- Introduction to Financial Accounting

(4 reviews)

David Annand, Athabasca University

Henry Dauderis

Copyright Year: 2017

Last Update: 2021

Publisher: Lyryx

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Katheryn Zielinski, Assistant Professor, Minnesota State University Mankato on 6/14/23

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students... read more

Comprehensiveness rating: 5 see less

The text reading follows typical financial accounting flow. Beginning with the foundational introduction to what accounting is through the full accounting cycle, while including financial statement analysis towards the end of the book. Students will find the format helpful; the voice is student-friendly. There is online homework help for students. Instructors will find the text format friendly to semester-long class as concepts broken down into 13 chapters. The chapters explain the learning outcomes, use examples to express concepts, with chapter summary at end. The topics included are consistent with intro accounting courses.

Content Accuracy rating: 5

No issues noticed with accuracy. The text includes accurate financial accounting information.

Relevance/Longevity rating: 5

For an introductory accounting class with focus on US the concepts covered are typical.

Clarity rating: 5

The content is presented in a student friendly manner. Answers are provided. The extra information is helpful for students wanting extra practice.

Consistency rating: 5

The format and layout of the book chapters are consistent. All users will quickly understand the format as it is applied the same to each chapter. This helps provide consistency for students learning introductory accounting.

Modularity rating: 5

The content within the chapters can be broken-down and assigned as instructor plans for the course length. The manner is which the material is presented flows easily as reading.

Organization/Structure/Flow rating: 5

The text organization is consistent and coherent. Each chapter is presented in same manner.

Interface rating: 5

No observed tech issues. PDF downloaded and used with ease.

Grammatical Errors rating: 5

No grammar or language issues.

Cultural Relevance rating: 5

No cultural insensitive or offensive context noted.

This is a student friendly text. However, students might find a glossary helpful, as well as an index.

Reviewed by Lawrence Overlan, Part-time Professor, Bunker Hill Community College on 6/4/20

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week.... read more

Comprehensiveness rating: 4 see less

I appreciate how the Statement of Cash Flows has a separate chapter towards the end of the book. Might be better to wait until that chapter instead of also discussing it in Chapter One.....lots of material for opening week....

I sampled several problems...all correct.

Hard to make accounting obsolete. All the required material is present.

Problems are presented clearly and with good font size. Excellent color schemes and graphics.

Yes....no problems detected in this area. Very straightforward.

Chapters contain the right amount of content. Not too long with out breakup diagrams or examples etc.

Standard flow of chapters with excellent subdivisions.

To the contrary, the graphics and flow charts break up the material very nicely.

No issues noticed in this area.

Nice work! I will definitely consider adopting.

Reviewed by Patty Goedl, Associate Professor, University of Cincinnati Clermont College on 3/27/18

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that... read more

The text covers all of the topics normally found in an introductory financial accounting (principles of accounting I) text. The table of contents essentially mirrors the table of contents found in the leading texts in this field. I like that this text also covers the classified balance sheet, financial disclosures and partnerships.

Content is error-free, accurate, and unbiased.

Relevance/Longevity rating: 4

The content is up-to-date. Introductory accounting does not change often so future updates should be minimal. The authors used the year 2015 in most of the problem and examples. This might make the text "seem" out-of-date in a few years.

The book is clear and concise. The topics are clearly explained and the technical terminology is appropriate for an introductory level.

The writing, style, and formatting are consistent throughout this text.

The text is divided into topical chapters, which is appropriate considering that the concepts build on each other. The chapters are further subdivided into sub-topics. This makes it easy for an instructor to pick which sub-topics to cover.

Excellent organization and flow. The concepts logically build upon each other and the material is presented in a clear fashion.

The HTML interface is excellent. The book has good graphics, end of chapter content, and even video examples.

I did not notice grammatical errors.

The text is not culturally insensitive or offensive in any way

Excellent book that is comparable to any of the leading financial accounting titles. The authors even provide end of chapter problems, videos, and interactive Excel problems for students. Overall, a great resource! I commend the authors for making something of this caliber freely available.

Reviewed by Margarita Maria Lenk, Associate Professor, Colorado State University on 1/7/16

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial... read more

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It is written by Canadian authors, but is relevant to US students. The text begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

My reviewed resulted in highest marks regarding accuracy. The only possible concern I would mention here is that the authors use a commonly used technique in chapter two which sometimes leads to students misunderstanding that revenues and expenses are not part of owners' equity until the revenues and expenses are closed at year end to retained earnings. It is my preference to teach introductory students that revenues and expenses are distinct and separate from equity, and then explain that revenues and expenses ultimately get closed to equity. So, this is not an inaccuracy by the authors, just a point that some instructors may want to know before adopting the textbook.

It is my opinion that the content of this textbook will be relevant and current for at least a decade. Any changes made to accounting principles, Canadian or International, will be very easy and straightforward to update.

It is my opinion that the clarity of this text is very high. The authors are succinct and use visuals often to highlight the theoretical structures.

This test is very consistent with the framework that is set up by the authors in the beginning of the text.

The textbook is very clearly divided into separable modules, making it easy for both students to read and for instructors to choose which modules to include in their course.

The content of this textbook matches the content and organization of most introductory financial accounting textbooks. It begins by explaining the role of financial accounting in society, and then describes the underlying structure of double entry accounting systems and the process of recording economic events that impact the value of the organization through the journals and the ledger. The records of these events are then summarized into the primary financial statements. The numeric subtotals and totals on these statements are used to calculate standard financial measures and ratios used to evaluate the organization's performance. The text's organization then proceeds sequentially through the balance sheet accounts, explaining in more detail how the accounting for each category of economic value is recorded and reported. The author's decision to move the most complex content to the end of the book matches how most faculty choose to organize their coverage of these topics.

The online text worked perfectly in my Chrome browser. The end of chapter exercises and problems are perfectly formatted on the screen. All assessment materials (quizzes, exams, etc.) are located on a different site that requires registration to have access.

I found the grammar to be very clear, concise and very effective. Because the book is written by Canadians, expenses are sometimes referred to as revenue expenditures, which does not match how US textbooks refer to expenses, but is perhaps a better learning tool, as the expenses are always recorded in the period in which they match the revenue generation, so I support the authors' choices regarding how they refer to the difference between assets (capital expenditures) and expenses (revenue expenditures).

The textbook adequately refers to the international accounting standards. That is the only cultural relevance which is relevant to introductory financial accounting.

I found this textbook and its exercises to be a useful teaching and learning tool. Instructors and students have access to pre-made PowerPoint slides, exercises and problems, and there is the option to enrol in an online service for online assessments, which seem to have student feedback capabilities in addition to assessment gathering capabilities.

Table of Contents

- The Accounting Process

- Financial Accounting and Adjusting Entries

- The Classified Balance Sheet and Related Disclosures

- Accounting for the Sale of Goods

- Assigning Costs to Merchandise

- Cash and Receivables

- Long-lived Assets

- Debt Financing: Current and Long-term Liabilities

- Equity Financing

- The Statement of Cash Flows

- Financial Statement Analysis

- Proprietorships and Partnerships

Ancillary Material

About the book.

This textbook is an adaptation by Athabasca University of the original text written by D. Annand and H. Dauderis. It is intended for use in entry-level college and university courses in financial accounting. A corporate approach is utilized consistently throughout the book.

The adapted textbook includes multiple ancillary student and instructor resources. Student aids include solutions to all end-of-chapter questions and problems, and randomly-generated spreadsheet problems that cover key concepts of each chapter. These provide unlimited practice and feedback for students. Instructor aids include an exam bank, lecture slides, and a comprehensive end-of-term case assignment. This requires students to prepare 18 different year-end adjusting entries and all four types of financial statements, and to calculate and analyze 16 different financial statement ratios. Unique versions can be created for any number of individual students or groups. Tailored solutions are provided for instructors.

The original Annand/Dauderis version of the textbook including .docx files and ancillary material remains available upon request to D. Annand ([email protected]).

About the Contributors

David Annand, EdD, MBA, CA, is a Professor of Accounting in the Faculty of Business at Athabasca University. His research interests include the educational applications of computer-based instruction and computer mediated communications to distance learning, the effects of online learning on the organization of distance-based universities, and the experiences of instructors in graduate-level computer conferences.

David completed his Doctorate in Education in 1998. His thesis deals with the experiences of instructors in graduate-level computer conferences.

Contribute to this Page

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Financial Accounting and Reporting Classroom Materials

Financial Accounting and Reporting is an important part of the accounting curriculum. The skills students learn in your classroom will not only prepare them for more advanced courses, but to one day succeed in a career. The below are supplemental curriculum resources that the AICPA Academics team have reviewed and think can be used in the classroom.

Award-Winning Curricula

The Academics team is proud to offer award-winning curricula designed to encourage faculty and expand the knowledge of accounting students. The curricula below is from the Accounting Professors Curriculum Resource tool and has been recognized for excellence with the Bea Sanders/AICPA Innovation and Teaching Award , the George Krull/Grant Thornton AAA Innovation in Junior and Senior-Level Teaching Award, or the Mark Chain/FSA Innovation in Graduate Teaching Award .

- A Better Way to Teach Effective Interest Method Related Problems in Accounting This resource presents a simpler method of teach accounting problems involving the use of the effective interest method. The method stimulates student interest by focusing on the economics of the transaction and relating it to real-life examples.

- Accounting in the Headlines: A News Blog for the Introductory Accounting Classroom This resource shares Wendy Tietz's "Accounting in the Headlines" blog in which she writes stories about real-life companies and events that can be used in the accounting classroom to illustrate introductory financial and managerial accounting concepts.

- Accounting Challenge (ACE): Mobile-Gaming App for Learning Accounting Accounting Challenge is the first mobile-gaming app for teaching financial accounting. ACE aims to enhance learning of accounting outside the classroom by engaging students to play and learn accounting on the go.

- A FASB Accounting Standards Codification Project for Introductory Financial Accounting This exercise is designed as a team project in which introductory accounting students act as a consultants to a client seeking guidance on issues surrounding a start-up venture. Students must access and cite the Codification as the basis for the materials they submit in fulfillment of the project requirements.

- Attracting the Best and Brightest to Accounting: Establishing an Honors Accounting Course This resource presents one school's approach to attracting and recruiting the best and brightest students toward accounting by offering an honors accounting course.

- Beyond Debits and Credits... Service Learning in Accounting This resource presents a service learning project implemented in two accounting courses to enhance student skills in communication and teamwork.

- Business From the Idea to the Seasoned Offering: Accounting and Financial Statements Reflecting Business Activities This project takes accounting education from bookkeeping to holistic active business learning including how financial statements build to reflect the business.

- Chocolate: Accounting as a First year Seminar This resource provides a thematic approach at combining first year seminars and accounting programs using student activities that are simultaneously engaging and assessable.

- Creative Strategies for Teaching MBA Level Accounting This resource presents a new concept for teaching accounting to MBA level students. At its heart, accounting centers on measurement of historical transactions or the measurement of future opportunities. this course turns the focus from rules, to the tools leaders need to manage a complex organization.

- Cultivating Deep Learning in the Principles of Accounting Classes through Philanthropy-Based Education This philanthropy project goes beyond service learning or volunteerism. Students make real decisions that have immediate impacts on their community. Students award funding to not-for-profit agencies based on a competitive proposal process.

