Asset Management

- Capital Planning

- Inventory Management

- Work Orders

- Service Requests

- Fleet Management

- GIS & Esri Integration

- Asset Performance Assessment

- Reporting & Analytics

Maintenance Management

Data management & mapping.

- Parks and Recreation

- Public Works

- White Papers

- Videos & Webinars

- Case Studies

- Infographics

- Our Partners

- AssetWorks Academy

- AssetWorks Annual Magazine

- Support and Training

5 Steps to Building an Effective Asset Management Plan and Asset Planning

Budget-Friendly Tips for Maintaining Government Facilities Without Compromising Quality

7 Questions You Must Ask Before Selecting a CMMS

Trail Maintenance 101: Ensuring a Safe and Enjoyable Outdoor Experience

Top 5 Facility Management Trends Set to Redefine 2024

Must-Watch Trends in Parks and Recreation for 2024

The Secret to Leveraging Asset Management Software to Optimize Operations

6 Reasons Why Your Parks Are Empty and How to Bring Them Back to Life

Paws and Play: Pet-Friendly Parks and Activities for You and Your Furry Friends

Must-Have Sustainability Strategies Every Government Facility Needs

Outdoor Fitness Trends: How Parks Are Keeping Up With Health and Wellness

EAM / Blog / 5 Steps to Building an Effective Asset Management Plan and Asset Planning

QUICK LINKS

- Fleet and Fuel Management

- Enterprise Asset Management

- Risk Management

- Surplus Property Management

- Fixed Asset Management

- Mobile Inventory Asset Management

- Government Property Management

- Education Facilities Management

SOCIAL LINKS

Copyright 2024 AssetWorks, Inc. | All Rights Reserved.

Business Plan Template for Asset Managers

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Creating a solid business plan is essential for asset managers looking to thrive in today's competitive landscape. With ClickUp's Business Plan Template for Asset Managers, you can easily outline your strategies, financial goals, investment portfolios, and more—all in one place!

This template empowers asset management firms and financial institutions to:

- Clearly define their target markets and establish a strong value proposition

- Develop robust risk management procedures to protect investments and enhance returns

- Streamline communication and collaboration with stakeholders through a centralized platform

- Efficiently allocate resources and track progress towards financial objectives

Don't let planning and communication hurdles hold your asset management firm back. Get started with ClickUp's Business Plan Template for Asset Managers today and set yourself up for success!

Business Plan Template for Asset Managers Benefits

A business plan template for asset managers offers numerous benefits for asset management firms and financial institutions, including:

- Streamlined strategic planning and goal-setting process

- Clear communication of investment strategies to stakeholders

- Comprehensive understanding of target markets and client segments

- Effective risk management procedures and protocols

- Efficient allocation of resources and investment portfolios

- Increased transparency and accountability to stakeholders

- Enhanced decision-making and alignment with organizational objectives

- Improved operational efficiency and effectiveness

- Facilitated compliance with regulatory requirements

- Better positioning for attracting and retaining investors.

Main Elements of Asset Managers Business Plan Template

ClickUp's Business Plan Template for Asset Managers provides a comprehensive framework for asset management firms and financial institutions to efficiently plan and communicate their strategies. Here are the main elements of this template:

- Custom Statuses: Track the progress of different sections of your business plan with statuses such as Complete, In Progress, Needs Revision, and To Do.

- Custom Fields: Use custom fields like Reference, Approved, and Section to add relevant information and streamline your business plan.

- Custom Views: Access different views to effectively manage your business plan, including Topics, Status, Timeline, Business Plan, and Getting Started Guide.

- Collaboration and Communication: Utilize ClickUp's collaboration features like task assignments, comments, and file attachments to ensure seamless communication and collaboration with stakeholders.

- Document Management: Leverage ClickUp's Docs feature to create and edit your business plan directly within the platform, ensuring easy access and version control.

How To Use Business Plan Template for Asset Managers

If you're an asset manager looking to create a comprehensive business plan, the Business Plan Template in ClickUp is the perfect tool to help you get started. Follow these four steps to effectively use the template and develop a solid plan for your asset management business:

1. Define your business objectives and strategies

Begin by clearly defining the objectives and strategies for your asset management business. What are your long-term goals? How do you plan to achieve them? Consider factors such as target market, investment strategies, and competitive analysis. This step will lay the foundation for your business plan.

Use the Goals feature in ClickUp to create and track your business objectives and strategies.

2. Conduct a thorough market analysis

To create a successful business plan, it's crucial to have a deep understanding of the market in which you operate. Conduct a thorough analysis of the asset management industry, including trends, opportunities, and potential risks. Identify your target market and analyze the competitive landscape to determine your unique value proposition.

Use the Table view in ClickUp to organize and analyze market research data.

3. Develop a financial plan

A comprehensive financial plan is essential for any business. Use the Business Plan Template in ClickUp to outline your revenue projections, expenses, and anticipated growth. Consider factors such as operating costs, fees, and potential sources of funding. This step will help you assess the financial viability of your asset management business.

Utilize the custom fields feature in ClickUp to track financial data and calculations.

4. Create an implementation and monitoring strategy

Once you have defined your objectives, conducted a market analysis, and developed a financial plan, it's time to focus on implementation and monitoring. Outline a clear strategy for executing your business plan, including specific actions, timelines, and responsibilities. Establish key performance indicators (KPIs) to track progress and regularly review and adjust your plan as needed.

Use the Automations feature in ClickUp to set reminders and notifications for important milestones and deadlines.

By following these four steps and utilizing the Business Plan Template in ClickUp, you'll be well-equipped to create a comprehensive and effective business plan for your asset management business.

Get Started with ClickUp’s Business Plan Template for Asset Managers

Asset managers in the financial industry can use the Business Plan Template for Asset Managers in ClickUp to effectively outline their strategies, financial goals, and operational framework for their firm.

To get started, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Designate the appropriate Space or location in your Workspace for this template.

Next, invite relevant team members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive business plan:

- Use the Topics View to organize your business plan by different sections such as strategies, financial goals, target markets, and risk management procedures.

- The Status View will help you track the progress of each section of your business plan, with statuses like Complete, In Progress, Needs Revision, and To Do.

- The Timeline View will provide a visual representation of your business plan's milestones and deadlines.

- The Business Plan View will give you a holistic overview of your entire plan, allowing you to easily navigate between sections.

- The Getting Started Guide View will provide step-by-step instructions on how to use the template effectively.

Additionally, customize your business plan template with these custom fields:

- Use the Reference field to link relevant documents or external resources to specific sections of your plan.

- The Approved field can be used to track the approval status of each section.

- The Section field will help you categorize and organize different sections of your business plan.

With these features, you can create a comprehensive and well-structured business plan for your asset management firm while ensuring effective planning and communication with stakeholders.

- Business Plan Template for Broadcasters

- Business Plan Template for Kawan Food Berhad

- Business Plan Template for College Students

- Business Plan Template for Mobile UX/UI Specialists

- Business Plan Template for Quorn

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Subscribe Sign In Register

A CEO’s Guide for How to Build an Asset Management Firm

Fundamental global founder kyle cerminara left point72 in 2012 to start his own firm. here’s how he did it..

- Copy Link copied

Illustration by II

Click on Kyle Cerminara’s Twitter page and you’ll find an image of him and Warren Buffett smiling into the camera. Scroll down to his pinned tweet, and there’s another photo with Buffett — but this time, Cerminara is hunched over, with Buffett’s arm locked around his neck.

The caption: “When Warren Buffett puts you in a headlock at a football game...”

For Cerminara, founder and CEO of Fundamental Global, relationships with other investors and industry professionals are critical to his success, a point he made clear in a series of tweets last week. In the thread, Cerminara offered “some unsolicited advice on how to build a multi-billion dollar asset management firm (from someone who did it).”

