR

- (Pro forma) B alance sheet – With your Sources & Uses done, you can now complete your pro forma balance sheet, and start laying the foundations for projecting it forward until the exit year. This includes setting up your debt schedule, if your modeling an LBO

- I ncome statement – next, you can start projecting forward your income statement, all the way down to net income; notably, do not yet integrate interest expense; leave this blank for now

- C ash flow – with your income statement and balance sheet up, you can project forward your cash flows. This and the prior two steps will be iterative as you set up schedules and make calculations that are interdependent on multiple statements (e.g. D&A)

- I nterest – finally, once your 3-statements are connected and projected forward, always the last step is to calculate interest expense and connect it to the income statement; turn on model iterations

- R eturns – the last step is to make an assumption about your exit, and to calculate your returns by comparing the entry investment amount to the exit investment amount

For the paper LBO, the only differences are:

- No need for B alance Sheet and I nterest Expense steps; these are both excluded; given this, you’re left with the Paper LBO short version: ASICR

- Instead of building a full 5-year projection, instead build up the model for Year 0 and Year 5 (from memory). To estimate the intervening years, you can either assume linear growth or you can use the “average” method

- To estimate the debt balance at exit (year 5), take the average of Year 0 FCF and Year 5 FCF. This will give you average FCF across all 5 projection years. Then take this number and multiply it by 5. This is an estimate of the total amount debt will decrease during the hold period

- Round numbers to the nearest $5 million

- 12+ video hours

- Excels & templates

PREMIUM COURSE

Become a Private Equity Investor

Paper LBO format

Sometimes your interviewer will give you calculation aids like a calculator or basic Excel functionality (which you shouldn’t count on).

However, most of the time your interviewer will want to hear you talk through your thought process. After all, they are hiring human talent, not a calculating robot. (AI isn’t coming for private equity – yet.)

Follow the ASICR flow above as you calculate and speak.

Plan anywhere between 5 and 20 minutes for total exercise time, both calculating and speaking.

As you practice, record yourself going through the entire thing, both to time yourself and to assess your confidence and speaking ability.

Paper LBO Example

This is a sample paper LBO prompt you might be given in an interview situation.

The assumptions here are pretty standard, but if there are any different ones in your interview, you will know about them. The final result of your paper LBO calculations will be the IRR and MoM for the deal.

Here’s the sample prompt:

