- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

Business Plan for Small Scale Mining Entrepreneur

Recent estimates show that small-scale, entrepreneurial mining operations produce around 20 percent of the world’s gold, 20 percent of the total diamond weight, and about 80 percent of usable sapphires.

Small Scale Mining Business Plan

Business planning is what we specialize in at wise.

Wisebusinessplans, a global leader in the business planning community, is now assisting small mine owners and operators in the quest for steady, sustainable growth through the use of effective Small Scale Mining Business plans and goals mapping options.

“A small mining operation can make a healthy profit when managed carefully by following specific planning practices that lead to earnings protection and secure long-term business life.

” said Joseph Ferriolo, Director of Wisebusinessplans. “At Wise, we look at each client as an individual, one whose interests, ideas, and goals are unique to that business and we work one-on-one with every client.”

Wisebusinessplans’ custom-crafted mining business plan is tailor-made to showcase startup or expansion concepts as companies seek to acquire funding from investors , look to raise capital through venture capitalists, or work with private investors.

All plans include market research and custom financials that are developed for each individual company. Design experts give every mining business plan a unique, professional look and each client is entitled to a free revision to ensure the plan is done right.”

We feel privileged to assist men and women in the business world, such as mining entrepreneurs, who are working hard to not only make a better life for themselves but are also creating employment opportunities for others in their communities,” said Ferriolo.

Firms in this industry provide support services, on a fee or contract basis, for mining, quarrying, and oil and gas extraction. Firms may also provide services such as drilling ; taking core samples and making geological observations at prospective mine sites. Download our mining business plan sample and related business plan sample here.

Wisebusinessplans , staffed with professional MBA Business Plan writers , researchers, and financial experts, is a trusted partner for businesses across a broad spectrum of products and services. Our mission is to empower our clients to make the best possible business decisions, boost company performance and facilitate their funding success by laying the groundwork for strong businesses that excite, inspire and retain talented and exceptional employees.

A business plan for a small-scale mining entrepreneur should include sections on the executive summary, company overview, market analysis, marketing and sales strategies, operational plan, financial projections, and risk management. It should also outline the entrepreneur’s goals, target minerals, mining methods, and environmental considerations.

Market analysis for a small-scale mining business involves researching the demand for specific minerals, identifying target customers or industries, assessing competition, and understanding market trends and pricing dynamics. This information helps in determining the viability and profitability of the mining venture.

The operational plan should cover aspects such as the location and accessibility of the mining site, equipment and machinery needed, workforce requirements, safety protocols, environmental considerations, mining processes, and extraction techniques. It should also address permits, licenses, and compliance with mining regulations.

Financial projections for a small-scale mining business involve estimating startup costs, including equipment, permits, and infrastructure expenses. Additionally, projecting revenues based on expected mineral extraction volumes, pricing, and market demand. Cost considerations, such as labor, maintenance, and operational expenses, should also be factored in.

Common risks in small-scale mining include geological uncertainties, price volatility, regulatory changes, environmental impacts, and safety hazards. Risk management strategies may include conducting thorough geological surveys, maintaining diverse mineral portfolios, staying informed about market trends, complying with regulations, implementing safety protocols, and developing contingency plans for unexpected events.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Everything You Need to Start & Grow a Business

Start Your Own Small Mining Company: An In-depth Guide

Looking to start a mining company but not sure where to begin? Want to unlock the commercial potential of natural minerals and rocks in your area? This article is here to help. From owning a mine to selling resources , we’ll provide you with the guidance you need to launch a successful venture.

While mining is a risky industry, with constantly fluctuating commodity prices, our tips on consistent hard work, thorough planning, and a dash of luck will set you on the path to profitability. Ready to learn more? Keep reading.

Assess Your Expertise

Assess your mining expertise to see if you’re ready to lead a mine to success. Essential skills include knowledge of environmental sciences, geology, engineering, mathematics, and related fields, as well as the operation and maintenance of mining equipment.

Gain hands-on experience through work at a mine before launching your own business venture. Ensure you have what it takes before starting out. Be sure to learn new skills in marketing and promoting your business to stand out from the rest.

Secure Financing for Your Mining Company

After assessing your expertise level in mining, it is essential to secure financing for your small-scale mining company from potential investors willing to make an initial investment into the venture capital fund needed for start-up costs such as land acquisition fees, permits & licenses fees and purchasing equipment & supplies as well as covering operational costs during the first years of business operations until revenue streams begin to flow in consistently over time from sales proceeds of mined minerals/resources.

It is important to note that since this type of business involves high-risk investments, it would be wise to approach bank loan officers who are more experienced with financing miners versus traditional lending institutions who are unfamiliar with this industry sector’s specific needs & requirements.

Establish a Business Plan for the Mining Company

After securing funding for start-up costs such as land acquisition fees and purchasing equipment & supplies, as well as covering operational costs during the first few years of business operations until revenue streams begin to flow in consistently over time from sales proceeds of mined minerals/resources, develop an effective business plan by considering factors like market analysis, competition & pricing strategies, financial projections, and operational management.

A well-planned business plan can help to ensure your small mining company’s success as it will serve as a guide for decision-making during the early stages of operations and over time.

Acquire Equipment & Supplies

Once your business plan is complete, purchase all necessary equipment & supplies needed to operate your small-scale mining business, such as drills, ventilation systems, and other machinery. Additionally, you should also consider investing in safety gear for staff operating these machines, such as helmets, overalls, and protective gloves. Invest in a Steel Roller to make your operation run smoothly.

Starting a small mining company requires dedication, research, and hard work. It is important to understand the industry you are entering by researching the types of minerals or resources available in your area as well as applicable laws and regulations related to mining. Goodluck

- Empower Your Business with GridPanel Comprehensive Web Scraping Solutions

- Understanding the Role of Elastic Fibers in Modern Fabrics

- Cyber Defenders: A Look at the Global Cybersecurity Industry

- Elevate Your Business with Strategies from an Entrepreneur Author

- Choosing the Right Liability Insurance for Your Business: Why It Matters

You may also like...

7 Common Misconceptions People Have About Being Self Employed

How To Evolve Your Business For The Future

- International edition

- Australia edition

- Europe edition

How to make small-scale mining sustainable

Dangerous. Polluting. Illegal. Wrong. The conventional narrative around artisanal and small-scale mining in Africa, Asia and Latin America tends to use words such as these. And while it is true that the sector has problems in spades, it also has the potential to clean up its act and provide sustainable livelihoods for millions of the world's poorest people.

Lina Villa knows what a difference a fresh approach can make. She runs the Alliance for Responsible Mining (ARM) , a global network that develops environmental and social standards for responsible artisanal and small-scale mining, so certified miners can sell their products for a premium.

One of the big inspirations for ARM is Oro Verde (Green Gold), a Colombian initiative working with Afro-Colombian artisanal gold miners in the Chocó bioregion – an area marked by high rates of poverty, social exclusion and a very sensitive ecosystem. Oro Verde has involved about 1,300 miners in the certification system and the premium they earn helps pay for local community development projects and diversification into other livelihood activities. Now a brand in its own right, the programme has successfully merged the ancestral knowledge of local communities with scientific and technical know-how to make mining clean, green and safe – the gold they mine is being certified and labelled as both Fairtrade and Fairmined .

But Oro Verde is – for now – a rare gem. Most small-scale mining operates at the fringes. Neglected by governments, in conflict with companies, and overlooked by donors who see small-scale agriculture and forestry as more worthy projects to support. Yet the sector provides jobs for 20-30 million people, often from the poorest and most marginalised of communities. That's 10 times more people worldwide than large-scale mining does. Small-scale miners produce about 85% of the world's gemstones and 20-25% of all gold.

For Villa, the first step is to change minds. Governments and big business need to recognise small-scale mining as both highly productive and as a legitimate part of the mining sector. It is time for governments to bring it into their economic and rural development plans, create incentives for small-scale miners to make their operations legal and help miners access finance, technology and secure land rights.

Villa says it is particularly crucial for governments to shake up the systems that license mining. While licences for big mining companies typically last 30 years or more, those for small operations can last as little as a year – even though some deposits are only suitable for smaller players. With such a skewed playing field, it's hardly surprising that artisanal miners struggle to invest in greener production techniques.

Attitudes won't change and policies won't improve on their own. A new report by IIED shows that what's needed first is better knowledge and understanding of the sector. Only then can the right institutions grow and the right investments flow. The report points to three major gaps in how knowledge shapes policy. First, the knowledge that does exist is poorly shared. Second, the experience of small-scale miners and local communities is largely overlooked – and that's a consequence of their marginalisation and lack of effective representative bodies in many countries. Third, there is no multi-stakeholder space where committed individuals and organisations from different parts of the sector can come together to build trust, learn, innovate and find shared solutions.

The report shows that, while there is good hands-on experience and innovation on-the-ground – for instance, with some governments adopting more inclusive policies and with the beginnings of ethical sourcing – these are often not widely known about, or face huge implementation challenges which stall progress. What is clear is that the only effective way for governments to deal with the social and environmental problems in small-scale mines will be if they work in partnership with the miners themselves.

IIED plans to help to fill the knowledge gap with a new programme of work that will connect stakeholders – including small-scale miners with decision-makers – and ensure that better quality information is generated and used effectively in policymaking at local, corporate, national and international levels. As well as operating national-level projects with partners in countries with large numbers of artisanal miners, it will also focus on global problems such as child labour, health hazards, informality, human rights, pollution, and transparency in supply chains. The new report presents several programme options that IIED has identified following initial consultations with sector stakeholders. The institute now welcomes responses to these options and expressions of interest in collaboration .

The time is ripe for policymakers, donors, companies and miners to come together to help small-scale mining realise its potential to be a force for good. The global demand for mineral resources continues to grow. Meanwhile, the UN's new Minamata Convention on Mercury, agreed in January 2013, will require signatory governments to develop plans to reduce or eliminate use of the pollutant mercury from artisanal and small-scale mines, and create public awareness campaigns as part of the plans. This will create opportunities for policymakers to look beyond mercury and ensure small-scale mining meets its potential to improve lives and take better care of local environments

Sarah Best is a senior researcher at the International Institute for Environment and Development. She can be emailed at [email protected].

This content is brought to you by Guardian Professional . Become a GSB member to get more stories like this direct to your inbox

- Guardian sustainable business

- Social impact

- Collaboration

Comments (…)

Most viewed.

Enter your search term

*Limited to most recent 250 articles Use advanced search to set an earlier date range

Sponsored by

Saving articles

Articles can be saved for quick future reference. This is a subscriber benefit. If you are already a subscriber, please log in to save this article. If you are not a subscriber, click on the View Subscription Options button to subscribe.

Article Saved

Contact us at [email protected]

Forgot Password

Please enter the email address that you used to subscribe on Engineering News. Your password will be sent to this address.

Content Restricted

This content is only available to subscribers

Set Default Regional Edition

Select your default regional edition of MiningWeekly.com

Note: When you select a default region you will be directed to the MiningWeekly.com home page of your choice whenever you visit miningweekly.com. This setting is controlled by cookies and should your cookies be re-set you will then be directed to the regional edition associated with the geographic location of our IP address. Should your cookies be reset then you may again use the menu to select a default region.

sponsored by

- LATEST NEWS

- LOADSHEDDING

- MULTIMEDIA LATEST VIDEOS RESOURCES WATCH SECOND TAKE AUDIO ARTICLES CREAMER MEDIA ON SAFM WEBINARS YOUTUBE

- SECTORS BASE METALS CHEMICALS COAL CORPORATE SOCIAL RESPONSIBILITY CRITICAL MINERALS DIAMONDS DIVERSIFIED MINERS ENVIRONMENTAL EXPLORATION FERROUS METALS FLUORSPAR GEMSTONES GOLD GRAPHITE HEALTH & SAFETY HYDROGEN LEGISLATIVE ENVIRONMENT LITHIUM MINERAL SANDS MINING SERVICES OIL & GAS PLATINUM GROUP METALS POTASH & PHOSPHATES PROJECT MANAGEMENT RARE-EARTH MINERALS SILVER URANIUM VANADIUM

- WORLD NEWS AFRICA ASIA AUSTRALASIA EUROPE MIDDLE EAST NORTH AMERICA SOUTH AMERICA

- SPONSORED POSTS

- ANNOUNCEMENTS

- BUSINESS THOUGHT LEADERSHIP

- ENGINEERING NEWS

- SHOWROOM PLUS

- PRODUCT PORTAL

- MADE IN SOUTH AFRICA

- PRESS OFFICE

- WEBINAR RECORDINGS

- COMPANY PROFILES

- ELECTRA MINING

- MINING INDABA

- VIRTUAL SHOWROOMS

- CREAMER MEDIA

- MINE PROFILES

- BACK COPIES

- BUSINESS LEADER

- SUPPLEMENTS

- FEATURES LIBRARY

- RESEARCH REPORTS

- PROJECT BROWSER

Article Enquiry

Viable project management for small-scale mining success

Email This Article

separate emails by commas, maximum limit of 4 addresses

As a magazine-and-online subscriber to Creamer Media's Engineering News & Mining Weekly , you are entitled to one free research report of your choice . You would have received a promotional code at the time of your subscription. Have this code ready and click here . At the time of check-out, please enter your promotional code to download your free report. Email [email protected] if you have forgotten your promotional code. If you have previously accessed your free report, you can purchase additional Research Reports by clicking on the “Buy Report” button on this page. The most cost-effective way to access all our Research Reports is by subscribing to Creamer Media's Research Channel Africa - you can upgrade your subscription now at this link .

The most cost-effective way to access all our Research Reports is by subscribing to Creamer Media's Research Channel Africa - you can upgrade your subscription now at this link . For a full list of Research Channel Africa benefits, click here

If you are not a subscriber, you can either buy the individual research report by clicking on the ‘Buy Report’ button, or you can subscribe and, not only gain access to your one free report, but also enjoy all other subscriber benefits , including 1) an electronic archive of back issues of the weekly news magazine; 2) access to an industrial and mining projects browser; 3) access to a database of published articles; and 4) the ability to save articles for future reference. At the time of your subscription, Creamer Media’s subscriptions department will be in contact with you to ensure that you receive a copy of your preferred Research Report. The most cost-effective way to access all our Research Reports is by subscribing to Creamer Media's Research Channel Africa - you can upgrade your subscription now at this link .

If you are a Creamer Media subscriber, click here to log in.

29th October 2021

By: Claire O'Reilly

Font size: - +

The multidisciplinary nature of mining projects requires strict, iterative processes in terms of establishing what will make the project and its future operation viable, says Johannesburg-based consulting and project management company Bowline.

While large mining companies are still executing new projects, small- to medium-scale companies are attempting to execute twice, even thrice as many new projects. These tend to be less successful. While these small-scale mining companies across Africa often receive financial support from their respective governments, a lack of planning and appropriate de-risking results in unsustainable operations, says Bowline MD Breton Scott .

“Smaller mining companies may not always have the in-house resources required to implement proper project management and it is highly recommended that they outsource.”

However, their inherent financial limitations ensure that they do not have the means to contract a large team of consultants. Although they need to be nimble and flexible, large teams may not be conducive to achieving those goals.

Small- or medium-scale mining companies tend to be more sensitive to macroeconomic factors and these, combined with mining projects being a long-term investment, mean that the projects need to be more resilient to economic fluctuations, especially during the project execution phases.

The project management approach and mine design should also be sufficiently flexible to create this resilience by accommodating economic fluctuations. The project management approach and project teams should be suitably conversant with these mitigating measures and respond accordingly, he explains.

“For example, should there be a downturn in commodity prices, the project should be in a position to adjust certain non-critical deliverables accordingly, by removing some of the less essential items, but maintaining the integrity of the project setup and remaining legally compliant.”

Scott says small-scale mines need not mimic the physical elements required at a large-scale mine to be legally compliant.

“Why build a R30-million brick-and-mortar equipment workshop when you can start by building a R30 000 hard stand, out in the open, that still enables you to maintain your mining equipment effectively and be legally compliant?”

The long-term goal should be to upgrade the workshop over time using operating costs and not capital expenditure, he adds.

Scott notes that small mining companies should not blindly accept the project management body of knowledge (PMBOK) as their code of practice, but appreciate that it is a guideline only.

PMBOK methodology creates a broad framework of standards, conventions, processes, best practices, terminologies and guidelines that are accepted as project management industry standards, as different-scale projects at different stages of development do not need to address all the elements of the PMBOK guidelines every time.

“The underlying principles should, however, be honoured for every project, but there should be a difference in use – PMBOK largely depends on the level of detail, scope of work and extent of resources required,” emphasises Scott.

When comparing large-scale mining projects to small- or medium-scale mining projects, the success factors or priorities are often very different, but aligning projects to business strategy is crucial.

The stipulated success factors for a given project dictates the appropriate project management approach and the PMBOK guidelines that should be followed.

Consequently, project owners must find the right balance between project management and effectively using resources without losing sight of critical items that can make or break a successful mining project.

Some of these critical items include risk management, resource management (mineral, human, financial and technical), budgeting, time management and balancing project delivery with sustainable business plans or strategies, Scott illustrates.

Accumulated Challenges

Addressing challenges relating to managing and tracking project performance of virtual project teams, and ensuring teams have been given very strict deadlines and deliverables, are imperative.

Another challenge in mining projects is collaboration or consultation with new emerging miners, which do not necessarily have extensive project development experience in the industry, as they tend to focus on “easy wins” as opposed to early, yet sustainable, wins, adds Scott.

Further, while the project management industry is facing challenges, technological development will create new opportunities.

“I see new development in the incorporation of artificial intelligence and data analytics, or project business analysis, into long-term projects. This is a means of simulating potential changes in the project’s environment to develop appropriate mitigating measures that can be activated in a timely fashion in response to contingencies such as new legislation instituted, governmental regime change, unexpected climatic conditions, project ownership change, other project related risks et cetera – that can impact quality, safety, time and cost.”

However, the project management industry is seeing some forward motion, as “big players in the mining industry are tired of waiting and are now entering into a ‘make or break’ stage: companies that have had projects lined up for a long time must execute them now or go out of business”.

Moreover, commodity prices are on an upswing, making some mining projects more viable and more attractive to investors. The current price trends also afford companies a certain level of flexibility and agility to adjust to changing market conditions, adds Scott.

He concludes that a balance between using experienced in-house resources and like-minded and expert outsourced resources is key to fast-tracking mining projects without taking shortcuts.

Edited by Nadine James Features Deputy Editor

Research Reports

Latest Multimedia

Latest News

Booyco Electronics, South African pioneer of Proximity Detection Systems, offers safety solutions for underground and surface mining, quarrying,...

Immersive Technologies is the world's largest, proven and tested supplier of simulator training solutions to the global resources industry.

sponsored by

Press Office

Announcements

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa) Receive daily email newsletters Access to full search results Access archive of magazine back copies Access to Projects in Progress Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1 PLUS Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

MAGAZINE & ONLINE

R1500 (equivalent of R125 a month)

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

All benefits from Option 1

Electricity

Energy Transition

Roads, Rail and Ports

Battery Metals

CORPORATE PACKAGES

Discounted prices based on volume

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

Intranet integration access to all in your organisation

Gold Mining Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Mining Sector

Do you want to start a gold mining company? If YES, here is a detailed sample small scale gold mining business plan template & feasibility report.

There are money spinning businesses that are monopolized by wealthy people and accredited investors and one of such businesses is operating a gold ore mine. The gold ore mining business is indeed a profitable business, but you must be ready to scale through very high barriers before launching this type of business.

If you have conducted your market research and feasibility studies, the next step to follow is to write a detailed blueprint of how you intend raising your seed capital, setting up the business, managing the flow of the business, sorting out tax and marketing your services amongst others.

Below is a sample gold mining company business plan template that will help you successfully launch your own business;

A Sample Gold Mining Business Plan Template

1. industry overview.

Players in the Gold and Silver Ore Mining industry primarily mine gold and silver-bearing ores. Mining activities include the development of mine sites and the on-site processing of ore into a concentrate or bullion. Gold and silver ore mining companies typically retain ownership of the semi-processed gold or silver products and pay for further refining on a toll-charge basis.

If you are an observer of the Gold and Silver Ore Mining industry, you will notice that the industry revenue is largely a function of production volume and commodity prices. For the Gold and Silver Ore Mining industry, output volumes and sales prices for both gold and silver have fallen over the past five years, leading to significant industry contraction.

Meanwhile, demand from manufacturers of electrical equipment, electronic products and jewelry, which comprises the industry’s primary markets, has stagnated or even declined over the past five years as a result of high import penetration and input costs. Overall, industry revenue is expected to decline over the five years to 2017.

In the united states of America, the industry generates over $9 billion annually from more than 162 gold and silver ore mining companies scattered all around the country. The industry is responsible for the employment of over 14,282 people.

Experts project the industry to grow at a -9.0 percent annual rate. Barrick, Kinross Gold and Newmont are the market leaders in this industry in the United States of America; they have the lion market share in the industry.

A recent report published by IBISWorld shows that the five years to 2017 have been volatile for the Gold and Silver Ore Mining industry. The report further stated that the industry revenue spiked until 2012, proving this industry to be one of the few that benefited from the financial crisis, as well as the years of economic instability that followed.

In times of economic turmoil, investors look to buy safe-haven assets such as gold and silver, causing gold and silver prices to surge. This helped industry revenue to grow through to 2012. In fact, strong demand from domestic and international investors drove gold prices to all-time highs.

Furthermore, an undersupply of gold due to decreased industry production in the 2000s further contributed to the spike in prices.

If you are considering starting a gold mining business whether on a small scale or on a large scale, then you should ensure that you obtain all the necessary permits from the local, state and federal government . The truth is that this type of business does pretty well when it is strategically positioned.

In summary, gold mining business is a profitable business venture and it is open for any aspiring entrepreneur to come in and establish his or her business; you can choose to start on a small scale on a large scale with robust distribution networks all across the United States of America and other countries of the world.

2. Executive Summary

TTK® Gold Mining Company is a standard and licensed gold and silver mining company that will be based in the Boise Basin in Boise County – Idaho, USA but we will own.

Our business goal as a gold mining company is to become the number one choice of jewelry making companies and other companies that make use of gold and silver in the United States and other countries of the world. As a business, we are willing to go the extra mile to invest in owning our own environmentally friendly gold and silver mines and also to hire efficient and dedicated employees.

We have been able to secure permits and licenses from all relevant departments both at the local government and state level in the United States of America. TTK® Gold Mining Company is set to redefine how a standard gold mining business should be run all across the world. This is why we have put plans in place for continuous training of all our staff .

The demand for gold and silver is not going to plummet any time soon which is why we have put plans in place to continue to explore all available market around the United States and other countries of the world. In the nearest future, we will ensure that we create a wide range of distribution channels all across the United States of America and other countries of the world.

TTK® Gold Mining Company will at all-time demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible. We will ensure that we hold ourselves accountable to the highest standards by meeting our customers’ needs precisely and completely.

TTK® Gold Mining Company is a partnership business that will be jointly owned by Tony Kenneth, Tyson Barker and Karis Murphy.

Tony Kenneth who is the Chief Executive Officer of the Company has a Degree in Mining Technology with over 10 years’ experience working in related industry as a senior manager cum mining engineer prior to starting TTK® Gold Mining Company. He will be working with a team of professionals to build the business and grow it to enviably heights.

3. Our Product and Service Offerings

TTK® Gold Mining Company is established with the aim of maximizing profits in the gold and silver mining industry. We want to compete favorably with leaders in the industry which is why we have but in place a competent team that will ensure that our products are of high standard.

We will work hard to ensure that TTK® Gold Mining Company is not just accepted in the United States of America, but also in other countries of the world where we intend supplying our products. Our products are listed below;

- Gold ore mining

- Silver ore mining

- Gold ore beneficiation

- Silver ore beneficiation

- gold and silver bullion , ore and concentrates

4. Our Mission and Vision Statement

- Our vision as a gold mining company is to own gold and silver mines all across the United States of America and other countries of the world; we want to become the number one brand in the gold and silver mining industry.

- Our mission is to establish a standard gold mining company that in our own capacity will favorably compete with leaders in the industry at the global stage. We want to build a gold mining company that will be listed amongst the top 5 gold mining companies in the world.

Our Business Structure

As part of our plan to build a top flight gold mining company in Boise County – Idaho that will favorably compete with leaders in the industry, we have perfected plans to get it right from the onset which is why we are going the extra mile to ensure that we have competent employees to occupy all the available positions in our company.

In view of that, we have decided to hire qualified and competent hands to occupy the following positions at TTK® Gold Mining Company;

- Chief Executive Officer (Owner)

- Gold Mine Manager

Human Resources and Admin Manager

- Sales and Marketing Officer

- Accountants/Cashiers

Gold and Silver Mining Casual Workers

Truck Drivers

- Customer Service Executives

5. Job Roles and Responsibilities

Chief Executive Officer – CEO (Owner):

- Increases management’s usefulness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; collaborating values, strategies, and objectives; assigning accountabilities; preparing, monitoring, and appraising job results; developing incentives; developing a climate for offering information and opinions; providing educational opportunities.

- Answerable for fixing prices and signing business deals

- Responsible for providing direction for the business

- Makes, connects, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Accountable for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Gold Mining Site Manager

- Oversees the smooth running of operations in the mine

- Makes sure that quality is maintained at all times

- Maps out strategies that will lead to efficiency amongst workers in the organization

- Responsible for training, evaluation and assessment of the workforce

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Ensures that our gold and silver mining site meets the expected safety and health standard at all times.

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Oversees the smooth running of the daily business activities.

Sales and Marketing Manager

- Manages external research and coordinate all the internal sources of information to retain the organizations’ best customers and attract new ones

- Models demographic information and analyze the volumes of transactional data generated by customer purchases

- Identifies, prioritize, and reach out to new partners, and business opportunities et al

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with customers

- Develops, executes and evaluates new plans for expanding sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

- Liable for operating excavators and other machines in the gold and silver mining site

- Handles the mining of gold and silver

- Assist in loading and offloading of our gold and silver into and out of the trucks

Accountant/Cashier

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management , general ledger accounting, and financial reporting

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization

- Assists in loading and unloading gold and silver et al

- Maintains a logbook of their driving activities to ensure compliance with federal regulations governing the rest and work periods for operators.

- Keeps a record of vehicle inspections and make sure the truck is equipped with safety equipment

- Inspects vehicles for mechanical items and safety issues and perform preventative maintenance

- Complies with truck driving rules and regulations (size, weight, route designations, parking, break periods etc.) as well as with company policies and procedures

- Reports defects, accidents or violations

Client Service Executive

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with customers on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the human resources and admin manager in an effective and timely manner

- Consistently stays abreast of any new information on the organizations’ products, promotional campaigns etc. to ensure accurate and helpful information is supplied to customers when they make enquiries (answer customer queries regarding our gold and silver ore mining business)

- Finds out the customer’s needs, recommend, select and help locate the right merchandise, describe a product’s features and benefits.

- make suggestions and encourage purchase of products

6. SWOT Analysis

Due to our drive for excellence when it comes to running a standard gold mining company, we were able to engage some of the finest business consultants in the United States of America to look through our business concept and together we were able to critically examine the prospect of the business and to assess ourselves to be sure we have what it takes to run a standard gold mining business that can compete favorably in the industry.

In view of that, we were able to take stock of our strengths, our weakness, our opportunities and also the threats that we are likely going to be exposed to in the United States of America. Here is a of what we got from the critically conducted SWOT Analysis for TTK® Gold Mining Company;

Our strength lies in the fact that we have state of the art gold and silver mining equipment and trucks that has positioned us to meet the demand of our clients even if the demand tripled overnight.

Another factor that counts to our advantage is the background of our Chief Executive Office; he has a robust experience in the industry and also a pretty good academic qualification to match the experience acquired which has placed him amongst the top flight players in the gold and silver mining industry.

We are not ignoring the fact that our team of highly qualified and dedicated workers will also serve as strength for our organization.

We do not take for granted the facts that we have weaknesses. In fact, the reality that we are setting up a gold mining company in the United States might pose a little challenge. In essence our chosen location might be our weakness.

- Opportunities:

The opportunities available to us are unlimited. There are loads of jewelry making companies and other manufacturing companies that make use of raw gold all across the globe and all what we are going to do to push our products to them is already perfected.

The threat that is likely going to confront us is the fact that we are competing with already established gold mining companies in the United States and other countries of the world. Of course, they will compete with us in winning over the available market. Another threat that we are likely going to face is unfavorable government policies and economic downturn.

7. MARKET ANALYSIS

- Market Trends

Gold and silver mining is a lucrative business in the United States and Canada and in looking at the trends of these mega countries over the course of gold’s bull, it is apparent that the results vary quite substantially; and China and Russia that have experienced the biggest growth over this stretch.

China in particular has carved out an incredible growth story, with its production volume up a staggering 92 percent since 2001.

Talking about the two North American land giants, their gold-mining trends have been ugly over the last decade or so. Incredibly, both the US and Canada have seen output fall by nearly a third to 2011’s respective tallies of 237mt and 110mt.

Their mature gold-mining infrastructures were just decimated by the secular bear that preceded the current bull. Up until the 1990s the US and Canada’s gold-mining industries operated like well-oiled machines, with the miners consistently putting forth sizeable capital towards exploration and development.

Exploration was successful in renewing and growing the reserves that were being mined, and continual expansion and new development sustained and even grew production. It is common trend in the gold and silver ore mining line of business to find mining companies positioning their business in locations and communities where they can easily have access to mines and of course cheap labor.

If you make the mistake of positioning this type of business in a location where you would have to travel a distance before you can access gold and silver mines, then you would have to struggle to make profits and maintain your overhead and logistics.

Also, another trend in this line of business is that most registered and well organized mining companies look beyond the market within their locations or state; they ensure that they strike business deals with leading jewelry making companies in the United States of America and other countries of the world.

The truth is that if as a gold mining company you are able to become a vendor to one or more jewelry making giants in the United States of America or in other countries of the world, you will always continue to smile to the bank.

8. Our Target Market

When it comes to supplying product from gold and silver mines, there is indeed a well-defined market. This goes to show that the target market for products from gold mining companies is far reaching. In view of that, we have conducted our market research and we have ideas of what our target market would be expecting from us. We are in business to engage in supply of raw gold and silver to the following organizations;

- Jewelry production companies

- Electronic components manufacturing companies

- Art and culture companies

- Gold and silver merchant

Our Competitive Advantage

Some of our competitive advantages are availability of resource, ability to forward sell production when appropriate and of course the ability to comply with environmental laws.

As a standard and licensed gold mining company, we know that gaining a competitive edge requires a detailed analysis of the demographics of the surrounding area and the nature of the existing competitors. And even if you are successful at first, new competitors could enter your market at any time to steal your regular customers.

Hence we will not hesitate to adopt successful and workable strategies from our competitors. Another competitive advantage that we have is the vast experience of our management team; we have people on board who understand how to grow a business from the scratch to becoming a national phenomenon.

Our large and robust distribution network and of course our excellent customer service culture will definitely count as a strong strength for the business.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry, meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

We will also give good working conditions and commissions to freelance sales agents that we will recruit from time to time.

9. SALES AND MARKETING STRATEGY

- Sources of Income

TTK® Gold Mining Company will generate income by simply supplying the following;

10. Sales Forecast

One thing is certain when it comes to gold and silver mining, if your business is strategically positioned and you have good relationship with players in the jewelry manufacturing industry, you will always attract customers cum sales and that will sure translate to increase in revenue generation for the business.

We are well positioned to take on the available market in and around the United States of America and we are quite optimistic that we will meet our set target of generating enough profits from the first six months of operation and grow the business and our clientele base.

We have been able to critically examine the gold and silver ore mining line of business, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projections are based on information gathered on the field and some assumptions that are peculiar to startups in the United States of America.

Below are the sales projections for TTK® Gold Mining Company, it is based on the location of our business and other factors as it relates to small scale and medium scale gold and silver mining company startups in the United States of America;

- First Fiscal Year: $900,000

- Second Fiscal Year: $2 million

- Third Fiscal Year: $4.5 million

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor offering same product and customer care services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Before choosing a location to start TTK® Gold Mining Company, we conducted thorough market survey and feasibility studies in order for us to penetrate the available market in the United States of America. We have detailed information and data that we were able to utilize to structure our business to compete with other gold and silver mining companies.

We hired experts who have good understanding of the gold and silver ore mining line of business to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market. TTK® Gold Mining Company will adopt the following sales and marketing approach to sell our raw gold and silver;

- Introduce our business by sending introductory letters to production companies and other stakeholders in and around the United States of America

- List our business and products on yellow pages’ ads (local directories)

- Leverage on the internet to promote our product cum business

- Engage in direct marketing and sales

- Encourage the use of Word of mouth marketing (referrals)

11. Publicity and Advertising Strategy

Regardless of the fact that our gold mining company can favorably compete with other leading mining companies in the United States of America and in any part of the world, we will still go ahead to intensify publicity for all our products and brand.

TTK® Gold Mining Company has a long term plan of exporting our product all across the United States of America and other countries of the world. This is why we will deliberately build our brand to be well accepted in Boise County – Idaho before venturing out to other cities all across the United States of America and other countries of the world.

As a matter of fact, our publicity and advertising strategy is not solely for selling our products but to also effectively communicate our brand. Here are the platforms we intend leveraging on to promote and advertise TTK® Gold Mining Company;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Sponsor relevant community programs

- Leverage on the internet and social media platforms like Instagram, Facebook, Twitter, et al to promote our brand

- Ensure that all our staff members wear our customized clothes, and all our official cars and distribution trucks are customized and well branded.

12. Our Pricing Strategy

At TTK® Gold Mining Company we will keep the prices of our products below the average market rate by keeping our overhead low and by collecting payment in advance from well – established jewelry manufacturing companies that would require constant supply of raw gold and silver.

- Payment Options

The payment policy adopted by TTK® Gold Mining Company is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America. Here are the payment options that TTK® Gold Mining Company will make available to her clients;

- Payment via bank transfer

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

In view of the above, we have chosen banking platforms that will enable our clients make payment for our gold and silver without any stress on their part. Our bank account numbers will be made available on our website and promotional materials.

13. Startup Expenditure (Budget)

From our market survey and feasibility studies, we have been able to come up with a detailed budget of how to achieve our aim of establishing a standard and highly competitive gold mining company in the United States of America and here are the key areas where we will spend our startup capital on;

- The total fee for registering the business in the United States of America – $750.

- Legal expenses for obtaining licenses and permits as well as the accounting services (software, P.O.S machines and other software) – $3,300.

- Marketing promotion expenses for the grand opening of TTK® Gold Mining Company in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of $3,580.

- The cost for hiring business consultant – $2,500.

- Insurance (general liability, workers’ compensation and property casualty) coverage at a total premium – ,400 .

- The cost for payment of rent for a gold and silver ore mine – $500,000 (Per Annum)

- The cost for acquiring gold and silver ore mine operating license fee – $500,000

- Other start-up expenses including stationery ( $500 ) and phone and utility deposits ( $2,500 ).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $150,000

- The cost for start-up inventory (gold and silver ore mining equipment, trucks and other related gold and silver mining devices) – $250,000

- The cost of launching a website – $600

- Miscellaneous – $5,000

We would need an estimate of two million dollars ( $2 million ) to successfully set up a standard and highly competitive gold mining company in the United States of America.

Generating Startup Capital for TTK® Gold Mining Company

No matter how fantastic your business idea might be, if you don’t have the required money to finance the business, the business might not become a reality. Finance is a very important factor when it comes to starting a gold and silver mining business.

TTK® Gold Mining Company is a partnership business that is owned and financed by Tony Kenneth, Tyson Barker and Karis Murphy. They do not intend to welcome any external business partner which is why they decided to restrict the sourcing of startup capital to 3 major sources.

- Generate part of the startup capital from personal savings and sell of stocks

- Source for soft loans from family members and friends

- Apply for loan from the Bank

N.B: We have been able to generate about $500, 000 ( Personal savings $400, 000 and soft loan from family members $100, 000 ) and we are at the final stages of obtaining a loan facility of $1.5 million from our bank. All the papers and documents have been signed and submitted, the loan has been approved and any moment from now our account will be credited with the amount.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have the capacity and competence of their employees, their investment strategy and their business structure. If all of these factors are missing from a business, then it won’t be too long before the business close shop.

One of our major goals of starting TTK® Gold Mining Company is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to supply our raw gold and silver a little bit cheaper than what is obtainable in the market and we are well prepared to survive on lower profit margin for a while.

TTK® Gold Mining Company will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing Point of Sales (POS) Machines: Completed

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit to operate gold and silver ore mines in the United Stated of America: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of a facility and renovating the facility as well: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for Loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: In Progress

- Recruitment of employees: In Progress

- Purchase of the needed gold and silver mining machines and equipment, furniture, racks, shelves, computers, electronic appliances, office appliances and CCTV: In progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business both online and around the community: In Progress

- Health and Safety and Fire Safety Arrangement (License): Secured

- Launching party planning: In Progress

- Establishing business relationship with Jewelry production companies and other stakeholders: In Progress

- Purchase of tippers and delivery trucks: Completed

Related Posts:

- Coal Mining Business Plan [Sample Template]

- Sand Mining Business Plan [Sample Template]

- Diamond Mining Business Plan [Sample Template]

Business Plan Considerations for a Small Scale Mining Operation

Mercy manyuchi, publisher: ieom society international, track: business management.

A business plan is a written document describing a company's core business activities, objectives, and how they plan to achieve their goals. Start-up companies like Zvicherwa Pvt Ltd, a gold mining company, in this case use business plans to get off the ground and attract outside investors. The Zvicherwa business plan includes: an executive summary, mission and vision, products and services, marketing strategy and SWOT analysis considering threats such as COVID 19, financial planning, and a budget. A total investment of USD 250, 000, 000.00 is required to kick-start Zvicherwa Pvt Ltd with a projected production of 200 000 ounces of gold over 20 years.

Published in : 6th North American International Conference on Industrial Engineering and Operations Management, Monterrey, Mexico

Publisher : IEOM Society International Date of Conference : November 3-5, 2021

ISBN : 978-1-7923-6130-2 ISSN/E-ISSN : 2169-8767

Related Research

Theoretical Aspects of the Short -Term Consumer Credit Interest Rate Model

4th African International Conference on Industrial Engineering and Operations Management

Published: 2023

Employee Performance Improvement As An Impact of Applying Organizational Culture

6th North American International Conference on Industrial Engineering and Operations Management

Published: 2021

The Effect of Discounts on Interest, Election, and Satisfaction with Shopee Food Services

7th North American International Conference on Industrial Engineering and Operations Management

Published: 2022

Mining Business Plan

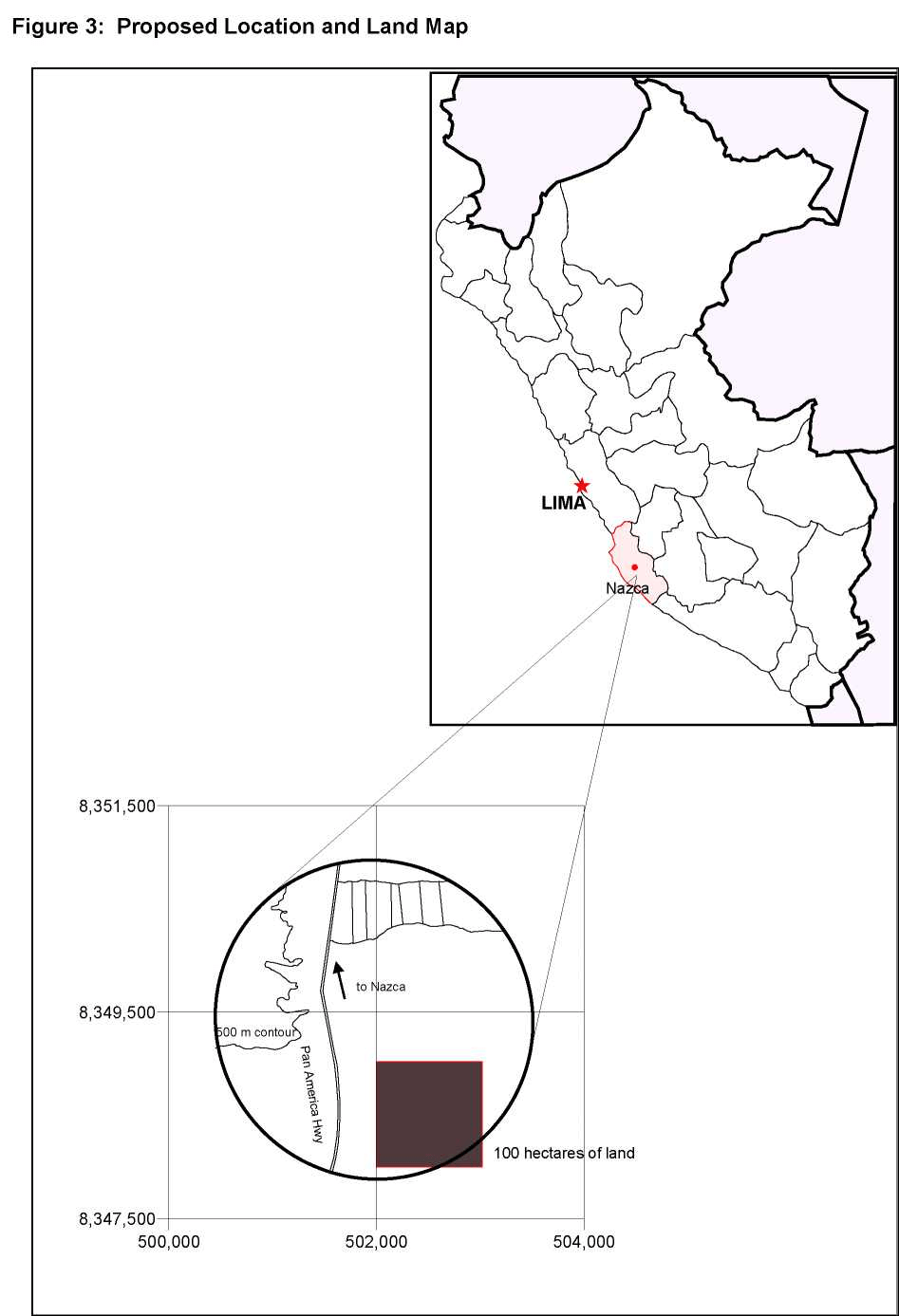

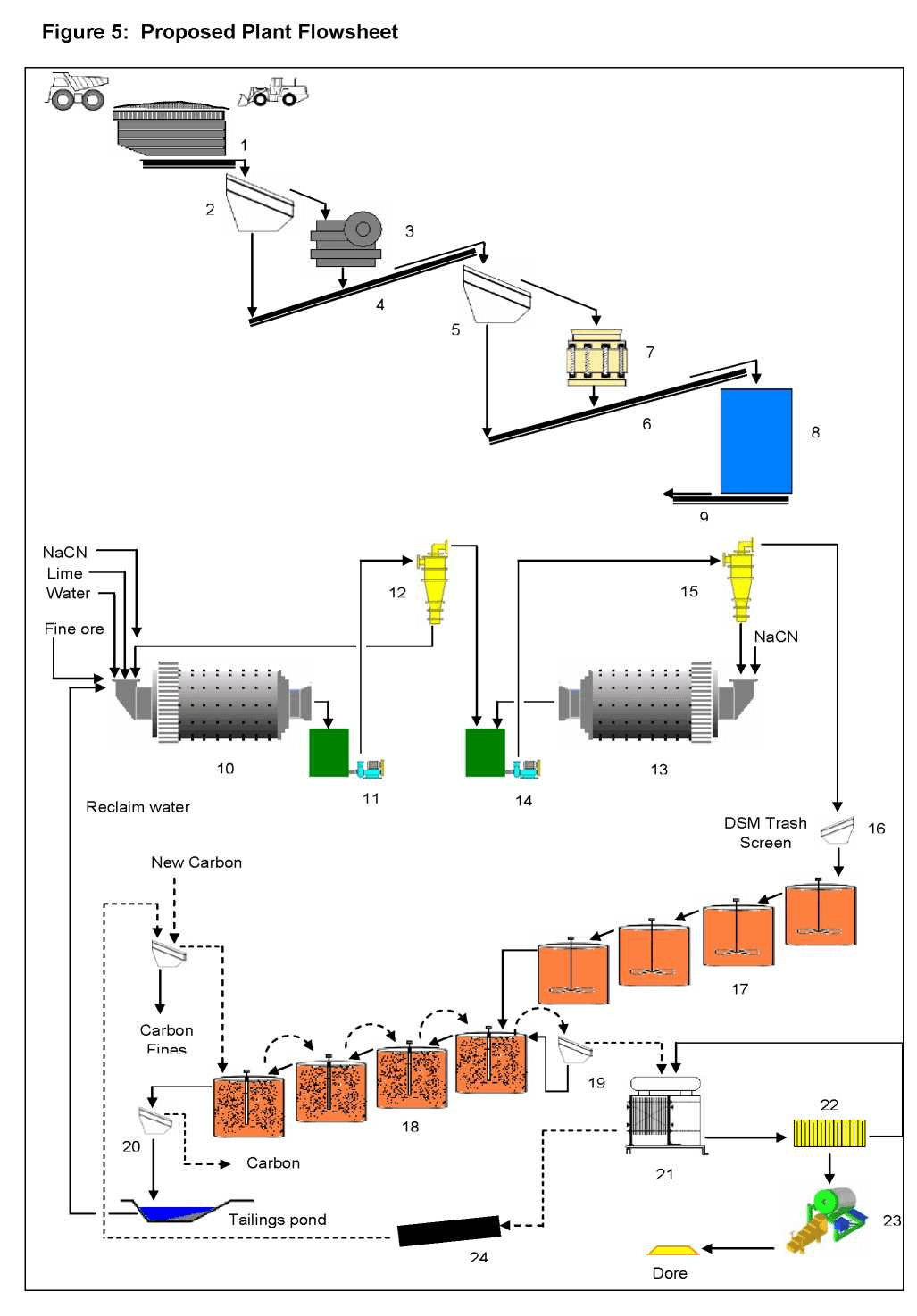

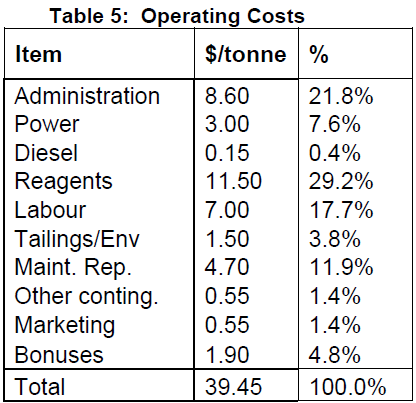

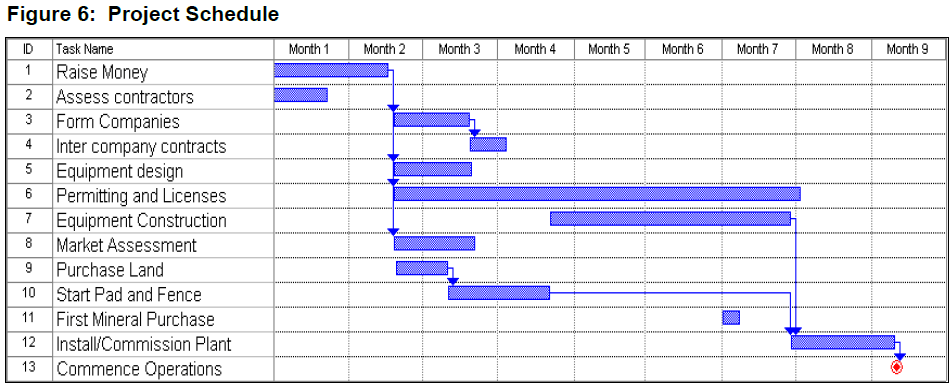

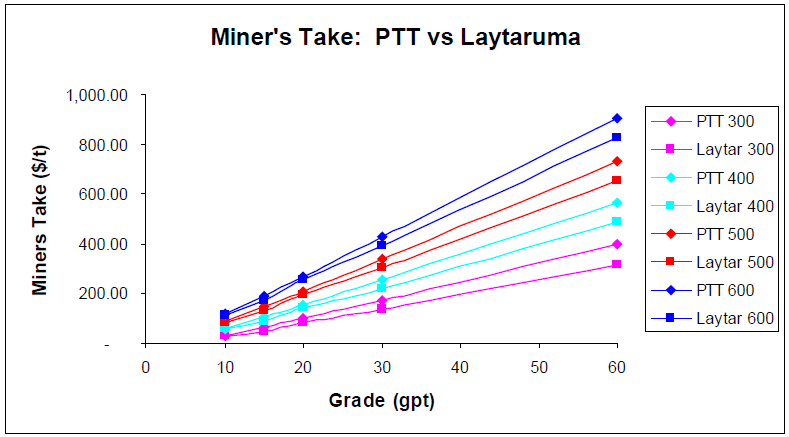

The following document outlines a mining business proposal to design and construct a free standing toll plant facility, known in this document as Peru Toll Treatment (PTT), in southern Peru to accommodate the needs of a growing quantity of small scale miners who produce up to 14 percent of the country’s annual gold production. The plan includes the basic design criteria on which the plant will be built, the model for generating revenue and a detailed annual cash flow forecast for the proposed operation for a period of ten years.

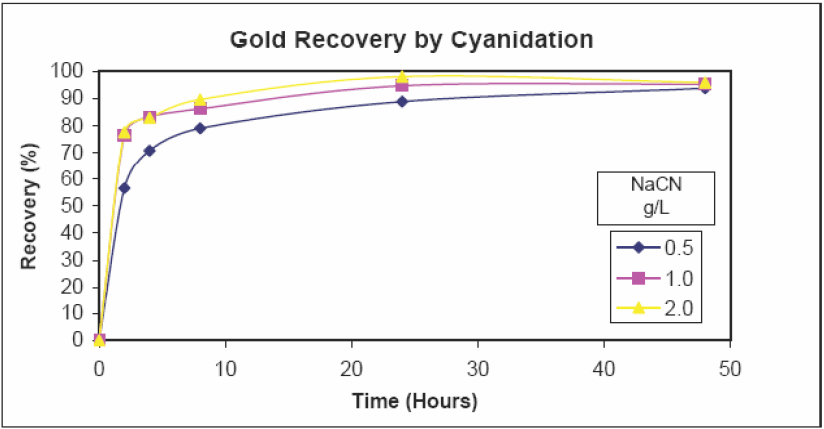

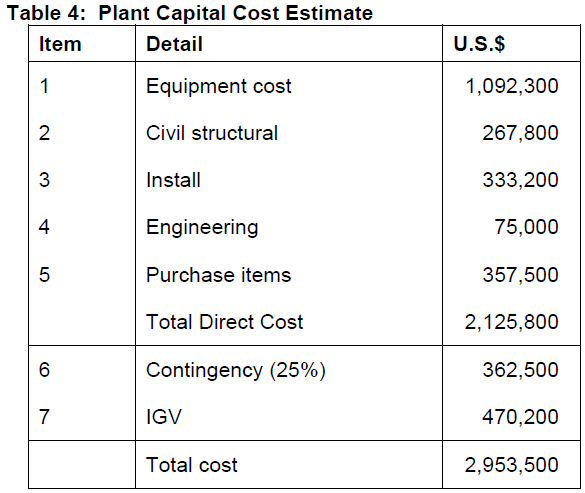

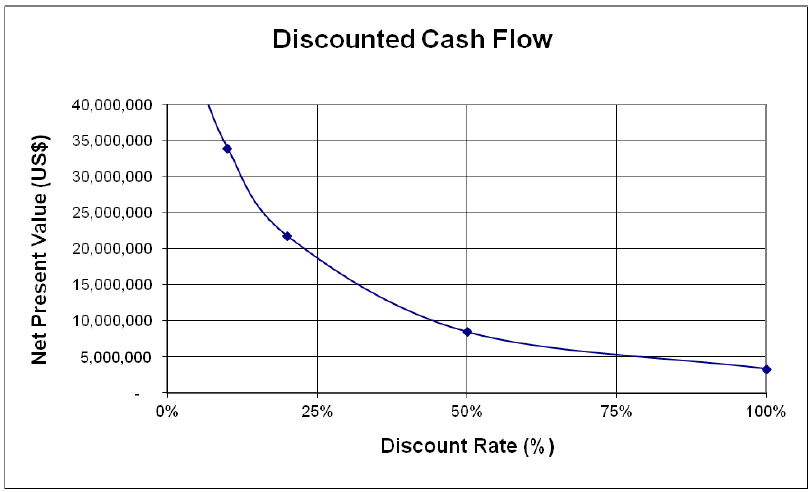

The proposed 7.5 tonne per hour plant will cost approximately $2.9 million to design (including $473,000 in VAT taxes which will be reimbursed from revenues), construct and startup and will generate revenues by providing a custom milling facility for small producers who sell their production to the plant. This business opportunity does not include any involvement in mining or the production of mineral. It only involves the purchase and treatment of gold minerals. While the market for such a plant can easily accommodate a 350 tonne per day operation the business plan is based on processing 150 tonnes per day only with the ability to later expand to multiple plants of 350 tonnes per day each.

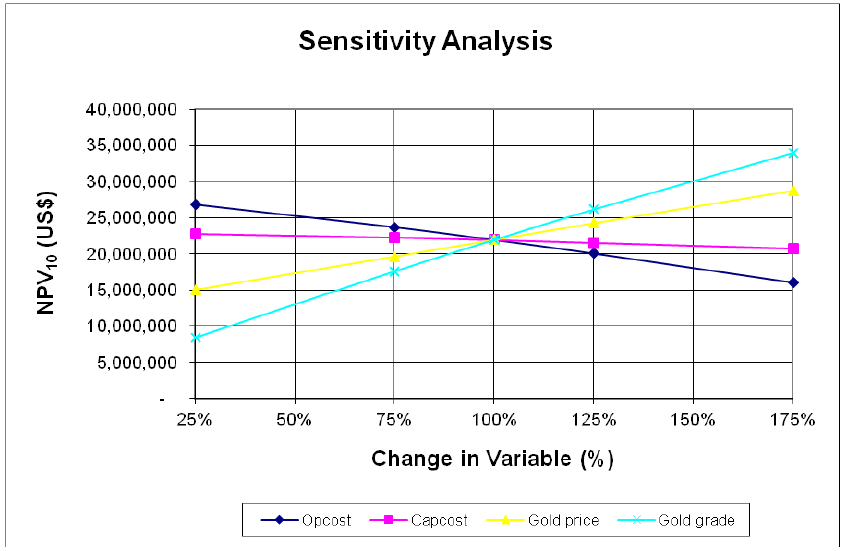

The plan calls for raising the $2.9 million from public equity financings. Once in operation, the operating company will retain $250,000 for working capital and all subsequent profits will be paid to the shareholders every 3 months as a dividend. The cash flow model is for a single plant of 150 tonnes per day, calculated on an after tax (Peruvian fiscal regime) basis for a 10 year project life. On a project basis using a $1500 per ounce gold price and a discount rate of 10 percent the project will generate a net present value of almost $22.0 million. The payout of the capital investment on a project basis is 1.1 years and the calculated rate of return is over 200%. Testing the project economics against changes in the primary input variables (capital cost, operating cost and gold price) indicates that the project is very robust and even with significant increases in costs or reductions in revenue sources the project has a positive rate of return.

How to Start a Mining Business for Gold & other Metals

Appendix 5 of this Business Plan includes expressions of interest from two formal miners who are 100% owners of their concessions and can offer 450 tonnes per day of production. PTT has visited one of the mines and confirms the potential for a 350 tonne per day operation. In order to facilitate the commencement of mining production PTT intends to rent $100,000 of mining equipment to these owners as part of a preferred mineral provider position. This cost has been included in the project economics.

PTT believes that health, environmental and social improvements will accrue to the informal miners in those areas of Peru in which the Company operates and these are important aspects of the expansion phase of the project. Current informal mining practice involves the uncontrolled use of the toxic substances mercury and sodium cyanide to obtain the gold at very low recovery rates. Many of the informal miners are, in effect, stealing the gold from the government or legitimate concession holders causing significant social disruption in the affected areas of the country. It is, therefore, an important aspect of this business plan to reduce the negative health and environmental aspects of informal mining activity by offering an advanced technology which safely removes up to 90% of the gold from the ores resulting in a much higher payback to the people who mine the ore. Purchasing gold ores from informal miners who do not own their concessions is illegal in Peru and rightfully so. It is the intention of PTT to work with informal miners to ensure that they legitimize their activities by entering into registered contracts with the owners of the mineral resources.

There are risks to the project but most can be mitigated by doing appropriate engineering prior to plant design and construction. The plant will use standard gold processing technology and country/political risk is the greatest threat to the project. Peru has signed free trade agreements with both Canada and the United States which is normalizing its business activities.

Overview of Peru

Mineral Wealth

From the days of the Spanish conquest, foreigners have come in search of the products of Peru’s mines and the mining sector has been a core part of the economy up until the modern era. Operations at the historic zinc-mining center of Cerro de Pasco began in 1905 and the Metallurgical Complex at La Oroya started production in 1922. Much of Peru’s rail network was created to serve the needs of the mining industry. Nevertheless, relatively little exploration was carried out in the 1960s and 1970s and development of the mining sector came to a halt. Peru’s favorable geology has been under-exploited and while reserves have been exploited intensively in the US, Canada and Chile, to date only about 12 per cent of Peru’s mineral resources have been identified. Peril has the capacity to double or triple current levels of output, especially in base metals. In all, Peru holds about 16 per cent of the world’s known mineral reserves, including 15 per cent of copper and 7 per cent of zinc reserves.

Mining activity contributes 45% of foreign currency to the national economy which implies investment commitments, promotion of a modern managerial philosophy, increased responsibility towards safety and care of the environment as well as improved rural social development.

While mining provides relatively few jobs, it is vital to Peru’s economy in other ways. Thanks both to high mineral prices and rising output, mineral exports were up by almost half last year, and accounted for 55% of total exports. Mining brings in 29% of total tax revenues. Of this money, the government last year returned $138m as a local royalty to mining areas, most of which are otherwise poor and remote.

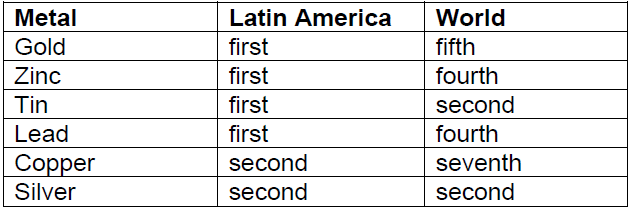

As a result of its favourable geology and improving economy Peru is taking a dominant position in the production and sale of many base and precious metals. It occupies first place in Latin America in zinc, tin, lead and gold; second place in silver and copper; fifth in iron. In the context of world mining production, Peru is in fifth place in gold, second place in silver, third place in tin, fourth place in zinc and lead, fifth place in copper and twenty-fifth place in iron as shown on Table 1 below.

