529 Plan: What It Is, How It Works, Pros and Cons

- Search Search Please fill out this field.

What Is a 529 Plan?

Understanding 529 plans, types of 529 plans, tax advantages of 529 plans.

- Pros and Cons

529 Plan Transferability Rules

Special considerations, how much does a 529 plan cost, the bottom line.

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

A 529 plan is a tax-advantaged savings plan designed to help pay for education. Originally limited to post-secondary education costs, it was expanded to cover K–12 education in 2017 and apprenticeship programs in 2019. After the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) and SECURE 2.0 of 2022 , 529s can also be used to pay off student loans and fund a Roth IRA.

The two major types of 529 plans are education savings plans and prepaid tuition plans.

Education savings plans grow tax-deferred , and withdrawals are tax-free if they're used for qualified education expenses. Prepaid tuition plans allow the account owner to pay current tuition rates for future attendance at designated colleges and universities. That means that, most likely, you can lock in a lower cost of college attendance.

529 plans are also referred to as qualified tuition programs and Section 529 plans.

Key Takeaways

- 529 plans are tax-advantaged accounts that can be used to pay educational expenses from kindergarten through graduate school.

- There are two basic types of 529 plans: educational savings plans and prepaid tuition plans.

- 529 plans are sponsored and run by the 50 states and the District of Columbia. The rules and fees of 529 plans can differ by state.

- 529 plans can be purchased directly from a state or via a broker or financial advisor.

- Up to $35,000 of leftover funds in a 529 account can be rolled over into a Roth IRA account, provided the fund is at least 15 years old.

Although 529 plans take their name from Section 529 of the federal tax code, the plans themselves are administered by the 50 states and the District of Columbia.

Anyone can open a 529 account, but they are typically established by parents or grandparents on behalf of a child or grandchild, who is the account's beneficiary . In some states, the person who funds the account may be eligible for a state tax deduction for their contributions.

The money in a 529 plan grows on a tax-deferred basis until it is withdrawn. What's more, so long as the money is used for qualified education expenses as defined by the Internal Revenue Service (IRS), those withdrawals aren't subject to either state or federal taxes. In addition, some states may offer tax deductions on contributions.

In the case of K–12 students, tax-free withdrawals are limited to $10,000 per year.

Since tax benefits vary depending on the state, it's important that you check the details of any 529 plan to understand the specific tax benefits that you may or may not be entitled to.

The two main types of 529 plans have some significant differences.

Education Savings Plans

529 savings plans are the more common type. The account holder contributes money to the plan. That money is invested in a preset selection of investment options.

Account holders can choose the investment (usually mutual funds) that they want to invest in. How those investments perform will determine how much the account value grows over time.

Many 529 plans offer target-date funds , which adjust their assets as the years go by, becoming more conservative as the beneficiary gets closer to college age.

Withdrawals from a 529 savings plan can be used for both college and K–12 qualified expenses. Qualified expenses include tuition, fees, room and board, and related costs.

The SECURE Act of 2019 expanded tax-free 529 plan withdrawals to include registered apprenticeship program expenses and up to $10,000 in student loan debt repayment for both account beneficiaries and their siblings.

The SECURE Act of 2022, passed as part of the 2023 Omnibus funding bill, permits rolling over up to $35,000 of unspent funds in a 529 account into a Roth IRA account. To qualify, the account must be at least 15 years old.

Prepaid Tuition Plans

Prepaid tuition plans are offered by a limited number of states and some higher education institutions. They vary in their specifics, but the general principle is that they allow you to lock in tuition at current rates for a student who may not be attending college for years to come. Prepaid plans are not available for K–12 education.

As with 529 savings plans, prepaid tuition plans grow in value over time. Eventual withdrawals from the account used to pay tuition are not taxable. However, unlike savings plans, prepaid tuition plans do not cover the costs of room and board.

Prepaid tuition plans may place a restriction on which colleges they may be used for. The money in a savings plan, by contrast, can be used at almost any eligible institution.

In addition, the money paid into a prepaid tuition plan isn't guaranteed by the federal government and may not be guaranteed by some states. Be sure you understand all aspects of the prepaid tuition plan before you utilize one.

Contribution Limits Differ Across States

There are no limits on how much you can contribute to a 529 account each year. However, many states put a cap on how much you can contribute in total. Those limits recently ranged from $235,000 to $575,000.

Withdrawals from a 529 plan are exempt from federal and state income taxes, provided the money is used for qualified educational expenses.

Any other withdrawals are subject to taxes plus a 10% penalty, with exceptions for certain circumstances, such as death or disability.