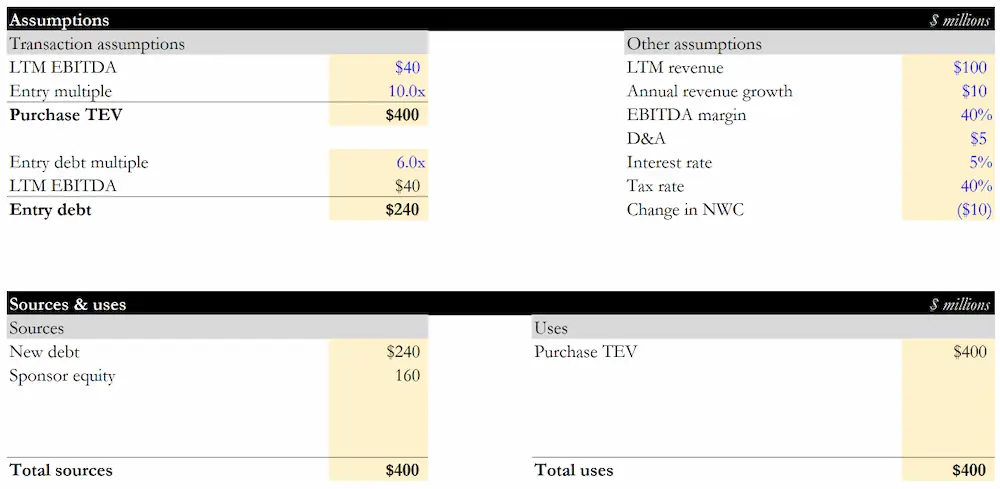

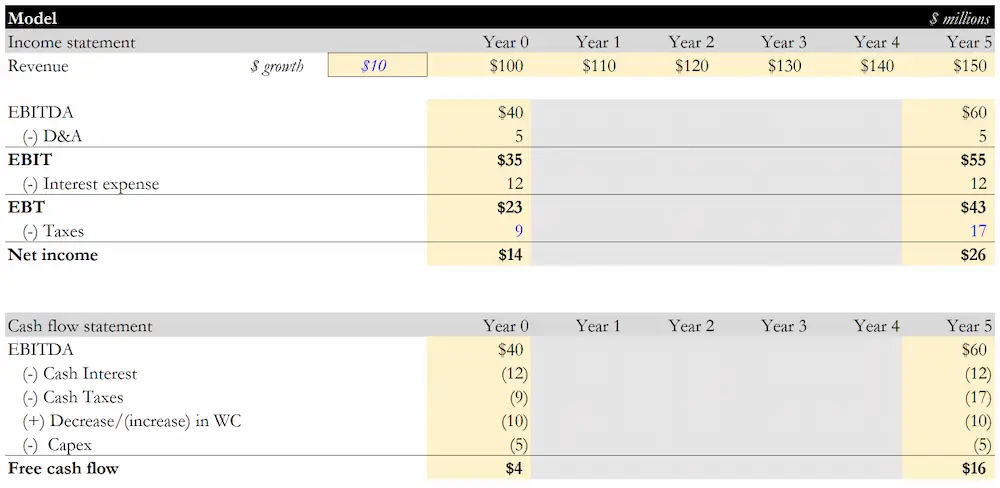

Imagine our firm is considering an LBO of Company X, and you’re on our investment team. Right now, create a paper LBO live with your interviewer to estimate the IRR and Multiple-on-Money return for the deal. Use the following assumptions: All dollar amounts are in millions. Year 0 revenue: $100 Revenue growth: $10 every year Year 0 EBITDA margin: 40% in Year 0 EBITDA margins: remain constant every year Entry timing: at end of Year 0 Entry multiple: 10x LTM EBITDA Pro forma debt: 6.0x LTM EBITDA with blended average interest rate of 5% Year 0 D&A: $5, flat across projection CapEx = D&A throughout projection Working capital: Cash investment of $10 every year Tax rate: 40% Entry timing: at end of Year 5 Assume entry-exit multiple parity

When you pencil out this Paper LBO, what IRR do you get? I get ~21% or 2.6x MoM.

Below are the key steps with outputs.

Step 1/2: Assumptions + Sources & Uses

Steps 3/4: Income & Cash flow Statements

Step 5: Returns

Special tricks for solving

- Follow the flow. The interviewer wants to see that you know how to think like an investor, and wants to see a clear, logical train of thought from beginning to end. Logical shortcuts are fine, as long as the interviewer can follow what you are doing.

- IRR is tough to calculate, but the multiple on money, or cash-on-cash return, is easy to calculate. You will need the beginning and ending equity values for the company. Then, you can use this to help you find IRR.

- Since IRR involves time value of money, it’s tricky to find without Excel or a calculator. A good rule of thumb is the Rule of 72. The Rule of 72 states that the time it takes to double your money is 72 divided by the MoM rate of return. There are also IRR tables you can memorize for common IRR values over a 5-year horizon, but the Rule of 72 has the advantage of being more flexible and easier to remember.

Paper LBO prep plan

Private equity headhunters and interviewers alike are looking for one thing: expertise.

Since the paper LBO calculation is one of the most technical things you will cover in your interview, it is worth your while to practice. Timing yourself is also key.

Memorize key deal financials

For each of the major deals you list on your resume, memorize the following financial metrics:

- Revenue- Year 0 (entry) and Year 5 (exit)

- EBITDA – Year 0 and Year 5

- FCF (calculated from EBITDA) – Year 0 and Year 5

- Entry valuation multiple

- Exit valuation multiple

- IRR & MoM of deal

If the deal wasn’t an LBO or acquisition, you should still memorize these figures because you might be asked to pencil out an LBO for it anyway.

Memorize the Rule of 72 and Rule of 115

These will help you go from multiple on money to IRR calculations for a 5 year period.

Practice with pen and paper

If you are working from pen-and-paper case studies, see if you can get your time down to 5-10 minutes for a straightforward case study, or 10-15 for a more complex example (e.g. read more about private equity case studies ).

Practice with your deals

You can also use deals on your private equity resume to generate paper LBO calculations. Go through each deal you completed and create a paper LBO scenario.

Basically, you need to reduce the full model from the actual deal to a simplified paper calculation. Ensure that the relevant ending metrics, such as the internal rate of return and the cash-on-cash return, are the same between the original and simplified versions (within rounding error).

