- Home

- University of Bedfordshire e-theses

- PhD e-theses

Risk management in banks: determination of practices and relationship with performance

Description

Collections.

The following license files are associated with this item:

entitlement

Export search results

The export option will allow you to export the current search results of the entered query to a file. Different formats are available for download. To export the items, click on the button corresponding with the preferred download format.

By default, clicking on the export buttons will result in a download of the allowed maximum amount of items.

To select a subset of the search results, click "Selective Export" button and make a selection of the items you want to export. The amount of items that can be exported at once is similarly restricted as the full export.

After making a selection, click one of the export format buttons. The amount of items that will be exported is indicated in the bubble next to export format.

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Dissertations / Theses on the topic 'Financial risk management'

Create a spot-on reference in apa, mla, chicago, harvard, and other styles.

Consult the top 50 dissertations / theses for your research on the topic 'Financial risk management.'

Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago, Vancouver, etc.

You can also download the full text of the academic publication as pdf and read online its abstract whenever available in the metadata.

Browse dissertations / theses on a wide variety of disciplines and organise your bibliography correctly.

Laurent, Marie-Paule. "Essays in financial risk management." Doctoral thesis, Universite Libre de Bruxelles, 2003. http://hdl.handle.net/2013/ULB-DIPOT:oai:dipot.ulb.ac.be:2013/211221.

Zhang, Lequn. "Extreme Risk Forecast for Quantitative Financial Risk Management." Thesis, Curtin University, 2022. http://hdl.handle.net/20.500.11937/89362.

Gueye, Djibril. "Some contributions to financial risk management." Thesis, Strasbourg, 2021. http://www.theses.fr/2021STRAD027.

Wang, Mulong. "Financial derivatives in corporate risk management." Access restricted to users with UT Austin EID, 2001. http://wwwlib.umi.com/cr/utexas/fullcit?p3036610.

Schaumburg, Julia. "Quantile methods for financial risk management." Doctoral thesis, Humboldt-Universität zu Berlin, Wirtschaftswissenschaftliche Fakultät, 2013. http://dx.doi.org/10.18452/16675.

Genin, Adrien. "Asymptotic approaches in financial risk management." Thesis, Sorbonne Paris Cité, 2018. http://www.theses.fr/2018USPCC120/document.

Nikoci, Besjana <1989>. "Stress Testing for Financial Risk Management." Master's Degree Thesis, Università Ca' Foscari Venezia, 2015. http://hdl.handle.net/10579/6935.

Aas, Roar. "Risk management using derivatives." Thesis, Heriot-Watt University, 1993. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.262000.

Eriksson, Kristofer. "Risk Measures and Dependence Modeling in Financial Risk Management." Thesis, Umeå universitet, Institutionen för fysik, 2014. http://urn.kb.se/resolve?urn=urn:nbn:se:umu:diva-85185.

Paltalidis, Nikolaos. "Essays on applied financial econometrics and financial networks : reflections on systemic risk, financial stability & tail risk management." Thesis, University of Portsmouth, 2015. https://researchportal.port.ac.uk/portal/en/theses/essays-on-applied-financial-econometrics-and-financial-networks(3534970d-eeba-4748-9812-d18430925664).html.

Černák, Peter. "Risk Management." Master's thesis, Vysoká škola ekonomická v Praze, 2009. http://www.nusl.cz/ntk/nusl-76579.

Zou, Lin. "Essays in financial economics and risk management." Thesis, [College Station, Tex. : Texas A&M University, 2007. http://hdl.handle.net/1969.1/ETD-TAMU-1476.

Graf, Mario. "Financial Risk Management State-of-the-Art /." St. Gallen, 2005. http://www.biblio.unisg.ch/org/biblio/edoc.nsf/wwwDisplayIdentifier/01665710001/$FILE/01665710001.pdf.

Ewers, Robin B. "Enterprise Risk Management in Responsible Financial Reporting." Thesis, Walden University, 2017. http://pqdtopen.proquest.com/#viewpdf?dispub=10637579.