His first tip: “You will likely not succeed if you do it all yourself.”

Cerminara started Fundamental Global in 2012 with help from Joe Moglia, the former chairman of the board at TD Ameritrade. Moglia is now the chairman of the firm.

“People try to do too much all at once,” Cerminara told Institutional Investor . “I really wanted to focus my time and effort on investing. We brought in an exciting financial advisors team.”

Looking to set his firm apart from other asset management firms, Cerminara decided to make its financial advisory team client-facing.

“A lot of asset management companies these days are buying exchange traded funds or indexing,” he said. “And, quite frankly, anybody can do index funds, so I didn’t understand why that was of value to people. I thought that we could create something using active management.”

To turn this vision into a reality, the firm built an advisory team in a 50/50 joint venture with a firm called Capital Wealth Advisors. Under this structure, advisors met face-to-face with clients and reviewed their risk-reward parameters and liquidity needs, Cerminara said.

“It really freed me up to really be able to invest the money,” he said.

Cerminara has an interesting pedigree: He started his career as an equity research analyst at T. Rowe Price, where he worked his way up to a portfolio management role before leaving in 2007 to work for celebrity hedge fund manager Steven Cohen . Cerminara worked with Cohen over the next five years, taking a brief hiatus in 2010 to run a portfolio for Tiger Management descendent Highside Capital Management.

There was nothing particularly special about 2012 that prompted him to start his own firm. It was just the right time in his career, Cerminara said. Together, he and Moglia built an investment team from the ground-up, pulling talent from their former firms.

“In 2012 when I was starting my own firm, [Moglia] decided to bet big on me,” Cerminara said. “He initially gave us $30 million of capital to manage and became a partner of the firm.”

In December 2020, FG divested its interest from Capital Wealth Advisors. By then, Cerminara said the firm was handling about $2 billion in assets under management. In 2021, Cerminara sold his stake in the asset manager. He now spends his time building public companies, including working as a sponsor for special purpose acquisition companies.

Cerminara said his relationships with his mentors, specifically Moglia and Cohen, “compounded over time,” producing a rolodex of investors and partners for him throughout his career.

“Networking is critical,” he said. “I think some people that are great investors can sometimes undervalue that.”

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

- Sample Business Plans

Investment Company Business Plan

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Products and services:.

Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of investment company you run and the name of it. You may specialize in one of the following investment businesses:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the investment company services your business will offer. This list may include services like,

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

Investment advisory services:

Additional services:.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

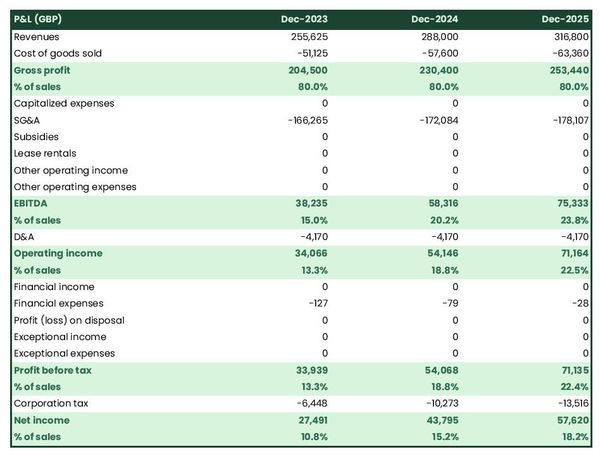

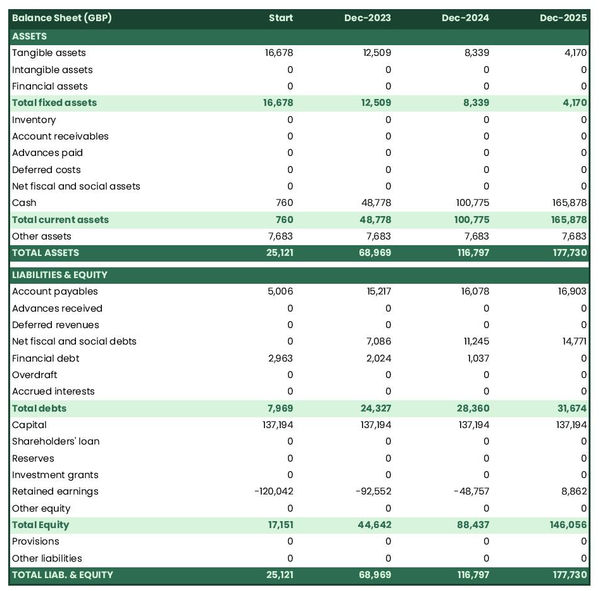

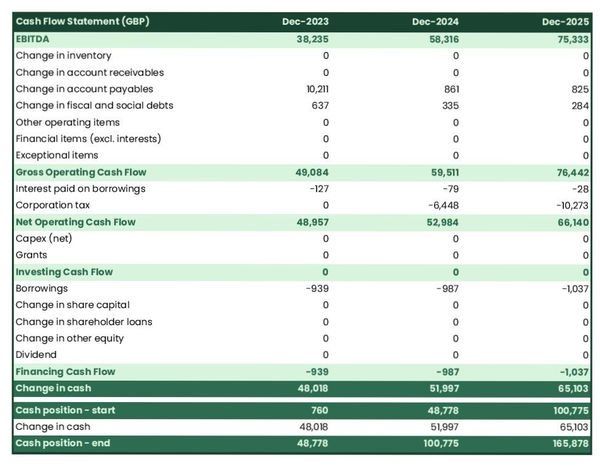

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write Business Plan Appendix

Frequently asked questions, why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to Develop and Write an Asset Management Strategy

This guide will e xplain the difference between an asset management policy and a strategy and share the information you will need to write your strategy with real-life examples.