Since it has more meaning to you than a case study, you should be able to memorize each paper LBO scenario for previous deals. Not only will this help you become more efficient with your paper LBO calculations, but it will also make you a more confident interviewee.

FAQ: How long should a paper LBO take?

A simple case study with pen and paper provided and no complicating factors can be completed in five minutes.

A more complex calculation where Excel is allowed should not take more than five minutes either.

If the LBO study has complicating factors like multiple investors or a one-time cash outflow within the case study timeline, it can take longer, but no more than about 20 minutes including discussion time.

FAQ: Are paper LBOs actually on paper?

Yes! Sometimes.

They can be on paper. Some firms may choose to do a simplified Excel version for more complex LBO examples.

Other firms may have paper or may simply do a fully verbal interview with a simpler example.

- Articles in Guide

- More Guides

DIVE DEEPER

The #1 online course for growth investing interviews.

- Step-by-step video lessons

- Self-paced with immediate access

- Case studies with Excel examples

- Taught by industry expert

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam ever, unsubscribe at any time

Copyright © Growth Equity Interview Guide 2023

HQ in San Francisco, CA

Phone: +1 (415) 236-3974

Growth Equity Industry & Career Primer

Growth Equity Interview Prep

How To Get Into Private Equity

Private Equity Industry Primer

Growth Equity Case Studies

SaaS Metrics Deep Dive

Investment Banking Industry Primer

How To Get Into Investment Banking

How To Get Into Venture Capital

Books for Finance & Startup Careers

Growth Equity Jobs & Internships

Mike Hinckley

Growth stage expertise.

Coached and assisted hundreds of candidates recruiting for growth equity & VC

with Mike Hinckley

Premium online course

- Private equity recruiting plan

- LBO modeling & financial diligence

- Interview case studies

Register for Waitlist

FREE RESOURCES

Get My Best Growth Equity Interview Tips

No spam ever, unsubscribe anytime

Username or Email Address

Remember Me

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The 3-Statement Model: Full Tutorial for a Timed 90-Minute Modeling Test

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

A long time ago, we received one complaint/criticism more than any other:

“All your models start from templates ! What about case studies where I have to start from a blank Excel sheet and do not get any data, formatting, or schedules?”

We did this mostly to save time : entering the historical information and setting up the formatting, layout, etc., usually takes at least 30 minutes and sometimes up to several hours.

But there is also value in learning how to build a full model from scratch .

We’ll cover a 90-minute 3-statement modeling test here and explain how to use the company’s financials, 10-K, and investor presentation to do everything.

WARNING: You must have a decent-to-high Excel proficiency to follow along and finish this in the allotted time.

The video walkthrough below has captions for some of the Excel shortcuts, but it’s not a full Excel tutorial, and we assume you already know the basics.

What is a 3-Statement Model?

In financial modeling , the “3 statements” refer to the Income Statement, Balance Sheet, and Cash Flow Statement.

Collectively, these show you a company’s revenue, expenses, cash, debt, equity, and cash flow over time, and you can use them to determine why these items have changed.

In a 3-statement model, you input the historical versions of these statements and then project them over a ~5-year period.

In real life, you do this to value companies, model transactions, and determine whether the company’s expected growth, margins, and cash flow metrics are plausible.

For example, if the company claims it will generate $5 billion of Free Cash Flow and use it to repay $1 billion of Debt and issue $4 billion in Dividends, is that realistic?

Will the company generate more or less cash flow? Might it need outside financing? How do the numbers change if market conditions worsen?

Banks like to test this topic because it’s a quick way to assess who’s proficient in Excel, accounting, and financial modeling.

If you cannot read or interpret a company’s historical financial statements, you won’t be working on complex deals anytime soon.

Types of 3-Statement Modeling Tests

Most 3-statement models and case studies fall into one of three categories:

- Blank Sheet / Strict Time Limit: These are more about working quickly, knowing the Excel shortcuts, simplifying, and making decisions under pressure.

- Template / Strict Time Limit: These tests are more about entering the correct formulas, justifying your assumptions, and answering questions based on your model’s output.

- No Strict Time Limit: These case studies are more about using outside research and data to justify your assumptions for the revenue, expenses, cash flow, etc. You might also have to give a presentation based on your findings.

The “strict time limit” could be anything from 30 minutes to 3-4 hours, and the complexity increases as the time limit increases.

