Case study: Personal financial plan

Major Professor

Committee member, journal title, journal issn, volume title, research projects, organizational units.

The Department of Human Development and Family Studies focuses on the interactions among individuals, families, and their resources and environments throughout their lifespans. It consists of three majors: Child, Adult, and Family Services (preparing students to work for agencies serving children, youth, adults, and families); Family Finance, Housing, and Policy (preparing students for work as financial counselors, insurance agents, loan-officers, lobbyists, policy experts, etc); and Early Childhood Education (preparing students to teach and work with young children and their families).

Dates of Existence 1991-present

Related Units

- College of Human Sciences ( parent college )

- Department of Child Development ( predecessor )

- Department of Family Environment ( predecessor )

Journal Issue

Is version of, description, subject categories, collections.

- Browse All Articles

- Newsletter Sign-Up

PersonalFinance →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Last Chance

Enroll in our full CFP® Certification Education Program with The Dalton Review® and save $1,200 with promo code CFPACT !

This course applies students' knowledge and skill set in personal financial planning techniques to a comprehensive case study. Students will integrate into a prioritized comprehensive financial plan core financial planning disciplines of: -Retirement -Investment -Risk management -Income tax -Employee benefits -General principles * Students are eligible to enroll in the capstone course (HS 333) after completing the first 6 courses of the curriculum in both the CFP Certification Education Program and the ChFC program (HS 300, HS 311, HS 321, HS 326, HS 328, HS 330). HS 333 is a course designed to bring together elements from all of the previous foundation courses, and prepares students to synthesize and apply their knowledge of the financial planning process, insurance, taxation, investments, retirement, and estate planning through the delivery of a comprehensive financial plan. 000279 CFP<sup>®</sup> ChFC<sup>®</sup> Single Course 7 1.00 Financial Planning Professional Designations & Certifications Early Career Professional Mid Career Professional No No 0002791 0

NGPF Case Studies

New to ngpf.

Save time, increase student engagement, and help your students build life-changing financial skills with NGPF's free curriculum and PD.

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Become an ngpf pro in 4 easy steps:.

1. Sign up for your Teacher Account

2. Explore a unit page

3. Join NGPF Academy

4. Become an NGPF Pro!

Want to see some of our best stuff?

Spin the wheel and discover an engaging activity for your class, your result:.

INTERACTIVE: Living Paycheck to Paycheck

Case Studies present personal finance issues in the context of real-life situations with all their ambiguities. Students will explore decision-making, develop communication skills, and make choices when there is no “right” answer.

To help get you started, NGPF has created support guides to walk you through how to complete case studies with ease:

- Teacher Support Guide

- Student Support Guide

(Sp) denotes resource is also available in Spanish

Behavioral Economics

Consumer skills, paying for college, types of credit, managing credit, ngpf mini-units, cryptocurrency, alternatives to 4-year colleges, buying a car, buying a house, entrepreneurship, philanthropy, racial discrimination in finance, sending form..., one more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

Personal Financial Planning, Fourth Edition by Benedict Koh, Wai Mun Fong

Get full access to Personal Financial Planning, Fourth Edition and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

18. Case Studies on Financial Planning

Introduction

In this chapter, we introduce three case studies to illustrate how financial planning is carried out for singles, young couples and mature couples with children. The concerns and needs of singles, young couples and mature married couples are different. In the case of singles, they are primarily concerned with their own financial well-being as they have no dependents to care for. Hence, financial planning for singles involves planning for their housing, protecting their income during their working life and planning for their retirement.

As regards young couples, they are primarily concerned with ...

Get Personal Financial Planning, Fourth Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

- Downloadable Forms

- Financial Solutions

- Graduates and Young Adults

- Young Couples and Parents with Children

- Middle Age and Approaching Retirement

- People Experiencing Life Changes

- The Financial Planning Process

- Defining Goals and Assembling Financials

- Financial Diagnostics

- Recommendations

- Implementation and Exectution

- Monitoring and Adjustments

- Young Married Couple with Children (Planning their Future)

- Single Professional (Managing Debt)

- Married Couple (Preparing for Retirement)

- Married Couple (Managing Proceeds of a Sale)

- Single Individual

Case Studies and Results

Young family - planning their future, single professional - managing debt, married couple - planning for retirement, married couple - managing proceeds from a sale, single individual - pursuing an mba.

David was recently promoted earlier this year as Director of Engineering for a very large oil and gas exploration firm in Farmington, NM. His salary is $150,000 per year plus substantial bonus opportunities and equity share of the firm. Tiffany is a graduate of an East Coast liberal arts college specializing in health care issues. She has worked as a consultant and now she is a full-time mom. They are devoted to their family and live well within their means. They have accumulated a substantial balance in their checking account. As a family they enjoy camping in the mountains in Southwest Colorado.

Step 1: What is important to David and Tiffany?

Step 2: financial diagnostics.

Tax Bracket: 33%

Anticipated taxes $63,250

Contributions to 401(k) plan: $150 per pay period or $3,600 per year. Contributions are primarily in an international fund.

Group Life Insurance: $150,000

Existing Mortgage Interest Rate: 6.125%, Current Rate: 2.85% (Rate as of February 2013)

Step 3: Goals Based Recommendation

- Establish a will or trust and name a guardian for the children.

- David: Purchase a $500,000 10 year term life insurance and a $1,000,000 20 year term.

- Tiffany: Purchase a $250,000 10 year term life insurance and a $500,000 20 year term.

- Refinance Mortgage to lower payments and save interest and pay off auto loan

- Maximize 401(K) contribution and reallocate retirement investments

- Establish Educational 529 plans for children, reserve a fund for David’s MBA

- Provide tax clarity to prepare David and Tiffany for the higher tax situation

Step 4: Implementation and Execution of Recommendation

- Set up an appointment with attorney to prepare an estate plans, including preparing documents.

- Meet with independent life insurance agent to compare and select term life insurance policies

- Meet with mortgage lender to refinance. Auto loan was paid off.

- Meet with human resource representative to increase 401(k) contribution and reallocate retirement investments.

- Meet with accountant to determine an prepare for higher income taxes and affirm tax saving practices

- Meet with an Investment Advisor to fund 529 plans and begin an investment savings program

Funding Retirement produced a tax deferred savings of $4,644 annually. The projected retirement and investment savings is estimated to have a balance of $750,000 in 10 years and well over $1,500,000 in 20 years. Based on that number it was determined that effective use of term life insurance will provide the protection gap until those balances are reached. The staggered term resulted in a total of $2,250,000 of insurance at a minimal cost of $750 annually. The mortgage refinance provided monthly savings of $283. Overall the saving and investment programs more than offset the cost of annual life insurance policies and the one-time expense of preparing an estate plan.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Kathy, age 44, is a radiologist in Taos who purchased a home in 2006 prior to the mortgage crises. Her home was in need of repairs and obtained a second mortgage and third mortgage, one was for a new roof and the other was to upgrade the electrical. In addition she had to borrow from her retirement plan in order to make other renovations. She also has credit card debt, student loans and a car loan. The burden of debt is overwhelming especially since she estimates that she purchased her home at the top of the market and the home value is less than the total outstanding mortgage debt. Her salary is $67,000 per year and that does not include the rent she receives from her roommate. Kathy is a hard worker and has worked extra hours to cover her debt. She does some travel to visit her family in another state. She also has been involved in business ventures. She is savvy and knows that she needs to deal with her financial issues. She does maintain a 403(b) fund and contributes to receive the maximum matching employer contribution. Her cash flow is restricted because of the amount of debt she carries.

Step 1: What is important to Kathy?

Tax Bracket: 25%

Anticipated taxes: $6,770

Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a well defined structured investment program.

Group Life Insurance: $65.000 and a universal life policy $13,000

Existing Mortgage Interest Rate: 6.0%, Current Rate: 4.5% (Home Affordable Refinance Program)

- Refinance first mortgage and pay off credit card debt. Upon payment of credit card debt,apply those payments to principal on second mortgage.

- Half of the $205 savings on the mortgage payment should be applied to the retirement plan.

- Upon the 403(b) loan payoff in two years, apply the 200 per monthly payments as retirement contributions.

- Make an appointment with an attorney to establish an estate plan.

Step 4: Implementation and Execution

- Set up an appointment with mortgage lender to refinance first mortgage. Increased principal payments to pay off credit card debt. Further principal reductions on other loans will continue as each debt is paid off.

- Increased initial contributions to retirement plan.

- Opted to defer an appointment with an attorney. Kathy will use the health care power forms provided by her employer.

- Will continue to set aside money for emergency saving.

Refinancing the mortgage provided $2,400 saving to Kathy’s mortgage payments, the term length did not change. Kathy will have no debt by the time she retires. Concurrently, Kathy will add to her retirement plan. It is projected that upon retirement she will have accumulated $469,000 by the time she retires based on an assumed 5% annual return. The first two years the cash flow will be tight, however, as debt is paid off, there should be ample surplus in her cash flow to provide more leisure spending.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Albert , age 73 and Anne, age 67 live in Las Cruces. Albert is a painting contractor and Cynthia teaches part-time at NM State University. Because of their transitional life from one college to another they have rented rather than purchased a home. Home ownership did not occur until the past five years. They were dedicated to providing for their daughter’s education. Now they are approaching retirement and drawing on Social Security even though both are still employed. Albert sees that, although he enjoys his profession, he finds that he is less physically able to continue painting. Cynthia would like to retire in two years and both would love to pursue art studies and literature. Their primary concern is a stronger retirement and to pay off debt. They live a modest lifestyle. Albert prepares the household tax returns.

Step 1: What is important to Albert and Cynthia?

Tax Bracket: 15% Federal and 4.9% New Mexico

Itemize: They cannot itemize deductions

Other tax issues: They are receiving Social Security Benefits and 85% of the benefits are taxable. Anticipated taxes: $8,044

Contributions to 403(b) plan: $200 per pay period or $3,600 per year. Retirement contributions are allocated to 50% cash and 50% equities. Tax savings comparison was calculated.

Met with an owner of a national tax preparation firm and ran tax scenarios on their tax software. This determined the impact of maximizing 403(b) contributions. In addition the tax preparer provided tax advice on Albert’s business.

- It was determined that Cynthia should maximize her contribution from $200 per pay period to 846 per pay period. In addition their retirement asset allocation was reviewed and recommended alignment to a strategy appropriate for their stage in life. Retirement projections were prepared and determined that Cynthia and Albert could retire in two years based on their current living standards and if she maximize her retirement contributions.

- That they prepare for the meeting with an attorney.

- That they have their financial plan available for their daughter in the event she needs to assist.

- That they utilize a tax preparation professional.

- Their budget and goals for education, travel, hobby and charity are doable.

Step 4: Implementation and Execution of Recommendations

- Cynthia increased her retirement contribution from $200 to $846 per pay period. She also further diversified her cash position to several diversified bond strategies. Her equities were reallocated to represent large-cap, mid-cap, small-cap, international developed and emerging market funds. In addition a real estate trust and a commodity index fund were represented in the retirement portfolio.

- An appointment was made with a local attorney to draft their estate plan.

- Two sets of plans were provided; one for Albert and Cynthia and the other for their daughter.

- Albert will consider the tax preparer’s advice and engage their services the following tax year.

- The projects, travel, charity and seminars are budgeted.

Maximizing the 403(b) contribution will enable Cynthia and Albert to save $4,380 in taxes. In addition, the 403(b) contributions will add $44,000 of principal to their retirement balance over the next two years. The advice of the tax preparer will also save them an additional $1,000 in taxes. Their attorney completed the estate plan. Also they are preparing for their trip to France and they have completed the garden arbor. Finally, they know that their budget will allow for charity and seminars.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Michael , age 61 and Anne, age 58 live in Albuquerque. Michael works at a major laboratory and Anne teaches music part-time at a local high school. Anne’s family large owns a large concrete company in San Diego of which she owned a partial interest. Her siblings purchased her share which amounted to around $7,000,000 and she has kept part of the money in cash. Since the housing market in California has severely declined, Anne wants to make set aside ample reserves to help her family’s business weather through the difficult time. One of the concerns is that monies have been spread to various banks in Albuquerque and much of it is uninsured. In addition there is not a structure to provide for bond investments. Michael and Anne are self-sufficient from their employment salary and do not rely on either the income or principal of the family business proceeds. Preservation of the business proceeds is important; however they appreciate the need for equity investments to provide diversification and to stay ahead of inflation. They hold no debt and are able to cover the educational expenses of their sons.

Step 1: What is important to Michael and Anne?

Tax Bracket: 33% Anticipated taxes: $40,000

Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a conservative fixed income program.

- It was determined that $2,000,000 should be set aside to either lend or invest in the family concrete business.

- Invest the remaining proceeds in an asset allocation strategy

- Make an appointment with an attorney to establish an estate plan.

- Increase the contribution to their company retirement plan.

- Of the $2,000,000 set aside as an emergency reserve for the family business, Michael and Anne felt it would be best to establish a mini bond ladder that did not extend beyond a three year term.

- Michael and Anne met with their investment advisors to implement a coordinated asset allocation strategy. Therefore they divided up the assets to provided a combined 50% bond/50% equity split. This consisted of municipals, cds, on a bond ladder that does not exceed 12 years. The equities were managed among large-cap, mid-cap, small-cap, international developed and emerging markets. Other positions included real estate trusts and a commodity index.

- They met with an attorney specializing in estate planning. This attorney established irrevocable life insurance trust to provide for estate taxes.

- Michael met with the human resources to increase his contribution to his retirement plan.

Restructuring the investment program increased their investment income from $50,000 to $200,000. Much of the income was from tax free municipal bonds and reduced taxes on qualified dividends. They did realize an increase in their tax bracket, but that was manageable. The estate plan is now in place and they are prepared for the various tax changes that could come about.

Miguel, age 28, is a research analyst for an American company that has an office in Madrid, Spain. He is single and no dependents. Miguel desires to obtain his MBA at a top-tier business school. His educational endeavor will be a major expense. Although Miguel is an American citizen, he pays both US and Spanish taxes and participates in the Spanish health care and retirement programs. Miguel monitors his income and spending. He also sets aside savings for investments as well as contributes to his retirement plans.

Step 1: What is important to Miguel?

Bracket: 29.7% (Foreign Tax Bracket) Anticipated taxes: $13,283

Contributions to retirement plan: $308 per pay period or $7,380 per year. Retirement contributions are allocated to a well defined structured investment program.

- Miguel has saving in the amount of $46,000

- Miguel has retirement savings with a provision that he can draw without penalty provided it is used to fund education

- Miguel will still need to rely on student loan ranging from 6.8% to 7.9% interest rates. However the above savings will reduce the reliance on such loans.

- Funding Source and Outlay – A plan was made to determine on when and how to draw on the mentioned resources to reduce the tax impact and the amount of loans necessary to finance his MBA.

- Loan Balance and Monthly Payment – A projection was made to determine what his student loan payment obligations will be after he obtains his MBA

- Miguel worked with his accountant to run a mock tax preparation to make sure there were no tax surprises in both foreign and US taxes. This plan was submitted as part of his application to one of the above MBA programs on how he intends to finance his education.

Miguel was accepted to the MBA of his choice and will be beginning the program in the Fall of 2014.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

- Free Goals Assessment

- Your Personal Financial Trainer

Contact Information

Thomas Bustamante [email protected] (505) 231-4607

Bustamante Financial Planning LLC is a registered investment advisor with the state of New Mexico. As such, it is registered to transact business with and provide investment advice to New Mexico residents. Only general information on available services is available through this website. In addition, it adheres to the de minimis requirements of other states for out-of-state clients.

© 2024 Bustamante Financial Planning

September 8, 2017

Financial plan with solutions of a real life case study.

Sadique Neelgund

Note – This case study is published in Steven Fernandes book There is always a financial solution … published by Bestsellers18 which is a compilation of different case studies. Sharing here with permission of author.

Name – Abhishek Goel (30)

Family – Father (67), Mother (63)

Resides in – Delhi

Occupation : Service

Job Details : Works as Chief Manager Claims for a Private General insurance company.

Background:

Abhishek is single and stays with his parents in his father’s house in Delhi. He has an elder brother who works abroad. Abhishek remembers that at an early age he got a first-hand experience on savings when his parents encouraged both the brothers to open a children’s bank account which was being operated from the school premises. Both brothers started saving Rs. 5 per month and this money was utilised in the next academic year to purchase some books, stationery, etc. His father used to work in an engineering firm while his mother was a teacher. When he was in the first standard, his father’s company faced lockout and for nearly 2 years the family survived on his mother’s income. His father got an opportunity to work in the gulf later and for some time the family’s finances were on track.

Again, tragedy struck when his mother had to give up her job due to health reasons. After working for a couple of years abroad, his father’s firm closed down and he had to come back. His mother started taking tuitions at home to make ends meet. Since the convent school where the siblings were studying were aided by the government, they did not have to pay any fees for their secondary school education. Abhishek’s mother ensured that every expense was monitored and followed a strict budget. Both the brothers understood the family’s grim financial situation and consciously supressed their desires for story books/ toys etc. The difficult financial situation made the brothers realise that good education and qualification was the single most path to getting a good job and ensure financial stability. With the generous help from charitable donors Abhishek and his brother got interest free loans to complete their higher education. Abhishek completed his BE in Automobile engineering while his brother did is Hotel management.

Even during his first few years of college, Abhishek had started earning by giving tuitions. Part of this money was deposited in his bank and rest was given to his mother to manage the family’s expenses. Abhishek has had a very good rise in his career in the last 9 years since he has been working and presently he is in a very good position with a well-known General insurance company. Since he has been only exposed to traditional investment options like Insurance, Post office and FD schemes, Abhishek started his investment journey from 2007 with these products. To save tax he purchased traditional insurance policies and invested the rest in Fixed deposits. Even then he has been able to create a good investment basket because he has kept his expenses to the minimum and tried to save as much as he could.

Last year he booked an under construction flat worth Rs. 62 lakhs for which he paid the down-payment of 10% from his own savings. He is expected to get possession of the flat by December 2018. So far, he has taken a loan of Rs. 18.50 lakhs and he intends to try and pay as much as he can from his own sources in the next 2 years before possession.

Savings habit: In almost all cases with a few exceptions, our parents are the initiators into the world of savings and investments. Abhishek too understood the importance of savings through his parents who encouraged him right from his school day. He had never looked back ever since. Most of us lose our way once we get caught up in our work and other family responsibilities. Abhishek continues this habit till today and now savings has become an integral part of his responsibilities. He only needs guidance on how/ where to invest the savings.

Insurance as an investment: Most people buy insurance as an investment product or rather it is sold that way to make it attractive for the buyer. Investment oriented insurance policies are of two types – Traditional and Unit linked. Traditional policies typically invest in government bonds, approved securities and instruments which provide fixed income while Unit linked policies invest in instruments varying from government bonds to equities as per the fund chosen by the investor.

Traditional insurance policies typically don’t provide more than 5-6% returns over the long term while equity oriented funds in unit linked policies can fare better than traditional policies in the long run. Therefore, traditional insurance policies don’t serve as a good investment for the long term. How can a product which cannot beat inflation help you to reach your long-term goals? Abhishek made an early start but due to lack of knowledge and with a view of saving tax, he invested in traditional insurance policies, allocating a good amount of premium.

What is the present situation?

Basic Numbers

Monthly Income: Rs 90000

Monthly surplus: Rs. 32522

Networth Statement

ASSET ALLOCATION

Emergency fund: Apart from the savings account, the fixed deposits provide a decent back up In case of any emergency.

Life insurance : Abhishek is covered for Rs. 1.09 crores through 1 term pan of 1 crore and two traditional plans. He also has a traditional pension plan for which his monthly contribution is Rs. 8145 and the maturity is in 2041. He has a limited premium traditional policy where the last payment is to be done next year. The last policy is an endowment policy which will mature in 2028.

Health Insurance : Abhishek is covered for Rs. 5 lakhs through his employer group insurance policy. His parents are covered for Rs. 2 lakhs each through a separate policy. He also has a separate health cover of Rs. 15 lakhs through a combination of mediclaim and top up policy.

Investments: Investments are very well diversified into debt and equity with debt comprising 55% of the allocation and equity at 45%. Property has been excluded as its for self-consumption.

Liabilities: Presently there is only 1 loan which is a home loan taken on the under-construction property.

Abhishek has opted for EMI payments (instead of only pre EMI interest) as it enables him to claim tax benefits on both principal and interest payments as well as loan outstanding keeps reducing with each EMI payment.

Risk Profile: Moderate

Recommendations:

Emergency fund: Abhishek needs to maintain an emergency fund of Rs. 1.75 lakhs, which should take care of nearly 3 months of expenses. Presently he has maintained Rs. 1.05 lakhs in savings account which can be maintained as it is and additionally he should move Rs. 70000 from his FDs into a liquid fund.

Accident Insurance: Abhishek should take a personal accident comprehensive policy which will cover for accidental death, permanent and partial disability including weekly/monthly compensation for loss of work due to total temporary disability. A PA cover of Rs. 50 lakhs with a TTD cover of Rs. 15 lakhs are suggested. The premium for this will be approximately Rs. 7000

Life Insurance: Considering the financial goals and outstanding liabilities, Abhishek’s cover is adequate. He needs to stop the traditional pension policy as well as the endowment policy which matures in 2028. The yield on these policies are less than 6% and hence coming out of those will make sense now rather than continue them till maturity which is more than 12 years to 20 years from now. Surrender of the 2 policies will fetch him approximately Rs. 3 lakhs. He should revisit the cover post marriage.

Health Insurance: The present cover is adequate as per his age. He should include his wife’s name when he gets married next year.

Debt Management: Even though the actual loan approval amount is Rs. 50 lakhs, Abhishek should not take the full disbursement. He should try and use his own sources to pay for the property and keep the loan to less than Rs. 30 lakhs. A higher loan and EMI can hamper future goals. He can use the Rs. 3 lakhs from insurance surrender to pay for slab wise payments. The policy surrender will also enable the increase in surplus amount every month.

Financial Goals:

1. Marriage (2017)

Current value: Rs 4 lakh

Future Value: Rs. 4.36 lakh

Status of goal 1:

Abhishek does not want to spend too much on marriage and considering the fact that the marriage expenses will be shared with his spouse, he would not like to exceed Rs. 4 lakhs. A part of the Fixed deposits can be used for this goal.

Returns expected in fixed deposits: 6% post tax.

2. Buying a car (2018)

Future Value: Rs. 4.66 lakhs

Status of goal 2:

He needs to start Sip of Rs. 18500 in ultrashort debt funds for a period of 24 months to achieve this goal.

Returns expected in Ultrashort debt funds: 6% post tax over the required time horizon.

3. Educational funding for 1 child (2036 – 2041 )

Current value: Rs. 32 lakhs

Future Value: Rs. 2.42 crores

Status of goal 3:

Considering the long-term nature of this goal, Abhishek needs to invest Rs. 14000 per month for 25 years in a combination of largecap and balanced funds. Due to the present surplus, he can easily invest for this goal.

Returns expected in the mutual funds portfolio: 13% over the required time horizon.

4. Retirement Planning (2041)

Present Annual expense (Excluding children’s expenses and EMI’s) –Rs. 3.60 lakhs

Future Annual Expense – Rs. 19.53 lakhs

Corpus required – Rs. 4.53 crores.

(Inflation considered: 7%, Returns on corpus during retirement 9%, Expected life expectancy at 85 years)

Status of retirement goal – One principle which Abhishek has followed when he left his last organisation in 2014 is to transfer his EPF to the new employer rather than withdraw which most people do. With compounding and regular contribution, the EPF turns out to be a good amount during retirement. Considering a 5% increase in basic year on year his EPF in the year 20141 should be worth Rs. 1.93 crores. The mutual funds and equity shares if maintained that long can fetch him Rs. 1.45 crore and Rs. 1.56 crore respectively. These 3 assets are sufficient to create a good retirement corpus as per today’s needs.

Most of us plan retirement when there are either 10 or less years for one to retire. That leaves very little time to enable compounding of your investment and the savings and investments required in the short time will also be huge.

Taxation: Abhishek’s EPF and life insurance premiums of 2 policies (Term and 1 traditional) exceed the limit of Rs. 1.5 lakhs provided under 80C. He is also utilizing the 80D deduction up to Rs. 25000 due to health insurance premium of self and parents. He can avail the home loan interest benefit on under construction property in 5 equal instalments from the year of completion of his flat.

Conclusion – It’s truly said, “Experience is the best teacher”. Abhishek’s life is a live example of how his childhood period of financial turmoil has moulded him to be a better saver and investor. At his age, he had done a fairly good job of creating a good investment basket. There are several like him who have an opportunity to choose what is right. Many of his age, having similar salary may not have accumulated as much as he has. In this age of uncertainty, it’s very critical that the younger generation focuses on saving and building up a good corpus right from the first salary. Else there will always be regrets and “I should have done that” sighs when you evaluate your life in your 40s and 50s.

Note – This case study is published in Steven Fernandes book There is always a financial solution … published by Bestsellers18 which is a compilation of different case studies. Sharing here with permission of author.

2 Thoughts to “Financial Plan with Solutions of a Real Life Case Study”

Perfect planning report for this family

Absolutely Perfect Planning.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Register for a free online QPFP Demo session on Friday, August 21, 2020 at 5 PM. Check out agenda and register now.

Join our WhatsApp Broadcast for weekly resources

- Personal Finance

- Investment Strategy

- Investing Essentials

- Earning and Saving

- Wealth Creation

Financial Planning Case Studies

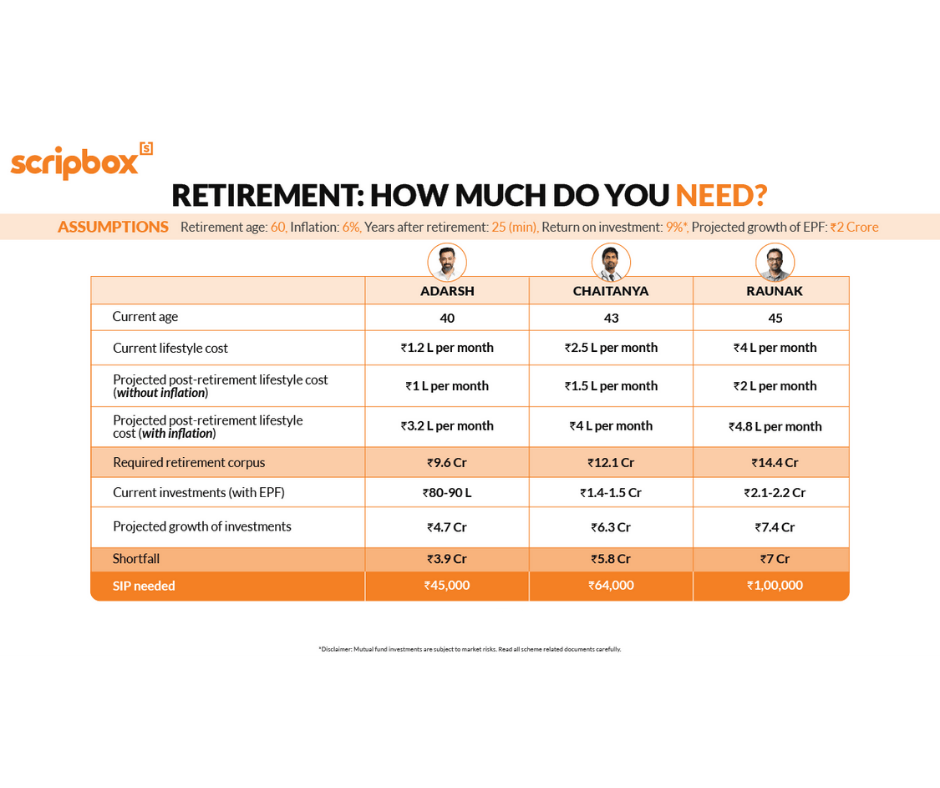

What does it take to retire comfortably if you start planning in your 40s?

Want to see a plan that can help you get started with your retirement goal, if you are in your 40s?

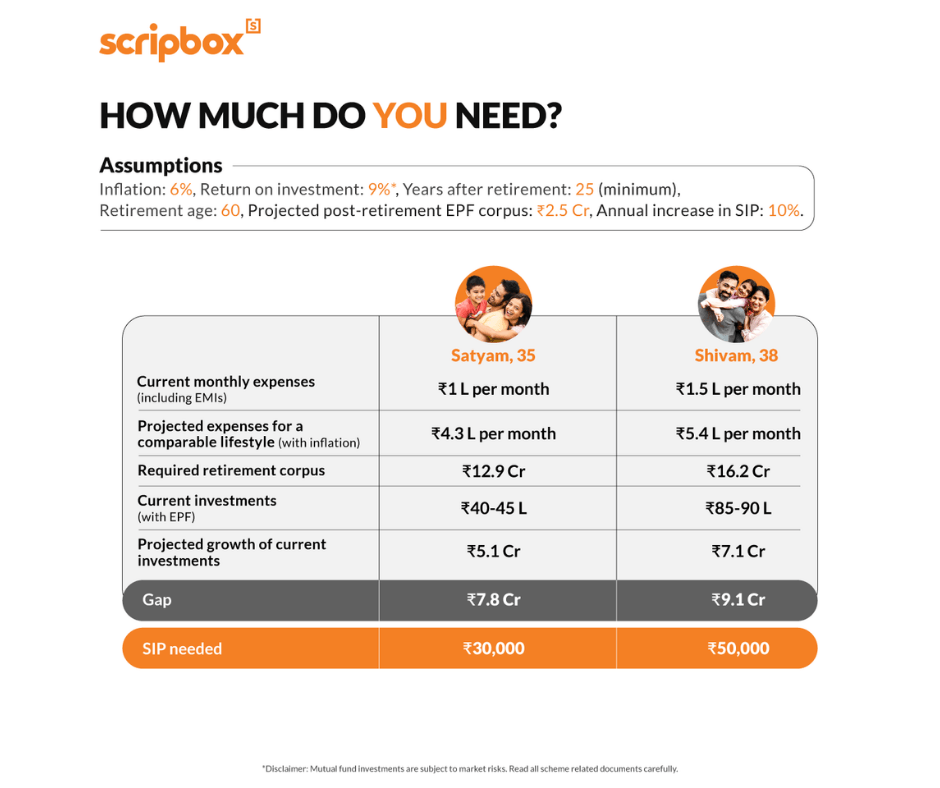

What does it take to retire comfortably if you start in your mid-30s?

Want to see a plan that can help you get started with your retirement goal, if you are in your 30s?

How to plan for both your children’s college education fund in India? – A case study.

Here we are with another case study. This one’s for Rohan (44) and Shriya (37), who want to send both their children to premier Indian institutions. Let’s take a look at the plan.

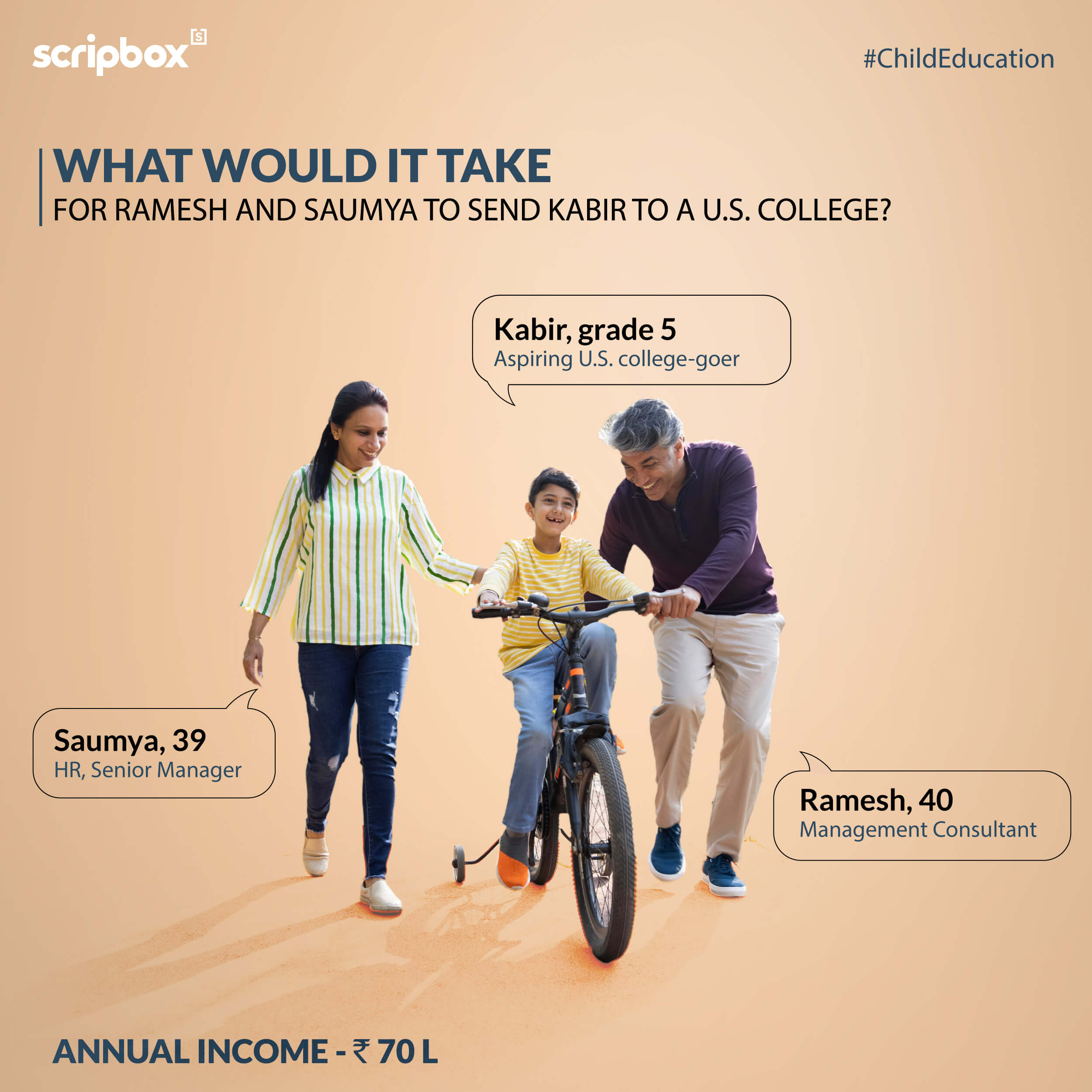

Can you give both your children a US college education? Let’s find out what it will take!

We’re back with another case study and this time we’ve planned for Sriram (42) and Sanjana (38), who want to send both their children to colleges in the US. Take a look!

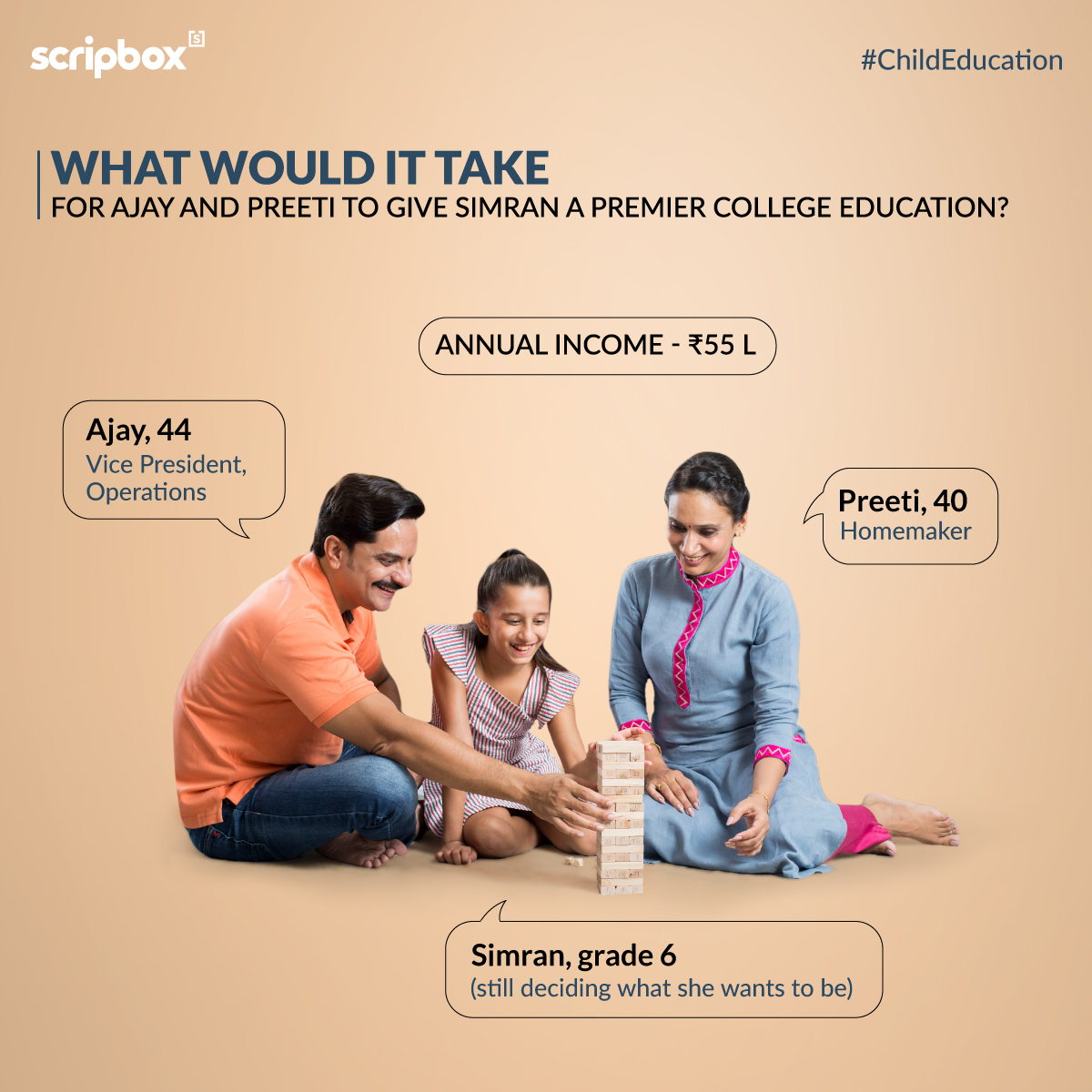

How to plan for your daughter’s college education fund in India? – A case study.

What would it take for Ajay & Preeti to give Simran a premier college education?

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

How to plan for a US college education fund for your child- A case study

Can Kabir’s parents afford his graduation from a US University? Let’s find out.

Please enter valid email address

Thanks for subscribing to our newsletter! You will start getting them soon.

Get the Scripbox App

View, Analyse, Manage, and Grow your wealth with just one app.

Practical wealth creation insights for you.

WE PLAN , SHAPE AND REALISE YOUR "finSMART" DREAMS

- Testimonial

- Mutual-Fund Login

- Distributor Login

Call Us : +91 98300 56612

- Financial Planning

- Tax Efficiency

- Insurance / Protection

- Future of Children

- Inheritance

- Contingency

Case Studies

Financial Planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life; it’s not just about buying products like a pension or an Invidual Saving Account. It might involve putting appropriate wills in place to protect your family, thinking about how your family will manage without your income should you fall ill or die prematurely, spending money differently, but it involves thinking about all of these things together i.e. your ‘plan’. You can build a plan on your own, or if your needs are more complex you might want the help of a Financial Consultant. Create a sound financial plan in six steps

- Establish your goals in life short, medium and long term

- Work out what assets and liabilities you have write them down

- Evaluate your current financial position how close are you to achieving your goals?

- Develop your plan create a “route map” for achieving your different goals

- Implement your plan make the changes and make it happen

- Monitor and review your plan at least yearly and make adjustments when needed

Courtesy http://www.financialplanning.org.uk/wayfinder/what-financial-planning

CASE STUDY 1

Name – mr. jishu saha.

D.O.B – 03.06.1969; Age – 41 yrs – Employment – Service

Other Family Members

Brief analysis from the shared data.

- 1. The only income generating machine in the family

- 2. Possibility of a substantial raise in income level with enhancement of standard of living

- 3. Concerned of family and dutiful towards parents.

- 4. As per tax is concerned is under the highest slab ( A.Y. 2011 -12 )

- 5. Possibility of a Home loan minimum in the tune of Rs.25 lacs with an expected EMI of around Rs.25,000.00 per month

- 6. Heavily under insured High Networth individual

Monthly expense as on date Rs.50,000.00

Monthly expenditure of Rs.50,000.00 as on date is equivalent to approximately Rs.1,60,500.00 after 20 yrs. ( Assuming inflation at 6% ) BUT in reality the expenditure comes down by 40% as certain expenses are generally not required at age 60.

Hence the mentioned value can be can be taken as Rs.96,500.00 approx. which is our 3rd goal i.e. the Retirement goal. Let us assume the pension rate to be 6.5% after 20 yrs. If it be so then we need a corpus of around Rs.1,78,00,000.00 to generate the said income per month then we need to follow the program given below. PROGRAMMEInvest Rs.21,000.00 per month in risk averse instruments AND Rs.5,000.00 per month in risk bearing instruments

Higher Education of ELDER SON in 2023 i.e. after 16-17 yrs, i.e. To create a corpus of around Rs.10,00,000.00 PROGRAMMEInvest Rs.1800.00 per month in risk averse instruments AND Rs.600.00 per month in risk bearing instruments

Higher Education for YOUNGER SON in 2029 i.e. after 23 yrs i.e. To build a corpus of around Rs.15,00,000.00 PROGRAMME Invest Rs.1350 .00 per month in risk averse instruments AND Rs.350.00 per month in risk bearing instruments

Sacred Thread Ceremony after 6 yrs i.e. To create a corpus of around Rs.3,00,000.00 PROGRAMME Invest Rs.2250 .00 per month in risk averse instruments AND Rs.1100.00 per month in risk bearing instruments

Medical coverage for self & family ( Excluding parents ) PROGRAMMEBuy a medical insurance policy for self & spouse preferably from a PSU before attaining 45 yrs that will cost around Rs.400.00 per month Additional recommendation ( Not asked for ) Buy a Term Insurance preferably for 50 lacs that will cost around Rs.26,000.00 i.e. approximately Rs.2175.00 per month for a standard life.

Touring abroad every 5 yrs i.e. to target of Rs.3,00,000.00 after 5 yrs PROGRAMMEInvest Rs.4,000.00 per month for 5 yrs in risk bearing instruments

Touring abroad every 10 yrs i.e. to target of Rs.6,00,000.00 after 5 yrs PROGRAMMEInvest Rs.2500.00 per month for 10 yrs in risk bearing instruments

Touring abroad every 15 yrs i.e. to target of Rs.10,00,000.00 after 15 yrs PROGRAMMEInvest Rs.1750.00 per month for 15 yrs in risk bearing instruments

Touring abroad every 15 yrs i.e. to target of Rs.15,00,000.00 after 20 yrs PROGRAMMEInvest Rs.1250.00 per month for 20 yrs in risk bearing instruments

From the above plan the total investment requirement per month = Rs. 45,500.00 out of which Rs. 26,375.00 in risk averse funds , Rs. 16,550.00 in risk bearing funds AND Rs. 2575.00 for protection purpose i.e.approximately 58% in risk averse instruments 36% in Risk bearing instruments AND 06% for protection purpose

BUT as per our last discussion investment possibility per month is Rs. 57,500.00

And our existing risk averse investment commitment per month is approximately Rs. 32,500.00. Hence we are now enjoying surplus of Rs. 25,000.00 out of which we may invest per month

Thus the final Risk Ratio comes as

66.75% in Risk averse instruments 28.75% in Risk bearing instruments AND 4.50% FOR Protection purpose

THE ABOVE IS DEFINITELY A CONSERVATIVE PLAN

Let us find out another option..

Invest Rs. 5,000.00 in VPF instead of the existing Rs. 15,000.00 and allocate Rs. 5600.00 in a pension plan making total pension contribution to approx 20% AND Rs.4,400.00 in risk related instruments or direct stocks. In this case the Risk Ratio changes as Rs. 33,975.00 i.e. 59% in risk averse papers Rs. 20,950.00 i.e. 36.50% in risk bearing papers AND Rs. 2,575.00 i.e. 4.50% for Protection oriented items

CASE STUDY 2

Name – mr. rajiv tibrewal.

D.O.B – 19.06.1958 Age – 52yrs 10mths Employment – Employed with family business ( Spouse is the proprietor) and is the sole key-man of the said business.

Under insured with the following dependants

Plan needed for retirement at age 65 yrs. with a current monthly surplus of approx. rs.10,000.00.

- 1. Invest Rs. 3,000.00 per month in a conventional pension plan for 13 yrs. that might build up a corpus of around Rs.7,00,000.00

- 2. Invest Rs.3,000.00 per month in PPF for 13 yrs that might build up a corpus of around Rs.7,70,000.00

- 3. Invest Rs.3,250.00 per month for 13 yrs in risk associated instruments that has the potential to build a corpus of around Rs.11,00,000.00

- 4. Allot approximately Rs.750.00 per month i.e. approx. Rs.4500.00 half yearly for protection worth Rs.5,00,000.00 for 7 yrs.

- 5. After 7 yrs. invest the unutilized Rs.750.00 per month for the next 6 yrs that might build up a corpus of around RS.75,000.00

- 6. The EXPECTED Corpus after 13 yrs from the above = Rs.26,45,000.00

The above plan is on the basis of certain assumptions and expectations and is not binding on anyone . The plan might fail due to various external factors like Government policies, Natural or unnatural calamities, unforeseen circumstances, etc. Whoever follows this plan does so entirely on his / her own risk and discretion

CASE STUDY 3

Name – mr. ashim kumar das.

D.O.B – 11.07.1980 Age – 41 yrs – Employment – Service

Present Financial Situation

- 1. Loan / Liability : No but intend to avail home loan after 4 yrs

- 2. Take home pay : Rs. 13,50,000.00 per annum after deduction of Tax liability

- 3. Current Monthly house hold expense : Rs. 40,000.00 i.e. Rs.4,80,000.00 per annum

Hence, current monthly investable surplus = Rs. 72,500.00 i.e. Rs.8,70.000.00 per annum Cash available for investment : Rs.2,50,000.00

Goals as per discussion :

- 1. Rs.20,00,000.00 for down payment to buy a property worth Rs. 80,00,000.00 after 4 yrs i.e. on or after July,2018

- 2. Buy a bigger car in the range of Rs. (15 to Rs. 20) lacs in the year 2020 i.e. after 6 yrs.

- 3. Corpus of Rs. 25,00,000.00 after 20 yrs i.e. on or after July,2034.

- 4. Retirement corpus of Rs. 2,50,00,000.00 i.e. after 24 yrs i.e. on or after July, 2038

Suggestion:

- Prioritization along with revamping of goal is required to achieve the above mentioned goals.

- Term insurance worth 75 lacs

PROGRAMMEInvestment of Rs. 29,000.00 per month in Risk Related SIP has the potential to generate Rs. 16,50,000.00 in 4 yrs @ 12% return compounded on an annualized basis. Investment of Rs.2,62,000.00 lump sum in a Risk Averse Fund will be able to generate Rs. 3,50,000.00 in 4 yrs at 7.5% return compounded on an annualized basis.

PROGRAMMEInvestment of Rs. 15,500.00 per month in Risk Oriented SIP has the potential to generate Rs. 15,00,000.00 in 4 yrs @ 12% return compounded on an annualized basis.

PROGRAMMEInvestment of Rs. 5,100.00 per month in PPF has the potential to generate Rs. 25,00,000.00 in 20 yrs @ 7% return compounded on an annualized basis.

PROGRAMMEInvestment of Rs. 7170.00 per month in PPF has the potential to generate Rs. 50,00,000.00 in 24 yrs @ 7% return compounded on an annualized basis. Investment of Rs. 7170.00 per month in Pension Fund may fetch around Rs. 46,00,000.00 in 24 yrs @ 6.5% compounded on an annualized basis and also has an built in life cover of approximately 21 lacs. Investment of Rs. 9380.00 per month in Risk Related SIP has the potential to generate Rs. 15,000,000.00 in 24 yrs @ 13% compounded on an annualized basis.

Risk Factor

From the above plan the total investment requirement per month = Rs. 45,500.00 out of which Rs.53,880.00 in monthly investment in risk oriented schemes i.e. 73.5% . Rs.19,440.00 Monthly investment in risk averse schemes i.e. 26. 5% of Total monthly investment of Rs.73,320.00 i.e.approximately 58% in risk averse instruments 36% in Risk bearing instruments AND 06% for protection purpose

Please note that the growth rate as well as the tax impact may vary due to change in Government policies. Hence needs review every year.

CASE STUDY 4

Name – mr. ashit chatterjee.

D.O.B – 11. 02. 1975 Age – 39yrs – Occupation – Service WITHOUT ANY Pension provision

Retirement :

In 2033 at age 58 that means another 19 years left to accumulate wealth for Retirement planning for self and spouse as well as old age medical cost provision for both

Current Monthly Take home :

Current monthly take home after deduction of all applicable tax : Rs.95,000.00

Current EMI against Car loan to be paid for the next 3 yrs.: Rs.8,200.00

Personal Loan :

Current EMI of Rs. 14,151.00 against Personal loan of Rs. 5,00,000.00 that has a possibility to get converted to a Home loan of Rs. 10,00,000.00 w.e.f. January 2015 with EMI of Rs. 10,000.00

@ 6% inflation rate Rs. 61,000.00 after 19 yrs = Rs. 1,85,000.00 & @ 7% = Rs. 2,21,000.00 Monthly House rent is Rs. 9,000.00 now that is supposed to become Nil w.e.f. 01.01.2016

Dependents :

Wife : Smt. Sreya Chatterjee by occupation House wife D.O.B.: 19/06/1978 Son : Master Rishav Chatterjee student with signs of nominal autism undergoing treatment D.O.B.: 06/10/2008

Hence it is advisable to provide for a Financial back up for the child even after retirement of the earning parent.

Existing Investment :

- 1. Rs. 1,00,000.00 Fixed Deposit with ABCD Bank

- 2. Rs. 40,000.00 Infrastructure bond

- 3. Accumulation of P.F. contribution till date = Rs. 8,50,000.00

Existing Protection :

- 1. Term Insurance worth Rs.25,00,000.00 for another 6 yrs.

- 2. Medical coverage of Rs. 2,00,000.00 provided by the Employer and another Rs. 2,00,000.00 worth individual mediclaim policy bought by self.

Already Decided :

- 1. To buy a 3 cottah plot of land worth Rs. 2,00,000,00 by November,2014.

- 1. To invest in Equity mutual fund on a regular basis.

- 2. To invest in Gold on a regular basis

- 3. To buy a flat worth Rs. 20,00,000.00 by the year 2017.

- 4. To start a business in another 5 to 8 yrs.

- 1. To buy a Land

- 2. To buy a flat worth Rs. 20,00,000.00 by the year 2017.

- 3. Provision for son’s Higher Education 2026 onward.

- 4. Retirement provision 2033 onward

PROGRAMME Regarding the 3 cottah of land worth Rs. 2 lacs within the next 3 months it is expected that the fund requirement for the same has also been already arranged for. Hence No Plan is required.

PROGRAMME Let us begin by planning to create a corpus of Rs.4,00,000.00 ( 20% Down payment amount to buy a flat ) by the year 2017 i.e. in 3 yr time. Invest Rs. 3,500.00 monthly in ELSS’s through SIP mode. Invest Rs. 6,500.00 monthly in Risk oriented schemes through SIP mode. Avail a home loan for the rest Rs. 16,00,000.00 This EMI to start after the closure of Car loan and discontinuance of House rent.

PROGRAMME Plan for son’s Higher Education corpus of Rs. 10,00,000.00 when he attains 18 yrs of age Rs. 2,200.00/mth in Risk averse schemes @ 8% CAGR = Rs. 5,00,000.00 approx. in 12 yrs Rs. 1,800.00/mth in Risk oriented schemes @ 12% CAGR = Rs. 5,00,000.00 approx. in 12 yrs

PROGRAMME Now, let us plan for Retirement corpus of Rs. 25,000,000.00 in the next 19years. Rs. 10,000.00/mth in Risk oriented schemes may generate with 12% CAGR = Rs. 51,00,000.00 approx. in 16 yrs Rs. 5,000.00/mth in Risk averse schemes may generate with 7.5% CAGR = Rs. 23,50,000.00 approx. in 19 yrs. Rs. 5,000.00/mth in Gold fund may generate with 9% CAGR = Rs. 27,00,000.00 approx. in 19 yrs. Rs. 6,000.00/mth in Risk oriented schemes may generate with 12% CAGR = Rs. 45,00,000.00 approx. in 19 yrs. Plot of land worth Rs. 2,00,000.00 has a growth potential @ 10% CAGR = Rs. 12,00,000.00 approx. in 19 yrs Flat worth Rs. 20,00,000.00 has a growth potential @ 10% CAGR = Rs. 91,50,000.00 approx.in 16 yrs. Mediclal Expense Cover Alternation : Opt for a Floater policy worth Rs 3,00,000.00 to Rs. 5,00,000.00 as per availability at the time of renewal.

Please note that the tax impact as well as the growth rate may vary due to change in Government policies. Hence needs review every year

CASE STUDY 5

Name – sri rahul khanna.

D.O.B – 13.01.1972 Age – 45yrs – Occupation – Service ( Pvt. Sector )

February, 2030 At age 58 yrs ( 13 yrs hence )

Current Annual Take home :

Current annual take home after deduction of all applicable tax : Rs.Rs. 13,00,000.00

Synopsis of current expenditure :

Loan outstanding : Rs. 3,00,000.00 with an EMI of Rs. 16,185.00 Monthly Expense : Rs. 90,000.00

Wife : Occupation : Service ( Pvt. Sector ) D.O.B.: 17.04.1979 Parents : Father aged around 83 yrs ( Pension holder ) Mother aged around 73 yrs ( Pension holder )

- 1. Term Insurance worth Rs. 50,00,000.00 along with Personal Accident Insurance worth Rs. 1 Crore

- 4..Individual Mediclaim worth Rs. 3,00,000.00 covering self, spouse and childrenr

Existing Investment:

- 1. PPF – Present value approx. Rs. 15,00,000.00.

- 2. PF – Present value approx. Rs.10,00,000.00

- 3. Stock – Present value approx. Rs. 10,00,000.00.

- 4. Deposit in Foreign currency equivalent to Rs. 10,00,000.00.

- 5. Gratuity ( A Terminal benefit ) expected Rs. 10,00,000.00.

- 6. Cash in bank savings a/c – Rs. 4,10,000.00.

- 7. Gift from grand parents to both children – @ Rs. 1,00,000.00 each .

- a. S.A. – Rs. 50,000.00 due in Feb. 2019 – Annual prem. – Rs. 3151.00

- b. S.A. – Rs. 2,00,000.00 due in July, 2020 – Annual prem. – Rs. 9608.00

- c. S.A. – Rs. 1,25,000.00 due in May, 2025 – Annual prem. – Rs. 6005.00

- d. S.A. – ? Pension to vest from March, 2032 – Annual prem. Rs. 10,089.00 – Expected annuity – Rs. 2800.00 per month ( S.A. assumed to be Rs. 3 lacs and monthly pension rate @ 6% ) .

- 9. Investable surplus in the range of Rs. 25,000.00 to Rs. 27,500.00 per month.

- 10. Flat – around 1250 sq. ft – worth Rs. 60,00,000.00

- 11. Flat – around 750 sq.ft. -worth Rs. 30,00,000.00

- 1 Creation of a Retirement corpus.

- 2 Provision for Higher Education cost for both the children.

- 3 Provision for daughter’s Marriage .

- 4 Medical insurance.

Observation :

- 1. Monthly expense is inclusive of EMI of Rs. 16,185.00

- 2. On foreclosure of the loan the monthly expense comes down to Rs. 75,000.00..

- 3. And 13 yrs hence this value is equal to Rs. 1,60,000.00

- 4. And 14 yrs hence is equal to Rs. 1,70,000.00 considering inflation @ 6% for both.

Let us also ignore the inflation rate supposed to prevail after retirement as this to some extent will offset with the growth rate in

income vis – a vis investment / savings amount during the accumulation period that is till retirement. From the available data it is observed that the major portion of investment till date is in real estate In comparison to liquid and or cash investment. It is also observed that

- 1. Coverage or protection regard to Accident insurance is adequate.

- 2. Coverage or protection regard to Life insurance may be increased by another Rs. 25,00,000.00

- 3. Medical insurance protection is much better than average and needs to be fine tuned with time.

PROGRAMME: Provision for Higher Education cost for both. For Son – Fund provision after 14 yrs – Rs. 25,00,000.00 ( as per our telephonic discussion as on 08/12/2016) For Daughter – Fund provision after 15 yrs – Rs. 25,00,000.00 ( as per our telephonic discussion as on 08/12/2016

PROGRAMME : Provision for Daughter’s Marriage 23 yrs hence – Rs. 25,00,000.00 ( as per our discussion ) Action required : 1.To invest Rs. 55,000.00 in a risk averse instrument that may grow to Rs. 2,50,000.00. 2. May consider an SIP of Rs. 2,000.00 per month in a risk oriented instrument that may grow to 22,50,000.00

PROGRAMME : Programme for Medical cover : To opt for a family floater policy for Rs. 5,00,000.00 along with a Top up of Rs. 5,00,000.00 instead of an individual mediclaim policy but needs to be reviewed / evaluated on a periodic basis.

1. Risk averse return has been calculated in between 7% and 8%. 2. Risk associated return has been calculated in between 11% and 12%. 3. Pension rate has been calculated @ 6%.

The above programme is on the basis of certain assumptions and expectations and is not binding on anyone . The plan might fail due to various external factors like Government policies, Natural or unnatural calamities, unforeseen circumstances, etc. Whoever follows this plan does so entirely on his / her own risk and discretion.

CASE STUDY 6

Name – sri biplab chowdhury.

D.O.B – 26.05.1976 Age – 41yrs Occupation – Service (Pvt. Sector)

February, 2036 At age 58 yrs ( 19 yrs hence )

Current annual take home after deduction of all applicable tax : Rs.3, 60,000.00

- 1. LICI – Approx. Rs. 24,000.00 annual premium and around Rs. 6, 00,000.00 Sum Assurance to mature after 15 yrs.Expected Amount Rs.9, 50,000.00 on maturity

- 2. Cash and Fixed deposits with bank: Rs. 5, 00,000.00 approx.

- 3.. PF Contribution – Rs.4200.00 p.m. Annual accumulation Rs. 100800.00 including Employer Contribution (Rs.4200.00)in PF.

Current available surplus for further investment : Rs. 20,000.00 per month with a provision for additional Rs. 10,000.00 per month after a year on a/c of Personal loan closure as well as a further provision of Rs. 10,000.00 per month on a/c of stoppage of Rent after shifting to own home.

Existing Protection:

Synopsis of current expenditure:.

- 1. To purchase a home / flat – Budget – Rs. 50,00,000.00 inclusive of renovation & other expense.

- 2. Retirement Corpus at age 60 yrs

- 1. Current Monthly expense is Rs. 25,000.00 the equivalent of which is Rs. 80,200.00 after 20 yrs i.e. on retirement at age 60 yrs ( inflation calculated @ 6% ) .But in reality the 35% to 40% of cost gets reduced on retirement due to certain factors related to old age.But again, being a newly married couple, it is advisable to stick to this mentioned inflated figure because of the probability of a bigger family structure. Thus the required monthly expense on retirement : Rs. 80,200.00 ( Ignoring inflation post retirement but considering a bigger family structure ).

- 2. No pension provision which is indeed a matter than needs to be taken care of.

- 3. Poor return oriented / insurance cover oriented investment : Rs. 24,000.00 Annual Lici premium ( It is neither an insurance product nor an investment product )

Advisable to buy an insurance product from an insurance co. only and an investment product from an investment co. only

PROGRAMME:Creation of Retirement corpus Monthly payment requirement 20 yrs hence – Rs. 80,200.00 ( Taking inflation @ 6% ) Corpus requirement – Rs. 1,62,00,000.00 ( Taking pension rate @ 6% and ignoring inflation after retirement )

Action Required : To continue investment of Rs. 100,000/annum in PF that may grow to Rs. 41,00,000.00 Terminal benefit like Gratuity expected to fetch Rs. 10,00,000.00 May opt for a PPF investment @ Rs. 96,000.00/annum i.e. Rs. 8,000.00 per month that may grow to Rs. 38,00,000.00 To continue existing LICI investments and judicious reinvestment on maturity that may grow to Rs. 13,00,000.00 May consider SIP in risk associated instrument @ Rs. 7,000.00/month that may grow to Rs. 60,00,000.00 I.E . Additional Monthly investment of Rs. 15,000.00 is required ( PPF & SIP ) It is also recommended to go for a Term Insurance for minimum Rs. 50,00,000.00 – premium should be around Rs. 12,000.00 per annum for a standard non-smoker life.

CASE STUDY 7

Name – smt roshni chattoraj.

D.O.B – 30.10.1983 Age – 32yrs Occupation – Service Tax Bracket : 20%

February, 2043 At age 58 yrs ( 26 yrs hence )

Monthly Expense : Rs. 25,000.00

- 1. Investment in SIP ( Risk oriented ) per month = Rs. 4,000.00

- 2. LIP on spouse’s life where annual premium = Rs. 18,000.00 approx.

- 3. LIP on self life with Rs. 2 lakh Sum Insurance where annual premium = Rs. 9,500.00 approx.

- 4. PPF – Investment for F.Y. 14-15 was = Rs. 1.00,000.00 approx.

- 5. Mediclaim for the entire family provided by the employer for Rs. 4,00,000.00 under floater scheme.

- 6. Housing loan : Rs. 18,75,000.00 where EMI = Rs. 19,200/ without any coverage.

- 7. Personal loan: Rs. 3,00,000.00 where EMI = Rs. 7,000/ without any coverage

- 8. Pension : No provision

- 9. Recurring : Rs. 3,000.00 per month with bank to mature in October,2016

- 10. Jeevan Sukanya : Rs. 3,000 per month

- 11. nvestable surplus : Rs. 8,000.00

Existing Loan

- 1.Housing loan : Rs. 18,75,000.00 where EMI = Rs. 19,200/ without any coverage.

- 2.Personal loan: Rs. 3,00,000.00 where EMI = Rs. 7,000/ without any coverage

Existing Protection

- 1. Mediclaim for the entire family provided by the employer for Rs. 4,00,000.00 under floater scheme..

- 2. Pension : No provision

- 3. LIP on spouse’s life where annual premium = Rs. 18,000.00 approx

- 4. LIP on self life with Rs. 2 lakh Sum Insurance where annual premium = Rs. 9,500.00 approx.

- 1. Contingency Provision .

- 2. Financial safe guard on a/c of an eventuality

- 3. Higher Education provision for child starting from age 18 till age 22 yrs i.e. for 5 consecutive years.

- 4. Medical Coverage for the entire family

- 5. Retirement at age 60.

- 6. Financial provision for Marriage of child at age 25 i.e. after 24 yrs

- 1.As per the data gathered the incumbent is under 20% tax bracket with a possibility to reach the 30% bracket by the next couple of years with positive approach.Hence, Fixed deposit with bank or Recurring deposit with bank or Post Office is not advisable as the interest accrued in these instruments is taxable thus reducing the net yield. So it is advisable to discontinue the Recurring of Rs. 3,000.00 per month and this amount will help to meet the requirements of the plan..

