- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.

Determine Assignability

Ensure that the contract is assignable. Some contracts, especially those involving personal services or unique skills, may not be assignable without the other party’s agreement.

Get Consent from the Other Party (if Required)

If the contract includes an anti-assignment clause or requires consent for assignment, seek written consent from the other party. This can often be done through a formal amendment to the contract.

Prepare an Assignment Agreement

Draft an assignment agreement that clearly outlines the transfer of rights and obligations from the assignor (the party assigning the contract) to the assignee (the party receiving the assignment). Include details such as the names of the parties, the effective date of the assignment, and the specific rights and obligations being transferred.

Include Original Contract Information

Attach a copy of the original contract or reference its key terms in the assignment agreement. This helps in clearly identifying the contract being assigned.

Execution of the Assignment Agreement

Both the assignor and assignee should sign the assignment agreement. Signatures should be notarized if required by the contract or local laws.

Notice to the Other Party

Provide notice of the assignment to the non-assigning party. This can be done formally through a letter or as specified in the contract.

File the Assignment

File the assignment agreement with the appropriate parties or entities as required. This may include filing with the original contracting party or relevant government authorities.

Communicate with Third Parties

Inform any relevant third parties, such as suppliers, customers, or service providers, about the assignment to ensure a smooth transition.

Keep Copies for Records

Keep copies of the assignment agreement, original contract, and any related communications for your records.

Here’s a list of steps on how to write an assignment agreement:

Step 1 – List the Assignor’s and Assignee’s Details

List all of the pertinent information regarding the parties involved in the transfer. This information includes their full names, addresses, phone numbers, and other relevant contact information.

This step clarifies who’s transferring the initial contract and who will take on its responsibilities.

Step 2 – Provide Original Contract Information

Describing and identifying the contract that is effectively being reassigned is essential. This step avoids any confusion after the transfer has been completed.

Step 3 – State the Consideration

Provide accurate information regarding the amount the assignee pays to assume the contract. This figure should include taxes and any relevant peripheral expenses. If the assignee will pay the consideration over a period, indicate the method and installments.

Step 4 – Provide Any Terms and Conditions

The terms and conditions of any agreement are crucial to a smooth transaction. You must cover issues such as dispute resolution, governing law, obligor approval, and any relevant clauses.

Step 5 – Obtain Signatures

Both parties must sign the agreement to ensure it is legally binding and that they have read and understood the contract. If a notary is required, wait to sign off in their presence.

Related Documents

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Contract : An agreement in which each party agrees to an exchange, typically involving money, goods, or services.

- Lease/Rental Agreement : A lease agreement is a written document that officially recognizes a legally binding relationship between two parties -- a landlord and a tenant.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

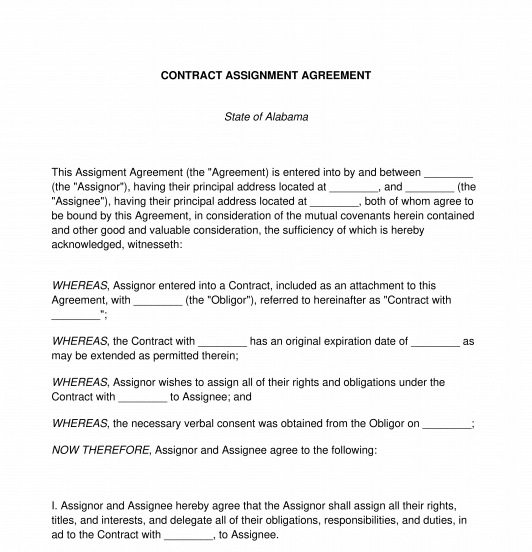

Contract Assignment Agreement

Rating: 4.8 - 105 votes

This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor who was a Party to the original contract can use this document to assign their rights under the original contract to the Assignee, as well as delegating their duties under the original contract to that Assignee. For example, a nanny who as contracted with a family to watch their children but is no longer able to due to a move could assign their rights and responsibilities under the original service contract to a new childcare provider.

How to use this document

Prior to using this document, the original contract is consulted to be sure that an assignment is not prohibited and that any necessary permissions from the other Party to the original contract, known as the Obligor, have been obtained. Once this has been done, the document can be used. The Agreement contains important information such as the identities of all parties to the Agreement, the expiration date (if any) of the original contract, whether the original contract requires the Obligor's consent before assigning rights and, if so, the form of consent that the Assignor obtained and when, and which state's laws will govern the interpretation of the Agreement.

If the Agreement involves the transfer of land from one Party to another , the document will include information about where the property is located, as well as space for the document to be recorded in the county's official records, and a notary page customized for the land's location so that the document can be notarized.

Once the document has been completed, it is signed, dated, and copies are given to all concerned parties , including the Assignor, the Assignee, and the Obligor. If the Agreement concerns the transfer of land, the Agreement is then notarized and taken to be recorded so that there is an official record that the property was transferred.

Applicable law

The assignment of contracts that involve the provision of services is governed by common law in the " Second Restatement of Contracts " (the "Restatement"). The Restatement is a non-binding authority in all of U.S common law in the area of contracts and commercial transactions. Though the Restatement is non-binding, it is frequently cited by courts in explaining their reasoning in interpreting contractual disputes.

The assignment of contracts for sale of goods is governed by the Uniform Commercial Code (the "UCC") in § 2-209 Modification, Rescission and Waiver .

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Assignment Agreement, Assignment of Contract Agreement, Contract Assignment, Assignment of Contract Contract, Contract Transfer Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

Assignment of Purchase Agreement

An assignment of purchase agreement and sale is when a buyer of a new home sells a third party the right to assume the purchase contract. 3 min read updated on February 01, 2023

An assignment of purchase agreement and sale is when a buyer of a new home sells a third party the right to assume the purchase contract. In this situation, the buyer is the assignor, and the third party is the assignee. Under the agreement, the assignee pays a higher price. This agreement must take place in the time between when the assignor agrees to buy the home, but before the contract closes with the builder.

With this period, the assignor never takes the title of the property. Instead, the title is put in the name of the assignee. This is informally known as "flipping a home." The flipping of a home occurs when:

- The original buyer enters into a purchase contract and assigns the contract to the third party before closing ends.

- The original buyer makes a profit from the sale.

If the sale does not close, the seller will lose time, money, and resources.

Advantages and Disadvantages of an Assignment of Contract

There are several advantages of an assignment of contract. With an assignment of contract, you are not actually flipping a home. Instead, you are flipping the contract, which means you don't have to have the financial backing to purchase the property. Not only do you not close on the property, but you will also not have to pay any closing costs or take on any additional expenses.