The money you contribute to a 529 plan isn't tax deductible for federal income tax purposes. However, more than 30 states provide tax deductions or credits of varying amounts for contributions to a 529 plan.

In general, you'll need to invest in your home state's plan if you want a state tax deduction or credit. If you're willing to forgo a tax break, some states will allow you to invest in their plans as a non-resident.

Benefits and Issues of 529 Plans

529 plans have specific transferability rules governed by the federal tax code (Section 529).

The owner (typically you) may transfer to another 529 plan just once per year unless a beneficiary change is involved. You are not required to change plans to change beneficiaries. You may transfer the plan to another family member, who is defined as:

- Son, daughter, stepchild, foster child, adopted child, or a descendant of any of them

- Brother, sister, stepbrother, or stepsister

- Father or mother or ancestor of either

- Stepfather or stepmother

- Son or daughter of a brother or sister

- Brother or sister of father or mother

- Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

- The spouse of any individual listed above

- First cousin

You aren't restricted to investing in your own state's 529 plan, but doing so may get you a tax break. Be sure to check out that plan first.

As with other kinds of investing, the earlier you get started, the better. With a 529 plan, your money will have more time to grow and compound the sooner it's opened and funded .

With a prepaid tuition plan, you'll most likely be able to lock in a lower tuition rate compared to what you'd pay down the road, since many schools raise their prices every year.

If you have money left over in a 529 plan—for instance, if the beneficiary gets a substantial scholarship or decides not to go to college at all—you'll have several options.

One is to change the beneficiary on the account to another relative who qualifies according to the transferability rules. Another is to keep the current beneficiary in case they change their mind about attending college or later go on to graduate school. If all possible beneficiaries are done with school, you may use up to $10,000 to pay off federal or private student loans for the original beneficiary or their siblings.

A fourth option, which became available in January 2024, is to transfer unspent funds to a Roth IRA account if your account meets the requirements for doing so. Finally, you can always cash in the account and pay the taxes and 10% penalty.

States often charge an annual maintenance fee for a 529 plan. These have ranged from as little as $0 to $25. In addition, if you bought your 529 plan through a broker or advisor, they may charge you an additional fee on the assets under management. The individual investments and funds that you have inside of your 529 may also charge ongoing fees. Look for low-cost mutual funds and ETFs to keep management fees low.

Who Maintains Control Over a 529 Plan?

A 529 plan is technically a custodial account , so an adult custodian will control the funds for the benefit of a minor. The beneficiary can assume control over the 529 once they turn 18. However, the funds must still be used for qualifying education expenses.

What Are Qualified Expenses for a 529 Plan?

Qualified expenses for a 529 plan include:

- College, graduate, or vocational school tuition and fees

- Elementary or secondary school (K–12) tuition and fees

- Books and school supplies

- Student loan payments

- Room and board

- Computers, internet, and software used for schoolwork (student attendance required)

- Special needs and accessibility equipment for students

Creating a 529 plan gives you a tax-advantaged strategy to save for educational expenses from kindergarten to graduate school, including apprenticeship programs. Now there is a new option to move up to $35,000 of unspent funds into a Roth IRA account if the 529 account is 15 or more years old. With many options for using your 529 plan, they offer great flexibility and the potential for tax-advantaged growth for your future scholars.

Congress.gov. " H.R.1994 - Setting Every Community Up for Retirement Enhancement Act of 2019 ," Sec. 302.

my529. " SECURE Act 2.0 ."

Internal Revenue Service. " Topic No. 313 Qualified Tuition Programs (QTPs) ."

U.S. Securities and Exchange Commission. " An Introduction to 529 Plans ."

Congress.gov. " H.R. 2617 - Consolidated Appropriations Act, 2023 ." Division T, Section 126.

529 College Savings Plan. " 529 Plan Comparison by State ."

Saving For College. " 529 Fee Study ."

The Wall Street Journal. " The Fees on Your ‘529’ Tuition-Savings Plan Matter More than Ever ."

Internal Revenue Service. " Publication 970 (2023), Tax Benefits for Education ."

U.S. Securities and Exchange Commission. " Investor Bulletin: 10 Questions to Consider Before Opening a 529 Account ."

