The 24 Best eCommerce Retail Case Studies Worth Reading

In the fast-paced world of retail and eCommerce, staying ahead of the game is not just a goal; it’s the lifeline of our industry. For seasoned retail executives, inspiration often comes from the experiences and successes of industry giants who paved the way with their innovative thinking and managed to thrive through thick and thin. That’s why we’re excited to bring you an exclusive collection of the 30 best eCommerce case studies meticulously curated to provide you with a wealth of insights and ideas to fuel your strategies. These case studies are more than just success stories; they are beacons of guidance for retail professionals navigating the ever-changing landscape of our industry.

In this article, we delve deep into the journeys of retail giants who have not only weathered the storms of disruption but have emerged as trailblazers in eCommerce. From adapting to shifting consumer behaviors to mastering the art of online engagement, this compilation offers a treasure trove of wisdom for the modern retail executive.

Table of Contents

- > Case studies for grocery/wholesale eCommerce retailers

- > Case studies for fashion eCommerce retailers

- > Case Studies for home & furniture eCommerce retailers

- > Case Studies for health & beauty eCommerce retailers

- > Case studies for electronics and tools eCommerce retailers

- > Case Studies for toys and leisure eCommerce retailers

Case studies for grocery/wholesale eCommerce retailers

Retail case study #1: tesco .

Industry : Grocery stores

Why worth reading:

- Historical evolution: Understanding Tesco’s rise from a group of market stalls to a retail giant provides valuable lessons on growth and adaptation to market changes.

- Customer service focus: Tesco’s long-term emphasis on customer service, which is consistent across their physical and online platforms, showcases the importance of customer-centric strategies.

- Innovation in eCommerce: The case study covers Tesco’s pioneering of the world’s first virtual grocery store in South Korea, a testament to its innovative approach to digital retailing.

- Crisis management: Insights into how Tesco handled the Horse Meat Scandal, including efforts to tighten its supply chain, contributing to its logistical success.

- Financial integrity: The study discusses the Accounting Scandal, offering a sobering look at financial transparency and the repercussions of financial misreporting.

Read the full Tesco case study here .

Retail case study #2: Walmart

Industry : Discount department and grocery stores

- Data-driven success: The case study provides a wealth of data, showcasing Walmart’s remarkable achievements. With an annual revenue of almost $570 billion, a global presence in 24 countries, and a customer base exceeding 230 million weekly, it’s a testament to the effectiveness of their strategies.

- Marketing strategies: The case study delves deep into Walmart’s marketing strategies. It highlights their focus on catering to low to middle-class demographics, the introduction of the Walmart Rewards loyalty program, and their commitment to environmental sustainability, all of which have contributed to their success.

- eCommerce transformation: As eCommerce continues to reshape the retail landscape, this case study details how Walmart shifted significantly towards omnichannel retail. Readers can learn about their innovative technologies and approaches, such as personalized shopping experiences and augmented reality, that have helped them adapt to changing consumer behavior.

- Supply chain innovation: Walmart’s proficiency in supply chain management is a crucial takeaway for retail executives. Their decentralized distribution center model , in-house deliveries, and data-driven optimization exemplify the importance of efficient logistics in maintaining a competitive edge.

Read the full Walmart case study here .

Retail case study #3: Sainsbury’s

Industry : Grocery stores

- Omnichannel success amidst pandemic challenges: With the fastest growth in online shopping among major retailers, the study illustrates how Sainsbury’s adapted and thrived during unprecedented times.

- Dynamic brand positioning: The analysis delves into Sainsbury’s strategic shift in brand positioning, demonstrating a keen responsiveness to changing consumer preferences. This shift showcases the brand’s agility in aligning with contemporary health-conscious consumer trends, supported by relevant data and market insights.

- Supply chain and quality assurance: The study highlights Sainsbury’s commitment to a stellar supply chain, emphasizing the correlation between high product quality, ethical sourcing, and customer loyalty. With data-backed insights into the extensive distribution network and sourcing standards, retail executives can glean valuable lessons in maintaining a competitive edge through a robust supply chain.

- Innovative technological integration: Sainsbury’s implementation of cutting-edge technologies, such as Amazon’s “Just Walk Out” and Pay@Browse, demonstrates a commitment to providing customers with a seamless and convenient shopping experience.

- Diversification beyond grocery: The case study unveils Sainsbury’s strategic partnerships with companies like Amazon, Carluccio’s, Itsu, Leon, and Wasabi, showcasing the brand’s versatility beyond traditional grocery retail.

Read the full Sainsbury’s case study here .

Retail case study #4: Ocado

- From startup to industry leader: The Ocado case study presents a remarkable journey from a three-employee startup in 2000 to becoming the UK’s largest online grocery platform.

- Omnichannel excellence: The study emphasizes Ocado’s success in implementing an omnichannel approach, particularly its early adoption of smartphone technology for customer engagement.

- Operational efficiency: From automated warehouses with machine learning-driven robots to digital twins for simulating order selection and delivery processes, the data-rich content sheds light on how technology can be leveraged for operational efficiency.

- Navigating challenges through innovation: Ocado’s strategic response to challenges, particularly its shift from primarily a grocery delivery service to a technology-driven company, showcases the power of innovative thinking. The case study details how Ocado tackled complexities associated with grocery deliveries and embraced technology partnerships to stay ahead.

- Strategic partnerships: The study sheds light on Ocado’s strategic partnerships with grocery chains and companies like CitrusAd for advertising opportunities on its platform.

Read the full Ocado case study here .

Retail case study #5: Lidl

Industry : Discount supermarkets

- Longevity and evolution: The article provides a detailed overview of Lidl’s origins and evolution, offering insights into how the brand transformed from a local fruit wholesaler to a global retail powerhouse. Understanding this journey can inspire retail executives to explore innovative strategies in their own companies.

- Global success: Retail executives can draw lessons from Lidl’s international expansion strategy, identifying key factors that contributed to its success and applying similar principles to their global ventures.

- Awards and recognitions: The numerous awards and accomplishments earned by Lidl underscore the effectiveness of its marketing strategy. Marketers and eCommerce professionals can learn from Lidl’s approach to quality, innovation, and customer satisfaction.

- Comprehensive marketing components: The article breaks down Lidl’s marketing strategy into key components, such as pricing strategy, product diversification, and target audience focus. Readers can analyze these components and consider incorporating similar holistic approaches in their businesses to achieve well-rounded success.

- Omnichannel transformation: The discussion on Lidl’s transformation to an omnichannel strategy is particularly relevant in the current digital age. This information can guide executives in adopting and optimizing similar omnichannel strategies to enhance customer experiences and drive sales.

Read the full Lidl case study here .

Retail case study #6: ALDI

Industry : FMCG

- Omnichannel approach: Aldi’s growth is attributed to a robust omnichannel strategy that seamlessly integrates online and offline channels. The case study delves into how Aldi effectively implemented services that can overcome the intricacies of a successful omnichannel approach in today’s dynamic retail landscape.

- Target market positioning: Aldi’s strategic positioning as the most cost-effective retail store for the middle-income group is explored in detail. The case study elucidates how Aldi’s pricing strategy, emphasizing the lowest possible prices and no-frills discounts, resonates with a wide audience.

- Transparency: Aldi’s commitment to transparency in its supply chain is a distinctive feature discussed in the case study. For retail executives, understanding the importance of transparent supply chain practices and their impact on brand perception is crucial in building consumer trust.

- Differentiation: Aldi’s successful “Good Different” brand positioning, which communicates that low prices result from conscientious business practices, is a key focus of the case study. Effective differentiation through brand messaging contributes to customer trust and loyalty, especially when combined with ethical business practices.

- CSR Initiatives: The case study highlights Aldi’s emphasis on social responsibility to meet the expectations of millennial and Gen-Z shoppers. By consistently communicating its CSR efforts, such as sustainable sourcing of products, Aldi creates a positive brand image that resonates with socially conscious consumers and builds brand reputation.

Read the full Aldi case study here .

Retail case study #7: ASDA

Industry : Supermarket chain

- Omnichannel implementation: The case study details how ASDA seamlessly integrates physical and virtual channels, offering customers a diverse shopping experience through in-store, digital checkouts, Click & Collect services, and a dedicated mobile app.

- Market segmentation strategies: The incorporation of partnerships with young British designers and influencer collaborations, coupled with socially progressive messaging, reflects a strategic shift that can inspire marketers looking to revitalize product lines.

- Crisis management and ethical branding: The study highlights ASDA’s strong response to the COVID-19 crisis, with ASDA’s actions showcasing a combination of crisis management and ethical business practices. This section provides valuable insights for executives seeking to align their brand with social responsibility during challenging times.

- Product and format diversification: ASDA’s product categories extend beyond groceries, including clothing, home goods, mobile products, and even insurance. The case study explores how ASDA continues to explore opportunities for cross-promotion and integration.

- Website analysis and improvement recommendations: The detailed analysis of ASDA’s eCommerce website provides actionable insights for professionals in the online retail space. This section is particularly beneficial for eCommerce professionals aiming to enhance user experience and design.

Read the full ASDA case study here .

Case studies for fashion eCommerce retailers

Retail case study #8: Farfetch

Industry : Fashion retail

- Effective SEO strategies: The Farfetch case study offers a detailed analysis of the company’s search engine optimization (SEO) strategies, revealing how it attracted over 4 million monthly visitors. The data presented underscores the importance of patient and dedicated SEO efforts, emphasizing the significance of detailed page structuring, optimized content, and strategic backlinking.

- Paid search advertising wisdom and cost considerations: The study delves into Farfetch’s paid search advertising approach, shedding light on its intelligent optimization tools and the nuances of running localized advertisements. Moreover, it discusses the higher cost of visitor acquisition through paid search compared to organic methods, providing valuable insights for marketers navigating the paid advertising landscape.

- Innovative LinkedIn advertising for talent acquisition: Farfetch’s unique use of LinkedIn advertising to attract talent is a standout feature of the case study and highlights the significance of proactive recruitment efforts and employer branding through social media channels.

- Strategic use of social media platforms: Exploring the brand’s highly consistent organic marketing across various social media channels, with a focus on visual content, highlights Farfetch’s innovative use of Instagram’s IGTV to promote luxury brands. The emphasis on social media engagement numbers serves as a testament to the effectiveness of visual content in the eCommerce and fashion sectors.

- Website design and conversion optimization insights: A significant portion of the case study is dedicated to analyzing Farfetch’s eCommerce website, providing valuable insights for professionals aiming to enhance their online platforms. By identifying strengths and areas for improvement in the website’s design, marketers, and eCommerce professionals can draw actionable insights for their platforms.

Read the full Farfetch case study here .

Retail case study #9: ASOS

Industry : Fashion eCommerce retail

- Mobile shopping success: eCommerce executives can draw inspiration from ASOS’s commitment to enhancing the mobile shopping experience, including features such as notifications for sale items and easy payment methods using smartphone cameras.

- Customer-centric mentality: ASOS emphasizes the importance of engaging customers on a personal level, gathering feedback through surveys, and using data for continuous improvement. This approach has contributed to the brand’s strong base of loyal customers.

- Inclusive marketing: ASOS’s adoption of an ‘all-inclusive approach’ by embracing genderless fashion and featuring ‘real’ people as models reflects an understanding of evolving consumer preferences. Marketers can learn from ASOS’s bold approach to inclusivity, adapting their strategies to align with the latest trends and values embraced by their target audience.

- Investment in technology and innovation: The case study provides data on ASOS’s substantial investment in technology, including visual search, voice search, and artificial intelligence (AI). eCommerce professionals can gain insights into staying at the forefront of innovation by partnering with technology startups.