For wholesale flippers, using the assignment of contract is a way to save thousands of dollars each month. For example, if the closing costs per property are $1,000, and you "flip" 10 properties, that is a $10,000 savings.

Wholesalers only need to put down the purchase contract deposit amount that will be held in escrow with the title company or with an attorney. The lower the deposit, the lower the risk that will be assessed. Deposits may be as low as $10 or $100 and will be easier to lose if there are any delays or issues.

An assignment of purchase agreement allows the assignee to buy into new and desirable neighborhoods that are no longer available through the builder.

The main disadvantage of an assignment of contract is the risk of not finding a buyer. If a third-party buyer is not found, and you are under contract, you are responsible for completing the contract. Additional responsibilities include the responsibility of:

- Existing liens.

- Property taxes.

In addition, if the financing of the assignee cannot be obtained before the closing, this may cause the assignor to be responsible for the closing costs and the purchase of the property. The assignor may also not be able to get his or her deposits returned.

Obtaining the Builder's Consent

For an assignment of a purchase agreement to be valid, the builder and assignor must first have a valid legal contract in place that shows the assignor is obligated to purchase a home or condominium unit from the builder.

The buyer may limit how the property can be sold, including that the property cannot be listed on the MLS (multiple listings service). If it is, it is seen as a competing with the builder. If the assignor puts the property on the MLS, it will be a breach of contract, and the builder will be entitled to damages or rescission of the contract. The buyer will also be able to retain any deposits that have been paid and any other money paid for upgrades and extras.

The assignor must also clearly state the property is an assignment of an agreement of purchase with the builder and not a direct sale from the assignor.

Preparing an Assignment of Purchase Agreement

When preparing the agreement documentation, there are questions that should be asked to determine responsibility. Some of the questions to be asked are:

- Who will be preparing the documents?

- Who will pay the cost to prepare the documents?

- Will the assignment agreement and written consent of the builder be prepared by the builder's attorney? And will they cover the costs?

- Can terms agreed to by the assignor and builder be negotiated by the assignee? If so, who will cover the costs, and how will they be resolved?

A detail that should also be negotiated is the responsibility of paying the commission of the assignment agreement.

If you need help with an assignment of a purchase agreement, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Assignor Definition

- What Is the Definition of Assigns

- Assignment of Rights Example

- Assignment Of Contracts

- Assignment of Rights and Obligations Under a Contract

- Assignment Agreement Definition

- Partial Assignment of Contract

- Assignment Law

- Legal Assignment

- Assignment Contract Law

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

April 25, 2024 · 11min read

How to start an LLC in 7 steps: A complete guide for 2024

It's easy to create a new LLC by filing paperwork with the state. But to set yourself up for success, you'll also need to think about your business name, finances, an operating agreement, and licenses and permits. Here's a step-by-step guide.

March 21, 2024 · 20min read

Anatomy of a share purchase agreement

- Using your device

Particulars regarding private acquisitions of companies

Key terms and explanations:

A share purchase agreement (“ SPA ”) is typically entered into by and between a buyer and seller(s) of a target company’s shares whereby the seller(s) agrees to sell a specific number of shares to the buyer for a specified price. The SPA serves to manifest mutual written agreement of the terms and conditions of the sale of some or all of the shares of a target company. In this article, assume a target company includes its subsidiaries. SPAs fall within the domain of mergers and acquisitions (“ M&A ”) and typically arise where an investor wholly or partially acquires a company. This article addresses the key terms associated with the private acquisition of a target company’s shares.

When a company acquires all, or a significant portion, of the shares of a target company that investor also acquires its liabilities. Consequently, an M&A transaction is typically accompanied by extensive due diligence (“ DD ”), not just to understand to what, if any, liabilities the acquirer will be exposed, but also clarify key information about the seller, such as its actual asset base (fixed assets, contracts, finances, human resources and customers, among others). DD is the fundamental audit or investigation of a target company conducted by a purchaser to compile and assess information that will directly impact the decision to make the acquisition. From a legal perspective, DD is typically conducted as to corporate records, general legal claims and litigation involving the target company, intellectual property (“ IP ”) and trade secrets, labour, anti-money laundering, anti-corruption, data privacy, environmental and other regulatory compliance that may be relevant to the specific industry of the target company. DD is also conducted in relation to the target company’s financials by accountants and auditors. In cross-border M&A, where the target has assets and operations in different countries, DD must be conducted in multiple jurisdictions and carefully co-ordinated to verify the target’s actual assets and liabilities in relation to the laws and customs of each location.

The consummation of an M&A transaction typically makes a successful DD investigation and the underlying provision of complete and accurate documents a critical condition of the closing of the acquisition. The completion of a robust DD investigation cannot be stressed enough in the case of most M&A transactions. Target companies typically have a heavy burden to provide an investor with all materials requested in this respect. Even a seemingly straightforward M&A involving a small company with limited assets and operations can be accompanied by significant hidden liabilities. In the past, data rooms were the norm and set-up at the premises of the target company or its lawyers, where all categories of requested documents would be deposited for inspection by the purchaser. Now, data rooms tend to be digital and law firms and other third parties provide in-house server-based or cloud-based platforms where all DD documents are uploaded by the seller and its advisers for collation and inspection by a purchaser and its professional advisers (typically lawyers and accountants) to the greatest extent possible. Access to such information is typically subject to strict non-disclosure requirements, therefore it should be clearly determined who will have access to such information to avoid a possible breach of those restrictions.

A key distinction should be made between a share purchase and an asset purchase. An asset transaction involves the purchase or sale of some or all of a company’s assets, such as equipment, inventory, real property, contracts or lease agreements. An asset purchase can be advantageous because it allows a purchaser to be selective about the assets it purchases. Moreover, an asset purchase allows a purchaser to acquire the property of a company without the liabilities that would accompany the assets in a share purchase. Extensive DD is still required in the case of an asset purchase, particularly with respect to ownership of, and liens on, those assets. Whether to conclude a share or an asset acquisition is dependent upon numerous considerations and the objectives of the acquirer.

Though not the focus of this article, mergers are also relevant in this context and generally consist of:

1. forward (or direct) mergers - the target merges into the purchaser, taking all the target’s assets, rights and liabilities (the target ceases to exist as a separate entity thereafter);

2. forward triangular (or indirect) mergers - the target merges into a subsidiary of the purchaser, which takes all the target’s assets, rights and liabilities (the target ceases to exist as a separate entity thereafter); and

3. reverse triangular mergers - the purchaser’s subsidiary merges into the target (the target survives and the purchaser’s subsidiary ceases to exist).

