- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Assignment of Accounts Receivable: Meaning, Considerations

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Jiaqi Zhou

What Is Assignment of Accounts Receivable?

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

The borrower pays interest, a service charge on the loan, and the assigned receivables serve as collateral. If the borrower fails to repay the loan, the agreement allows the lender to collect the assigned receivables.

Key Takeaways

- Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables.

- This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

- Usually, new and rapidly growing firms or those that cannot find traditional financing elsewhere will seek this method.

- Accounts receivable are considered to be liquid assets.

- If a borrower doesn't repay their loan, the assignment of accounts agreement protects the lender.

Understanding Assignment of Accounts Receivable

With an assignment of accounts receivable, the borrower retains ownership of the assigned receivables and therefore retains the risk that some accounts receivable will not be repaid. In this case, the lending institution may demand payment directly from the borrower. This arrangement is called an "assignment of accounts receivable with recourse." Assignment of accounts receivable should not be confused with pledging or with accounts receivable financing .

An assignment of accounts receivable has been typically more expensive than other forms of borrowing. Often, companies that use it are unable to obtain less costly options. Sometimes it is used by companies that are growing rapidly or otherwise have too little cash on hand to fund their operations.

New startups in Fintech, like C2FO, are addressing this segment of the supply chain finance by creating marketplaces for account receivables. Liduidx is another Fintech company providing solutions through digitization of this process and connecting funding providers.

Financiers may be willing to structure accounts receivable financing agreements in different ways with various potential provisions.

Special Considerations

Accounts receivable (AR, or simply "receivables") refer to a firm's outstanding balances of invoices billed to customers that haven't been paid yet. Accounts receivables are reported on a company’s balance sheet as an asset, usually a current asset with invoice payments due within one year.

Accounts receivable are considered to be a relatively liquid asset . As such, these funds due are of potential value for lenders and financiers. Some companies may see their accounts receivable as a burden since they are expected to be paid but require collections and cannot be converted to cash immediately. As such, accounts receivable assignment may be attractive to certain firms.

The process of assignment of accounts receivable, along with other forms of financing, is often known as factoring, and the companies that focus on it may be called factoring companies. Factoring companies will usually focus substantially on the business of accounts receivable financing, but factoring, in general, a product of any financier.

:max_bytes(150000):strip_icc():format(webp)/Accounts_Recievable_Financing_Final_3-2-9d907a15511b455f94a1f064a1cc5ae8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Receivables

- Notes Receivable

- Credit Terms

- Cash Discount on Sales

- Accounting for Bad Debts

- Bad Debts Direct Write-off Method

- Bad Debts Allowance Method

- Bad Debts as % of Sales

- Bad Debts as % of Receivables

- Recovery of Bad Debts

- Accounts Receivable Aging

- Assignment of Accounts Receivable

- Factoring of Accounts Receivable

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan, because the assigned receivables serve as collateral for the loan received.

By assignment of accounts receivable, the lender i.e. the financing company has the right to collect the receivables if the borrowing company i.e. actual owner of the receivables, fails to repay the loan in time. The financing company also receives finance charges / interest and service charges.

It is important to note that the receivables are not actually sold under an assignment agreement. If the ownership of the receivables is actually transferred, the agreement would be for sale / factoring of accounts receivable . Usually, the borrowing company would itself collect the assigned receivables and remit the loan amount as per agreement. It is only when the borrower fails to pay as per agreement, that the lender gets a right to collect the assigned receivables on its own.

The assignment of accounts receivable may be general or specific. A general assignment of accounts receivable entitles the lender to proceed to collect any accounts receivable of the borrowing company whereas in case of specific assignment of accounts receivable, the lender is only entitled to collect the accounts receivable specifically assigned to the lender.

The following example shows how to record transactions related to assignment of accounts receivable via journal entries:

On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on note payable to the bank on April 1. $3,000 of the sales were returned by the customers.

Record the necessary journal entries by Company A.

Journal Entries on March 1

Initial fee = 0.01 × 50,000 = 500

Cash received = 50,000 – 500 = 49,500

The accounts receivable don't actually change ownership. But they may be to transferred to another account as shown the following journal entry. The impact on the balance sheet is only related to presentation, so this journal entry may not actually be passed. Usually, the fact that accounts receivable have been assigned, is stated in the notes to the financial statements.

