- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

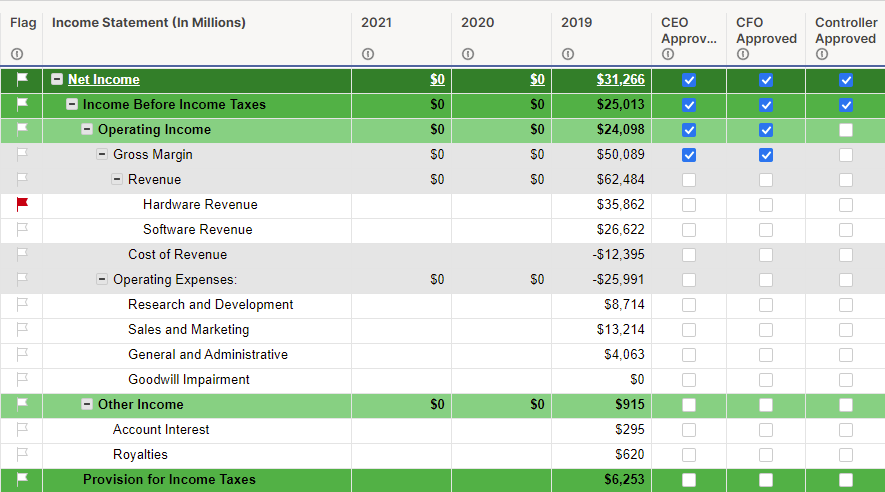

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

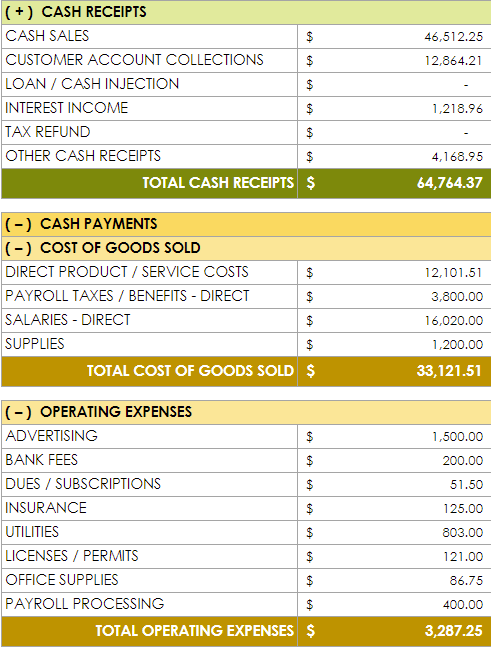

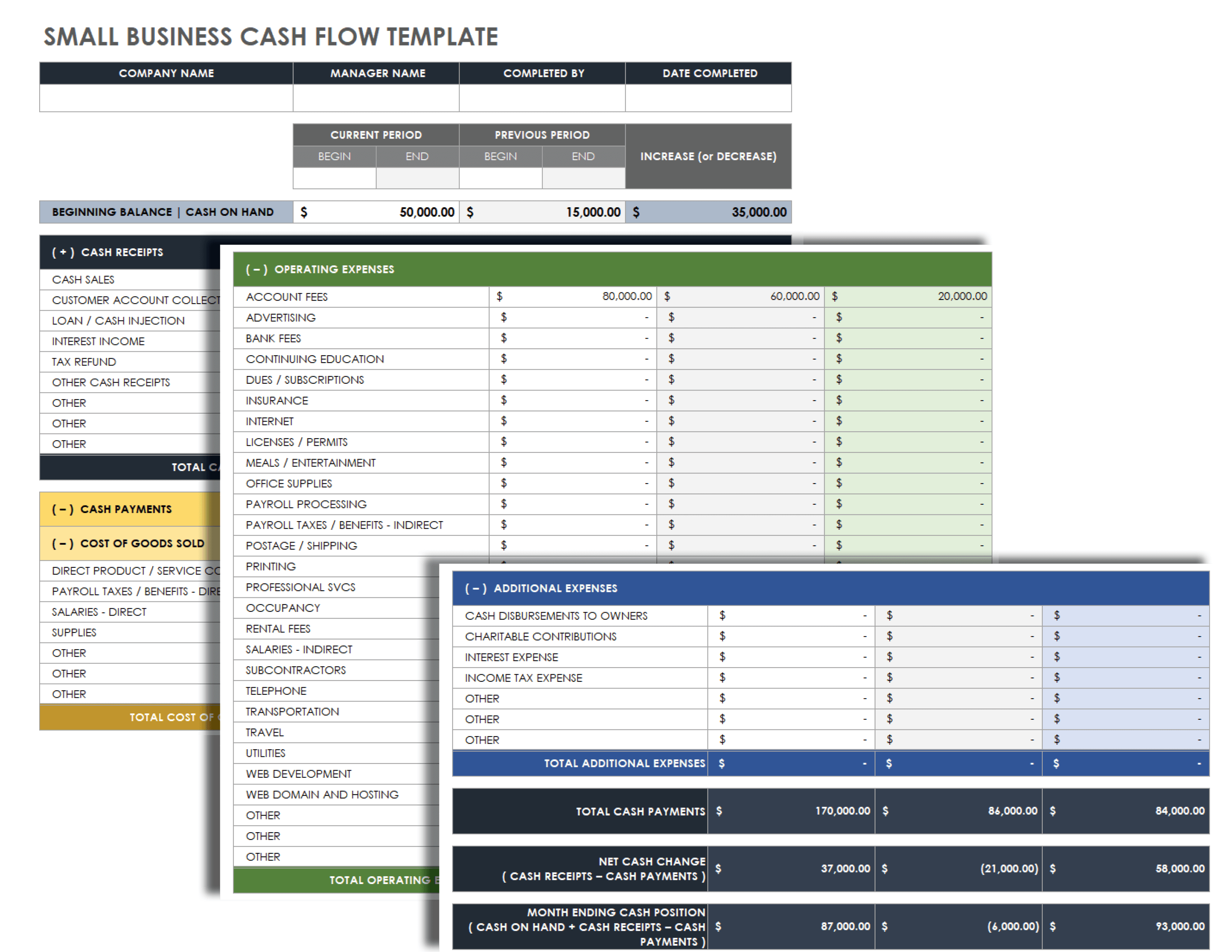

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

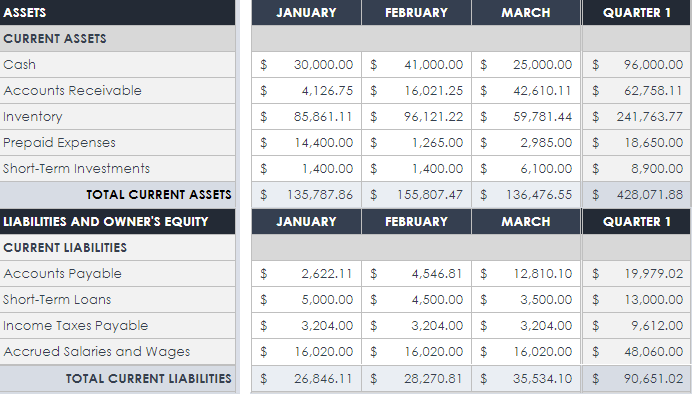

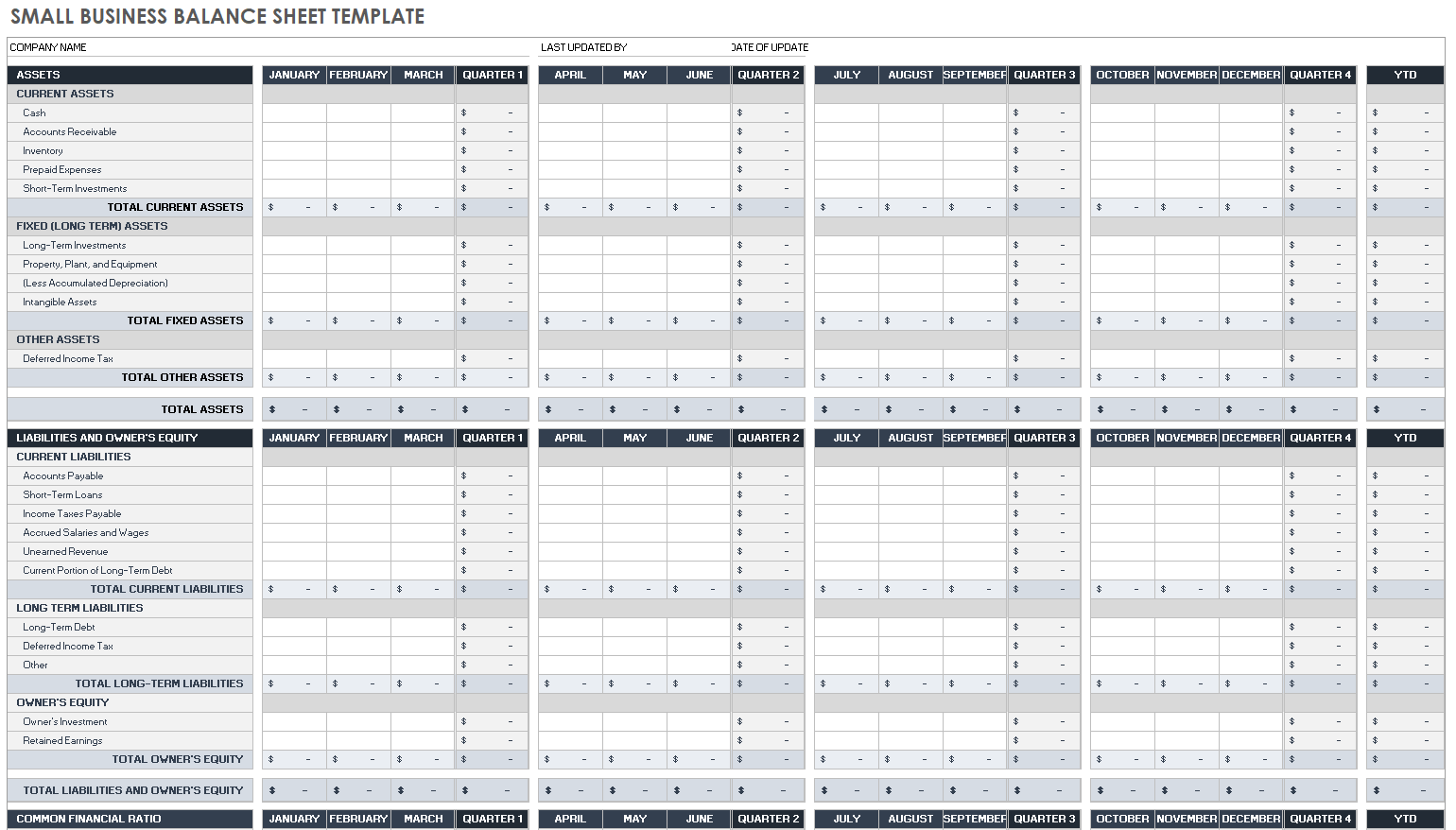

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

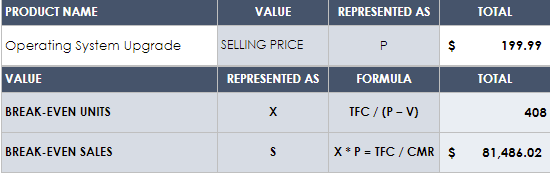

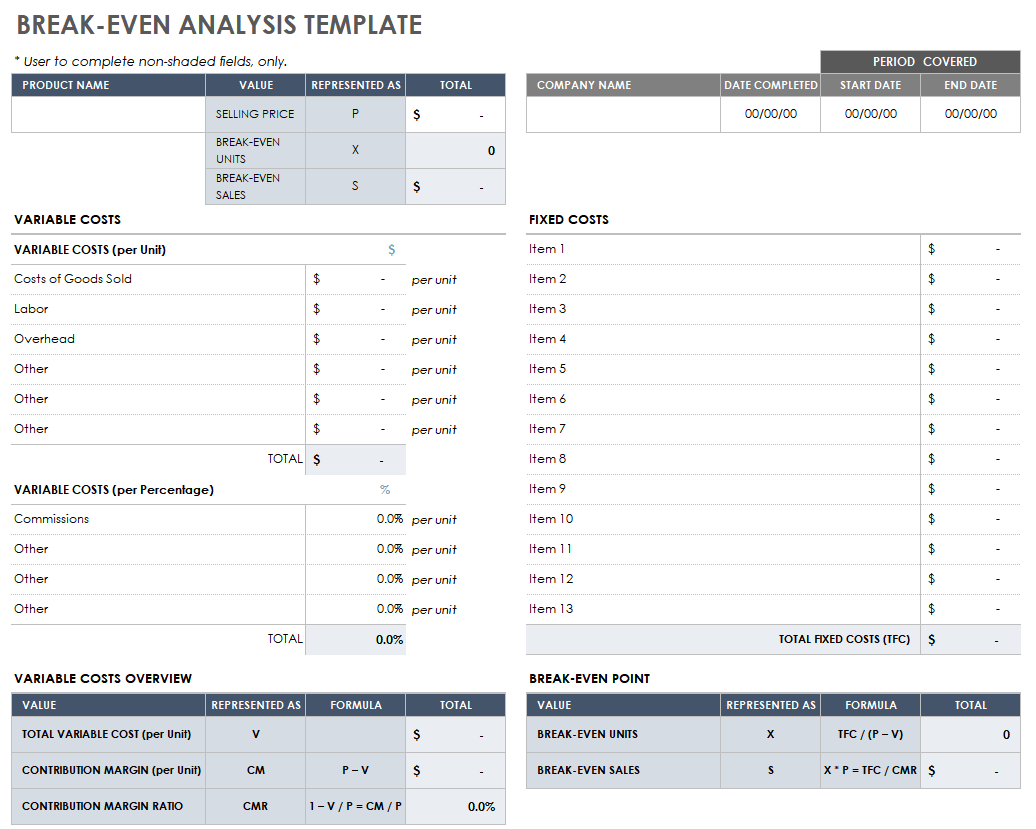

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

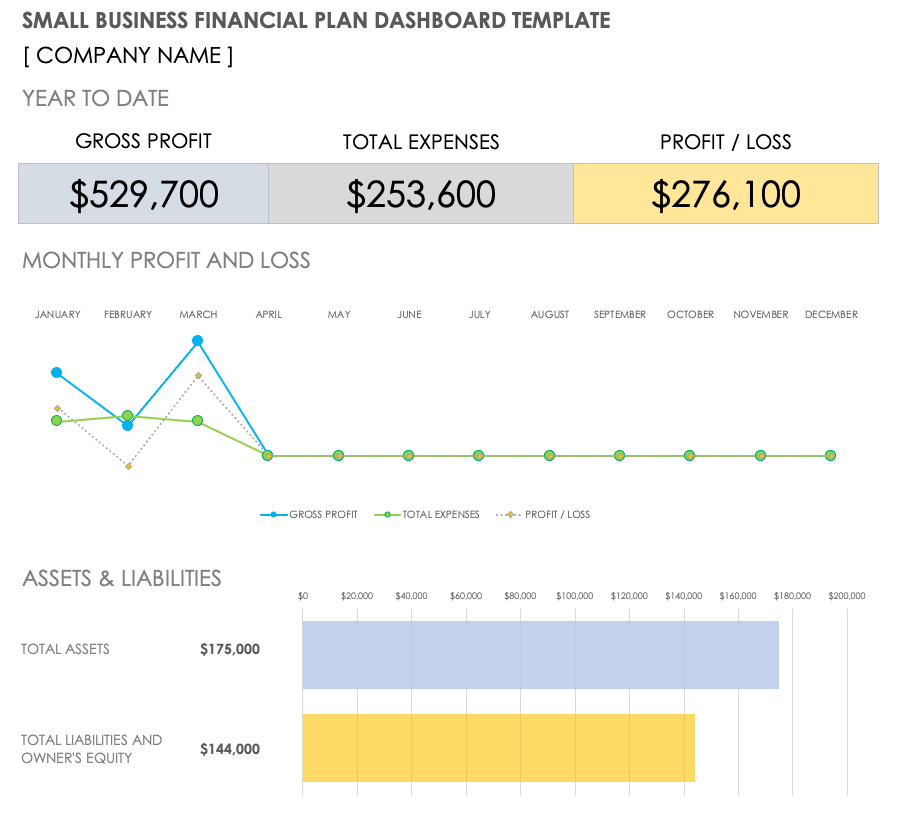

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

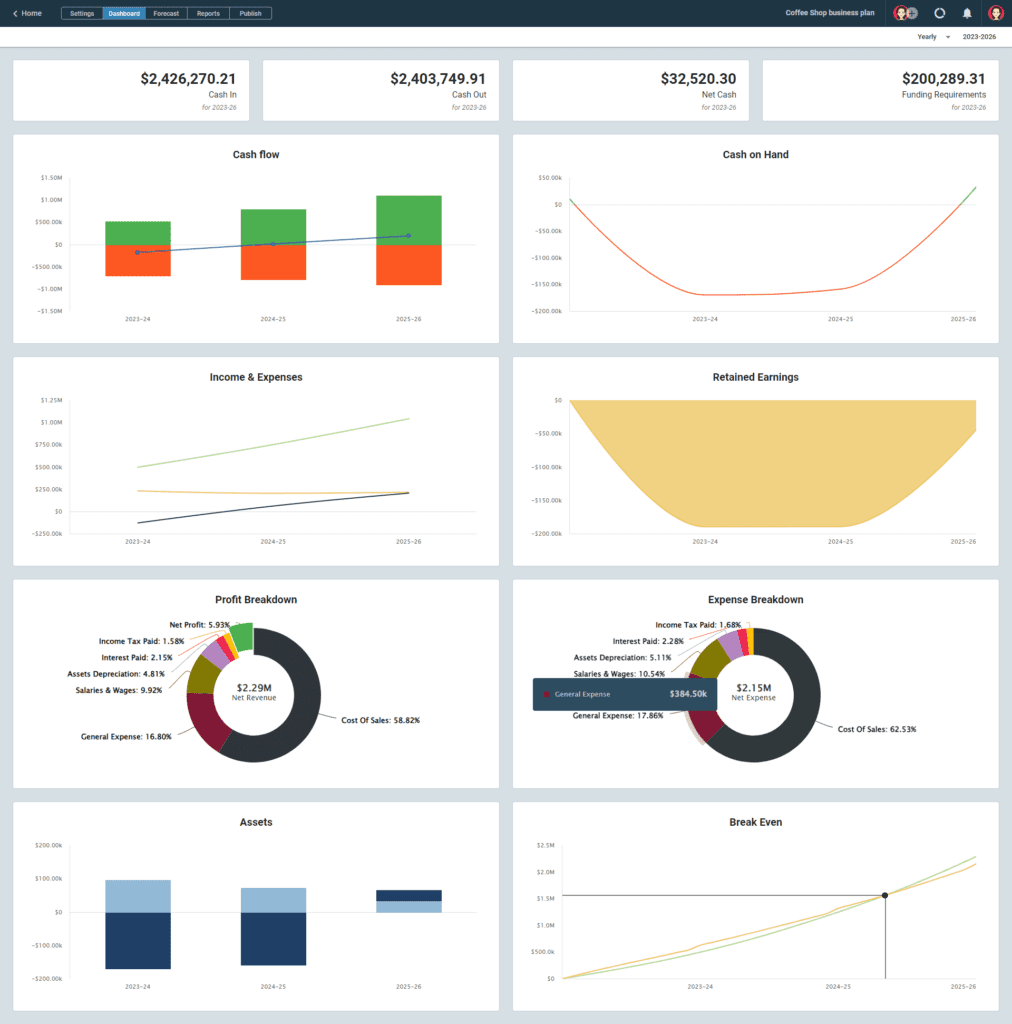

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

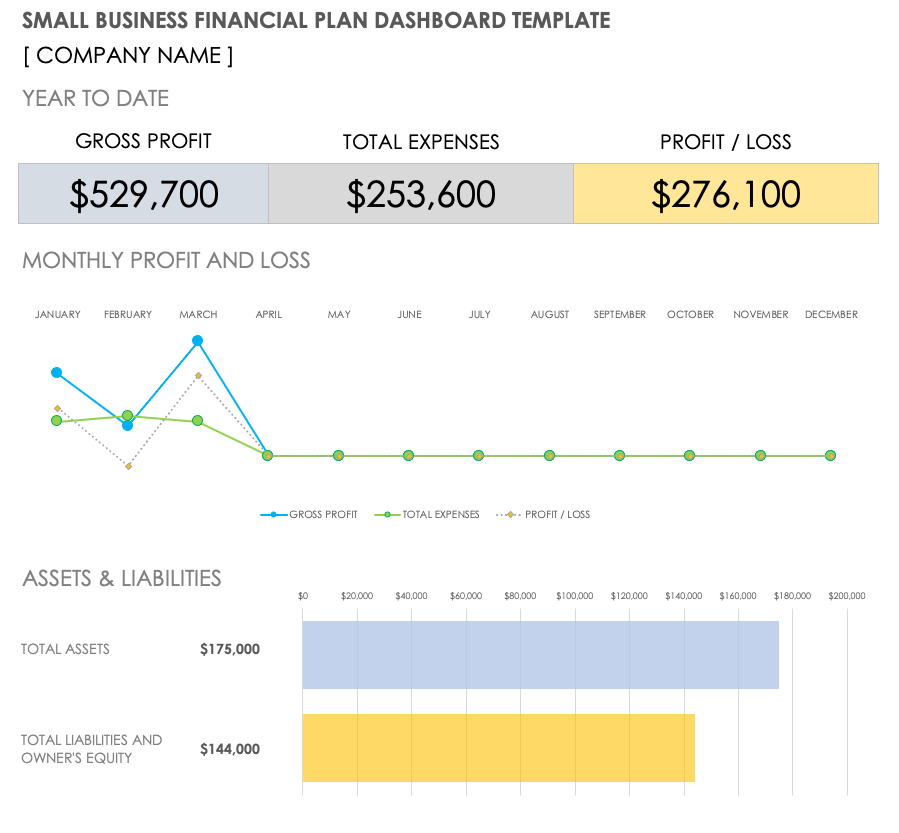

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

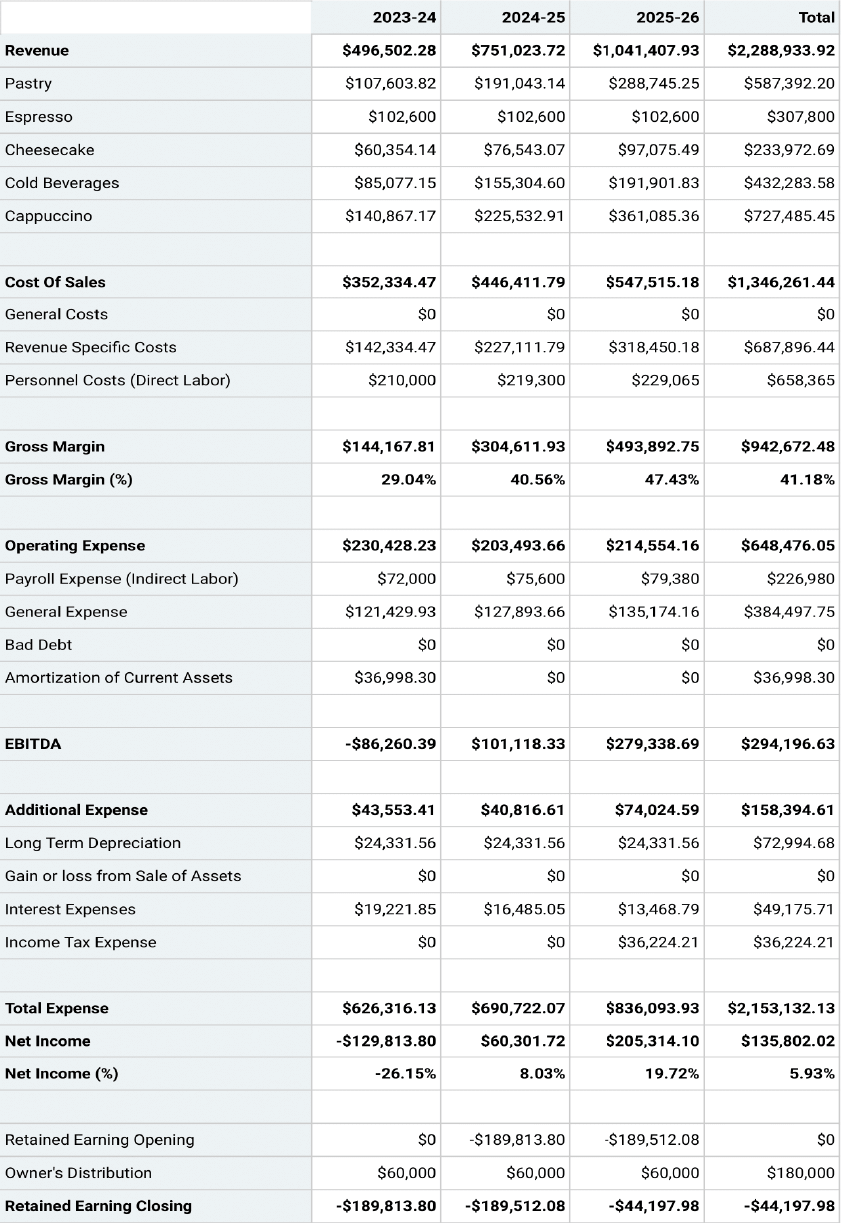

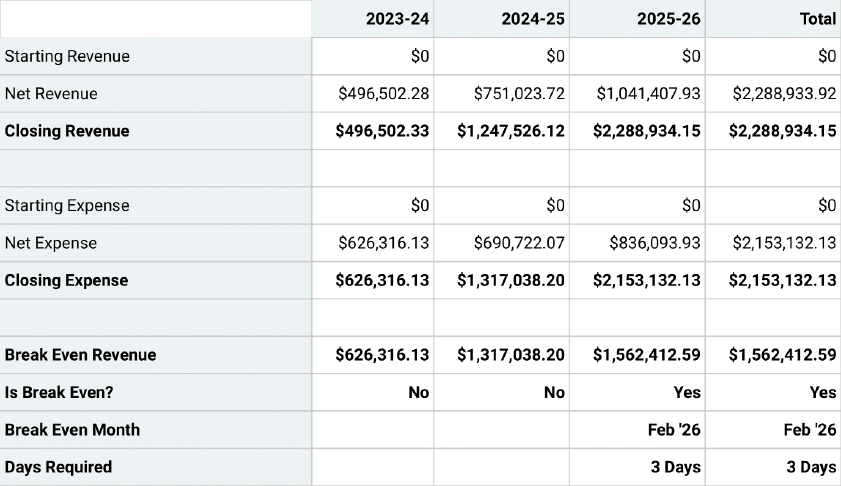

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

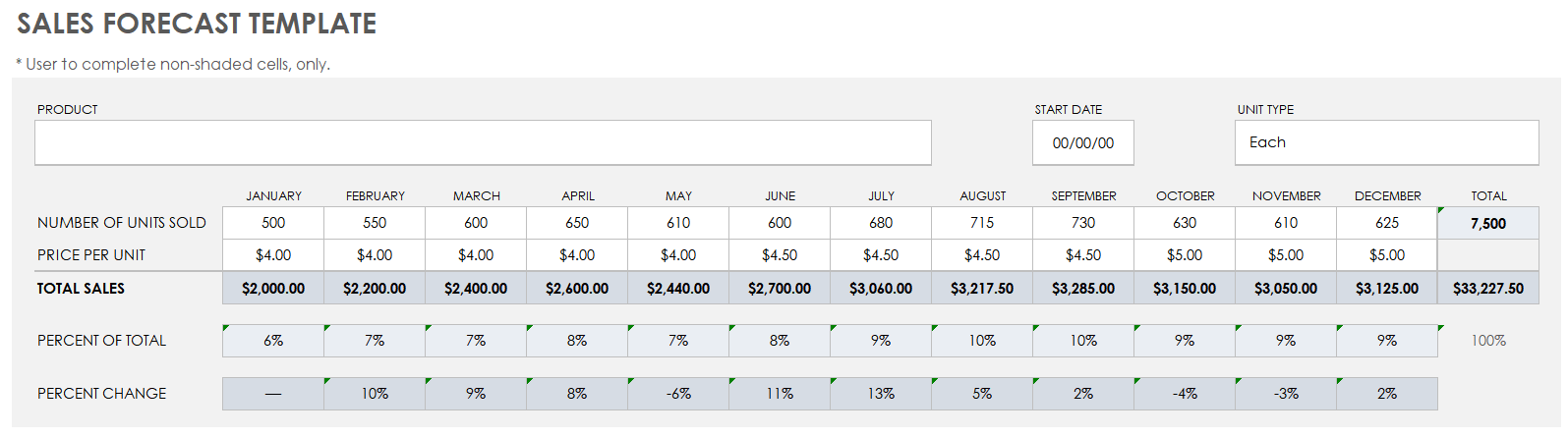

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

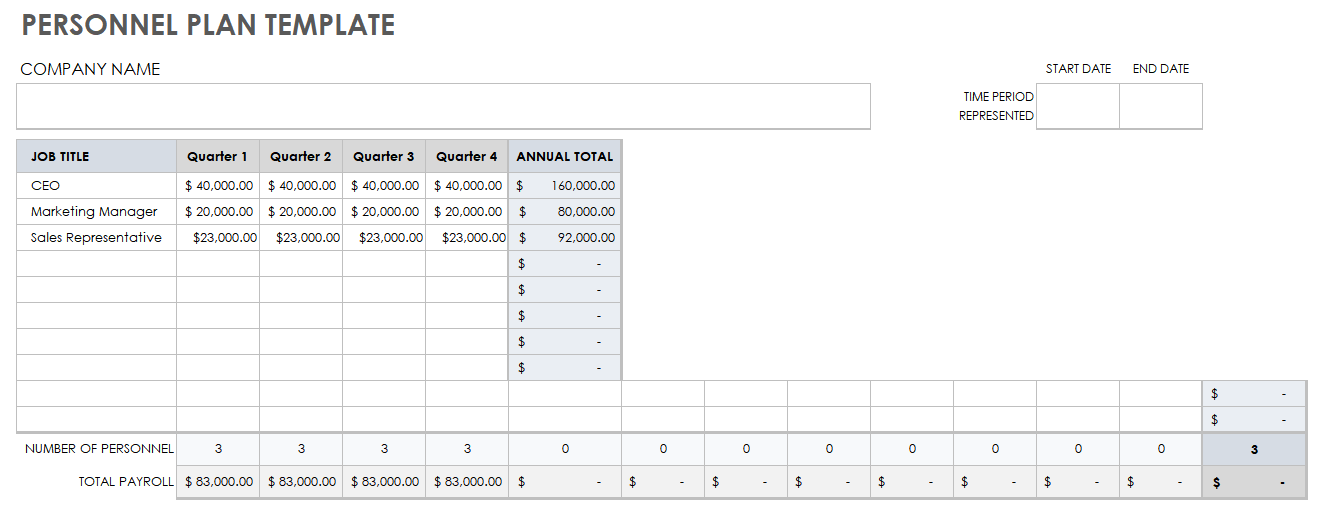

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

How to Write the Company Overview for a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

- Franchise Trends

- The Female Founder

- The Roadmap

- The Small Business Show

- U.S. Chamber of Commerce Small Business Update

- Company Culture

- Customer Experience