Prior to expending time to draft an SPA, the parties should negotiate and execute a term sheet, which addresses all the key and principal terms of the transaction, which can then be incorporated into an SPA. Term sheets should be formatted in simple rows and columns making key terms easy to enter and review with space for each of the counterparties to make entries and comments. Term sheets relieve the parties of separating key terms from the remaining language found in a contract allowing for greater clarity, comprehension and organisation. Once principal terms are agreed and drafted into an SPA, material changes to the terms of the SPA will be more onerous and time consuming to achieve than if revised at the term sheet stage.

A well negotiated and agreed term sheet:

- Helps counterparties to more clearly distil key issues before they are embedded in a lengthy legal document;

- Mitigates the possibility of later disputes;

- Typically is binding and contains non-disclosure, no-shop and other protective restrictions with respect to its terms and related negotiations; and

- Can mitigate legal fees because revising a term sheet is easier and faster than revising an agreement that has been drafted without a term sheet on the basis of multiple conference calls, meetings and emails from the client and counterparty’s lawyers, particularly once the terms have been already been incorporated into an SPA (this is an ill-advised approach).

Sometimes it is necessary to revise an SPA, even after a term sheet has been agreed, because the situations of the parties may require it. However, the investment in a well-crafted term sheet should not be considered optional and will almost certainly be less costly and time-consuming than revising an SPA because it was sloppily drafted on the basis of piecemeal input from the parties.

This article addresses common terms and variations of an SPA but is in no way exhaustive. Specific transactions, and companies in different industries, will require different terms and will often be subject to extensive negotiations between the parties. This article does not consider the laws of any specific jurisdiction nor does it address anti-trust or anti-competition considerations that may be relevant in certain M&A transactions. Additionally, SPAs may also be controlled or affected by existing shareholders’ agreements between the shareholders of a target company.

Definitions

Specific meanings should be attributed to specific words in any contract to be precise or alter the meaning of words as commonly used in particular industries or contexts. While certain words or phrases can be defined in the body of a contract, any words or phrases with meanings that are critical, ambiguous or require lengthy definitions or explanations should be included in the definitions section. This is particularly useful in the case of recurring words, phrases or concepts. Each defined term should initially be in quotation marks so it is clear it is a defined term, bold (so it is easily found) and the first letter of each defined word capitalised so it is clear throughout the agreement that when the word is in such capitalised form it is in fact a defined term and is less easily misconstrued (as has been done in this article). If for example “Party,” is a defined term referring to a Party to the agreement it will avoid confusion when the word “party,” all in lower case, is used to refer to any party other than a Party to the agreement.

Sale and Purchase of Shares

As a key component of any SPA, this section of the agreement typically specifies the number of shares to be acquired and states the rights, title and interest acquired in the shares by the purchaser. This section should also specify the purchase price for the shares and how it is to be paid (cash, securities of the purchaser, assumption of debt/liabilities, exchange of assets (real property, personal property, IP, etc), or a combination of the foregoing), as well as the time and place of the transaction closing. In this respect, it should also be specified if the execution of the SPA and closing will be simultaneous or if there will be a gap between execution and closing (a deferred closing). Deferred closings are common and may be necessary for various reasons, including because the parties will need to obtain various regulatory approvals and third-party consents and in certain instances the purchaser may need time to arrange third party financing (as may be the case in a private equity scenario). In some cases, regardless of whether simultaneous or deferred, the full purchase price is not paid at closing, with a certain portion of it payable upon the occurrence of certain future events.

Purchase price adjustments and earn-outs

In most M&A transactions, the purchase price is typically determined in relation to a target’s most recent financial statements. Purchase price adjustments generally shield a purchaser from changes in the value of the target between the date the target was valued and the transaction closing. In this respect, the purchaser and seller must agree on a valuation method and have adopted accounting policies that are similar or that can be reconciled.

Earn-outs typically consist of contingent, additional payment(s) that can be made after closing upon the satisfaction of certain milestones related to future performance, and expire at a specified date. Earn-outs mitigate acquisition risk for a purchaser and offer the seller a better price if it achieves the earn-out objectives. Earn-outs can be financial (e.g. hitting future sales targets) or non-financial (e.g. key customers of the target are maintained after the transaction) and can help manage disagreements about the value of the target if, among others: uncertainty exists about its future prospects, it is a start-up with limited financial results but has growth potential, or where the seller will continue to manage the company and the purchaser wants to motivate the seller’s future performance. There are risks related to the misrepresentation of achievements or simply unaligned accounting policies; therefore, earn-out provisions must be carefully drafted and should include very specific milestones, a clear earn-out period, a clear formula or method for determining the earn-out, a method of securing the earn-out payment (such as escrow or a guarantee) and earn-out-specific post-closing covenants. Thus, an earn-out can be viewed as an additional payment for achieving agreed post-closing goals.

A holdback is a tool used by purchasers to withhold payment of a portion of the purchase price until some post-closing condition has been satisfied. A holdback is a covenant by the purchaser to pay the withheld amount(s) (usually held in escrow) upon satisfaction of the conditions and provides certainty about uncertain matters at closing. Holdbacks can relate to achieving a specific working capital threshold or if litigation is outstanding at closing. If, for example, the target has a large number of accounts receivable, that amount could be held back from the purchase price. The holdback (or a portion of it) would be paid by a specified future date depending on the amount of receivables actually collected after closing. Thus, a holdback can be viewed as a reduction in the purchase price if certain post-closing conditions are not achieved.

Holdbacks can be very useful to bridge the gap between divergent valuations of the target and allow such valuations to prove themselves for a specified period of time after closing (the holdback period) and even protect a purchaser’s access to indemnification payments for post-closing risks so they are secured (usually by escrow) and do not depend on later recovery from the seller. However, it should be noted that where indemnification is the exclusive remedy, this method could operate as an indemnification cap by limiting the purchaser’s recovery options to what is available in that pool of secured funds.

An escrow is an arrangement where a third party (such as a law firm or bank) temporarily holds, and is responsible for, the assets related to a transaction until it closes to provide security for the parties. In the case of M&A, all or a portion of the purchase price may be placed in escrow to secure the interests of the parties. Escrow is particularly useful in the case of holdbacks, earn-outs and purchase price adjustments as well as a repository for indemnification funds (if necessary). Escrow is the subject of a separate agreement and specifies the terms and conditions by which the escrowee may distribute the escrowed funds or property it holds on behalf of the parties. An escrow agreement must be drafted carefully, and with specificity, to capture the key elements that determine whether funds are to be paid or withheld in relation to its subject matter.