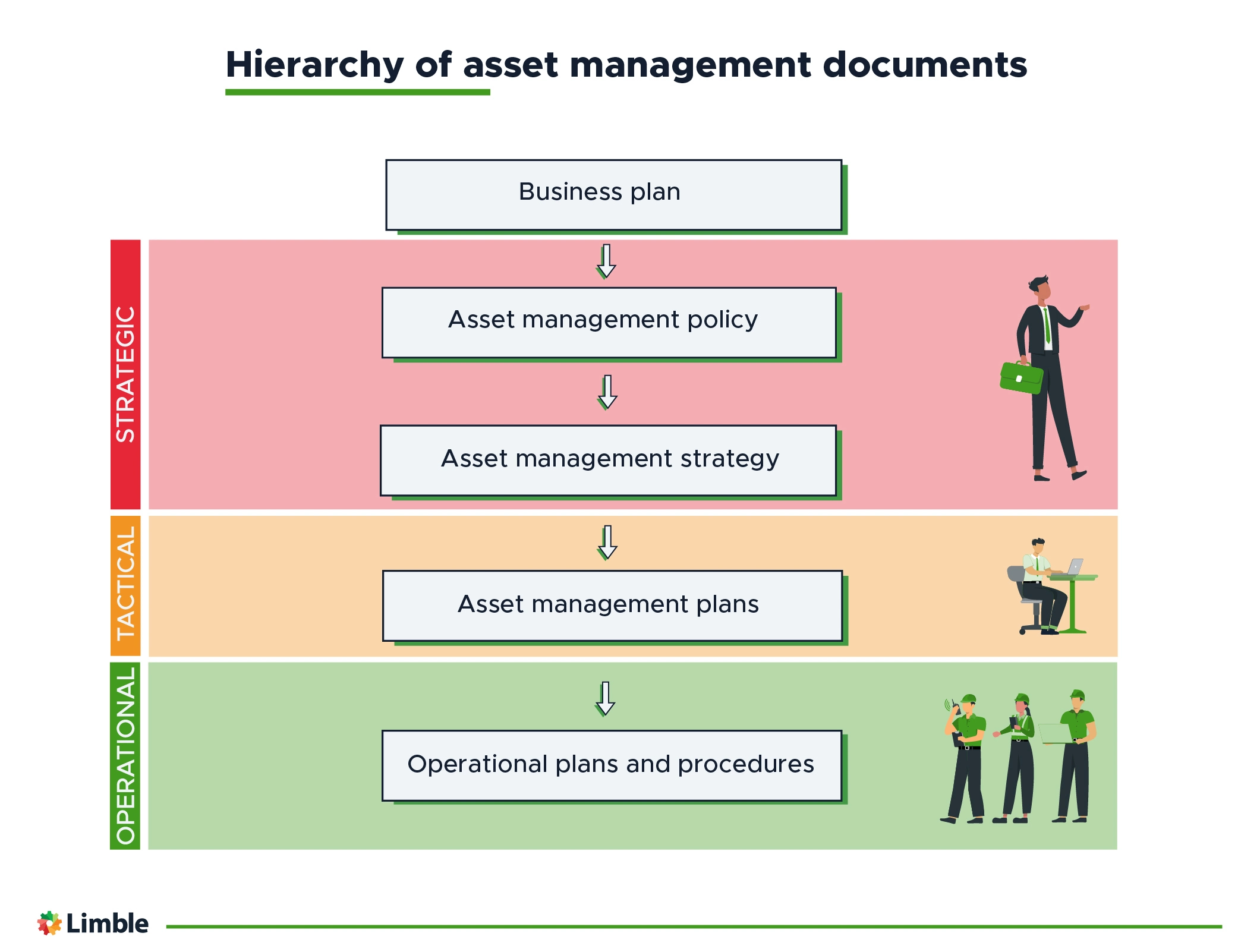

Where does the asset management strategy sit in the document hierarchy?

Businesses use an asset management strategy to describe the high-level goals they need to achieve in order to meet the company’s asset ownership, use, and care requirements. The document usually includes a business case showing the potential benefits the company can achieve by following the outlined strategy.

The image below illustrates where the asset management strategy sits in the asset management document hierarchy.

Here are quick explanations to help differentiate between a policy, strategy, and plan:

- Asset Management Policy : The policy outlines the company’s objectives and requirements for asset ownership, use, and care. It provides guiding principles for asset management, including applicability, responsibility, high-level procedures, and a clear statement of the company’s overall approach to maintenance.

- Asset Management Strategy: A strategy document takes the company objectives and requirements from the policy, and turns them into specific focus areas for the next three to five years. It outlines the current state of asset management within the company and its goals for improvement. It often includes a business case that predicts potential benefits of pursuing the strategy.

- Asset Management Plans : A plan takes the high-level aspirations and goals in the strategy document and turns them into shorter-term, actionable tasks. One strategy document will result in many plans, usually one for each department or business unit.

Now that we know its purpose, let’s see what it takes to create a proper asset management strategy.

The Essential Guide to CMMS

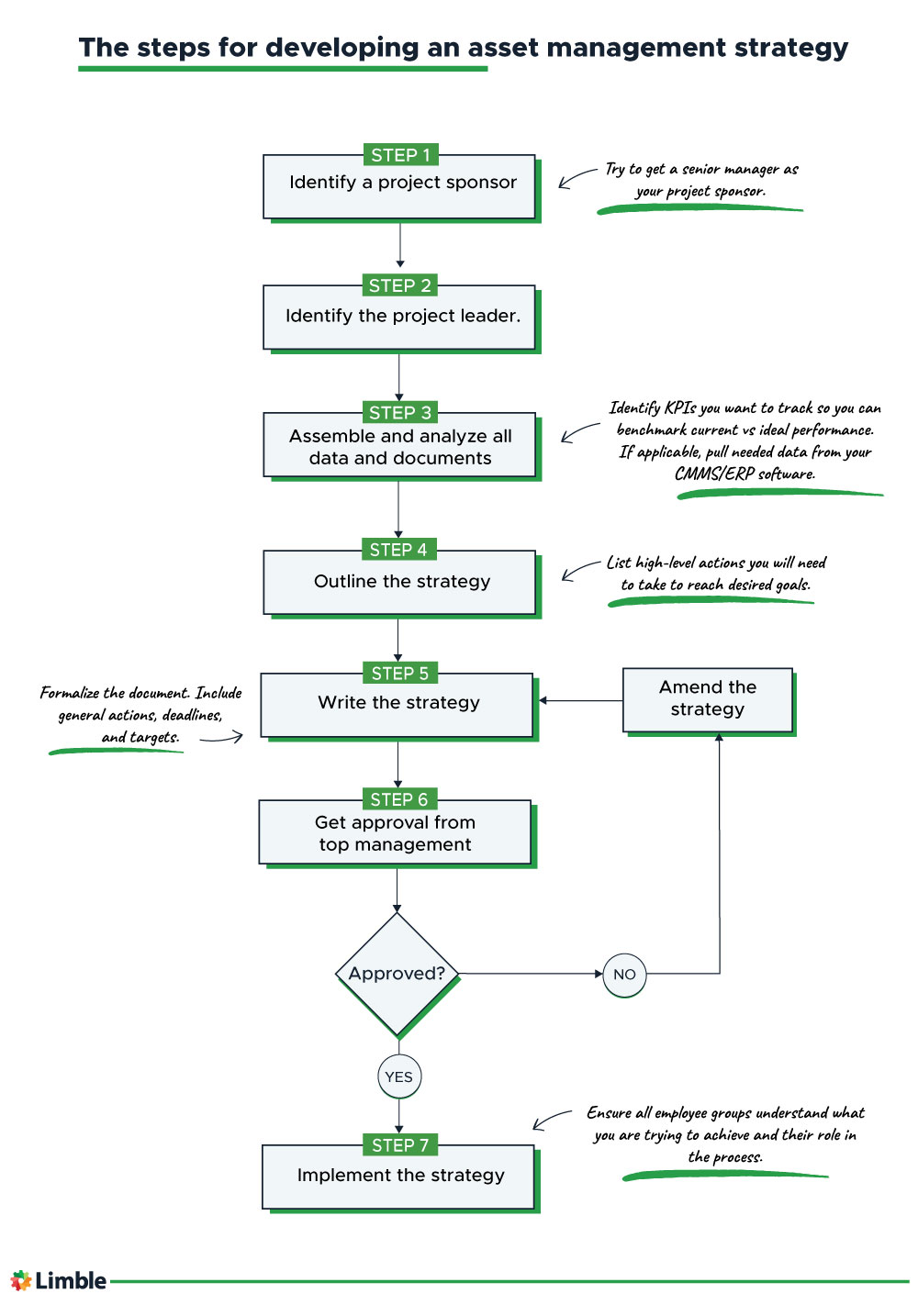

The steps for developing your asset management strategy

There are clearly many details and considerations that go into creating an effective asset management strategy. So how does an organization create one?

By taking the following steps, you’ll end up with an asset management strategy that captures all the necessary details, fits the needs of your company, and sets the stage for effective asset management that supports your business plan.

Step #1: Identify a project sponsor

Creating an intricate, strategic approach to improving your asset management processes is a waste of time if nobody acknowledges or follows the guidelines.

Appointing a senior manager as a project sponsor provides several benefits:

- Their involvement gives authority to the strategy production and provides line of sight to its impact across departments.

- Active involvement by the sponsor removes organizational roadblocks and helps with work prioritization — which keeps the strategy on track.