- Digital Storytelling for Engaged Student Learning This resource uses digital story telling, a movie, to enhance students' technical competence in accounting. The story uses 12 episodes to follow three young business graduates who started their own business and discover along the way the role of financial information in managing a business venture.

- FASB Accounting Standards Codification: Student-Authored Research Exercises This resource is based on the notion that the best way to learn something is to teach it. Students in a financial accounting graduate class demonstrate their master of GAAP research skills by creating research assignments using the FASB Accounting Standards Codification.

- Forming Groups in the Age of YouTube This resource uses a variation of speed dating as a means for forming groups in an introductory accounting class. By learning more about their classmates prior to self-selecting a group this method allows students to choose better groups.

- Getting Started in the Throughbred Horse Business: A Review of Some Basic Accounting Principles This resource provides reinforcement of common accrual accounting concepts centered on the breeding and racing operations of a small thoroughbred horse business. This curriculum is appropriate to use after students have been exposed to fixed assets, inventory, profit and loss and cash flow reporting.

- IFRS Immersion This resource provides instructions for teaching an IFRS course from the standpoint of foreign companies that have already dealt with the problems and issues associated with converting from local GAAP to international GAAP.

- IFRS Projects Using Dual Reporting of IFRS and U.S. GAAP This resource illustrates integrating IFRS learning into financial accounting curricula by incorporating valuable contrasting information from the dual reporting.

- Integrated Accounting Principles: A New Approach to Traditional Accounting Principles Courses This resource describes an integrated accounting principles course that combines traditional financial and managerial accounting courses into a single six hour course.

- Introducing Freshmen Students in the Accounting/Finance Course to the Library This resource describes a series of online, interactive tutorials and quizzes to help students learn fundamental concepts and skills of company and industry related research.

- Introduction to Financial Accounting Case Project: Arctic Blast Ice Cream Store This case provides an opportunity for students to apply accounting concepts to a simple business venture. The project lasts 4-6 weeks and covers three distinct phases of the management process: business decision making, performance and evaluation.

- Let's Go to the Movies: Using Movies as an Ethics Assignment This project involves students watching a series of predetermined movies and noting the ethical dilemma. At the end of the semester each student must defend one of the movies as a nominee for "A Must See Ethics Movie" for accounting/business students.

- Mini-responsibility Centers: A Strategy for Learning by Leading This resource explains the concept of using mini-responsibility centers (MRCs) to decentralize large financial, managerial and cost accounting courses. In return the students are more focused and engaged.

- Modeling Uncertainty in C-V-P Assignments: Going Beyond the Basics! This resource provides an outline for using the Monte Carlo Simulation to offer graduate students an opportunity to rapidly come to insights about probabilistic model building and interpretation. The simulation combines quantitative skills and qualitative skills along with reports and presentations.

- Northwind Data Query Exercise This project encourages students to consider the evolution of data sources for financial reporting and evaluate how to acquire and manipulate information in this emerging business reality; by actually practicing queries and exporting information to worksheets.

- Reinventing Student Engagement and Collaboration within Introductory Accounting Courses This resource provides ideas for increasing engagement and collaboration in the introductory accounting class. Examples include student projects, flipped classroom applications and in-class problems.

- Responsibilities and Choices: An Active Engagement Exercise for Introductory Accounting Courses This exercise provides students with an opportunity to perform a basic due diligence task, complete a relatively simple working paper to document their work and make a decision. The exercise has embedded moral temptation and ethical issues and examines ethical choices that students make in the presence of time pressure and reward structures that encourage aggressive performance.

- TeachingIFRS.com This document provides information on TeachingIFRS.com which was created in response to the rapid growth of IFRS and lack of high quality and effective teaching resources. The site consolidates and provides links to numerous freely available IFRS pedagogical materials.

- Testing Critical Thinking Skills in Accounting Principles This resource describes a method for testing critical thinking skills in an accounting principles course. Using this method, each testing period is divided into two parts. First, students complete an individual traditional test. The second part is a critical thinking exercise called "the challenge problem".

- The Accounting Profession Post Sarbanes-Oxley: An Approach to Impart Knowledge About the Conceptual Framework and Attract Students to the Accounting Major This document provides the description of a program entitled "The Accounting Profession Post Sarbanes-Oxley". The program provides students with an opportunity to better understand important elements of the conceptual framework. It also provides an overview of the career opportunities in accounting.

- The Accounting Tournament - March Madness in Financial Accounting This resource describes implementation of an end of year comprehensive review using brackets as a model. Students are randomly placed in the bracket and compete against each other for extra credit points.

- The Amazing Accounting Race: An Introductory Accounting Semester Project This project engages students with an exciting internet race around the professional world of accounting. Students obtain clues to complete tasks, encounter detours, road blocks and fast forwards. The assignments utilize students' synthesis skills and computer application skills as they collect facts about accounting careers from the internet and assemble data in an organized format.

- The College to Professional Experience This resource outlines a program that serves to better prepare students for the "real world" by changing the perception of education from "learning by doing" to "doing and making to learn with technology". The project aims to move beyond traditional models of education to leverage technology to facilitate new methods of delivery and understanding.

- The Farming Game and the Introductory Financial Accounting Course: An Accounting Simulation The Farming Game enables students to develop many of the skill-based competencies needed by students entering the accounting profession, regardless of career path. The Game provides experiential learning of various accounting principles. It is a learning opportunity that offers students a degree of reality and a larger view of the system.

- Understand FX Risk by Playing Monopoly This resource uses a short version of Monopoly to understand the FX risk impact on net income.

- Back to the Future: Using Accounting History to Explore Professional Opportunities In this project students read an article about a period of time in accounting history and present their findings to the class in a video format. Students then tie what they have learned in the presentations to the field of accounting today as well as the future.

- From Pacioli to Picasso: Using Art to Enhance Critical Thinking in Accounting Capstone Courses This resource outlines using name cards, picture drawings and classic artwork to help students enhance their critical thinking skills. The exercise sets the tone for a course that requires them to think about more than rules and regulations and instead delve into the "why" and "what could be."

- Digging Deep: Using Forensic Analytics as a Context to Teach Microsoft Excel and Access This resource describes a graduate level case that focuses on the development of technology skills through the lens of forensic analysis.

- Who Moved My Classroom? Community Linked Learning and Assessment This resource describes three exercises that expand learning beyond the classroom. The first exercise allows students to discover the linkage between classroom studies and what practitioners do in the "real world". The second allows students to apply the COSO model to internal controls. The third requires students to interpret financial statements for a friend.

Additional Materials

Here are additional materials we reviewed and think are useful to incorporate into the classroom.

- IIRC Database of Research on Integrated Reporting The International Integrated Reporting Council (IIRC) launched the <IR> Academic Database, a searchable collection of more than 200 articles, books, chapters, dissertations, and other pieces of scholarly research on the advancement, adoption, and practice of integrated reporting.

- A destination is only as good as its compass. The new My 360 is here to help you create a free plan personalized to your financial needs by helping guide you through all the resources 360 Degrees of Financial Literacy has to offer.

We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

About AICPA

- Mission and History

- Annual Reports

- AICPA Media Center

- AICPA Research

- Jobs at AICPA

- Order questions

- Forgot Password

- Store policies

Association of International Certified Professional Accountants. All rights reserved.

- Terms & Conditions

Multiple Choice

Answers will vary but should include factors such as starting salaries, value of fringe benefits, cost of living, and other monetary factors.

Answers will vary but should include considerations such as price, convenience, features, ease of purchase, availability, and other decision-making factors.

Responses should comment on the growth Netflix has experienced. Although this may have been due to subscription price increases, the biggest driver of these increases is the number of subscriptions. While this is only a few data points, it does appear likely that Netflix will continue to grow sales in the next year or so. Factors influencing this prediction would be competition, changes in the streaming market, and economic considerations.

Answers will vary, but responses should state, in a sentence or two, the primary purpose of the entity. The goal of this exercise is to have students clearly communicate why the entity exists, the stakeholders served by the entity, and the role accounting plays in the organization.

Answers will vary but should highlight aspects of each model: Brick-and-mortar : higher investment in physical storefront, interior, etc., to attain visual appeal; insurance and regulatory requirements; space/storage considerations; lower delivery costs; no delivery time. Online : less overhead costs, higher delivery costs, higher website and technology costs, competition.

Manufacturer: movies; service: hotels, restaurants, waste removal, entertainment; retail: shopDisney, clothes and apparel.

Answers will vary but should include the key services of the SEC related to regulation and enforcement. You may be particularly interested to explore the SEC’s whistle-blowing initiatives. Responses regarding required filings for publicly traded companies should include a discussion about the relationship between transparency and protecting the public interest. The significant amount of invested capital by the investing public is also relevant to the discussion.

Answers will vary but should include the increase in popularity of energy drinks and Monster’s partnership with the Coca-Cola Company (which now owns close to a 17% stake in Monster). Considerations as to whether or not to purchase Monster shares today would include the estimated future performance of the company, the energy drink market, purchasing at a high point, etc.

Answers will vary but should include a discussion of the importance for accountants to provide information that is unbiased. Accountants have an obligation to protect the public interest by reporting information that is useful for decision-making but does not sway the user in a particular way. Accountants are in a unique position where they serve many stakeholders, including their employer, clients, and the public. The interests of all stakeholders must be considered while maintaining the highest level of integrity.

Answers will vary and may include certifications/licensing in nursing, information technology, engineering, human resources management, counseling, medicine, and many other occupations.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/chapter-1

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Accounting in Business

Accounting involves a process of collecting, recording, and reporting a business’s economic activities to users. It is often called the language of business because it uses a unique vocabulary to communicate information to decision-makers . To understand accounting, we first look at the basic forms of business organizations. The concepts and principles that provide the foundation for financial accounting are then discussed. With an emphasis on the corporate form of business organization, we will examine how we communicate to users of financial information using financial statements. Finally, we will review how financial transactions are analyzed and then reported on financial statements.

Chapter 1 Learning Objectives

In this chapter, you will learn how to:

LO1 – Define accounting.

LO2 – Identify and describe the forms of business organization.

LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP).

LO4 – Identify, explain, and prepare the financial statements.

Concept Self-Check

Use the following as a self-check while working through Chapter 1:

- What is accounting?

- What is the difference between internal and external users of accounting information?

- What is the difference between managerial and financial accounting?

- What is the difference between a business organization and a non-business organization?

- What are the three types of business organizations?

- What is a PAE? A PE?

- What does the term limited liability mean?

- Explain how ethics are involved in the practice of accounting.

- Describe what GAAP refers to.

- Identify and explain the six qualitative characteristics of GAAP.

- Identify and explain at least five of the nine principles that support the GAAP qualitative characteristics.

- How is financial information communicated to external users?

- What are the four financial statements?

- Which financial statement measures financial performance? Financial position?

- What information is provided in the statement of cash flows?

- Explain how retained earnings and dividends are related.

- What are the three primary components of the balance sheet?

- Equity consists of what two components?

- How are assets financed?

- Identify and explain the three types of activities a business engages in.

- What are notes to the financial statements ?

- What is the accounting equation?