Journal Entries on April 1

Interest expense = 50,000 × 12%/12 = 500

by Irfanullah Jan, ACCA and last modified on Oct 29, 2020

Related Topics

- Sales Returns

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

- Advance Medical Directive Forms

- Affidavit and Declaration Forms

- Arbitration Forms

- Assignment Forms

- Auditor Forms

- Confidentiality Forms

- Court Forms

- Employment Contract Forms

- Energy and Environmental Forms

- Escrow Agreements

- Incorporation and Company Forms

- Independent Contractor Forms

- Intellectual Property Forms

- Landlord and Tenant Notices

- Law Office Management

- Letters of Intent

- Limited Liability Companies

- Marriage and Family Law

- Mergers, Amalgamations and Takeovers

- Partnerships and Joint Ventures

- Personal Guarantees

- Power of Attorney Forms

- Releases and Waivers

- Shareholder Forms

- Software Licensing and Development Forms

- Stock Options and Incentive Plans

- Trust Agreements

- Wills & Estate Planning Forms

- Advertising and Marketing Forms

- Animal Services Forms

- Bids, Tenders and Proposals

- Business and Marketing Plans

- Business Presentations

- Buying or Selling a Business

- Catering Forms

- Cleaning Contracts and Forms

- Construction Industry Forms

- Consulting Contract Forms

- Customer Service Forms

- Distributor and Dealership Agreements

- Equipment Sales and Leasing

- Film and TV Contracts

- Forms for Online Businesses

- Franchise Forms

- Graphic Arts Forms

- Health Services Forms

- Hotel Management Forms

- Information Technology Forms

- Manufacturing Forms

- Music Contracts

- Nanny and Childcare Forms

- Painting Contractor Forms

- Photographer Contracts

- Publishing Business Forms

- Purchasing Forms

- Restaurant Management Forms

- Roofing Contractor Forms

- Sales and Auction Forms

- Security Services

- Service Contracts

- Sports and Fitness Forms

- Starting Up a Small Business

- Storage Contracts and Parking Leases

- Vehicle Sales and Leasing Forms

- Website Development and Hosting

- Workplace Manuals and Policies

- Accounts Receivable & Credit Forms

- Asset Protection and Tax Planning

- Bankruptcy Forms

- Bill of Sale Forms

- Financial Service Contracts

- Insurance Forms

- Investor Forms

- Loan Transaction Forms

- Mortgage Forms

- Promissory Note Forms

- Retirement Planning Information

- Succession Planning

- Commercial Lease Forms

- Condominium and Strata Forms

- Facility Rental Forms

- Farm Land Leases

- Hunting and Fishing Leases

- Mobile Home Forms

- Property Appraisal Forms

- Real Estate Forms

- Rental Property Management Forms

- Residential Lease and Tenancy Forms

- Vacation Property Rental Forms

- Discount Plans

- Subscribers

- UNITED KINGDOM

- UNITED STATES

- NEW ZEALAND

- Civil Actions

- Criminal Cases

- New South Wales

- Northern Territory

- South Australia

- Western Australia

- British Columbia

- New Brunswick

- Newfoundland & Labrador

- Northwest Territories

- Nova Scotia

- Prince Edward Island

- Saskatchewan

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

- District of Columbia

- BRITISH COLUMBIA

- NEW BRUNSWICK

- NEWFOUNDLAND & LABRADOR

- NORTHWEST TERRITORIES

- NOVA SCOTIA

- PRINCE EDWARD ISLAND

- SASKATCHEWAN

- YUKON TERRITORY

- MASSACHUSETTS

- MISSISSIPPI

- NEW HAMPSHIRE

- NORTH CAROLINA

- NORTH DAKOTA

- PENNSYLVANIA

- RHODE ISLAND

- SOUTH CAROLINA

- SOUTH DAKOTA

- WEST VIRGINIA

- Free Celebrity Wills

- Cast and Crew Contracts

- Film Clearance and Release Forms

- Film Distribution and Licensing Forms

- Film Financing and Budget Forms

- Film Production Logs and Forms

- Film Tax Credit Forms

- Rental Contracts for Film and TV

- Script and Screenwriter Forms

- Soundtracks and Scores

- Theater Production Forms

- TV Production Contracts

- Video Production Forms

- Booking Agent & Manager Contracts

- Music Publishing Forms

- Recording Contract Forms

- Songwriter Contracts

- Australian Capital Territory

- Financial /

- Accounts Receivable & Credit Forms /

Assignment of Accounts Receivable Forms

Factor the receivables of a business with this package of Assignment of Accounts Receivable forms which contains two templates:

- Assignment with Recourse . The assignee has recourse to re-transfer back any customer account which is not paid in full within a specified time period, and the assignor will buy them back for the amount of the unpaid balance.

- Assignment Without Recourse . The assignor does not have the option to take back the accounts if they remain unpaid. The right to collect the unpaid accounts remains with the assignee.