Despite regulatory guidelines, unreliable financial reporting exists in organizations, creating undue financial risk-harm for their stakeholders. Normal accident theory (NAT) identifies factors in highly complex integrated systems that can have unexpected, undetected, and uncorrected system failures. High-reliability organization (HRO) theory constructs promote reliability in complex, integrated systems prone to NAT factors. Enterprise risk management (ERM) integrates NAT factors and HRO constructs under a holistic framework to achieve organizational goals and mitigate the potential for stakeholder risk-harm. Literature on how HRO constructs promote ERM in responsible integrated financial systems has been limited. The purpose of this qualitative, grounded theory study was to use HRO constructs to identify and define the psychological factors involved in the effective ERM of responsible organizational financial reporting. Standardized, open-ended interviews were used to collect inductive data from a purposeful sample of 13 reporting agents stratifying different positions in organizations that have maintained consistent operational success while attenuating stakeholder risk-harm. The data were interpreted via transcription, and subsequent iterative open, axial, and narrative coding. Results showed that elements of culture and leadership found in the HRO construct of disaster foresightedness and mitigation fostered an internal environment of successful enterprise reporting risk management to ethically achieve organizational goals and abate third-party stakeholder risk-harm. The findings will contribute to positive social change by suggesting an approach for organizations to optimize strategic objectives while minimizing stakeholders’ financial risk-harm.

Siyi, Zhou. "Essays on financial and insurance risk management." Thesis, Imperial College London, 2012. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.586894.

Abbas, Sawsan. "Statistical methodologies for financial market risk management." Thesis, Lancaster University, 2010. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.547964.

Ben, Hadj Saifeddine. "Essays on risk management and financial stability." Thesis, Paris 1, 2017. http://www.theses.fr/2017PA01E003/document.

Pillay, Levina. "Risk practitioner experiences of enterprise risk management in financial institutions." Diss., University of Pretoria, 2015. http://hdl.handle.net/2263/52296.

Shedden, Jason Patrick. "A qualitative approach to financial risk." Pretoria : [s.n.], 2006. http://upetd.up.ac.za/thesis/available/etd-05092007-152751.

Yao, Rui. "Patterns of financial risk tolerance 1983-2001 /." Columbus, Ohio : Ohio State University, 2003. http://rave.ohiolink.edu/etdc/view?acc%5Fnum=osu1060624755.

Yang, Xi. "Applying stochastic programming models in financial risk management." Thesis, University of Edinburgh, 2010. http://hdl.handle.net/1842/4068.

MORAES, ALEX SANDRO MONTEIRO DE. "ESSAYS IN FINANCIAL RISK MANAGEMENT OF EMERGING COUNTRIES." PONTIFÍCIA UNIVERSIDADE CATÓLICA DO RIO DE JANEIRO, 2015. http://www.maxwell.vrac.puc-rio.br/Busca_etds.php?strSecao=resultado&nrSeq=26131@1.

Haar, Lawrence. "Business cycles and the management of financial risk." Thesis, University of Surrey, 2000. http://epubs.surrey.ac.uk/844543/.

Zabarankin, Michael Yurievich. "Optimization approaches in risk management and financial engineering." [Gainesville, Fla.] : University of Florida, 2003. http://purl.fcla.edu/fcla/etd/UFE0001048.

Hays, Douglas C. "Enterprise risk management solutions a case study /." Monterey, Calif. : Naval Postgraduate School, 2008. http://handle.dtic.mil/100.2/ADA483512.

Derrocks, Velda Charmaine. "Risk management." Thesis, Nelson Mandela Metropolitan University, 2010. http://hdl.handle.net/10948/1480.

Bedendo, Mascia. "Density forecasting in financial risk modelling." Thesis, University of Warwick, 2003. http://wrap.warwick.ac.uk/2661/.

HADJI, MISHEVA BRANKA. "Measuring Financial Risks: The Application of Network Theory in Fintech Risk Management." Doctoral thesis, Università degli studi di Pavia, 2020. http://hdl.handle.net/11571/1344336.

Chen, Hua. "Contingent Claim Pricing with Applications to Financial Risk Management." Digital Archive @ GSU, 2008. http://digitalarchive.gsu.edu/rmi_diss/22.

Baldwin, Sheena. "Extreme value theory : from a financial risk management perspective." Thesis, Stellenbosch : Stellenbosch University, 2004. http://hdl.handle.net/10019.1/53743.