- A member of senior management will facilitate buy-in and decision-making from other leaders and ensure accountability for the strategy.

Step #2: Identify the project leader

The project leader manages the development of the asset management strategy. In this role, they are responsible for:

- Ensuring the process gets completed within time and budget constraints.

- Liaising with the project sponsor to brief them on progress.

- Considering all relevant data and other company information necessary for a thorough and thoughtful outcome.

In a small company, the project leader may also perform the data collection and writing of the strategy document. Larger companies may use a small team, which the project leader will manage.

Step #3: Assemble and analyze all data and documents

This is a time-intensive step that often requires data from multiple departments including engineering, maintenance, finance, procurement, and production.

You will analyze this data to evaluate the effectiveness of your current asset management strategy and how well it meets business objectives. We will discuss more details of data analysis in a later section.

Data collection and analysis is considerably easier if your company uses a centralized database like an asset management software, a computerized maintenance management system (CMMS) , or an enterprise resource planning system (ERP).

Step #4: Outline the strategy

After analyzing the data, you should have clear insights into your current asset management practices, their effectiveness, and their efficiency. The data will point you to:

- Current activities and processes that deliver less than desirable results.

- High-level changes and initiatives to include in your strategy to work toward improvement.

- Potential benefits of pursuing those high-level changes and shifts in strategy.

During this process, the project sponsor will be a key resource providing guidance, insight, and support from management and other departments.

Step #5: Write the strategy

At this stage, you should have all the necessary pieces to formalize the strategy.

The writing process should present a narrative explaining the current state of asset management in your company and the benefits of making a change. It should also outline general actions, deadlines, and targets.

This can sound a little abstract. In the following sections, we will look at a few real-life examples, show you how to structure the document, and review what to include.

Step #6: Get approval from top management

Top management must review and accept the proposed language for your new asset management strategy to ensure it aligns with business objectives. Approval from decision-makers means it is ready for implementation and employees will be held accountable for carrying it out.

Enter the document into your quality system for revision and amendment control. Any major changes should require resubmission for further approval.

Step #7: Implement the strategy

Sending out the document and expecting compliance will not work. There is an education component to implementation. Ensure all employee groups are trained and fully understand the goal of the strategy and their role in achieving it.

While they might have helped you gather data in previous steps, this is probably the first time they’re seeing the final strategy. They need to buy into the final product and believe it will be an improvement if you want it to be fully embraced and followed.

The data collection process

The data you collect in step four will be used for a gap analysis. This analysis will show the “gap” between how efficient your assets are today, and how efficient they could be at their best. It will also shed light on the operational and capital costs they incur.

There are two components to consider for the gap analysis: current performance and theoretical maximum efficiency.

Benchmarking current performance

Find out what key performance indicators (KPI) your production team uses to measure their efficiency and effectiveness. Examples include equipment downtime (or uptime) and setup time.

Many of these measures will be in percentages. However, we recommend translating them into actual, data-driven outputs — whether the numbers of products, frequency of stock turns, or the count of non-conforming products.

Remember, raw data is easier to relate to!

Identifying theoretical maximums

What could your plant achieve if everything ran like clockwork?

To answer that question, gather original equipment manufacturer data or the asset performance results from similar plants that are an example of best practice.

For example, if the KPI you are using is OEE (overall equipment effectiveness) , an often-quoted best OEE rating for a pure manufacturing plant is 85%. That would require equipment availability, performance, and quality metrics to be in the mid to high 90-percent range.

If your OEE rate is 68%, you know the performance management gap you need to close through asset strategy management.

Capturing operational and capital costs

By capturing data on the cost of your current performance, you have a baseline against which you can compare future costs. Comparing these over time will show you the financial impact of the changes you implemented as part of your updated strategy.

Consider operational budgets — like engineering, maintenance, and spares turnover. Capital costs for asset replacements may also be important, as poor asset life cycles or frequent modifications require more capital spending, and thus can reduce profitability.

Revenues, cost savings, and operating costs will be key to measuring production efficiency.

Developing your asset management strategy

With the gap analysis done, you must define the strategies that will close the gap between current and desired performance. These will become the basis for your strategy document.

Articulate an operational vision

Define a clear production goal for the business. It should be a stretch goal with measurable targets on a five to ten-year horizon.

For example, you may choose to:

- Reduce maintenance costs by V%

- Improve cycle time by W%

- Increase production capacity to X units

- Increase equipment reliability to 93%

- Move the factory to total productive maintenance (TPM)

Define the required high-level actions

Identify the broad practices the organization must change or implement to achieve the goals. These action plans should span three to five years due to the impact on employee workload, the available resources, and the budget.

Stay away from operational details and optimization . Leave that to the people writing the asset management plans .

Establish a business case

The effect of the changes on costs and production will have to be explained in order to justify the strategy. The business case you present should lay out the financial and operational justification and the expected change in key performance indicators .

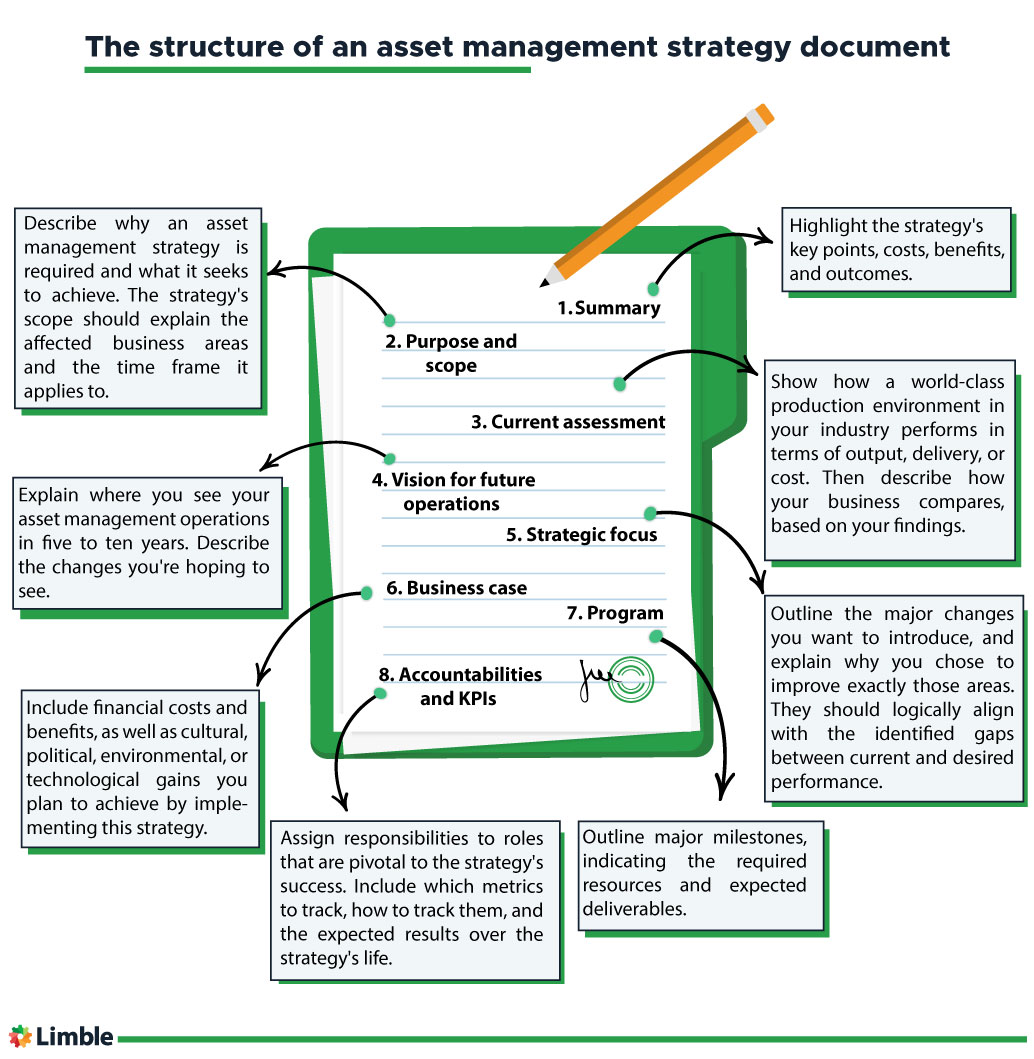

Structuring your asset management strategy document

While the layout of such documents varies widely across industries and countries, the following list provides a basic key components that you may want to include in yours.

The summary should come first in the document to allow senior management to review the document’s findings without wading through all the details. It must be concise, highlighting the strategy’s key points, costs, benefits, and outcomes.

2. Purpose and scope

Describing the purpose and scope in-depth establishes strategic alignment with business needs.

Describe why an asset management strategy is required and what it seeks to achieve. The strategy’s scope should explain the affected business areas and the time period — in years — to which the document applies.

3. Current assessment

This chapter summarizes the outcomes of the data analysis. Show how a world-class production environment in your industry performs in terms of output, delivery, or cost. Then describe how your business compares, based on your findings.

Cover maintenance and reliability comparisons, including:

- Overall equipment effectiveness (OEE) rates

- Reliability performance

- Cost per unit produced

This chapter should also clarify why effective asset management is important, why changes are required, and how far the business has to go to achieve best-in-class operations.

4. Vision for future operations

When crafting the vision, describe what the business could look like in five or ten years. Be sure to focus on more than just production and maintenance metrics. Illustrate:

- How the company culture may have changed

- What the organizational structure may have evolved into

- How roles and responsibilities will have altered

- Any physical changes or modifications that may have occurred to the structure of the business.

Avoid making unbelievable statements.

If your business is in the third or fourth quartile for industry benchmarks, promising world-class performance in three years undermines the document and the analysis that supports it. You’ll struggle to gain buy-in, and your strategy is likely to fail.

What creates support are realistic, continuous improvement targets, and a real business case that acknowledges the difficulty of the journey .

5. Strategic focus

Outline the key areas the organization needs to focus on over the timeframe covered by the strategy document. You had hundreds of areas for improvement to choose from. Yet, you selected only six to eight of them. Explain why.

Having clarified the focus, describe the expected outcomes. These must logically align with and help close the gaps between actual and theoretical performance.

Finally, outline the processes to follow.

For example, assume you have identified OEE as one focus area. Explain that the targets for improvement are equipment availability and performance, and the processes to be implemented will include reliability-centered maintenance and root cause analysis techniques .

6. Business case

This is the part of the document where you’ll need to make assumptions about the year-over-year improvements, the costs required to implement the changes, and the resulting benefits.

Remember to include financial costs and benefits, as well as cultural, political, environmental, or technological gains.

The business case is a justification for the strategy based on what the company expects to earn from improved production efficiency .

This section is your project plan. It outlines major milestones and timelines, indicating the required resources and the expected deliverables. It becomes the guideline for managers tasked with writing asset management plans.

8. Responsibilities and KPIs

The company’s asset management strategy will affect a wide cross-section of the organization. Therefore, the stakeholders and roles that are pivotal to the plan’s success must have clearly defined responsibilities.

It should also include key metrics, describing what will be measured, how to calculate KPIs, and the results expected over the strategy’s life.

Examples of public asset management strategies

Most privately owned companies do not publish their asset management strategies, given the confidential information they contain. But many public entities like councils or government organizations must publish theirs.

Here are three examples, along with some notes on what they do right.

- South Australian Government : This asset management strategy works at the right level, without dipping into unnecessary detail. It describes areas of focus and gives guidance on things to consider when individual agencies formulate their plans. Great examples are the life-cycle costing and asset register chapters on page nine.

- Eastleigh Borough Council : This council’s strategy has a good example of a forward plan , describing key strategic objectives.

- Kent County Council : This comprehensive plan has a good introduction, context, and purpose section. The vision and mission descriptions are first-class, and the strategy breakdown into thematic chapters is a great example of clear communication.

Start sooner rather than later

An asset management strategy drives improvements by comparing actual with ideal performance. By highlighting this performance gap and identifying priorities, best practices, and problem areas, the strategy sets goalposts for maintenance and other middle managers.

It provides a clear case for change and sets expectations on timelines and results, providing a map for the organization to follow in the next three to five years.

When done well, it supports constant incremental improvement for businesses that are intent on maintaining competitiveness through best-practice asset utilization.

To learn more about asset management and maintenance, keep browsing the Limble blog .

Request a Demo

- Platform OUR PRODUCT & MODULES Connected CMMS Maintenance Management Service Management Vendor Management Connected Workplace Work Order Management Inspections Asset Management Connected Buildings Utility Tracking & Benchmarking Energy Analytics & BI Cloud based Optimization Fault Detection & Diagnostics Connected Refrigeration Refrigeration Energy Optimization Remote Multi-site Monitoring Refrigerant Leak Compliance PLATFORM OVERVIEW Facilio O&M Platform Facilio IoT Edge Integrations Schedule time with a solutions expert

- Solutions By Industry Commercial Portfolios A complete real estate O&M suite built to boost building value Corporate Facilities Maximize efficiency and make 'experience' the new dimenson of your enterprise FM Services Empower workforce, make data-backed decisions, and create more value to clients Retail Enhance the in-store customer experience, operational efficiency, and run energy efficient stores across your portfolio. By Outcome Data-driven Portfolio Operations Remove friction points and ensure insight-led operations across buildings and teams FM Visibility More than just a CaFM/CMMS - gain contextual insights on contracted services 360* Asset Lifecycle Visualise assets, track performance, and streamline lifecycle processes Continuous Sustainability Close the energy efficiency gap by embedding sustainability with operations Customer Success at Facilio

Quick Guides

Our collection of playbooks on data-driven building operations to fuel efficiency. Get all the insights you need to improve portfolio operations.

Facilio Blog

Noteworthy articles on all things building ops. Strategies and videos on how to improve maintenance, sustainability, and tenant retention.

What's New with Facilio

We're constantly working to improve your Facilio experience so you can fasttrack your property operations to success. Here's what's new!

- Partners Become a Partner Locate a Partner AWS

- Company About Futureproof Careers Customers Contact Us Events

Featured Asset Management

Creating a strategic asset management plan (samp) with five handy steps.

Manaswini Rao

An asset management strategy is a high-level, strategic plan that defines the framework for accomplishing asset management objectives in an organization. It includes asset acquisition, planning, and maintenance.

An effective asset management strategy helps asset managers optimize the value and performance of tangible and intangible assets throughout the asset lifecycle .

As a result, you can reduce asset downtime, save on repair costs, increase productivity, and boost profitability.

By the end of this article, you will learn how to develop a strategic asset management plan and ways to simplify it with a computerized maintenance management system (CMMS) .

Why is an asset management strategy important?

An asset management strategy helps you create a long-term asset maintenance plan which eases asset condition assessment and optimization.

The result is a better return on asset (ROA), improved decision-making, and efficient resource allocation.

- Improved decision-making: An asset management strategy equips you with critical asset information to inform decisions like asset shutdown, turnaround, and outage (STO) to repair or replacement to operating expense (OpEx) prioritization. So, you’re better able to combine financial and non-financial strategies for decision-making and meeting the asset management objectives of the organization.

