9 inspiring case studies of Customer Lifetime Value (CLV)

- Marketing: How much should I spend to acquire a customer?

- Product: How can I offer products and services tailored for my best customers?

- Customer Support: How much should I spend to service and retain a customer?

- Sales: What types of customers should sales reps spend the most time on trying to acquire?

- Design: What type of graphic designs are required to attract customers? Which tool is used to design logos, Color palettes, and Icons?

To calculate Customer Lifetime Value, here is how to do it. If you want examples of brands that are making the most of it, here are 9 inspiring case studies of Customer Lifetime Value (CLV).

- AMAZON : Consumer Intelligence Research Partners estimates that Amazon Kindle owners spend approximately $1,233 per year buying stuff from Amazon, compared to $790 per year for other customers. So Amazon pays close attention to Customer Lifetime Value (CLV). Amazon Prime has been developed to enable Amazon to efficiently compete on price and to increase customer lifetime value. According to a 2013 study by the Consumer Intelligence Research Partners, Amazon Prime members spend $1,340 annually. And that was 3 year ago. It’s more now. By applying Customer Lifestyle Value (CLV) to the development of Amazon Prime, Amazon knows how to get the most out of their most profitable customer segments.

- BONOBOS : Is a leading e-commerce driven men’s apparel brand focused on delivering great fit, a fun approach to style, and superb customer experience . Bonobos has always been a data-driven, customer-focused retailer. With Guideshops, Bonobos has service-oriented e-commerce stores that enable men to try on Bonobos clothing in person before ordering online. Bonobos discovers that Guideshops bring in customers with the highest lifetime value across all of its marketing channels. Insights into which channels are attracting Bonobos’ highest-value shoppers has helped Bonobos increase the predicted lifetime value of its new customers by 20% .

- CROCS : has always had a data-driven, customer-centric approach to marketing. When the marketing team is given a mandate to transform Crocs’ online business by becoming less reliant on promotions and discounts, the team is excited by the opportunity to improve Crocs’ profitability. The team tests to optimize promotions aimed at customers who are predicted to churn, and expands programs to coordinate a “no discount” experience across site, email and display for customers with the lowest price sensitivity. Crocs realizes 10X and 2X lift in revenue.

- HEAR AND PLAY MUSIC : A provider of music lesson products, uses automated lead nurturing and scoring to turn prospects into customers and repeat customers. Many of the company’s products cost less than $100. With automated messages that have a personalized tone to high value prospect, the company has seen: 1) 416% increase in Customer Lifetime Value, 2) 67% increase in click through rate from the best prospects (increased from 24.73% to 41.28% for subscribers with the highest lead scores) and 3) 18.4% improvement in lead-to-purchase time.

- KIMBERLY-CLARK : According to Nielsen, the typical family spends over $1,000 on diapers and baby wipes during the two-and-a-half years their children are in diapers. A Nielsen study was able to quantify the dollar value of key consumer segments, the critical nature of brand selection at various points in the consumer lifecycle and distinct differences in channel choices through key points in the baby care lifecycle. Kimberly-Clark has a clearer picture of its target market and where its greatest marketing and promotional opportunities exist to extend and expand their market share. “Nielsen’s lifetime.

- NETFLIX : An average Netflix subscriber stays on board for 25 months. According to Netflix, the lifetime value of a Netflix customer is $291.25. Netflix knows that customers are impatient and some customers cancel because they don’t like waiting for movies to arrive in the mail. Due to this they’ve added a feature where you can stream movies on the web, which not only satisfies your movie urge, but it keeps you busy while you are waiting. By tracking these stats and behavior, Netflix has reduced their churn to 4%.

- STARBUCKS : One of the most effective ways to boost Customer Lifetime Value (CLV) is to increase customer satisfaction. Bain & Co has found a 5% increase in customer satisfaction can increase by 25% to 95%. The same study shows it costs 6 to 7 times more to acquire a new customer than keep an existing one. Starbucks’ customer satisfaction has been reported as high as 89%. Due to high customer satisfaction, Starbucks’ Customer Lifetime Value has been calculated at $14,099.

- U.S. AUTO PARTS : Realizes the competitive advantage of loyalty and decided to invest. The company debuted the Auto Parts Warehouse loyalty program, known as APW Rewards. U.S. Auto Parts began to leverage capabilities such as increased rewards for high-margin products, personalized post-purchase enrollment offers, a status tier, and triggered email campaigns based off of a person’s repurchase history to maximize customer lifetime value. U.S. Auto parts increased its spend per member by 20%, its repurchase rate by 14%, and its enrollment rate by 45% after updating the loyalty program of its flagship brand,

- ZAPPOS : Has found people who regularly return items can be some of your best customers. It says that clients buying its most expensive shoes have a 50% return rate. Placing a priority on Customer Lifetime Value, Zappos has identified their best customers have the highest returns rates. They are also the ones that spend the most money and their most profitable customers. That’s why Zappos has a 365-day returns policy, free two-way shipping and doesn’t charge for returns.

Do the way these companies pay attention to Customer Lifetime Value inspire you with ideas for your company. Do you want to learn more about making the most of out of CLV.

Rob Petersen

Related posts.

10 best customer loyalty metrics and how experts measure them

6 straightforward steps to calculate Customer Lifetime Value

12 big business benefits of customer lifetime value, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Free Resources

5 mini case studies about understanding and serving the customer

This article was originally published in the MarketingSherpa email newsletter .

Mini Case Study #1: 34% increase in conversion for powdered health drink company by helping customers come to their own conclusions

A single-product company that sells high-quality, all-natural, powdered health drinks engaged MECLABS Institute to help better understand their potential customers and increase the conversion rate of prospects reaching the homepage.

The original homepage took a claims-driven approach – it provided several bold statements about what the product would do for a customer with no information about the product to help the customer understand why it would work for them. Here is a look at the upper left of the original homepage.

Creative Sample #1: Upper left of original homepage for health drink company

The MECLABS team created a version of the homepage that took a conclusion-driven approach – instead only trying to convince potential customers with only bold claims about the product, the homepage copy included information about the product to help customers understand why the product would help them.

Creative Sample #2: Upper left of treatment homepage for health drink company

The team tested this version as the treatment against the original homepage (the control) to help better understand what communication style customers would respond to.

The treatment generated a 34% increase in conversion rate.

This experiment highlights a classic disconnect between customers and marketers. If you work in a company or with a client, you have intimate knowledge of the product and believe in its effectiveness. You spend all day thinking about it. You personally know some of the people who designed it. Your paycheck depends on the success of the product.

A customer does not have this same understanding or belief in the product. They have a significant gap in their knowledge about your product. Bold claims alone are not enough to close that gap. They have to understand why the product will work and come to their own conclusions about the company’s ability to deliver on its promises.

You can learn more about this experiment in The Conversion Heuristic Analysis: Overcoming the prospect’s perception gap from MarketingExperiments (MarketingSherpa’s sister publication).

Mini Case Study #2: Bags company increases conversion 191% by adding clarity to homepage

“I'm the CEO of Doubletake , a tennis and pickleball bag company, but I spent the majority of my career focused on messaging and research, consulting as a strategist for top brands for the last 10 plus years, and in-house prior to that. I'm almost embarrassed that I have this example to share, but I thankfully came to my senses!,” Shawna Gwin Krasts told me.

“It is interesting that crafting messaging/copy for products that aren't ‘your baby’ is so much easier – there is just more distance to see it for what it is. If this wasn't so near and dear to my heart, I would have caught it in a second.”

The team launched its homepage with only the headline “Sports Meets Style” over a photo of a bag. The headline was meant to differentiate the brand from competitors that were either only sporty or fashionable. Below the headline was a call-to-action (CTA) button with the word “shop.”