Compare Personal Loan Rates with Our Partners at Fiona.com

- 529 Plan: What It Is, How It Works, Pros and Cons 1 of 14

- 529 Plan Contribution Limits in 2024 2 of 14

- How New Tax Changes Promote 529 Investments 3 of 14

- More than One Child? Does Each Need a Separate 529 Plan? 4 of 14

- UGMA/UTMA 529 Plan: Definition, Pros & Cons vs. Traditional 529 5 of 14

- Can I Roll a Traditional IRA Into a 529 Plan for My Grandchild? 6 of 14

- 529 Risks to Take (or Not) 7 of 14

- 529 Strategies That Maximize Student Aid Options 8 of 14

- Why You Should Front-Load Your 529 Plan 9 of 14

- Using Your 529 Savings to Study Abroad 10 of 14

- Can a 529 Plan Be Applied to a Student Loan? 11 of 14

- A Penalty-Free Way to Get 529 Money Back 12 of 14

- Best 529 Plans for College Savings of 2024 13 of 14

- The Vanguard 529 College Savings Plan: A Review 14 of 14

:max_bytes(150000):strip_icc():format(webp)/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Please enter a valid email address

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity.com: "

Your email has been sent.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Clicking a link will open a new window.

529 plans are flexible, tax-advantaged accounts designed specifically for education savings. Funds can be used for qualified education expenses at schools nationwide.

Before you start you will need to know the child's date of birth, social security number and what investment choices you want.

Current account owners - log in

Why choose a 529 plan?

529 funds can be used for a wide range of education expenses, including college expenses at postsecondary schools nationwide, tuition for K-12 schools, certain apprenticeship costs, and student loan repayments. 1 An overview of key features is below.

Earnings grow tax deferred

While your money is in the account, no taxes will be due on investment earnings.

No annual account fees

Also, no account minimums required to open a Fidelity-managed 529 account.

Tax-free withdrawals for qualified education expenses

Withdrawals for qualified education expenses are free from federal income tax.

Federal tax treatment of gifts

Contributions up to $18,000 annually are not subject to the federal gift tax. 2

In a 529, you can combine 5 years worth of contributions, or $90,000. 3

Little effect on financial aid eligibility

529 assets have a relatively small effect on federal financial aid eligibility because they are considered assets of the parent in the Student Aid Index (SAI) formula. 4

Beneficiary changes

The 529 account beneficiary can be changed to an eligible family member to use for their qualified education expenses. 5

State tax incentives for contributions

Some states may offer tax incentives for contributions by state residents. 6

Investment options

Choose from a menu of portfolios managed by professional fund managers.

Calculators

View all FAQs

Where do you live?

Depending on your state of residence, a Fidelity-managed, state-specific plan may be a good option for you. If Fidelity does not manage a plan for your state, you may want to consider our national plan, the UNIQUE College Investing Plan (sponsored by the state of New Hampshire). Be sure to consider your own or the beneficiary's home state 529 plan as some states offer favorable tax treatment or other benefits to their residents only if they invest in their own state's 529 plan. 6

Connecticut

Massachusetts, new hampshire, another state.

You can invest in 529 savings plans from states across the country. Be sure to consider your own state plan as it may have additional benefits, including state tax advantages.

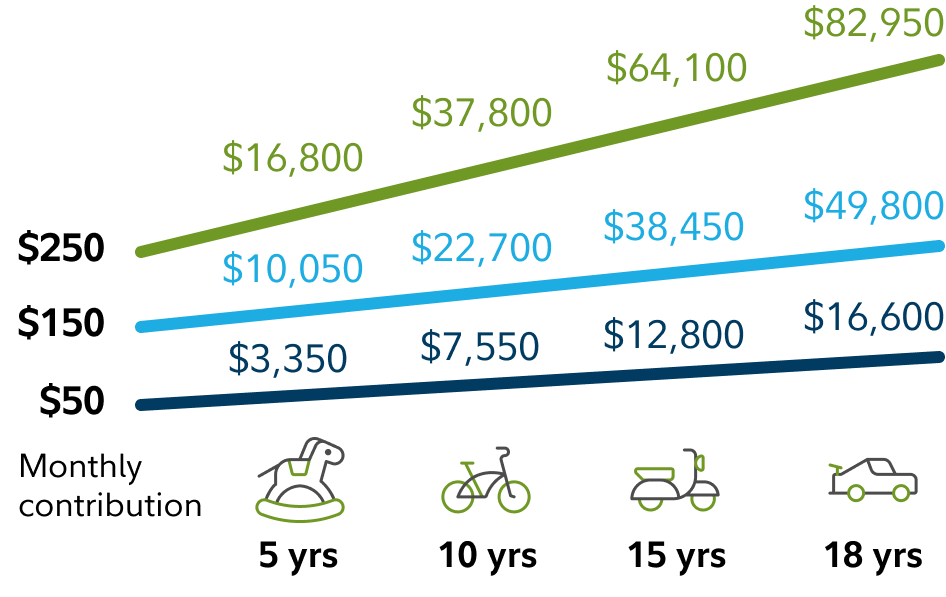

Saving a little over time can go a long way*

Help reduce the amount of loans borrowed for education expenses

Hypothetical chart

- Collapse all

*This hypothetical example illustrates the potential value of different regular monthly investments for different periods of time and assumes an average annual return of 4.5% rounded to the nearest $50. Contributions to a 529 plan account must be made with after-tax dollars. This does not reflect an actual investment and does not reflect any taxes, fees, expenses, or inflation. If it did, results would be lower. Returns will vary, and different investments may perform better or worse than this example. Periodic investment plans do not ensure a profit and do not protect against loss in a declining market. Past performance is no guarantee of future results.