- Entrepreneurship

- Growth Strategy

- Recruitment

- Small Business Grants

- Social Media

- Contribute Content Request

- Show Appearance Request

How entrepreneurs embrace risk, vision, leadership, and resilience for business success…

Last 8% culture: the key to high performance and innovation in…, how aarti sahgal bridges the gap between people with disabilities and…, melinda emerson unveils key branding strategies for business success.

- business plan

- small busienss

- balance sheet

How to Complete the Financial Section of Business Plan

A plan intends to explain the business, introduce critical contributors, products and, services and defines the goals for the future. It paints a picture of the founder’s expectations and helps others see their vision. The financial section of the plan provides the proof behind the story. It is the section that investors and lenders are most interested in, and often the first section they read, despite it being near the end of the plan. It also acts as a roadmap and a guide for the direction the company will take into the future.

Financial Section Elements

While it may sound complicated, the financial section of a business plan only contains three documents and a brief explanation of each. It is necessary to prepare an income statement, cash flow projection and a balance sheet either using spreadsheets, or software that does all of the calculations automatically. Before beginning this statement, it’s necessary to gather the following information:

Business Start-Up Expenses

This list of all of the costs associated with getting the business up and running comprises what primarily are one-time fees such as registering the company. Following is only a partial list of possible start-up costs, every business is unique, and the list may, or may not, contain these items and more.

- Business registration fees

- Licensing and permits

- Product inventory

- Deposit on rental property

- Down payment to purchase property

- Down payment on machines and equipment

- Set-up fees for utilities

Business Operating Costs

As the name implies, operating costs are the ongoing expenses that need to be paid to keep the business running. These expenses are usually monthly bills, and for a start-up, estimate six months worth of these costs. A company’s list of operating expenses might include:

- Monthly mortgage payment or rent

- Logistics and distribution

- Marketing and promotion

- Loan paymentsRaw materials

- Office supplies

- Building/vehicle maintenance

The Income Statement

This financial statement details the company’s revenues, expenses, and profit for a set period. Established businesses generated these annually, or semi-annually, based on actual performance. Start-ups with no previous years to look at have to use statistical data within the industry to make reasonable projections. A start-up will also produce monthly versions of this statement to show the forecast of growth. This section will include the data such as:

- Gross revenue (sales, interest income and sales of assets)

- General and administrative expenses (start-up and operating costs)

- Corporate tax rate (expected tax liabilities)

The math is simple here: subtract the expenditures from the revenue, and the remaining number is profit. When put into the proper format, an income statement gives a clear view of the financial viability of a company.

Cash-Flow Projection

This statement shows how you expect cash to flow in to, and out of, your business. It’s an essential internal cash management tool and a source of data that shows what your business’s capital needs will be in the near future. For investors and bank loan officers, it helps determine your creditworthiness and amount you can borrow. The cash-flow projection contains three parts:

- Cash revenues — This part details the incoming cash from sales for specific periods of time, usually monthly. It is an estimate, based upon past performance and future projections for current businesses, and industry averages for start-ups.

- Cash disbursements — Every monthly bill or other expense that is paid out in cash gets listed in this section. As with revenue, these are estimates, either based upon historical data, current data, or industry data.

- Cash flow projection — This merely is a reconciliation of the cash revenues to cash disbursements. Adding the current month’s revenues to the carried-over balance, then subtracting the month’s disbursements creates estimated cash flow.

The Balance Sheet

The final financial statement required for the business plan’s financial section is a balance sheet. This statement is a snapshot of the company’s net worth at a given point in time. Established businesses produce a balance sheet annually. Information from the income statement and cash flow projection are used to complete this statement. It summarizes the business’s financial data into three main categories:

- Assets — This is the total of all of the tangible items that the company owns that hold monetary value. That includes equipment, property, and cash-on-hand, for example.

- Liabilities — This is the total amount of debt that the company owes its creditors. You’ll include every debt, whether recurring, one-time, fixed, or variable.

- Equity — This is merely the difference between the company’s assets, including retained earnings and current earnings, and its liabilities.

Side-Notes and Details

In some cases, it may be necessary to explain details within the financial statements. Denote these instances within the statement and include a brief explanation sheet as an attachment. It may also be useful to add information on the process used to estimate revenues and expenses, which will show interested parties the intent and help them better understand the data.

Don’t Sweat the Process

It’s important to note that the order in which these financial statements is created may vary from the way they are presented here. This is to be expected. In fact, most business plan creators end up going back and forth with these statements as the numbers reveal the business’s financial reality. It paints a crystal clear picture of its economic viability, which can present to a lender, investor, or shareholder with confidence.

All of these financial documents can be created by using accounting and business software readily available online. Even so, some people aren’t entirely comfortable creating financial statements for their business plan, and outsource this critical task to a professional. Even the largest corporations struggle with financial planning and reporting, and they often hire the job out to someone more qualified. It’s merely a matter of making sure that the data is accurate, easy to track, and based on sound accounting practices.

Related Articles

How entrepreneurs embrace risk, vision, leadership, and resilience for business success – george deeb | red rocket ventures, how to avoid audit risks filling for a business tax extension, last 8% culture: the key to high performance and innovation in the workplace – dr. jp pawliw-fry | ihhp.

- Terms of Use

- Privacy Policy

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

6 Small Business Financial Statements for Startup Financing

Financial Statements You'll Need for Your Startup Business Plan

You're ready to start your small business and your're working on a great business plan to take to a bank or other lender. A key part of that plan is the financial statements. These statements will be looked at carefully by the lender, so here are some tips for making these documents SELL your business plan .

Financial Statements You Will Need

You may need several different types of statements, depending on the requirements of your lender and your own technical expertise.

The statements you will certainly need are:

- A startup budget or cash flow statement

- A startup costs worksheet

- A pro forma (projected) profit and loss statement

- A pro forma (projected) balance sheet

Your lender may also want these financial statements:

- Sources and uses of funds statement

- Break-even analysis

Putting these Statements in Order

First, work on your startup budget and your startup costs worksheet. You'll need to do a lot of estimating.

The trick is to underestimate income and overestimate expenses, so you can create a more realistic picture of your business over the first year or two.

Then work on a profit and loss statement for the first year. A lender will definitely want to see this one. And, even though it's not going to be accurate, lenders like to see a startup balance sheet.

Some lenders may ask for a break-even analysis, a cash flow statement, or a sources and uses of funds statement. We'll go over these statements so you can quickly provide them if asked.

Business Startup Budget

A startup budget is like a projected cash flow statement, but with a little more guesswork.

Your lender wants to know your budget - that is, what you expect to bring in and how much to expect to spend each month. Lenders want to know that you can follow a budget and that you will not over-spend.

They also want to see how much you will need to pay your bills while your business is starting out (working capital), and how long it will take you to have a positive cash flow (bring in more money than you are spending).

Include some key information on your budget:

- What products or services you are selling, including prices and estimated volumes

- Key drivers for expenses, like how many employees you'll need and your marketing initiatives

A typical budget worksheet should be carried through three years, so your lender can see how you expect to generate the cash to make your monthly loan payments.

Startup Costs Worksheet

A startup costs worksheet answers the question "What do you need the money for?" In other words, it shows all the purchases you will need to make in order to open your doors for business. This could be called a "Day One" statement because it's everything you will need on your first day of business.

- Facilities costs, like deposits on insurance and utilities

- Office equipment, computers, phones

- Supplies and advertising materials like signs and business cards

- Fees to set up your business website and email

- Legal fees licenses and permits

Profit and Loss Statement/Income Statement

After you have completed the monthly budget and you have gathered some other information, you should be able to complete a Profit and Loss or Income Statement. This statement shows your business activity over a specific period of time, like a month, quarter, or year.

To create this statement, you'll need to list all your sources to get your gross income over that time. Then, list all expenses for the same time.

Because you haven't started yet, this statement is a called a projected P&L, because it projects out your estimates into the future.

This statement gathers up all your sources of income, including shows your profit or loss for the year and how much tax you estimate having to pay.

Break-Even Analysis

A break-even analysis shows your lender that you know the point at which you will start making a profit or the price that will cover your fixed costs . The break-even analysis is primarily for businesses making or selling products, or to set the right price for a product or service.

It's usually shown as a graph with sales volume on the X axis and revenue on the Y axis. Then fixed an variable costs (those you must pay) are included. The break-even point marks the place where costs are covered.

This analysis can also be useful for service-type businesses to show an overall profit point for specific services. If you include a break-even analysis, be sure you can explain it.

Beginning Balance Sheet

A startup balance sheet is difficult to prepare, even if there isn't much to include. The balance sheet shows the value of the assets you have purchased for startup, how much you owe to lenders and other creditors, and any initial investments you have made to get started. The date for this spreadsheet is the day you open the business.

Sources and Uses of Funds Statement

Large businesses use Sources and Uses of Funds statements in their annual reports, but you can create a slightly different simple statement to show your lender what you need the money for, what sources you have already, and what's left over to be financed.

To create this statement, list all your startup and working capital(on-going cash needs), how much collateral you will be bringing to the business, other sources of funding, and how much you need to borrow.

Optional: A Business Requirements Document

A business requirements document is similar to a proposal document, but for a larger, more complex project or startup. It gives a complete picture of the project or the business plan. It goes into more detail on the project that will be using the financial statements.

Include Financial Statements in Your Business Plan

You will need a complete startup business plan to take to a bank or other business lender. The financial statements are a key part of this plan. Give the main points in the executive summary and include all the statements in the financial section.

Finally, Check for Mistakes!

Before you submit your startup business plan and financial statements, check this list. Don't make these common business plan mistakes !

Check all numbers for accuracy and consistency. Especially make sure the amounts you are requesting are specific and that they are the same throughout all the parts of your business plan.

SCORE.org. " How to Set Up and Maintain a Budget for Your Small Business ." Accessed Sept. 10, 2020.

SCORE.org. " Financial Projections Template ." Accessed Sept. 10, 2020.

Harvard Business Review. " A Quick Guide to Breakeven Analysis ." Accessed Sept. 10, 2020.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Become a small business member and save!

Become an integral voice in the world’s largest business organization when you join the U.S. Chamber of Commerce as a small business member. Members also receive exclusive discounts from B2B partners, including a special offer from FedEx that can help your business save hundreds a year on shipping. Become a member today and start saving!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

Micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one, how to use ai tools to write a business plan.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Home > Finance > Accounting

The 6 Most Useful Financial Documents for Small Businesses

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

The day you opened your doors, you had an inkling of how much paperwork doing business would entail—from signing building leases to tracking customer receipts. But unless you were already familiar with bookkeeping basics , you might not have known just how crucial the right financial documents are to your success.

How so? Because the right financial information helps you check your business’s temperature. Are you running too hot, burning through cash too fast? Or is your business too cold, leaving you with fewer sales than you need to turn a net profit? The documents we list below will help you find out. Keep reading to learn what these documents are, how they work, and how they can help you keep your business in the black.

Six most useful financial documents for small businesses

- Income statement

- Cash flow statement

- Balance sheet

- Accounts receivable aging report

- Business plan

- Budget report

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

1. Income statement

An income statement lists your revenue and expenses to indicate if your business is profitable or not—which is why an income statement is your business’s most important document.

To create an income statement, list all your sources of revenue (e.g., income from property you lease or money made from sales). Next, list your direct costs, or all the money you invest directly in creating your product or selling your service. When you subtract direct costs from revenue, you end up with your gross profit .

- Profit and loss statement (P&L)

- Statement of income

- Statement of operations

- Revenue statement

2. Cash flow statement

A cash flow statement documents how cash is flowing into and out of your business in three main categories: operations, investments, and financing. The statement shows which parts of your business are creating the most cash and which areas are spending the most cash.

Cash flow statements are useful for calculating upcoming budgets. For instance, if you have a negative cash flow, meaning you’re spending more money than you’re making, the statement clearly identifies places for you to cut back in next month’s budget.

Plus, if you’re looking for investors, the cash flow statement clearly shows if your business is profitable or not—which can impact who wants to invest and how much. And if the documents reveal you're likely to lose money, you might decide you need a small business loan until profit rolls in someday.

By signing up I agree to the Terms of Use and Privacy Policy .

3. Balance sheet

A balance sheet shows you if your assets balance with your liabilities at a specific moment in time. In other words, the document relies on a fundamental accounting equation:

Assets = Liabilities + Equity

Think of a balance sheet as a snapshot of your business’s financial health—on one side of the sheet, you list your (tangible and intangible) assets, and on the other side, you list your liabilities (like debts owed) and equity (the amount you or other shareholders invested in the company). The numbers on both sides of the sheet should be the exact same. If you have more liabilities than you do assets, you’re losing money and need to reevaluate.

And now that we've covered the top three most useful financial documents. we should tell you there are tools to help you manage all these jargon-laced papers. Accounting and bookkeeping software, such as Intuit QuickBooks , can offer a simple point-and-click solution. We recommend comparing some of the best bookkeeping software titles out there to discover the most ideal option for your business.

4. Accounts receivable aging report

The accounts receivable aging report (a.k.a. the A/R aging report or, simply, the aging report) is a list of overdue customer invoices. The aging report covers when a customer’s payment was due, how late the payment is, and how to contact the customer for collection purposes.

5. Business plan

A business plan maps out where your business is, where you hope it’s going, and how you plan to get there. The document can be pretty informal, especially if you just want to use it internally to guide your company’s strategy. But if you want to share your business plan with investors or lenders, you’ll want it to look a little more formal. In particular, it should include information about your business and the details of your financial plan.

6. Budget report

While other financial documents show you where your business stands, a budget report is a future projection based on the financial documents in your repertoire, particularly the cash flow statement and income statement. The numbers in a budget report estimate your projected income and losses over a specific period of time, from a month to several years. A bookkeeper or bookkeeping software can draw up a budget report template that makes the most sense for your unique business.

The takeaway

When you put in the time to assemble and analyze these financial documents, you’re giving yourself the tools to keep your small business on track. Set aside some time each week (at least!) to balance your books, draw up crucial financial reports, and create financial goals for the coming weeks, months, and years.

Need a way to quickly assemble accurate documents? See our page on the best bookkeeping software for small businesses.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Compare the year's best accounting software

Data as of 3/9/23. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 90% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

Primarily, these key financial documents are for you, but they’re also the first things other stakeholders will use to evaluate your business’s profitability. For instance, if you want to take out a small-business loan, your lender will always look at your income statement, business plan, and several other documents to boot.

You can draw up most of these documents using a spreadsheet program like Excel or Google Sheets. If you want to save time, accounting software like QuickBooks Online will generate these types of documents for you and help identify trends that could impact your bottom line.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

How to Develop a Small Business Financial Plan

By Andy Marker | April 29, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Financial planning is critical for any successful small business, but the process can be complicated. To help you get started, we’ve created a step-by-step guide and rounded up top tips from experts.

Included on this page, you’ll find what to include in a financial plan , steps to develop one , and a downloadable starter kit .

What Is a Small Business Financial Plan?

A small business financial plan is an outline of the financial status of your business, including income statements, balance sheets, and cash flow information. A financial plan can help guide a small business toward sustainable growth.

Financial plans can aid in business goal setting and metrics tracking, as well as provide proof of profitable ideas. Craig Hewitt, Founder of Castos , shares that “creating a financial plan will show you if your business ideas are sustainable. A financial plan will show you where your business stands and help you make better decisions about resource allocation. It will also help you plan growth, survive cash flow shortages, and pitch to investors.”

Why Is It Important for a Small Business to Have a Financial Plan?

All small businesses should create a financial plan. This allows you to assess your business’s financial needs, recognize areas of opportunity, and project your growth over time. A strong financial plan is also a bonus for potential investors.

Mark Daoust , the President and CEO of Quiet Light Brokerage, Inc., explains why a financial plan is important for small businesses: “It can sometimes be difficult for business owners to evaluate their own progress, especially when starting a new company. A financial plan can be helpful in showing increased revenues, cash flow growth, and overall profit in quantifiable data. It's very encouraging for small business owners who are often working long hours and dealing with so many stressful decisions to know that they are on the right track.”

To learn more about other important considerations for a small business, peruse our list of free startup plan, budget, and cost templates .

What Does a Small Business Financial Plan Include?

All small businesses should include an income statement, a balance sheet, and a cash flow statement in their financial plan. You may also include other documents, such as personnel plans, break-even points, and sales forecasts, depending on the business and industry.

- Balance Sheet: A balance sheet determines the difference between your liabilities and assets to determine your equity. “A balance sheet is a snapshot of a business’s financial position at a particular moment in time,” says Yüzbaşıoğlu. “It adds up everything your business owns and subtracts all debts — the difference reflects the net worth of the business, also referred to as equity .” Yüzbaşıoğlu explains that this statement consists of three parts: assets, liabilities, and equity. “Assets include your money in the bank, accounts receivable, inventories, and more. Liabilities can include your accounts payables, credit card balances, and loan repayments, for example. Equity for most small businesses is just the owner’s equity, but it could also include investors’ shares, retained earnings, or stock proceeds,” he says.

- Cash Flow Statement: A cash flow statement shows where the money is coming from and where it is going. For existing businesses, this will include bank statements that list deposits and expenditures. A new business may not have much cash flow information, but it can include all startup costs and funding sources. “A cash flow statement shows how much cash is generated and used during a given period of time. It documents all the money flowing in and out of your business,” explains Yüzbaşıoğlu.

- Break-Even Analysis: A break-even analysis is a projection of how long it will take you to recoup your investments, such as expenses from startup costs or ongoing projects. In order to perform this analysis, Yüzbaşıoğlu explains, “You need to know the difference between fixed costs and variable costs. Fixed costs are the expenses that stay the same, regardless of how much you sell or don't sell. For example, expenses such as rent, wages, and accounting fees are typically fixed. Variable costs are the expenses that change in accordance with production or sales volume. “In other words, [a break-even analysis] determines the units of products or services you need to sell at least to cover your production costs. Generally, to calculate the break-even point in business, divide fixed costs by the gross profit margin. This produces a dollar figure that a company needs to break even,” Yüzbaşıoğlu shares.

- Personnel Plan: A personnel plan is an outline of various positions or departments that states what they do, why they are necessary, and how much they cost. This document is generally more useful for large businesses, or those that find themselves spending a large percentage of their budget on labor.

- Sales Forecast: A sales forecast can help determine how many sales and how much money you expect to make in a given time period. To learn more about various methods of predicting these figures, check out our guide to sales forecasting .