Creative Sample #3: Previous homepage copy for bag company

Internally it seemed obvious that the company sells tennis and pickleball bags since a bag was in the photo.

But they came to realize that it might not be as clear to website visitors. So the team added the subhead “Gorgeous Yet Functional Tennis and Pickleball Bags.” They also added the word “bags” to the CTA so it read “shop bags.”

Creative Sample #4: New homepage copy for bag company

These simple changes increased the website's conversion rate by 191%.

“It is so important for marketers to get out of their own heads,” Krasts said. “I suppose this is why I struggle with messaging so much for Doubletake. I am the target customer – I have the answers in my head and I suppose my natural curiosity isn't as strong. But clearly, I also have to remember that I've seen my homepage 10,000 more times than my customers, which means things that seem obvious to me, like the fact that Doubletake is a tennis brand not a reseller, might not be obvious.”

Mini Case Study #3: Online motorcycle gear retailer doubles conversion with personalized emails

There are ways to better tap into what customers perceive as valuable built into certain marketing channels. Email marketing is a great example. Marketers can build off information they have on the customer to send more relevant emails with information and products the customer is more likely to value.

"Very early in my marketing career I was taught, 'You are not the target audience' and told to try to see things from my customer's perspective. Empathizing with customers is a good start towards seeing products from the customers' perspective, but marketers really need to focus on quantifiable actions that can help identify customers' needs. That means continuous testing across messaging, price points, packaging, and every other aspect of a product. This is where personalization can really shine. Every time a marketer personalizes a message, it brings them closer to their customer and closes that gap," said Gretchen Scheiman, VP of Marketing, Sailthru.

For example, 80% of the email messages RevZilla sent were generic. But the website sells motorcycle parts and gear to a wide range of riders, each with their own preference in brand and riding style. The online motorcycle gear retailer partnered with Sailthru to better connect with customer motivations. The team started by upgrading the welcome series for new customers by personalizing the email messages based on the customers’ purchases and preferences.

The company has tested and added many new triggers to the site, and now has 177 different automation journeys that include triggers for browse and cart abandonment as well as automations for different product preferences, riding styles and manufacturer preferences.

The conversion rate from personalized email is double what RevZilla was getting for generic batch-and-blast sends. Automated experiences now account for 40% of email revenue. Triggered revenue is up 22% year-over-year and site traffic from triggers has increased 128% year-over-year.

"Customizing the buyer journey isn't about one long flow, but about lots of little trigger points and tests along the way. For any marketer that is intimidated about getting started with personalization, it's important to realize that it's more like a lot of small building blocks that create a whole experience. We started with a custom welcome series using testing and built from there. We're still adding new tests and new trigger points, but it's with the same concept that we started with,” said Andrew Lim, Director of Retention Marketing, RevZilla.

Mini Case Study #4: Pet protection network increases revenue 53% thanks to survey feedback

Huan makes smart tags for pets to help owners find their pets if they go missing. Initially, the company focused on the technical features in its homepage copy. For example, the tags don’t emit harmful radiation, are water-resistant and have a replaceable one-year battery.

From customer feedback surveys, the team discovered that customers purchased the product because they were worried they wouldn’t be able to find their pet if the pet went missing. This discovery prompted the team to change its messaging.

The new messaging on the homepage read, “Keep your pet safe and prevent heartbreak. Huan Smart Tags help you find your missing pet automatically.”

Revenue increased 53% increase following the change in messaging. “We immediately saw an increase in engagement on our website, with a lower bounce rate, higher click-through rate and a higher conversion rate. There were also a few people who messaged us on social media saying how our new message resonated with them,” said Gilad Rom, Founder, Huan.

Mini Case Study #5: Talking to new customers leads SaaS to change strategy, increase sales 18%

When Chanty launched, the marketing messages focused on pricing since the Saas company is 50% less expensive than the best-known competitor. However, when the team started talking to customers, they discovered most people had switched from the competitor for different reasons – ease of use, better functionalities in the free plan, better experience with the customer support team, and a better mobile app.

The team changed its marketing to focus around these product attributes and only listed pricing in the end as an additional benefit.

“It turned out that this was the way to go because we attracted people who wanted a better experience, rather than just customers who wanted to save money. After six months of implementing this new marketing and sales strategy, our sales grew by 18%,” said Jane Kovalkova, Chief Marketing Officer, Chanty.

Related resources

The Prospect’s Perception Gap: How to bridge the dangerous gap between the results we want and the results we have

Customer-First Marketing: Understanding customer pain and responding with action

Marketing Research Chart: How customer understanding impacts satisfaction

Improve Your Marketing

Join our thousands of weekly case study readers.

Enter your email below to receive MarketingSherpa news, updates, and promotions:

Note: Already a subscriber? Want to add a subscription? Click Here to Manage Subscriptions

Get Better Business Results With a Skillfully Applied Customer-first Marketing Strategy

The customer-first approach of MarketingSherpa’s agency services can help you build the most effective strategy to serve customers and improve results, and then implement it across every customer touchpoint.

Get headlines, value prop, competitive analysis, and more.

Marketer Vs Machine

Marketer Vs Machine: We need to train the marketer to train the machine.

Free Marketing Course

Become a Marketer-Philosopher: Create and optimize high-converting webpages (with this free online marketing course)

Project and Ideas Pitch Template

A free template to help you win approval for your proposed projects and campaigns

Six Quick CTA checklists

These CTA checklists are specifically designed for your team — something practical to hold up against your CTAs to help the time-pressed marketer quickly consider the customer psychology of your “asks” and how you can improve them.

Infographic: How to Create a Model of Your Customer’s Mind

You need a repeatable methodology focused on building your organization’s customer wisdom throughout your campaigns and websites. This infographic can get you started.

Infographic: 21 Psychological Elements that Power Effective Web Design

To build an effective page from scratch, you need to begin with the psychology of your customer. This infographic can get you started.

Receive the latest case studies and data on email, lead gen, and social media along with MarketingSherpa updates and promotions.

- Your Email Account

- Customer Service Q&A

- Search Library

- Content Directory:

Questions? Contact Customer Service at [email protected]

© 2000-2024 MarketingSherpa LLC, ISSN 1559-5137 Editorial HQ: MarketingSherpa LLC, PO Box 50032, Jacksonville Beach, FL 32240

The views and opinions expressed in the articles of this website are strictly those of the author and do not necessarily reflect in any way the views of MarketingSherpa, its affiliates, or its employees.

The CEO guide to customer experience

What do my customers want? The savviest executives are asking this question more frequently than ever, and rightly so. Leading companies understand that they are in the customer-experience business, and they understand that how an organization delivers for customers is beginning to be as important as what it delivers.

This CEO guide taps the expertise of McKinsey and other experts to explore the fundamentals of customer interaction, as well as the steps necessary to redesign the business in a more customer-centric fashion and to organize it for optimal business outcomes. For a quick look at how to improve the customer experience, see the summary infographic.

Armed with advanced analytics, customer-experience leaders gain rapid insights to build customer loyalty, make employees happier, achieve revenue gains of 5 to 10 percent, and reduce costs by 15 to 25 percent within two or three years. But it takes patience and guts to train an organization to see the world through the customer’s eyes and to redesign functions to create value in a customer-centric way. The management task begins with considering the customer—not the organization—at the center of the exercise.

Customer experience

More insight into creating competitive advantage by putting customers first and managing their journeys.

Observe: Understand the interaction through the customer’s eyes

Technology has handed customers unprecedented power to dictate the rules in purchasing goods and services. Three-quarters of them, research finds, expect “now” service within five minutes of making contact online. A similar share want a simple experience, use comparison apps when they shop, and put as much trust in online reviews as in personal recommendations. Increasingly, customers expect from all players the same kind of immediacy, personalization, and convenience that they receive from leading practitioners such as Google and Amazon.