Material adverse effect

Material adverse effect (“ MAE ”) is used to determine a threshold to measure the negative effect of an event on the target business. A buyer will desire protection from acquiring a business that has materially changed since it executed the SPA (typically where there is a deferred closing). MAEs are typically used to qualify representations, warranties and covenants. Consequently, an SPA can contain a condition precedent that permits a party to refuse to close a deal if the counterparty has suffered any MAE between the time the SPA was executed and the closing (a bring-down). A bring-down provision causes the representations and warranties made at the time the SPA was executed to be restated at the closing. MAE is negotiated by the parties and should be clearly articulated in the definitions of the SPA. The breadth of the definition of MAE depends on the type of transaction, industry and negotiating power of the parties.

Materiality and MAE qualifications are generally used to determine:

- Whether the conditions precedent have been satisfied;

- The scope of the seller’s disclosures;

- If a misrepresentation or breach of warranty has occurred; and

- The losses resulting from such a misrepresentation or breach.

Conditions precedent

Conditions precedent, or closing conditions, are stipulations agreed by the parties that must be satisfied, or waived, before the acquisition may close. Conditions precedent are typically attributed to a specific party but some can be mutually applicable. Failure to satisfy a closing condition typically gives the counterparty the right to abandon the transaction without liability. This protects the parties from not receiving that for which they have bargained. In the case of a deferred closing, events may transpire after the SPA is executed requiring a party to terminate the SPA prior to closing (by mutual agreement or due to the occurrence -or lack of occurrence - of specified events).

Conditions precedent must be drafted with care. They are typically specific to a transaction and the needs and circumstances of the parties. Conditions precedent typically found in SPAs, among others, are:

- Bring-downs of representations and warranties - in the case of a deferred closing, the representations and warranties made when the SPA was executed shall remain true at the time of closing - the parties typically must each deliver closing certificates to verify the accuracy and satisfaction of each party’s representations and warranties (and compliance with pre-closing covenants) on the closing date, certified by an officer of each party as well as certification by the company secretary of each party that its resolutions authorising the consummation of the transaction are correct and properly resolved;

- Approvals - both parties shall have received all relevant regulatory and other governmental approvals in relation to the transaction from any place with jurisdiction over the subject matter of the SPA;

- No legal impediments - no government or authority with any jurisdiction over the subject matter of the SPA shall have enacted any law or rule that would make consummation of the transaction illegal or act to restrain or prohibit closing or deprive the purchaser of that for which it has bargained;

- Delivery of documents - each party shall have delivered executed copies of all ancillary documents;

- Payment - the purchaser shall have delivered the purchase price to the seller (or escrowee);

- Disencumbrance - the seller shall have proven the release of any security interests or liens on the assets of the target (unless the purchaser has agreed to accept and assume the encumbrances);

- Consents - the seller shall have obtained and provided all third-party consents (usually required by contracts to which the seller is a party, such as customer contracts, supply contracts, and/or leases) agreed by the parties (note that because sellers tend to desire certainty that a deal will close, some may be disinclined to agree to conditions outside their control, whereas buyers want protection from acquiring a business the operations of which are impaired or impracticable after closing due to a failure to obtain third-party consents);

- Compliance - the parties shall have complied with all pre-closing covenants (parties to an SPA typically negotiate whether these conditions are qualified by materiality or an MAE);

- MAE - no MAE shall have occurred since the execution of the SPA;

- Litigation - each party certifies no litigation shall have been commenced, or is expected, that would impede its participation in the transaction; and

- Legal opinions - all necessary legal opinions in connection with the transaction shall have been delivered.

In the case of share acquisitions, binding legal opinions are often provided by the seller’s lawyers and their delivery to the purchaser is a common condition precedent to closing. Such legal opinions are meant to be relied upon by a purchaser and provide security. If inaccurate or incorrect, the purchaser can seek recourse against the law firm, as well as the seller as they relate to any breaches of the SPA or ancillary documents. In such legal opinions, the seller’s counsel will typically opine on matters such as, among other things:

- Good standing and valid existence of the target;

- Correct authorisation, execution, and delivery of transaction documents;

- Absence of conflict between the transaction documents and the target’s charter document and other contracts (including shareholders’ agreements) or applicable laws;

- Absence of governmental filings, consents or constraints as to the target entering into and performing the SPA (and other documents) and consummating the transaction;

- Absence of litigation against the target;

- Authorised and outstanding shares; and

- Effect of the transfer of shares and a statement of the rights or status obtained by the purchaser as to the shares under applicable law.

A purchaser may inadvisably choose to forego such a legal opinion and rely solely upon the representations and warranties of the seller, but this choice depends on the risk tolerance of the purchaser.

Representations and warranties

In M&A transactions, representations and warranties are given by both parties to disclose material information to each other. While a seller’s representations and warranties tend to be more extensive because they include information about the target company, its business, assets and liabilities, they can be in favour of the seller depending on the respective negotiating power of the parties, the nature of the transaction and the industry. Representations and warranties allocate risk between the parties and form the basis for a legal claim in case of a misrepresentation or breach. They can be as complex or rudimentary as the parties negotiate but are integral to an M&A transaction.

Representations are assertions of fact (past or existing) on the date made and given to persuade another party to enter into a contract or take (or forbear from) some other action. A representation precedes and induces agreement and is typically information used by a party to decide whether to enter into a contract. A warranty is a guarantee, given to assure something is as promised, will remain so and is typically accompanied by a promise of indemnification if the assertion proves to be false.

Traditionally, remedies for representations and warranties are different. Generally, if representations are untrue or inaccurate (i.e. misrepresentations) a contract may be able to be rescinded. However, in the case of breach of a warranty, a cause of action for breach of contract would typically arise with a claim for damages to cover the losses of the aggrieved party.

In the context of an SPA, a seller’s representations and warranties generally cover, among others, that the:

- Target legally exists, has the power to carry on its business and is legally authorised to do business in any jurisdiction where it does business (organisation, power and standing);

- Target’s records are complete and accurate (charter documents and any amendments);

- Target has no undisclosed liabilities;

- Confirmation of target’s capital structure (number of authorised shares, par value (if any) and if unencumbered);

- Seller has authority to enter into the SPA and its execution does not contravene any limitations attached to the shares being purchased (board minutes and resolutions should be provided);

- Target is legally compliant and possesses all government approvals to conduct its business, and there are no violations or claimed violations of any such approvals or any applicable laws or regulations;

- No conflict will be caused by the execution of the SPA with the target’s charter documents or any law or regulation;

- Target is not involved in any litigation (as a defendant or plaintiff);

- Target’s liabilities (usually financial and capped as at the closing date);

- Target’s accounting records are true and accurate and comply with accepted accounting guidelines;

- Target has properly filed tax returns, all taxes due on, or prior to, closing will be paid, there are no ongoing or pending tax audits and tax authorities will have no grounds for reassessment for additional taxes up to the closing date;