- Reduced costs: An asset management strategy also puts checks in place to track under-used, duplicate, or overused assets. This knowledge of asset utilization drives your understanding of equipment health. For example, overused assets are more likely to experience breakdowns at frequent intervals and go through costly repairs. Linking preventive maintenance with an asset management strategy helps you ensure cost savings and reduce the total cost of ownership (TCO).

- Better resource allocation: An asset management strategy helps you identify which assets cause bottlenecks, those that need upgrades or replacements, and how you can use the assets at your disposal to reach facility goals and objectives with maximum efficiency.

What is strategic asset management?

Strategic asset management (SAM) is a top-down equipment management framework for long-term maintenance and operation planning.

This approach prioritizes long-term physical asset investments while balancing capital and operational expenditure from a total expenditure (TOTEX) standpoint.

An SAM framework provides a holistic view of current asset needs and what you’ll need 5, 10, or 20+ years down the line.

This framework gives you the data you need to make asset decisions that align with the company’s goals, instead of relying on budget and guesswork to manage assets.

Read More: Integrate asset and energy management for real-time building performance

What does an asset management strategy include?

SAM dives deep into the following areas to help you maximize the return on every dollar you spend.

Asset inventory

Understanding the assets you own, their state, energy utilization, useful life, and whereabouts helps you create a single source of truth for all decisions.

If you’ve been using pen-and-paper inventory or spreadsheets to assign unique ID numbers and maintain asset records, it’s time to migrate to an asset management system.

An infrastructure asset management system simplifies the upkeep of asset information. Plus, it helps you form a basis for maintenance planning, resource allocation, and continuous assessment.

Asset prioritization

Assessing assets and how critical they are for smooth business operations is vital to asset management success. To rank assets, you need to answer two questions:

- What are the chances of any asset experiencing failure?

- What are the consequences of asset failure?

Set parameters to define the probability and consequences of an asset's failure. This will allow you to establish risk tolerance levels and rank assets by criticality. Also, concentrate on the most critical assets to get the most out of your investment.

Maintenance plans

Create maintenance schedules for each asset based on manufacturer recommendations, location, condition, and impact on operations.

For example, production assets running infrequently will benefit from corrective maintenance , whereas highly critical assets need total productive maintenance to stay in good shape.

Life cycle management

Prioritize maintenance for assets based on risk, energy consumption, cost of replacement, or whichever factor matters most to you.

This eases day-to-day resource management and reliability engineering for assets. Additionally, it helps you figure out the capital budget for asset upkeep as per operation and maintenance (O&M) manuals .

Performance monitoring

Your SAMP should also include a reliability-centered maintenance process that monitors asset conditions.

ISO 55000, the international asset management standard, requires you to report on asset performance and the effectiveness of the asset management system.

The best way to meet this requirement is to leverage both reactive and proactive monitoring.

- Reactive monitoring uses periodic audits to spot existing nonconformities in an asset management system and find asset deterioration, or failures.

- Proactive monitoring incorporates procedures in your asset monitoring process to find what’s affecting asset performance and reliability.

You can also use leading and lagging metrics, like energy usage per unit or labor hours per unit, to understand what needs breakdown maintenance or how to reduce failure-centric deficiencies.

SAMP is essential to determine which goals are realistic, or if you’ll have sufficient funds to maintain assets for the desired level of service.

Maintaining an asset register with asset-related transactions also helps you tackle fixed asset depreciation and asset revaluation for fiscal reporting.

Risk management

Define a risk tolerance policy to measure safety and environmental risks to inform contingency plans to address specific risks.

These elements help you consistently meet service levels, manage utilities without service interruptions, and generate predictable revenues.

Is your CMMS doing enough to keep your assets in excellent shape?

Your legacy cmms is probably costing you time, productivity, and money., what are the pillars of an asset management strategy.

A good asset management strategy relies on five key pillars to boost asset productivity while minimizing asset costs.

- Asset classification involves registering and sorting assets systematically based on their properties and attributes for easy asset management.

- Centralized asset information means you have all important asset data in one place. Companies using spreadsheets to manage asset information often struggle with data redundancy. Using an enterprise asset management system improves your asset management efficiency.

- Asset indicators offer real-time insights into asset performance. Common maintenance KPIs include mean time to repair, mean time between failures, availability, and downtime. They tell you which assets are more reliable and which have the longest downtimes.

- Maintenance plan usually combines preventive, corrective, and predictive maintenance techniques.

You can leverage a CMMS to plan and automate key maintenance tasks like:

- Preventive maintenance scheduling

- Unplanned and planned maintenance management

- Work order management

- Asset inventory tracking

- Real-time asset performance monitoring

- Energy consumption tracking

- Maintenance reporting

- Asset calibration involves scheduling, planning, executing, and analyzing equipment calibrations. Consider setting and meeting due dates for internal and external calibrations.

Now that you know the what , let's focus on the how .

5 steps to develop an asset management strategy

As you build or refine your asset management strategy, use these steps to reduce expenses and maximize asset performance.

1. Review the organization’s structure

Start by understanding how your organization operates or makes investment decisions. Then, you can focus on creating asset management goals that align with business objectives. Consider presenting strategic ideas to management and staff to win their confidence and support.

2. Conduct an asset condition assessment

Periodic asset monitoring gives you crucial data on the condition of each asset in your facility. This data tells you if the asset needs preventive maintenance to reach its expected useful life.

3. Prepare and implement an asset management action plan

These asset management initiatives altogether help you create an action plan. This implementation plan must support the current business cycle.

4. Review and monitor your progress

With an asset management system, you can capture data about asset performance and use it to optimize investment decisions.

Progress monitoring also reveals critical areas that you should prioritize in the next enterprise asset management strategy planning cycle.

5. Get feedback from all stakeholders

Conduct panels and focus groups with staff to hear their thoughts on existing asset management processes. This feedback lets you develop more effective solutions to meet organizational expectations.

Creating, enforcing, and m0nitoring the effectiveness of your strategic asset management plan is simple with a CMMS software .

Leverage a CMMS to streamline and automate 360° asset lifecycle management

A CMMS centralizes asset maintenance and performance data so you can easily track asset utilization, improve ROA, and stay compliant.

Modern maintenance management software like Facilio’s Connected CMMS also use IoT and machine learning to understand asset health and performance, and proactively maintain them to keep them performing at their peak, and prolong useful life.

Further, it simplifies asset condition assessment and digitizes compliance to realize improved asset value. It also gives data-driven insights for optimizing performance, health, and energy efficiency for different assets.

Overtime, using machine learning algorithms, it understands the faults and failures an asset is prone to, and determines failure modes to help you proactively tend to its maintenance needs.

The mockup shows how, by analyzing root cause of failure and automatically creating work orders, Facilio helps you eliminate unplanned equipment downtimes.

If you’d like to learn more about how Facilio’s Connected CMMS can help your organization switch from reactive to proactive maintenance, and keep your assets healthy and productive, our product experts are only a click away!

Keeping your assets humming along is simple with Facilio.

We are Hiring!

© 2024 Facilio.Inc | All rights reserved

connect with us

- [email protected]

- Call (866) 670-7483

- Equipment Financing

- Posted on December 31, 2022

- Kortney Murray

The first step in asset planning is, of course, to create the plan . An asset management plan will serve as a road map for you and your company to carry out your asset management strategy. Not sure how to get started?

In this article, we will lay out five essential steps to building an asset management plan for your organization.

What is an Asset Management Plan (AMP)?

But first, what exactly is an asset management plan (AMP)? An AMP is an organizational plan that defines the actions that will be taken to develop, operate, maintain, upgrade, and dispose of company assets. It will also define what resources will be applied to carry out these objectives.

All of this will be done most cost-effectively through the analysis of all the costs, risks, and performance attributes associated with the assets. An AMP can be created for an individual asset, a portfolio of assets, a group of assets, or a class of assets.

