- Bahasa Indonesia

- Sign out of AWS Builder ID

- AWS Management Console

- Account Settings

- Billing & Cost Management

- Security Credentials

- AWS Personal Health Dashboard

- Support Center

- Expert Help

- Knowledge Center

- AWS Support Overview

- AWS re:Post

Case Studies for Financial Services

- Recently Added

- Headline (a-z)

- Headline (z-a)

Get started

Leading companies in the financial services industry are already using aws. contact our experts and start your own aws cloud journey today..

Ending Support for Internet Explorer

The Regulation of Consumer Financial Products: An Introductory Essay with Four Case Studies

In this section.

- Faculty Publications

- Publications by Centers & Initiatives

- Student Publications

- Browse All Articles

- Newsletter Sign-Up

FinancialMarkets →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Financial Innovation and Engineering in Islamic Finance pp 163–176 Cite as

Case Study: Analysis of Selected Shariah Compliant Financial Products

- Samir Alamad 2

- First Online: 14 April 2017

565 Accesses

Part of the book series: Contributions to Management Science ((MANAGEMENT SC.))

The previous chapter (Chap. 10 ) built on analysis in the previous chapters in order to paint the picture for the framework of engineering Shariah compliant solutions for a financial innovation to be offered by IFIs. This framework for financial innovation and engineering was established in the previous chapter with a clear demonstration of the thinking and analytical processes from an Islamic juristic perspective.

- Previous Chapter

- Financial Innovation

- Islamic Bank

- Investment Product

- Rental Payment

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

This is a preview of subscription content, log in via an institution .

Buying options

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

AAOIFI. (2014). Shariah standards . Bahrain: Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Google Scholar

Dusuki, A. W., & Mokhtar, S. (2010). Critical appraisal of Shariah Issues on ownership in asset-based sukuk as implemented in the Islamic debt market . ISRA Research Paper No. 8/2010.

Dusuki, A. W., et al. (2012). A framework for Islamic financial institutions to deal with Shariah non-compliant transactions . ISRA Research Paper No. 42/2012.

El-Diwany, Tarek (editor). (2010). Islamic Banking and Finance: What It Is and What It Could Be, UK: 1st Ethical Charitable Trust.

Khir, K., Gupta, L., & Shanmugam, B. (2008). Longman Islamic banking a practical perspective . Malaysia: Pearson.

Lotter, P., & Howladar, K. (2007). Understanding Moody’s approach to unsecured corporate sukuk . Dubai: Moody’s Investors Service.

Rammal, H. G. (2006). The importance of Shari’ah supervision in IFIs. Corporate Ownership and Control, 3 (3), 204–208.

Article Google Scholar

Download references

Author information

Authors and affiliations.

Al Rayan Bank, Birmingham, UK

Samir Alamad

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2017 Springer International Publishing AG

About this chapter

Cite this chapter.

Alamad, S. (2017). Case Study: Analysis of Selected Shariah Compliant Financial Products. In: Financial Innovation and Engineering in Islamic Finance . Contributions to Management Science. Springer, Cham. https://doi.org/10.1007/978-3-319-52947-9_11

Download citation

DOI : https://doi.org/10.1007/978-3-319-52947-9_11

Published : 14 April 2017

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-52946-2

Online ISBN : 978-3-319-52947-9

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Finance Case Studies

Featured finance case studies:.

Canary Wharf: Financing and Placemaking

Fondaco dei Tedeschi: A New Luxury Shopping Destination for Venice

Nathan Cummings Foundation: Mission-Driven Investing

The Decline of Malls

Expand the sections below to read more about each case study:, nathan cummings foundation, ellie campion, dwayne edwards, brad wayman, anna williams, william goetzmann, and jean rosenthal.

Asset Management, Investor/Finance, Leadership & Teamwork, Social Enterprise, Sourcing/Managing Funds

The Nathan Cummings Foundation Investment Committee and Board of Trustees had studied the decision to go “all in” on a mission-related investment approach. The Board voted 100% to support this new direction and new goals for financial investments, but many questions remained. How could NCF operationalize and integrate this new strategy? What changes would it need to make to support the investment strategies' long-term success? How could NCF measure and track its progress and success with this new strategy?

William Goetzmann, Jean Rosenthal, Jaan Elias, Edoardo Pasinato, Lukas Cejnar, Ellie Campion

Business History, Competitor/Strategy, Customer/Marketing, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The renovation of the Fondaco dei Tedeschi in Venice represented a grand experiment. Should an ancient building in the midst of a world heritage site be transformed into a modern mall for luxury goods? How best to achieve the transformation and make it economically sustainable? Would tourists walk to the mall? And would they buy or just look? What could each stakeholder learn from their experiences with the Fondaco dei Tedeschi?

Gardner Denver

James quinn, adam blumenthal, and jaan elias.

Asset Management, Employee/HR, Investor/Finance, Leadership & Teamwork

As KKR, a private equity firm, prepared to take Gardner-Denver, one of its portfolio companies, public in mid-2017, a discussion arose on the Gardner-Denver board about the implications of granting approximately $110 million in equity to its global employee base as part of its innovative "broad-based employee ownership program." Was the generous equity package that Pete Stavros proposed be allotted to 6,100 employees the wisest move and the right timing for Gardner Denver and its new shareholders?

Home Health Care

Jean rosenthal, jaan elias, adam blumenthal, and jeremy kogler.

Asset Management, Competitor/Strategy, Healthcare, Investor/Finance

Blue Wolf Capital Partners was making major investments in the home health care sector. The private equity fund had purchased two U.S. regional companies in the space. The plan was to merge the two organizations, creating opportunities for shared expertise and synergies in reducing management costs. Two years later, the management team was considering adding a third company. Projected revenues for the combined organization would top $1 billion annually. What was the likelihood that this opportunity would succeed?

Suwanee Lumber Company

Jaan elias, adam blumenthal, james shovlin, and heather e. tookes.

Asset Management, Investor/Finance, Sustainability

In 2016, Blue Wolf, a private equity firm headquartered in New York City, confronted a number of options when it came to its lumber business. They could put their holdings in the Suwanee Lumber Company (SLC), a sawmill they had purchased in 2013, up for sale. Or they could continue to hold onto SLC and run it as a standalone business. Or they could double down on the lumber business by buying an idle mill in Arkansas to run along with SLC.

Alternative Meat Industry: How Should Beyond Meat be Valued?

Nikki springer, leon van wyk, jacob thomas, k. geert rouwenhorst and jaan elias.

Competitor/Strategy, Customer/Marketing, Investor/Finance, Sourcing/Managing Funds, Sustainability

In 2009, when experienced entrepreneur Ethan Brown decided to build a better veggie burger, he set his sights on an exceptional goal – create a plant-based McDonald’s equally beloved by the American appetite. To do this, he knew he needed to transform the idea of plant-based meat alternatives from the sleepy few veggie burger options in the grocer’s freezer case into a fundamentally different product. Would further investments in research and development help give Beyond Meat an edge? Would Americans continue to embrace meat alternatives, or would the initial fanfare subside below investor expectations?

Hertz Global Holdings (A): Uses of Debt and Equity

Jean rosenthal, geert rouwenhorst, jacob thomas, allen xu.

Asset Management, Financial Regulation, Sourcing/Managing Funds

By 2019, Hertz CEO Kathyrn Marinello and CFO Jamere Jackson had managed to streamline the venerable car rental firm's operations. Their next steps were to consider ways to fine-tune Hertz's capital structure. Would it make sense for Marinello and Jackson to lead Hertz to issue more equity to re-balance the structure? One possibility was a stock rights offering, but an established company issuing equity was not generally well-received by investors. How well would the market respond to an attempt by Hertz management to increase shareholder equity?

Twining-Hadley Incorporated

Jaan elias, k geert rouwenhorst, jacob thomas.

Employee/HR, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

Jessica Austin has been asked to compute THI's Weighted Average Cost of Capital, a key measure for making investments and deciding executive compensation. What should she consider in making her calculation?

Shake Shack IPO

Vero bourg-meyer, jaan elias, jake thomas and geert rouwenhorst.

Competitor/Strategy, Innovation & Design, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds, Sustainability

Shake Shack's long lines of devoted fans made investors salivate when the company went public in 2015 and shares soared above expectations. Was the enthusiasm justified? Could the company maintain its edge in the long run?

Strategy for Norway's Pension Fund Global

Jean rosenthal, william n. goetzmann, olav sorenson, andrew ang, and jaan elias.