- Target has disclosed all bank and financial accounts together with names of signatories and signature or company chop/stamp specimens for withdrawals;

- From the execution of the SPA to closing, the target will conduct itself in the ordinary course of business and there will be no material changes to the business;

- Target has adequate insurance (legally required and as otherwise needed);

- Target’s real property is intact (assurances of ownership, encumbrance, leases properly entered and maintained and all fees and taxes paid);

- Target has unencumbered title to assets;

- Condition of target’s assets (including inventory);

- Target’s IP (ownership, knowledge of infringement and steps to protect trade secrets);

- Target’s material contracts (validity and enforceability and none with improper affiliates);

- Target’s labour status (full legal compliance, no labour claims or disputes);

- Target’s environmental compliance;

- Target’s anti-corruption compliance;

- Full disclosure (seller has made full, complete and accurate disclosures); and

- Reliance (seller understands purchaser is relying upon seller’s representations and warranties in entering the SPA).

Purchasers typically desire broad, absolute and unqualified representations and warranties from sellers to provide stronger grounds for termination and indemnification. Sellers can mitigate the risk of representations and warranties by confining them only to ‘material’ matters and use ‘knowledge’ standards to limit statements of fact to those things about which the seller has, or should have, actual knowledge. Qualifying representations and warranties can reduce the potential for future claims of misrepresentation and breach of warranty based on non-disclosure of material information. Sellers can also reduce risk by confining representations and warranties to specific time periods.

Purchasers also make representations and warranties in an SPA. Typically, a seller wants to ensure the purchaser can legally acquire the target, can close and has the funds to pay the purchase price. Typical purchaser representations and warranties address, among other things:

- Organisation, power and standing of the purchaser;

- Authorisation to enter into the SPA with provision of appropriate board resolutions to that effect;

- Power and authority of the purchaser to make the representations and warranties and any other covenants in the SPA and to execute and perform the SPA;

- Purchaser’s compliance with any applicable laws for the lawful conduct of its business and that it is in good standing in this respect;

- The execution of the SPA will not conflict with its charter documents or contravene any law;

- Solvency of the purchaser as of the closing date;

- Legality of funds – consideration used by the purchaser to pay for the shares of the target are from legal sources; and

- No litigation is ongoing or expected that would impede the purchaser’s obligations under the SPA.

Indemnification

A subject of heavy negotiation and nuance, an SPA will typically contain an indemnification clause that addresses liability for losses incurred due to misrepresentations and breach of warranties, covenants and other agreements. The indemnification clause can be drafted as an exclusive remedy or a non-exclusive remedy to assert such claims. As an exclusive remedy, the indemnification provisions should specify when and how claims must be made, processed and paid, as well as any limitations or qualifications with respect to payment and liability. Agreement to an exclusive remedy would normally constitute a waiver by the parties of any remedies that would otherwise be available under applicable law(s). However, there are exceptions to this exclusivity in the case of fraud, intentional breaches, wilful misconduct and equitable remedies.

In some cases, a purchaser may desire the flexibility of indemnification as a non-exclusive remedy, allowing it to pursue other causes of action or remedies to ensure it can be made whole. This is desirable where there is a risk the indemnification provisions may not adequately protect the purchaser in the event of unforeseeable damage and would allow it to benefit from all protections and remedies provided by applicable laws without being confined to just those remedies provided in the SPA. Sellers may prefer exclusive remedy provisions because of the perception that without them a purchaser might circumvent the negotiated terms and impair the core purpose of the indemnification provisions. Exclusive remedies can also act as a cap on indemnification liability.

Typical indemnification obligations of a seller are, among others, to indemnify the purchaser from:

- Breaches of representations and warranties made by the seller;

- Breaches of covenants or other obligations of the seller;

- Any liabilities stemming from seller’s ownership or operation of the target before closing;

- Any product manufactured or shipped, or any services provided, by the seller before closing;

- Those specific matters disclosed in the disclosure schedules; and

- Any liabilities specifically retained by the seller.

Typical methods of mitigating a seller’s indemnification risk are, among others:

- Materiality and knowledge qualifiers that constrain the breadth and scope of representations, warranties and covenants;

- Imposing time limits on when and for how long a purchaser can make a claim;

- Caps on the seller’s liability;

- An indemnity basket (or deductible) requiring a purchaser’s damages to exceed a threshold amount before triggering indemnification liability (to avoid petty claims);

- Requiring any insurable loss to be insured and the purchaser to first claim from insurance before seeking indemnification from the seller; and

- Prohibiting the purchaser from making a claim for indemnification in relation to anything disclosed in the DD investigation or about which it had knowledge.

A ‘materiality scrape’ is a provision commonly included in an SPA indemnification clause to favour a purchaser. It typically provides that when determining if a representation is inaccurate or a warranty breached or when calculating the quantum of damages or loss due to an inaccuracy or breach (or both), any materiality or knowledge qualifiers in the seller’s representations and warranties will be disregarded (scraped) for indemnification purposes.

A ‘single materiality scrape’ retains materiality and knowledge qualifiers when determining if a seller has made a misrepresentation or breached a warranty but, where a misrepresentation or breach has been found to occur, the materiality qualifier will be disregarded in determining damages. Thus, subject to any deductible and other indemnity limitations in the SPA, the purchaser can recover the full amount of its damages due to the breach. A ‘double materiality scrape’ negates materiality and knowledge qualifiers from both determining whether a misrepresentation has been made and a warranty breached, as well as in the calculation of damages due to such a breach.

The materiality and MAE qualifiers most commonly covered by a materiality scrape relate to the determination of:

- Whether there has been a misrepresentation or breach of a warranty;

- The quantum of damages or losses suffered by the purchaser due to the misrepresentation or breach;

- The scope of disclosure required in the seller’s SPA disclosure schedules; and

- Whether the closing conditions have been fulfilled.

Pre-closing covenants

Pre-closing covenants generally limit what a seller can do before the closing. Typically, covenants given by the seller are heavier than those given by the purchaser because the seller typically retains control of the target until the transaction closes. As promises to do or not do certain things, pre-closing covenants are common in transactions with deferred closings to protect and preserve the value of the business being acquired between the execution of the SPA and the closing of the acquisition.