Common questions on 529 college savings plans

What is a 529 savings plan.

529 savings plans are flexible , tax-advantaged accounts designed specifically for education savings.

Earnings on contributions grow federal income tax-deferred, and withdrawals taken to pay for qualified higher education expenses such as tuition, fees, books, computer expenses, or room and board are free from federal income taxes.

Am I on track? How do I estimate higher education costs?

Anyone can use our college savings calculator to figure out how much to save each month. Login or become a member to create a personalized savings plan and track your progress.

It's hard to predict your child's future educational path. Visit the Fidelity Learning Center for a variety of strategies and tips to help you prepare.

What can I do with the money left in the account?

The 529 account beneficiary can be changed to an eligible family member to use for their qualified education expenses.

Under certain conditions you may be eligible to transfer assets from your 529 to a Roth IRA established for the beneficiary of the 529 account. 7

You can also take a non-qualified withdrawal . Only the portion of the non-qualified withdrawal attributed to investment earnings will be subject to federal and state income taxes plus a 10% federal penalty.

Still unsure?

Learn more about why a 529 is a good option

How can the gifting feature help out?

Family and friends can contribute easily with our free online gifting feature . Even small amounts can add up over time.

It's as simple as sharing a link to your College Gifting page. And we do not display your account information, helping to protect your privacy.

Ready to get started?

An accelerated transfer to a 529 plan (for a given beneficiary) of $90,000 (or $180,000 combined for spouses who gift split) will not result in federal transfer tax or use of any portion of the applicable federal transfer tax exemption and/or credit amounts if no further annual exclusion gifts and/or generation-skipping transfers to the same beneficiary are made over the five-year period and if the transfer is reported as a series of five equal annual transfers on Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return . If the donor dies within the five-year period, a portion of the transferred amount will be included in the donor's estate for estate tax purposes.

If you or the designated beneficiary is not a New Hampshire, Massachusetts, Delaware, Arizona or Connecticut resident, you may want to consider, before investing, whether your state or the beneficiary's home state offers its residents a plan with alternate state tax advantages or other state benefits such as financial aid, scholarship funds and protection from creditors .

Beginning January 2024, the Secure 2.0 Act of 2022 (the "Act") provides that you may transfer assets from your 529 account to a Roth IRA established for the Designated Beneficiary of a 529 account under the following conditions: (i) the 529 account must be maintained for the Designated Beneficiary for at least 15 years, (ii) the transfer amount must come from contributions made to the 529 account at least five years prior to the 529-to-Roth IRA transfer date, (iii) the Roth IRA must be established in the name of the Designated Beneficiary of the 529 account, (iv) the amount transferred to a Roth IRA is limited to the annual Roth IRA contribution limit, and (v) the aggregate amount transferred from a 529 account to a Roth IRA may not exceed $35,000 per individual. It is your responsibility to maintain adequate records and documentation on your accounts to ensure you comply with the 529-to-Roth IRA transfer requirements set forth in the Internal Revenue Code. The Internal Revenue Service (“IRS”) has not issued guidance on the 529-to-Roth IRA transfer provision in the Act but is anticipated to do so in the future. Based on forthcoming guidance, it may be necessary to change or modify some 529-to-Roth IRA transfer requirements. Please consult a financial or tax professional regarding your specific circumstances before making any investment decision.

The UNIQUE College Investing Plan, U.Fund College Investing Plan, DE529 Education Savings Plan, AZ529, Arizona's Education Savings Plan, and the Connecticut Higher Education Trust (CHET) 529 College Savings Plan - Direct Plan are offered by the state of New Hampshire, MEFA, the state of Delaware, and the state of Arizona with the Arizona State Treasurer's Office as the Plan Administrator and the Arizona State Board of Investment as Plan Trustee, and the Treasurer of the state of Connecticut respectively, and managed by Fidelity Investments.

Units of the portfolios are municipal securities and may be subject to market volatility and fluctuation.

Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC , 900 Salem Street, Smithfield, RI 02917

- Mutual Funds

- Fixed Income

- Active Trader Pro

- Investor Centers

- Online Trading

- Life Insurance & Long Term Care

- Small Business Retirement Plans

- Retirement Products

- Retirement Planning

- Charitable Giving

- FidSafe , (Opens in a new window)

- FINRA's BrokerCheck , (Opens in a new window)

- Health Savings Account

Stay Connected

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

An eligible family member is a person who has one of the following relationships with the original beneficiary: (1) son or daughter; (2) stepson or stepdaughter; (3) brother, sister, stepbrother, or stepsister; (4) father, mother, or an ancestor of either; (5) stepfather or stepmother; (6) son or daughter of a brother or sister; (7) brother or sister of a father or mother; (8) son or daughter-in-law, father or mother-in-law, brother or sister-in-law; (9) spouses of the individuals listed in (1)–(8) or the spouse of the beneficiary; and (10) any first cousin.

Information you'll need

Important Information Virtual Assistant is Fidelity’s automated natural language search engine to help you find information on the Fidelity.com site. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results. Responses provided by the virtual assistant are to help you navigate Fidelity.com and, as with any Internet search engine, you should review the results carefully. Fidelity does not guarantee accuracy of results or suitability of information provided. Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 796549.1.0

Get Started

The Education Plan for Families

We help families reduce student loan debt and save for the future..

No matter what path they choose, it starts with a plan. A 529 account with The Education Plan can help children realize their dreams and reduce the burden of student loan debt. It’s a smart, tax-advantaged way to plan for the future.

- Tax advantages

- Robust gifting options

- Flexible investment options

- Open an account with just $1

- Variety of uses and qualified expenses

Top Reasons to Save with The Education Plan

From tax savings to the low-fee structure and multiple ways to invest, there are many reasons to choose The Education Plan for your future education and college savings goals. Here are the top reasons.

“The Education Plan makes saving for future education and college easy and gives me peace of mind.”

Learn about saving with a 529 plan, what are qualified expenses, tax benefits of a 529 plan, glossary of common terms.

SIGN UP & STAY CONNECTED

Sign up for our newsletter, follow us on social media.

The Education Plan® and The Education Plan® Logo are registered trademarks of The Education Trust Board of New Mexico used under license.

Privacy & Cookie Policy

Phone: 1-877-337-5268 We're available Monday to Friday 8 a.m. to 7 p.m. MT

For more information about The Education Plan, call 1.877.337.5268 or view the Plan Description and Participation Agreement , which includes investment objectives, risks, charges, expenses, and other important information; read and consider it carefully before investing.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You also should consult a financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 plan(s), or any other 529 plan, to learn more about those plan’s features, benefits and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

The Education Plan is administered by The Education Trust Board of New Mexico. Ascensus College Savings Recordkeeping Services, LLC, the Program Manager, and its affiliates, have overall responsibility for the day-today operations, including investment advisory, recordkeeping and administrative services. The Education Plan’s portfolios invest in: (i) mutual funds; (ii) exchange traded funds; and/or (iii) a funding agreement issued by New York Life. Investments in The Education Plan are not insured by the FDIC. Units of the portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns will vary depending upon the performance of the portfolios you choose. You could lose all or a portion of your money by investing in The Education Plan depending on market conditions. Account owners assume all investment risks as well as responsibility for any federal and state tax consequences.

Ugift is a registered service mark of Ascensus Broker Dealer Services, LLC.

All other marks are the exclusive property of their respective owners.

Not FDIC-Insured. No Bank, State or Federal Guarantee. May Lose Value.

Enter your e-mail address and password to login. For security, we track login attempts.

Don't have an account? Sign Up

Reset Password

Enter your e-mail address to begin the reset password process.

Once entered, we will send a key to the e-mail address you specified. If you use a mail filtering tool make sure you allow email from [email protected] prior to submitting the request.

Nevermind. Go Back

Who are you saving for?

Knowing this helps us better customize your experience

Knowing this helps us better customize your experience and offer better recommendations

I want to learn more about college savings

I'm ready to open a 529 plan

I want to accelerate my 529 plan savings

Get FREE access to:

Track your child’s 529 plan growth and performance

Notifications to help you better manage your child’s 529 plan

Tips on how to accelerate the growth of your child’s 529 plan

Many 529 plans offer gifting platforms to allow friends and family to contribute.

Save time by skipping steps you’ve already completed.

Enter your email address to begin the reset password process.

Once entered, we will send a reset link to the email address you specified. If you use a mail filtering tool make sure you allow email from [email protected] prior to submitting the request.

Popular articles and how-to guides

How to save for college, compare college savings options.