- Efficient global presence: ASOS’s success in offering a wide range of brands with same and next-day shipping globally is attributed to its strategic investment in technology for warehouse automation. This highlights the importance of operational efficiency through technology, ensuring a seamless customer experience and reduced warehouse costs.

Read the full ASOS case study here .

Retail case study #10: Tommy Hilfiger

Industry : High-end fashion retail

- Worldwide brand awareness: The data presented highlights Tommy Hilfiger’s remarkable journey from a men’s clothing line in 1985 to a global lifestyle brand with 2,000 stores in 100 countries, generating $4.7 billion in revenue in 2021. This strategic evolution, exemplified by awards and recognitions, showcases the brand’s adaptability and enduring relevance in the ever-changing fashion landscape.

- Adaptation and flexibility to changing market trends: The discussion on how the brand navigates changing trends and overcame market saturation, particularly in the US, provides practical insights for professionals seeking to navigate the challenges of evolving consumer preferences.

- Successful omnichannel marketing: Tommy Hilfiger’s success is attributed to a brand-focused, digitally-led approach. The analysis of the brand’s omnichannel marketing strategy serves as a map for effective promotion and engagement across various channels.

- Decision-making and customer engagement: The case study emphasizes the brand’s commitment to data-driven decision-making with insights into customer behavior, leveraging data for effective customer engagement.

Read the full Tommy Hilfiger case study here .

Retail case study #11: Gap

- Overcoming challenges: The case study provides a comprehensive look at Gap Inc.’s financial performance, and growth despite the challenges. These insights can offer valuable takeaways into effective financial management and strategies for sustained success.

- Strong branding: Gap’s journey from a single store to a global fashion retailer reveals the importance of strategic brand positioning. Understanding how Gap targeted different market segments with unique brand identities, can inspire retail executives looking to diversify and expand their brand portfolios.

- Omnichannel adaptation: The case study delves into Gap’s omnichannel strategy, illustrating how the company seamlessly integrates online and offline experiences.

- Unique use of technology: By exploring the technologies Gap employs, such as Optimizely and New Relic, retail executives can learn about cutting-edge tools for A/B testing, personalization, and real-time user experience monitoring. This insight is crucial for staying competitive in the digital retail landscape.

- Inspiring solutions: The case study highlights challenges faced by Gap, including logistical, technological, financial, and human resource challenges.

Read the full Gap case study here .

Retail case study #12: Superdry

- Success story: The case study emphasizes SUPERDRY’s successful transition to an omnichannel retail strategy, with in-depth insights into their adaptation to online platforms and the integration of technologies like the Fynd app.

- Mobile-first and social-first strategies: As mobile internet usage continues to rise, understanding how SUPERDRY leverages videos and social media to engage customers can offer valuable takeaways for optimizing digital strategies.

- Sustainable fashion focus: Executives looking to appeal to environmentally conscious consumers can gain insights into how SUPERDRY navigated the shift towards sustainable practices and became a leader in eco-friendly fashion.

- Data-driven marketing strategies: The case study delves into SUPERDRY’s social media marketing strategies, showcasing how the company uses targeted campaigns, influencers, and seasonal keywords.

- Global market understanding: By exploring SUPERDRY’s experience in the Chinese market and its decision to exit when faced with challenges, the case study offers valuable insights into global market dynamics.

Read the full SUPERDRY case study here .

Retail case study #13: New Look

Industry : Fast-fashion retail

- Strategic pivots for profitability: A decade of revenue contraction led New Look to adopt transformative measures, from restructuring credits to withdrawing from non-profitable markets.

- Omnichannel strategy: Marketers and eCommerce professionals can study New Look’s journey, understanding how the integration of physical stores and online platforms enhances customer experience, reduces costs, and improves profitability.

- Social media mastery: The case study underscores the pivotal role of social media in engaging audiences, showcasing how New Look leverages user-generated content to build brand loyalty and maintain a positive brand perception.

- Effective partnerships for growth: New Look strategically partners with major eCommerce platforms like eBay & Next to expand its brand presence, and tap into new audiences and markets.

Read the full New Look case study here .

Retail case study #14: Zara

- Rapid international expansion through innovative strategies: Zara’s unique approach to continuous innovation and quick adaptation to fashion trends fueled its global success. Marketers can learn how to build brand narratives that resonate across diverse markets, and eCommerce professionals can glean strategies for seamless international expansion.

- Revolutionary eCommerce tactics: The case study provides a deep dive into Zara’s eCommerce strategy, emphasizing the importance of agility and responsiveness. The brand can be a bright example of implementing supply chain strategies for a swift market adapting to rapid fashion cycles.

- Visionary leadership: Amancio Ortega’s low-profile persona and visionary leadership style are explored in the case study, aiding retail executives to learn about leadership strategies that prioritize customer-centric business models.

- Omnichannel marketing and integrated stock management: Zara’s successful integration of automated marketing and stock management systems is a focal point in the case study. With insights into implementing integrated stock management systems to meet the demands of both online and offline channels, Zara can inspire professionals to improve their operations.

- Co-creation with the masses: Zara’s innovative use of customer feedback as a driving force for fashion trends is a key takeaway. Marketers can learn about the power of customer co-creation in shaping brand identity, and eCommerce professionals can implement similar models for product launches and updates.

Read the full Zara case study here .

Case Studies for home & furniture eCommerce retailers

Retail case study #15: john lewis.

Industry : Homeware and clothing retail

- Omnichannel perspective: The data-driven approach, especially in tracking orders and customer behavior, serves as a blueprint for any retail business aiming to enhance its omnichannel experience.

- Strategic growth factors: This case study offers concrete data on the strategies that contributed to the company’s sustained success, inspiring similar endeavors.

- Innovative customer engagement: John Lewis’s take on customer engagement showcases the brand’s agility and responsiveness to evolving consumer needs, supported by data on the effectiveness of these initiatives.

- eCommerce best practices and pitfalls: The analysis of John Lewis’s eCommerce website provides a data-backed evaluation of what works and what could be improved. The critique is grounded in data, making it a valuable resource for those looking to optimize their online platforms.

Read the full John Lewis case study here .

Retail case study #16: Argos

Industry : Homeware catalog retail

- Adaptation to the changing retail landscape: Argos’s journey from a catalog retailer to a retail giant demonstrates its ability to successfully adapt to the evolving retail landscape.

- Omnichannel success story: The case study provides a detailed analysis of Argos’s omnichannel strategy, showcasing how the company effectively integrated online and offline channels to achieve a seamless shopping experience across multiple touchpoints.

- Market share and financial performance: The inclusion of data on Argos’s market share and financial performance offers retail executives concrete metrics to evaluate the success of the marketing strategy. Understanding how Argos maintained a robust market share despite challenges provides actionable insights.

- Technological advancements: The case study delves into the technologies employed by Argos, such as Adobe Marketing Cloud, New Relic, and ForeSee.

- Overcoming obstacles: By examining the challenges faced by Argos, including logistical, technological, financial, and human resources challenges, retail executives can gain a realistic understanding of potential obstacles in implementing omnichannel strategies.

Read the full Argos case study here .

Retail case study #17: IKEA

Industry : Home & furniture retail

- Data-driven evolution: This detailed case study offers a data-rich narrative, illuminating the brand’s evolution into a leader in omnichannel retail.

- Pandemic response: This exploration delves into the integration of eCommerce strategies, online expansions, and the balance between physical and digital customer experiences.

- Advanced mobile apps and AR integration: A deep dive into IKEA’s innovative applications, notably the AR app “IKEA Place,” showcases how the brand leverages technology for a seamless customer experience.

- Democratic design approach: The study meticulously breaks down IKEA’s success factors, emphasizing the brand’s holistic approach through the lens of “Democratic Design.”

- DIY mentality and demographic targeting: A detailed analysis of how IKEA’s affordability is intertwined with a Do-It-Yourself (DIY) mentality. The case study explores how IKEA strategically tapped into a shift in consumer behavior, particularly among younger demographics, influencing not only purchasing patterns but also reshaping industry norms.

Read the full IKEA case study here .

Retail case study #18: Marks & Spencer

Industry : Clothing and home products retail

- Valuable lessons in eCommerce: The Marks & Spencer eCommerce case study offers a profound exploration of the brand’s journey from a latecomer to the online scene to a digital-first retailer.

- Real-world application of effective solutions: By diving into the history of Marks & Spencer, the case study provides tangible examples of how a retail giant faced setbacks and strategically pivoted to revitalize its eCommerce platform.

- Data-driven analysis of eCommerce failures: The case study meticulously analyzes the pitfalls Marks & Spencer encountered during its eCommerce journey, offering a data-driven examination of the repercussions of a poorly executed website relaunch.

- Multichannel customer experience: Marks & Spencer’s shift towards a multichannel customer experience is dissected in the case study, emphasizing the significance of a seamless user journey for increased customer satisfaction and loyalty.

- Embracing technology: Exploring Marks & Spencer’s technological innovations, such as the introduction of an intelligent virtual assistant can enhance the customer shopping journey, foster engagement, and contribute to revenue growth.

Read the full Marks & Spencer case study here .

Retail case study #19: Macy’s

Industry : Clothing and homeware retail

- Resilience and adaptability: The case study showcases Macy’s ability to navigate and triumph over obstacles, especially evident during the COVID-19 pandemic. Despite hardships, Macy’s not only survived but thrived, achieving $24.4 billion in net sales for 2022.

- Omnichannel innovation: Macy’s successful transition to omnichannel retailing is a standout feature. The case study delves into Macy’s implementation of a seamless omnichannel strategy, emphasizing the integration of physical and digital retail channels.

- Private label strategy: The introduction of new private brands and the emphasis on increasing the contribution of private brands to sales by 2025 provides a strategic lesson. Retailers can learn from Macy’s approach to enhancing control over production and distribution by investing in private brands, ultimately aiming for a more significant share of profits.

- Groundbreaking retail media strategy: Macy’s innovative approach to retail media and digital marketing is another compelling aspect. For marketers, this presents a case study on how to leverage proprietary shopper data for effective advertising, including entry into connected TV (CTV).

- Community engagement and social responsibility: The case study explores Macy’s “Mission Every One” initiative, highlighting its commitment to corporate citizenship and societal impact, integrating values into business strategies.

Read the full Macy’s case study here .

Case Studies for health & beauty eCommerce retailers

Retail case study #20: the body shop .

Industry : Beauty, health, and cosmetics

- Activism and ethical values: The Body Shop has pioneered promoting eco-friendly, sustainable, and cruelty-free products. The brand’s mission is to empower women and girls worldwide to be their best, natural selves. This strong ethical foundation has been integral to its identity.

- Recycling, community fair trade, and sustainability: The Body Shop initiated a recycling program early on, which turned into a pioneering strategy. It collaborates with organizations to create sustainable solutions for recycling, such as the Community Trade recycled plastic initiative in partnership with Plastics for Change.

- Product diversity: The Body Shop’s target demographic primarily focuses on women, but it has expanded some product lines to include men. Its products include skincare, hair and body treatments, makeup, and fragrances for both men and women.

- Omnichannel strategy, technology, and eCommerce best practices: The Body Shop has embraced an omnichannel approach that incorporates personalization, customer data and analytics, and loyalty programs. The Body Shop utilizes technology, including ContactPigeon, for omnichannel customer engagement, personalization, and data-driven decision-making.

Read the full The Body Shop case study here .

Retail case study #21: Boots

Industry : Pharmacy retail

- Long-term success: Boots’ rich history serves as a testament to the effectiveness of the brand’s strategies over time, offering valuable insights into building a brand that withstands the test of time.

- Strategic omnichannel approach: The Boots case study provides a deep dive into the marketing strategy that propelled the brand to success, with valuable insights into crafting effective omnichannel growth.

- Impactful loyalty program: Marketers can glean insights into designing loyalty programs that resonate with customers, fostering brand allegiance.

- Corporate Social Responsibility (CSR) as a pillar: The case study sheds light on how Boots addresses critical issues like youth unemployment and climate change, showcasing how a socially responsible approach can positively impact brand perception.

- Adaptive strategies during crises: Boots’ proactive role during the COVID-19 pandemic, offering vaccination services and supporting the National Health Service (NHS), demonstrates the brand’s agility during crises.

Read the full Boots case study here .

Retail case study #22: Sephora

Industry : Cosmetics

- Authentic customer experience-focused mentality: Backed by an impressive array of data, the case study meticulously outlines how Sephora transforms its in-store spaces into digital playgrounds, leveraging mobile technologies, screens, and augmented reality to enhance the customer shopping experience.

- Exceptional omnichannel business plan: The early adoption of an omnichannel strategy has been pivotal to Sephora’s ascendancy. The case study delves into the mobile app’s central role, acting as a comprehensive beauty hub with data-driven insights that drive the success of groundbreaking technologies.

- Omnichannel company culture: The case study illuminates this by detailing how this amalgamation allows a holistic view of the customer journey, blurring the lines between online and in-store interactions. This unique approach positions Sephora as a global leader in turning omnichannel thinking into a robust business strategy.

- Turning data into growth: Sephora’s adept utilization of mobile technologies to harness customer insights is a beacon for retailers in an era where data reigns supreme. The case study dissects how a surge in digital ad-driven sales, showcases the power of data-driven decision-making.

Read the full Sephora case study here .

Case studies for electronics and tools eCommerce retailers

Retail case study #23: screwfix.

Industry : Tools and hardware retail

- Innovative omnichannel approach: The case study highlights how the company strategically implemented online ordering with in-store pickup, creating a seamless shopping experience that contributed to a significant sales growth of 27.9% in just one year.

- Customer-centric strategies: Marketers can gain insights from Screwfix’s emphasis on customer experience. By studying customer feedback and incorporating personalized shopping experiences, Screwfix achieved success in the competitive home improvement sector.

- Supply chain management for rapid growth: The company strategically opened distribution centers to keep up with demand, ensuring efficient inventory management for both online and in-store orders.

- Mobile-first approach for trade professionals: With a customer base primarily consisting of trade professionals, the company’s mobile app allows for easy inventory search, order placement, and quick pickups, catering to the needs of time-sensitive projects.

- Commitment to employee well-being and community: Retail executives and marketers can draw inspiration from Screwfix’s commitment to building a positive workplace culture.

Read the full Screwfix case study here .

Case Studies for toys and leisure eCommerce retailers

Retail case study #24: lego.

Industry : Toys and leisure retail

- Global reach strategies: LEGO’s case study meticulously outlines LEGO’s focused approach, investing in flagship stores and understanding the local market nuances.

- Diversification and licensing brilliance: LEGO’s commitment to diversification through licensing and merchandising emerges as a beacon for marketers. The collaboration with well-established brands, the creation of movie franchises, and themed playsets not only elevate brand visibility but also contribute significantly to sales.

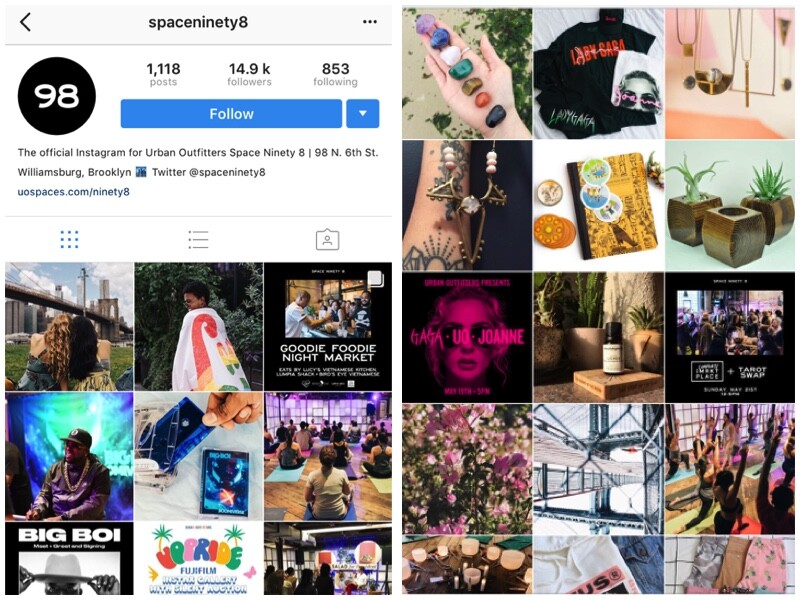

- Social media takeover: The case study unveils LEGO’s unparalleled success on social media platforms, boasting over 13 million Facebook followers and 10.04 billion views on YouTube. LEGO’s adept utilization of Facebook, Instagram, and YouTube showcases the power of social media in engaging customers.

- User-generated content (UGC) as a cornerstone: LEGO’s innovative use of digital platforms to foster a community around user-generated content is a masterclass in customer engagement. This abundance of UGC not only strengthens brand loyalty but also serves as an authentic testament to LEGO’s positive impact on users’ lives.

- Education as a marketing pillar: LEGO’s unwavering commitment to education, exemplified by its partnerships and $24 million commitment to educational aid, positions the brand as more than just a toy. Aligning brand values with social causes and leveraging educational initiatives, builds trust and credibility.

- Cutting-edge mobile strategy: Sephora’s foresight into the mobile revolution is dissected in the case study, presenting a playbook for retailers aiming to capitalize on the mobile landscape.

Read the full LEGO case study here .

Tons of eCommerce retail inspiration, in one place

In the realm of business, success stories are not just tales of triumph but blueprints for aspiring executives to carve their paths to growth. The case studies explored here underscore a common theme: a mindset poised for evolution, a commitment to experimentation, and an embrace of emerging trends and technologies are the catalysts for unparalleled growth.

For any executive eager to script their growth story, these narratives serve as beacons illuminating the way forward. The dynamic world of retail beckons those ready to challenge the status quo, adopting the strategies and technologies that promise scalability. The key lies in constant optimization, mirroring the agility demonstrated by industry leaders.

As you embark on your growth journey, consider the invaluable lessons embedded in these success stories. Now is the time to experiment boldly, adopting new trends and technologies that align with your brand’s ethos. If you seek personalized guidance on navigating the intricate landscape of growth, our omnichannel retail experts at ContactPigeon are here to assist. Book a free consultation call to explore how our customer engagement platform can be the linchpin of your growth strategy. Remember, the path to scaling growth begins with a willingness to innovate, and your unwritten success story awaits its chapter of transformation.

Let’s Help You Scale Up

Loved this article? We also suggest:

Sofia Spanou

Sign up for a demo.

Strategic Retail Management

Text and International Cases

- © 2017

- Joachim Zentes 0 ,

- Dirk Morschett 1 ,

- Hanna Schramm-Klein 2

FB Wirtschaftswissenschaften, Universität des Saarlandes FB Wirtschaftswissenschaften, Saarbrücken, Germany

You can also search for this author in PubMed Google Scholar

University of Fribourg, Fribourg, Switzerland

University of siegen, siegen, germany.

Retail management in 18 lessons

Each lesson includes key issues and a comprehensive case study

Includes supplementary material: sn.pub/extras

2.04m Accesses

41 Citations

15 Altmetric

- Table of contents

About this book

Authors and affiliations, about the authors, bibliographic information.

- Publish with us

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents(20 chapters)

Front matter, functions, formats and players in retailing, retail functions.

- Joachim Zentes, Dirk Morschett, Hanna Schramm-Klein

Store-based Retailing – Food and Near-food

Store-based retailing – general merchandise, online retailing, cross-channel retailing, vertical players – manufacturers and verticals, strategic marketing in retailing, growth strategies, the internationalisation of retailing, retail branding and positioning, corporate social responsibility, marketing mix in retailing, store location – trading area analysis and site selection, merchandise and category management, marketing communication, in-store marketing, customer relationship management.

- International case studies

- Multichannel retailing

- Online retailing

- Retail formats

- Retailing Performance measurement

- Retailing logistics

Joachim Zentes

Dirk Morschett

Hanna Schramm-Klein

Book Title : Strategic Retail Management

Book Subtitle : Text and International Cases

Authors : Joachim Zentes, Dirk Morschett, Hanna Schramm-Klein

DOI : https://doi.org/10.1007/978-3-658-10183-1

Publisher : Springer Gabler Wiesbaden

eBook Packages : Business and Management , Business and Management (R0)

Copyright Information : Springer Fachmedien Wiesbaden GmbH 2017

Softcover ISBN : 978-3-658-10182-4 Published: 18 October 2016

eBook ISBN : 978-3-658-10183-1 Published: 07 October 2016

Edition Number : 3

Number of Pages : XVI, 468

Number of Illustrations : 150 b/w illustrations

Topics : Trade , Sales/Distribution , Marketing

Policies and ethics

- Find a journal

- Track your research

Retail Management Notes, PDF I MBA 2024

- Post last modified: 5 April 2022

- Reading time: 10 mins read

- Post category: Uncategorized

Download Retail Management Notes, PDF, Books, Syllabus for MBA 2024. We provide complete retail management pdf. Retail Management study material includes retail management notes, book, courses, case study, syllabus, question paper, MCQ, questions and answers and available in retail management pdf form.

Retail Management subject is included in MBA so students are able to download retail management notes for MBA 3rd year and retail management notes for MBA 5th semester.

Table of Content

- 1 Retail Management Syllabus

- 2 Retail Management PDF

- 3 Retail Management Notes

- 4 Retail Management Questions and Answers

- 5 Retail Management Question Paper

- 6 Retail Management Books

Retail Management Notes can be downloaded in retail management pdf from the below article.

Retail Management Syllabus

A detailed retail management syllabus as prescribed by various Universities and colleges in India are as under. You can download the syllabus in retail management pdf form.

- Unit 1: Introduction to Retailing: An overview of Global Retailing – Challenges and opportunities – Retail trends in India – Socio-economic and technological Influences on retail management – Government of India policy implications on retails.

- Unit 2: Retail Formats: Organized and unorganized formats – Different organized retail formats – Characteristics of each format – Emerging trends in retail formats – MNC’s role in organized retail formats.

- Unit 3: Retailing Decisions: Choice of retail locations – internal and external atmospherics – Positioning of retail shops – Building retail store Image – Retail service quality management – Retail Supply Chain Management – Retail Pricing Decisions. Merchandising and category management – buying.

- Unit 4: Retail Shop Management: Visual Merchandise Management – Space Management – Retail Inventory Management – Retail accounting and audits – Retail store brands – Retail advertising and promotions – Retail Management Information Systems – Online retail.

- Unit 5: Recent Trends in Retailing: Ethics in Retailing – CRM in Retailing – Research in Retailing – Common woes of Retailing – consumerism in Retailing

Retail Management PDF

Retail management notes.

According to Phillip Kotler: “Retailing includes all the activities involved in selling goods or services to the final consumers for personal and non-business use.”

Retailing is the world’s largest private sector contributing to 8% of the GDP and it employs one sixth of the labor force. The estimated retail trade is expected to be 7 trillion US $. Many countries have developed only due to retailing and presently we see there is a vast change in the retail industry. As far as India is concerned it contributes to 14% of our GDP and it is the second largest sector next to agriculture which provides employment to more number of persons.

Retail Management Questions and Answers

If you have already studied the retail management and notes, then it’s time to move ahead and go through previous year retail management question and answers.

- Explain the Challenges and opportunities of retailing.

- Explain the retail trends in India.

- Briefly explain the socio economic influences on retail management.

- Describe the government of India policy implications on retails.

- Elucidate the organized and unorganized format.

- Explain the different organized retail formats.

- Describe the characteristics of an Explain the choice of retail locations.

- Explain the internal and external atmospherics.

- Describe the positioning of retail shops organized retail format.

- Explain visual merchandise management.

- Briefly describe the space management.

- Explain the retail shopper behavior.

- Explain the shopper profile analysis.

- Describe the shopping decision process.

- Describe the factors influencing retail shopper behavior.

Retail Management Question Paper

If you have already studied the retail management and notes, then it’s time to move ahead and go through previous year retail management question paper.

It will help you to understand the question paper pattern and type of retail management question and answer asked in MBA 3rd year retail management exam. You can download the syllabus in retail management pdf form.

Retail Management Books

Below is the list of retail management books recommended by the top university in India.

- Michael Havy, Boston, Aweitz and Ajay Pandit, Retail Management, Tata McGraw Hill, Sixth.

- Ogden Integrated Retail Management, Biztantra, India, 2008.

- Suja R.Nair – Retail Management. Himalaya book Publishers.

- Patrick M. Dunne and Robert F Lush, Retailing, Thomson Learning, 4th Edition 2008.

- Chet an Bajaj, Rajnish Tow and Nidhi V. Srivatsava, Retail Management, Oxford University.

- Swapna Pradhan, Retail Management -Text and Cases, Tata McGraw Hill, 3rd Edition, 2009.

- Dunne, Retailing, Cengage Learning, 2nd Edition, 2008.

- Ramakrishna and Y.R.Srinivasan, Indian Retailing Text and Cases, Oxford University Press,.

- Dr.Jaspreet Kaur, Customer Relationship

In the above article, a student can download retail management notes for MBA 3rd year and retail management notes for MBA 6th semester. Retail Management study material includes retail management notes, retail management books, retail management syllabus, retail management question paper, retail management case study, retail management questions and answers, retail management courses in retail management pdf form.

Go On, Share & Help your Friend

Did we miss something in MBA Study Material or You want something More? Come on! Tell us what you think about our post on Corporate Taxation Notes | PDF, Book, Syllabus | MBA 2024 in the comments section and Share this post with your friends.

You Might Also Like

What is technopreneurship traits, challenges, importance, risk, boolean algebra and logic gates, what is kaizen practice, benefits, backconnect proxy: the key to your online anonymity and security, auction sale: types, rules, relationship, what is benchmarking types, process, what is group dynamics factors effecting, groupthink, strategies, financial decision making, group decision making, industrial relations management notes, pdf i mba 2024, what is taxation objectives, structure, types, tds, indian political system notes, pdf i mba 2024, leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

Free Case Studies on Retail Management

Here is a compilation of top four case studies on retail management.

1 . Case Study on Kanchi Silks:

Kanchi Silks is a well-known fashion saree retailer in Kanchipuram that provides one-stop shopping for all sarees. The product variety is truly amazing, covering a wide range including Arani, Bangalore, Dharmavaram, Kanchipuram, Kumbhakonam, Pochampalli, Salem, Tanjavur, Venkatagiri etc. Kanchi Silks was established in 1981 at Vilakadi Kovil Street.

Its original site of 500 sq. ft. has now grown to more than 1,00,000 sq. ft. in two or three floors in adjacent locations, with over 1,00,000 SKUs. The store sales revenue in 2007 was more than Rs.20 crore. The founder, Mr. Murugan, can often be seen serving customers, unrecognized by those whom he serves.

On normal weekdays, 15-25 customers visit the store with the number increasing to 100 plus customers at times on weekdays as well as the weekends. His early memories begin with the time he joined the family profession of manufacturing silk saree boxes, made out of paper boards which he supplied to leading silk saree manufacturers. He started his first store with an area of 500 sq. ft. at his residence in Kanchipuram.

ADVERTISEMENTS:

Kanchipuram town is known as the silk city since the main profession of the people is weaving silk sarees. Its economy is entirely dependent on tourism and the well-established handloom industry. Approximately 70 per cent of Kanchi Silks customers are tourists and the rest are locals. The tourists are mainly from the neighboring states especially from Karnataka, Andhra Pradesh and Kerala.

In terms of competition, Kanchi Silks unique positioning is its location. This area is closer to the market area where all the leading silks manufactures have their stores. This store is located at residential area having some great advantages like ample parking facility and easy accessibility from the main road. Even local retailers find difficult to compete with Kanchi Silks on pricing due to higher overheads.

Kanchi Silks practices discounted pricing and provide fair value to its customers. Although it does not necessarily have the lowest prices in town, it is often perceived to be competitive by its customers. The gross margin on products is more than 40 per cent on an average, with the range between 25 to 30 per cent.

Kanchi Silks is very careful in its sourcing practices. They buy products on consignment basis from the weavers from in and around the town. Where it previously used only a few suppliers, it has now widened its purchasing network and buys sarees from different places like Bangalore, Arani, Dharmavaram, Selam and Thanjavour. Kumaran himself does the sourcing from the cheapest suppliers, bypassing all the intermediaries.

Mustafa mainly employs local people and weavers. The silk weavers of Kanchi settled more than 400 years ago and have given it an enviable reputation as the producer of the best silk sarees in the country.

Kanchipuram has thousands of handloom and skilled weavers that make its silk sarees one of the best in the entire world. About 75% of the city’s population is associated with the handloom industry in some way or the other. About 75% of Kanchipuram’s population is dependent on the silk saree industry, either directly or indirectly.

The market for South Indian silk sarees, popularly known in North India as ‘Kanchipuram silk’ irrespective of the place of production — Arni, Bhuvanagiri Thanjavur or elsewhere — is growing briskly. Conjeevaram is the English name of the ancient Kanchipuram. Like all ancient cities, this city was the capital of the early Cholas dating back to 2nd century BC and a Pallava capital between the 6th and 8th century.