Pre-closing covenants ensure the parties to the SPA make efforts (the parties must negotiate to determine the legal standard of effort – ‘best efforts’ (the highest standard of obligation) vs ‘commercially reasonable efforts’ (a lower standard of obligation)) to close the transaction and commonly include, among others:

- The purchaser’s right to access the target’s premises, books and records (including its designees such as lawyers, accountants and business advisors);

- Requirements that the seller conducts business as usual and does not enter into any extraordinary transactions;

- Requirements the seller makes necessary regulatory filings and gets any required approvals;

- Requirements to use [best or commercially reasonable] efforts to close the transaction;

- No-shop provisions preventing the seller from using the signed SPA to seek better offers;

- Requirements for the seller to restructure the target company to effect the transaction; and

- Requirements for the target company to terminate related-party transactions or transactions with entities owned or controlled by the target company’s management, founders or affiliates.

In order to prevent the seller and target company management from impairing the company, a purchaser will typically use pre-closing covenants to prohibit the target company, its shareholders, directors and management from:

- Issuing new shares (or repurchasing any equity in the target company or its subsidiaries);

- Transferring any shares in the target company to any person other than the purchaser or its designee;

- Paying any dividends or repaying any shareholder loans;

- Incurring any new debts;

- Granting any security interest on any assets of the target company;

- Entering into any merger, acquisition or consolidation with any entity other than a restructuring agreed by the parties to the SPA;

- Entering into any joint venture, strategic partnership or other relationship with a third party other than as specifically agreed by the purchaser and seller;

- Acquiring or disposing of any target company assets other than in the ordinary course of business;

- Amending any target company constitutional documents other than as needed to fulfil the obligations of the SPA;

- Increasing the compensation of any current or former director, officer, employee or consultant or pay any bonuses to any of those individuals;

- Making any material changes to the target’s business;

- Incurring capital expenditures above a specified threshold and that would not be in the ordinary course of business; and

- Entering into, amending or terminating any material contract.

Termination rights

Connected with closing conditions are termination rights, which would permit a party to terminate the SPA prior to closing. Typically negotiated termination rights found in an SPA, among others, are termination:

- By mutual written consent of the parties;

- Due to a party’s breach of a warranty, material misrepresentation or failure to perform a covenant;

- If a party has failed to satisfy its closing conditions by the agreed date (a drop dead date); and

- By either party if any government or authority with jurisdiction over the subject matter of the SPA has enacted any law or rule that would make consummation of the transaction(s) illegal or in some way act to restrain or frustrate consummation of the transaction (legal impediment).

Ancillary documents and agreements

Ancillary documents and agreements typically consist of a number of documents enumerated in a schedule appended to an SPA that the parties must deliver to each other at or prior to closing in order for an M&A transaction to close and include, among others:

- Non-disclosure, non-compete, and non-solicitation agreements with the selling shareholders;

- Board minutes and resolutions from both parties to approve the terms of the transaction and the transaction documents as well as authorise them to be executed and to approve matters that must be handled at the close, following satisfaction of the conditions;

- A guarantee, in the event the purchaser requires a guarantor for any of the seller’s obligations under the SPA, (which can be added to the terms of the SPA rather than a separate document in which case the guarantor would also be a party to the SPA (the guarantor is often be the seller’s parent company));

- Loan notes, if the consideration includes the issue of loan notes by the purchaser to the seller (an instrument must be negotiated and drafted that articulates the terms and conditions of the issue of loan notes);

- An escrow deed, when it is agreed escrow will be used to facilitate transaction-related payments such as earn-outs or indemnification claims, in which case an escrow account must be established and an escrow deed negotiated, drafted and executed appointing an escrowee to administer the escrow account;

- A deed of contribution, where the target company has multiple individual shareholders as the sellers in order to apportion liabilities among them in the event of warranty claims and other potential actions against the sellers by the purchaser;

- A shareholder’s agreement (typically prepared by the purchaser) signed and executed by the selling shareholders where the acquisition is not for 100% of the shares of the target or where any of the target’s shareholders will remain as shareholders in the acquired target; and

- Employment or consulting agreements signed by the selling shareholders (if individuals) where it is desirable to retain them or lock them in as employees or consultants at the new newly acquired company.

Post-closing covenants

SPAs may also include post-closing covenants that apply after a transaction closes. Post-closing covenants are tailored to the needs of the parties and are contextual. They may, among other things:

- Ensure the purchaser co-operates with the seller to maintain certain tax and business records (in case of tax or other regulatory audits);

- Ensure the purchaser maintains directors’ and officers’ insurance for outgoing directors and officers of the target company;

- Prevent the seller from competing with the target company;

- Prevent the seller from soliciting employees of the target company; and

- Ensure IP transferred to the purchaser or retained by the seller in relation to the transaction is not used by the counterparty.

Confidentiality and non-disclosure

An SPA typically contains language specifying that the terms of the SPA itself, including its existence, are deemed confidential information and not to be disclosed to any third party. However, this language should incorporate and specifically reference any prior non-disclosure agreement (“ NDA ”) that was (and should have been) entered into between the purchaser and seller during a prior phase of the transaction, such as the term sheet or DD phase and emphasise that any such agreement remains in full force and effect until that agreement terminates or is superseded. Any NDA language in the SPA can reflect additions to prior NDAs and incorporate the language of the prior NDA by reference into the SPA, supersede such prior NDAs in their entirety or maintain that only that language in the prior NDA that is inconsistent with the SPA is superseded.

Additionally, this clause of the SPA should contain restrictive language with respect to press communications. Any press releases, public announcements, conferences or advertisements relating to the transaction, the SPA and its existence should be prohibited unless the consent of the parties to the SPA is obtained.

An NDA establishes the parameters of the disclosures of sensitive, proprietary and confidential information by the parties. An NDA should contain, at a minimum, among others:

- A definition of what constitutes confidential information;

- Exceptions to confidential information;

- Covenants to maintain confidentiality;

- Non-compete and non-solicitation provisions; and

- Well considered miscellaneous provisions (see below).

Typically, sellers want definitions of confidential information to be drafted as broadly as possible to protect proprietary information. Conversely, purchasers tend to prefer less inclusive definitions to mitigate potential liability.

Non-compete and non-solicitation provisions are often included as a component of an NDA. They are covenants that restrict a seller from competing with the target company and from soliciting employees and customers of the target company or the buyer for a specified period of time after the closing.

Miscellaneous provisions

Miscellaneous provisions are an essential component of any well-drafted agreement. Many gloss over these terms and consider them standard boilerplate when in fact they are important. It is a place where lawyers may cache terms that could be overlooked.

Miscellaneous provisions are common to most contracts, including SPAs. They typically consist of provisions on, among others:

- Notices to the parties and how they are to be sent;

- Severability as to illegal or unenforceable terms and rectification;

- Survival of certain provisions beyond the expiration or termination of the SPA;

- Merger and integration that makes the SPA the final written manifestation of the parties’ intentions and agreements and disregards or supersedes any prior agreements or understandings unless specifically included or referenced in the SPA;

- If and how the SPA may be amended;

- Governing law and jurisdiction;

- Dispute resolution method;

- Further assurances to do anything necessary to carry out the provisions of the SPA or ancillary agreements;

- Allocation of costs in case of disputes; and

- Prevailing language of the SPA if it is bi- or multi-lingual (necessary in a cross-border context, where the parties do not all natively use the same language).