Central to connecting better with customers is putting in place several building blocks of a comprehensive improvement in customer experience.

Identify and understand the customer’s journey.

It means paying attention to the complete, end-to-end experience customers have with a company from their perspective. Too many companies focus on individual interaction touchpoints devoted to billing, onboarding, service calls, and the like. In contrast, a customer journey spans a progression of touchpoints and has a clearly defined beginning and end.

The advantage of focusing on journeys is twofold.

First, even if employees execute well on individual touchpoint interactions, the overall experience can still disappoint (Exhibit 1). More important, McKinsey research finds that customer journeys are significantly more strongly correlated with business outcomes than are touchpoints. A recent McKinsey survey, 1 1. McKinsey US cross-industry customer-experience survey, June–October 2015 data. for example, indicates customer satisfaction with health insurance is 73 percent more likely when journeys work well than when only touchpoints do. Similarly, customers of hotels that get the journey right may be 61 percent more willing to recommend than customers of hotels that merely focus on touchpoints.

Quantify what matters to your customers.

Customers hold companies to high standards for product quality, service performance, and price. How can companies determine which of these factors are the most critical to the customer segments they serve? Which generate the highest economic value? In most companies, there are a handful of critical customer journeys. Understanding them, customer segment by customer segment, helps a business to maintain focus, have a positive impact on customer satisfaction, and begin the process of redesigning functions around customer needs. Analytical tools and big data sources from operations and finance can help organizations parse the factors driving what customers say satisfies them and also the actual customer behavior that creates economic value. Sometimes initial assumptions are overturned. In one airport case study, customer satisfaction had more to do with the behavior of security personnel than with time spent in line (Exhibit 2). For a full view of the airport’s insightful customer-satisfaction exercise, see “ Developing a customer-experience vision .”

Define a clear customer-experience aspiration and common purpose.

In large, distributed organizations, a distinctive customer experience depends on a collective sense of conviction and purpose to serve the customer’s true needs. This purpose must be made clear to every employee through a simple, crisp statement of intent: a shared vision and aspiration that’s authentic and consistent with a company’s brand-value proposition. The most recognizable example of such a shared vision might be the Common Purpose 2 2. The Common Purpose is the intellectual property of The Walt Disney Company. See Talking Points , “Be our guest. . .again,” blog post by Jeff James, December 22, 2011, on disneyinstitute.com/blog. of the Walt Disney Company: “We create happiness by providing the finest in entertainment for people of all ages, everywhere.” The statement of purpose should then be translated into a set of simple principles or standards to guide behavior all the way down to the front line.

Customer journeys are the framework that allows a company to organize itself and mobilize employees to deliver value to customers consistently, in line with its purpose. The journey construct can help align employees around customer needs, despite functional boundaries. As McKinsey’s Ron Ritter elaborated in a recent video, rallying around customers can bring the organization together.

Shape: Redesign the business from the customer back

Customer-experience leaders start with a differentiating purpose and focus on improving the most important customer journey first—whether it be opening a bank account, returning a pair of shoes, installing cable television, or even updating address and account information. Then they improve the steps that make up that journey. To manage expectations, they design supporting processes with customer psychology in mind. They transform their digital profile to remove pain points in interactions, and to set in motion the culture of continuous innovation needed to make more fundamental organizational transformations.

Apply behavioral psychology to interactions.

Deftly shaping customer perceptions can generate significant additional value. One tool leading customer-experience players deploy is behavioral psychology, used as a layer of the design process. Leading researchers have identified the major factors in customer-journey experiences that drive customer perceptions and satisfaction levels. 3 3. Richard Chase and Sriram Dasu, The Customer Service Solution: Managing Emotions, Trust, and Control to Win Your Customer’s Business , Columbus, OH: McGraw-Hill Education, 2013. For example, savvy companies can design the sequence of interactions with customers to end on a positive note. They can merge different stages of interactions to diminish their perceived duration and engender a feeling of progress. And they can provide simple options that give customers a feeling of control and choice. One pilot study at a consumer-services firm found that improvements in customer-satisfaction scores accrued from “soft” behavioral-psychology initiatives as well as from “hard” improvements in operations (Exhibit 3).

Reinvent customer journeys using digital technologies.

Customers accustomed to the personalization and ease of dealing with digital natives such as Google and Amazon now expect the same kind of service from established players. Research shows that 25 percent of customers will defect after just one bad experience.

Customer-experience leaders can become even better by digitizing the processes behind the most important customer journeys. In these quick efforts, multidisciplinary teams jointly design, test, and iterate high-impact processes and journeys in the field, continually refining and rereleasing them after input from customers. Such methods help high-performing incumbents to release and scale major, customer-vetted process improvements in less than 20 weeks. Agile digital companies significantly outperform their competitors, according to some studies. 4 4. See The 2015 Customer Experience ROI Study , Watermark Consulting, watermarkconsult.net. To achieve those results, established businesses must embrace new ways of working.

Perform: Align the organization to deliver against tangible outcomes

As the customer experience becomes a bigger focus of corporate strategy, more and more executives will face the decision to commit their organizations to a broad customer-experience transformation. The immediate challenge will be how to structure the organization and rollout, as well as figuring out where and how to get started. Applying sophisticated measurement to what your customers are saying, empowering frontline employees to deliver against your customer vision, and a customer-centric governance structure form the foundation. Securing early economic wins will deliver value and momentum for continuous innovation.

Use customer journeys to empower the front line.

Every leading customer-experience company has motivated employees who embody the customer and brand promise in their interactions with consumers, and are empowered to do the right thing. Executives at customer-centered companies engage these employees at every level of the organization, working directly with them in retail settings, taking calls, and getting out into the field. In the early years, for example, Amazon famously staged “all hands on deck” sessions during the year-end holidays, a tradition that lives on in the employee-onboarding experience. 5 5. Brad Stone, The Everything Store: Jeff Bezos and the Age of Amazon , New York, NY: Little, Brown, 2013. Some organizations create boards or panels of customers to provide a formal feedback mechanism .

Establish metrics that capture customer feedback.

The key to satisfying customers is not just to measure what happens but also to use the data to drive action throughout the organization. The type of metric used is less important than the way it is applied . The ideal customer-experience measurement system puts journeys at the center and connects them to other critical elements such as business outcomes and operational improvements. Leading practitioners start at the top, with a metric to measure the customer experience, and then cascade downward into key customer journeys and performance indicators, taking advantage of employee feedback to identify improvement opportunities (Exhibit 4).

Put cross-functional governance in place.

Even for companies that collaborate smoothly, shifting to a customer-centric model that cuts across functions is not an easy task. To move from knowledge to action, companies need proper governance and leadership . Best-in-class organizations have governance structures that include a sponsor—a chief customer officer—and an executive champion for each of their primary cross-functional customer journeys. They also have full-time teams carrying out their day-to-day work in the existing organization. To succeed, the transformation must take place within normal operations. To foster understanding and conviction, leaders at all levels must role-model the behavior they expect from these teams, constantly communicating the changes needed. Formal reinforcement mechanisms and skill-building activities at multiple levels of the organization support the transformation, as well. In a recent video, McKinsey’s Ewan Duncan describes how rewiring a company in this way is typically a two- to four-year journey.

Log early wins to demonstrate value creation.

Too many customer-experience transformations stall because leaders can’t show how these efforts create value. Executives, citing the benefits of improved customer relations, launch bold initiatives to delight customers that end up having clear costs and unclear near-term results. The better way is to build an explicit link to value creation by defining the outcomes that really matter, analyzing historical performance of satisfied and dissatisfied customers, and focusing on customer satisfaction issues with the highest payouts. This requires discipline and patience, but the result will be early wins that will build confidence within the organization and momentum to innovate further.