See how 529 plans compare to other types of savings accounts.

- 529 plans vs. Roth IRAs

- Understand Coverdell ESAs

- 6 ways to save for college

What is a 529 Plan?

What is a 529 plan.

529 plans are the best way to save for college.

- How much can I contribute?

- What can I pay for with a 529?

- 529 plans and financial aid

How to Choose a 529 Plan

How to select a 529 plan.

Four steps to choosing the right 529 plan for your family.

- Should I open my state's plan?

- Compare 529 plans

- Best 529 plans

Grandparents and 529 Plans

Before you open a 529 plan....

Five things to consider when saving for a grandchild's college education.

- Why grandparents love 529s

- 10 ways grandparents can help

- Financial aid impact

Find a 529 plan in state Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Other Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Select your state below

Find a 529 plan in, popular tools, getting started.

- College Savings Calculator

- K-12 Savings Calculator

- 529 Comparison Tool

Paying for college

- Financial Aid Calculator

- Find 529 Eligible Institutions

- 529 Savings vs. Loans Calculator

Tools for professionals

- 529 Pro Evaluator

- 529 State Tax Calculator

- 529 Superfunding Calculator

Message Board

Excess 529 plan withdrawl.

If a taxpayer does not qualify for education tax credits (American Opportunity / Lifetime Learning /...

FAFSA Appeal for incorrect EFC

My son has been eligible for the past 2 years for the Federal Pell Grant. He was denied the grant fo...

529 Establishment prior to child being born

If you were a childless couple and want to establish 529 for each spouse and each spouse would be th...

Using 529 money to fund Florida Prepaid College fund

I have two 529 accounts for my son who will begin college in 2020. The sum of those two accounts is ...

- Two kids, two 529 plans?

- Coverdell ESA vs. 529 Plan: Which to choose? (Script)

- Top 529 Plan Withdrawal Tips. (Script)

- Top 529 Plan Withdrawal Tips. (Video)

- What are the 3 biggest 529 plan myths? (Video)

- What are the 3 biggest 529 plan myths? (Script)

Popular Links

- Article Directory

- Learn about student loans

- Financial aid basics

- 529s for grandparents

- 529 ABLE for individuals with disabilities

Best 529 Plans

Smart529 wv direct college savings plan, the education plan's college savings program, future scholar 529 college savings plan (direct-sold), start saving program, florida 529 savings plan, path2college 529 plan.

The 15 lowest-cost 529 savings plans

Can You Use Student Loans to Pay for Rent?

Can I Buy a House and Pay My Mortgage with 529 Plan Money?

6 Best Banks for College Students

Download the Family Guide to College Savings Ebook

The Savingforcollege.com Family Guide is a must-read for all parents with college costs in their future. Whether you have toddlers or teenagers, this ebook will help you develop a simple and cost-effective strategy for saving and paying for college.

Download the free guide today to learn more about:

- Financial aid

- Federal and state tax benefits

- Student loans

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Saving for Education - 529 Plans

Legislative Changes

Setting Every Community Up for Retirement Enhancement (SECURE) Act (2019) made some important changes to 529 plans.

- It allows 529 plan distributions of up to $10,000 to repay qualified student loans of the beneficiary. An additional $10,000 can be used for the qualified student loans of each of the beneficiary’s siblings. The $10,000 cap is a lifetime – not annual – limit.

- It allows 529 plan distributions to pay for registered apprenticeship programs.

What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

There are two types of 529 plans: prepaid tuition plans and education savings plans . All fifty states and the District of Columbia sponsor at least one type of 529 plan. In addition, a group of private colleges and universities sponsor a prepaid tuition plan.

What are the differences between prepaid tuition plans and education savings plans?

Prepaid Tuition Plans . Prepaid tuition plans let a saver or account holder purchase units or credits at participating colleges and universities (usually public and in-state) for future tuition and mandatory fees at current prices for the beneficiary . Prepaid tuition plans usually cannot be used to pay for future room and board at colleges and universities and do not allow you to prepay for tuition for elementary and secondary schools.

Most prepaid tuition plans are sponsored by state governments and have residency requirements for the saver and/or beneficiary. Prepaid plans are not guaranteed by the federal government. Some state governments guarantee the money paid into the prepaid tuition plans that they sponsor, but some do not. If your prepaid tuition payments aren’t guaranteed, you may lose some or all of your money in the plan if the plan’s sponsor has a financial shortfall. In addition, if a beneficiary doesn’t attend a participating college or university, the prepaid tuition plan may pay less than if the beneficiary attended a participating college or university. It may only pay a small return on the original investment.