Yamashita, Mamiko. "Three Essays on Financial Risk Management and Fat Tails." Thesis, Toulouse 1, 2020. http://www.theses.fr/2020TOU10056.

Simonson, Peter Douglas. "Limiting Financial Risk from Catastrophic Events in Project Management." Diss., North Dakota State University, 2020. https://hdl.handle.net/10365/31939.

Madaleno, Mara Teresa da Silva. "Essays on energy derivatives pricing and financial risk management." Doctoral thesis, Universidade de Aveiro, 2011. http://hdl.handle.net/10773/7302.

Yazid, Ahmad Shukri. "Perceptions and practices of financial risk management in Malaysia." Thesis, Glasgow Caledonian University, 2001. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.364743.

Masie, Desné Rentia. "Mediating markets : financial news media and reputation risk management." Thesis, University of Edinburgh, 2014. http://hdl.handle.net/1842/14196.

Holifield, Suzanne Marie. "Risk management and hedge accounting decisions at financial institutions." Connect to resource, 1995. http://rave.ohiolink.edu/etdc/view.cgi?acc%5Fnum=osu1267632084.

Awiszus, Kerstin [Verfasser]. "Actuarial and financial risk management in networks / Kerstin Awiszus." Hannover : Gottfried Wilhelm Leibniz Universität Hannover, 2020. http://d-nb.info/1215427298/34.

Vuillemey, Guillaume. "Derivatives markets : from bank risk management to financial stability." Thesis, Paris, Institut d'études politiques, 2015. http://www.theses.fr/2015IEPP0007/document.

Anastasio, Edoardo <1996>. "The relationship between financial risk management and shareholders value." Master's Degree Thesis, Università Ca' Foscari Venezia, 2022. http://hdl.handle.net/10579/20812.

Kwok, Ying-kit Tony. "A study on treasury risk control in financial institutions in Hong Kong /." Hong Kong : University of Hong Kong, 1995. http://sunzi.lib.hku.hk/hkuto/record.jsp?B14038912.

Siu, Kin-bong Bonny. "Expected shortfall and value-at-risk under a model with market risk and credit risk." Click to view the E-thesis via HKUTO, 2006. http://sunzi.lib.hku.hk/hkuto/record/B37727473.

Ye, Kang. "Knowledge level modeling for systemic risk management in financial institutions /." access full-text access abstract and table of contents, 2009. http://libweb.cityu.edu.hk/cgi-bin/ezdb/thesis.pl?phd-is-b30082274f.pdf.

Neis, Eric. "Three essays in financial economics." Diss., Restricted to subscribing institutions, 2006. http://proquest.umi.com/pqdweb?did=1158520261&sid=1&Fmt=2&clientId=1564&RQT=309&VName=PQD.

Weiss, Susan F. "Implications of Executive Succession Upon Financial Risk and Performance." ScholarWorks, 2011. https://scholarworks.waldenu.edu/dissertations/958.

Wang, Letian. "Global supply chain risk management through operational and financial hedges." Thesis, McGill University, 2010. http://digitool.Library.McGill.CA:80/R/?func=dbin-jump-full&object_id=95041.

Seidel, Henry [Verfasser], and Alexander [Akademischer Betreuer] Szimayer. "Essays in Financial Risk Management / Henry Seidel ; Betreuer: Alexander Szimayer." Hamburg : Staats- und Universitätsbibliothek Hamburg, 2017. http://d-nb.info/1148650563/34.

Reddy, Harry 1963. "Financial supply chain dynamics : operational risk management and RFID technologies." Thesis, Massachusetts Institute of Technology, 2005. http://hdl.handle.net/1721.1/33729.

Zhu, Yanhui. "Nature and management of financial risk in global stock markets." Thesis, Cardiff University, 2008. http://orca.cf.ac.uk/55720/.

Yousefi, Sepehr. "Credit Risk Management in Absence of Financial and Market Data." Thesis, KTH, Matematisk statistik, 2016. http://urn.kb.se/resolve?urn=urn:nbn:se:kth:diva-188800.

Seidel, Henry Verfasser], and Alexander [Akademischer Betreuer] [Szimayer. "Essays in Financial Risk Management / Henry Seidel ; Betreuer: Alexander Szimayer." Hamburg : Staats- und Universitätsbibliothek Hamburg, 2017. http://d-nb.info/1148650563/34.