Delighting customers by mastering the concept and execution of an exceptionally good customer experience is a challenge. But it is an essential requirement for leading in an environment where customers wield growing power.

Related Articles

Designing and starting up a customer-experience transformation

From touchpoints to journeys: Seeing the world as customers do

Why the customer experience matters

The Customer Value Guy

Signed in as:

- Consulting / Advisory

Case Studies

Customer value consulting case studies, optmising customer engagment in b2c banking, ltv optimised propositions and brand in b2b saas, cvm as competitive advantage in b2c publishing.

In this case study, read how Mike worked with a global bank to redefine and optimise cross-sell using customer value consulting. Mike advised on the CVM operating model, team structure, segmentation and targeting, and worked with the customer marketing team to outline a new cross-sell programme incorporating these improvements, worth £47m in revenue to the bank.

In this customer value consulting case study, read how Mike worked collaboratively with the teams at a global publisher to expand the customer lifecycle, enhance segmentation and targeting, introduce CVM and help lay the groundwork for the brand to better differentiate amongst its peers, helping to drive 27% higher ARPUs and the lowest churn rate of any comparable business in the parent group.

In this customer value consulting case study, read how Mike Migliore worked with a B2B SaaS business in the defence industry to optimise their proposition portfolio, re-launch their brand, and better manage the conversion funnel. The business enjoyed a doubling of revenues in the subsequent 12 months.

Future-Proofing Profit in B2B Media

In this customer value consulting case study, read how Mike Migliore stepped in at a well-known B2B defence publisher to ensure a profitable transition to a direct-to-consumer revenue model. Mike launched the marketing function, defined the strategy and laid the groundwork for major marketing programmes, increasing y.o.y revenue by 50%.

Subscriptions Launch in FMCG

Cvm driven growth at b2c scale-up.

In this customer value consulting case study, read how Mike Migliore stepped in at a global FMCG sports nutrition retailer to rescue their floundering subscription programme across both their brands. Mike redefined the subscription proposition portfolio based on customer engagement and LTV; coordinated marketing teams for launch and ensured technology teams delivered on time, all the while keeping executive leadership and the board informed. 50% of subscribers were previously dormant customers, LTVs increased by 10% on average and retention was on target at 15%.

In this customer value consulting case study, read how Mike worked with an exciting UK-based scale-up to optimise their LTVs with the introduction of customer value management strategy, including the redefinition of the firm’s unit economics with a more compelling proposition portfolio that leveraged community engagement. The work delivered a 30% increase in net sales over the subsequent six months and an average 3:1 LTV/CAC ratio, up from -1:1.

Copyright © 2023 W3H Consultants t/a Customer Value Guy - All Rights Reserved.

- Privacy Policy

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

- Browse All Articles

- Newsletter Sign-Up

CustomerValueandValueChain →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Products Contact Center & Customer Service InGenius – Computer Telephony Integration (CTI) powering personalized customer service.

3 Case Studies That Prove the Value of a Customer-Focused Content Strategy

3 minute read

Marketing Sales Kapost Blog

The majority of B2B marketers believe in the value of content marketing. 93% have incorporated it into their strategy, and 51% rate their content marketing practices as “very mature.” But very few are seeing the return on their investment.

According to Forrester, an overwhelming 85% of marketers fail to connect content marketing activity to business value.

This major disconnect stems from the difficulty most marketers have shifting their messaging focus away from the product and toward the buyer.

“The majority of marketers find producing content that engages buyers to be a major challenge,” said Forrester’s Business Marketing Association Chair, Steve Liguori. “To create content that attracts and builds customer relationships…B2B marketers must make a fundamental shift from writing about features and benefits to delivering valuable information that drives business results.”

The following 3 case studies are proof that this shift to buyer-focused content is worth making.

1. UrbanBound

The Problem: UrbanBound, a B2B relocation management software company , wasn’t seeing the value of their broad, scattered content efforts. So, they decided to develop a content-rich, customer-focused campaign instead.

The Approach: To find out what topics to focus on, UrbanBound tapped information from sales to learn about customer pain points and frequently asked questions. The top customer concern? Creating a streamlined process and benefits package for relocating employees. They had their topic. So, they set out to create a variety of different content surrounding it, including:

- Multiple blog posts

- Webinar (with slides posted to SlideShare

- Infographics

- Social messages

The Results:

- 37% increase in blog traffic

- 35% increase in leads

- 102% increase in marketing-qualified leads

- 66% increase in interactions (when someone reconverts and submits multiple forms)

The Problem: When Five9, providers of cloud contact center software , first started investing in content, they went with a product-centered approach that didn’t provide much value . The two videos they made, which were oriented around detailing the benefits of Five9 products, stopped producing leads and engagement after two or three weeks when the promotion budget died off.

The Approach: Five9 knew they needed to stop making content in a vacuum and start listening to what their customers actually wanted. And listening, it turned out, wasn’t so hard. In a survey, they asked their audience what kind of content they were most interested in receiving from Five9.

The results were conclusive. Buyers wanted help improving contact center agent efficiency. Once they had a theme, Five9 produced their first-ever content pillar : “Practical/Tactical: A Guide to the Process, Technology, and Tactics of Agent Efficiency.”

The Results:

The eBook drove:

- 4X the leads

- 4X the closed wins

3. ShipServ

The Problem: ShipServ, an e-marketplace for the marine industry , connects more than 8,000 ships, 200 ship owners, managers, and yards with upwards of 45,000 marine suppliers. In 2008, they realized their brand image was in trouble: their customers, who weren’t very tech-savvy, deemed them too impersonal and opaque.

The Approach: To help shake this perception, ShipServ dedicated the entirety of their small marketing budget toward customer-focused content. They revamped their website, launched a blog, published a series of whitepapers, created a LinkedIn group to build community, and worked on search engine optimization.

- Website visitors increased by 59%

- LinkedIn and Twitter went from zero to the top 20 traffic sources

- Contact-to-lead (landing page contact) conversions increased by 150%

- Lead-to-opportunity conversions increased by 50%

- Campaign management costs decreased by 80%

- The number of sales-ready leads increased by 400%

- Measurable increase in brand awareness

Dedicating resources, budget, and manpower to content development is a great first step for B2B companies entering the content marketing space. But it’s not enough.

To see true business value, the content must be rooted in the customer.

Reliable products. Real results.

Every day, thousands of companies rely on Upland to get their jobs done simply and effectively. See how brands are putting Upland to work.

View Success Stories

Building and evaluating a customer value blog

- Published: 20 May 2023

- Volume 11 , pages 551–557, ( 2023 )

Cite this article

- Art Weinstein 1

257 Accesses

1 Altmetric

Explore all metrics

Blogging isn’t about publishing as much as you can. It’s about publishing as smart as you can. —Jon Morrow, CEO, Smartblogger.com.

Organizations often use blogs as a promotional vehicle to create superior value for their stakeholders. While blogs are one of the most utilized digital marketing tools, there has been limited academic research and in-depth applications on how to successfully design and execute such initiatives. This article fills that gap by providing a sound and systematic approach for implementing and improving this marketing communications priority. The case study explains how to launch, assess, and enhance a customer value blog to inform and engage readers. Using blogging and customer value literature as well as qualitative and quantitative metrics, research and strategic marketing insights are offered. Data are presented and analyzed from the Customer Value blog on viewership, comments, popular topics, categories of interest, and usage by geography, technology, and traffic sources. Recommendations to generate strong content, adapt and promote the blog, and teaching ideas are offered. Students, marketers, and businesspersons gain real world knowledge on the latest customer value topics from thought leaders. The process described in this article is readily adaptable by marketing educators and businesses interested in creating a blog to strengthen relationships with their target audiences.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price excludes VAT (USA) Tax calculation will be finalised during checkout.