An assignment of your accounts receivable is a quick way to increase cash flow during slow periods. These are downloadable forms that you can use again and again.

Accounts Receivable Security Agreement | Canada

Factoring and Security Agreement with Full Recourse | Canada

Factoring and Security Agreement with Limited Recourse | Canada

Broker Agreement for Factoring | USA

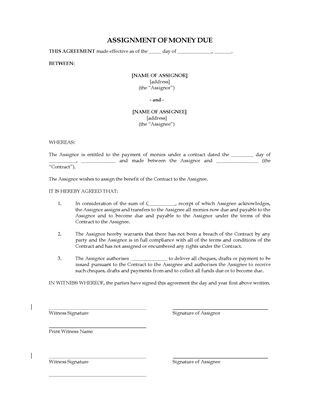

Assignment of Money Due | UK

- Glossary of Common Legal and Business Terms

- Find a Lawyer

- Legal In A Box

- Privacy Policy

- About MegaDox

- Frequently Asked Questions

- Guest Bloggers

- Exchanges and Refunds

- Save Money with a Subscription or Discount Plan

- Testimonials

- Conditions of Use

- Customer info

- Shopping cart

- Calgary, Alberta, Canada

- [email protected]

- 359-889-23-01-90; 359-889-23-01-90

Our Insights

Assignment of Accounts Receivable – Trap for the Unwary

By Steven A. Jacobson

Most businesses are familiar with the mechanics of an assignment of accounts receivable. A party seeking capital assigns its accounts receivable to a financing or factoring company that advances that party a stipulated percentage of the face amount of the receivables.

The factoring company, in turn, sends a notice of assignment of accounts receivable to the party obligated to pay the factoring company’s assignee, i.e. the account debtor. While fairly straightforward, this three-party arrangement has one potential trap for account debtors.

Most account debtors know that once they receive a notice of assignment of accounts receivable, they are obligated to commence payments to the factoring company. Continued payments to the assignee do not relieve the account debtor from its obligation to pay the factoring company.

It is not uncommon for a notice of assignment of accounts receivable to contain seemingly innocuous and boilerplate language along the following lines:

Please make the proper notations on your ledger and acknowledge this letter and that invoices are not subject to any claims or defenses you may have against the assignee.

Typically, the notice of assignment of accounts receivable is directed to an accounting department and is signed, acknowledged and returned to the factoring company without consideration of the waiver of defenses languages.

Even though a party may have a valid defense to payment to its assignee, it still must pay the face amount of the receivable to the factoring company if it has signed a waiver. In many cases, this will result in a party paying twice – once to the factoring company and once to have, for example, shoddy workmanship repaired or defective goods replaced. Despite the harsh result caused by an oftentimes inadvertent waiver agreement, the Uniform Commercial Code validates these provisions with limited exceptions. Accordingly, some procedures should be put in place to require a review of any notice of assignment of accounts receivable to make sure that an account debtor preserves its rights and defenses.

- Announcement

Assignment of Accounts Receivable

The financial accounting term assignment of accounts receivable refers to the process whereby a company borrows cash from a lender, and uses the receivable as collateral on the loan. When accounts receivable is assigned, the terms of the agreement should be noted in the company's financial statements.

Explanation

In the normal course of business, customers are constantly making purchases on credit and remitting payments. Transferring receivables to another party allows companies to reduce the sales to cash revenue cycle time. Also known as pledging, assignment of accounts receivable is one of two ways companies dispose of receivables, the other being factoring.

The assignment process involves an agreement with a lending institution, and the creation of a promissory note that pledges a portion of the company's accounts receivable as collateral on the loan. If the company does not fulfill its obligation under the agreement, the lender has a right to collect the receivables. There are two ways this can be accomplished:

General Assignment : a portion of, or all, receivables owned by the company are pledged as collateral. The only transaction recorded by the company is a credit to cash and a debit to notes payable. If material, the terms of the agreement should also appear in the notes to the company's financial statements.

Specific Assignment : the lender and borrower enter into an agreement that identifies specific accounts to be used as collateral. The two parties will also outline who will attempt to collect the receivable, and whether or not the debtor will be notified.

In the case of specific assignment, if the company and lender agree the lending institution will collect the receivables, the debtor will be instructed to remit payment directly to the lender.

The journal entries for general assignments are fairly straightforward. In the example below, Company A records the receipt of a $100,000 loan collateralized using accounts receivable, and the creation of notes payable for $100,000.

In specific assignments, the entries are more complex since the receivable includes accounts that are explicitly identified. In this case, Company A has pledged $200,000 of accounts in exchange for a loan of $100,000.