Boeing: Next CEO's Problem Is Engineering, Not Management

- Boeing's current CEO and other high-level executives are stepping down amid a series of quality issues and management changes.

- Potential candidates for the new CEO position include former executive Patrick Shanahan and current GE CEO Larry Culp, both highly accomplished professional executives.

- However, I view the root problem at Boeing as an engineering issue, not a management issue.

- As such, I have reservations about the likelihood of these candidates to successfully restore its engineering rigor.

- Looking for a helping hand in the market? Members of Envision Early Retirement get exclusive ideas and guidance to navigate any climate. Learn More »

ICHIRO/DigitalVision via Getty Images

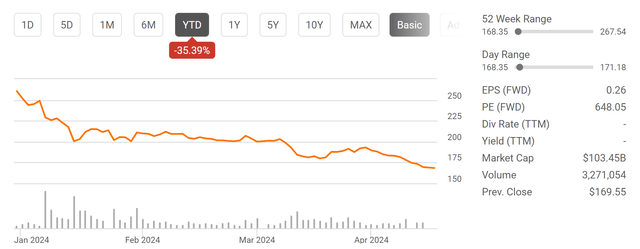

The goal of this article is to argue for a hold thesis on The Boeing Company ( NYSE: BA ). The key consideration for this thesis is the mixed outlook I'm seeing. As such, I anticipate the stock price to move sideways without a definitive direction. For existing investors, this means that I do not see too much room for the stock to fall in a downward direction anymore. The large corrections so far (the stock lost more than 35% year-to-date alone as shown below) have already priced in most of the negatives.

For potential investors, I don't see too much upside potential either. Most of the bullish thesis on BA that I've read so far essentially is betting on a successful and speedy turnaround. I'm skeptical of this expectation. I will argue that A) BA's issues are not a management issue but a deep-routed engineering issue, and B) fixing this issue will not only take the right CEO but also time and resources to restore its engineering vigor.

Seeking Alpha

Boeing's Next CEO

If you're reading this article, I assume you're aware of the recent accidents and management changes surrounding BA. So here I will just skip the background and directly get to the part of the story that's of the most relevance to my thesis.

Following a series of quality issues, Boeing's current President and CEO Dave Calhoun announced that he will step down by the end of 2024. At the same time, Boeing Commercial Airplanes President Stan Deal announced his retirement, while Boeing Chairman Lawrence W. Kellner also announced that he will not seek re-election at the upcoming shareholder meeting. The gist is that BA has to replace multiple high-level executives quickly amid a crisis.

Boeing is currently in the process of selecting a new CEO, and there are a few potential candidates. You can see a more complete list and a more thorough discussion of the candidates here . Based on these analyses, the most likely candidates in my mind seem to include its former executive and Deputy Secretary of Defense Patrick Shanahan, current General Electric CEO Larry Culp, and Chief Operating Officer Stephanie Pope. Judging by their resumes, they should also be favored by Wall Street as professional executives.

However, can they truly address Boeing's pressing issues? I have to say that I'm not totally sure. I'm not questioning their capability - these candidates are some of the most accomplished individuals. All candidates mentioned above have MBAs as their terminal degrees (and to make it crystal clear, I have nothing against MBAs). It's just that I view BA's root problem as an engineering problem, not a business (or even a management problem). I think BA needs a transformational leader whose roots are in engineering (someone like Jack Welch, PhD, in chemical engineering).

In the remainder of this article, I will elaborate this argument further.

Boeing: Historical Perspective

Boeing's current issue goes back to its merger with McDonnell Douglas, in my view. That was among Boeing's biggest moments. This merger, the largest aviation merger in U.S. history, made Boeing the world's largest aircraft manufacturer and the undisputed leader in the civil aviation market. After the merger, Boeing's goal has changed from "building the best aircraft" to "maximizing shareholder returns." This change of goal has gradually eroded Boeing's once-proud engineering culture.