Education Savings Plans . Education savings plans let a saver open an investment account to save for the beneficiary’s future qualified higher education expenses – tuition, mandatory fees and room and board. Withdrawals from education savings plan accounts can generally be used at any college or university, including sometimes at non-U.S. colleges and universities. Education savings plans can also be used to pay up to $10,000 per year per beneficiary for tuition at any public, private or religious elementary or secondary school.

A saver may typically choose among a range of investment portfolio options, which often include various mutual fund and exchange-traded fund (ETF) portfolios and a principal-protected bank product. These portfolios also may include static fund portfolios and age-based portfolios (sometimes called target-date portfolios). Typically age-based portfolios automatically shift toward more conservative investments as the beneficiary gets closer to college age. If you are using a 529 account to pay for elementary or secondary school tuition, you may have a shorter time horizon for your money to grow. You also may not feel comfortable taking on riskier or more volatile investments if you plan on withdrawing the money soon. Because of these things, you may consider different investment options depending on when you plan to use the money that is invested.

All education savings plans are sponsored by state governments, but only a few have residency requirements for the saver and/or beneficiary. State governments do not guarantee investments in education savings plans. Education savings plan investments in mutual funds and ETFs are not federally guaranteed, but investments in some principal-protected bank products may be insured by the FDIC. As with most investments, investments in education savings plans may not make any money and could lose some or all of the money invested.

What fees and expenses will I pay if I invest in a 529 plan?

It is important to understand the fees and expenses associated with 529 plans because they lower your returns. Fees and expenses will vary based on the type of 529 plan (education savings plan or prepaid tuition plan), whether it is a broker- or direct-sold plan, the plan itself and the underlying investments. You should carefully review the plan’s offering circular to understand what fees are charged for the plan and each investment option.

Prepaid Tuition Plans . Prepaid tuition plans may charge an enrollment/application fee and ongoing administrative fees.

Education Savings Plans . Education savings plans may charge an enrollment/application fee, annual account maintenance fees, ongoing program management fees, and ongoing asset management fees. Some of these fees are collected by the state sponsor of the plan and some are collected by the plan manager . The asset management fees will depend on the investment option you select. Investors that purchase an education savings plan from a broker are typically subject to additional fees, such as sales loads or charges at the time of investment or redemption and ongoing distribution fees.

Fee Saving Tips . Many states offer direct-sold education savings plans in which savers can invest without paying additional broker-charged fees. In addition, some education savings plans will waive or reduce the administrative or maintenance fees if you maintain a large account balance, participate in an automatic contribution plan, or are a resident of the state sponsoring the 529 plan. Some 529 plans also offer fee waivers if the saver accepts electronic-only delivery of documents or enrolls online.

How does investing in a 529 plan affect federal and state income taxes?

Investing in a 529 plan may offer savers special tax benefits. These benefits vary depending on the state and the 529 plan. In addition, state and federal laws that affect 529 plans could change. You should make sure you understand the tax implications of investing in a 529 plan and consider whether to consult a tax adviser.

Contributions . Many states offer tax benefits for contributions to a 529 plan. These benefits may include deducting contributions from state income tax or matching grants but may have various restrictions or requirements. In addition, savers may only be eligible for these benefits if you invest in a 529 plan sponsored by your state of residence.

Withdrawals . If you use 529 account withdrawals for qualified higher education expenses or tuition for elementary or secondary schools, earnings in the 529 account are not subject to federal income tax and, in many cases, state income tax. However, if 529 account withdrawals are not used for qualified higher education expenses or tuition for elementary or secondary schools, they will be subject to state and federal income taxes and an additional 10% federal tax penalty on earnings.

One of the benefits of 529 plans is the tax-free earnings that grow over a period of time. The longer your money is invested, the more time it has to grow and the greater your tax benefits. You will lose some of these potential benefits if you withdraw money from a 529 plan account within a short period of time after it is contributed.

What restrictions apply to an investment in a 529 plan?

There will likely be restrictions on any 529 plan you may be considering. Before you invest in a 529 plan, you should read the plan’s offering circular to make sure that you understand and are comfortable with any plan restrictions.

Investments . Education savings plans have certain pre-set investment options. It is not permitted to switch freely among the options. Under current tax law, an account holder is only permitted to change his or her investment option twice per year or when there is a change in the beneficiary.

Withdrawals . With limited exceptions, you can only withdraw money that you invest in an education savings plan for qualified higher education expenses or tuition for elementary or secondary schools without incurring taxes and penalties. Beneficiaries of prepaid tuition plans may only use their purchased credits or units at participating colleges or universities. If a beneficiary doesn’t attend a participating college or university, the prepaid tuition plan may pay less than if the beneficiary attended a participating college or university. It may only pay a small return on the original investment.