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Data availability

Data is not available.

99Content. 2020. Blogging statistics. https://99firms.com/blog/blogging-statistics/

Agarwal, A. 2021. Top 15 business education blogs and websites in 2021. https://blog.feedspot.com/business_education_blogs/

Ahuja, V., and Y. Medury. 2010. Corporate blogs as e-CRM tools—Building consumer engagement through content management. Database Marketing & Customer Strategy Management 17 (2): 91–105.

Article Google Scholar

Barton, C., L. Koslow, and C. Beauchamp. 2014. How Millennials are changing the face of marketing forever, January 15, retrieved from https://www.bcgperspectives.com/content/articles/marketing_center_consumer_customer_insight_how_millennials_changing_marketing_forever/

Castronovo, C., and L. Huang. 2012. Social media in an alternative marketing communication model. Journal of Marketing Development and Competitiveness 6: 117–134.

Google Scholar

Chua, A.P.H., K.R. Deans, and C.M. Parker. 2009. Exploring the types of SMEs which could use blogs as a marketing tool: A proposed future research agenda. Australasian Journal of Information Systems 16 (1): 117–136.

Colton, D.A. 2018. Antecedents of consumer attitudes’ toward corporate blogs. Journal of Research in Interactive Marketing 12: 94–104.

Colton, D.A., andPoploski. 2018. A content analysis of corporate blogs to identify communications strategies, objectives, and dimensions of credibility. Journal of Promotion Management 24: 1–22.

Hubspot, Inc. 2021. The ultimate list of marketing statistics for 2021. www.hubspot.com/marketing-statistics/

Keller, K.L. 2009. Building strong brands in a modern marketing communications environment. Journal of Marketing Communications 15 (2–3): 139–155.

Kodish, S. 2017. Venturing into the unknown: Blogs as a means of advancing leadership skills. Journal of Education for Business 92 (6): 315–321.

Kotler, P., and L. Keller. 2016. A Framework for Marketing Management , 6th ed. Upper Saddle River, NJ: Pearson Education.

MSI. 2020. MSI announces 2020–2022 research priorities, May 7, https://www.msi.org/articles/2020-22-msi-research-priorities-outline-marketers-top-concerns/

Marshall, G.W., and M.W. Johnston. 2023. Marketing Management , 4th ed. New York: McGraw-Hill Education.

McFarlane, D.A. 2019. On Art Weinstein’s superior customer value … in the Now Economy. Journal of Marketing Communications . https://doi.org/10.1080/13527266.2019.1706187/ .

Murphy, T. 2021. New study reveals the lifetime value of a blog post, Convince&Convert, New Study Reveals the Lifetime Value of a Blog Post (convinceandconvert.com)

Namwar, Y., and A. Rastgoo. 2008. Weblog as a learning tool in higher education. Turkish Online Journal of Distance Education-TOJDE 9 (3): Article 15.

Niederhoffer, K., R. Mooth, D. Wiesenfeld, and J. Gordon. 2007. The origin and impact of CPG new-product buzz: Emerging trends and implications. Journal of Advertising Research 47: 420–426.

Ojala, M. 2005. Blogging: For knowledge sharing, management and dissemination. Business Information Review 22: 269–276.

Peter, J.P., and J.H. Donnelley Jr. 2019. A Preface to Marketing Management , 15th ed. New York: McGraw-Hill Education.

Rowley, J. 2001. Remodeling marketing communications in an Internet environment. Internet Research 11 (3): 203–212.

Safko, L. 2012. The social Media Bible: Tactics, Tools & Strategies for Business Success . Hoboken, NJ: Wiley.

Santonino, M.D., III. 2020. Review on Weinstein’s superior customer value: Finding and keeping customers in the now economy. Journal of Marketing Analytics 8: 39–41.

Saravanakumar, M., and T. SuganthaLakshmi. 2012. Social media marketing. Life Science Journal 9: 4444–4451.

Sean. 2020. 11 benefits of blogging for small business owners in 2020, Lyfe Marketing , June 30, https://www.lyfemarketing.com/blog/benefits-of-blogging/

Seth, Y. 2021. Your business needs a blog in 2021 and how to measure its performance, July 13, Importance of Blog for your Business & Metrics to measure Success (readwrite.com)

Strong, C., and A. Beetles. 2017. Editorial: Adding value to marketing education. Journal of Strategic Marketing 25 (2): 99–100.

Thackeray, R., B.L. Neiger, and C.L. Hanson. 2007. Developing a promotional strategy: Important questions for social marketing. Health Promotion Practice 8: 332–336.

Wang, M., R. Fix, and L. Bock. 2004. Blogs: Useful tool or vain indulgence. Elearn 2005 World Conference on E-Learning in Corporate, Government, Healthcare, and Higher Education , October 2004, pp. 24–28.

Waters, R.D., P. Ghosh, T.D. Griggs, and E.M. Searson. 2014. The corporate side of the blogosphere: Examining the variations of design and engagement among Fortune 500 blogs. Journal of Promotion Management 20 (5): 537–552.

Wayland, J.P., and C.Y. Lin. 2015. Blogging: Trial and Error in the Services Marketing Course. In: Sharma, D., Borna, S. (eds) Proceedings of the 2007 Academy of Marketing Science (AMS) Annual Conference. Developments in Marketing Science: Proceedings of the Academy of Marketing Science. Springer, Cham. https://doi.org/10.1007/978-3-319-11806-2_32 .

Weinstein, A. 2019. Superior Customer Value: Finding and Keeping Customers in the Now Economy , 4th ed. London, New York: Routledge-Taylor Group.

Weinstein, A.T., and D.A. McFarlane. 2016. Case study—how a business school blog can build stakeholder relationships and create added value in an MBA marketing program. Journal of Strategic Marketing . https://doi.org/10.1080/0965254X.2016.1182574 .

Weinstein, A.T., and D.A. McFarlane. 2017. Using a marketing faculty blog as an image differentiator and learning resource to enhance MBA student engagement and loyalty. Journal of Marketing and Consumer Research 34: 50–56.

Wright, J. 2006. Blog Marketing: The Revolutionary New Way to Increase Sales, Build Your Brand, and Get Exceptional Results . New York: The McGraw-Hill Companies.

Download references

Author information

Authors and affiliations.

H. Wayne Huizenga College of Business and Entrepreneurship, Nova Southeastern University, Fort Lauderdale, FL, USA

Art Weinstein

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Art Weinstein .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Weinstein, A. Building and evaluating a customer value blog. J Market Anal 11 , 551–557 (2023). https://doi.org/10.1057/s41270-023-00229-3

Download citation

Revised : 11 March 2023

Accepted : 01 May 2023

Published : 20 May 2023

Issue Date : September 2023

DOI : https://doi.org/10.1057/s41270-023-00229-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Customer engagement

- Customer value

- Marketing education

- Value creation

- Find a journal

- Publish with us

- Track your research

Keeping now integrates directly with HubSpot's Sales Hub. Learn More

- Customer Interaction

4 Customer Service Case Studies to Inspire You

Customer service case studies help attract new customers to your business by showing them how your company can help them. Instead of simply telling customers what you can do for them, you demonstrate it with storytelling and draw them in.

November 24, 2022

6 mins read

If you’ve researched any brand it’s more than likely you’ve come across a customer service case study. Real-life customer experiences are a powerful way to advertise a brand and showcase the real interactions customers have when approaching a company’s customer service department.

Instead of simply telling a customer what it’s like to benefit from a company’s customer service, they demonstrate genuine examples of customers who have submitted tickets to their customer service team.