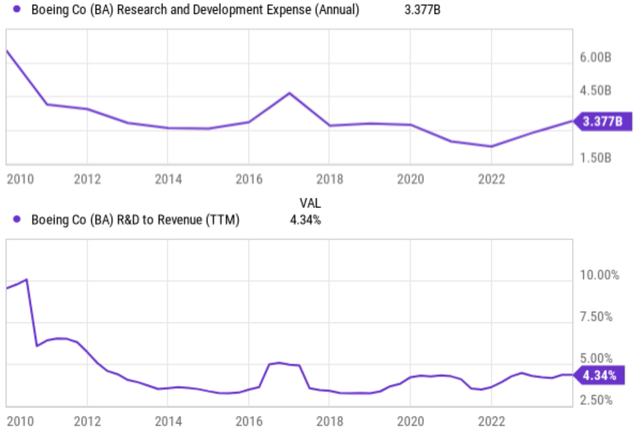

You can get a vivid view of this change in the chart below. The next chart shows BA's research and development expenses ("R&D") since 2010, a few years after the merger. The top panel shows the annual R&D expenses in dollar amount and the bottom panel shows the R&D expenses as a percentage of total revenue. As seen, in terms of actual spending, BA's R&D expenses have been in an overall decreasing trend since then. It started at more than $6 billion in 2010 and declined to a bottom of ~$3.00 billion, roughly halved despite the tremendous growth of sales and profit during this period. That's why, as a percentage of total revenue, R&D spending has declined even more dramatically since 2010. In 2010, it was close to 10% of total revenue, and it fell to a bottom of around 3% only in 2022.

Headwinds Ahead

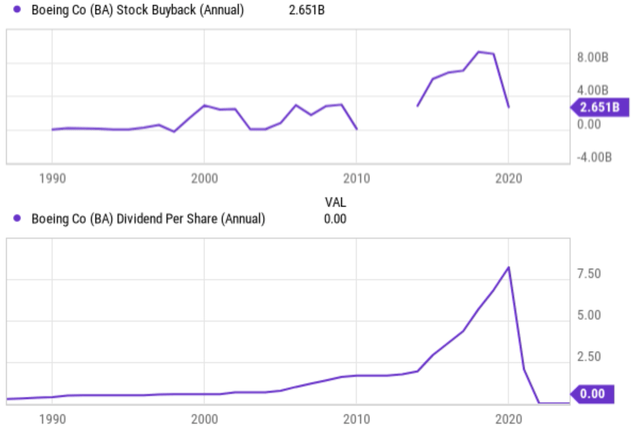

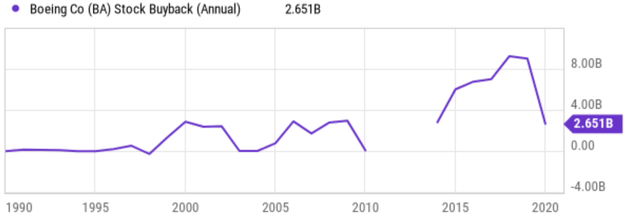

Then where did the money go? A large part of it went to shareholders as dividends and share repurchases (see the next chart below). BA has been spending large sums on buybacks and generously increasing its dividends in the past until 2020 when COVID-19 broke out. Between 2015 and 2019, my analyses show that BA has cumulatively allocated more than $34 billion for stock buybacks and more than $15 billion on dividends. To better contextualize things, these amounts are more than the entire development cost of the Boeing 787 Dreamliner . The development cost of Airbus' new aircraft model the Airbus A350 is around €11 billion cost. Thus, these funds spent on near-term shareholder returns would have been sufficient to develop two entirely new aircraft models. Now thanks to the capital allocation priorities, I do not think Boeing has any meaningful plan for the development of a new aircraft model before 2030 - even if the next CEO successfully navigates it out of the current crisis.

Such focus on shareholder returns has led to several structural shifts in BA's current management culture. These shifts, when put in a positive light (and in popular management jargon) involve cost reduction and operations streamlining.

However, when put in a more negative light, these shifts have caused a reduction in investment in research and development as mentioned above. This decline in R&D is really trading BA's long-term future (with new competitive aircraft models) for short-term returns. In the meantime, outsourcing has dramatically increased as a way to cut costs. Many manufacturing and engineering tasks at BA are outsourced these days. While outsourcing can offer cost advantages, it can also introduce risks related to quality control. For example, the following report pointed out that:

The recent emergency landing incident, attributed to missing bolts, has cast a harsh light on Boeing's oversight and quality control, particularly with suppliers like Spirit AeroSystems.