Does investing in a 529 plan impact financial aid eligibility?

While each educational institution may treat assets held in a 529 account differently, investing in a 529 plan will generally impact a student’s eligibility to receive need-based financial aid for college. You may also need to consider how having money in your 529 account for future qualified higher education expenses might affect financial aid for your student’s elementary or secondary school tuition. For many families, the larger part of a financial aid package may be in loans. So, the more you can save for school, the less debt you or your student may have to incur.

Where can I find more information?

Offering Circulars for 529 Plans . You can find out more about a particular 529 plan by reading its offering circular. The National Association of State Treasurers created the College Savings Plan Network , which provides links to most 529 plan websites.

Underlying Mutual Funds or Exchange-Traded Funds . Additional information about a mutual fund or ETF that is an investment option in an education savings plan is available in its prospectus , statement of additional information, and semiannual and annual shareholder reports . You can obtain these documents from the plan manager for no charge. You can also review these documents on the SEC’s EDGAR database .

Fees and Expenses. You can read about the impact fees and expenses have on your investment portfolios in the SEC’s Office of Investor Education and Advocacy’s Investor Bulletin: How Fees and Expenses Affect Your Investment Portfolio .

Brokers or Investment Advisers. Many education savings plans’ program managers are registered investment advisers. You can search for an investment adviser and view its Form ADV on Investor.gov . You can also search for any disciplinary sanctions against a broker who may sell a 529 savings plan product, as well as information about his or her professional background and registration and licensing status, on Investor.gov .

Financial Aid . You can read more about federal financial aid at the U.S. Department of Education’s Federal Student Aid website .

Other Online Resources. You can learn more about 529 plans and other education saving options on FINRA’s Saving for College website . The website contains links to other sites, including the College Savings Plan Network and the Internal Revenue Service’s Publication 970 (Tax Benefits for Higher Education) . You can also find educational information about 529 plans on the Municipal Securities Rulemaking Board’s education center website .

Featured Content

Investing Quiz – April 2024

Celebrate financial capability month by testing your knowledge of IRAs, index funds, and more!

Free Financial Planning Tools

Access savings goal, compound interest, and required minimum distribution calculators and other free financial tools.

Loud Budgeting

What is “loud budgeting” and how can it help you meet your financial goals? Learn more by reading our latest Director’s Take article.

How to Open a Brokerage Account

Read our Investor Bulletin to learn what to expect when opening a brokerage account.

Sign up for Investor Updates

IMAGES

VIDEO

COMMENTS

WHAT IS. A 529 PLAN? WHY CHOOSE THE EDUCATION PLAN? EXPLORE INVESTMENT OPTIONS. Take the Pledge to Save for Higher Education. With just $500 saved, children are three times more likely to attend. and four times more likely to graduate college. TAKE THE PLEDGE. SET A GOAL. START SAVING.

529 plans are tax-advantaged accounts that can be used to pay educational expenses from kindergarten through graduate school. There are two basic types of 529 plans: educational savings plans...

A 529 plan is an investment account that offers tax-free withdrawals and other benefits when used to pay for qualified education expenses. You can use a 529 plan to pay for college, K-12 tuition, apprenticeship programs, and even student loan repayments.

Updated: Apr 1, 2024, 1:17pm. Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations. For most parents looking...

A 529 is a tax-advantaged college savings plan designed to help students reach their full potential. Learn more about what a 529 plan is and how it can help your family reach its future education goals. WHAT IS A 529 PLAN? OPEN AN ACCOUNT. Making Contributions to Your 529 Account.

529 plans are flexible, tax-advantaged accounts designed specifically for education savings. Funds can be used for qualified education expenses at schools nationwide. Open a 529 account. Before you start you will need to know the child's date of birth, social security number and what investment choices you want. Current account owners - log in.

Open an account with just $1. Variety of uses and qualified expenses. OPEN AN ACCOUNT. Top Reasons to Save with The Education Plan. From tax savings to the low-fee structure and multiple ways to invest, there are many reasons to choose The Education Plan for your future education and college savings goals. Here are the top reasons.

529 plans are the best way to save for college. How much can I contribute? What can I pay for with a 529? 529 plans and financial aid. How to Choose a 529 Plan. Four steps to choosing the right 529 plan for your family. Should I open my state's plan? Compare 529 plans. Best 529 plans. Grandparents and 529 Plans.

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

A 529 plan, also known as a qualified tuition plan, is a tax-advantaged savings plan designed to help you pay for education. While 529 plans were originally earmarked for college and...