It should keep in mind all timelines of each asset to extract as much value from each. In simple terms, with an AMP, you will summarize the goals of each asset’s life cycle, then break down weekly, monthly, and yearly tasks to help achieve those goals.

So why should you create an AMP? Well, not only does it act as a guide for important decision-making processes, but you will also find there are many benefits to your business.

Benefits of Asset Management

Here are some of the most common benefits companies will experience when undergoing asset management processes:

- Reduction of customer complaints

- Increases customer value

- Improves efficiency

- Helps create a budget for the future

- Ensures compliance with regulations and industry standards

- Assets are well-maintained

- Reduces loss

- Prevents theft

Sounds good? Great! But what if you don’t have the organizational skills to come up with an AMP? You can consult an asset management firm to help you. These experts can provide you with more information to help organize and manage your assets.

But if you are ready to dive in yourself, check out the following 5 steps to building an asset management plan for your business.

1. Come Up With A Strategy

If your organization does not already have one in place, you will first want to come up with an asset management strategy. To do so, you will need to:

- Assess stakeholder needs: Identify and prioritize the people who will be affected by your AMP. Then do a stakeholder analysis to assess how stakeholder interests should be addressed in your plan.

- Do a SWOT analysis/risk assessment: Analyze SWOT (strengths, weaknesses, opportunities, and threats) in your organization. This will help you identify and analyze the factors that can shape current and future operations.

After these assessments, you can go about creating the following:

- Policy and Objectives: These should outline how your company will value, support, use, and implement asset management activities. Make sure the owner/most senior staff member signs off on this document!

- Strategic Asset Management Plan (SAMP): This organizational strategy document will highlight the objectives you want to achieve in your asset management strategy . Outline the tactics your organization will take to convert organizational objectives into asset management objectives. In the SAMP, focus on identifying your assets, defining stakeholders’ needs, and connecting these things to other plans or standards.

2. Analyze and Record Current Assets

As you are completing your SAMP, you will also want to do a complete asset inventory of your current assets. This will bring an awareness of what exactly you’ll be managing. Your asset inventory should include the following information:

- Asset description

- Asset location

- Current asset value

- Purchase date

- Estimated useful life

Complete an asset register recording all your current assets. The asset register should outline how and what asset data should be collected throughout its lifecycle. It is most helpful to input the register into an Enterprise Asset Management (EAM) system, or a Computerized Maintenance Management System (CMMS).

Having asset management software to keep track of your assets will save lots of time, keep you organized, and prevent errors from occurring. As you record your assets, make sure to assess the condition of each item and how critical they are in implementing the company’s needs.

Having a grasp on the current state of your assets will allow you to schedule maintenance as needed. It can also help you specify how much you want to invest in each asset for the needs of your organization. For instance, ask yourself how long you will allow the depreciation of your equipment until you renew or replace it.

If possible, circle back on an annual basis to best optimize each critical asset’s maintenance plan. This will help ensure the asset is getting the exact care and maintenance it needs to reach organizational objectives. And you’ll save some money in the long run.

It is also helpful to be aware of how important each asset is. What would happen if it failed to perform its function? If it would upset the workflow of the whole business, you will need to prioritize it above other less important assets.

3. Calculate Asset Costs

To figure out an asset’s value, not only will you need the asset’s purchase price, but you will also need to assess other asset life-cycle costs. This is a part of lifecycle management. Getting as accurate as possible with your asset costs will directly relate to an effective and efficient AMP.

To calculate total asset costs, you will need to know things like:

- Maintenance costs

- If the asset is a capital asset or an expense

- Condition and performance modeling

- Disposal costs

From there, you can determine the cost, quality, quantity, efficiency, reliability, function, capacity, and safety of the services you will provide your assets. It is important that your AMP is able to match the level of service that assets provide to the customers’ expectations. You will need to find the balance between the cost to deliver the asset and the level required.

Think about the following:

- How do the business’s goals impact the asset’s service levels?

- How do regulatory requirements impact service levels?

- What level of service is the asset currently getting?

- Does the service level meet the needs and expectations of the asset’s users?

- If that level of service could change, how, and if there is enough funding for it?

- How much does it cost to service the asset annually?

Once you’ve determined the levels of service you want to achieve, use a lifecycle modeling tool to help you come up with a financial plan for maintenance, renewal, or replacement for each asset. Factor in any forecasted growth.

Is the demand for the assets expected to increase or decrease? What investments will you need in the future to reach the expected demand? Also, prepare for any possible contingencies. With all of this information, create a five-year plan, a 10-year plan, or even a 20-year plan.

Include the following:

- Background information: Include the asset’s age, size, capacity, condition, performance, current value, and previous management summaries.

- Risk management plan: List any possible risks that can affect the service delivered by the asset. Do the risks threaten any of the business’s objectives? How will the risk be identified and evaluated? What measures will be taken to mitigate those risks?

- Operating plan: Define the strategies to maintain the required service levels, determine which operational tasks will be a priority, and summarize any possible future costs of operation.

- Asset maintenance plans: Define the maintenance strategies necessary to maintain the required service levels, determine which maintenance tasks are a priority, and summarize any possible future costs of planned maintenance. Include any expenditures that will be for the restoration, replacement, or renewal of an existing to be restored to its original capacity.

- Capital planning: Name any possible new investments that will create a new asset or upgrade or improve an existing one to a higher potential. If you need help with this section, you may want to consult an investment advisory service with registered investment advisors on staff.

- Disposal plan: Figure out in which ways you will want to dispose of an asset that has reached the end of its useful life. Will it be sold, demolished, or relocated? Consider when you will be disposing of these assets and how much it will cost to dispose of them.

Make sure to keep this data up-to-date by reviewing and updating it quarterly. Then track any changes that have occurred every year.

4. Implement Proactive Asset Management

Using the data collected from the previous steps, come up with an asset management plan that is the most cost-effective and proactive. Plan when to do preventative maintenance or repairs for each critical asset. Also, plan when to dispose of and replace the asset after its estimated life cycle is over.

Having a plan in place will inevitably increase asset performance long term. The Annual Works Plan will give you a short-term plan for those assets that need preventative maintenance. Make sure that you are following the guidelines of the manufacturer to ensure you follow the timeline of expected repairs.

There may also be some statutory requirements for the asset that you must follow. You can, however, modify the expected plans in case it benefits your business in some way. Once your Annual Works Plan is completed, you can establish work orders to carry out the scheduled maintenance.

This can be done on a daily or weekly basis, or as needed. It will be helpful to have some kind of planner or scheduler or staff member to keep up with these work orders. After implementing your plan, take a step back to see if it is helping you achieve the outcomes you were looking for from your AMP.

Look closely to see if the plan helped shaved off any extra costs or avoided any risk. Are you getting the most efficiency and effectiveness possible out of your resources? It can help if you can establish a good working relationship with your contractor and procurement teams.

Ensure you are getting the best resources for each maintenance job. Be communicative about the work being done to improve the chances of it being done most effectively and efficiently. To increase the ability of workers and staff to plan, assign, and carry out maintenance, use a mobile work order application .

If all members have the same application, this will be a far less hassle than sourcing data from completed jobs, then manually entering them into your current system.

5. Make A Long-term Financial Plan

Having your asset management systems in place will help you plan your business’s finances long-term. With all the information accurate and organized, now is the time to look further down the line.

With a long-term financial plan, you will be able to speculate whether your current asset management objectives are feasible. Then you can make adjustments as needed.