On the surface of it, one company can appear much like another without powerful customer service case studies to demonstrate its impact. Customers will be required to actually sign up to your service before they can experience your customer support for themselves.

What is a customer service case study?

A customer service case study is a strategy to show the experiences of customers that have actually signed up to use your product or service and have actually witnessed your customer service for themselves.

Potential customers who are researching what your company has to offer will benefit from the case studies of customers that have already passed through the buying decision. Instead of a company simply telling prospective customers what they have to offer, they will be able to demonstrate their service in reality.

A customer service case study goes beyond being a simple testimonial, however. It’s factual evidence of customers who have implemented your company’s product or service and a demonstration of its ability to actually deliver results.

Why are customer service case studies important?

Without customer service case studies, your business will struggle to show how it is helping its customers. A case study shows your prospective customers how the business has performed in a real-life example of customer service, and helps them imagine what it would be like to do business with your company.

Customer service case studies show potential customers how your business has helped customers to solve their problems and further their business goals. Although there are other ways to market your business, customer service case studies are a solid way to reach out to new prospects and convert them into customers.

Successful customer case studies showcase successful examples of customer service that persuade your prospects to actually buy. They show prospects how well your customer service actually works and highlights your product’s value.

How do you write a customer service case study?

There are a few strategies you need to follow when writing a customer service case study. Having a variety of different case studies will enable you to reach more potential customers which cover a range of situations and needs.

1. Focus on your personas

You need to consider the type of the customer that you want to attract with your customer service case study. Mapping out your personas is an important part of your marketing strategy because it helps you identify prospects with unique wants and needs. Your customer service may appeal to different types of individuals and it’s crucial to target each one specifically.

2. Tell a story

At their core, customer service case studies are stories about particular customers. Simply raving about how great your company is wil be boring for your readers, and you need to take them on a journey. Stories need to have obstacles to overcome, and your case study should show how your product or service is the hero of the narrative.

3. Emphasize benefits

The benefits of your customer service will help to appeal to customers that have a specific pain point to solve. Instead of focusing on products or features it’s important to show how your service will help them. Your customer service case study is likely to be a representative example of a customer that has similar problems to other prospects, and it’s important to help prospective customers visualize using your service.

4. Highlight the results

Highlighting the results that your customer service will help your customers achieve means focusing on the before and after of using your service. Genuine improvements to your customer’s business will help to convince them that your product or service is the answer. Showing the results of your customer service helps customers see how they can save or make more money after choosing your business.

4 interesting customer service case studies

Quick heal and kayako.

Here’s the first interesting customer service case study from Kayako. There was a company called Quick Heal Technologies which was a provider of internet security tools and anti-virus software. They had millions of global users, but they were struggling to deliver outstanding customer service due to a high volume of customer service requests.

One of their main issues was the absence of a system to track requests from different sources. Agents were checking many different platforms for customer service requests, and lacked a vital overview of the customer experience. They were losing tickets and suffering from incomplete information. There were delays in the customer support experience and the existing system couldn’t manage its workflow.

Enter Kayako, help desk software. Their Shared Inbox Solution brought together the different customer service platforms such as email, Facebook, Twitter, and live chat. Quick Heal agents were able to support customers seamlessly and minimize the number of tickets that were dropped. They could significantly reduce their ticket response times and accelerate the time to resolution. Agents were able to much more effectively collaborate and reduce duplication of effort.

Springboard and Help Scout

The next customer service case study is about Springboard, a platform which provides online resources and personalized mentors to help students build their dream careers. Their aim is to make a great education accessible to anyone in the world.

So far, they have worked with 250 mentors to train more than 5,000 students over 6 continents. Their success has depended on their ability to create an open environment where students feel comfortable requesting feedback and discovering course information on their own.

Springboard needed a solution that could help them build relationships with their students, even if it’s over email, and they decided that Help Scout was the answer. They chose Help Scout because it means they can have human conversations rather than treating their students like a ticket number.

They make use of Help Scout’s help desk features to find key insights into students’ conversations, as well as their Docs knowledge base which provides answers to common questions. As a result, students are able to more effectively learn and overcome problems when they arise.

We’ve got another customer service case study from an airline – in this case, JetBlue. They really know how to make their customers smile with small gestures and ensure they can win customers for life.

One customer called Paul Brown was flying with JetBlue from the smaller terminal at Boston’s Logan airport. He realized that he couldn’t grab his usual Starbucks coffee because there was no Starbucks at the terminal. On a whim, he sent a tweet to JetBlue asking them to deliver his venti mocha, and to his surprise they obliged! Within minutes JetBlue customer service representatives had delivered the coffee to Paul’s seat on the plane.

This example of customer service shows that JetBlue is willing to go the extra mile for customers and will ensure that the company can continue to attract more customers.

Gympass and Slack

Gympass is an international platform that gives companies and their employees 50% to 70% off a global network of fitness studios, digital workouts, and mental health and nutrition services. It was founded in 2012 and has experienced steady growth, now worth more than USD $1 billion. Users of Gympass have access to 50,000 gyms and studios in more than 7,000 cities, so they can work out while they are on the move.

The problem with this growing company was communication across the globe. The company was overly reliant on emails which led to silos and employees missing out on vital information. The solution to this problem was Slack, a communications platform which is made accessible to all new employees so they have everything they need right from the start.

Now, teams at Gympass work across a range of 2,000 Slack channels which are open to 1,000 employees. They can share documents, messages and information, keeping connected across locations and facilitating new projects like event planning. It’s enabled Gympass to build a strong culture of collaboration and ensure that every employee can find the information they need.

Wrapping up

Customer service case studies help attract new customers to your business by showing them how your company can help them. Instead of simply telling customers what you can do for them, you demonstrate it with storytelling and draw them in. Showing your customers benefits and outcomes support them to make the decision to purchase.

Before they actually have a trial of using your product or service, it’s hard for customers to know what it would be like. Case studies can give a valuable preview into what it would be like to work with your company and highlight customers that have already achieved success.

Catherine is a content writer and community builder for creative and ethical companies. She often writes case studies, help documentation and articles about customer support. Her writing has helped businesses to attract curious audiences and transform them into loyal advocates. You can find more of her work at https://awaywithwords.co.

Join 150+ teams that are sharing inboxes with us

The easiest way to upgrade your shared Gmail account. There’s no credit card is required.

The Missing Shared Inbox for Google Workspace

Continue reading.

27 Hilarious Customer Service Jokes

Sorry for the Late Response: How to Apologize in Email

The Golden Rules of Communication with Customers

- Integrations

- Case Studies

- State of Competitive Intelligence

- Partner Directory

- In the News

- Crayon Academy

Crayon Competitive Intelligence blog

Your guide to creating customer case studies (+ some show-stopping examples).

Teams are constantly looking for ways to stand out in crowded markets. Customer case studies may be just the differentiator companies have been seeking to give them that competitive edge. Not only do customer case studies showcase the types of pain points that a product or service can address, but they also highlight the results and successes real-life users have seen.

To put it simply, a customer case study is a real-life, detailed story that spotlights a customer’s opinions and achievements based upon the usage of a product or service.

Typically, customer case studies follow this format:

- Introduction: Setting the stage with situational context

- Challenge: Evaluating the problem at hand

- Solution: Providing an overview of how the product or service was used

- Benefits: Highlighting the key advantages

- Results: Recapping the aftereffect once the product or service was implemented

Similar to how competitive comparison landing pages provide trust and credibility for a brand through real-life recommendations, customer case studies deliver the same effect. These studies are people-focused, factual, and stray away from the promotional lingo that prospective customers have seen time and time again during their product search. After all, what prospect wouldn’t want some insight on the successes users have seen thus far?

Now that you have a better understanding of what a customer case study is, let’s dive into why they are important from a competitive standpoint and explore some tips on how to incorporate them into your marketing strategy.