The “no strict time limit” type might give you several days or even 1 week+.

There is still a deadline, but you don’t need to rush around like a madman to finish.

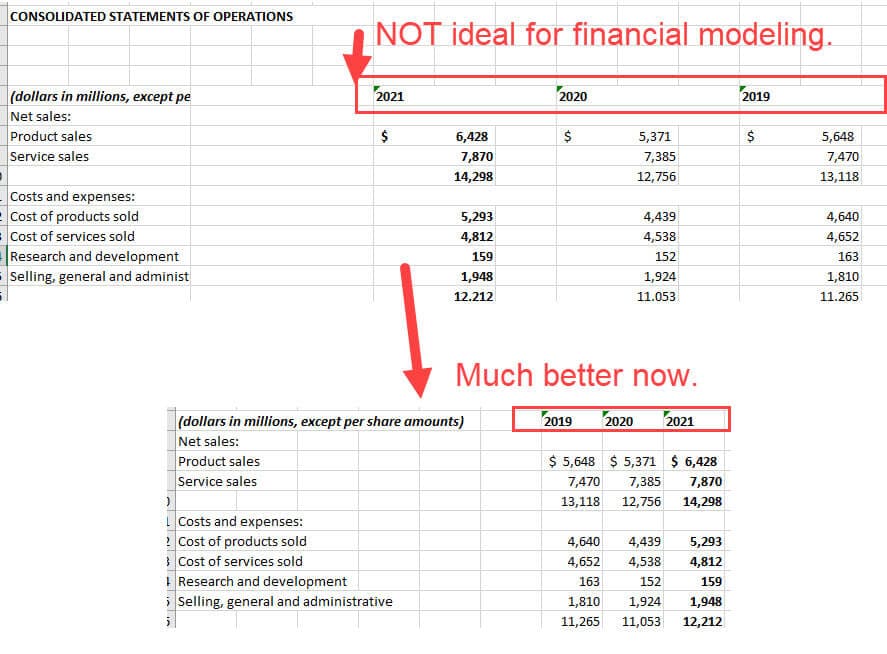

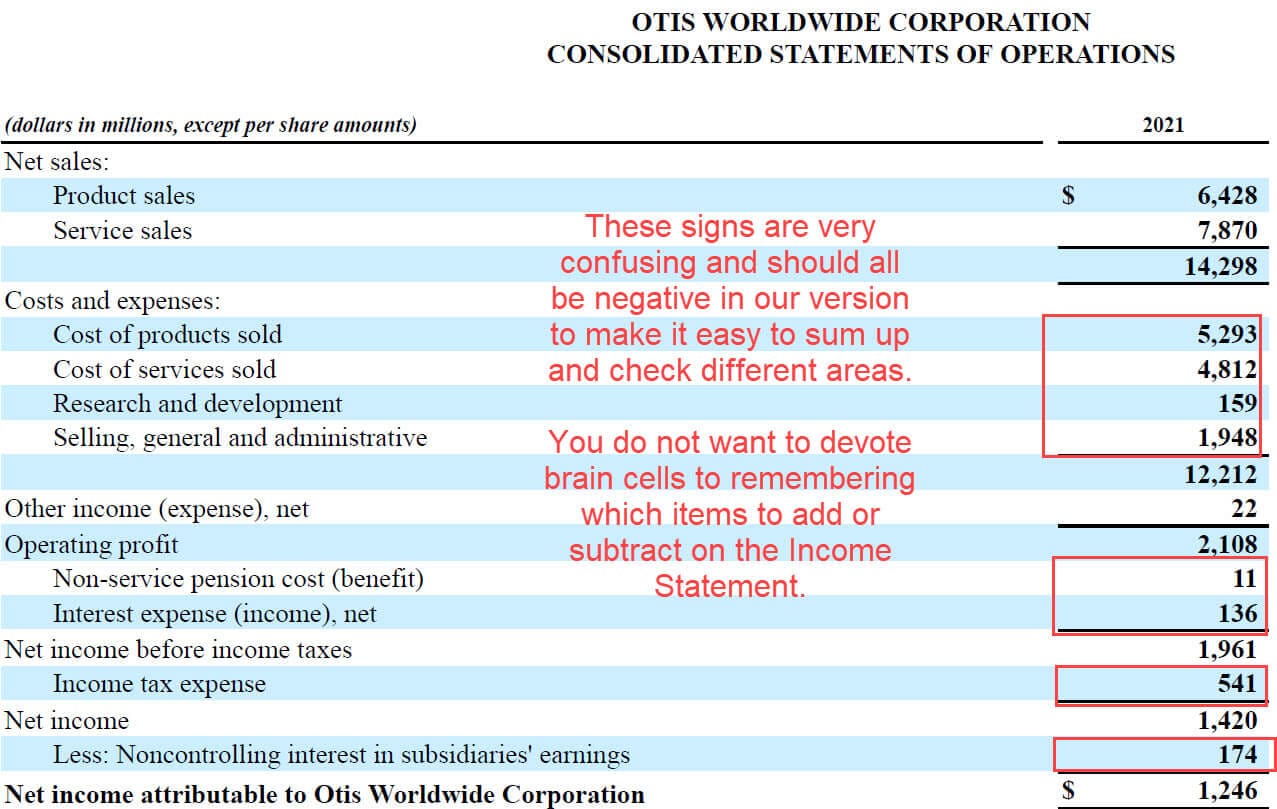

The 90-Minute 3-Statement Model from a Blank Sheet

For this tutorial, I picked an example where you start from a blank sheet and review the company’s filings and presentations .

So, you must demonstrate Excel proficiency and the ability to interpret data and make reasonable assumptions.

You can get the case study prompt, the company documents, and the completed Excel file below:

- 90-Minute 3-Statement Model – Case Study Prompt (PDF)

- 90-Minute 3-Statement Model – Completed Excel File (XL)

- Overview of Main Points in 90-Minute 3-Statement Modeling Test – Slides (PDF)

- Otis – 10-K (PDF)

- Otis – 10-K in Excel Format – Raw (XL)

- Otis – User-Friendly 10-K in Excel with Swapped Columns (XL)