Asset Management, Investor/Finance, Sourcing/Managing Funds

Norway's Pension Fund Global was the largest sovereign wealth fund in the world. With questions in 2014 on policies, ethical investment, and other concerns, what was the appropriate investment strategy for the Fund?

Factor Investing for Retirement

Jean rosenthal, jaan elias and william goetzmann.

Asset Management, Investor/Finance

Should this investor look for a portfolio of factor funds to meet his goals for his 401(k) Retirement Plan?

Bank of Ireland

Jean w. rosenthal, eamonn walsh, matt spiegel, will goetzmann, david bach, damien p. mcloughlin, fernando fernandez, gayle allard, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork, Macroeconomics, State & Society

In August 2011, Wilbur Ross, an American investor specializing in distressed and bankrupt companies, purchased 35% of the stock of Bank of Ireland. Even for Ross, investing in an Irish bank seemed risky. Observers wondered if the investment made sense.

Commonfund ESG

Jaan elias, sarah friedman hersh, maggie chau, logan ashcraft, and pamela jao.

Asset Management, Investor/Finance, Metrics & Data, Social Enterprise

ESG (Environmental Social and Governance) investing had become an increasingly hot topic in the financial community. Could Commonfund offer its endowment clients some investment vehicle that would satisfy ESG concerns while producing sufficient returns?

Glory, Glory Man United!

Charles euvhner, jacob thomas, k. geert rouwenhorst, and jaan elias.

Competitor/Strategy, Employee/HR, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds

Manchester United might be the greatest English sports dynasty of all time. But valuation poses unique challenges. How much should a team's success on the pitch count toward its net worth?

Walmart de México: Investing in Renewable Energy

Jean rosenthal, k. geert rouwenhorst, isabel studer, jaan elias, and juan carlos rivera.

Investor/Finance, Operations, State & Society, Sustainability

Walmart de México y Centroamérica contracted for power from EVM's wind farm, saving energy costs and improving sustainability. What should the company's next steps be to advance its goals?

Voltaire, Casanova, and 18th-Century Lotteries

Jean rosenthal and william n. goetzmann.

Business History, State & Society

Gambling has been a part of human activity since earliest recorded history, and governments have often attempted to turn that impulse to benefit the state. The development of lotteries in the 18th century helped to develop the study of probabilities and enabled the financial success of some of the leading figures of that era.

Alexander Hamilton and the Origin of American Finance

Andrea nagy smith, william goetzmann, and jeffrey levick.

Business History, Financial Regulation, Investor/Finance

Alexander Hamilton is said to have invented the future. At a time when the young United States of America was disorganized and bankrupt, Hamilton could see that the nation would become a powerful economy.

Kmart Bankruptcy

Jean rosenthal, heather tookes, henry s. miller, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance

Less than 18 months after Kmart entered Chapter 11, the company emerged and its stocked soared. Why had the chain entered Chapter 11 in the first place and how had the bankruptcy process allowed the company to right itself?

Oil, ETFs, and Speculation

So alex roelof, k. geert rouwenhorst, and jaan elias.

Since the markets' origins, traders sought standardized wares to increase market liquidity. In the 1960s and later, they sought assets uncorrelated to traditional bonds and equities. By late 2004, commodity-based exchange-traded securities emerged.

Newhall Ranch Land Parcel

Acquired by a partnership of two closely intertwined homebuilders, Newhall Ranch was the last major tract of undeveloped land in Los Angeles County in 2003.

Brandeis and the Rose Museum

Arts Management, Asset Management, Investor/Finance, Social Enterprise, Sourcing/Managing Funds

The question of the role museums should play in university life became urgent for Brandeis in early 2009. Standard portfolios of investments had just taken a beating. Given that environment, should Brandeis sell art in order to save its other programs?

Taking EOP Private

Allison mitkowski, william goetzmann, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork

With 594 properties nationwide, EOP was the nation’s largest office landlord. Despite EOP's dominance of the REIT market, analysts had historically undervalued EOP. However, Blackstone saw something in EOP that the analysts didn’t, and in November, Blackstone offered to buy EOP for $48.50 per share. What did Blackstone and Vornado see that the market didn’t?

Subprime Lending Crisis

Jaan elias and william n. goetzmann.

Asset Management, Financial Regulation, Investor/Finance, State & Society

To understand the collapse of the subprime mortgage market, we look at a failing Mortgage Backed Security (MBS) and then drill down to look at a single loan that has gone bad.

William N. Goetzmann, Jean Rosenthal, and Jaan Elias

Asset Management, Business History, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The financial engineering of London's Canary Wharf was as impressive as the structural engineering. However, Brexit and the rise of fintech represented new challenges. Would financial firms leave the U.K.? Would fintech firms seek new kinds of space? How should the Canary Wharf Group respond?

The Future of Malls: Was Decline Inevitable?

Jean rosenthal, anna williams, brandon colon, robert park, william goetzmann, jessica helfand .

Business History, Customer/Marketing, Innovation & Design, Investor/Finance

Shopping malls became the "Main Street" of US suburbs beginning in the mid-20th century. But will they persist into the 21st?

Hirtle Callaghan & Co

James quinn, jaan elias, and adam blumenthal.

Asset Management, Investor/Finance, Leadership & Teamwork

In August 2019, Stephen Vaccaro, Yale MBA ‘03, became the director of private equity at Hirtle, Callaghan & Co., LLC (HC), a leading investment management firm associated with pioneering the outsourced chief investment office (OCIO) model for college endowments, foundations, and wealthy families. Vaccaro was tasked with spearheading efforts to grow HC’s private equity (PE) market value from $1 billion to a new target of roughly $3 billion in order to contribute to the effort of generating higher long-term returns for clients. Would investment committees overseeing endowments typically in the 10s or 100s of millions embrace this shift, and, more pointedly, was this the best move for client portfolios?

The Federal Reserve Response to 9-11

Jean rosenthal, william b. english, jaan elias.

Financial Regulation, Investor/Finance, Leadership & Teamwork, State & Society

The attacks on New York City and the Pentagon in Washington, DC, on September 11, 2001, shocked the nation and the world. The attacks crippled the nerve center of the U.S. financial system. Information flow among banks, traders in multiple markets, and regulators was interrupted. Under Roger Ferguson's leadership, the Federal Reserve made a series of decisions designed to provide confidence and increase liquidity in a severely damaged financial system. In hindsight, were these the best approaches? Were there other options that could have taken place?

Suwanee Lumber Company (B)

In early 2018, Blue Wolf Capital Management received an offer to sell both its mill in Arkansas (Caddo) and its mill in Florida (Suwanee) to Conifex, an upstart Canadian lumber company. Blue Wolf hadn’t planned to put both mills up for sale yet, but was the deal too good to pass up? Blue Wolf had invested nearly $36.5 million into rehabilitating the Suwanee and Caddo mills. However, neither was fully operational yet. Did the offer price fairly value the prospects of the mills? How should Blue Wolf consider the Conifex stock? Should Blue Wolf conduct a more extensive sales process rather than settle for this somewhat unexpected offer?

Occidental Petroleum's Acquisition of Anadarko

Jaan elias, piyush kabra, jacob thomas, k. geert rouwenhorst.

Asset Management, Competitor/Strategy, Investor/Finance, Sourcing/Managing Funds

In May of 2019, Vicki Hollub, the CEO of Occidental Petroleum (Oxy), pulled off a blockbuster. Bidding against Chevron, one of the world's largest oil firms, she had managed to buy Anadarko, another oil company that was roughly the size of Oxy. Hollub believed that the combination of the two firms brought the possibility for billions of dollars in synergies, more than offsetting the cost of the acquisition. Had Hollub hurt shareholder value with Oxy's ambitious deal, or had she bolstered a mid-size oil firm and made it a major player in the petroleum industry? Why didn't investors see the tremendous synergies in which Hollub fervently believed?

Hertz Global Holdings (B): Uses of Debt and Equity 2020

In 2019, Hertz held a successful rights offering and restructured some of its debt. CEO Kathyrn Marinello and CFO Jamere Jackson were moving the company toward what seemed to be sustainable profitability, having implemented major structural and financial reforms. Analysts predicted a rosy future. Travel, particularly corporate travel, was increasing as the economy grew. With all the creativity that the company had shown in its financial arrangements, did it have any options remaining, even while under the court-led reorganization?

Prodigy Finance

Vero bourg-meyer, javier gimeno, jaan elias, florian ederer.

Competitor/Strategy, Investor/Finance, Social Enterprise, State & Society, Sustainability

Having pioneered a successful financing model for student loans, Prodigy also was considering other financial services that could make use of the company’s risk model. What new products could Prodigy offer to support its student borrowers? What strategy should guide the company’s new product development? Or should the company stick to the educational loans it pioneered and knew best?

tronc: Valuing the Future of Newspapers

Jean rosenthal, heather e. tookes, and jaan elias.

Business History, Competitor/Strategy, Investor/Finance, Leadership & Teamwork

Gannet offered Tribune Publishing an all-cash buyout offer. Tribune then made a strategic pivot: new stock listing, new name "tronc," and a goal of posting 1,000 videos/day. Should the Tribune board take the buyout opportunity? What was the right price?

Role of Hedge Funds in Institutional Portfolios: Florida Retirement System

Jaan elias, william goetzmann and lloyd baskin.

Asset Management, Financial Regulation, Investor/Finance, Metrics & Data, State & Society

The Florida Retirement System, one of the country’s largest state pensions, had been slow to embrace hedge funds, but by 2015, they had 7% of their assets in the category. How should they manage their program?

Social Security 1935

Jean rosenthal, william n. goetzmann, and jaan elias.

Business History, Financial Regulation, Innovation & Design, Investor/Finance, State & Society

Frances Perkins, Franklin Roosevelt's Secretary of Labor, shaped the Social Security Act of 1935, changing America’s pension landscape. What might she have done differently?

Ant Financial: Flourishing Farmer Loans at MYbank

Jingyue xu, jean rosenthal, k. sudhir, hua song, xia zhang, yuanfang song, xiaoxi liu, and jaan elias.

Competitor/Strategy, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Leadership & Teamwork, Operations, State & Society

In 2015 Ant Financial's MYbank (an offshoot of Jack Ma’s Alibaba company) created the Flourishing Farmer Loan program, an all-internet banking service for China's rural areas. Could MYbank use financial technology to create a program with competitive costs and risk management?

Low-Carbon Investing: Commonfund & GPSU

Jaan elias, william goetzmann, and k. geert rouwenhorst.

Asset Management, Ethics & Religion, Investor/Finance, Social Enterprise, State & Society, Sustainability

In August of 2014, the movement to divest fossil fuel investments from endowment portfolios was sweeping campuses across the United States, including Gifford Pinchot State University (GPSU). How should GPSU and its investment partner Commonfund react?

360 State Street: Real Options

Andrea nagy smith and mathew spiegel.

Asset Management, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

360 State Street proved successful, but what could Bruce Becker construct on the 6,000-square-foot vacant lot at the southwest corner of the project? Under what set of circumstances and at what time would it be most advantageous to proceed? Or should he build anything at all?

Centerbridge

Jean rosenthal and olav sorensen.

When Jeffrey Aronson and Mark Gallogly founded Centerbridge, they hoped to grow the firm, but not to a point that it would lose its culture. Having added an office in London, could the firm add more locations and maintain its collegial character?

George Hudson and the 1840s Railway Mania

Andrea nagy smith, james chanos, and james spellman.

Business History, Financial Regulation, Investor/Finance, Metrics & Data

Railways were one of the original disruptive technologies: they transformed England from an island of slow, agricultural villages into a fast, urban, industrialized nation. George Hudson was the central figure in the mania for railroad shares in England. After the share value crashed, some analysts blamed Hudson, others pointed to irrational investors and still others maintained the crash was due to macroeconomic factors.

Demosthenes and Athenian Finance

Andrea nagy smith and william goetzmann.

Business History, Financial Regulation, Law & Contracts

Demosthenes' Oration 35, "Against Lacritus," contains the only surviving maritime loan contract from the fourth century B.C., proving that the ancient Greeks had devised a commercial code to link the economic lives of people from all over the Greek world. Athenians and non-Athenians alike came to the port of Piraeus to trade freely.

South Sea Bubble

Frank newman and william goetzmann.

Business History, Financial Regulation

The story of the South Sea Company and its seemingly absurd stock price levels always enters into conversations about modern valuation bubbles. Because of its modern application, discerning what was at the root of the world's first stock market crash merits considerable attention. What about the South Sea Company and the political, economic and social context in which it operated led to its stunning collapse?

Jean W. Rosenthal, Jaan Elias, William N. Goetzmann, Stanley Garstka, and Jacob Thomas

Asset Management, Healthcare, Investor/Finance, Sourcing/Managing Funds, State & Society

A centerpiece of the 2007 contract negotiations between the UAW and GM - and later with Chrysler and Ford - was establishing a Voluntary Employee Beneficiary Association (VEBA) to provide for retiree healthcare costs. The implications were substantial.

Northern Pulp: A Private Equity Firm Resurrects a Troubled Paper Company

Heather tookes, peter schott, francesco bova, jaan elias and andrea nagy smith.

Investor/Finance, Macroeconomics, State & Society, Sustainability

In 2008, the lumber industry was in a severe recession, yet Blue Wolf Capital Management was considering investment in a paper mill in Nova Scotia. How should they proceed?

Lahey Clinic: North Shore Expansion

Jaan elias, andrea r. nagy, jessica p. strauss, and william n. goetzmann.

Asset Management, Financial Regulation, Healthcare, Investor/Finance

In early 2007 the Lahey Clinic in Massachusetts believed that expansion of its North Shore facility was not only a smart strategy but also a business necessity. The two years of turmoil in the Massachusetts health care market prompted observers to question Lahey's 2007 decisions. Did the expansion strategy still make sense?

Carry Trade ETF

K. geert rouwenhorst, jean w. rosenthal, and jaan elias.

Innovation & Design, Investor/Finance, Macroeconomics, Sourcing/Managing Funds

In 2006 Deutsche Bank (DB) brought a new product to market – an exchange traded fund (ETF) based on the carry trade, a strategy of buying and selling currency futures. The offering received the William F. Sharpe Indexing Achievement Award for “Most Innovative Index Fund or ETF” at the 2006 Sharpe Awards. These awards are presented annually by IndexUniverse.com and Information Management Network for innovative advances in the indexing industry. The carry trade ETF shared the award with another DB/PowerShares offering, a Commodity Index Tracking Fund. Jim Wiandt, publisher of IndexUniverse.com, said, "These innovators are shaping the course of the index industry, creating new tools and providing new insights for the benefit of all investors." What was it that made this financial innovation successful?

William Goetzmann and Jaan Elias

Asset Management, Business History

Hawara is the site of the massive pyramid of Amenemhat III, a XII Dynasty [Middle Kingdom, 1204 – 1604 B.C.E.] pharaoh. The Hawara Labyrinth and Pyramid Complex present a wealth of information about the Middle Kingdom. Among its treasures are papyri covering property rights and transfers of ownership.

Industries Overview

Latest articles, gen zers fixate on wealth because of social media, but need banks’ help to know where they stand, meta, alphabet acquisitions on the decline as antitrust scrutiny ramps up, the digital ad industry’s overreliance on cookies could create a crisis, how marketers can prepare for ai’s impact on creative work, digital retailers want to use ai to get hyperpersonal in 2024, why beyond is bringing retail brands back from the dead, disney+ and hulu ctv ad inventory will be available via google and the trade desk, social shopping, gen z dualities, and creators on the big screen: 3 shoptalk takeaways, pets, membership perks, and smaller-format stores: three predictions for how walmart can continue to expand, shein and amazon are trying to stay one step ahead of the competition, about emarketer, financial services industry overview in 2023: trends, statistics & analysis.

Powerful data and analysis on nearly every digital topic

Want more research .

Sign up for the EMARKETER Daily Newsletter

- Financial services describes the various offerings within the finance industry, including money management and digital banking technology.

- And below we’ve outlined major terms, topics, and trends to provide a high-level financial services industry overview.

- Do you work in the Financial Services industry? Get business insights on the latest tech innovations, market trends, and your competitors with data-driven research .

The financial services sector is accelerating its adoption of digital technology. Paying with cash, participating in in-personal meetings with financial consultants, and even using an ATM are all fading facets of financial services.

To help you navigate the evolving industry, we’ve outlined major terms, topics, and trends to provide a high-level financial sector overview.

What is the financial services industry?

Financial services is a broad term used to describe the various offerings within the finance industry–encompassing everything from insurance and money management to payments and digital banking technology.

There are a multitude of stakeholders and moving parts within financial services, from credit card issuers and processors, to legacy banks and emerging challengers. And with financial activity becoming increasingly digitized, especially as consumers are choosing to manage their finances from home amid the ongoing coronavirus pandemic, financial institutions and startups are sharpening their technology and expanding remote services.

Financial Services Industry Overview

There are three general types of financial services: personal, consumer, and corporate. These three categories encompass the major players and influencers for companies and organizations trying to climb the ladder of the industry.

Personal Finance

Why is personal finance management (PFM) important? Personal finance is an individual’s budgeting, saving, and spending of monetary resources, like income, over time–while taking into consideration various monthly payments or future life events. It sets consumers up for all stages and major events in life, from buying their first car to retirement planning.

When choosing a bank or other financial institution, consumers typically look for businesses that offer personal finance services, such as financial advisors. As money management activities increasingly migrate online, consumers are looking to banks that allow them to manage personal accounts remotely and take control of their own financial health via online platforms and mobile apps.

Financial institutions that offer personal finance management (PFM) tools are particularly attractive to younger, tech-savvy consumers. Some of the top players in the personal finance market include:

- Chime: This US neobank provides fee-free financial services through its mobile app. It recently launched a new Visa credit card, designed to help customers build a credit history. And during the coronavirus pandemic, Chime built customer loyalty by rolling out $200 stimulus check advances to 100,000 customers.

- N26: This German-headquartered neobank has no branch network, meaning it reaches consumers completely virtually. N26 products include a free checking account, personal loans, and a suite of PFM tools.

- Personal Capital: This US-headquartered direct-to-consumer (D2C) digital wealth manager offers savings and retirement planning services.

- Varo: In 2020, Varo became the first neobank to receive FDIC approval and to receive a national bank charter. According to Insider Intelligence, Varo plans to use the approval to add credit products such as short-term loans, credit cards, and home financing.

- Cleo: You may recognize this service from Facebook Messenger. This AI-powered money management chatbot is now offered as an app that pulls in customers’ bank data to analyze spending in real time and generate personalized financial insights.

Like what you’re reading? Click here to learn more about Insider Intelligence’s leading Financial Services research.

Consumer Finance

From investing in real estate to paying for college, consumer finance helps people afford products and services by paying in installments over a fixed period of time. The consumer financial services market is made up of key players including credit card services, mortgage lenders, and personal and student loan services.

Some popular consumer finance services include:

- American Express: Amex is a popular payment firm, known for its charge and credit card services accompanied by various rewards programs. Recently, Amex partnered with Marriott Bonvoy to offer rewards for spending at gas stations and restaurants to a travel-focused credit card, in an effort to adjust perks based on the effects of the pandemic.

- Ally Financial: This digital-only bank went public in 2014 and is currently used by over 8.5 million people. It provides financial services ranging from vehicle financing and insurance to mortgages and personal loans.

- LendingTree: This is the largest online lending marketplace in the US. LendingTree connects borrowers with various lenders to help them find the best deals on loans–including car, home, and personal–credit cards, deposit accounts, and insurance.

Corporate Finance

Corporate financing is an all-encompassing term to describe the financial activities of a business, such as sources of funding, capital structure, actions to increase the company value, and tools to allocate resources.

Jobs in the corporate finance sector include accountants, analysts, treasurers, and investor relation experts that all work to maximize the value of a company.

Three key sources of funding in corporate finance include:

- Private equity: This is the value of company shares not publicly listed. High-net-worth investors buy shares of private companies or established mature companies that are failing. They are essentially in complete control of the companies they invest in.

- Venture capital: Venture capital (VC) is financing provided to startups that firms believe are poised for long-term growth. Due to the risk associated with investing in young businesses, venture capitalists typically invest in less than 50% of the equity of the companies.

- Angel investors: These are independently wealthy individuals looking for small businesses and startups to invest in. Angel investors are essentially purchasing a portion of the company, which forces founders to relinquish some control.

Financial Services Industry Regulations

Regulatory bodies are interconnected with various industries, and financial services is no exception. Independent agencies are designated to oversee different financial institutions’ operations, uphold transparency, and ensure their clients are treated fairly.

Two key regulatory agencies within financial services include: The Financial Industry Regulatory Authority (FINRA) and the Office of the Comptroller of the Currency (OCC).

- FINRA: This is the largest independent US regulator that oversees brokerage firms and exchange markets. In 2019 the FINRA launched the Office of Financial Innovation to aid communication between regulators, investors, and financial service providers. Essentially, it was set up to assist in understanding and regulating the technological advancements in the finance industry.

- OCC: This is an independent bureau within the US Department of the Treasury designed to regulate all national banks. Most recently, the OCC announced that banks cannot use the coronavirus pandemic as a means for accelerating branch closures. According to Insider Intelligence, the OCC is standing by existing rules that govern bank closures.

Financial Services Industry Trends & Statistics

From personal finance to commercial banks, digital advancement and increased financial technology is rapidly transforming the financial sector. And two trends in particular that are driving this digital evolution are: tapping into a huge gig worker opportunity and the growing influence of big tech companies.

Gig Economy Workers

According to Insider Intelligence, gig workers have been massively underserved by financial services because they represent a high-risk demographic.

But thanks to technological advancement in the financial sector, institutions can conduct more thorough risk assessments, which could make serving gig workers worthwhile. Half of the US population is expected to do gig work by 2028, and financial institutions that cater to this demographic could capture a major monetization opportunity.

Digital gig work generated $204 billion in customer volume in 2018 and is expected to grow to $455 billion by 2023, according to a recent Mastercard study.

Big Tech Companies

Big tech companies, like Apple and Amazon, could grab up to 40% of the $1.35 trillion in US financial services revenue from incumbent banks, according to an Insider Intelligence report.

Apple’s launch of the Apple Card could open doors to additional financial tools such as debit cards or PFM applications. And Amazon could bring Amazon Pay in-store–which could attract merchants by saving them interchange costs, cutting into a $90 billion annual source of revenue for issuers and networks.

And with 54% of respondents to a Bain study indicating that they trust at least one tech company more than their own bank, consumer trust is making big tech players a huge threat in the finance industry.

Financial Services Industry Analysis

The influence of tech-savvy consumers, looming threat of big tech companies, and shifting attitudes of regulators toward new tech, are all impacting the financial services industry.

Financial growth can be achieved with a touch of a button. And whether you’re an individual exploring wealth management options, or a CEO trying to increase the value of your company to shareholders, advanced tech will guide you to success within the finance sector.

Want more financial industry insights?

Sign up for Banking & Payments, our free newsletter.

By clicking “Sign Up”, you agree to receive emails from EMARKETER (e.g. FYIs, partner content, webinars, and other offers) and accept our Terms of Service and Privacy Policy . You can opt-out at any time.

Thank you for signing up for our newsletter!

Editor's Picks

Top 10 Biggest US Banks by Assets in 2023

Three emerging priorities for CMOs at banks

The payment industry’s biggest trends in 2022—and the pandemic’s impact on digitization in the payments landscape

Industries →, advertising & marketing.

- Social Media

- Content Marketing

- Email Marketing

- Browse All →

- Value-Based Care

- Digital Therapeutics

- Online Pharmacy

Ecommerce & Retail

- Ecommerce Sales

- Retail Sales

- Social Commerce

- Connected Devices

- Artificial Intelligence (AI)

Financial Services

- Wealth Management

More Industries

- Real Estate

- Customer Experience

- Small Business (SMB)

Geographies

- Asia-Pacific

- Central & Eastern Europe

- Latin America

- Middle East & Africa

- North America

- Western Europe

- Data Partnerships

Media Services

- Advertising & Sponsorship Opportunities

Free Content

- Newsletters

Contact Us →

Worldwide hq.

One Liberty Plaza 9th Floor New York, NY 10006 1-800-405-0844

Sales Inquiries

1-800-405-0844 [email protected]

- Search Search Please fill out this field.

What Is Financial Analysis?

Understanding financial analysis, corporate financial analysis, investment financial analysis, types of financial analysis, horizontal vs. vertical analysis.

- Example of Financial Analysis

- Financial Analysis FAQs

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Analysis: Definition, Importance, Types, and Examples

:max_bytes(150000):strip_icc():format(webp)/david-kindness-cpa-headshot1-beab5f883dec4a11af658fd86cb9009c.jpg)

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. Typically, financial analysis is used to analyze whether an entity is stable, solvent , liquid , or profitable enough to warrant a monetary investment.

Key Takeaways

- If conducted internally, financial analysis can help fund managers make future business decisions or review historical trends for past successes.

- If conducted externally, financial analysis can help investors choose the best possible investment opportunities.

- Fundamental analysis and technical analysis are the two main types of financial analysis.

- Fundamental analysis uses ratios and financial statement data to determine the intrinsic value of a security.

- Technical analysis assumes a security's value is already determined by its price, and it focuses instead on trends in value over time.

Investopedia / Nez Riaz

Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. This is done through the synthesis of financial numbers and data. A financial analyst will thoroughly examine a company's financial statements —the income statement , balance sheet , and cash flow statement . Financial analysis can be conducted in both corporate finance and investment finance settings.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance.

For example, return on assets (ROA) is a common ratio used to determine how efficient a company is at using its assets and as a measure of profitability. This ratio could be calculated for several companies in the same industry and compared to one another as part of a larger analysis.

There is no single best financial analytic ratio or calculation. Most often, analysts use a combination of data to arrive at their conclusion.

In corporate finance, the analysis is conducted internally by the accounting department and shared with management in order to improve business decision making. This type of internal analysis may include ratios such as net present value (NPV) and internal rate of return (IRR) to find projects worth executing.

Many companies extend credit to their customers. As a result, the cash receipt from sales may be delayed for a period of time. For companies with large receivable balances, it is useful to track days sales outstanding (DSO), which helps the company identify the length of time it takes to turn a credit sale into cash. The average collection period is an important aspect of a company's overall cash conversion cycle .

A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin , into an estimate of the company's future performance. This type of historical trend analysis is beneficial to identify seasonal trends.

For example, retailers may see a drastic upswing in sales in the few months leading up to Christmas. This allows the business to forecast budgets and make decisions, such as necessary minimum inventory levels, based on past trends.

In investment finance, an analyst external to the company conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach. A top-down approach first looks for macroeconomic opportunities, such as high-performing sectors, and then drills down to find the best companies within that sector. From this point, they further analyze the stocks of specific companies to choose potentially successful ones as investments by looking last at a particular company's fundamentals .

A bottom-up approach, on the other hand, looks at a specific company and conducts a similar ratio analysis to the ones used in corporate financial analysis, looking at past performance and expected future performance as investment indicators. Bottom-up investing forces investors to consider microeconomic factors first and foremost. These factors include a company's overall financial health, analysis of financial statements, the products and services offered, supply and demand, and other individual indicators of corporate performance over time.

Financial analysis is only useful as a comparative tool. Calculating a single instance of data is usually worthless; comparing that data against prior periods, other general ledger accounts, or competitor financial information yields useful information.

There are two types of financial analysis: fundamental analysis and technical analysis .

Fundamental Analysis

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

Technical Analysis

Technical analysis uses statistical trends gathered from trading activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements . Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

When reviewing a company's financial statements, two common types of financial analysis are horizontal analysis and vertical analysis . Both use the same set of data, though each analytical approach is different.

Horizontal analysis entails selecting several years of comparable financial data. One year is selected as the baseline, often the oldest. Then, each account for each subsequent year is compared to this baseline, creating a percentage that easily identifies which accounts are growing (hopefully revenue) and which accounts are shrinking (hopefully expenses).

Vertical analysis entails choosing a specific line item benchmark, then seeing how every other component on a financial statement compares to that benchmark. Most often, net sales is used as the benchmark. A company would then compare cost of goods sold, gross profit, operating profit, or net income as a percentage to this benchmark. Companies can then track how the percent changes over time.

Examples of Financial Analysis

In the nine-month period ending Sept. 30, 2022, Amazon.com reported a net loss of $3 billion. This was a substantial decline from one year ago where the company reported net income of over $19 billion.

Financial analysis shows some interesting facets of the company's earnings per share (shown above. On one hand, the company's EPS through the first three quarters was -$0.29; compared to the prior year, Amazon earned $1.88 per share. This dramatic difference was not present looking only at the third quarter of 2022 compared to 2021. Though EPS did decline from one year to the next, the company's EPS for each third quarter was comparable ($0.31 per share vs. $0.28 per share).

Analysts can also use the information above to perform corporate financial analysis. For example, consider Amazon's operating profit margins below.

- 2022: $9,511 / $364,779 = 2.6%

- 2021: $21,419 / $332,410 = 6.4%

From Q3 2021 to Q3 2022, the company experienced a decline in operating margin, allowing for financial analysis to reveal that the company simply earns less operating income for every dollar of sales.

Why Is Financial Analysis Useful?

The financial analysis aims to analyze whether an entity is stable , liquid, solvent, or profitable enough to warrant a monetary investment. It is used to evaluate economic trends, set financial policies, build long-term plans for business activity, and identify projects or companies for investment.

How Is Financial Analysis Done?

Financial analysis can be conducted in both corporate finance and investment finance settings. A financial analyst will thoroughly examine a company's financial statements—the income statement, balance sheet, and cash flow statement.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance. A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin, into an estimate of the company's future performance.

What Techniques Are Used in Conducting Financial Analysis?

Analysts can use vertical analysis to compare each component of a financial statement as a percentage of a baseline (such as each component as a percentage of total sales). Alternatively, analysts can perform horizontal analysis by comparing one baseline year's financial results to other years.

Many financial analysis techniques involve analyzing growth rates including regression analysis, year-over-year growth, top-down analysis such as market share percentage, or bottom-up analysis such as revenue driver analysis .

Last, financial analysis often entails the use of financial metrics and ratios. These techniques include quotients relating to the liquidity, solvency, profitability, or efficiency (turnover of resources) of a company.

What Is Fundamental Analysis?

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

What Is Technical Analysis?

Technical analysis uses statistical trends gathered from market activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements. Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

Financial analysis is a cornerstone of making smarter, more strategic decisions based on the underlying financial data of a company. Whether corporate, investment, or technical analysis, analysts use data to explore trends, understand growth, seek areas of risk, and support decision-making. Financial analysis may include investigating financial statement changes, calculating financial ratios, or exploring operating variances.

Amazon. " Amazon.com Announces Third Quarter Results ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1473508651-3d4f933caf57486ea0412bd4738991f4.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

JavaScript seems to be disabled in your browser. You must have JavaScript enabled in your browser to utilize the functionality of this website.

- My Wishlist

- Customer Login / Registration

FB Twitter linked in Youtube G+

- ORGANIZATIONAL BEHAVIOR

- MARKETING MANAGEMENT

- STATISTICS FOR MANAGEMENT

- HUMAN RESOURCE MANAGEMENT

- STRATEGIC MANAGEMENT

- OPERATIONS MANAGEMENT

- MANAGERIAL ECONOMICS

FINANCIAL MANAGEMENT

- CONSUMER BEHAVIOR

- BRAND MANAGEMENT

- MARKETING RESEARCH

- SUPPLY CHAIN MANAGEMENT

- ENTREPRENEURSHIP & STARTUPS

- CORPORATE SOCIAL RESPONSIBILITY

- INFORMATION TECHNOLOGY

- BANKING & FINANCIAL SERVICES

- CUSTOMER RELATIONSHIP MANAGEMENT

- ADVERTISING

- BUSINESS ANALYTICS

- BUSINESS ETHICS

- DIGITAL MARKETING

- HEALTHCARE MANAGEMENT

- SALES AND DISTRIBUTION MANAGEMENT

- FAMILY BUSINESS

- MEDIA AND ENTERTAINMENT

- CORPORATE CASES

- Case Debate

- Course Case Maps

- Sample Case Studies

- IIM KOZHIKODE

- VINOD GUPTA SCHOOL OF MANAGEMENT, IIT KHARAGPUR

- GSMC - IIM RAIPUR

- IMT GHAZIABAD

- INSTITUTE OF PUBLIC ENTERPRISE

- IBM Corp. & SAP SE

- Classroom Classics

- Free Products

- Case Workshops

- Home

- Case Categories

Pricing of Swap Contracts

Time and money: home investment dilemma, the basil tree day care centre, evaluation of atal pension yojana using time value of money, investment in wee infant milk formula: a capital budgeting dilemma, dividend payout policy of infosys limited: how much to pay, investment fraud: the case of sahara india pariwar*.

Solar Photovoltaic Systems Bring Happiness to Residential Societies*

What went wrong with ‘bombay dyeing’, the implications of sebi & fmc merger on financial services sector: a case of daruwala broking pvt ltd.*.

Securitization between Reliance Communications Ltd. and Reliance Jio Infocomm Ltd.: Strategic Financial Analysis*

Microsoft acquisition of nokia: an analysis from strategic and financial perspective*.

MP Taps and Fittings Enterprise*

Feasibility study: case of a biomass project*, take over of transportation business in uttarakhand*.