Overall, as also pointed out by the same report,

The outsourcing approach, which saw over 70% of the 787's design and manufacturing handed off to over 50 key suppliers, has been linked to a range of problems, from production delays to fatal crashes.

Other risks and final thoughts

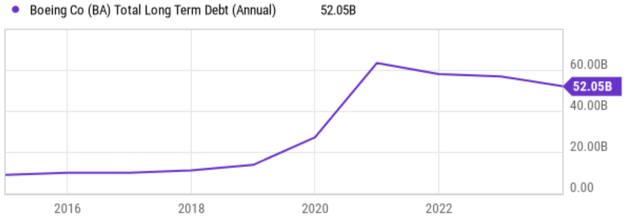

To recap, beyond the damaged reputation and declining orders, I see the key issue at BA as an engineering issue accumulated over many years. I'm not entirely sure if a new CEO out of the current potential list of candidates can solve these problems in the next few years. To solve its quality issues and safety concerns, the fundamental solution is to restore its engineering rigor, reinvigorate its R&D program, and restructure manufacturing operations. All of these become increasingly difficult due to the capital allocation decisions that focus on the near term in recent years. Its earnings are projected to be barely breaking even in FY 2024 (with an EPS projection of around $0.26 only) and its debt is quite high (see the next chart below).

On the upside, I do not think the stock has too much downside risk. The recent correction (from the 52-week peak of $267 in early 2024 to the current level of $170) has largely priced in the risks analyzed above. Civilian aviation is of course a key segment for BA, but it also has substantial defense segments, which are of importance for national security. Actually, one could also argue that its civilian aviation is of national security importance too considering BA's dominating role in this space.

Weighing these mixed factors, I rate BA stock as a hold under current conditions. The company faces a variety of strong headwinds in the next few years, including management changes, quality control issues, reputation damages, and potential profit issues. But in my mind, the root cause is an engineering problem. Restoring its engineering rigor will take time and resources and I don't expect a speedy turnaround.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

Envision Research, aka Lucas Ma, has over 15+ years of investment experience and holds a Masters with in Quantitative Investment and a PhD in Mechanical Engineering with a focus on renewable energy, both from Stanford University. He also has 30+ years of hands-on experience in high-tech R&D and consulting, housing sector, credit sector, and actual portfolio management.

He leads the investing group Envision Early Retirement along with Sensor Unlimited where they offer proven solutions to generate both high income and high growth with isolated risks through dynamic asset allocation. Features include: two model portfolios - one for short-term survival/withdrawal and one for aggressive long-term growth, direct access via chat to discuss ideas, monthly updates on all holdings, tax discussions, and ticker critiques by request.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About ba stock, related stocks, trending analysis, trending news.

IMAGES

VIDEO

COMMENTS

University of Stavanger 30. June 2020 Page 2 of 84 UNIVERSITY OF STAVANGER MASTER'S IN RISK AND SECURITY MANAGEMENT MASTER'S THESIS SEMESTER: Fall/Spring 2019-2020 AUTHOR: Cecilie Fleming ADVISER: Jon Tømmerås Selvik TITLE OF THESIS: Approaches to risk management in international projects: A comparative case study

Department of Civil and Environmental Engineering Division of Construction Management. Chalmers University of Technology SE-412 96 Göteborg Sweden Telephone: + 46 (0)31-772 1000. Sweden 2011. Risk Management Practices in a Construction Project - a case study. Master of Science Thesis in the Master's Programme.

continues to unfold at the time of writing this thesis, it has already million claimed 2.8 lives as of 30 March 2021 (19 MapCOVID-, n.d.). Despite the many difficulties of this time, it also provides an opportunity to understand, document, and learn from the disaster risk management efforts and challenges in order to be better prepared for future

One of the most relevant particularities of the ISO 31000:2009 standard 1 , on risk management-principles and guidelines, is the promotion of a risk management framework overseeing the ...

This risk management framework designed in this report will act as a guideline for any healthcare organization of any size, with any level of technological readiness, and at any level outbreak severity in the country. Keywords: Digital Transformation, COVID-19, Healthcare, Risk Management, Statistical Analysis, Risk Assessment, COVID-19 Impact.