The importance of customer case studies

Competition is heating up more quickly than ever before and is not expected to cool off anytime soon. Our 2021 State of Competitive Intelligence Report found that 53% of businesses say that the majority of their deals are competitive–an 8% increase from last year.

Sales teams need the help of marketers more than ever before to combat the growing number of industry rivals. To be successful in prospective calls, in particular, they need to be equipped with loads of marketing collateral, battlecards to guide them through objection-handling, and more. Customer case studies may be that piece of collateral they didn’t realize was missing from their stack to help seal the deal.

According to Eccolo Media’s 2015 B2B Technology Content Survey Report , customer case studies rank as the fifth most influential content marketing type in the purchase process for both small technology businesses and large enterprises. That’s an impressive ranking when it's being compared to assets such as product brochures, emails, and white papers. In fact, 42% of respondents said that in the last six months of the survey, they had consumed customer case studies as a way to evaluate a technology purchase.

As I’m sure you can see, there’s no doubt that customer case studies can help you stand out from your competitors. Let’s take a look at some examples that you can model yours after.

Successful customer case study examples

While some customer case studies come in the written form (typically distributed as a PDF), other organizations opt to turn it into a video–or do a combo of both.

Check out these examples from Zoom, Hootsuite, and AT&T below:

1. Zoom featuring Groupon

In this example, Zoom opted for a video case study. It opens up with a multimedia services manager at Groupon discussing the company’s pain points and then goes into how Zoom helped solve them. The video is professional, to-the-point, and highlights how Zoom has provided Groupon with a standardized platform that meets the needs of its video-first culture.

As you can see above, Zoom also has an entire web page dedicated to case study videos–all highlighting different industries but with the same end-goal–streamline companies’ telecommunications needs. It’s clear that the page can resonate with a variety of audiences and that’s the key to success.

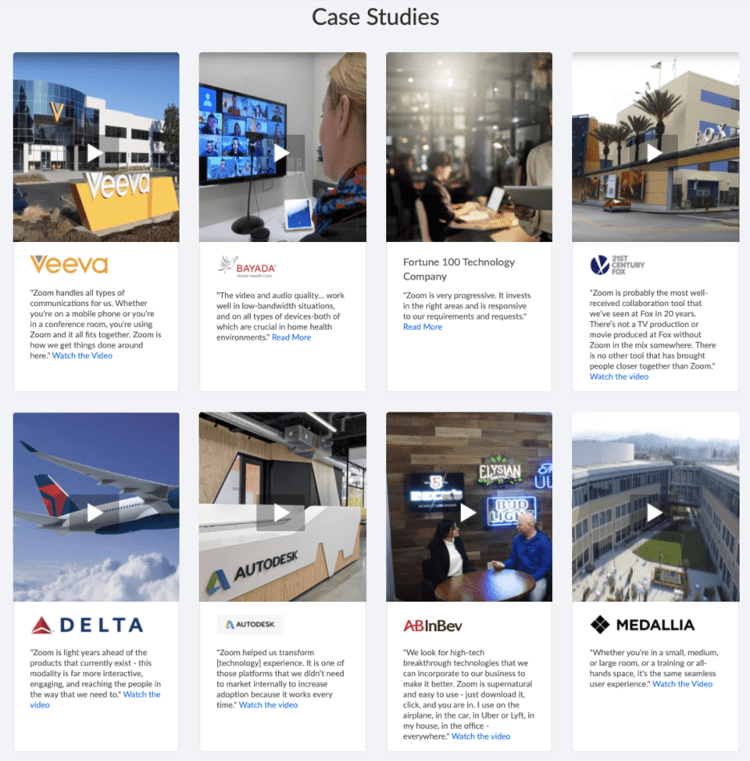

2. Hootsuite featuring The British Museum

This case study example from Hootsuite is a combination of both text and video. When you first open the page, it provides some context at the top describing who is being spotlighted and why ( The British Museum ). The page then immediately dives into a video. Following that video are the following sections: “What They Did," “How They Did It," and “The Results." This approach appeals to prospects looking for both a quick synopsis (the video) or more in-depth information (the written portion).

Looking at the example above, the page ends with some impressive statistics bolded to grab a reader's attention and a quote provided by a member of the customer’s leadership team. Prospects will walk away with a comprehensive understanding of how the platform could benefit them and the types of results customers have achieved.

3. AT&T featuring Birkey's Farm Store

AT&T chose a more traditional route for a customer case study with Birkey’s Farm Store –a PDF format. This format ensures that all of the information is organized, clearly displayed and that the key elements are emphasized. This format allows for a visual representation of data and easy scanning for important details. For those in a time crunch, chances are they’ll prefer this format–just be sure you’re engaging readers through graphics, bolded text, colors, etc.

Historically, customer case studies were in written form but as technology evolves, videos have come into play, stealing the spotlight. While there is no right or wrong format to use (it truly does depend on a reader’s preference), it is important to note that HubSpot estimated that over 50% of consumers want to see videos from brands more than any other type of content. My vote goes to a combination of both like the Hootsuite example!

5 tips for creating a customer case study

Now that you’ve checked out some examples of what a good customer case study looks like, let’s dive into some tips on how to be successful in creating one.

1. Determine your target persona(s) upfront

Before putting pen to paper, pinpoint the groups within your target audience that your case study should resonate with. Catering your studies to specific personas will ensure that the right audience is reached and that it is relevant to your readers.

2. Connect with your team

Be sure to connect with your company’s customer success and sales teams to hear what customers they think are best to target. After all, they will have great insight since they are the day-to-day contacts. You’ll want to choose customers with whom you have strong relationships and who, of course, have seen great results based upon implementing your solution. While the case study would be “free advertising” for them, there’s no doubt that they’d be doing you a favor by going out of their way to help you bring this asset to life.

3. Create case study interview questions

Once you’ve got your customer(s) selected for the case study (and they’ve agreed to participate), take some time to draft out universal interview questions. Ideally, these questions can be used in the future and are general enough to translate to all industries that would be spotlighted on your page.

Your customer(s) will also be appreciative of your preparedness. It’s important to make the process as easy as possible for them and coming in prepared with a list, will ensure that your conversation is focused and strategic. After all, your case study needs a beginning, middle, and an end–make sure you gather enough information to put it all together into a full story.

4. Utilize statistics

Although your customer’s “results” won’t be revealed until the end of the case study, don’t shy away from using stats throughout it–in fact, it’s encouraged! Statistics stick out to any viewer and can be helpful for those trying to sway decision-makers. For example, when setting the scene, describe how many employees and locations the customer has and make those numbers stand out. Although it may seem minute, these stats can help readers determine whether their company is similar and the results achieved are comparable.

5. Build out a case study web page

It’s important to showcase your case studies in a strategic, organized, and easily accessible way (scroll back up to the Zoom example as an example). Create a designated case study hub on your website. When building out this page, it’s important to have a plethora of customer case studies–that way there will always be a case study that a prospect can relate to. Be sure that all types of industries you work with are represented and that your page is broad enough to appeal to the masses.

Incorporate case studies into your marketing plan

Marketing teams are always looking for ways to express the benefits of a product or service authentically and creatively. This type of non-promotional collateral can make a major impact on the number of leads generated and can add a new level of credibility to your brand name. It paints a picture of the types of success a prospect could have and that’s the recipe to success for any deal getting closed.

Not only do customer case studies showcase the value of your product or service, but potential customers are provided with a better sense of how real customers leverage it to excel their business. And as a bonus, it’s free publicity for your customers – that's a win-win in my book!

If you have any other tips for creating a successful customer case study, let us know in the comments below!

See why Gong, Mastercard, and ZoomInfo trust Crayon to help them win more competitive deals.