- last 6 months (0)

- last 12 months (0)

- last 24 months (0)

- older than 24 months (47)

- FINANCIAL MANAGEMENT (47)

- Finance, Insurance & Real Estate (1)

- CASE FLYER (1)

- CASE SLIDE (1)

- CASE STUDY (20)

- CASELET (25)

Information

- Collaborations

- Privacy Policy

- Terms & Conditions

- Case Format

- Pricing and Discount

- Subscription Model

- Case Writing Workshop

- Case Submission

- Reprint Permissions

CUSTOMER SERVICE

Phone: +91 9626264881

Email: [email protected]

ET CASES develops customized case studies for corporate organizations / government and non-government institutions. Once the query is generated, one of ET CASES’ Case Research Managers will undertake primary/secondary research and develop the case study. Please send an e-mail to [email protected] to place a query or get in touch with us.

Don’t miss out!

Be the first to hear about new cases, special promotions and more – just pop your email in the box below.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Financial Statements Examples – Amazon Case Study

Financial Statements are informational records detailing a company’s business activities over a period.

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

- What Are Financial Statements?

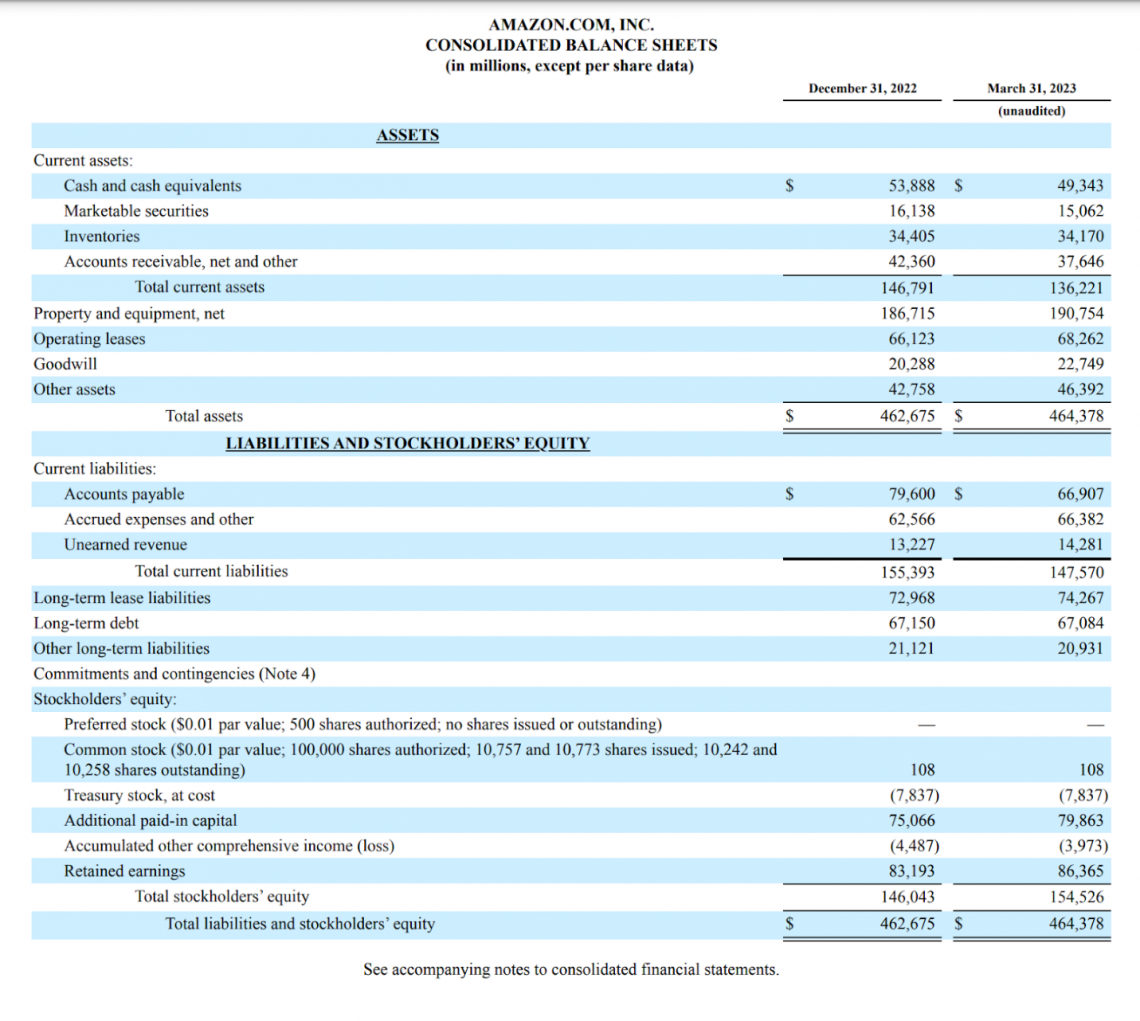

Amazon’s Balance Sheet

Amazon’s income statement, amazon’s cash flow statement, usage of financial statements, amazon case study faqs, what are financial statements.

Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon , profitability metrics used to analyze most businesses cannot be used to compare the company to businesses in the same sector.

Amazon remains low in profitability continuously to reinvest in growing operations and new business opportunities. Instead, investors can point to the metrics signified in Amazon’s cash flow statement to demonstrate growth in revenue generation over the long term.

There are three main types of financial statements, all of which provide a current or potential investor with a different viewpoint of a company’s financials. These include the following below.

Balance Sheet

The balance sheet represents a company’s total assets, liabilities, and shareholder ’s equity at a certain time.

Assets are all items owned by a company with tangible or intangible value, while liabilities are all debts a company must repay in the future.

Shareholders' equity is simply calculated by subtracting total assets from total liabilities. This represents the book value of a business.

Income Statement

The income statement represents a company’s total generated income minus expenses over a specified range of time. This can be 3 months in a quarterly report or a year in an annual report .

Revenue includes the total money a company makes over a set time.

This includes operating revenue from business activities and non-operating revenue, such as interest from a company bank account.

Expenses include the total amount of money spent by a company over time. These can be grouped into two separate categories, Primary expenses occur from generating revenue, and secondary expenses appear from debt financing and selling off held assets.

Cash Flow Statement

The cash flow statement represents a company’s total cash inflows and outflows over a specified time range, similar to the income statement. Cash in a business can come from operating, investing, or financing activities.

Operating activities are events in which the business produces or spends money to sell its products or services. This would be income from the sales of goods or services or interest payments and expenses such as wages and rent payments for company facilities.

Investing activities include selling or purchasing assets, which can include investing in business equipment or purchasing short-term securities. Financing activities include the payment of loans and the issuance of dividends or stock repurchases.

Key Takeaways

- Financial statements have information relevant for investors to understand the operations and profitability of a business over a specified time.

- Fundamental analysis typically focuses on the main three financial statements: the balance sheet, income statement, and cash flow statement.

- Although analyzing business financials can provide an unaltered outlook into the operations of a business, the numbers don’t always demonstrate the full story, and investors should always conduct thorough due diligence beyond pure statistics.

- Investors must ensure all of a company's financial statements are analyzed before forming a thesis, as inconsistencies in one sheet may be caused by an unusual one-time expense or dictated by a global measure out of the company’s control (ex., COVID-19).

Now that we have a general understanding of the financial statements, we can begin to take a look at Amazon’s most recent quarterly filing.

Company filings can be found by using EDGAR (database of regulatory filings for investors by the SEC) or from Amazon’s investor relations website.

Before we begin analyzing this sheet, it is important to take note of the statement just below the title, indicating that the data is being displayed in millions.

This can throw off newcomers, who may be very confused upon seeing Amazon’s revenue is $53,888. Amazon’s quarterly revenue is indeed $53.8 billion as calculated in millions.

When looking at Amazon’s assets, it is important to note the difference between current and total assets. Current assets are categorized separately due to the expectation that they can be converted to cash within the fiscal year.

Current assets can be used in the current ratio to analyze Amazon’s ability to pay off its short-term obligations. The current ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Amazon’s current ratio sits at 0.92, which is below the e-commerce industry average of 2.09 as of March 2023 (Source: Macrotrends ).

This could mean that Amazon is potentially overvalued compared to competitors, but this is only one metric and should ultimately be all of an investment decision, especially considering the capital-intensive nature of Amazon’s business model.

It is also important to understand all of the vocabulary used to detail items in Amazon’s balance sheet. Some of the major items’ definitions can be found below:

Assets are classified as follows.

- Cash and cash equivalents: Assets of high liquidity, such as certificates of deposit or treasury bonds.

- Marketable securities: Liquid securities can be sold in the public market, such as stock in another company or corporate bonds.

- Accounts receivable (A/R): Money owed to the company that has not been received yet, such as from items previously bought on credit.