This article will not deviate from its core subject matter and explore in any detail the panoply of important miscellaneous provisions. However, survival clauses deserve special attention in this context. Parties often include a survival clause to limit or extend the effectiveness of certain provisions beyond a contract’s term.

The representations, warranties and covenants made in an SPA should survive the execution and delivery of the SPA and closing of the transaction, thus extending them beyond the closing of the transaction. It is possible that some misrepresentations and breaches of warranty will only be discoverable after the closing. The survival of the representations, warranties and covenants (as well as indemnification terms) beyond the closing of the transaction protects the purchaser if it receives less than that for which it bargained. However, the parties should carefully consider the governing law of the SPA to determine how that jurisdiction interprets and enforces statutes of limitations. Some jurisdictions prohibit breach of contract claims to extend beyond the jurisdiction’s statute of limitations even where the parties to an SPA specifically agree on survival language that allows a claim for a breach to extend beyond the jurisdiction’s statute of limitations.

Choice of law and forum selection

An SPA specifies the contractual terms that will regulate the transaction. However, the interpretation and effect of those terms will vary depending upon which country’s laws are applicable. A choice-of-law clause is a selection by the parties to use the law of a specific jurisdiction to govern the SPA and determine issues regarding the parties’ rights and obligations.

It would be rare for a choice-of-law provision to be excluded from an SPA (or any other cross-border agreement). The lack of a choice-of-law clause in an SPA would subject the parties to unnecessary expense and complex rules to determine which law to apply by considering where the parties are located and where their obligations are to be performed, among other things. In the context of international M&A, failure to specify what law governs the SPA could be a disaster in relation to any dispute, particularly where the buyer is based in one jurisdiction and the seller in another, with subsidiaries and assets in multiple other jurisdictions.

Additionally, the parties must consider how and where adjudication of disputes occurs. Parties are generally free to choose the governing law and it need not have a connection with the location of the parties or the subject matter of the contract. Therefore, the parties to an SPA should also specify in what country a dispute must be adjudicated and whether such adjudication will occur in the courts or via arbitration. Some courts are willing to apply the laws of another jurisdiction. Some courts will require one of the parties or the transaction to have some connection with the jurisdiction where adjudication is to occur and apply a test to determine a connection with the jurisdiction or apply a monetary value threshold that a dispute must exceed in order for the courts of that jurisdiction to have standing to hear the case. Arbitration, which is private adjudication, can occur virtually anywhere, notwithstanding the location of the parties or the transaction. A well-crafted dispute resolution clause is very important and should specify the governing law, the seat of adjudication and select a forum (arbitration or the courts).

Arbitration offers certain advantages over courts because it gives complete flexibility to the parties. Arbitration allows the parties to select virtually any governing law, determine which arbitration body will adjudicate a dispute, choose the jurisdiction where the arbitration will occur and the arbitration rules that will govern the adjudication of the dispute. This allows the party to indirectly determine procedure, evidentiary burdens and processes and directly control the language in which the arbitration is conducted and the selection of the number of adjudicators. There are numerous arbitration organisations around the world that can draw from a diverse pool of adjudicators that will have extensive professional experience both with M&A, and specific industries, that will facilitate the adjudication of a dispute that may involve complex circumstances that court judges may not understand. Additionally, arbitration may be safer in jurisdictions where the courts are known to have corruption issues. Moreover, because of the Convention on the Recognition and Enforcement of Foreign Arbitral Awards (the “ New York Convention ”), which currently has 161 signatories, arbitration awards can be enforced in any signatory jurisdiction. Conversely, foreign court judgments are less easily enforced in other jurisdictions and sometimes unenforceable. Arbitration can be more expensive than traditional court litigation, depending on the jurisdiction, but it is generally faster and less complicated.

A quality SPA cannot make a bad business acquisition good. However, backed by a well-negotiated term sheet and effective DD, an SPA is an essential tool to mitigate risk in M&A. Experienced, competent lawyers are indispensable not only to craft a term sheet and draft an SPA (and ancillary documents) that sufficiently meet the needs and objectives of the parties to an M&A transaction but also to manage and coordinate all the moving parts of the deal. This article is meant to provide general guidance to laypeople and non-corporate lawyers to better understand the complications that can arise in M&A.

Hill Dickinson, founded in 1810, has lawyers with decades of experience in dealing with a full range of corporate matters involving M&A and due diligence, conventional and complex investments and structures, venture capital, private equity, joint ventures, business sales, corporate reorganisations and capital markets offerings. Our combination of technical expertise, commercial acumen and excellent service, together with the quality of our team, market knowledge and commitment to achieving client success, makes us Hill Dickinson.

This article is for general information purposes only and does not constitute legal advice.

If you have queries regarding transactional issues or corporate matter, you may contact Alexander May .

- Intellectual property

- Share purchase agreement

- Mergers and acquisitions

- Extensive due diligence

Related insights

Hill dickinson advises zipa precious metals on the listing and admission to trading of gold securities.

25 April 2024

Our London Corporate team recently advised Zipa Precious Metals Public Limited Company in connection with admission to trading on the Main Market of the London Stock Exchange.

Hill Dickinson advises electrical engineering group SeaKing on Modutec majority stake investment

19 April 2024

Our Liverpool Corporate team recently advised SeaKing Group on a majority stake investment by Modutec that is set to create "an exciting opportunity for growth and collaboration".

Hill Dickinson advises Duality Group shareholders on sale to Sureserve

17 April 2024

We recently advised the shareholders of Duality Group, a provider of heating, energy saving and renewable solutions, on the sale of the Duality Group to Sureserve.

Hill Dickinson advises AIM-Listed Capital Metals on receipt of strategic investment

10 April 2024

We recently advised AIM-listed client Capital Metals plc on receipt of a strategic investment of £1.25 million from ASX-listed Sheffield Resources.

Hill Dickinson advises AIM-Listed Arc Minerals on £4.14m fundraise

03 April 2024

We are pleased to have advised AIM-listed client Arc Minerals Ltd on a placing and subscription, which raised gross proceeds of £4.14 million from investors.

Hill Dickinson advises Xeinadin Group on David Cadwallader and Everitt Kerr acquisitions

04 March 2024

Our Manchester Corporate team has advised business advisory and accountancy firm Xeinadin Group on its acquisition of Bicester-based David Cadwallader & Co. Read more...