Table 1: Peruvian Minerals Production

Business Climate

Since the constitutional and business/economic reforms of the early 1990’s Peru has enjoyed a robust economy with strong economic growth tied closely to the business cycles of its primary metals production. The country allows any person or company to create and own a Peruvian entity and all profits can be repatriated to another jurisdiction free of additional levies.

The tax code is relatively simple and taxes are calculated as 30% of net profits after depreciation. Machinery and equipment are all subject to depreciation on a straight line basis and the majority of items are considered to have a 10 year life. A recently introduced royalty provision requires an additional payment to the government depending upon mine production level – the higher the production level, the higher the royalty to a maximum of 3% of sales. Currently small producers (less than 350 tonnes per day) are exempt from this royalty.

Labour laws are not restrictive and employee burden is approximately 30% of base salary. Unskilled labour is relatively inexpensive and university trained and skilled trades labour are paid commensurate with the level of training. Skilled and professional talent exists in abundance and is of a high quality.

Political Stability

Peru has a long history of political instability. In 1993 Alberto Fujimori enacted several far-reaching legal and constitutional reforms which have stabilized the political situation. Although he left the country under a cloud of suspicion in 2001, his legacy is a well performing economy and a gradually improving jurisprudence and governing infrastructure. As the government bureaucracy becomes more stable and professional the incidence of corruption is diminishing. Corruption remains an unfortunate fact of life in Peru but it has noticeably declined in the past 10 years.

The governments of Alejandro Toledo and Alan Garcia have been much maligned but the outgoing president has turned over to the new president (on July 28, 2011) an enviable economic record and a strong financial position.

There is a confidence in the Peruvian economy as it moves forward buoyed by continued high commodity prices and a wider spreading wealth across all social classes. Many of functionaries have made considerable personal advances on the basis of the resurging mining economy so it is expected that the new government will be friendly to the mining industry and investment.

Social Development and Corporate Social Responsibility

A significant benefit of this business plan, apart from the very robust economics, is the opportunity to advance the indigenous mining industry through improving the health and environmental impacts as well as obtaining a higher recovery of gold from the mined rock returning a greater economic benefit to the mineral owners – the people of Peru. PTT has commitment letters for 450 tonnes per day of mineral production from two legitimate, small scale miners and as it expands production beyond this, its policies will have beneficial impacts as follows;

Health Issues

Informal and small miners in Peru currently do not have the financial capacity to install modern, large capacity plants. As a result, the mine producers crush the ore in stone grinding mills called quimbaletes and then agglomerate the gold in the crushed material with natural mercury. Not only is the process very labour intensive with low productivity, it also leads to significant health problems. In order to release the gold from the mercury amalgam, the material is heated on open fires to boil off the mercury creating a mercury poisoning risk for anyone nearby including children. The mercury vapour eventually cools and condenses on the ground to create an ongoing health hazard.

In those cases in which sodium cyanide is used to leach the gold from the ore there is the additional health problem due to cyanide spills which may contaminate local water supplies.

Environmental Degradation

As described above the uncontrolled use of mercury and sodium cyanide often lead to issues of significant environmental degradation. The gold mining regions of Peru are noted for the deep blue staining in areas where ore is leached in cyanide baths that are developed without due regard for the environment. The baths are rarely lined with geomembrane to prevent the liquid toxins from moving out into the rock and eventually into the nearby water courses. To argue that many of these areas are in arid zones with no natural vegetation or water courses does not obviate the fact that environmental destruction occurs when toxic materials are allowed to accumulate in surface soils.

Ore Recovery

All subsurface materials are owned by the people of Peru under the trusteeship of the Peruvian government and any practices which do not optimize the recovery of wealth from these subsurface materials denies the people of Peru their rightful share of this wealth. The antiquated processing methods described above rarely recover more than 35% to 40% of the gold from the ore material. Modern plant recovery techniques can often recover more than 90% of this same gold returning a higher value to the people of Peru.

Corporate Social Responsibility

The current state of informal mining in Peru is somewhat chaotic and in many cases, informals are, in effect, stealing ore from the concession owners who are powerless to stop them. PTT will not purchase ore from informal miners who do not have a rightful claim to the ore they are selling and will go further in attempting to bring some order to the regions in which it works by;

- Assisting informal miners to obtain concession rights to the areas they are mining if there are no pre-existing concession rights and

- Assisting informal miners who are illegally selling ore obtained from concessions that belong to third parties by obtaining agreements with the owners of the concessions. In this way the production of gold ore is legal and the concession owners will get a return for their ownership of the concession.

Thus PTT will permit informal and small scale miners to earn much greater returns on their labour (through higher recoveries of gold) with much less effort. Modern plants, built to the exacting environmental standards of the Peruvian Ministry of Energy and Mines using state of the art gold processing technologies will result in an improved environment and fewer health risks to the miners. Perhaps as important, the social chaos which characterizes many gold mining areas of Peru will become more orderly as concession owners are paid a return (royalty) on the gold mined from their concessions.

Southern Peru Gold Belt Analysis

Nazca – ocona gold belt.

The Nazca-Ocona Gold Belt is 350 km long and 40 km wide covering portions of three Departments; Ayacucho, Ica and Arequipa. It is typified by narrow, gold bearing quartz veins, which are formed in hypothermal to mesothermal environments. The mineralized structures are found in andesitic volcanic rocks and in the intrusives of the Andean Batholith. Veins found to crosscut granodiorite and diorite, tonalite or andesite often contain higher gold grades in the diorite, tonalite or andesite than in granodiorite. The mineralization is known locally as “rosario” formations due to the fact that the veins tend to narrow and widen in a regular pattern much like the beads on a rosary.

The mining activity that has developed in the Nasca-Ocona belt has largely been by artesanal methods although there are some more modern mines in the area. There exist also mining formal activities of iron and copper.

Artesanal mining is characterized by its labor intensity and lack of modern mining equipment. As a result, the miners develop lodes or veins of narrow thickness but high grade Au. The veins range in width from 30 centimeters to 1.5 meters. In some exceptional circumstances they reach up to 2 m wide. The concentrations of Au range from 15 to 150 grams per tonne (gpt).

The artesanal miners selectively extract from the lode and veins using a technique called the circado. This is essentially a resuing method whereby an opening large enough for a person to work is made alongside the vein and the ore is then slashed off the wall. This reduces dilution and the ore is removed from the opening in small canister with as much as 1.6 grams of gold per 45 kilogram canister (35 grams per tonne). The treatment of the mineral begins with the “pallaqueo”, or hand sorting to selectively upgrade the ore before being processed or sold.

The mineral extracted from high grade (> 2 grams gold (Au) / canister), is crushed and processed directly in a quimbaletes or manually operated, wetted grinding stones at a rhythm of 30 minutes per canister. While no formal reporting is done it is believed that the gold production in lca and Arequipa is 9 tonnes of dore annually.

Cyanide is sometimes used to extract the gold and the dissolved gold is recovered using activated charcoal. Typically the tails of the quimbaletes process contains important quantities of gold that can be recovered only by cyanide. The grade of the tailings ranges between 12.8 and 25.6 gpt and contains considerable quantities of mercury (introduced from mercury amalgam processes) which end up in the cyanidation tails.

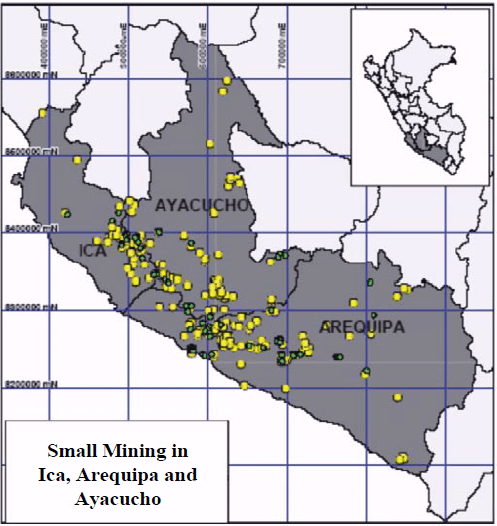

Figure 2: Informal Mining in Southern Peru

The map shown above comes from information taken from the Ministry of Energy and Mines (MEM) and includes 68 artesanal mining locations. The MEM database includes a total of 270 locations and even this is known to understate the actual number of small mining operations.