In your long-term financial plan:

- Include and summarize all the financial requirements to manage assets

- Include cash flow forecasts for the next one to five years

- Provide in detail how assets should be treated in the long-term scenario (as capital or expense)

- Determine the best funding strategies and when to implement them

If necessary, contact a financial advisor to help determine when and if you may need additional funding. They can also help you tweak your plan to have a more accessible financial flow. Need more financing ? Here at Coastal Kapital, we can help.

Road Map to Success

Asset planning may sound complicated. But if you break down the five steps we’ve laid out, you will find that once you’ve got a process in place, your company will turn into a well-oiled machine. Having a strategy will allow a unified vision for your staff to work from.

Then defining your assets in detail, calculating their life-cycle costs, and planning proactive management will ensure each asset is getting the level of care to perform at its best. And finally, completing the long-term financial plan will give you an idea of any roadblocks you may encounter along the way, allowing a clear road map to success (and profit !).

All Formats

12+ Asset Management Plan Templates – PDF, Word

Every business has its own set of assets. Holding assets is a part of any enterprise in the public or private sector. It’s important that business owners know what theirs are as they need to know the best ways in which they can use them. You can also like management plans in PDF . In order for them to do that, they’ll also need to come up with a simple plan that will allow them to make full use of whatever business assets they happen to have. And that’s why this article is going to teach you how to come up with an asset maintenance plan template.

Simple Asset Management Plan Creative Template

- Google Docs

Printable Asset Management Design Plan

Corporate Asset Management Plan Template

Asset Management Maintenance Plan Template

- Apple Pages

Software Asset Management Implementation Plan

IT Service Asset and Configuration Management Plan

Standard Asset Management Plan Template

Sample Asset Management Plan

Strategic Asset Management Plan

Simple School Asset Facility Management Plan

How to Create Your Business’s Asset Management Plan

1. take note of the necessary acquisitions, 2. plan for asset operations, 3. come up with a plan for maintaining these assets, corporate oraganzational asset equipment management plan.

Real Estate Property Asset Management Strategy Plan

4. Plan Out the Disposal of Old Assets

5. include information in regards to funding, 6. manage all of the different risks towards your assets, more in business, inventory management sheet template, inventory management template, retail inventory management template, business ledger template, accounting ledger template, general ledger template, student loan calculator, student budget calculator, student loan repayment calculator template, sla calculator template.

- What is a Template?

- How to Create a Sales Plan + Templates

- 28+ Blank Check Template – DOC, PSD, PDF & Vector Formats

- 39+ Free Obituary Templates in MS Word | PDF | Apple Pages | Google Docs

- 41+ Christmas Brochures Templates – PSD, Word, Publisher, Apple Pages

- 23+ Christmas Brochure Templates

- 11+ Scholarship Profile Templates in DOC | PDF

- 4+ Hospitality Induction Templates in DOC | PDF

- 7+ Financial Plan Templates

- 10+ Operational Plan Templates

- 11+ Student SWOT Analysis Templates – PDF

- 9+ Training Plan Templates

- 7+ Production Evaluation Templates

- 5+ Shooting Schedule Template

- 5+ Budget Planner Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

How to write a business plan for a fund management company?

Creating a business plan for a fund management company is an essential process for any entrepreneur. It serves as a roadmap that outlines the necessary steps to be taken to start or grow the business, the resources required, and the anticipated financial outcomes. It should be crafted with method and confidence.

This guide is designed to provide you with the tools and knowledge necessary for creating a fund management company business plan, covering why it is so important both when starting up and running an established business, what should be included in your plan, how it should be structured, what tools should be used to save time and avoid errors, and other helpful tips.

We have a lot to cover, so let's get to it!

In this guide:

Why write a business plan for a fund management company?

- What information is needed to create a business plan for a fund management company?

- What goes in the financial forecast for a fund management company?

- What goes in the written part of a fund management company business plan?

- What tool can I use to write my fund management company business plan?

Understanding the document's scope and goals will help you easily grasp its structure and content. Before diving into the specifics of the plan, let's take a moment to explore the key reasons why having a fund management company business plan is so crucial.

To have a clear roadmap to grow the business

Small businesses rarely experience a constant and predictable environment. Economic cycles go up and down, while the business landscape is mutating constantly with new regulations, technologies, competitors, and consumer behaviours emerging when we least expect it.

In this dynamic context, it's essential to have a clear roadmap for your fund management company. Otherwise, you are navigating in the dark which is dangerous given that - as a business owner - your capital is at risk.

That's why crafting a well-thought-out business plan is crucial to ensure the long-term success and sustainability of your venture.

To create an effective business plan, you'll need to take a step-by-step approach. First, you'll have to assess your current position (if you're already in business), and then identify where you'd like your fund management company to be in the next three to five years.

Once you have a clear destination for your fund management company, you'll focus on three key areas:

- Resources: you'll determine the human, equipment, and capital resources needed to reach your goals successfully.

- Speed: you'll establish the optimal pace at which your business needs to grow if it is to meet its objectives within the desired timeframe.

- Risks: you'll identify and address potential risks you might encounter along the way.

By going through this process regularly, you'll be able to make informed decisions about resource allocation, paving the way for the long-term success of your business.

To maintain visibility on future cash flows

Businesses can go for years without making a profit, but they go bust as soon as they run out of cash. That's why "cash is king", and maintaining visibility on your fund management company's future cash flows is critical.

How do I do that? That's simple: you need an up-to-date financial forecast.

The good news is that your fund management company business plan already contains a financial forecast (more on that later in this guide), so all you have to do is to keep it up-to-date.

To do this, you need to regularly compare the actual financial performance of your business to what was planned in your financial forecast, and adjust the forecast based on the current trajectory of your business.

Monitoring your fund management company's financial health will enable you to identify potential financial problems (such as an unexpected cash shortfall) early and to put in place corrective measures. It will also allow you to detect and capitalize on potential growth opportunities (higher demand from a given segment of customers for example).

To secure financing

Crafting a comprehensive business plan for your fund management company, whether you're starting up or already established, is paramount when you're seeking financing from banks or investors.

Given how fragile small businesses are, financiers will want to ensure that you have a clear roadmap in place as well as command and control of your future cash flows before entertaining the idea of funding you.

For banks, the information in your business plan will be used to assess your borrowing capacity - which is defined as the maximum amount of debt your business can afford alongside your ability to repay the loan. This evaluation helps them decide whether to extend credit to your business and under what terms (interest rate, duration, repayment options, collateral, etc.).

Similarly, investors will thoroughly review your plan to determine if their investment can yield an attractive return. They'll be looking for evidence that your fund management company has the potential for healthy growth, profitability, and consistent cash flow generation over time.

Now that you understand the importance of creating a business plan for your fund management company, let's delve into the necessary information needed to craft an effective plan.

Information needed to create a business plan for a fund management company

You need the right data in order to project sales, investments and costs accurately in the financial forecast of your fund management company business plan.

Below, we'll cover three key pieces of information you should gather before drafting your business plan.

Carrying out market research for a fund management company

As you consider writing your business plan for a fund management company, conducting market research becomes a vital step to ensure accurate and realistic financial projections.

Market research provides valuable insights into your target customer base, competitors, pricing strategies, and other key factors that can significantly impact the commercial success of your business.

Through this research, you may uncover trends that could influence your fund management company.

You could discover that your fund management company may need to focus more on digital marketing strategies, as research might reveal that more and more people are investing online. Additionally, research might indicate that investors may be looking for more diverse investment options, so you may need to adjust your offerings accordingly.

Such market trends play a significant role in forecasting revenue, as they offer valuable data about potential customers' spending habits and preferences.

By incorporating these findings into your financial projections, you can present investors with more accurate information, helping them make informed decisions about investing in your fund management company.

Developing the sales and marketing plan for a fund management company

As you embark on creating your fund management company business plan, it is crucial to budget sales and marketing expenses beforehand.