How to Write a Small Business Financial Plan

Writing a financial plan begins with collecting financial information from your small business. Create income statements, balance sheets, and cash flow statements, and any other documents you need using that information. Then share those documents with relevant stakeholders.

“Creating a financial plan is key to any business and essential for success: It provides protection and an opportunity to grow,” says Yüzbaşıoğlu. “You can use [the financial plan] to make better-informed decisions about things like resource allocation on future projects and to help shape the success of your company.”

1. Create a Plan

Create a strategic business plan that includes your business strategy and goals, and define their financial impact. Your financial plan will inform decisions for every aspect of your business, so it is important to know what is important and what is at stake.

2. Gather Financial Information

Collect all of the available financial information about your business. Organize bank statements, loan information, sales numbers, inventory costs, payroll information, and any other income and expenses your business has incurred. If you have not already started to do so, regularly record all of this information and store it in an easily accessible place.

3. Create an Income Statement

Your income statement should display revenue, expenses, and profit for a given time period. Your revenue minus your expenses equals your profit or loss. Many businesses create a new statement yearly or quarterly, but small businesses with less cash flow may benefit from creating statements for shorter time frames.

4. Create a Balance Sheet

Your balance sheet is a snapshot of your business’s financial status at a particular moment in time. You should update it on the same schedule as your income statement. To determine your equity, calculate all of your assets minus your liabilities.

5. Create a Cash Flow Statement

As mentioned above, the cash flow statement shows all past and projected cash flow for your business. “Your cash flow statement needs to cover three sections: operating activities, investing activities, and financing activities,” suggests Hewitt. “Operating activities are the movement of cash from the sale or purchase of goods or services. Investing activities are the sale or purchase of long-term assets. Financing activities are transactions with creditors and investments.”

6. Create Other Documents as Needed

Depending on the age, size, and industry of your business, you may find it useful to include these other documents in your financial plan as well.

- Sales Forecast: Your sales forecast should reference sales numbers from your past to estimate sales numbers for your future. Sales forecasts may be more useful for established companies with historical numbers to compare to, but small businesses can use forecasts to set goals and break records month over month. “To make future financial projections, start with a sales forecast,” says Yüzbaşıoğlu. “Project your sales over the course of 12 months. After projecting sales, calculate your cost of sales (also called cost of goods or direct costs). This will let you calculate gross margin. Gross margin is sales less the cost of sales, and it's a useful number for comparing with different standard industry ratios.”

7. Save the Plan for Reference and Share as Needed

The most important part of a financial plan is sharing it with stakeholders. You can also use much of the same information in your financial plan to create a budget for your small business.

Additionally, be sure to conduct regular reviews, as things will inevitably change. “My best tip for small businesses when creating a financial plan is to schedule reviews. Once you have your plan in place, it is essential that you review it often and compare how well the strategy fits with the actual monthly expenses. This will help you adjust your plan accordingly and prepare for the year ahead,” suggests Janet Patterson, Loan and Finance Expert at Highway Title Loans.

Small Business Financial Plan Example

Download Small Business Financial Plan Example Microsoft Excel | Google Sheets

Here is an example of what a completed small business financial plan dashboard might look like. Once you have completed your income statement, balance sheet, and cash flow statements, use a template to create visual graphs to display the information to make it easier to read and share. In this example, this small business plots its income and cash flow statements quarterly, but you may find it valuable to update yours more often.

Small Business Financial Plan Starter Kit

Download Small Business Financial Plan Starter Kit

We’ve created this small business financial plan starter kit to help you get organized and complete your financial plan. In this kit, you will find a fully customizable income statement template, a balance sheet template, a cash flow statement template, and a dashboard template to display results. We have also included templates for break-even analysis, a personnel plan, and sales forecasts to meet your ongoing financial planning needs.

Small Business Income Statement Template

Download Small Business Income Statement Template Microsoft Excel | Google Sheets

Use this small business income statement template to input your income information and track your growth over time. This template is filled to track by the year, but you can also track by months or quarters. The template is fully customizable to suit your business needs.

Small Business Balance Sheet Template

Download Small Business Balance Sheet Template Microsoft Excel | Google Sheets

This customizable balance sheet template was created with small businesses in mind. Use it to create a snapshot of your company’s assets, liabilities, and equity quarter over quarter.

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Template Microsoft Excel | Google Sheets

Use this customizable cash flow statement template to stay organized when documenting your cash flow. Note the time frame and input all of your financial data in the appropriate cell. With this information, the template will automatically generate your total cash payments, net cash change, and ending cash position.

Break-Even Analysis Template

Download Break-Even Analysis Template Microsoft Excel | Google Sheets

This powerful template can help you determine the point at which you will break even on product investment. Input the sale price of the product, as well as its various associated costs, and this template will display the number of units needed to break even on your initial costs.

Personnel Plan Template

Download Personnel Plan Template Microsoft Excel | Google Sheets

Use this simple personnel plan template to help organize and define the monetary cost of the various roles or departments within your company. This template will generate a labor cost total that you can use to compare roles and determine whether you need to make cuts or identify areas for growth.

Sales Forecast Template

Download Sales Forecast Template Microsoft Excel | Google Sheets

Use this customizable template to forecast your sales month over month and determine the percentage changes. You can use this template to set goals and track sales history as well.

Small Business Financial Plan Dashboard Template

Download Small Business Financial Plan Dashboard Template Microsoft Excel | Google Sheets

This dashboard template provides a visual example of a small business financial plan. It presents the information from your income statement, balance sheet, and cash flow statement in a graphical form that is easy to read and share.

Tips for Completing a Financial Plan for a Small Business

You can simplify the development of your small business financial plan in many ways, from outlining your goals to considering where you may need help. We’ve outlined a few tips from our experts below:

- Outline Your Business Goals: Before you create a financial plan, outline your business goals. This will help you determine where money is being well spent to achieve those goals and where it may not be. “Before applying for financing or investment, list the expected business goals for the next three to five years. You can ask a certified public accountant for help in this regard,” says Thé. The U.S. Small Business Administration or a local small business development center can also help you to understand the local market and important factors for business success. For more help, check out our quick how-to guide on writing a business plan .

- Make Sure You Have the Right Permits and Insurance: One of the best ways to keep your financial plan on track is to anticipate large expenditures. Double- and triple-check that you have the permits and insurances you need so that you do not incur any fines or surprise expenses down the line. “If you own your own business, you're no longer able to count on your employer for your insurance needs. It's important to have a plan for how you're going to pay for this additional expense and make sure that you know what specific insurance you need to cover your business,” suggests Daost.

- Separate Personal Goals from Business Goals: Be as unbiased as possible when creating and laying out your business’s financial goals. Your financial and prestige goals as a business owner may be loftier than what your business can currently achieve in the present. Inflating sales forecasts or income numbers will only come back to bite you in the end.

- Consider Hiring Help: You don’t know what you don’t know, but fortunately, many financial experts are ready to help you. “Hiring financial advisors can help you make sound financial decisions for your business and create a financial roadmap to follow. Many businesses fail in the first few years due to poor planning, which leads to costly mistakes. Having a financial advisor can help keep your business alive, make a profit, and thrive,” says Hewitt.