Related Terms

Contributors

Moneyzine Editor

- Join us on LinkedIn

- Follow us on Twitter

Notice of Assignment of Accounts Receivable Under the PPSA: What Every Factor Should Know

- Share on LinkedIn

- Share on Twitter

- Share on Facebook

INTRODUCTION

Factoring is the legal relationship between a financial institution (the “Factor”) and a business (the “Client”) selling goods or providing services to a trade customer (the “Customer”), pursuant to which the Factor purchases the accounts receivable owing to the Client by its Customer. The Courts in Ontario have determined that a factoring agreement creates a security interest and, as such, is subject to the provisions of the Ontario Personal Property Security Act R.S.O. 1990 c.P.10 (the “PPSA”). This means, among other things, that the Factor must register a financing statement against the Client under the PPSA claiming a security interest in the Client’s accounts receivable. A factoring agreement may be on a notification or a non-notification basis.

A factoring agreement on a notification basis requires that the Client’s Customer be notified regarding the purchase of the accounts receivable by the Factor and the assignment of the accounts receivable by the Client to the Factor. One purpose of notifying the Customer is to require the Customer to make payment on the accounts receivable directly to the Factor, instead of to the Client.

A notice of assignment is governed by Section 40(2) of the PPSA, which states that an account debtor (i.e., the Customer) may pay the assignor (i.e., the Client) until the Customer receives notice, reasonably identifying the relevant rights, that the accounts receivable have been assigned. If requested by the Customer, the Factor is required, within a reasonable period of time, to furnish proof of the assignment and, if the Factor fails to do so, the Customer may pay the Client.

What constitutes adequate notice of an assignment of accounts receivable? The PPSA does not set out a statutory form of notice of assignment. In RPG Receivables Purchase Group Inc. v. Krones Machinery Co. Limited , 2010 ONSC 2372, C. W. Hourigan J. of the Ontario Superior Court of Justice was required to review a notification of assignment and to determine whether it was adequate. The Court’s decision is an important guide to the essential elements that should be included in the notice of assignment.

The facts were as follows:

1. On July 14, 2005, RPG Receivables Purchase Group Inc. (“RPG”) entered into a factoring agreement with its client Kennedy Automation Limited (“Kennedy”), pursuant to which RPG agreed to purchase certain of Kennedy’s accounts receivable, including accounts receivable due from its customer Krones Machinery Co. Limited (“Krones”).

2. On July 14, 2005, Kennedy faxed a notification of assignment to Krones, which read as follows:

“NOTIFICATION OF ASSIGNMENT

In order to grow and serve you better, we have retained the services of RPG Receivables Purchase Group Inc. to accelerate and stabilize our cash flow. Through their accounts receivable program, RPG has purchased and we have assigned to them all of our right, title and interest in all currently outstanding as well as all future accounts receivable from your company.

We request that all payments be made payable and mailed directly to:

RPG Receivables Purchase Group Inc. (“RPG”)

Suite 300, 221 Lakeshore Road East

Oakville, ON L6J 1H7

Tel (905) 338-8777 (800) 837-0265

Fax (905) 842-0242

This notice of assignment and payment instructions will remain in full force and effect until RPG advises you otherwise in writing. Please note that their receipt of payment is the only valid discharge of the debt and that RPG’s interest has been registered under the Personal Property Security Act of the Province of Ontario.

Although this notification is effective upon receipt by you, in order to complete RPG’s records, we would appreciate your acknowledgement of this notification and your confirmation that:

- the invoices on the attached statement are for goods and/ or services completed to your satisfaction (please note any exceptions or simply provide a listing from your accounts payable); and

- that payments will be scheduled in accordance with the invoice terms and that your accounts payable records have been modified to ensure payment of the full invoice amounts directly to RPG or you will notify RPG of any disputes or potential chargebacks in a timely manner.

Please fax and mail the signed copy of this letter to RPG Receivables Purchase Group Inc., who shall be entitled to rely upon your notification and confirmation as a separate agreement made between you and them. Thanks for your help and cooperation. We look forward to serving you in the future.”

3. On August 5, 2006, Krones executed the notification of assignment and returned the executed copy to RPG.

4. In 2007, Kennedy entered into agreements with Krones for the supply of services and materials to Krones in relation to various projects including projects in Etobicoke, Edmonton, and Moncton.

5. Before Kennedy submitted its invoices to Krones, Kennedy provided the invoices to RPG and RPG stamped each invoice as follows:

“NOTICE OF ASSIGNMENT All payments hereunder have been assigned and are to be made directly to:

RPG RECEIVABLES PURCHASE GROUP INC.