Delivering a high-quality combination of technical expertise, commercial acumen and excellent client service, our clients value the quality of our people, our market knowledge and our commitment to achieving success for them. We always aim to exceed their expectations.

Our highly experienced and recognised corporate team operates from our offices in Liverpool, Manchester, London, Leeds, Hong Kong and Singapore. We offer our clients accessible corporate support from our experienced national and international network and specialise in advising a range of clients, from large listed companies and private equity funds to smaller start-up and owner-managed businesses and management teams on the full range of transactions – both domestic and cross-border. Our advice is distinctly commercial and focused on our clients’ commercial goals.

We work in small partner-led teams, providing our clients with easy access to our partners on transactions. We offer an innovative approach to managing client relationships and fee arrangements, which sets us apart from many of our competitors. We are able to offer our clients a timely, relevant and cost-effective service, that adds real value to the transaction process.

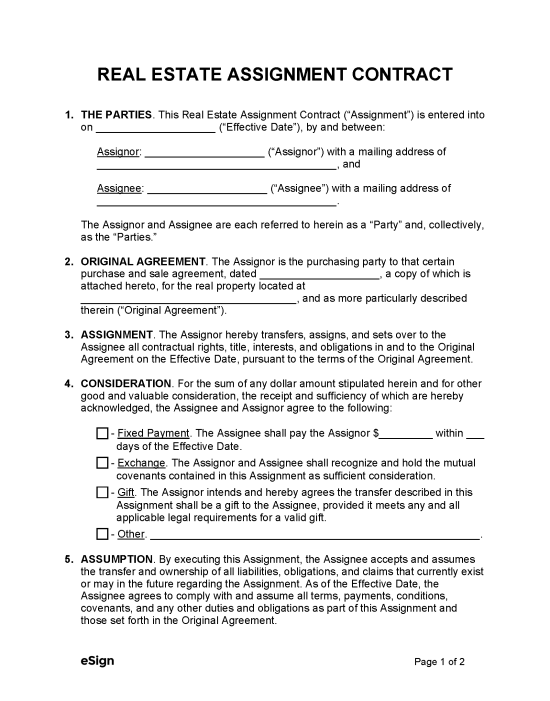

Real Estate Assignment Contract

Email delivery.

Last updated April 17th, 2023

- Purchase Agreements »

A real estate assignment contract allows a real estate buyer to transfer their purchasing rights and responsibilities to someone else before the closing date. Typically, the new buyer pays a fee to the original buyer for the assignment. The form specifies the amount and due date of the assignment fee (if applicable), as well as all other details of the transaction, including the new buyer’s liabilities , payment requirements , and rights under the purchase agreement .

Download: PDF , Word (.docx) , OpenDocument

REAL ESTATE ASSIGNMENT CONTRACT

1. THE PARTIES . This Real Estate Assignment Contract (“Assignment”) is entered into on [MM/DD/YYYY] (“Effective Date”), by and between:

Assignor : [ASSIGNOR’S NAME] (“Assignor”) with a mailing address of [ADDRESS] , and

Assignee : [ASSIGNEE’S NAME] (“Assignee”) with a mailing address of [ADDRESS] .

The Assignor and Assignee are each referred to herein as a “Party” and, collectively, as the “Parties.”

2. ORIGINAL AGREEMENT . The Assignor is the purchasing party to that certain purchase and sale agreement, dated [MM/DD/YYYY] , for the real property located at [PROPERTY ADDRESS] , and as more particularly described therein (“Original Agreement”).

3. ASSIGNMENT . The Assignor hereby transfers, assigns, and sets over to the Assignee all contractual rights, title, interests, and obligations in and to the Original Agreement on the Effective Date, pursuant to the terms of the Original Agreement

4. CONSIDERATION . For the sum of any dollar amount stipulated herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree to the following: [DESCRIBE PAYMENT OR OTHER CONSIDERATION] .

5. ASSUMPTION . By executing this Assignment, the Assignee accepts and assumes the transfer and ownership of all liabilities, obligations, and claims that currently exist or may in the future regarding the Assignment. As of the Effective Date, the Assignee agrees to comply with and assume all terms, payments, conditions, covenants, and any other duties and obligations as part of this Assignment and those set forth in the Original Agreement.

6. REPRESENTATIONS . The Parties acknowledge that they have a full understanding of the terms of this Assignment. The Assignor further warrants and represents that they own the rights transferred in this Assignment and has prior consent to execute this Assignment under the terms of the Original Agreement or otherwise through the written consent of the selling party under the Original Agreement; in the latter case, the written and signed consent of said party shall be attached to this Assignment. The Parties agree to provide and complete any obligations under this Assignment and the Original Agreement.

Assignor Signature : ___________________ Date: [MM/DD/YYYY] Print Name: [ASSIGNOR’S NAME]

Assignee Signature : ___________________ Date: [MM/DD/YYYY] Print Name: [ASSIGNEE’S NAME]

Thank you for downloading!

How would you rate your free form, when you're ready, visit our homepage to collect signatures or sign yourself - 100% free.

Free Share Purchase Agreement Template for Microsoft Word

Download this free Share Purchase Agreement template as a Word document to help you negotiate the purchase of shares in a company or organisation

Share Purchase Agreement

THIS SHARE PURCHASE AGREEMENT (the “Agreement”) made and entered into this [Insert date] (the “Execution Date”),

[Insert name] of [Insert address] (the “Seller”)

[Insert name] of [Insert address] (the “Purchaser”)

A. The Seller is the owner of record of [Insert number] shares (the “Shares”) of [Insert company] (the “Corporation”).

B. The Seller desires to sell the Shares to the Purchaser and the Purchaser desires to purchase the Shares from the Seller.

IN CONSIDERATION OF and as a condition of the parties entering into this Agreement and other valuable consideration, the receipt and sufficiency of which consideration is acknowledged, the parties to this Agreement agree as follows:

Purchase and Sale

1. Except as otherwise provided in this Agreement, all monetary amounts referred to in this Agreement are in [Insert currency].

2. The Seller agrees to sell and the Purchaser agrees to purchase all the rights, title, interest, and property of the Seller in the Shares for an aggregate purchase price of $__________ (the “Purchase Price”).

3. A fixed sum of $__________ will be payable on closing of this Agreement.

4. All payments will be in the form of certified cheque, wire transfer, or bank draft of immediately available funds. In the case of a direct wire transfer the Seller will give notice to the Purchaser of the bank account particulars at least 5 business days prior to the Closing Date.

Representations and Warranties of the Seller

5. The Seller warrants and represents to the Purchaser as follows: