JPMorgan Chase & Co.'s growth through mergers and acquisitions

Table of contents.

JPMorgan Chase & Co. is an American multinational investment bank and financial services institution that’s ranked No.1 in the United States and 5th in the world.

Standing today on the base of its 1200 predecessor financial companies and banks, JP Morgan Chase’s history dates back to 1799.

JPMorgan Chase is a vast network of subsidiaries and companies across the globe dealing in all fields of finance, ranging from asset management and investment banking to private banking and financial advisory. JPMorgan Chase’s three primary business segments include:

- Consumer and Community Banking

- Corporate and Investment Banking

- Commercial Banking and Asset Management

JP Morgan Chase's market share and key statistics from 2021

- Net Revenue of $125.3 billion

- Net Income of $48.3 billion

- Assets under management worth $2.5 trillion

- Total assets worth $3.7 trillion globally

- Earnings per share (EPS) of $15.3

- Stock price of $158.4 as of December 2021

- Market Capitalization worth $336.8 billion

- More than 270,000 employees worldwide

- Operations in more than 60 countries

- Global market share of 8% in investment banking

- Market share of 24.7 percent in the US banking industry

- Ranks 24th on Fortune 500

- #1 bank in the world by market cap

- World’s 4th largest public company

Let’s go through the tumultuous history of JPMorgan Chase and find out how it climbed to the top of the banking and financial services industry.

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

Humble beginnings: How did JP Morgan Chase start?

The JP Morgan Chase we see today is a product of dozens of mergers and acquisitions in the past two centuries – the major one being of JP Morgan and Chase Manhattan.

The history of Chase goes as far back as 1799, when the third-oldest bank in the US opened, whereas JP Morgan’s history starts in the early 1800s.

Let’s take a look at how one of the biggest banks in the US and the world came into being and evolved over time.

Chase Manhattan Begins As The Bank of Manhattan

Chase Manhattan was founded in 1799 as a water supply company called the Manhattan Company.

The company’s founders actually intended to turn it into a banking company later on. They wanted to challenge the hegemony of the two key banks at that time: the Bank of the United States and the Bank of New York. The Bank of Manhattan opened the same year making it the third-oldest bank in the US.

The founding charter of the bank was quite lax, which enabled the management to loan out to several corporations and individuals, especially in the 1820s.

Soon enough, the bank was expanding exponentially. The massive public construction and need for financing in the early 1800s augmented the bank’s revenues in the financial sector.

How Did J.P Morgan Start?

The roots of Morgan, the second important company in JPM’s history, go back to 1838 when a banker named George Peabody started a banking firm.

Mr. John Junius Morgan became a partner and later took over the firm. His son, Junius Pierpont Morgan renamed the business J.P Morgan and Co. in 1890.

J.P. Morgan played a key role in uplifting several businesses in the US, including AT&T and General Electric, by providing financing.

The bank held immense power in the financial sector, so much so that, in the 1907 crisis, J.P. Morgan was a key partner of the Federal Reserve (FED) in ending the crisis and dealing with the aftershocks.

In the 1929 stock market crash, however, J.P. Morgan, like other banks, was not able to bail out the banking system even after using their own money, and the depression deepened, leaving factories closed, banks failed, regulators furious, and people anxious.

Wiggin’s Business Strategy For Chase National Bank

The Chase National Bank was established in 1877, and it would soon grow and become a force to be reckoned with in the 1900s.

Initially, the bank made slow progress. Only when renowned banker, Henry Wiggins joined as CEO did Chase National start penetrating the banking market and growing exponentially.

He prioritized diversifying the services of the bank. The number of corporate accounts began to skyrocket as the bank started providing trust services, bonds, and stock underwriting. Wiggins also hired directors from top financial institutions across the globe as he firmly believed that the leadership and senior management were crucial to achieving success.

The most remarkable feat of Wiggins was the mergers and acquisitions he was able to pull off. In the 1920s and 30s, six major banks in the US merged with Chase, including the massive Equitable Company, which had more than a billion reserves at that time. By the end of the 50s, Chase had become the largest bank in the world.

However, the era of Wiggins was not all sunshine and roses as he had to resign, and Winthrop Aldrich replaced him. Toward the second World War, Aldrich made several structural changes to breathe new life into the bank after the Wall Street Crash of 1929.

Key Takeaway 1: Start Today And Continue To Make Iterative Improvements In Your Offerings

Lofty ambitions. Grand plans. Unparalleled success. None of them can be achieved overnight. The first and foremost thing every business needs to do is take the leap of faith and just start wherever they are with whatever they have.

Chase Manhattan kicked off its operations as a water supply company. JP Morgan and Co. was set up by a banking executive and continued to reinvent itself. Both of these incredible companies went through a series of trials and tribulations but kept on improving, innovating, and pouncing on opportunities. All of this, in turn, helped them grow and make an impact.

The 20th Century: JP Morgan's acquisition strategy

Both Chase and JP Morgan were making rapid progress and hence, it didn’t come as a surprise that they became rivals in the financial sector.

Post World War II, a major merger took place. Chase reached new heights but started facing issues later on as the US dealt with the Third World Debt crisis.

The Bank of Manhattan merges with the Chase National Bank

In 1955, Chase National and Bank of Manhattan merged, forming one of the biggest banks of that time.

One of the key personnel in the merger was David Rockefeller. He had joined the company as an assistant manager and worked his way up the hierarchy. As the merger concluded, he became vice president. 14 years later, he was named chairman of the newly incorporated Chase Manhattan Corporation.

Under his leadership, the bank continued to expand. As the CEO, Rockefeller quickly rose to prominence as a significant global power broker. He started traveling widely and engaging with influential corporate and political figures all over the world.

Rockefeller used the bank to advance the American foreign policy he believed to be desirable as a result of his prominent international standing. As one of the cornerstones of the American establishment, his sway over the Council of Foreign Relations was quite a lot.

Chase faces an existential threat

For the bank, the 1970s was a challenging decade.

Due to regional banks' decreasing reliance on Chase for their development and growth, as well as the fact that they no longer needed loans from the "banker's banker," it suffered considerable domestic losses.

In addition, Chase incurred large losses in subprime loans to South American nations, which led to the FED listing it as a "problem bank." Despite the fact that throughout this roughly $4 billion period the company's overseas income rose to more than sixty percent of its overall income, the bank struggled to compete with Citibank's explosive growth. Chase still remained the third-largest bank in the nation.

The issue of subprime loans continued in the 80s. As several governments and major corporations defaulted on their loans, Chase incurred heavy losses. The workforce was cut and the stock price plummeted. In fact, the bank reported a loss in 1987, the worst year for the banking industry. Rockefeller retired and picked Willard Butcher as his successor. Butcher left early as the stakeholders decided to tackle the crisis by forming a new team.

How did Chase revamp itself?

The new CEO, Thomas Labrecque, began to shift focus back to domestic operations.

Several operations outside the US and even outside New York were eliminated. The workforce was further cut by 10%. This was opposite to the status of its competitor, Citigroup, which was a global bank.

Labrecque recognized the significance of transforming using innovative technologies. The bank started developing a long-term technological strategy and even invested half a billion dollars to upgrade its information system. It also entered the new arena of online banking and teamed up with prominent tech companies Microsoft and America Online.

Key Takeaway 2: Develop an alternative plan and be ready to adapt fast

Let’s face it: it’s not going to work out according to your plans. The same way it didn’t for J.P Morgan and Chase Manhattan. High domestic losses, being listed as a "problem-bank", and tarnished reputation were just some of the problems faced by Chase. Yet, it not only persevered but thrived as well.

How? By taking a few hard, unpopular decisions such as cutting the workforce, proactively forming new strategies, and ensuring the leadership has the vision to help the company succeed.

Remember that there will be numerous challenges along the way – that’s just how the world of business operates as it takes no prisoners – and so you’ll have to adapt and plan ahead.

The merging of two big banks and the birth of JP Morgan

As Chase was recovering from a tumultuous period and JP Morgan was slowly expanding, the time was close for the historic merger between the two.

Chase merged with the massive Chemical Banking. Only 5 years later, JP Morgan Chase & Co. was formed and the combined assets and resources enabled the company to begin its journey from good to great.

While Labrecque made efforts to restructure Chase and recover from losses, profit and growth prospects were still not ambitious. The margins were still low, and the stock price had yet to recover.

At last, the much-anticipated merger took place between Chase and the Chemical Banking Corporation in 1995. Considering the size of Chemical, it may even be considered a sort of acquisition rather than a merger. The combined assets were 300 billion, and the bank was now the largest one in the US!

What Was the History of Chemical?

Similar to Chase, the Chemical Bank was initially started as a manufacturing entity. The banking arm was later added to it. Its history dates back to 1844, when it was incorporated as a bank.

It managed to survive the depression of 1857, and by the end of the 19th century, it was one of the largest banks in the country. However, its growth remained stagnant for the next few decades. It was after diversification into other finance fields and overseas expansion that Chemical regained its growth momentum. By the 1950s, it had become the seventh largest bank in the US

Towards the 1990s, Chemical expanded rapidly but had to suffer from similar issues as Chase due to the Third World debt crisis. Chemical merged with the Manufacturers Hanover Corporation, making it the largest merger in US history at the time. The bank was now the fifth-largest in the states.

The merger with Chase in 1995 was a sigh of relief for both entities as they were recovering from the subprime debt issue. The bank was now one of the biggest ones in the country and a leader in several banking areas.

Towards the end of the century, the bank made a few key acquisitions of several investment firms in the US. Chase increased its footprint in investment banking by purchasing Robert Fleming Holdings, setting the stage for a stronger presence not just in Europe but also in the Asian region. But Chase had its sights set on even greater things, soon making the announcement that it was joining forces with JPM.

The Iconic Merger of J.P. Morgan and Chase Manhattan

At the turn of the century, in 2000, J.P. Morgan merged with the Chase Manhattan Corporation, becoming J.P. Morgan Chase & Co. – the global financial powerhouse we know today.

This was long time coming as just a couple of years prior to it, J.P. Morgan made public its intention to merge with another bank in order to augment its offerings and solidify its position as one of the leading financial institutions.

The Chase Manhattan Corporation, with its strong commercial and investment banking, was the perfect match for J.P. Morgan, which was dominant in debt and equity securities underwriting. With assets north of 650 billion, the bank now was only behind Bank of America and Citigroup in size.

Key Takeaway 3: Strategic Acquisitions Can Unlock Exponential Growth

Growth of a business doesn’t have to be linear. It can be exponential – but only if you have the right business strategies in place.

Strategic acquisitions are a proven and time-tested way of boosting business growth. First Chase merged with Chemical Banking and then just a few years later, Chase acquired JP Morgan, becoming J.P. Morgan Chase & Co.

These mergers and acquisitions helped J.P. Morgan Chase gain greater financial strength to be bold and take risks, acquire market share, reduce overheads, and offer a wide variety of quality products and services to its customers.

JP Morgan Chase's growth in the 21st century

JP Morgan Chase’s illustrious history has been well documented – there’s no doubt about it.

But if there was a time period that was most crucial for the company’s success and standing today, it was the two decades from 2000-onwards.

During the sensitive period post the dot-com bubble, the global financial crisis in 2007-08, the rise of digital banking and Industry 4.0, and the Covid-19 pandemic in 2020 and beyond, the company faced an array of challenges and opportunities faced. Yet, it continued to grow due to its business strategy.

J.P. Morgan Chase & Co enhances its services with further acquisitions

In 2004, J.P. Morgan Chase & Co. merged with Bank One in a bid to leverage the latter’s consumer banking business that can complement its own well-established investment and commercial banking business, making is ready to take on the largest bank in the United States – Citigroup.

Plus, the synergies would enable the JPMorgan Chase & Co. to reform the company, enhance business operations, and cut down costs. The icing on the cake was bringing Jamie Dimon, the CEO of Bank One, as the president and COO of the merged entity. He soon went on to become the CEO of J.P. Morgan Chase & Co. and led it to greater heights.

In 2006, Chase purchased New York Mellon’s retail and small business banking network, expanding its footprint in New York, New Jersey, and Connecticut and Collegiate Funding Services, an education finance company.

JPMorgan Chase & Co. continued its acquisitions strategy even during the most challenging times of all – the subprime mortgage meltdown and subsequent 2007/08 financial crisis. It acquired the investment bank Bear Stearns and the banking operations of Washington Mutual. This not only helped prevent a systemic crisis but also bolstered JPMorgan and added to its portfolio of companies.

What’s worth noting here is that JPMorgan Chase & Co. stood beside and worked alongside the government during the most critical time.

In 2010, the company acquired J.P. Morgan Cazenove having initially operated as a joint venture with the UK investment bank, Cazenove. The very next year, in 2011, Chase led General Motors historic initial public offering (IPO) – the world’s largest IPO back then, highlighting its stature as the world’s premier financial services company.

JP Morgan Chase’s Digital Transformation Strategy

When it comes to digital transformation, Chase has been ahead of its time with an eye on the future.

While it is indeed a traditional organization with a long, illustrious history, JP Morgan Chase is constantly modernizing and staying a step ahead of the latest trends, including cloud computing, machine learning, artificial intelligence, and blockchain among others to offer a holistic digital experience to cater to its customers’ ever-changing needs.

JP Morgan Chase & Co’s Digital Transformation From 2010 to Present

With the financial crisis behind it, JPMorgan Chase & Co. prepared itself to become future-ready.

Chase released mobile banking features in 2010, empowering its customers to manage their accounts and finances, seamlessly.

Plus, the company announced the use of supercomputers to enhance overall business operations and customer experience.

In 2019, JP Morgan launched JPM Coin – a digital token to settle transactions between its wholesale payment business’ clients. Just a couple of years later, in 2021, JPMorgan Chase launched an app-based current account. Then in 2022, JP Morgan Chase embraced the much talked about blockchain technology for collateral settlements.

JP Morgan Chase & Co.'s sustainability initiatives

No, JPMorgan Chase & Co. is not just a global leader in financial services catering to the needs of the world’s most important corporations and government. JPMorgan Chase & Co. is much more than that. It’s a socially responsible firm that goes above and beyond to make the world a better place.

Following are a few of the steps Chase has taken over the years to do just that:

- Joined the 100,000 Jobs Mission to promote hiring of U.S. military veterans and military spouses.

- Launched Women on the Move initiative to empower women in the workplace

- Set up a Global Health Investment Fund to finance final-stage drug, vaccine, and medical device studies to find healthcare solutions

- Initiated a New Skills at Work program and invested up to $600 million to upskill people to stay relevant in a dynamic working world

- Committed $100 million to support and scale efforts to transform Detroit’s economy

- Implemented New Skills for Youth program to address the economic opportunity crisis young people face and enable them to land jobs

- Doubled down on investing in world’s communities and cities that have been ignored and not yielded the benefits of economic growth through a global $500 million initiative, AdvancingCities

- Inaugurated the Advancing Black Pathways initiative to provide more personal and professional growth opportunities to black people

- Supported the summer youth employment programs (SYEPs) across 24 cities in the United States with a $20 million commitment.

- Committed to aligning key sectors of portfolio with the goals of Paris Agreement to create a sustainable future and address climate change by achieving net-zero emissions by 2050.

Key Takeaway 3: Digital Transformation Can Give You An Edge To Win Market Share

Regardless of the industry, geographic region, business vertical, or target audience you cater to, digital transformation is essential for your business. Without it, you cannot survive let alone thrive.

JPMorgan Chase & Co. knew it and hence, gained a first-mover advantage in the digital space as it invested heavily and committed to transforming the business.

The result? It leveraged emerging technologies such as cloud computing, machine learning, artificial intelligence, and blockchain among others to scale up.

Why is JP Morgan Chase & Co. So Successful?

JP Morgan Chase & Co. is a result of a number of mergers and acquisitions over the decade. From being the pioneer of television banking to ushering in the era of online banking, JP Morgan Chase has a long history.

JP Morgan Chase & Co. is the oldest, largest, and one of the most renowned financial companies in the world. With its history tracing back to 1799 and a network of organizations in over sixty countries worldwide, JP Morgan Chase & Co.’s influence spreads far and wide.

What Are The Core Business Principles of JP Morgan Chase & Co.?

Here are JP Morgan Chase & Co.'s three core principles:

- Delivering exceptional client service

- Acting with integrity and responsibility

- Sporting the growth of employees

What Is The Mission of JP Morgan Chase & Co.?

JP Morgan Chase & Co. aims to ensure inclusive, sustainable growth and become the most respected financial services company in the world and the foremost choice of individuals, corporations, and governments worldwide.

Who Owns JP Morgan Chase & Co.?

JP Morgan Chase & Co. is owned by:

- Institutional investors such as BlackRock, The Vanguard Group, State Street, Fidelity Investment, and Capital Research & Management among others. Collectively, they own up to 76% of JP Morgan Chase & Co’s common stock.

- General public a.k.a individual investors. Collectively, they own up to 23 percent of JP Morgan Chase & Co’s common stock.

- Company insiders and board executives, including James Crown, Jamie Dimon, and Daniel Pinto. Collectively, they own up to 0.6 percent of JP Morgan Chase & Co’s common stock.

JP Morgan Chase & Co.’s Growth By Numbers

JP Morgan Chase & Co. is among the list of world’s select-few companies that need no introduction and are recognized globally. With illustrious dating back to 1799 and over 1200 predecessor organizations joining together to form JP Morgan Chase & Co., it doesn’t come as a surprise that the firm’s name is closely tied to innovations in finance and growth of the US as well as world economies.

Please update your browser.

- Careers Home

- Student & Graduate Careers

- Jobs, Student Programs & Internships

Asset and Wealth Management Challenge

Discover where your skills can take you.

Our Asset & Wealth Management business provides strategies that encompass the full spectrum of asset classes. Our global investment professionals provide personalized service and advice for individuals, advisors and institutions. Learn about Asset & Wealth Management by immersing yourself in the dynamics and decisions of this case challenge. Through a hypothetical case study, you’ll find out what it takes to work as an Analyst in Asset Management or Global Private Bank. Take this opportunity to learn more about the industry and the important role we play in it.

Program information

Learn more about our Asset and Wealth Management Challenge

What you'll do

Who we're looking for

What we offer

As part of the challenge, you’ll compete in a team of four across different locations in Asia by completing a case study. You’ll gain knowledge of how the business works, get access to senior leaders and gain invaluable skills to prepare you for future opportunities at the firm. The Competition will consist of written submissions and presentations. It will be held independently in each location with two phases – “First Round” and “Second Round”. Finalists of each location will move on to compete in the Final Round.

Desired qualities

We're looking for motivated and driven team players with excellent communication and analytical skills; highly inquisitive, focused and collaborative. You enjoy tackling new challenges and solving intellectual problems.

We're looking for excellent problem solvers with a strong interest in financial markets and economic trends.

On-the-job experience

The Challenge puts you right in the middle of the action. Through a hypothetical case study, you'll find out what it takes to work as an Analyst in Global Private Bank. Students will work in teams of 4 to complete a case study analysis, gaining exposure to asset allocation, client management and scenario analysis. You’ll develop valuable industry knowledge, communication and analytical skills.

Teams that move past the first round will work with J.P. Morgan business representatives and mentors to provide guidance and advice on their presentations from second round to final round.

Career Progression

Participants who perform well may have the opportunity to have their application prioritized for review in consideration for our upcoming summer internships.

Our people

How we hire

Where we work

Our presence in over 100 markets around the globe means we can serve millions of consumers, small businesses and many of the world's most prominent corporate, institutional and government clients.

Keep in touch

Join our Talent Network to stay informed on news, events, opportunities and deadlines.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

JP Morgan interview (41 real questions, process, and prep)

Today we’re going to show you what to expect during JP Morgan interviews, and what you should do to prepare .

The information in this guide is based on an analysis of over 100 JP Morgan interview reports (from real candidates for analyst roles), which were recorded between 2016-2021.

And here’s one of the first things you’ll want to know:

JP Morgan heavily emphasizes “behavioral” questions (as do Goldman Sachs and Morgan Stanley ). So, if you want to prioritize your preparation, then you’ll want to pay close attention to the questions section below.

Let’s get started.

- Process and timeline

- Behavioral questions

- Business sense questions

- Technical questions

- How to prepare

1. Interview process and timeline

Want to get more interviews click here for a 1-to-1 resume review with an ex-investment banker from jp morgan, goldman sachs,etc.

Here we’ll cover what you can expect at each stage of JP Morgan's application process. In this article, we’ll focus primarily on investment banking (IBD) roles, but the below process likely has some overlap with the steps for other roles.

The interview process at JP Morgan typically takes around 4 weeks to complete, but it can often take 2 months or even longer, so be prepared for an extensive process.

Let’s begin with an overview of each step you’ll encounter, then we’ll dig deeper into each one.

1.1 What interviews to expect

Whether applying for a full-time position or an internship program, JP Morgan candidates will typically go through 4 steps:

- Application and resume

- Pymetrics test (~30min)

- HireVue interview (~20min )

- Final-round interviews / Super day

1.1.1 Application and resume

There are three main ways that the JP Morgan interview process will begin:

- You’ll apply on their website

- You’ll apply through an event or career fair

- A recruiter will reach out to you

Regardless of which of these starts your application journey, you’ll want to be ready with a polished resume that is targeted to JP Morgan.

If you'd like expert feedback on your resume, you can get help from our team of ex-investment bankers , who will cover what achievements to focus on (or ignore), how to fine tune your bullet points, and more.

It’s also important to spend some time learning about the specific division within JP Morgan where you intend to apply. If you don’t have a clear perspective on the division where you want to work within the company, then this can be a red flag for recruiters.

You should also understand the teams that exist within your target division. This will demonstrate that you’re highly motivated and familiar with how the firm operates.

If you really want to get your foot in the door, another way to set yourself apart is by attending career fairs or events hosted by JP Morgan. Try to make genuine connections with people from the company. Then, when you go to apply, specifically name drop the people you’ve met in your cover letter. You could even write in a quote you heard from them, or mention what you learned from them about the company.

1.1.2 Pymetrics test

If your application meets JP Morgan’s basic requirements, you’ll receive an email to complete an online " Pymetrics " test (note: if you’re an experienced hire, expect to be invited to some video-call interviews without having to go through Pymetrics or HireVue).

The Pymetrics test aims to measure your “cognitive, social, and behavioral attributes.” It does this by giving you 12 “games” to play, each taking a couple of minutes to complete. You’ll be assessed on 90 different character traits , and afterwards you’ll receive a report on what your natural strengths and talents are.

As soon as you’ve completed the Pymetrics test, regardless of your performance, you’ll receive an email inviting you to the next stage: the HireVue interview.

Be aware that once you take the Pymetrics test, you can’t take it again for another year. If you apply to another company and they also use Pymetrics, they’ll be given your score from the test you’ve already taken.

1.1.3 HireVue video interview

Soon after you’ve taken the Pymetrics test, you’ll receive an email inviting you to a HireVue video interview. We've actually written a detailed guide on this topic, so feel free to check out our JPM Hirevue interview guide . We'll also provide a summary of Hirevue below:

HireVue is a digital tool that allows you to record your responses to a series of interview questions, without having an interviewer on the other side of the camera. You’ll be asked 3-5 questions during the interview. For each question, you’ll have a few moments to prepare your answer, and then you’ll have a time limit of 2-3 minutes to give your answer on camera.

You’ll only be allowed one opportunity to re-record each answer, so we’d recommend preparing answers to common questions in advance. You can get started with the example questions listed later in this article. You can also take unlimited practice questions within HireVue before starting your actual interview, which we strongly encourage you to do.

Most JP Morgan candidates say they faced the following types of questions in the Hirevue:

- One question about their motivations (e.g “Why JP Morgan?” or “Why investment banking?”)

- One behavioral question (e.g “Provide an example of when you sought out relevant information and used it to develop a plan of action”)

- One question about current economic affairs (e.g "What business deal in the news has interested you recently?”).

We'll go deeper into the questions you'll face in section 2.

1.1.4 Final-round interviews / Super Day

If you do well enough in the Pymetrics test and HireVue interview, you’ll be invited to a final round of interviews.

For entry level positions at the firm (internships and graduate hires) this may take the form of a “Super Day” (or Assessment Centre in the UK). This is where a large number of candidates spend the day interviewing at a JP Morgan office or a conference center, although due to COVID-19 this is now normally done on Zoom. Each interview should last around 30 minutes, and you'll face at least two interviewers in each.

If you’re a more experienced hire, you probably won’t be invited to a Super Day. Instead, your final-round interview will consist of at least 3 back-to-back interviews with JP Morgan team members of varying seniority. Each interview should last around 30 minutes.

Now that you know what to expect from the interview process, let's take a look at the kind of questions you'll need to answer.

2. Question types

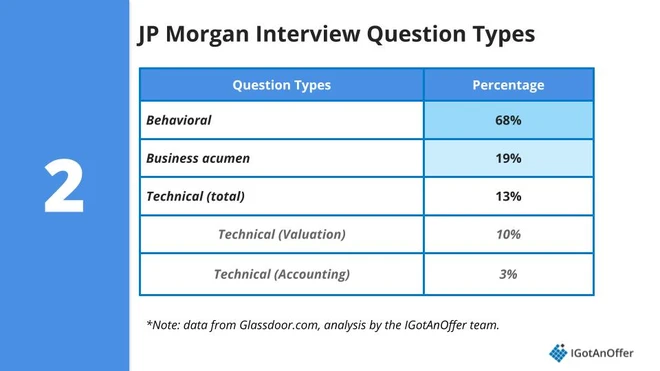

During the interview process at JP Morgan, you’ll face the following question types:

- Behavioral

- Business sense

However, some of these questions are asked more frequently than others. Here’s a summary of the data:

As you can see, behavioral questions are by far the most common, so we’ll cover that category next.

Below, we’ve curated a list of practice questions for each question type.

Note: The questions below were originally posted on Glassdoor , but we have improved the grammar or phrasing in some places to make them easier to understand.

2.1 Behavioral questions [69% of questions]

Behavioral questions focus on your motivation for applying to the position, your resume, and scenario based questions (e.g. “Tell me about a time…”).

Below is a list of behavioral interview questions that have been asked in JP Morgan investment banking interviews in the last few years. These are excellent questions to practice with because many of the same questions tend to come up repeatedly.

You’ll want to pay special attention to the first three questions (bolded below), because they are extremely common. You should definitely have an answer prepared for each of them before your interview. For a complete list of practice questions, including sample answers and an answer framework, take a look at our guide to JP Morgan behavioral interview questions .

Example behavioral questions at JP Morgan

Why do you want to work in investment banking?

Why JP Morgan?

Tell me about yourself

Walk me through your resume

What's your career plan within five years?

Why are you a good fit for this position?

What’s one of your biggest weaknesses?

What is the biggest challenge you have faced, and how has that made you a better person?

Tell me about a recent achievement

Tell me about a time you worked in a team

What would your co-workers say about you?

Provide an example on when you sought out relevant information and used it to develop a plan of action

Tell me about a time when you encountered a difficult client and describe how you handled the situation

Tell me about a time during which you had a positive impact on a project, and how did you measure your success?

Name a time you had to make a quick decision, then describe your thought process and what the final decision was

Make a sales pitch for something you're interested in

2.2 Business sense [19% of questions]

The second type of questions you can expect to encounter during your JP Morgan interviews are business sense questions.

These questions cover a few different areas, but generally, these questions will be focused on assessing your industry knowledge and critical thinking skills.

To make it easier to organize your practice time, we’ve grouped the below questions into a few subcategories. You should be prepared to answer questions from each subcategory. And you can also learn more about this type of question in our separate business sense questions guide .

Example business sense questions asked at JP Morgan

- Tell us about a recent news story and why it sparked your attention

What is going on in the current market right now that has interested you and why?

What is the biggest challenge facing the financial market in the next 5 years?

What current issues will affect the sustainability of investments in future

How will the bond market react to the interest rate drop?

- What's your view on the European debt crises?

- What do you know about public finance?

- What deals has our group done that you liked and why?

- Tell me about a recent deal you've been paying attention to

3. Industry

What makes JP Morgan different from other banks and the financial industry as a whole?

What's the biggest threat to J.P. Morgan?

4. Investing

How would you compare X company with Y company (e.g. GE and GM)?

What interests you about IPO's?

- How many coins would fit in this room?

- How many cigarettes are sold in the US each year?

2.3 Technical questions [12% of questions]

Technical questions help your interviewers evaluate whether you have the knowledge and skills to perform on-the-job tasks.

These technical questions can be split into two main categories:

Valuation questions at JP Morgan focus on your ability to calculate the value of a business and your familiarity with DCFs, whereas accounting questions focus on your knowledge of financial statements and accounting principles. Valuation questions tend to be asked more frequently, but you should prepare for both.

Below is a list of example questions from each category for you to practice with. The questions in bold are extremely common, so you should have a strong answer prepared for them.

You can learn more about common technical questions in our technical questions guide , and you can also find helpful summaries in our investment banking interview cheat sheet .

Example technical questions asked at JP Morgan

1. Valuation

- Walk me through a DCF

- What are the ways to work out a company's value?

- Talk to me about some leverage ratios you may use to value the risk on the company's balance sheet

- Value Airbnb using DCF, LBO, and Comps

- When would you not use a DCF to evaluate a company?

- How would a DCF change for a company in the biotechnology space?

- How do interest rate changes transmit to corporate balance sheets?

- Walk me through a depreciation expense, in year 0 and then in year 1, of a $100,000 purchase of a building

- A shoemaker in New York makes shoes for his clients. Give me your scenario of his balance sheet this season. Now link his balance sheet, income statement, and cash flows together.

3. How to prepare

Before you spend weeks (or months) preparing for JP Morgan interviews, you should pause for a moment to learn about the company’s culture.

This is important for two reasons.

First, it will help you to clarify whether JP Morgan is actually the right fit for you. JP Morgan is prestigious, so it can be tempting to apply without thinking more deeply. But, it's important to remember that the prestige of a job (by itself) won't make you happy in your day-to-day work. It's the type of work and the people you work with that will.

Second, having a clear understanding of JP Morgan’s culture will give you an edge in your interviews, because it will help you frame your skills and experiences to align with what the company values. In addition, you will almost definitely be asked about your specific motivations for applying to JP Morgan.

If you know any current or former JP Morgan employees, see if you can chat with them about the company’s culture for a few minutes. In addition, we would recommend checking out the following resources:

- Who we are (By JP Morgan)

- JP Morgan weekly brief (By JP Morgan)

- JP Morgan strategy teardown (by CB Insights)

Looking for more tips on how to set yourself apart in an investment banking interview? Take a look at our list of 15 essential IB interview tips .

3.2 Practice by yourself

As we mentioned above, you’ll face 3 main types of questions in your JP Morgan interviews: behavioral, technical, and business sense questions.

And you’re going to want to do specific preparation for each question type.

3.2.1 For behavioral questions

For behavioral questions, we recommend that you use a repeatable method for delivering your answers. You may have heard of the STAR method before, but we recommend a slightly different approach, which is explained in this guide .

Once you’ve learned a method for structuring your answers, we recommend that you practice answering all of the example questions we provided above, especially the first four questions in the list.

It’s best to rehearse the answers to these questions out loud, so that you’ll get comfortable giving good, concise answers. It may feel weird to practice answering questions out loud without an interviewer across from you. But trust us, this will dramatically improve how you communicate your answers.

In addition, it’s helpful to prepare a few “stories” that highlight your past experiences and accomplishments, so that you have examples to use for unexpected interview questions. For example, if you have a good example of a time you handled a team conflict, rehearse this story, and you could potentially use it for a variety of different questions during your interviews.

3.2.2 For business sense questions

For business sense questions, there are a few different areas you’ll need to cover.

First, it’s important for you to be up to speed on current events related to JP Morgan, the investment banking industry, and the broader economy.

To help you stay current, we recommend developing a habit of reading the Investment Banking section of the Financial Times, which will give you the main news from the industry as well as frequent stories specifically on JP Morgan. For broader economic news, you can use your favorite news publication. If you don’t have one, consider giving The Economist a try.

To take this a step further, it’s a good exercise to “quiz” yourself on these current events by reframing them in the form of a question. For example, if you read a story about an M&A deal, ask yourself something like: “Is this really a good deal? Why?” We’d recommend that you analyze and develop an opinion on at least a couple of recent deals, because it’s likely to be useful during your interviews.

Finally, JP Morgan very occasionally also asks “estimation” questions, which test your math and critical thinking skills. This would be something like “how many golf balls would fit in a one gallon milk jug?” To prepare for this type of question, we recommend learning the approach covered in this market sizing guide .

And of course, practicing the above example questions (out loud) will go a long way in preparing you for your interviews.

3.2.3 For technical questions

For technical questions, we recommend that you start by brushing up on the key valuation and accounting concepts used in investment banking.

For valuation, we recommend reading Street of Wall’s valuation overview guide .

And for accounting concepts, we recommend using this free guide as a quick refresher. Then, you can study accounting topics more deeply with this free course .

Once you’ve refreshed your memory on the fundamental concepts, then go ahead and practice with the technical questions we’ve provided above. Again, we’d recommend that you practice answering questions out loud, because this more closely replicates the conditions of a real interview.

3.3 Practice with peers

Practicing by yourself is a critical step, but it will only take you so far.

One of the main challenges of interviewing at JP Morgan is communicating your answers in a way that is clear and leaves a strong impression.

As a result, we recommend that you also do some mock interviews. This is much closer to the real interview experience. Plus, the feedback you get from an interview partner could help you avoid mistakes that you wouldn’t notice on your own.

You can practice with a friend or family member to start. This will help you polish your “stories” and catch communication mistakes. However, if your interview partner isn’t familiar with investment banking interviews, then practicing with an ex-interviewer will give you an extra edge.

3.4 Practice with ex-interviewers

I f you know someone who runs interviews at JP Morgan or another investment bank, then that’s amazing! They would be a great person to give you interview feedback.

But most of us don’t, and it can be REALLY tough to make a new connection with an investment banker. And even if you do have a good connection already, it might also be difficult to practice multiple hours with that person unless you know them extremely well.

Here's the good news. We want to help you make these connections. That’s why we've launched a coaching platform where you can find ex-interviewers at JP Morgan to practice with. Learn more and start scheduling sessions today .

- Harvard Business School →

- Faculty & Research →

- February 2007

- HBS Case Collection

Behavioral Finance at JP Morgan

- Format: Print

- | Pages: 20

About The Author

Malcolm P. Baker

More from the authors.

- January 2024

- Faculty Research

BWX Technologies

- September 2023

Cost of Capital at DraftKings

- BWX Technologies By: Suraj Srinivasan, Yuan Zou and Aldo Sesia

- Cost of Capital at DraftKings By: Malcolm Baker

- Cost of Capital at DraftKings By: Malcolm Baker, Sebastian Hillenbrand and James Barnett

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The JP Morgan “Whale” Report and the Ghosts of the Financial Crisis

- Ben W. Heineman, Jr.

Beyond the losses, the incident poses an enigma which business and government must ponder.

The apparition of 2008 returns once more. Two recently released JP Morgan Chase (JPM) reports on the causes of the “London Whale” trading losses raise important questions about whether financial service firms can exorcise the spectral issues which were so central to the financial crisis. They read as if JPM and a key headquarters unit — the Chief Investment Office — had not learned a single lesson from the meltdown four years ago. And unfortunately, they suggest that, in our huge, complex financial institutions, major failures of organizational discipline and major losses are likely to recur, despite greater attention to risk management.

- Ben W. Heineman, Jr. is former GE General Counsel and is a senior fellow at Harvard University’s schools of law and government. He is author of the new book, The Inside Counsel Revolution: Resolving the Partner-Guardian Tension , as well as High Performance With High Integrity .

Partner Center

- Financial Institutions

- Consultants / VARs

- Students and New Grads

- Security Features

- Case Studies

- Book a demo

Client Q&A

Featuring J.P. Morgan

We sat down with jason tiede, managing director at j.p. morgan chase, to ask him about their experience partnering with fispan to provide an embedded banking experience to their corporate clients..

The partnership allows J.P. Morgan to essentially embed their payments and treasury functionality into their clients’ ERP environment. In this Q&A case study, we ask Jason how the two parties met and why J.P. Morgan chose to partner with FISPAN.

Managing Director, J.P. Morgan Chase

THE CHALLENGE

The exposed nerve for our clients was 'I’m a Treasurer or CFO of a fast-growing tech company or a life sciences company. I use one of the cloud-based ERP systems for my daily jobs and my teams daily jobs (like Netsuite for example). As our business grows, we would like to use J.P. Morgan’s Global Payments capabilities and receivable capabilities but the real challenge is we don’t necessarily have a ton of resources on the client side to do a more traditional implementation that would require file testing and a lot of integration work'.

So the problem statement from our clients was; ‘Can you bring your services and embed all of what J.P. Morgan offers within my ecosystem without me having to embark upon a large IT project that requires a significant budget or spending?’ Essentially, ‘can I download J.P. Morgan into my environment?’.

THE SOLUTION

Now, through FISPAN, J.P. Morgan offers embedded banking services and end-to-end working capital products to support their client’s treasury and finance teams domestically and on a global basis, with new features being added to reflect their clients’ valued feedback.

LOOKING AHEAD

"We see this as embedded financial services that we started in a few ERP platforms. We think there are other industry-specific tools and platforms where we can embed ourselves and expand geographically. Then also from our standpoint, expanding products and services. This kind of end-to-end connectivity with our clients is going to allow for new products based around data products and different ways to look at credit and client needs and health."

Book Your Demo Today

Interested in how you can join leading banks like J.P. Morgan in providing their corporate clients a friction-free banking experience that improves loyalty, increases revenue, and boosts customer satisfaction scores?

Privacy Overview

Dimon and the Whale

THE PLAYERS

Bruno Iksil (The London Whale). Bruno Iksil, a trader for JP Morgan’s London office, earned the nickname, the London Whale, for his predisposition to take on big, risky trades. [ii] Some people called him ‘Voldemort’ because of his perceived aggressiveness and power to move the Credit Derivative Swaps index with his trades. Yet, before Iksil’s trades were exposed, he was relatively low profile and under the radar. Senior executives apparently supported him with full knowledge of his trades. As a trader for JP Morgan’s Chief Investment Office, Iksil was part of a team responsible for protecting JP Morgan from risk. Whenever the firm made a big investment bet, Iksil and his team insure it in case the bet went wrong. [iii] This process is known as hedging, a way to protect JP Morgan against risk even when customers suffer losses.

Ina Drew. Chief Investment Officer and Bruno Iksil’s ultimate boss, responsible for overseeing Iksil’s trading unit.

Jamie Dimon. The Chairman, President, and Chief Executive Officer of JP Morgan.

Boaz Weinstein. A derivatives trader and hedge fund manager at Saba Capital Management.

THE INSTRUMENTS

Credit Default Swap (CDS) . A credit default swap is a financial derivative that works like an insurance policy. The buyer makes payments until maturity, and the seller must pay off a third party debt to the buyer if the third party defaults on its loan. Essentially, a buyer of a CDS bets the lender will default, while the seller bets there will be no default. CDSs may be used as a way to hedge default risk for those who own bonds , or they can be used as a way to speculate (commonly referred to as naked credit default swaps) on debt issues and the creditworthiness of other parties without having to hold their bonds.

Credit Derivative Index . The index tracks the spreads on a basket of credit derivatives.

CDX.NA.IG.9 Index . A credit derivative index that tracks the spread on credit derivatives of US corporations.

In February 2012, Boaz Weinstein, a derivatives trader and hedge fund manager of Saba Capital Management, gives an important presentation at the Harbor Investment Conference that ultimately leads to the exposure of JP Morgan’s hedging loss. [iv] Ironically, the conference takes place at the JP Morgan office in Manhattan. Nearing the end of his presentation, Weinstein advocates buying the index of a certain kind of CDS. Credit default swaps have been criticized as responsible for the infamous failures of Lehman Brothers and AIG during the financial crisis of 2008. The particular swaps Weinstein recommends are known as Investment Grade Series 9 10-Year Index CDS (maturing on 12/20/2017), and apparently are relatively low risk. The so called, CDX NA IG 9 is an index that tracks a basket of credit derivatives on US corporate bonds . Weinstein recommends a buy on these particular CDSs because he notes a discrepancy in the way the swaps are trading, saying, “They are very attractive and can be bought at a very good discount [21%].” [v]

With this discount, the CDS index is fairly inexpensive. What he and the investing public do not realize at that time, is the London Whale is shorting these derivatives at immense cost to JP Morgan.

Iksil and his team have $350 billion, or 15% of JP Morgan’s assets to invest and speculate. The problem is that rather than simply using hedges as a means for protection, Iksil pursues outsized bets on complex investment securities. The large, risky bets of complex derivatives more resemble proprietary trading than risk hedging. The trades are intended to produce profits. The investment thesis behind Iksil’s CDS trade is to bet the economy improves and investment grade bonds do not default.

Weinstein inadvertently plays a large part in sinking the London Whale. Initially, no one knows JP Morgan is the force skewing the CDS index market. By February 2012, Weinstein’s convincing buy recommendation on CDX NA IG 9 begins a tug of war against JP Morgan. Hedge fund managers and investment professionals flock in on the opposite side of the Whale’s trade. Iksil continues to sell but Weinstein and hedge funds persist in buying. The London Whale is so massive that he initially sinks the bets made by the hedge funds. Through May, the losses increase to the point where Weinstein’s funds at Saba Capital are down by about 20 percent. The hedge funds are furious about the losses and suspect a single player has cornered and distorted the market by putting on huge trades. They realize that player is the London Whale. They leak the information to financial media who then begin to uncover Bruno Iksil and his trading positions. This exposure, combined with renewed concerns about the Eurozone debt crisis, catalyzes the downturn of JP Morgan’s trade. The US and European economies weaken, corporate investment grade bonds become riskier, and Iksil is unable to buy back credit default swaps to cover his losses from the short position. As a result, JP Morgan loses an initially reported $2 billion, which has since been corrected to $5.8 billion.

THE OUTCOME

Bruno Iksil, the London Whale, is fired from JP Morgan and has compensation clawed back by the bank. He is under investigation by criminal and civil authorities. The authorities are examining whether Iksil’s group mismarked positions to cover up losses.

Ina Drew, resigns as the Chief Investment Officer after seven years at the position. She forfeits two years’ worth of compensation but is allowed to keep her stock in JP Morgan. According to regulatory filings Ina Drew earned $14m in the past year.

Jamie Dimon is called to Capitol Hill a few times in the face of political and media criticism. A humbled Dimon openly apologises, “…we have let a lot of people down, and we are sorry for it”, assuring the episode is an “isolated event”, which will not happen again. [vi] When the loss first is announced to the media in April, Dimon tries to mitigate concern over the loss by addressing the furor as a “tempest in a teapot”. It becomes clear when Dimon announces the losses on May 10 the hedging losses are more severe. While he blames traders in the Chief Investment Office as well as the CIO herself, he also has openly accepted responsibility .

Jamie Dimon admits the traders did not fully understand the risk, that he trusted those who managed the division to not compromise the bank, and rightfully takes responsibility for the losses. Dimon even acknowledges the concerns of government and the public by instituting claw backs on executive compensation to ensure against a lower probability of future trading failure.

The Securities and Exchange Commission, the Office of the Comptroller of the Currency and the Federal Reserve are looking into the failed trades at JP Morgan.

ETHICAL ANALYSIS

We analyze this case using a virtue ethics framework. Virtue ethics is a moral theory developed by Greek philosophers, but rediscovered and popularized in the late twentieth century. Aristotle elaborates and refines the theory in his Nicomachean E thics . In a nutshell, Aristotle states having a virtuous character is the basis for right action . Put another way, an act is ethical if it is one that would be done by a virtuous person. Compare this view with utilitarianism , where an act is judged to be ethical by the consequences of the act. According to virtue ethics, one develops a virtuous character by constantly doing virtuous acts. Virtuous characters possess the virtues of honesty, humility, and prudence . In this case, JP Morgan betrays its institutional character as a trusted banking institution because the institution and its agents do not exhibit virtues of honesty, prudence, and humility.

Honesty. JP Morgan does not reveal its hedging losses immediately. The bank delays the revelation of losses because inside players (Iksil and Ina Drew) believe they can deal with the losses before the losses are discovered and made public. When the London Whale’s trades blows up, JP Morgan remains non-transparent and announces the bank had lost $2 billion. Actual losses are finally reported to be $5.8 billion.

Prudence . Where were the institutional safeguards to prevent Iksil from engaging in these enormous and risky trades? Iksil himself, does not show any prudence when he puts on large trades in these derivatives. Perhaps the institutional culture of JP Morgan does not encourage the virtue of prudence amongst its employees. Does the culture instead, nurture intemperateness? It appears there were no institutional safeguards that prevented the London Whale from growing such large and risky trades. The lack of prudence is both a cause and effect of the lack of internal risk management and the inability of of government to provide effective oversight o f financial institutions. In financial markets, prudence is possessing the judgement to diffferentiate between appropriate and excessive risk. Traders like Iksil are essentially incentivized to take on big, risky trades because of outsized monetary rewards. The compensation system demonstrates a problem within the institutional culture of JP Morgan and financial institutions in general. Prudence can be inculcated by encouraging transparency, which in turn discourages intemperateness . If senior management demands transparency throughout an organization’s operations, finance professionals may be more prudent thereby, protecting the bank’s credibility. In JP Morgan’s hedging loss, Iksil and his team act without moderation. They assume no rules or superiors impede their actions and therefore, act in an exclusively self-interested way, disregarding the implications on the broad economy. [vii] JP Morgan’s internal risk management inadequacy is evident in the lack of knowledge on the risk or size of the trades.

Humility . Does Jamie Dimon exhibit arrogance when he dismisses the initial questions about the Whale’s loss as a “tempest in a teacup”? It appears Dimon and his senior bankers are overconfident. They believe the bank has in place, the structures to detect and handle risks and top management has sufficient knowledge of transactions taking place in the bank. Dimon may be accused of arrogance in his appearing of possessing knowledge and control of transactional risks at the bank. The JP Morgan CEO never admits the London Whale trades are executed unethically. He also continues to defend against government regulation, criticizing Dodd-Frank legislation and the Volcker rule.

In this hedging case, JP Morgan and its agents fail to show the virtues of honesty, prudence, and humility. These virtues are vital in financial institutions and for the proper functioning of markets. Without these virtues, trust , which binds markets, erodes.

BY: Matthew Hsu

Edited By: Dr. Kara Tan Bhala

References:

- Farrell, Maureen. “JPMorgan’s trading loss: $5.8 billion.” CNNMoney. Last modified July 18, 2012. http://money.cnn.com/2012/07/18/investing/jpmorgan-earnings/index.htm.

- Salmon, Felix. “How Bruno Iksil lost $2 billion.” Reuters Blogs. Last modified May 16, 2012. http://blogs.reuters.com/felix-salmon/2012/05/16/how-bruno-iksil-lost-2-billion/.

- Moore, Heidi N. “JP Morgan’s Loss: The Explainer.” Marketplace. Last modified May 11, 2012. http://www.marketplace.org/topics/business/easy-street/jp-morgans-loss-explainer.

- Pollack, Lisa. “Hedge funds and the Whale, credit index edition.” Financial Times Alphaville. Last modified April 6, 2012. http://ftalphaville.ft.com/blog/2012/04/06/951941/hedge-funds-and-the-whale-credit-index-edition/.

- Protoss, Ben, and Michael J De La Merced. “‘Proud’ JPMorgan Chief Apologizes.” The New York Times: DealBook. Last modified June 13, 2012. http://dealbook.nytimes.com/2012/06/13/pro ud-jpmorgan-chief-apologizes/.

- Sheppard, Lee. “Did JP Morgan Violate the Volcker Rule?” Forbes. Last modified June 4, 2012. http://www.forbes.com/sites/leesheppard/2012/06/04/did-jp-morgan-violate-the-volcker-rule-2/.

- Stanford University. “Virtue Ethics.” Stanford Encyclopedia of Philosophy. Last modified July 18, 2003. http://plato.stanford.edu/entries/ethics-virtue/ .

- Goodman, Amy. “Bill Black: On JP Morgan’s ‘Hedge’, Jamie Dimon’s Integrity , and the Epic Conflicts of Interest in the Federal Reserve System.” Capitalism Without Failure. http://www.capitalismwithoutfailure.com/2012/05/bill-black-on-jp-morgans-hedge-that.html .

- Henning, Peter J. “JPMorgan’s Loss: Illegal, or Just Bad Judgment?” The New York Times: DealBook. Last modified May 14, 2012. http://dealbook.nytimes.com/2012/05/14/ jpmorgans-loss-illegal-or-just-bad-judgment/.

- Knowledge@Wharton. “JPMorgan’s Big Loss: Why Banks Still Haven’t Learned Their Lesson.” Knowledge@Wharton. Last modified May 23, 2012. http://knowledge.wharton.upenn.edu/a rticle.cfm?articleid=3008.

[i] Farrell, Maureen. JPMorgan’s trading loss: $5.8 billion.

[ii] Moore, Heidi N. JP Morgan’s Loss: The Explainer.

[iii] Pollack, Lisa. Hedge funds and the Whale, credit index edition.”

[iv] Salmon, Felix. How Bruno Iksil lost $2 billion.

[vi] Protoss, Ben, and Michael J De La Merced. ‘Proud’ JPMorgan Chief Apologizes

[vii] Henning, Peter J. JPMorgan’s Loss: Illegal, or Just Bad Judgment?

- Investment Grade Bonds

- Corporate Bonds

- Proprietary Trading

- Derivatives

- Default Risk

- Hedge Funds

- Responsibility

- Virtue Ethics

- Utilitarianism

- Trust/trustworthiness

- Name First Last

- Your Message

JPMorgan Chase

Designing both retail and corporate projects for a long-standing client.

JPMorgan Chase & Co. is a U.S. multinational banking and financial services holding company. The consumer and commercial banking businesses serve customers under the Chase brand. Our relationship with JPMorgan Chase dates back over 35 years before they acquired Chemical Bank of New York. Over the years, the firm has been working with the client on various retail and corporate projects throughout the metropolitan area and across the country. The longstanding relationship with JPMorgan Chase began in the retail sector. Our design work includes the renovation of over 500 retail branches, including in-line renovations, base-building projects, and retrofits. Two iconic design projects are our work at One Chase Manhattan Plaza and the landmarked Brooklyn Trust building. In addition to working on 10 ground-up retail projects, our team has worked on various retail roll-outs including the implementation of Chase Private Client, a concierge banking service within the JPMorgan Chase retail branch that required designated private offices. Other roll-outs include ATM implementation and ADA assessments. Most recently, our firm is working with Chase in rolling out a pilot teller-less branch, referred to as “Everyday Express” in Queens, and its first full location in NYC. As well as our substantial retail work, TPG has collaborated with JPMorgan Chase on their corporate workplace design as well. Our firm recently completed a 30,000 square-foot conference center at the Newport Office Center (NOC 5) in Jersey City, NJ. Our relationship continues to flourish as we are in the process of working on a 500,000 square-foot densification and relocation project for JPMorgan Chase at 277 Park Avenue. Due to the volume, scope, and scale of projects, TPG has developed a dedicated team of employees to service JPMorgan Chase. These talented project managers, designers, and architectural project professionals understand the client’s evolving standards and approach to the working environment.

- Interior Design

- Architecture

Services Provided

- Base Building

- In-line Renovations

- Ground-Up Architecture

Contact us today!

We’d love to hear about your project.

- Success stories

By industry

- Financial industry

- Insurance industry

- Private industry

- Healthcare Industry

By reglamentation

- Sarbanes-Oxley

- AS/NZS 4360

- Keep informed about everything you need to know regarding integral risk management and ML/TF fraud prevention.

- Videos | Webinars

- Pirani Explains

- Risk Management School

- Check out the upcoming events and keep up with us.

Next class: How to do risk mitigation Wednesday, April 24th, 9:00 a.m. GMT-5.

- Financial services industry

- Video | Webinars

- Operational risk management

- Information security risks

- Normative compliance

- Money laundering risk management

- Case Studies

Case study: JP Morgan Chase's financial troubles

written by Juan Pablo Calle , On October 06, 2022

One of the oldest banks in the world and the largest in the United States has been involved in various legal proceedings due to its poor risk management.

For financial institutions, reputation is one of the most important factors , because it defines them, keeps them in the market and enables them to reach new customers.

In the case of JP Morgan Chase Bank, speculative, market, financial and legal risks have blemished the organization's image, which has led to a decrease in its assets and a loss of confidence on the part of its customers and investors.

The magnitude of the cases of financial fraud related to this bank has been echoed all over the world, from Argentina to the United States, through Europe and even Asia. Here are some of them.

Hernán Arbizu: the fraud of a senior executive

In June 2016, the Argentine Federal Police arrested Hernán Arbizu, former vice president of the JP Morgan Chase bank, in a house in the Belgrano neighborhood of Buenos Aires.

Arbizu had an extensive career as a banker, holding various positions in the world's most prestigious banks: Citibank, Bank Boston, Bank of America, UBS and Deutsche Bank.

Arbizu left each bank with a vast list of data including usernames and company names. Accessing this privileged information, which he then used to contact potential clients, brought him juicy commissions as a reward.

When he became Vice President of JP Morgan Chase, Arbizu continued to secretly manage different bank accounts from different banks in which he had already worked. He was also carrying out unauthorized bank transfers . Through them he was laundering the money of some of his clients in Argentina, by moving the assets to tax havens.

When the situation became untenable, Arbizu extracted confidential information from the bank and used it as evidence to report JP Morgan Chase for tax evasion.

Eventually, the banker's complaint turned against him, resulting in his own extradition to the United States, accused of fraud, money laundering, identity theft and fraudulent transfers.

Although this case appears to be an isolated personnel action, the truth is that much of the responsibility fell on the bank itself.

Lack of oversight and poor financial risk management within the bank allowed Arbizu to operate comfortably to set up an asset laundering and tax evasion scheme at the expense of the financial institution's own resources.

Bernard Madoff: a pyramid scheme difficult to ignore

With a sad look and the appearance of an old man, when he speaks, Bernard Madoff moves his hands like a snake charmer. He swings them in the air and rocks them like an orchestra conductor. He pauses for a moment and, in the meantime, crosses the fingers of both hands to stop and think about what he will say next.

Behind that harmless face and the grandfatherly gaze that calculates every word, hides the brain of the biggest financial scam ever seen in the United States.

USD 64,000 million, 13,600 people swindled and several suicides, including Madoff's own son, are the result of an unprecedented pyramid scheme, a financial scam that looks like something out of a film .

The supposed multimillion-dollar trades that Bernard Madoff was carrying out on Wall Street were nothing more than an illegal money-raising system that worked by adding new "investors" who contributed capital to pay off the old ones.

Madoff was using JP Morgan Chase accounts to conceal his transactions. However, the outrageous amount of money and the enormous volume of transactions seemed difficult for the bank to ignore.

In spite of this, some of the bank's employees ignored the warning signals triggered by the scammer's transactions and failed to report the suspicious transactions in a timely manner. In addition, the bank's money-laundering policies seemed very flexible or were not implemented as thoroughly as required.

These were the arguments of the U.S. financial authorities when it ordered the bank in 2014 to pay a sum of USD 1,700 million dollars to compensate the victims of the pyramid built by Bernard Madoff .

Bear Stearns: an unprofitable purchase

On the verge of bankruptcy, Bear Stearns was acquired by JP Morgan in 2008 with the authorization of the U.S. Federal Reserve.

Bear Stearns had gone bankrupt after making large investments in subprime mortgage securities. These mortgages were granted to people with low financial solvency or who did not have a stable income, i.e. high risk profiles. For this reason, the banks were insuring the investment by charging high interest rates or by seizing the properties that were mortgaged, a vicious circle driven by unpayable loans.

Through misleading information provided by bank employees, many of these mortgages were offered as secure investments.

Thus, subprime mortgages, which were granted to people who could not afford them, created a false appearance of growth in the U.S. real estate sector, but when the bubble burst, it wound up affecting the global banking system.

When those mortgage securities lost value , Bear Stearns owed more than USD 48,000 million, and confidence in that bank declined to the point where the bank had to file for bankruptcy.

That was when JP Morgan Chase appeared on the scene . Although this bank also participated on its own account in the subprime mortgage housing bubble, its influence in the 2008 crisis increased after buying Bear Stearns Bank to save it from collapse.

This blemished JP Morgan Chase's reputation as an organization and caused its credibility as a financial institution to diminish significantly. That is why this bank was sanctioned with a fine of USD 13,000 million dollars for engaging in bad practices.

Again, poor financial risk management, poor credit risk and operational risk management and poor management led to a series of reputational risks that are still impacting the image of the largest bank in the United States.

1MDB: A RISKY PRESENT

By the end of 2017, JP Morgan Chase was under investigation by the financial authorities of Switzerland, Singapore and the United States, all on account of the 1MDB (1Malaysia Development Berhad) scandal, a state investment fund belonging to the Malaysian government.

Malaysian Prime Minister Najib Razak reportedly appropriated several million dollars of the 1MDB fund through illegal financial transactions he carried out in different banks around the world.

Specifically, JP Morgan Chase is accused of failing to identify money laundering risks associated with transactions between business and personal accounts of this state fund.

In one case, billions of dollars were transferred from the 1MDB fund account, allegedly to buy a business, to the personal account of an individual close to a company associated with the Malaysian fund.

JP Morgan Chase did not question the origin, purpose or procedure of this transaction, which involved an extraordinary sum of money. It also approved inconsistent customer data without first conducting a rigorous review thereof.

For now, the U.S. bank will not be fined, but the mismanagement of money laundering risk and the poor segmentation of its customers were unmistakable.

Like the 1MDB case, many of the legal issues JP Morgan Chase has suffered in its history still have repercussions today. Some of them have not been settled or have negative consequences that seem permanent.

This shows that, when one risk materializes, it not only triggers others, as if it were a snowball, but can also have a long duration over time, leading from a lawsuit to a sanction, and from a fine to a bankruptcy.

That is why it is important for financial institutions to have tools that allow them to have good risk management and avoid future lawsuits, claims or million-dollar fines.

You can start by downloading our guide to warning signs for the prevention of money laundering below . This way you will be able to identify unusual operations that may harm your company.

Leave us your comments

Follow Pirani

If you are a customer request help here →

A popular YouTuber's negative video of Humane's AI Pin raises questions about critical reviews in the age of innovation

- This post originally appeared in the Insider Today newsletter.

- You can sign up for Business Insider's daily newsletter here .

Hello there! If you're struggling to decide the foods worth buying organic, best-selling author Michael Pollan has some suggestions for the ones worth splurging on to avoid harmful chemicals .

In today's big story, we're looking at a critical tech review that caused a bit of a stir on social media .

What's on deck:

Markets: Goldman Sachs quiets the haters with a monster earnings report .

Tech: Leaked docs show one of Prime Video's biggest issues, forcing customers to abandon shows .

Business: The best bet in business these days? Targeting young men who like to gamble .

But first, the review is in!

If this was forwarded to you, sign up here.

The big story

Up for review.

"The Worst Product I've Ever Reviewed… For Now"

Marques Brownlee, the YouTuber better known as MKBHD, didn't mince words with the title of his review of Humane's AI Pin .

In a 25-minute video , Brownlee details all the issues he encountered using the AI device. (Spoiler alert: There were a lot.)

Brownlee's review aligns with other criticisms of the device . But not all of those came from someone with as much sway. His YouTube channel has more than 18 million subscribers.

One user on X pointed that out , calling the review "almost unethical" for "potentially killing someone else's nascent project" in a post reposted over 2,000 times.

Most of the internet disagreed, and a Humane exec even thanked Brownlee on X for the "fair and valid critiques."

But it highlights the power of Brownlee's reviews. Earlier this year, a negative video of Fisker's Ocean SUV by Brownlee also made waves on social media .

Critical reviews in the age of innovation raise some interesting questions.

To be clear, there was nothing wrong with Brownlee's review. Humane's AI Pin costs $700. Watering down his review to ease the blow would be a disservice to the millions of fans relying on his perspective before making such a significant purchase.

Too often, companies view potential customers as an extension of their research and development. They are happy to sell a product that is still a work in progress on the promise they'll fix it on the fly. ("Updates are coming!")

But in a world of instant gratification, it can be hard to appreciate that innovation takes time.

Even Apple can run into this conundrum. Take the Apple Vision Pro. Reviewers are impressed with the technology behind the much-anticipated gadget — but are still struggling to figure out what they can do with it . Maybe, over time, that will get sorted out. It's also worth remembering how cool tech can be, as Business Insider's Peter Kafka wrote following a bunch of trips in Waymo's software-powered taxis in San Francisco . Sure, robotaxis have their issues, Peter said, but they also elicit that "golly-gee-can-you-believe-it" sense.

As for Humane, America loves a comeback story. Just look at "Cyberpunk 2077." The highly anticipated video game had a disastrous launch in 2020 , but redeemed itself three years later, ultimately winning a major award .

Still, Humane shouldn't get a pass for releasing a product that didn't seem ready for primetime, according to the reviews.

And its issue could be bigger than glitchy tech. Humane's broader thesis about reducing screen time might not be as applicable. As BI's Katie Notopolous put it: " I love staring at my iPhone ."

3 things in markets

1. Goldman finally strikes gold. After a rough stretch, the vaunted investment bank crushed earnings expectations , sending its stock soaring. A big tailwind, according to CEO David Solomon, is AI spawning " enormous opportunities " for the bank.

2. Buy the dip, Wedbush says. Last week's drop among tech stocks shouldn't scare away investors , according to Wedbush. A strong earnings report, buoyed by the ongoing AI craze, should keep them soaring, strategists said. But JPMorgan doesn't see it that way, saying prices are already stretched .

3. China's economy beat analysts' expectations. The country's GDP grew 5.3% in the first quarter of 2024, according to data published by the National Bureau of Statistics on Tuesday. It's a welcome return to form for the world's second-largest economy, although below-par new home and retail sales remain a cause for concern .

3 things in tech

1. Amazon Prime Video viewers are giving up on its shows. Leaked documents show viewers are fed up with the streamer's error-ridden catalog system , which often has incomplete titles and missing episodes. In 2021, 60% of all content-related complaints were about Prime Video's catalog.