- Inventories: Unsold finished or unfinished products from a company that has yet to be sold.

- Property and equipment (PP&E): Assets owned by a company that is used for business activities. It may include factory assets or other types of real estate.

- Operating leases: Assets rented by a business for operational purposes. Calculated as the net present value on the balance sheet.

- Goodwill: Calculates intangible assets that cannot be sold or directly measured, such as customer reputation and loyalty.

Liabilities are of the following types.

- Accounts payable (A/P): Obligations accrued through business activities that must be paid off shortly.

- Accrued expenses: Current liabilities for a business that must be paid in the next 12 months.

- Unearned revenue: This represents revenue earned by a business that has not yet received. Prevents profits from being overstated for a specific period.

- Long-term debt: Debts in which payments are required over 12 months.

- Lease liabilities: Payment obligations of a lease taken out by a company.

- Stockholders’ equity: Net worth of a business/asset value to shareholders.

- Retained earnings: Net profit remaining for a company after all liabilities are paid.

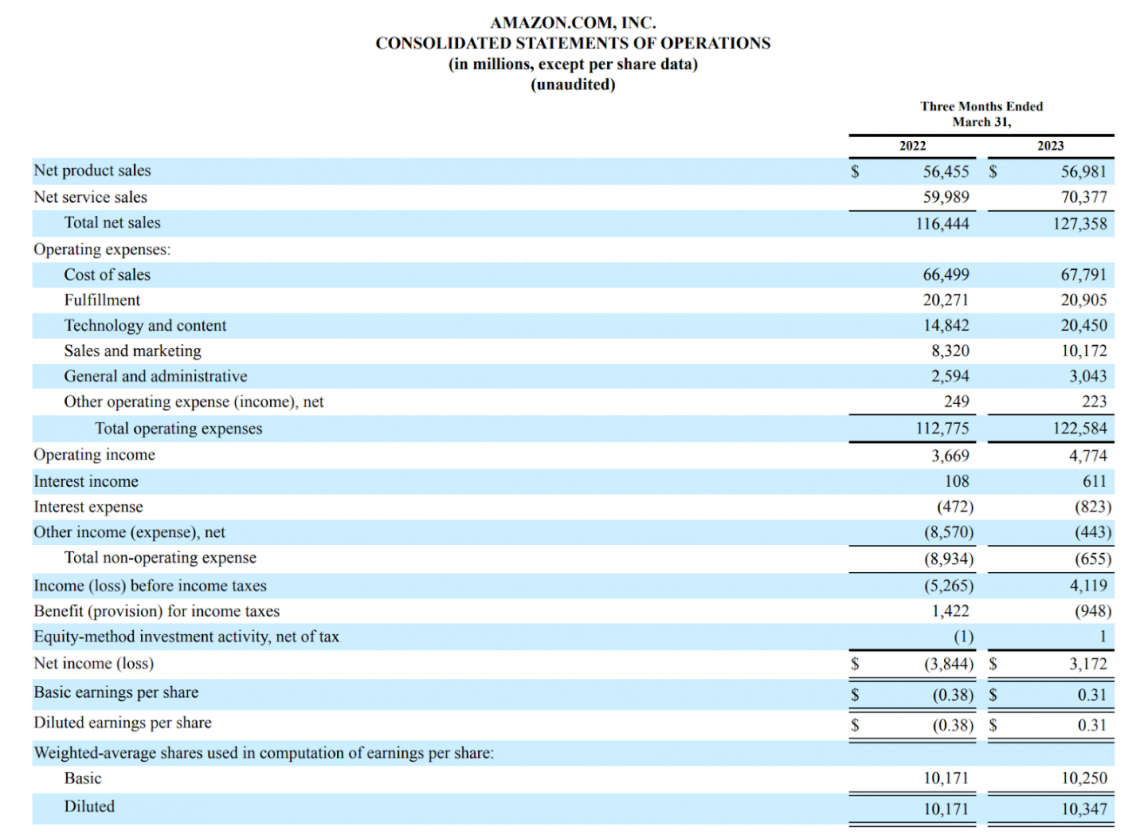

Amazon’s next statement in its quarterly filing is the income statement. The income statement is useful for comparing a company’s growth over time and matching it up against competitors in the same or different sectors.

An essential factor to note when looking at a company’s income statement is whether its revenue and net income are consistently growing year over year. Investors should also be aware of Wall Street expectations, as they can heavily influence the business’s share price.

Many important ratios are used when analyzing a company’s income statement. Some of the most notable ones include:

- EV/EBITDA = (Market Capitalization + Debt - Cash) / (Revenue - Cost of Goods Sold - Operating Expenses)

- Gross Margin = (Revenue - Cost of Goods Sold) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Average Shareholder Equity (End Value + Beginning Value / 2)

- Earnings Per Share = Net Income / Shares Outstanding

Let’s use these ratios to conduct a comparables analysis between Amazon and eBay, a company at a much lower valuation relative to the e-commerce giant. Here are their ratios side-by-side, as of Amazon’s Q1 2023 and eBay’s Q1 2023 filings:

* = EV/EBITDA ratios sourced from finbox.com , March 2023 trailing twelve months (TTM)

Looking at these statistics on paper, it is clear to see that Amazon seems overvalued compared to eBay due to lower margins, negative earnings per share, and an EV/EBITDA multiple over three times as high as the business.

However, pure stats on an income statement cannot fully justify purchasing one company or another. The statement merely shows what a company is doing without a corporate spin.

One thing to note that is unique about Amazon’s business model is how the company invests huge amounts of capital into R&D and technology to expand its operations continuously.

Their numbers don’t account for the massive cash flows and growth opportunities that the business takes advantage of.

When conducting fundamental analysis, an investor must consider all aspects of a business beyond the financial statements, including comparing business models to competitors and setting benchmarks encompassing the overall sector.

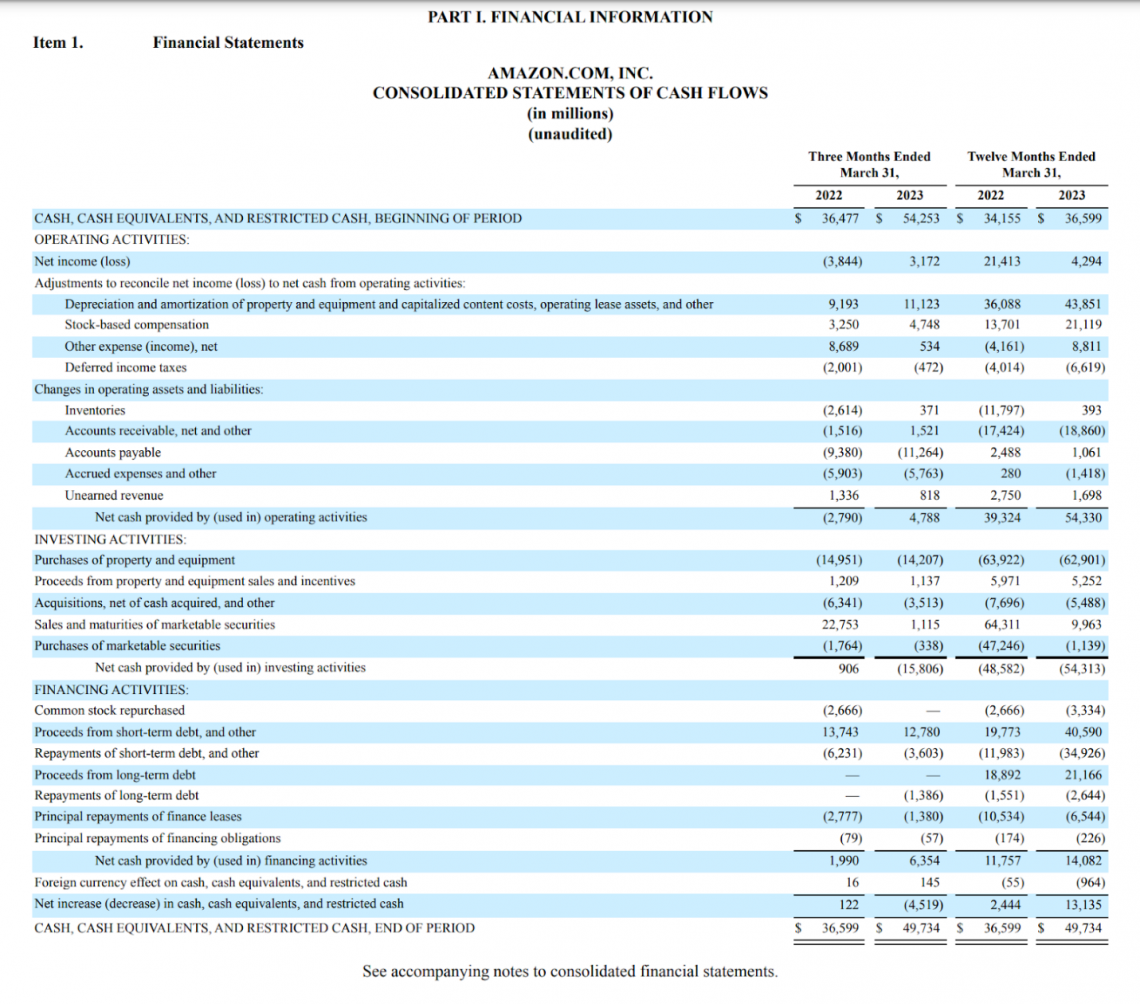

Amazon’s cash flow statement is where the company begins to shine compared to its competitors in the online commerce sector. The company has consistently increased cash flow from operating activities and constantly returns value to shareholders in the form of capital appreciation.