221 Lakeshore Road East, Suite 300

Any offsets or claims should be reported to:

(905) 338-8777 Ontario

(800) 837-0265

Fax (905) 842-0242”

6. Krones paid 13 of the 16 invoices issued by Kennedy. RPG did not receive any notice from Krones regarding any disputes, off-sets, chargebacks or claims arising out of the Edmonton or Etobicoke projects.

7. At or about the time that the three unpaid invoices were rendered, Kennedy began to experience difficulty in paying its subcontractors on the Moncton project.

8. When the Moncton project ran into difficulty, Krones stopped making payments on the Edmonton and Etobicoke invoices in a timely fashion.

9. RPG commenced an action against Krones in respect of the unpaid invoices for the Moncton project that RPG had factored.

10. Krones also commenced an action for damages against Kennedy relating to the Moncton project.

11. Krones denied liability in respect of the unpaid invoices on the grounds that it had a right to set- off due to alleged overpayments, chargebacks, and damages relating to the Moncton project. It also raised issues with respect to the validity of the assignment of the invoices by Kennedy to RPG and the validity of the invoices.

12. The Court decided in favour of RPG and granted it summary judgment in the amount of $183,172.61, plus interest, for payment of the three outstanding invoices.

THE DEFENCE OF SET-OFF

The primary defence of Krones was that it had a valid defence of set- off. In reviewing this defence, the Court referred to the legal principle of “mutuality”. In order to establish a valid claim of legal set-off, there must be mutuality which requires that the debts be between the same parties and that the debts be in the same right. The Court stated that this mutuality is lost where the debt has been assigned to another party (i.e., the Factor), unless the rights to set-off have accrued between the debtor (i.e., the Customer) and the original creditor (i.e., the Client) prior to receipt of the notice of assignment by the debtor. At the time that the accounts receivable owing by Krones to Kennedy were assigned to RPG, no right of set- off had accrued in respect of the alleged overpayments, chargebacks, and damages relating to the Moncton property. Therefore, Krones had no legal right to set-off, because the mutuality required for this defence was lost when the accounts receivable were assigned by Kennedy to RPG.

The Court also reviewed the purchase order for the Moncton project to see whether it contained a contractual right of set-off. The Court rejected this claim by Krones and found that there was no contractual right of set-off.

Finally, the Court considered the issue of equitable set-off and concluded that it was not available to Krones.

OTHER DEFENCES

In its other defences, Krones took issue with the validity of the invoices and the validity of the assignment by Kennedy to RPG. Krones argued that the notification of the assignment was limited to the invoice attached to the notification of assignment. The Court rejected this argument for three reasons:

1. This argument ignored the clear statement in the notice of assignment that “RPG has purchased and we have assigned to them all of our right, title and interest in all currently outstanding as well all future accounts receivable from your company”.

2. Each of the disputed invoices contained a stamped notification of assignment; and

3. Krones paid RPG directly for 13 of the 16 invoices. The Court also rejected a number of other arguments raised by Krones in its defence relating to the validity of the invoices.

CONCLUSIONS

In a notification factoring arrangement, a Factor needs to protect its interest in the purchased accounts receivable by giving written notice of the assignment to the Client’s Customer. According to Section 40(2) of the PPSA, the Customer may continue to pay the Client until the Customer receives notice that the accounts receivable have been assigned to the Factor. However, the PPSA does not set out a statutory form of notice, nor does the PPSA deal with any right of set- off that the Customer may claim with respect to the purchased accounts receivable. In general, a Factor can only “step into the shoes” of his Client and assert the same right that his Client has against the Customer. This means that, if the Customer has any right to claim a set-off against the accounts receivable owing to the Client, then the Factor is required to accept the reduction in payment as a result of any legitimate claim asserted by the Customer.

In order to protect its interest in the purchased accounts receivable, the Factor should send a notice of assignment, which when signed by the Customer, should accomplish the following purposes:

1. it should require the Customer to make payment on the purchased invoices directly to the Factor, instead of to the Client;

2. it should request the Customer to verify the accuracy of the purchased invoices;

3. it should eliminate the Customer’s right to claim any set-off or reduction in the amount payable on the accounts receivable in respect of the Client’s obligations arising after the delivery of the notice; and

4. It should create an enforceable direct contract between the Factor and the Customer.

Since the notification of assignment in the RPG case has been given the “judicial seal of approval”, it is recommended that this form be used by a Factor in Ontario. It is also recommended that the Factor follow the procedure referred to in the RPG case pursuant to which the Customer is requested to acknowledge and confirm the terms of the notification of assignment and return a signed copy to the Factor.