One of these concerns risk management models: The goals of ESGs have assumed increasing importance in aligning the risk management framework within an economic context increasingly influenced by issues related to CSR. In recent scientific papers, the relationship between CSR and risk has deepened in terms of reworking traditional risk ...

The main purpose of COSO Enterprise Risk Management-Integrated Framework (2004) is to help management achieve companies' strategic, operational, reporting, and compliance objectives. Although, COSO (2004) does not make ERM mandatory, it did create public pressure for a more systematic risk management system (Liebenberg and Hoyt, 2003).

Enterprises Risk Management Framework (SMERMF). The limitation of the research is that the empirical part of the research has not been concluded yet. To present the results, that will be compared to the theory and conclude the research. Keywords: enterprise risk management (ERM); risk management (RM); risk management framework

1.2 Purpose. This master thesis will focus on how these two key project actors, the developer and the contractor, are managing risk in construction projects. By an abductive research approach, risks with the current risk management processes within the construction industry in Sweden will be investigated.

much, or inappropriate risk management might stifle innovation. There are many separate models for innovation and risk management. This study develops a combined theoretical model which aims to help the understanding of appropriate risk management in innovation. The theoretical model is based on the classic innovation

for risk management decisions and for implementation of an effective risk management program. 2.1.3 NIST SP 800-39 And the Multi-Tiered Risk Management NIST 800-39 suggest a Multi-Tiered risk management model. 800-39 covers almost all three tiers but it is more focused on Tier 1 and Tier 2. NIST SP 800-37 will focus more on Risk management

abstract. Risk assessment and management was established as a scientific field some 30-40 years ago. Principles. and methods were developed for how to conceptualise, assess and manage risk ...

The goal of this Thesis is to create a framework for review of risk management process and to practically apply it in a case study. Objectives of the theoretical parts are: stating the reasons for risk management in non-financial companies, addressing the main parts of risk management and providing guidance for review of risk management process ...

shaping of risk management in the banking sector. Through the three exploratory field studies in Sweden and Italy, the thesis posits two important contributions. First, the thesis posits a framework, demonstrating how the dynamic shaping of risk management is changing the conceptions of risk management in the banking sector.

The objective of this project is to explore risk management trends and. challenges that SMEs currently face and to provide recommendations to. business owners, executives, and security professionals in the form of methods. and tools to limit threats and reduce the attack surface. An enterprise risk.

2.2 Relationship between the risk management principles, framework and process 9 2.3 Components of the framework for managing risk 10 2.4 The AS/NZS 4360 risk management process 12 2.5 The PMBOK guide project risk management process 13 2.6 The PRAM guide risk management process 14 2.7 The M_o_R guideline risk management process 14

An Empirical Procurement Risk Management Framework in Supply Chain Networks : A Hybrid Approach December 2018 Industrial Engineering & Management Systems 17(4):730-744

current early detection and prevention methods in financial statement fraud using a risk management conceptual framework. The research question focused on current fraud detection and prevention policies and risk management strategies that are currently used for proactively detecting and preventing financial statement fraud. Multiple sources of

The main contribution of this thesis is to assess airline risk management systems, identify core drivers of effective risk management practice, and provide a framework with the aim of guiding airlines in the development of enterprise-wide risk management ... 2.5.2 COSO Enterprise Risk Management - Integrated Framework ..... 49 2.5.3 ISO 31000 ...

The issue of risk management in banks has become the centre of debate after the recent financial crises. Several efforts have been made to improve the risk management and performance of banks including introducing the Basel Accords as well as risk management guidelines by central banks. Consequently, the State Bank of Pakistan has issued risk ...

Consult the top 50 dissertations / theses for your research on the topic 'Financial risk management.'. Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago ...

Accordingly, it is essential that a sound and adequate liquidity risk management framework be adopted by banks to mitigate the effect of an unanticipated liquidity squeeze. Accordingly, this thesis proposes a liquidity risk management framework based on Basel II principles while taking account of the recent Basel III regime.

Thesis. The goal of this ... On the upside, I do not think the stock has too much downside risk. The recent correction (from the 52-week peak of $267 in early 2024 to the current level of $170 ...