- What are the distinctions among calendar, interim, and fiscal year ends?

NOTE: The purpose of these questions is to prepare you for the concepts introduced in the chapter. Your goal should be to answer each of these questions as you read through the chapter. If, when you complete the chapter, you are unable to answer one or more the Concept Self-Check questions, go back through the content to find the answer(s). Solutions are not provided to these questions.

1.1 Accounting Defined

LO1 – Define accounting

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users. Users need information for decision making. Internal users of accounting information work for the organization and are responsible for planning, organizing, and operating the entity. The area of accounting known as managerial accounting serves the decision-making needs of internal users. External users do not work for the organization and include investors, creditors, labour unions, and customers. Financial accounting is the area of accounting that focuses on external reporting and meeting the needs of external users. This book addresses financial accounting. Managerial accounting is covered in other books.

1.2 Business Organizations

An organization is a group of individuals who come together to pursue a common set of goals and objectives. There are two types of business organizations: business and non-business . A business organization sells products and/or services for profit. A non-business organization , such as a charity or hospital, exists to meet various societal needs and does not have profit as a goal. All businesses, regardless of type, record, report, and, most importantly, use accounting information for making decisions.

This book focuses on business organizations. There are three common forms of business organizations — a proprietorship , a partnership , and a corporation .

Proprietorship

A proprietorship is a business owned by one person. It is not a separate legal entity, which means that the business and the owner are considered to be the same entity. This means, for example, that from an income tax perspective, the profits of a proprietorship are taxed as part of the owner’s personal income tax return. Unlimited liability is another characteristic of a sole proprietorship meaning that if the business could not pay its debts, the owner would be responsible even if the business’s debts were greater than the owner’s personal resources.

Partnership

A partnership is a business owned by two or more individuals. Like the proprietorship, it is not a separate legal entity and its owners are typically subject to unlimited liability.

Corporation

A corporation is a business owned by one or more owners. The owners are known as shareholders . A shareholder owns shares of the corporation. Shares 1 are units of ownership in a corporation. For example, if a corporation has 1,000 shares, there may be three shareholders where one has 700 shares, another has 200 shares, and the third has 100 shares. The number of shares held by a shareholder represents how much of the corporation they own. A corporation can have different types of shares; this topic is discussed in a later chapter. When there is only one type of share, it is usually called common shares .

A corporation’s shares can be privately held or available for public sale. A corporation that holds its shares privately and does not sell them publicly is known as a private enterprise (PE) . A corporation that sells its shares publicly, typically on a stock exchange, is called a publicly accountable enterprise (PAE) .

Unlike the proprietorship and partnership, a corporation is a separate legal entity. This means, for example, that from an income tax perspective, a corporation files its own tax return. The owners or shareholders of a corporation are not responsible for the corporation’s debts so have limited liability meaning that the most they can lose is what they invested in the corporation.

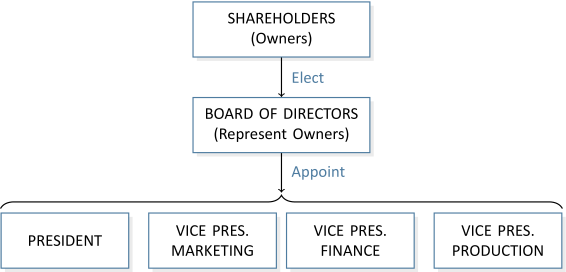

In larger corporations, there can be many shareholders. In these cases, shareholders do not manage a corporation but participate indirectly through the election of a Board of Directors . The Board of Directors does not participate in the day-to-day management of the corporation but delegates this responsibility to the officers of the corporation. An example of this delegation of responsibility is illustrated in Figure 1.1:

Shareholders usually meet annually to elect a Board of Directors. The Board of Directors meets regularly to review the corporation’s operations and to set policies for future operations. Unlike shareholders, directors can be held personally liable if a company fails.

Learning Activity 1.1 – Forms of Organization

This first activity provides you with the opportunity to self-assess how well you know the different types of business organizations.

Instructions: Identify properties of different types of business organizations. In all cases, incorrect entries will be shaded red. Correct entries will be shaded green. Note – this is not a graded activity.

1.3 Generally Accepted Accounting Principles (GAAP)

LO3 – Identify and explain the Generally Accepted Accounting Principles (GAAP)

The goal of accounting is to ensure information provided to decision-makers is useful. To be useful, information must be relevant and faithfully represent a business’s economic activities. This requires ethics , beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles. These underlying accounting concepts or principles are known as Generally Accepted Accounting Principles (GAAP) .

GAAP in Canada, as well as in many other countries, is based on International Financial Reporting Standards (IFRS) for publicly accountable enterprises (PAE). IFRS are issued by the International Accounting Standards Board (IASB) . The IASB’s mandate is to promote the adoption of a single set of global accounting standards through a process of open and transparent discussions among corporations, financial institutions, and accounting firms around the world. Private enterprises (PE) in Canada are permitted to follow either IFRS or Accounting Standards for Private Enterprises (ASPE) , a set of less onerous GAAP-based standards developed by the Canadian Accounting Standards Board (AcSB). The AcSB is the body that governs accounting standards in Canada. The focus in this book will be on IFRS for PAEs.

Accounting practices are guided by GAAP which are comprised of qualitative characteristics and principles. As already stated, relevance and faithful representation are the primary qualitative characteristics. Comparability, verifiability, timeliness, and understandability are additional qualitative characteristics.

Information that possesses the quality of:

- relevance has the ability to make a difference in the decision-making process.

- faithful representation is complete, neutral, and free from error.

- comparability tells users of the information that businesses utilize similar accounting practices.

- verifiability means that others are able to confirm that the information faithfully represents the economic activities of the business.

- timeliness is available to decision makers in time to be useful.

- understandability is clear and concise.

Table 1.1 lists the nine principles that support these qualitative characteristics.

Note: Some of the principles discussed above may be challenging to understand because related concepts have not yet been introduced. Therefore, most of these principles will be discussed again in more detail in a later chapter.

Learning Activity 1.2 – Check Your Knowledge

This Learning Activity provides you with the opportunity to self-assess how well you know key-terms from sections 1.1-1.3.

Instructions: Match each term with the correct definition. Note – this is not a graded activity.

1.4 Financial Statements

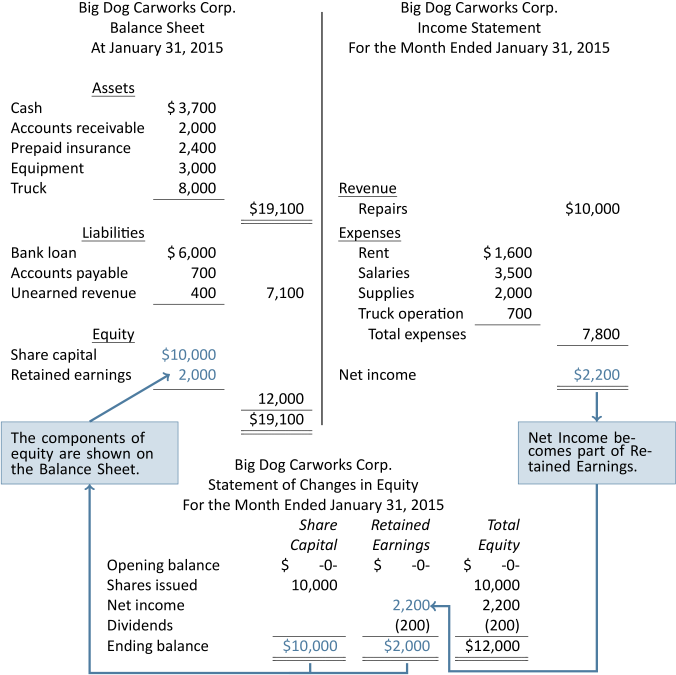

Recall that financial accounting focuses on communicating information to external users. That information is communicated using financial statements . There are four financial statements: the income statement, statement of changes in equity, balance sheet, and statement of cash flows. Each of these is introduced in the following sections using an example based on a fictitious corporate organization called Big Dog Carworks Corp.

The Income Statement

An income statement communicates information about a business’s financial performance by summarizing revenues less expenses over a period of time. Revenues are created when a business provides products or services to a customer in exchange for assets. Assets are resources resulting from past events and from which future economic benefits are expected to result. Examples of assets include cash, equipment, and supplies. Assets will be discussed in more detail later in this chapter. Expenses are the assets that have been used up or the obligations incurred in the course of earning revenues. When revenues are greater than expenses, the difference is called net income or profit . When expenses are greater than revenue, a net loss results.

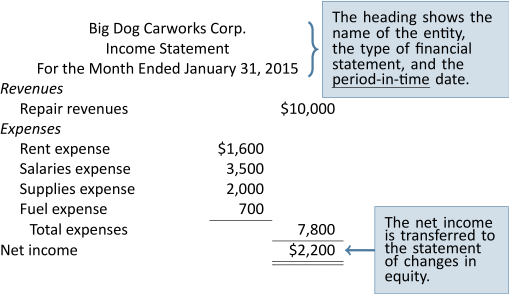

Consider the following income statement of Big Dog Carworks Corp. (BDCC). This business was started on January 1, 2015 by Bob “Big Dog” Baldwin in order to repair automobiles. All the shares of the corporation are owned by Bob.

At January 31, the income statement shows total revenues of $10,000 and various expenses totaling $7,800. Net income, the difference between $10,000 of revenues and $7,800 of expenses, equals $2,200:

The Statement of Changes in Equity

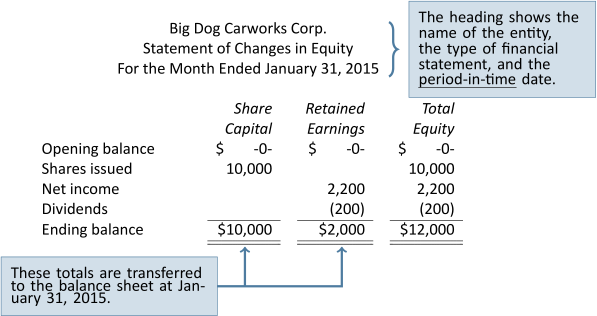

The statement of changes in equity provides information about how the balances in Share capital and Retained earnings changed during the period. Share capital is a heading in the shareholders’ equity section of the balance sheet and represents how much shareholders have invested. When shareholders buy shares, they are investing in the business. The number of shares they purchase will determine how much of the corporation they own. The type of ownership unit purchased by Big Dog’s shareholders is known as common shares. Other types of shares will be discussed in a later chapter. When a corporation sells its shares to shareholders, the corporation is said to be issuing shares to shareholders.

In the statement of changes in equity shown below, Share capital and Retained earnings balances at January 1 are zero because the corporation started the business on that date. During January, Share capital of $10,000 was issued to shareholders so the January 31 balance is $10,000.

Retained earnings is the sum of all net incomes earned by a corporation over its life, less any distributions of these net incomes to shareholders. Distributions of net income to shareholders are called dividends . Shareholders generally have the right to share in dividends according to the percentage of their ownership interest. To demonstrate the concept of retained earnings, recall that Big Dog has been in business for one month in which $2,200 of net income was reported. Additionally, $200 of dividends were distributed, so these are subtracted from retained earnings. Big Dog’s retained earnings were therefore $2,000 at January 31, 2015 as shown in the statement of changes in equity below:

To demonstrate how retained earnings would appear in the next accounting period, let’s assume that Big Dog reported a net income of $5,000 for February, 2015 and dividends of $1,000 were given to the shareholder. Based on this information, retained earnings at the end of February would be $6,000, calculated as the $2,000 January 31 balance plus the $5,000 February net income less the $1,000 February dividend. The balance in retained earnings continues to change over time because of additional net incomes/losses and dividends.

The Balance Sheet

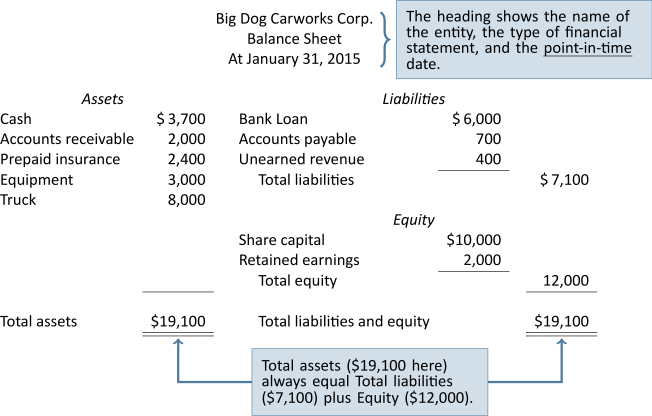

The balance sheet , or statement of financial position , shows a business’s assets, liabilities, and equity at a point in time. The balance sheet of Big Dog Carworks Corp. at January 31, 2015 is shown below:

What Is an Asset?

Assets are economic resources that provide future benefits to the business. Examples include cash, accounts receivable, prepaid expenses, equipment, and trucks. Cash is coins and currency, usually held in a bank account, and is a financial resource with future benefit because of its purchasing power. Accounts receivable represent amounts to be collected in cash in the future for goods sold or services provided to customers on credit. Prepaid expenses are assets that are paid in cash in advance and have benefits that apply over future periods. For example, a one-year insurance policy purchased for cash on January 1, 2015 will provide a benefit until December 31, 2015 so is a prepaid asset. The equipment and truck were purchased on January 1, 2015 and will provide benefits for 2015 and beyond so are assets.

What Is a Liability?

A liability is an obligation to pay an asset in the future. For example, Big Dog’s bank loan represents an obligation to repay cash in the future to the bank. Accounts payable are obligations to pay a creditor for goods purchased or services rendered. A creditor owns the right to receive payment from an individual or business. Unearned revenue represents an advance payment of cash from a customer for Big Dog’s services or products to be provided in the future. For example, Big Dog collected cash from a customer in advance for a repair to be done in the future.

What Is Equity?

Equity represents the net assets owned by the owners (the shareholders). Net assets are assets minus liabilities. For example, in Big Dog’s January 31 balance sheet, net assets are $12,000, calculated as total assets of $19,100 minus total liabilities of $7,100. This means that although there are $19,100 of assets, only $12,000 are owned by the shareholders and the balance, $7,100, are financed by debt. Notice that net assets and total equity are the same value; both are $12,000. Equity consists of share capital and retained earnings. Share capital represents how much the shareholders have invested in the business. Retained earnings is the sum of all net incomes earned by a corporation over its life, less any dividends distributed to shareholders.

In summary, the balance sheet is represented by the equation: Assets = Liabilities + Equity. Assets are the investments held by a business. The liabilities and equity explain how the assets have been financed, or funded. Assets can be financed through liabilities, also known as debt , or equity. Equity represents amounts that are owned by the owners, the shareholders, and consists of share capital and retained earnings. Investments made by shareholders, namely share capital, are used to finance assets and/or pay down liabilities. Additionally, retained earnings, comprised of net income less any dividends, also represent a source of financing.

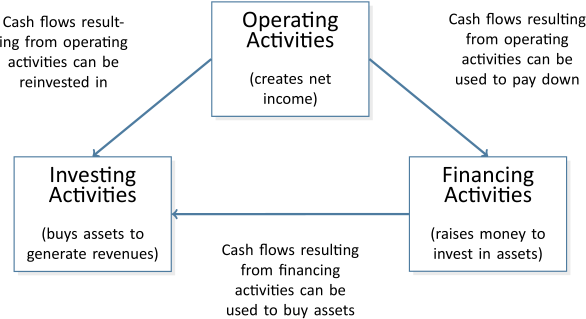

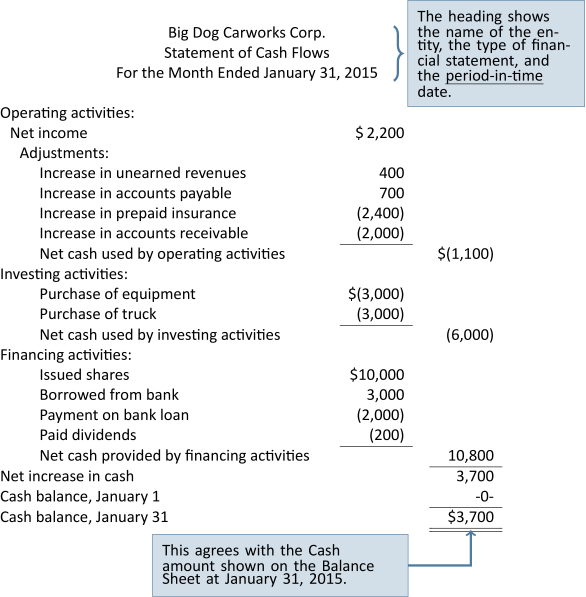

The Statement of Cash Flows (SCF)

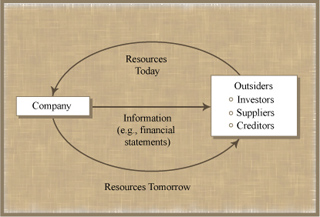

Cash is an asset reported on the balance sheet. Ensuring there is sufficient cash to pay expenses and liabilities as they come due is a critical business activity. The statement of cash flows (SCF) explains how the balance in cash changed over a period of time by detailing the sources (inflows) and uses (outflows) of cash by type of activity: operating, investing, and financing, as these are the three types of activities a business engages in. Operating activities are the day-to-day processes involved in selling products and/or services to generate net income. Examples of operating activities include the purchase and use of supplies, paying employees, fuelling equipment, and renting space for the business. Investing activities are the buying of assets needed to generate revenues. For example, when an airline purchases airplanes, it is investing in assets required to help it generate revenue. Financing activities are the raising of money needed to invest in assets. Financing can involve issuing share capital (getting money from the owners known as shareholders) or borrowing. Figure 1.2 summarizes the interrelationships among the three types of business activities:

The statement of cash flows for Big Dog is shown below:

The statement of cash flows is useful because cash is one of the most important assets of a corporation. Information about expected future cash flows are therefore important for decision makers. For instance, Big Dog’s bank manager needs to determine whether the remaining $6,000 loan can be repaid, and also whether or not to grant a new loan to the corporation if requested. The statement of cash flows helps inform those who make these decisions.

Important : Notes to the Financial Statements

An essential part of financial statements are the notes that accompany them. These notes are generally located at the end of a set of financial statements. The notes provide greater detail about various amounts shown in the financial statements, or provide non-quantitative information that is useful to users. For example, a note may indicate the estimated useful lives of long-lived assets, or loan repayment terms. Examples of note disclosures will be provided later.

Learning Activity 1.3 – Check Your Knowledge

This Learning Activity will focus on your understanding of the content from section 1.4. In this activity, indicate whether each of the following is an Asset , Liability , or an Equity item. Note: This activity is intended to be used as a self-assessment – it is not for grades.

1.5 Transaction Analysis and Double-entry Accounting

LO5 – Analyze transactions by using the accounting equation.

The accounting equation is foundational to accounting. It shows that the total assets of a business must always equal the total claims against those assets by creditors and owners. The equation is expressed as:

When financial transactions are recorded, combined effects on assets, liabilities, and equity are always exactly offsetting. This is the reason that the balance sheet always balances.

Each economic exchange is referred to as a financial transaction — for example, when an organization exchanges cash for land and buildings. Incurring a liability in return for an asset is also a financial transaction. Instead of paying cash for land and buildings, an organization may borrow money from a financial institution. The company must repay this with cash payments in the future. The accounting equation provides a system for processing and summarizing these sorts of transactions.

Accountants view financial transactions as economic events that change components within the accounting equation. These changes are usually triggered by information contained in source documents (such as sales invoices and bills from creditors) that can be verified for accuracy.

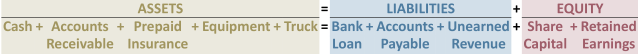

The accounting equation can be expanded to include all the items listed on the Balance Sheet of Big Dog at January 31, 2015, as follows:

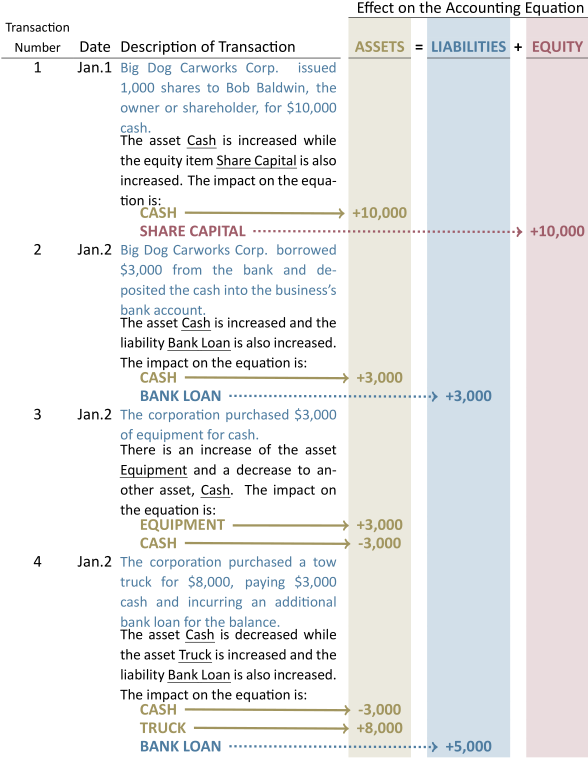

If one item within the accounting equation is changed, then another item must also be changed to balance it. In this way, the equality of the equation is maintained. For example, if there is an increase in an asset account, then there must be a decrease in another asset or a corresponding increase in a liability or equity account. This equality is the essence of double-entry accounting . The equation itself always remains in balance after each transaction. The operation of double-entry accounting is illustrated in the following section, which shows 10 transactions of Big Dog Carworks Corp. for January 2015.

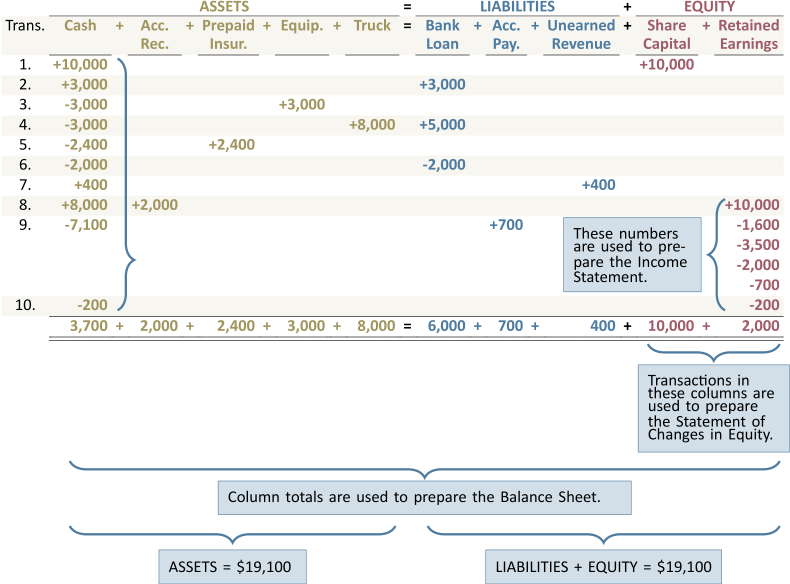

These various transactions can be recorded in the expanded accounting equation as shown below:

Figure 1.3 Transactions Worksheet for January 31, 2015

Transactions summary:

- Issued share capital for $10,000 cash.

- Received a bank loan for $3,000.

- Purchased equipment for $3,000 cash.

- Purchased a truck for $8,000; paid $3,000 cash and incurred a bank loan for the balance.

- Paid $2,400 for a comprehensive one-year insurance policy effective January 1.

- Paid $2,000 cash to reduce the bank loan.

- Received $400 as an advance payment for repair services to be provided over the next two months as follows: $300 for February, $100 for March.

- Performed repairs for $8,000 cash and $2,000 on credit.

- Paid a total of $7,100 for operating expenses incurred during the month; also incurred an expense on account for $700.

- Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.

The transactions summarized in Figure 1.3 were used to prepare the financial statements described earlier, and reproduced in Figure 1.4 below:

Figure 1.4 Financial Statements of Big Dog Carworks Corp.

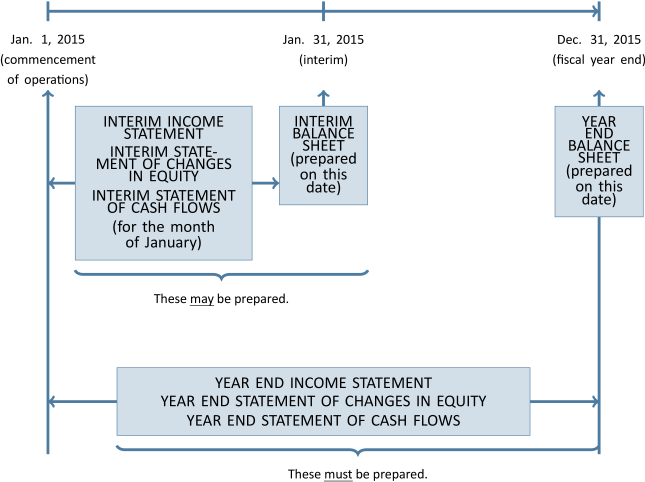

Accounting Time Periods

Financial statements are prepared at regular intervals — usually monthly or quarterly — and at the end of each 12-month period. This 12-month period is called the fiscal year . The timing of the financial statements is determined by the needs of management and other users of the financial statements. For instance, financial statements may also be required by outside parties, such as bankers and shareholders. However, accounting information must possess the qualitative characteristic of timeliness — it must be available to decision makers in time to be useful — which is typically a minimum of once every 12 months.

Accounting reports, called the annual financial statements , are prepared at the end of each 12-month period, which is known as the year-end of the entity. Some companies’ year-ends do not follow the calendar year (year ending December 31). This may be done so that the fiscal year coincides with their natural year . A natural year ends when business operations are at a low point. For example, a ski resort may have a fiscal year ending in late spring or early summer when business operations have ceased for the season.

Corporations listed on stock exchanges are generally required to prepare interim financial statements , usually every three months, primarily for the use of shareholders or creditors. Because these types of corporations are large and usually have many owners, users require more up-to-date financial information.

The relationship of the interim and year-end financial statements is illustrated in Figure 1.5:

Figure 1.5 Relationship of Interim and Year-end Financial Statements

Summary of Chapter 1 Learning Objectives

Below, you will find each of the Learning Objectives covered in Chapter 1. Additionally, there is a brief summary that highlights the important elements you learned about for each corresponding objective:

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users for decision making. Internal users work for the organization while external users do not. Managerial accounting serves the decision-making needs of internal users. Financial accounting focuses on external reporting to meet the needs of external users.

The three forms of business organizations are a proprietorship, partnership, and corporation.

The following chart summarizes the key characteristics of each form of business organization.

GAAP followed in Canada by PAEs (Publicly Accountable Enterprises) are based on IFRS (International Financial Reporting Standards). PEs (Private Enterprises) follow GAAP based on ASPE (Accounting Standards for Private Enterprises), a less onerous set of GAAP maintained by the AcSB (Accounting Standards Board). GAAP have qualitative characteristics (relevance, faithful representation, comparability, verifiability, timeliness, and understandability) and principles (business entity, consistency, cost, full disclosure, going concern, matching, materiality, monetary unit, and recognition).

The four financial statements are: income statement, statement of changes in equity, balance sheet, and statement of cash flows. The income statement reports financial performance by detailing revenues less expenses to arrive at net income/loss for the period. The statement of changes in equity shows the changes during the period to each of the components of equity: share capital and retained earnings. The balance sheet identifies financial position at a point in time by listing assets, liabilities, and equity. Finally, the statement of cash flows details the sources and uses of cash during the period based on the three business activities: operating, investing, and financing.

The accounting equation, A = L + E, describes the asset investments (the left side of the equation) and the liabilities and equity that financed the assets (the right side of the equation). The accounting equation provides a system for processing and summarizing financial transactions resulting from a business’s activities. A financial transaction is an economic exchange between two parties that impacts the accounting equation. The equation must always balance.

Review Questions

After reading through Chapter 1, take some time to review the questions below. These questions can be used as part of a discussion with other members of your class, or they can be used for your own self-assessment as you prepare for your graded assessments.

Use the questions below to self-assess how well you understand the content from Chapter 1:

- What are generally accepted accounting principles (GAAP)?

- When is revenue recognised?

- How does the matching concept more accurately determine the Net Income of a business?

- What are the qualities that accounting information is expected to have? What are the limitations on the disclosure of useful accounting information?

- What are assets?

- To what do the terms liability and equity refer?

- Explain the term financial transaction . Include an example of a financial transaction as part of your explanation.

- Identify the three forms of business organization.

- What is the business entity concept of accounting? Why is it important?

- What is the general purpose of financial statements? Name the four financial statements?

- Each financial statement has a title that consists of the name of the financial statement, the name of the business, and a date line. How is the date line on each of the four financial statements the same or different?

- What is the purpose of an income statement? a balance sheet? How do they interrelate?

- Define the terms revenue and expense .

- What is net income? What information does it convey?

- What is the purpose of a statement of changes in equity? a statement of cash flows?

- Why are financial statements prepared at regular intervals? Who are the users of these statements?

- Explain double-entry accounting.

- What is a year-end? How does the timing of year-end financial statements differ from that of interim financial statements?

- How does a fiscal year differ from a calendar year?

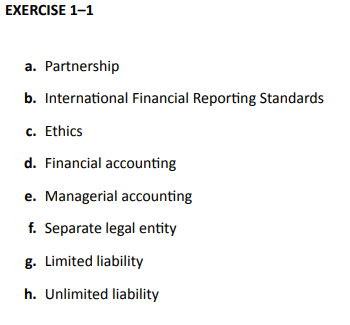

Match each term in the above alphabetized list to the corresponding description below.

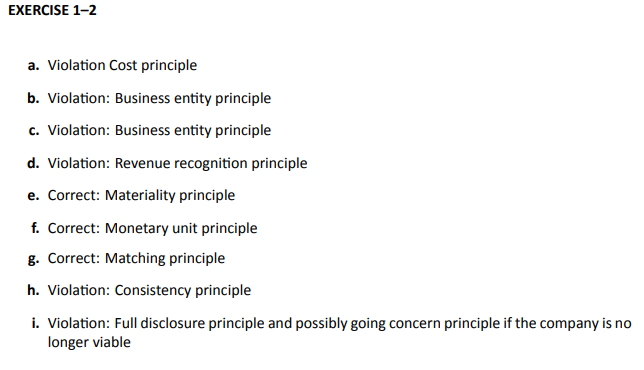

Identify whether each of the following situations represents a violation or a correct application of GAAP, and which principle is relevant in each instance.

- A small storage shed was purchased from a home supply store at a discount sale price of $5,000 cash. The clerk recorded the asset at $6,000, which was the regular price.

- One of the business partners of a small architect firm continually charges the processing of his family vacation photos to the business firm.

- An owner of a small engineering business, operating as a proprietorship from his home office, also paints and sells watercolour paintings in his spare time. He combines all the transactions in one set of books.

- ABS Consulting received cash of $6,000 from a new customer for consulting services that ABS is to provide over the next six months. The transaction was recorded as a credit to revenue.

- Tyler Tires, purchased a shop tool for cash of $20 to replace the one that had broken earlier that day. The tool would be useful for several years, but the transaction was recorded as a debit to shop supplies expense instead of to shop equipment (asset).

- Embassy Lighting, a small company operating in Canada, sold some merchandise to a customer in California and deposited cash of $5,000 US. The bookkeeper recorded it as a credit to revenue of $7,250 CAD, which was the Canadian equivalent currency at that time.

- An owner of a small car repair shop purchased shop supplies for cash of $2,200, which will be used over the next six months. The transaction was recorded as a debit to shop supplies (asset) and will be expensed as they are used.

- At the end of each year, a business owner looks at his estimated net income for the year and decides which depreciation method he will use in an effort to reduce his business income taxes to the lowest amount possible.

- XYZ is in deep financial trouble and recently was able to obtain some badly needed cash from an investor who was interested in becoming an equity partner. However, a few days ago, the investor unexpectedly changed the terms of his cash investment in XYZ company from the proposed equity partnership to a long-term loan. XYZ does not disclose this to their bank, who they recently applied to for an increase in their overdraft line-of-credit.

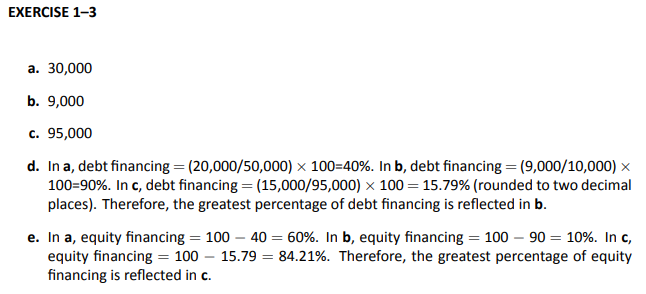

Calculate the missing amounts in a , b , and c above. Additionally, answer each of the questions in d and e below.

d. Assets are financed by debt and equity. The greatest percentage of debt financing is reflected in a , b , or c ?

e. The greatest percentage of equity financing is reflected in a , b , or c ?

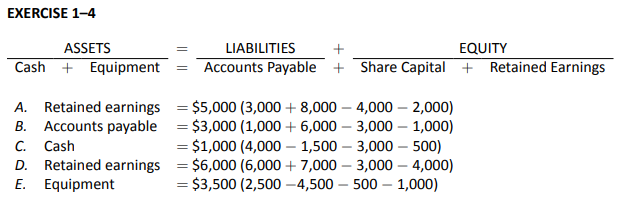

Calculate the missing amounts for companies A to E .

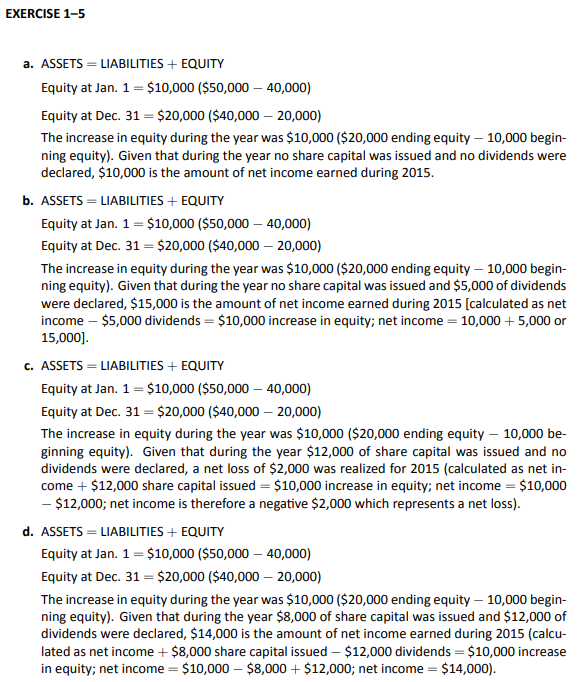

Using the information above, calculate net income under each of the following assumptions.

- During 2015, no share capital was issued and no dividends were declared.

- During 2015, no share capital was issued and dividends of $5,000 were declared.

- During 2015, share capital of $12,000 was issued and no dividends were declared.

- During 2015, share capital of $8,000 was issued and $12,000 of dividends were declared.

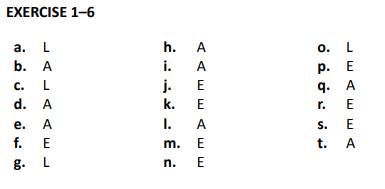

Indicate whether each of the following is an asset (A), liability (L), or an equity (E) item.

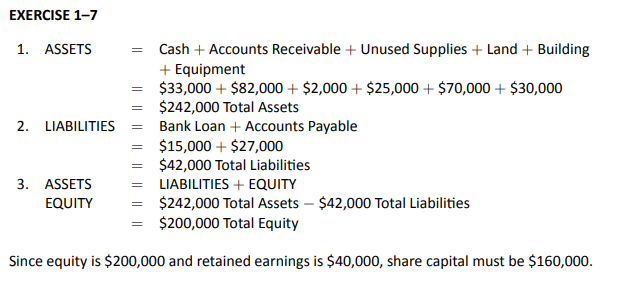

The following information is taken from the records of Jasper Inc. at January 31, 2015, after its first month of operations. Assume no dividends were declared in January.

- Calculate total assets.

- Calculate total liabilities.

- Calculate share capital.

- Calculate retained earnings.

- Calculate total equity.

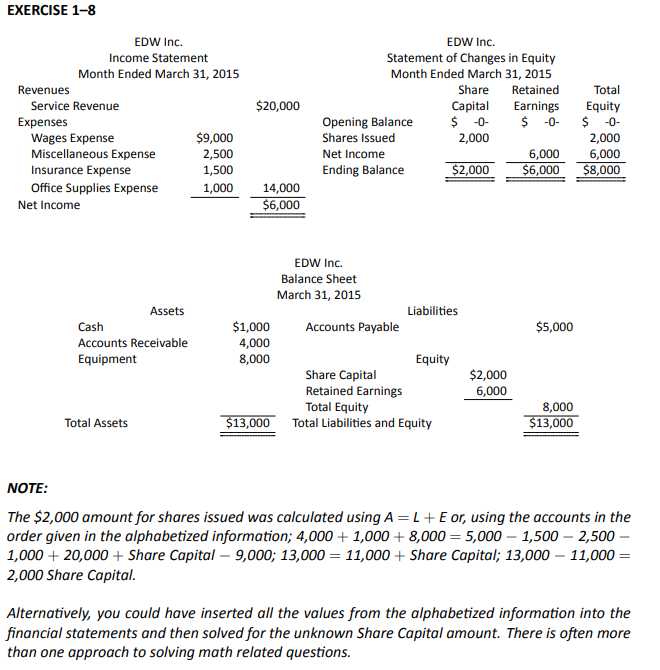

Using the alphabetized information above for EDW Inc. after its first month of operations, complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

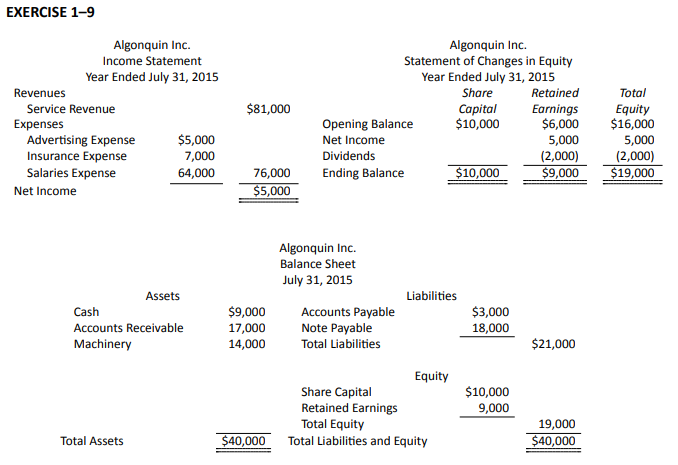

Algonquin Inc. began operations on August 1, 2013. After its second year, Algonquin Inc.’s accounting system showed the information above. During the second year, no additional shares were issued. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

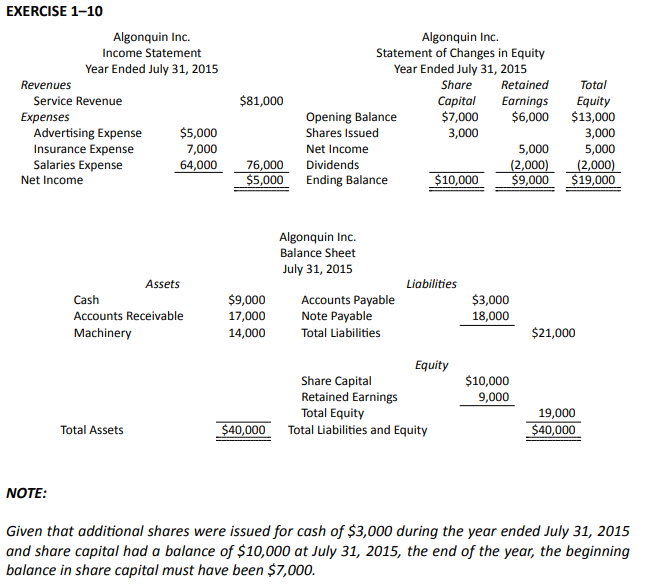

Refer to EXERCISE 1–9. Use the same information EXCEPT assume that during the second year, additional shares were issued for cash of $3,000. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

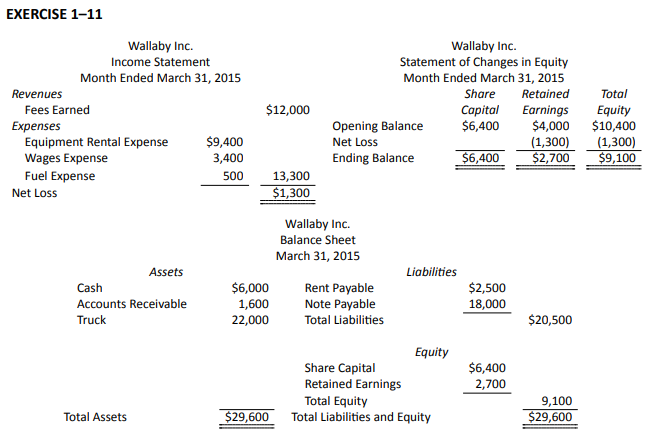

Wallaby Inc. began operations on February 1, 2014. After its second month, Wallaby Inc.’s accounting system showed the information above. During the second month, no dividends were declared and no additional shares were issued. Complete the income statement, statement of changes in equity, and balance sheet using the templates provided below.

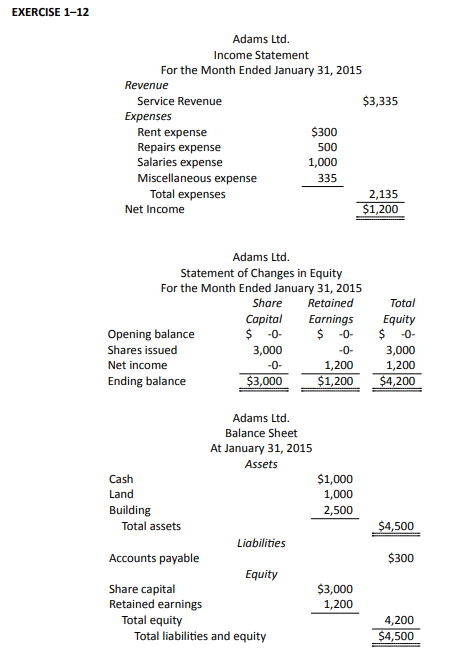

A junior bookkeeper of Adams Ltd. prepared the following incorrect financial statements at the end of its first month of operations.

Prepare a corrected income statement, statement of changes in equity, and balance sheet.

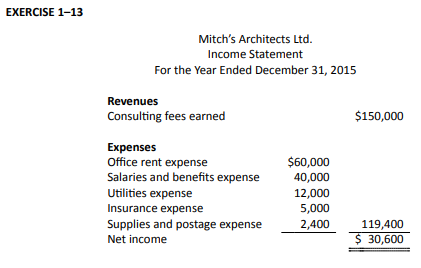

Below are the December 31, 2015, year-end accounts balances for Mitch’s Architects Ltd. This is the business’s second year of operations.

Additional information:

- Included in the share capital account balance was an additional $10,000 of shares issued during the current year just ended.

- Included in the retained earnings account balance was dividends paid to the shareholders of $1,000 during the current year just ended.

Use these accounts to prepare an income statement similar to the example illustrated in Section 1.4.

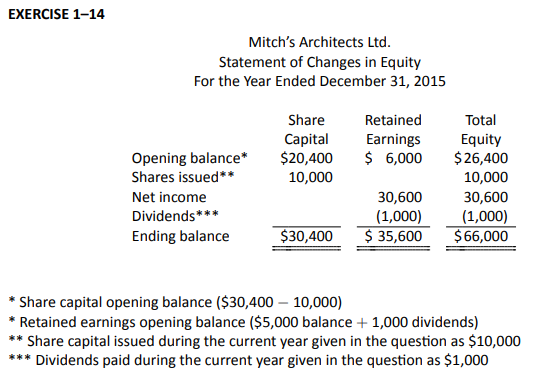

Using the data in EXERCISE 1–13, prepare a statement of changes in equity similar to the example illustrated in Section 1.4.

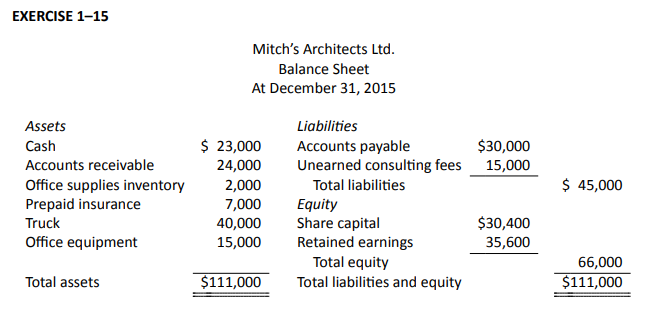

Using the data in EXERCISE 1–13, prepare a balance sheet similar to the example illustrated in Section 1.4.

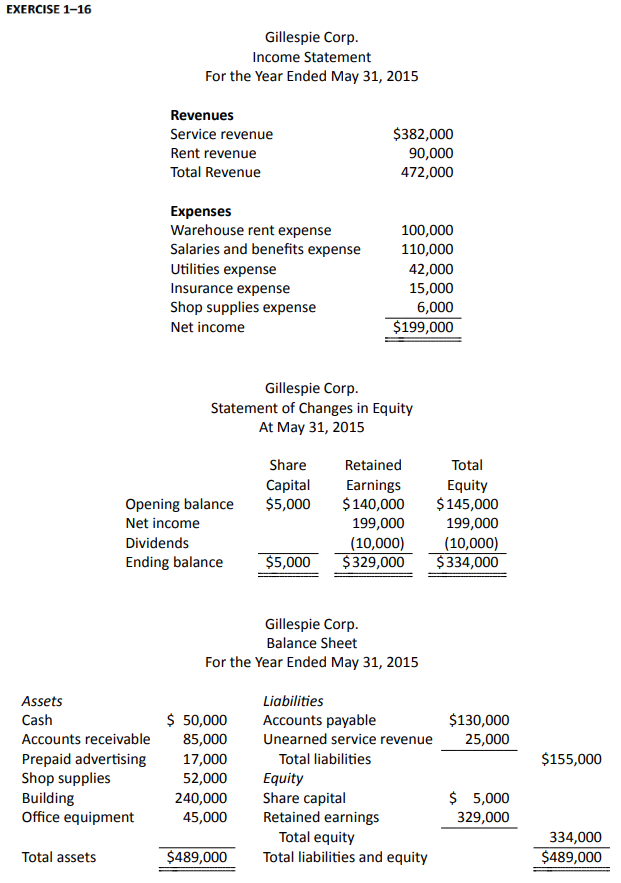

Below are the May 31, 2015, year-end financial statements for Gillespie Corp., prepared by a summer student. There were no share capital transactions in the year just ended.

Using the data above, prepare a corrected set of financial statements similar to the examples illustrated in Section 1.4.

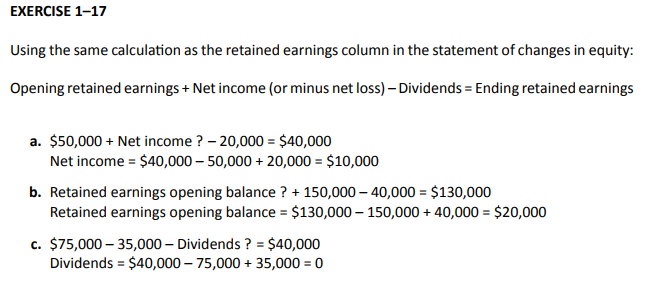

Complete the following calculations for each individual company:

- If ColourMePink Ltd. has a retained earnings opening balance of $50,000 at the beginning of the year, and an ending balance of $40,000 at the end of the year, what would be the net income/loss, if dividends paid were $20,000?

- If ForksAndSpoons Ltd. has net income of $150,000, dividends paid of $40,000 and a retained earnings ending balance of $130,000, what would be the retained earnings opening balance?

- If CupsAndSaucers Ltd. has a retained earnings opening balance of $75,000 at the beginning of the year, and an ending balance of $40,000 at the end of the year, what would be the dividends paid, if the net loss was $35,000?

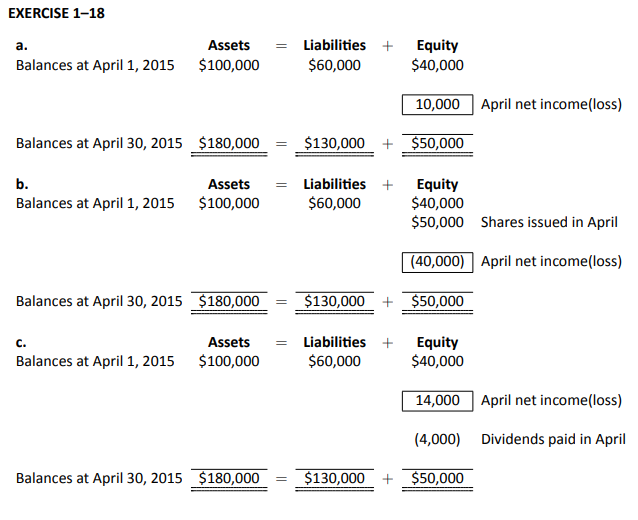

Using the information provided above, calculate the net income or net loss realized during April under each of the following independent assumptions.

- No shares were issued in April and no dividends were paid.

- $50,000 of shares were issued in April and no dividends were paid.

- No shares were issued in April and $4,000 of dividends were paid in April.

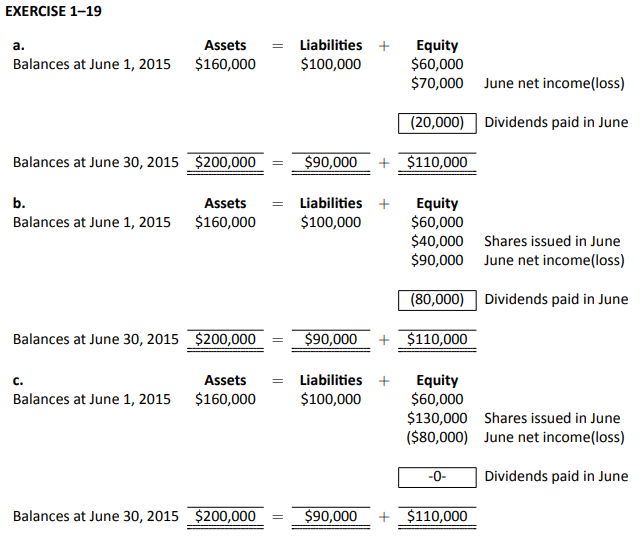

Using the information provided above, calculate the dividends paid in June under each of the following independent assumptions.

- In June no shares were issued and a $70,000 net income was earned.

- $40,000 of shares were issued in June and a $90,000 net income was earned.

- In June $130,000 of shares were issued and an $80,000 net loss was realized.

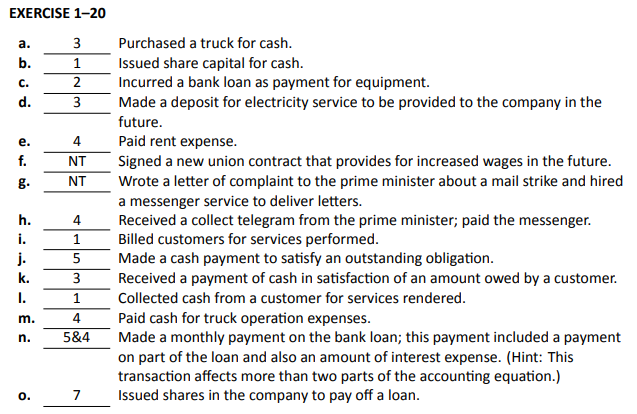

The following list shows the various ways in which the accounting equation might be affected by financial transactions.

Match one of the above to each of the following financial transactions. If the description below does not represent a financial transaction, indicate ‘NT’ for ‘No Transaction’. The first one is done as an example.

Practice Problems

The problems that have been included in this section are more complex. They are intended to offer students the opportunity to apply what they have learned. Although these Practice Problems are optional (not for grades), they can help students better prepare for the assignment in Module 1. It is recommended that students review any relevant sections that they struggled with in answering these problems.

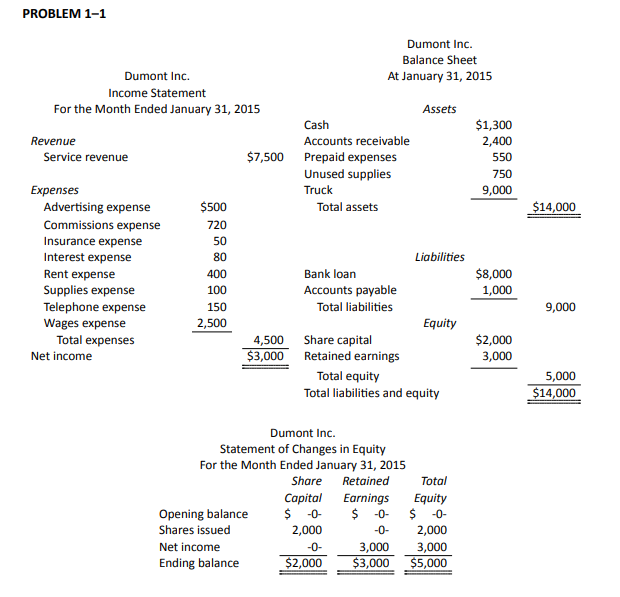

Following are the asset, liability, and equity items of Dumont Inc. at January 31, 2015, after its first month of operations.

- Prepare an income statement and statement of changes in equity for Dumont’s first month ended January 31, 2015.

- Prepare a balance sheet at January 31, 2015.

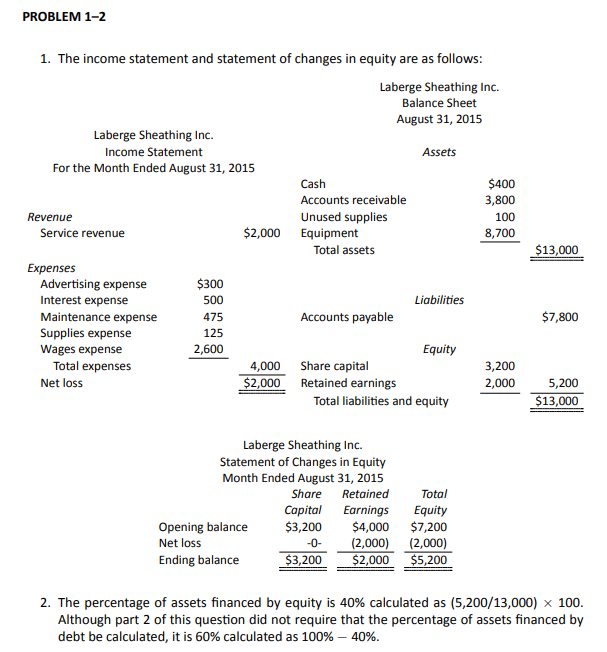

Laberge Sheathing Inc. began operations on January 1, 2015. The office manager, inexperienced in accounting, prepared the following statement for the business’s most recent month ended August 31, 2015.