The Court in RPG also referred to the “stamped notification of assignment” on each of the disputed invoices as one of the reasons for rejecting the Customer’s defences. For this reason, it is recommended that this form of stamp also be used by a Factor in Ontario on each factored invoice before the invoice is submitted to the Customer.

If a Factor follows the above procedures, then the Factor should be able to collect from the Customer on the invoice, regardless of what issues arise between the Client and the Customer subsequent to the delivery of the notice of assignment. If the Customer refuses to acknowledge and sign the notice of assignment, then the Factor will have limited recourse against the Customer and will have to make a business decision regarding the risk involved in funding the invoice. Even if the Customer acknowledges and signs the notice of assignment, the Factor will still have to be on the alert for any future disputes between the Client and the Customer. For example, the form of notification used in the RPG case requires the Customer to notify the Factor of “any disputes or potential chargebacks” and the stamp on the invoices in this case requires the Customer to report “any offsets or claims”. If the Customer notifies the Factor about any such disputes, chargebacks, offsets, or claims, then the Factor will also have to evaluate the funding of the invoice.

A properly drafted notice of assignment will put the Factor in a stronger position to resist any reduction in payment claimed by the Customer. As a practical matter, however, the Factor should also try to confirm with the Customer prior to funding an invoice that there are no disputes between the Customer and the Client. This extra step could avoid the time and expense of litigation over the purchased accounts receivable.

Jeffrey Alpert

- T. 416 777 5418

- E. [email protected]

Banking & Financial Services

Publications, termination clauses and fixed term contracts: significant court decisions.

Torkin Manes LegalPoint

The CRA’s “How to Guide” for Charities Making Grants to Non-Qualified Donees

The government of canada enacts the fighting against forced labour and child labour in supply chains act ; now what, bc tribunal confirms companies remain liable for ai chatbot-created information, british columbia legislation targeting revenge porn comes into effect, supreme court of canada rules that ford government mandate letters are exempt from disclosure.

Table of Contents

Assignment of accounts receivable form.

Assignment Of Accounts Receivable Form , Accounts receivable forms are an important tool for businesses and organizations to keep track of their receivables. An assignment of accounts receivable form is a document used by businesses to transfer the rights to collect money owed on an invoice from one party to another. This ensures that the debt is paid in a timely manner, allowing the business or organization to maintain consistent cash flow.

Accounts Receivable Assignment Form – The Easy Way To Get Paid

If you’re a business owner, you know how important it is to get paid for the services you provide. One of the best ways to ensure payment is to use an Assignment Of Accounts Receivable Form. This document assigns responsibility for collecting payment to a third-party, making it easy for businesses to get paid on time and avoid debt collection headaches. In this blog post, we’ll discuss the benefits of using an Assignment Of Accounts Receivable Form and how it can help you get paid quickly and efficiently.

What Is An Accounts Receivable Assignment Form?

An Assignment Of Accounts Receivable Form is a legal document that allows businesses to assign rights to collect payments owed by customers to a third party. This is usually done when the business is unable to collect the money itself or if it wishes to outsource the collection process. The Assignment Of Accounts Receivable Form is an important tool for businesses looking to get paid quickly and efficiently.

In essence, the form assigns the rights of the accounts receivable from the business to the third-party collection agency. This means that the collection agency will be responsible for contacting the customer and collecting the payment owed. This can help streamline the collection process and ensure that payments are made in a timely manner.

The Assignment Of Accounts Receivable Form should include details about the customer and the payment due. It should also specify the agreement between the business and the third-party collection agency. The form should also include details about fees and any other terms associated with the arrangement.

Overall, an Assignment Of Accounts Receivable Form is a great way for businesses to make sure they get paid on time. It can also help streamline the collection process and provide peace of mind that payments will be collected in a timely manner.

Why Use An Accounts Receivable Assignment Form?

Assignment of accounts receivable forms are an invaluable tool when it comes to managing business finances. With an assignment of accounts receivable form, you can easily assign debts owed to you by customers to a third-party collector. This can help you get paid faster and more efficiently than if you were trying to collect the debt yourself.

An accounts receivable assignment form is easy to fill out and requires minimal effort from both parties. All it requires is for the original creditor (you) to provide basic information about the customer and the outstanding balance, and for the third-party collector to provide their information and agree to the terms of the assignment. The process is quick and straightforward, making it much easier to get paid what is owed to you.

By using an accounts receivable assignment form, you can ensure that your rights as a creditor are protected and that the third-party collector will abide by all laws and regulations pertaining to collection of debts. You can also save time and money by not having to chase down payments yourself.

In short, an accounts receivable assignment form can be a great way to make sure you are getting paid what is owed to you in a timely manner. If you’re looking for an easy and reliable way to collect your debt, then an assignment of accounts receivable form may be the perfect solution.

How To Use An Accounts Receivable Assignment Form

When it comes to getting paid, an Assignment of Accounts Receivable Form is one of the most important documents you can use. This form allows you to assign your accounts receivable to another party, ensuring that you are paid in a timely and secure manner.

An Assignment of Accounts Receivable Form is easy to fill out and can be done quickly. All you need to do is provide the necessary information about yourself, the other party involved in the assignment, and the details about the accounts receivable being assigned. After everything is filled out, you will then sign the document to make it legally binding.

Once your Assignment of Accounts Receivable Form is signed and submitted, it will be forwarded to the other party, who will then pay the debt that is owed to you. You will then receive a payment from the other party for the full amount of the debt. This makes it a great way to ensure that you get paid for any services or products that you have provided.

Using an Assignment of Accounts Receivable Form is an easy and secure way to ensure that you get paid on time. It is important to make sure that you read through the document thoroughly before signing and submitting it. This will help to make sure that everything is clear and that you are aware of any fees or restrictions associated with the assignment. If you have any questions, it is always a good idea to consult a lawyer before signing and submitting the form.

Benefits Of Using An Accounts Receivable Assignment Form

Assigning Accounts Receivable (AR) is a great way to ensure you get paid quickly and easily. An Assignment Of Accounts Receivable Form is a simple document that assigns your receivables to a third-party finance company or individual, making sure that you get paid in full. Using this form has many advantages, including improved cash flow, faster payment processing, and better risk management.

First, using an Assignment Of Accounts Receivable Form can help improve your cash flow. When you assign receivables to a third-party, they are responsible for collecting payments from customers. This frees up time and resources that you would have spent collecting payments yourself, allowing you to focus on more important aspects of your business. Additionally, the payment process is typically much faster when you use an assignment form, meaning you get paid quicker.

Second, using an Assignment Of Accounts Receivable Form helps reduce the risk of bad debt. Assigning your receivables to a third-party removes the risk of nonpayment from your shoulders and transfers it to the finance company or individual. This gives you peace of mind knowing that you will be paid, even if customers do not make payments on time.

Finally, using an Assignment Of Accounts Receivable Form simplifies the payment process for both you and your customers. Instead of dealing with multiple payment methods, customers can make one payment to the third-party who will then disburse it according to the assignment form. This saves time and reduces confusion for both parties involved.

Using an Assignment Of Accounts Receivable Form is a great way to ensure that you get paid quickly and efficiently. It also reduces the risk of bad debt and simplifies the payment process for both you and your customers. By using this form, you can improve your cash flow and protect yourself from the risks associated with Accounts Receivable .

Who is responsible for assigning accounts receivable?

Assignments of accounts receivable are the responsibility of the credit manager. However, if you’re buying or selling insurance policies, your salesperson may be assigned accounts receivable.

How should I document my assignment of accounts receivable?

Assignments of Accounts Receivable (AOR) are important documents that help you fully understand the accounts assigned to you. These documents should be in an easy-to-read format, contain detailed work instructions, and have all items listed on the account.

What are the consequences of failing to assign accounts receivable?

Although it’s not always apparent, failing to assign accounts receivable can have serious consequences on your company. Failing to properly assign accounts receivable can result in unpaid bills and damaged relationships with clients that may affect your overall business results.

IMAGES

VIDEO

COMMENTS

Make sure to research the market rate for delinquent accounts receivable (e.g. $0.50 per $1.00). 1. Assignment. The Assignee agrees to pay to the Assignor on this day the sum of $[x]. In return, the Assignor assigns all right, title, and interest in and to this Account Receivable to the Assignee for collection.

b. This Assignment is exclusive and made solely to the Assignee. None of the accounts receivable listed in Section 2 has been sold or assigned to any other party. c. The accounts stated in Section 2 of this Assignment are valid and fully collectible from the purchasers. d.

Download the Template. This Assignment of Accounts Receivable with Recourse Template can be used to quickly remove valuable receivables from the operating entity. Cash paid to the operating entity for the receivables is then quickly withdrawn as payments to the owner (or the holding entity) as salary, rents, loan payments, etc. Warning.

Assigning accounts receivable is a fairly straightforward business financing option where a company receives a loan using its outstanding invoices as collateral. It is a form of asset-based financing. In general assignment, the company uses all accounts receivable as collateral. In specific assignment, the borrower only puts up select invoices ...