Related Blog Posts

Popular Posts

Customer Lifetime Value Analytics: Case Study

- April 29, 2023

Download the dataset below to solve this Data Science Case Study on Customer Lifetime Value Analytics.

Customer lifetime value (CLTV) is the estimated total amount a customer will spend on a business throughout their relationship with that business. It takes into account the revenue generated by the customer as well as the costs associated with acquiring and serving that customer. By analyzing the relationship between customer acquisition costs and revenue generated, we can determine which channels are the most cost-effective for acquiring and retaining high-value customers.

The given data includes information about the customer’s channel, cost of acquisition, conversion rate, and revenue generated. Your task is to analyze the CLTV of customers across different channels and identify the most profitable channels for the business.

References to Solve this Data Science Case Study

- Customer Lifetime Value Analysis by Aman Kharwal

Recommended Case Studies & Datasets

Market Size of EVs: Case Study

- March 18, 2024

User Profiling: Case Study

- February 25, 2024

Optimizing Cost and Profitability: Case Study

- February 11, 2024

Discussion Cancel reply

Discover more from statso.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

High Value Customer Acquisition Case Study [With Dylan’s Candy Bar]

How dylan’s achieved greater engagement, loyalty & profits, sweet results.

Executive Summary

- In this Case Study, we’ll cover how Dylan’s implemented BuyerGenomics’ Predictive Marketing Automation (PMA) platform to solve problems that traditionally takes months, in a matter of days . As a result, Dylan’s time, energy, and investment was focused on taking action and generating conversions .

- Mike Ferranti and Kevin Cohen discussed and illustrated how the Best Customers You Have Today are actually the root of The Answer to Acquiring Net New Customers that not only spend more , but more often than the rest.

- Cohen elaborated on specifically how Dylan’s developed a dramatically deeper view and understanding of the customer, developed new unique cohorts that explained the heterogeneity that existed in their customer base, and identified in high resolution who their Most Valuable Buyers really were — which then drove the target definition of for net new customers.

Table of Contents

- The Business Situation – While Dylan’s was generating high consumer traffic, they lacked the high-value, repeat buyers that would drive their business.

- The Approach – BuyerGenomics designed an intelligent, actionable data-driven campaign that specifically targeted net new customers who spent most like the best of their current base.

- Our Methodology – Within just three weeks, Dylan’s was able to generate a clear view of its customer base and implement a \”Buy-A-Like\” acquisition campaign.

- The Solution – A multi-step omni-channel campaign was used to reach the right customers, at the right place, at the right time – driving engagement and understanding the motivating factors that led customers to purchase.

- The Results – Dylan’s experienced massive increases in new valuable customer acquisition, conversion rate, average spend, and repeat purchase rate.

- The Future – Dylan’s continues to grow as a vibrant, dynamic business, and BuyerGenomics continues to support Dylan’s growing high-value customer acquisition campaign.

Did Dylan’s Have a Problem Worth Solving?

The Business Situation: High Consumer Traffic & Trial, Low Customer Loyalty

Dylan’s one-time buyers: high traffic, low customer loyalty.

Dylan’s One-Time Buyers: High Consumer Traffic, Low Customer Loyalty (Cont’d)

The Approach: BuyerGenomics Buy-A-like Acquisition

BuyerGenomics’ Strategy

- Launch a customer intelligence platform on BuyerGenomics to rapidly enable the accurate quantification and targeting of high-value opportunities.

- Launch a targeted prospecting campaign that utilized the most advanced forms of customer intelligence, machine intelligence, and automation.

- Shift the mix of net new customers to those who spend more and are more likely to become repeat customers.

- Implement a multi-channel approach.

Our Methodology: The 70, 20, 10 Axiom

“70% of the marketers success comes from getting the target right, 20% of success comes from getting the offer right, and 10% comes from getting the creative right.”

Rapidly Produce Highly Actionable Customer Intelligence

- The range of available intelligence and insights we have available is truly astounding, relative to all previous experience. We know exactly who our MVB really is, and we don’t rely on anecdotal narratives like we used to.

- Cohen provided examples of demographics, psychographics, lifestyles, purchasing behaviors, channel behaviors, predictive analytics, and much more.

- Who is the customer?

- How should we talk to them?

- How to engage them over time?

- How to avoid stagnation and increase repeat purchases? (Today, 1-time buyers make up the bulk of customers)

- How to build the direct to consumer relationship?

- How to drive in-store retail traffic?

Rapidly Create Actionable Loyalty Measures

Discern What Makes the Customers More or Less Homogeneous

Move From Initial Data Capture to “Buy-A-Like” Acquisition in Three Weeks

- Centralize online and offline data.

- Create a 360 degree view of the customer.

- Perform optimal target intelligence to define the MVB.

- Match the target with Buy-A-like targeting to acquire high potential new customers.

Buy-A-Like Targeting

Buy-A-Like Targeting (Cont’d)

The Solution: Omnichannel Campaigns “Surround” Buy-A-Like Prospects

Omnichannel Campaigning – Drive Response and Understand Motivations for Responders & Converters

Design Direct Mail Creatives [That Worked]

The Results: Sweet Success

The Numbers Behind Dylan’s Scaling of Profitable Customer Acquisition

- 145% of New “Most Valuable Buyers” acquired vs. Goal.

- Over 225% Conversion Improvement (on 30% of Investment).

- Over 50% Increase in Average Spend.

- Over 63% Increase in Repeat Purchase Rate.

How Dylan’s Can Scale Up High Value Customer Acquisition

How Dylan’s is Scaling Profitable Customer Acquisition

The Future: Just Desserts

Next Steps: Autonomously Grow Lifetime Value and Profit with Machine Intelligence

- Prospects – Not yet customers, signed up for an email newsletter, etc.

- Actives – Individuals currently engaged and/or spending with you.

- In Market – Buyers currently shopping for your products and are prepared/likely to buy again.

- Faders – Subjects no longer purchasing at the rate their customer profile suggests they can.

- At Risk – Buyers most likely to stop spending with your brand and fall into attrition.

- Inactives – Customers who have ceased purchasing your products.

Conclusions

Recent posts.

HOW TO CREATE A HIGH-PERFORMANCE FUNNEL IN META ADS BY CONSUMER JOURNEY STAGE [STEP-BY-STEP GUIDE]

Mastering the new 2024 email deliverability standards: staking your place in gmail and yahoo subscriber’s inboxes.

The 3 Immutable Laws of Email Marketing

What meta advertising is best for driving sales growth, unlocking customer sentiment: buyergenomics’ heartbeat revolutionizes insights.

HOW GOOGLE MEASURES STORE VISITS… (AND IS IT ACCURATE?)

What percentage of sales should my marketing spend be?

The full price customer: how to get & keep them, one-time buyers: the biggest retention problem in retail commerce.

3 Critical Priorities for New CMO’s

Solving the One-Time Buyer Problem

Reveal your true customer & drive growth..

- Generate more email revenues using AI to predict the next purchase by individual.

96.7% of BG Users drive material incremental sales by trying BuyerGenomics, free . If you later decide to sign up your 300% ROI is Guaranteed.

Free Access. Unlock Your Growth. Guaranteed.

In submitting my Free Access request I agree to the BuyerGenomics Terms & Conditions .

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Open access

- Published: 13 April 2023

How to really quantify the economic value of customer information in corporate databases

- Carlos Lamela-Orcasitas ORCID: orcid.org/0000-0003-3942-5535 1 &

- Jesús García-Madariaga ORCID: orcid.org/0000-0002-9073-0482 1

Humanities and Social Sciences Communications volume 10 , Article number: 166 ( 2023 ) Cite this article

1940 Accesses

1 Citations

1 Altmetric

Metrics details

- Business and management