- 2. The primary earning member of the said family is Mrs. Chattoraj and hence first and foremost the requirement is to cover the life of Mrs. Chattoraj

- 3. As per the data No pension provision has been made till date. So provision for pension is a priority as well.

PROGRAMME:Contingency Plan Cash at hand and in savings a/c, proceeds of recurring to be treated as Contingency fund and the amount needs to be equivalent to minimum 6 months monthly expense along with EMI AND savings or investment needs to be liquid enough such that any time after 3 yrs from this date the Loan amount could be foreclosed, if demands so.

PROGRAMME: Financial safe guard to family Home loan and Personal loan are without any protection. Recommended to opt for a Term insurance worth RS. 100,00,000.00 with maximum 25 years term. Premium range expected within Rs. 15,0000.00 and Rs. 18,000.00 for a standard female life with smoking habit.

PROGRAMME: Financial Provision for Higher education of child Invest Rs. 8,500.00 every month Sukanya Samriddhi Yoyona for 17 yrs and beyond as per requirement when she attains 18 yrs of age.Though at present the rate is 9.2% let us consider the average rate of return @ 7% for the next 17 yrs. such that corpus may become Rs. 31, 50,000.00..

PROGRAMME: Financial provision for marriage of child after 24 yrs. Invest Rs. 1200.00 per month in a risk bearing instrument for the next 24 yrs such that the target corpus is Rs. 15,00,000.00

PROGRAMME: Retirement at age 60 Needs a corpus of around Rs 2 Crores such that at 6% rate of interest the monthly interest income is Rs. 1,05,000.00.Please note that monthly expense of Rs. 25,000.00 as on today is equivalent to approximately Rs. 1, 30,000.00 after 26 years with 6.5% inflation. Due to limited needs after retirement we may arbitrarily consider the requirement to be Rs. 1,05,000.00 i.Contribute Rs. 7,800.00 per month in PPF for the next 26 yrs such that the corpus reaches Rs. 64,00,000.00. ii.Contribute Rs. 7,600.00 per month in risk bearing instrument for the next 26 yrs such that the corpus target is Rs. 1,36,00,000.00 iii.Contribution expected to be Rs. 750.00 per month approximately in Atal Pension Yoyona for the next 25 yrs such that to receive Rs. 5,000.00 pension every month.

1.Other existing investments in self name and spouse’s name and terminal benefits are not being considered in the above plan as these may act as a buffer to some extent in case of any adverse situation beyond control. 2.The above plan needs an investment of less than Rs. 27,250.00 per month at the initial stage but needs review with change in income level, liability, expense, etc 3.Please note that the tax impact as well as the growth rate may vary due to change in Government policies. 4.The above plan is on the basis of certain assumptions and expectations and is not binding on anyone . The plan might fail due to various external factors like Government policies, Natural or unnatural calamities, unforeseen circumstances, etc. Whoever follows this plan does so entirely on his / her own risk and discretion.

- 1.Term Insurance for Rs. 1 Cr for 25 yrs.

- 2. Investment of an additional Rs. 5,000.00 per month in a risk associated instrument

- 3. Atal Pension Yoyona : Rs. 750.00 each per month for both the spouses till age 60

- 4. Continue Recurring of Rs. 3,000.00 per month till October, 2016 and on maturity invest the same in a liquid instrument under a Contingency plan

- 5. PPF : Target Rs.7,800.00 per month for 26 yrs

- 6. Sukanya Sammriddhi Yoyona : Target Rs. 8,500.00 per month for 17 yrs and beyond

——————–

Get regular updates about latest financial products, schemes and news

Subscribe for FREE NEWSLETTERS

COMMENTS

250 Case Study 12: Susan Wood Case Study Facts Today is December 31, 2018. Susan Wood has come to you, a CFP® professional, for help in developing a plan to accomplish her financial goals. From your initial meeting together, you have gathered the following information. PERSONAL BACKGROUND AND INFORMATION Susan Wood (Age 50)

Financial Planning Challenge 2021 Phase 1: Written Financial Planning Case Study The first phase of the competition consists of a financial planning case study for two hypothetical clients. Students must assess the client's needs and prepare a comprehensive financial plan for the clients based on the data provided. Use of commercially available

Study with Quizlet and memorize flashcards containing terms like You have a new goal of saving at least $4,500 over the course of the next year. You already have $900 saved. By how much would you need to increase your monthly net savings in order to meet this goal? A. $100 B. $150 C. $200 D. $250, Open this link to read more about how credit card interest works. Use this information to ...

The Department of Human Development and Family Studies focuses on the interactions among individuals, families, and their resources and environments throughout their lifespans. It consists of three majors: Child, Adult, and Family Services (preparing students to work for agencies serving children, youth, adults, and families); Family Finance ...

financial planning. They agree to a Scope of Engagement for financial planning that includes all seven steps of the financial planning process. The Millers provide Joe information about their personal and financial circumstances. Joe tells the Millers more about his practice and his firm. Joe prepares and provides to the Millers an Engagement

Research was conducted by Harvard Business School professors Bo Becker, Daniel Bergstresser, and Guhan Subramanian. Key concepts include: Firms that would have been most affected by the proxy access rule, based on institutional ownership, lost value on October 4, 2010, following the news of the rule's delay.

Phase 1: Written Financial Planning Case Study The first phase of the competition consists of a financial planning case study for a hypothetical client. Students must assess the client's needs and prepare a comprehensive financial plan for ... Following TikTok personal finance advice, Sky realized that she wanted her money to always be ...

This course applies students' knowledge and skill set in personal financial planning techniques to a comprehensive case study. Students will integrate into a prioritized comprehensive financial plan core financial planning disciplines of: -Retirement -Investment -Risk management -Income tax -Employee benefits -General principles * Students are eligible to enroll in the capstone course (HS 333 ...

NGPF Case Studies. Case Studies present personal finance issues in the context of real-life situations with all their ambiguities. Students will explore decision-making, develop communication skills, and make choices when there is no "right" answer. To help get you started, NGPF has created support guides to walk you through how to complete ...

In this chapter, we introduce three case studies to illustrate how financial planning is carried out for singles, young couples and mature couples with children. The concerns and needs of singles, young couples and mature married couples are different. In the case of singles, they are primarily concerned with their own financial well-being as ...

The Master of Science degree program in Personal Financial Planning is tailored for financial planners who are interested in expanding their knowledge beyond typical financial licensing and credentials. The curriculum is based on a client-centered, problem-solving method using case studies to give you a hands-on approach to the material.

Study with Quizlet and memorize flashcards containing terms like When revising a budget, it is important to make choices that allow you to continue ____________ money., Buying a new car can create a financial challenge because, To revise a monthly budget, changes in which categories might need to be addressed? Check all that apply. and more.

all current monthly expenditures. A good rule is to spend no more than 25-30% of your ___ income on housing. gross. Simon bought a computer and made monthly payments. By the end of the month, Simon had no money left for groceries. Which step in the decision-making process should Simon now take?

Financial plan fnce 627: week case study below, am including case study for you to complete covering portion of the material we covered this semester. evaluate. ... Personal Financial Planning (FNCE 627) 82 Documents. Students shared 82 documents in this course. University University Canada West. Academic year: 2023/2024.

CFP ® Education Materials. College for Financial Planning ® —a Kaplan Company 's CFP Board-registered education materials provide the focus and structure you need to master the 8 major domains on the CFP ® exam. To place an order by phone, call Student Support at 800-237-9990, option #2 . Please have the ISBN ready when you call.

Step 4: Implementation and Execution of Recommendation. Set up an appointment with attorney to prepare an estate plans, including preparing documents. Meet with independent life insurance agent to compare and select term life insurance policies. Meet with mortgage lender to refinance.

Accident Insurance: Abhishek should take a personal accident comprehensive policy which will cover for accidental death, permanent and partial disability including weekly/monthly compensation for loss of work due to total temporary disability. A PA cover of Rs. 50 lakhs with a TTD cover of Rs. 15 lakhs are suggested.

D. Study with Quizlet and memorize flashcards containing terms like You will need to revise your budget to account for a car payment. Which expense category would be the most difficult to change or reduce?, Discretionary spending: $450 per month New car Insurance: $175 per month Gas: $100 per month Used car Insurance: $125 per month Gas: $100 ...

Want to see a plan that can help you get started with your retirement goal, if you are in your 30s? How to plan for both your children's college education fund in India? - A case study. Here we are with another case study. This one's for Rohan (44) and Shriya (37), who want to send both their children to premier Indian institutions.

The case study revolves around the realm of Personal Financial Planning. Here, Shawn Krukowski adapted a proposal into a presentation, which contains several slides related to financial problems and proposed solutions. Shawn's proposal might relate to ways of creating a financial plan, reducing unnecessary spending, investing wisely, and saving ...

the up-front cost. Study with Quizlet and memorize flashcards containing terms like When making a decision about housing, the first step should be, When revising a budget, it is important to make choices that allow you to continue _________ money., When planning a budget, the biggest consideration should be the and more.

Case Studies. Financial Planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life; it's not just about buying products like a pension or an Invidual Saving Account. It might involve putting appropriate wills in place to protect your family, thinking about how your family will ...

10 of 10. Quiz yourself with questions and answers for Case-Study: Personal Financial Planning (QUIZ!!!), so you can be ready for test day. Explore quizzes and practice tests created by teachers and students or create one from your course material.