- Prepare an income statement and statement of changes in equity for the month ended August 31, 2015, and a balance sheet at August 31, 2015. No shares were issued in August.

- Using the information from the balance sheet completed in Part 1, calculate the percentage of assets financed by equity.

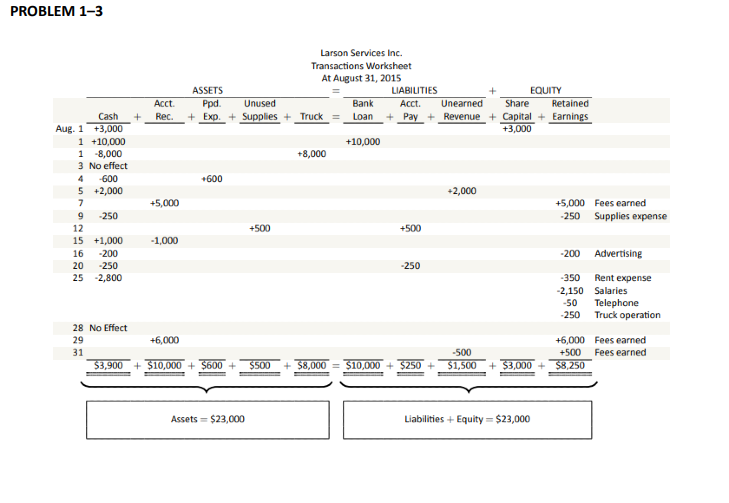

The following transactions of Larson Services Inc. occurred during August 2015, its first month of operations.

- Use additions and subtractions in the table created in Part 1 to show the effects of the August transactions. For non-transactions that do not impact the accounting equation items (such as August 3), indicate ‘NE’ for ‘No Effect’.

- Total each column and prove the accounting equation balances.

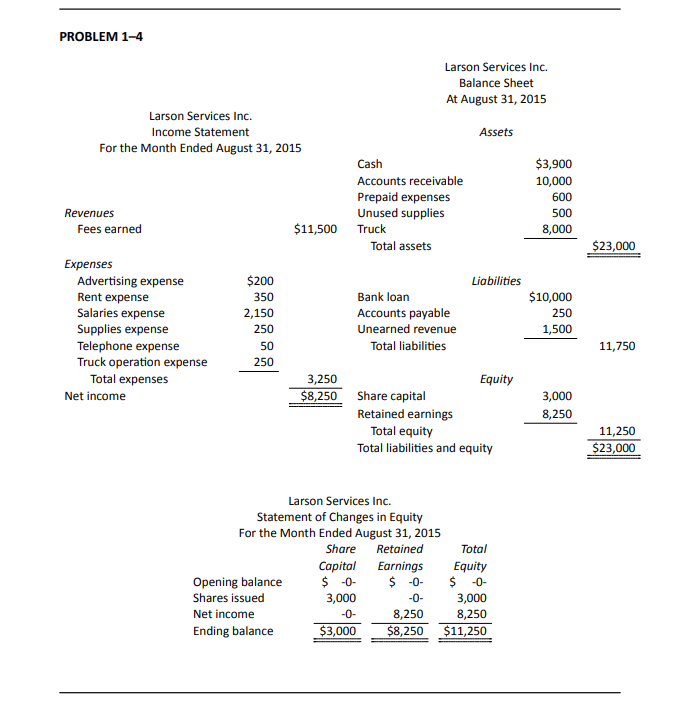

Refer to your answer for Problem 1–3. Prepare an income statement and a statement of changes in equity for the month ended August 31, 2015. Label the revenue earned as Fees Earned. Prepare a balance sheet at August 31, 2015.

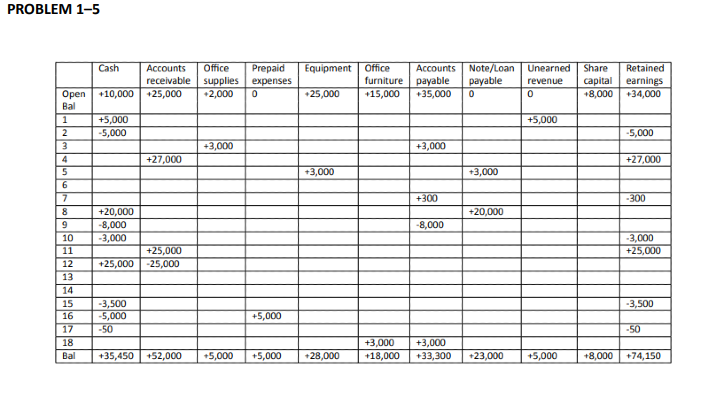

The following transactions occurred for Olivier Bondar Ltd., an restaurant management consulting service, during May, 2016:

Create a table with the following column headings and opening balances. Below the opening balance, number each row from 1 to 18:

Using the table as shown in Figure 1.3 of the text, complete the table for the 18 items listed in May and total each column. If any of the items are not to be recorded, leave the row blank.

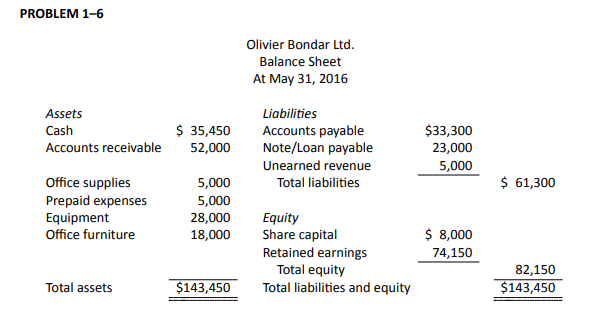

Using the data from the table in PROBLEM 1–5, prepare the balance sheet as at May 31, 2016.

1. Shares are also called stock .

2. It should be noted, however, that at the introductory level, there are no significant differences in how IFRS and ASPE are applied.

3. Business income is added to the owner’s personal income and the owner pays tax on the sum of the two.

4. Business income is added to the owner’s personal income and the owner pays tax on the sum of the two.

5. A corporation can have one or more owners.

Introduction to Financial Accounting Copyright © by Corey Hadden. All Rights Reserved.

Share This Book

Browse Course Material

Course info.

- Prof. Sugata Roychowdhury

Departments

- Sloan School of Management

As Taught In

Learning resource types, introduction to financial and managerial accounting, course description.

You are leaving MIT OpenCourseWare

Financial Accounting

Table of Contents

Course contents.

- About This Course

- Course Contents at a Glance

- Learning Outcomes

Faculty Resources

- Faculty Resources Overview

- Faculty & Technical Support

Course Resources

- Course Resources Overview

- Offline Content Access

- PowerPoints

- Assignments

- Case Studies

- Interactives

- OHM Assessments

- Accessibility Guide

Module 0: Personal Accounting

- Why It Matters: Personal Accounting

- Introduction to Financing Your Education

- Financial Aid

- Working While Studying

- Other Sources of Income

- Introduction to Financing the Present

- Budgeting Personal Finances

- Major Purchases

- Introduction to Financing the Future

- Retirement Planning

- Putting It Together: Personal Accounting

- Discussion: Winning the Lottery

- Assignment: Creating a Budget

Module 1: The Role of Accounting in Business

- Why It Matters: The Role of Accounting in Business

- Introduction to Accounting Defined

- What Is Accounting?

- Why Accounting Matters

- Introduction to Accounting Information

- Users of Accounting Information

- Financial vs Managerial Accounting

- Government Reporting

- Introduction to the Basic Accounting Equation

- The Accounting Equation

- Liabilities

- Owner’s Equity

- Introduction to Accounting in Business

- Transactions and the Accounting Equation

- Types of Business Activities

- Financial Statements

- Introduction to Challenges in Accounting

- Ethics in Accounting

- Significant Events in Accounting

- Putting It Together: The Role of Accounting in Business

- Discussion: The Crafty Coffee Crook

- Assignment: Lopez Consulting

Module 2: Accounting Principles

- Why It Matters: Accounting Principles

- Introduction to Financial Accounting Standards in the United States

- The Role of the FASB

- Generally Accepted Accounting Principles

- Introduction to Fundamental Concepts of US Accounting Standards

- Monetary and Cost Considerations

- Economic Assumptions

- Full Disclosure

- Other Guiding Principles

- Introduction to Accrual Basis Accounting

- The Accrual Basis and Cash Basis of Accounting

- Foundational Rules of Accrual Basis Accounting

- Introduction to International Financial Reporting Standards

- International Accounting Standards

- Convergence

- Putting It Together: Accounting Principles

- Discussion: SoftSheets

- Assignment: Accounting Principles

Module 3: Recording Business Transactions

- Why It Matters: Recording Business Transactions

- Introduction to Double-Entry Bookkeeping

- Rules of Debits and Credits

- Introduction to Journals and Ledgers

- Introduction to the Recording Process

- Create Journal Entries

- Post to the Ledger

- Calculate Account Balances

- Prepare a Trial Balance

- Putting It Together: Recording Business Transactions

- Discussion: Baker’s Breakfast Bars

- Assignment: Recording Business Transactions

Module 4: Completing the Accounting Cycle

- Why It Matters: Completing the Accounting Cycle

- Introduction to the Adjusting Process

- Adjusting Journal Entries

- Types of Adjusting Journal Entries

- Introduction to Creating Adjusting Journal Entries

- Adjusting Deferred and Accrued Revenue

- Adjusting Deferred and Accrued Expense Items

- Adjusting for Errors

- Introduction to Preparing an Adjusted Trial Balance

- Posting Adjusted Journal Entries to the Ledger

- Using the Worksheet

- Introduction to Preparing Financial Statements

- Income Statement

- Statement of Owner's Equity

- Balance Sheet

- Statement of Cash Flows

- Practice: Preparing Financial Statements

- Introduction to Closing the Books

- Closing Entries

- Post-Closing Trial Balance

- Reversing Entries

- Putting It Together: Completing the Accounting Cycle

- Discussion: Closing the Books in QuickBooks

- Assignment: Completing the Accounting Cycle

Module 5: Accounting for Cash

- Why It Matters: Accounting for Cash

- Introduction to Establishing Internal Controls

- Internal Controls

- Cash Receipts

- Cash Disbursements

- Introduction to Accounting for Petty Cash

- Voucher System

- Journalizing Petty Cash Transactions

- Practice: Journalizing Petty Cash Transactions

- Introduction to Preparing a Bank Reconciliation

- Reconciling Items

- Bank Reconciliation

- Reconciling Journal Entries

- Practice: Preparing a Bank Reconciliation

- Introduction to Accounting for Credit Card Transactions

- Record Sales and Purchases by Credit Card

- Internal Controls for Credit Card Transactions

- Introduction to Financial Statement Presentation

- Cash and Cash Equivalents

- Putting It Together: Accounting for Cash

- Discussion: Counter Culture Cafe

- Assignment: Accounting for Cash

Module 6: Receivables and Revenue

- Why It Matters: Receivables and Revenue

- Introduction to Revenue Recognition

- Recognizing Revenue under the Accrual Basis