It is notable for focusing on what the company is doing inside of its cash flow statements to get a better picture of why its income or stock price is trending a certain way.

For example, an explosive drop in net income in an otherwise stable company could be due to mismanagement or hampered growth but is most likely due to M&A activity charged in a quarter that may be skewing the numbers. The cash flow statement clears this up.

Compared to 2022, Amazon has increased its annual cash from operating activities by over 38% from the previous year based on a 12-month rolling basis.

This increase has also resulted in an 11.7% increase in investment expenditures, which should allow Amazon to continue growing faster than similar companies.

In comparison, according to eBay’s most recent 10-K filing , the company generated an 82% growth in operating cash flow (OCF), however, this stat can be very misleading due to the company’s lack of investment in processes such as R&D and SG&A.

In 2022, the company reported $92M in investing activities, representing only 26% of operating cash flows. Amazon reported over $37.6B in investing activities representing approximately 88% of its OCF.

The income statement can misrepresent how well a company is doing, as while eBay has a higher net income, Amazon strategically reinvests its cash flows into R&D and other expenses to produce more over time continuously.

What makes the cash flow statement so essential to fundamental analysis is the fact that it is tough to manipulate its numbers through financial engineering or clever accounting.

The statement purely shows precisely where all of the money a company makes is being used. Many investors use the cash flow statement to tell the true financial health of a business, as profits can often not be indicative of a growth company's value.

The stock price of a company can easily be swayed by sentiment or the market cycle , and the income statement can be skewed through large one-time transactions or large amounts of financed revenue. The amount of money in the possession of a company is very hard to adjust.

Amazon currently has much better growth prospects than eBay and thus sells at a higher premium in the open market , but you wouldn’t understand why unless you took in the full picture of the company.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Financial statements are excellent tools to learn more about a business in terms of an overall market or sector of operation. Using financial statements to determine the current value of a business is essential for understanding a company’s stock price.

Along with the ratios mentioned, analysts often form their methodologies over time to focus on companies that are strong in specific financial circumstances.

Tools such as stock screeners can sort millions of companies by certain factors. For instance, some investors may seek defensive companies with consistent dividend growth over long periods, while others may seek growth companies with the most innovative new technology.

Investors should keep all of this information in mind, as well as pay attention to the reports of analysts with varied performance outlooks. It is essential to seek out the opinions of multiple sources before establishing an opinion on a business.

Looking at reports from analysts specializing in the industry can also ensure that your expectations are reasonable compared to industry experts.

If your thesis results in Amazon growing its revenues by 20% a year while analysts across the country are only expecting growth in the range of 5-7%, it could be a sign that you may have overlooked a key factor in your due diligence .

The overall goal of using financial statements is to fully understand the company you are investing in to justify a position. Although your views may slightly differ from experts, quality due diligence can result in somewhat varied outcomes based on an investor’s outlook for the future.

Using EBITDA instead of net income strips away the capital structure and taxation of a business to analyze the pure earnings potential of a business. This is more practical for investors to see the general trajectory of a company’s income over time.

For example, companies may decide on completing a merger or acquiring another company. This will require a company to report its current and acquired assets on its balance sheet .

Over time, these assets must be recorded as expenses through the use of depreciation, which is the process of deducting from gross revenue to account for the decreasing value of company plant assets.

If these assets increase in value over time, this could decrease revenues over time not due to company performance but because of increased prices for equipment outside of the company’s control.

Without looking at EBITDA, company financials may paint a completely different picture with the use of net income that may or may not be justified at all.

ROE is an important metric to distinguish how good a company is at generating profits with investor capital compared to its share price and competitors. It is yet another indicator used to analyze the trajectory of a business over time.

Using ROE can also demonstrate how much financing a company requires to generate its revenue and if investors are really getting a great return for the amount of money shareholders contribute.

A startup that has recently gone public on the stock exchange may have a very low to negative ROE compared to an established company. Still, the startup may have the margins and growth to justify its valuation .

Much like every financial ratio, ROE doesn’t demonstrate the entire story of a business, and the full picture of a business must be considered to decide on an equity investment.

To proliferate and take market share from competitors, Amazon undercuts prices on many products to decrease competition and remain the top player in the industry.

Amazon, like many other companies recently since the pandemic, has also faced significant increases in operating expenses , thus lowering operating and net margins in the short term. Once Amazon begins to slow expansion, these margins are expected to rise.

Amazon’s net income is very low for many of the same reasons. The company is profitable yet is constantly reinvesting into new businesses and products to further grow cash flows for future expenditures.

Amazon investors are not focused on income but rather on its ability to continuously grow in the long term. Growth companies like Amazon do not issue dividends because they believe that the money is better reinvested in business operations.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Tanner Hertz | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Conservatism

- Accounting Equation

- Accounting Ratios

- Three Financial Statements in FP&A

- Working Capital Cycle

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Every Client That Comes To Work With Us Has Their Own Story.

Here are some case studies that best exemplify how we’ve helped different clients over the years., every client that comes to us has their own story., case studies, cash flow planning for burnt out physician.

Jackie and Larry Stein Jackie and Larry are in their mid-50s. As a department chair at one of Boston’s large healthcare networks, Jackie must balance her clinical workload, administrative duties, and research goals. However, after several decades in medicine, the workload and stress

Pharma Executive with Complex Stock Options

Robert and Claire McDonough Robert and Claire are both in their early 40s with twin eight-year-old boys. Claire works in the development office for an international non-profit and Robert is a cardiologist turned pharmaceutical executive

Retiring With A Concentrated Stock Portfolio

Stacy and John Simmons Stacy and John came to Artemis to get their financial house in order in preparation for their retirement. They had long-managed their investment portfolio on their own but felt they were ready to enlist some professional support

Physician Couple with Public Pensions and Estate Planning Needs

Betsy and Tyler Armstrong Betsy and Tyler are both physicians in their early 50s. They live in Cambridge with their two teenage children and beloved golden retriever. Betsy has spent her entire career in the public sector

Financial Ally for Her Next Chapter

Tiffany Jones Tiffany is single, in her early 40’s, and a PANK™ (Professional Aunt, No Kids). She decided to retire early after a successful 20-year career in technology sales and start her own consulting business. Initially, Tiffany hired us to create a

Diversification and Discretion For Busy Finance Executives

Susan Rice Susan and her partner, Imani, are both busy executives with two children. Susan works in the investment division of an asset management firm. Because of her role, she needs an advisor who can have discretion over her

Am I Going to Run Out of Money?

Linda Gonzalez Linda has been widowed for 15 years. She retired from work 10 years ago, and now owns a beautiful condo in the city. Due to all the recent volatility in the stock market, she has become concerned that she may run out of money to cover her lifestyle

Seeking Sustainable Investing with a Gender Lens

Kristin Seeley Kristin is a single woman and has never had a problem managing her finances. Recently, she has become interested in sustainable and gender lens investing. Yet when she approached her current financial advisor about restructuring her

Young Family – Overwhelmed By Decisions

John and Mary Freedman John and Mary were married three years ago and have a two-year-old son. Mary works in private equity and earns a nice income but a good portion of it is going to be paid over time in the form of “carry” and not available to spend, nor is it very

Help Me Give it All Away!

Hilary Arnold Hilary Arnold, a busy senior executive in the healthcare industry, has saved quite a bit of money over the years. In addition, she comes from an extremely wealthy family and is the beneficiary of several large trusts. Although Hilary is capable of

Can I Afford To Divorce?