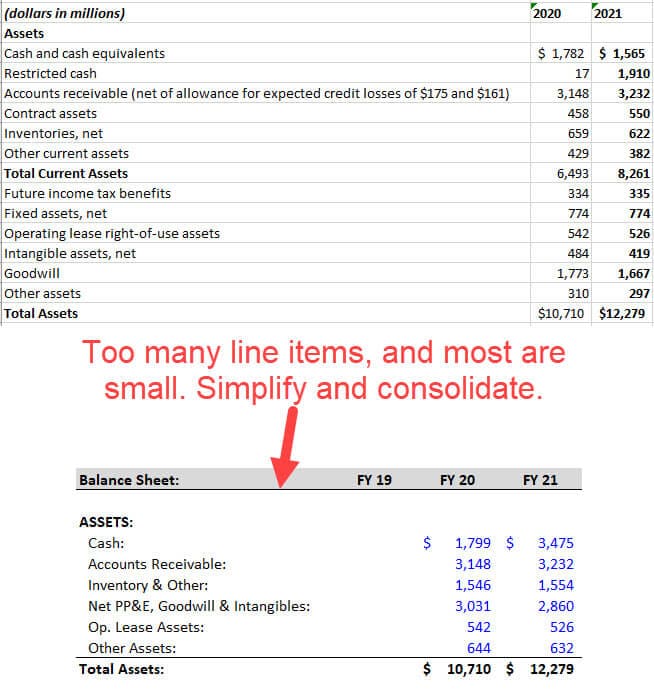

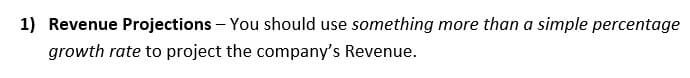

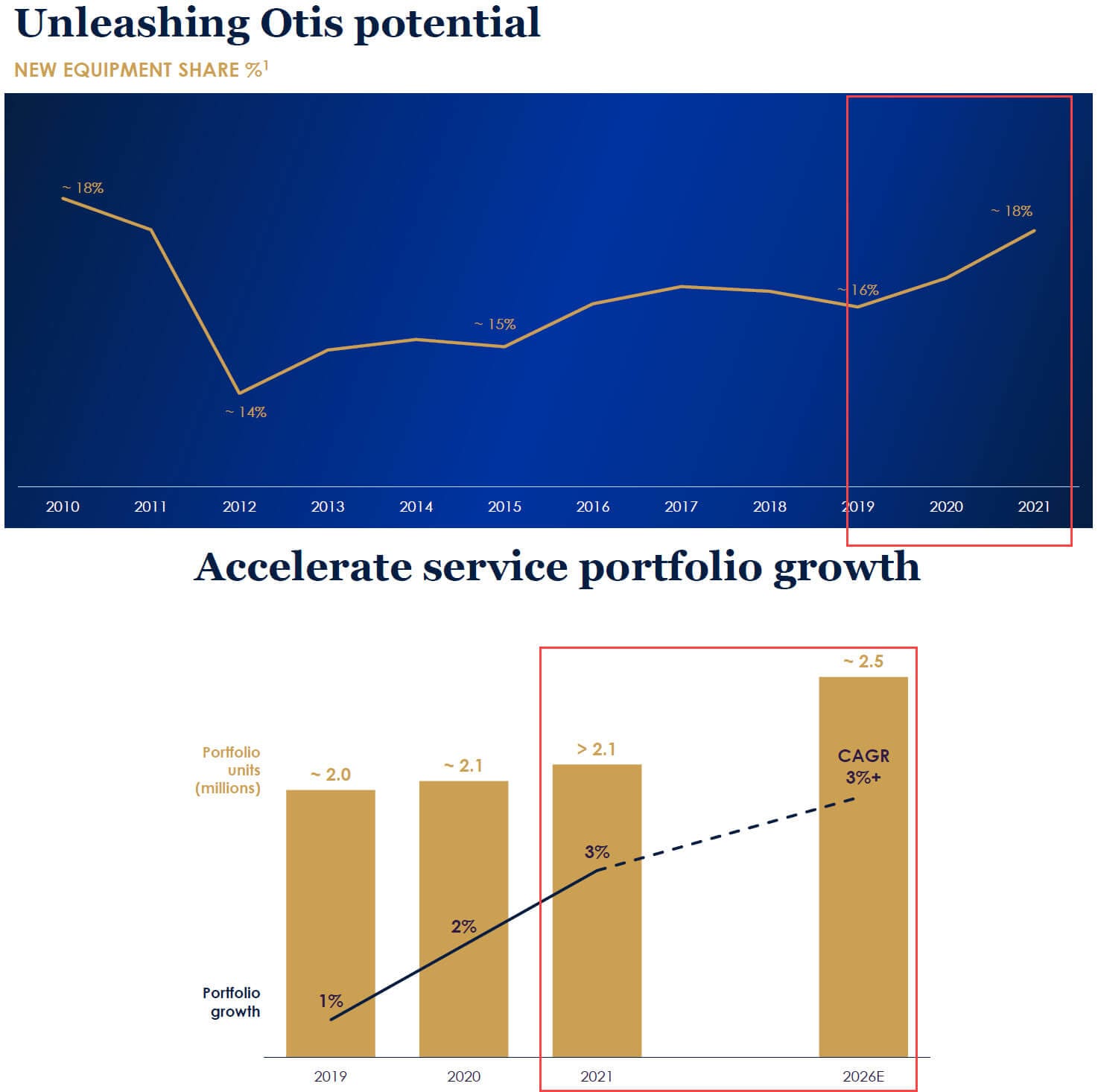

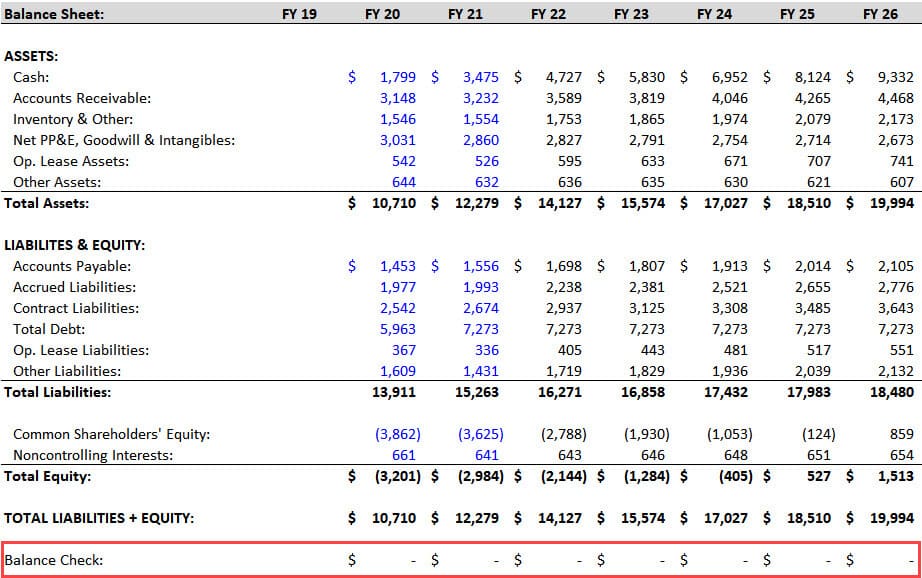

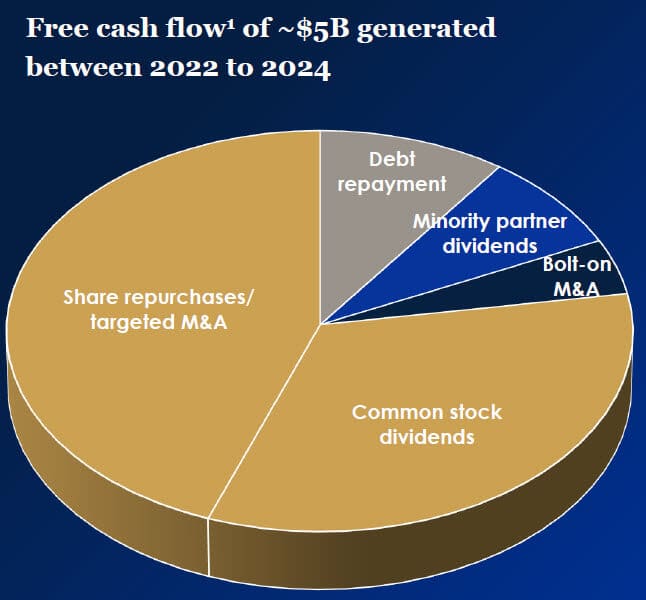

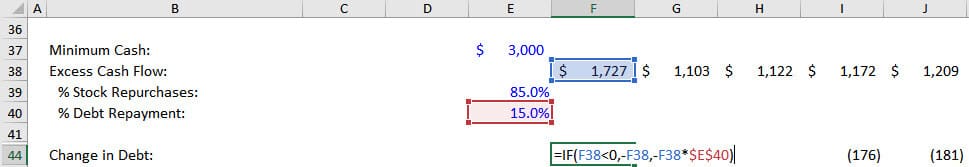

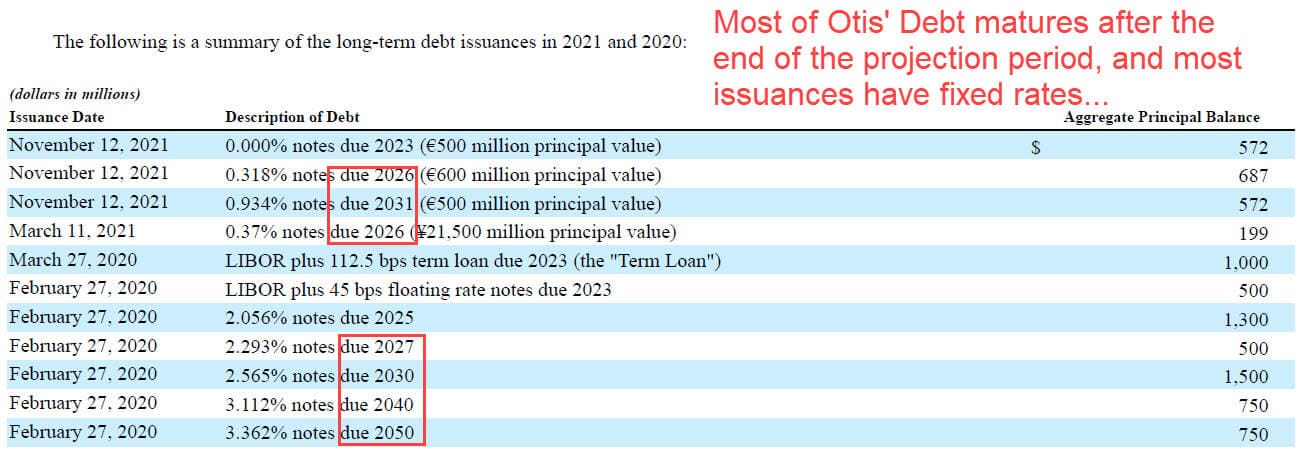

- Otis – Investor Presentation (PDF)