Assignment of accounts receivable is a lending agreement, often long term , between a borrowing company and a lending institution whereby the borrower assigns specific customer accounts that owe ...

Under an assignment of arrangement, a pays a in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the , the lender has the right to collect the assigned receivables. The receivables are not actually sold to the lender, which means that the borrower retains the of not collecting ...

Example. On March 1, 20X6, Company A borrowed $50,000 from a bank and signed a 12% one month note payable. The bank charged 1% initial fee. Company A assigned $73,000 of its accounts receivable to the bank as a security. During March 20X6, the company collected $70,000 of the assigned accounts receivable and paid the principle and interest on ...

The assignor does not have the option to take back the accounts if they remain unpaid. The right to collect the unpaid accounts remains with the assignee. An assignment of your accounts receivable is a quick way to increase cash flow during slow periods. These are downloadable forms that you can use again and again. Download Type: Microsoft Word.

Description Accounts Form. This form is an Assignment of Accounts Receivable. The assignor conveys all interest in the accounts listed on the Attachment included in the form. The accounts represent all outstanding accounts of the assignor from the sale of products or services.

Description. This form is an Assignment of Accounts Receivable. The assignor conveys all interest in the accounts listed on the Attachment included in the form. The accounts represent all outstanding accounts of the assignor from the sale of products or services. Georgia Accounts Receivable — Assignment refers to the process of transferring ...

4. Put the My Signature field where you need to approve your sample. Type your name, draw, or upload a picture of your handwritten signature. 5. Click Save and Close to finish modifying your completed form. Once your assignment of accounts receivable form template is ready, download it to your device, export it to the cloud, or invite other ...

A party seeking capital assigns its accounts receivable to a financing or factoring company that advances that party a stipulated percentage of the face amount of the receivables. The factoring company, in turn, sends a notice of assignment of accounts receivable to the party obligated to pay the factoring company's assignee, i.e. the account ...

Definition. The financial accounting term assignment of accounts receivable refers to the process whereby a company borrows cash from a lender, and uses the receivable as collateral on the loan. When accounts receivable is assigned, the terms of the agreement should be noted in the company's financial statements.

A notice of assignment is governed by Section 40 (2) of the PPSA, which states that an account debtor (i.e., the Customer) may pay the assignor (i.e., the Client) until the Customer receives notice, reasonably identifying the relevant rights, that the accounts receivable have been assigned. If requested by the Customer, the Factor is required ...

This form is an Assignment of Accounts Receivable. The assignor conveys all interest in the accounts listed on the Attachment included in the form. The accounts represent all outstanding accounts of the assignor from the sale of products or services.

3.Acceptance and Assumption by Assignee.Assignee hereby accepts the assignment, transfer and conveyance of the Accounts Receivable. Assignee agrees to perform all of the obligations, liabilities, covenants, duties and agreements of Assignor with respect to the Accounts Receivable to the extent arising and accruing from and after the Effective Date and to assume all liabilities with respect to ...

This Deed of Assignment is made pursuant to and subject to all the warranties, representations, covenants and stipulations contained in the Memorandum of Agreement dated ___________ between the Assignor and the Assignee ("MOA"). All terms and conditions of the MOA relative to the Account Receivables assigned shall prevail in case of any ...

Filling out the accounts receivable assignment form with airSlate SignNow will give better confidence that the output template will be legally binding and safeguarded. Quick guide on how to complete accounts receivable assignment. Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents ...

Description. This form is an Assignment of Accounts Receivable. The assignor conveys all interest in the accounts listed on the Attachment included in the form. The accounts represent all outstanding accounts of the assignor from the sale of products or services. Florida Accounts Receivable — Assignment refers to the legal process by which ...

An assignment of accounts receivable form is a document used by businesses to transfer the rights to collect money owed on an invoice from one party to another. This ensures that the debt is paid in a timely manner, allowing the business or organization to maintain consistent cash flow. Topic. Deadline.

There are various types of Louisiana Accounts Receivable — Assignment, depending on the specific needs and requirements of businesses. Some common types include: 1. Factoring: Factoring is a widely used form of accounts receivable assignment in which a business sells its accounts receivable to a factoring company at a discount.

8. Notarization: Depending on local regulations, you may need to have the assignment of accounts receivable notarized. If required, make sure to have a notary public present before signing the document. 9. Copies: Make copies of the assignment of accounts receivable for both the assignor and assignee to retain for their records.

This form is a factoring agreement for the assignment of accounts receivable. Factoring is a financial transaction in which a firm sells its accounts receivable invoices to a third party called a factoring firm at a discount, so that it receives immediate money to continue its business. The factoring firm pays a percentage of the invoices ...