Kanchi Silks communication efforts are limited because of the brand name. It leverages the city name and believes on the word-of-mouth concept and the past customer referrals. Although it does buy airtime on local TV (mainly Tamil speaking) and advertises in the local newspapers, it believes positive word-of-mouth communication is a more effective means of promotion.

The Indian women apparel market has undergone a transformational phase over the past few years — growing number of working women, changing fashion trends, rising level of information and media exposure, and entry of large number of brands have given the industry a new dimension.

The highly lucrative market was estimated at more than Rs.37, 000 crore in 2007. The market, in the past five years, posted a growth rate of good 14%. And with the growing presence of organized retail and rapidly spreading mall culture, the industry is all set to grow further in future, according to “Women Wear Market Forecast to 2010”.

Founder Kumaran has now expanded his store operations in different parts of the country. He started his outlet in Hyderabad in late 90s. Kanchi Silks has its own website www (dot)kanchisilks(dot)com that is meant to replace its catalogs. The website receives order for almost 5-8 sarees in day worth of Rs.30, 000 with the orders coming mainly from across the world especially from countries like Singapore, Malyasia, Sri Lanka and the United States.

Today, they also get order from different states like Maharashtra, Kerala, UP, MP, and the North East. Online store uses the technology that allows for the user’s name and address as well as critically sensitive information such as the credit card number. But on an average he sells very limited sarees through internet. Also it is difficult to deliver the products across the country because different states will have different taxing procedures.

However, the US slowdown has resulted in low values of NRI purchases, although the volume has grown. They usually come down on business and won’t mind spending a huge amount on silk sarees because they earn in dollars. But because of the job loss there and uncertainty about the future there has been a five per cent dip in NRI purchases.

Kumar laments the unavoidable loss in excellence as zari is today made from copper, which is electroplated with silver and given a gold coating. In commercial terms, this is called ‘tested zari’. The gaudy shine is produced by treating the zari chemically and the ‘gold’ borders become lack-lustre within five years. He says, “To those who look at the price we give tested zari and the ones who are particular about quality we give them pure zari”. The price of zari has also doubled tremendously in recent years.

The maximum length possible on a traditional loom is an 18-yard wrap, which means that no more than three silk sarees can exactly look alike. In the new millennium, as the ‘Kanchipuram’ silk route traverses continents, hundreds of sarees designed for standardized tastes, are produced on the power looms.

The silk production turned competitive with the emergence of new silk houses in Tamil Nadu. Today, perhaps Kanchi silk are better known than Kanchi cottons. Kumaran, now a days also owns power looms to cater into cotton sarees business, which aims to target office going women.

2. Case Study on Shreejii:

It was 9.00 pm and standing in front of the store Ajay saw the busy Ghatkopar MG Road still filled with commuters as his employees rolled the shutters of his store down. Ajay is the third generation businessman of Shreeji Opticians and Contact Lens Clinic.

He slid back in memory and remembered his father and grandfather who ran the showroom. It was the same store of about 350 sq. ft. which they managed with a handful of employees. They did business much better than he could manage today. Shreeji was established in 1972 as the first AC Opticians showroom in Ghatkopar, but in the recent years it remains forgotten.

Walking back home Ajay started thinking — he had a good variety of frames, lenses and sunglasses and they also started contact lens dispensing from mid-90’s. He had four salesmen out of which three were there with the store for more than seven years now. He also had one optometrist for eye testing of the customers, which was offered as a free service.

But despite this, Shreeji lost in the competition. Ghatkopar had about 23 standalone opticians; most of them had mushroomed in the last decade. Of late he was more disturbed with the entry of a major player — Gangar Eye Nation with a huge footprint of about 2,000 sq.ft. that was about 12 mins walking distance from his store. He had also got the news that Titan Eye Plus was eyeing Ghatkopar and was looking out for a suitable store location there.

He reached home, sat down on his study table, and started analyzing his sales for the past 10 years. Earlier the store had bigger profit margins with an average footfall of 20-25 people per day with a good conversion rate. Shreeji used to deal in local brands like Sillotti, and frames procured usually from wholesale players like Alankar Opticians.

Lenses were procured from Central Optics, Ghag etc. But now, times were changing. Today the profit margins were reduced because of competition from national players and high operating cost. Interestingly the store footfall has gone up to 75-90 per day and most of the customers are youngsters who prefer to use branded frames like Optimed, Swaroski, cK and Steppers. In lenses Essilor, Kodak, Nikon, is what customers demand for. Today, Shreeji has the conversion rate of 20%.

Ajay also found some of the interesting facts of the competitors in the vicinity like most of the stores deal with the branded products but only a few of them have better walk-in and conversion rates.

Ajay was skeptical from dispensing branded products as brands did not offer the kind of margin. Ajay could manage from the locally sourced products. But he missed out on the fact that brands could charge a premium for the same product that otherwise would have been considered as a rip off.

Players like Gangar sold only branded products like Prada, Gucci etc. while Titan dealing with the products under its own Brand Eye+ stores sold frames under the Titan brand as well as the Eye+ and Dash brands (the Dash brand targets children). The stores also deal with frames and sunglasses from a large number of international fashion brands like Elle, Vogue, Versace, Dior, Steppers, Hugo Boss, Armani, Levis, Esprit, Oxydo, Tommy Hilfiger, Dolce & Gabbana, Calvin Klein, Silhouette, Swarovski, Dunhill and Mont Blanc etc.

In early 2007, the prescription eyewear market in India was estimated to be worth between Rs. 18-20 billion with around 30 million pieces (frames with glasses) being sold every year. The organized eyewear market is still at an infant stage. This segment however, was largely dominated by the unorganized sector, which accounted for 95% of the prescription eyewear business. India has an estimated Rs. 1, 500 crore eyewear market and that is poised to grow between 15 to 20 per cent annually.

TITAN EYE, Kodak, Luxottica Group, Eye was from Odysseys, Vision Express from Reliance Retail and major international players will change the way eyewear industry operates in the country. They aim to introduce the concepts of branding, right pricing and value for money, which is non-existent now.

3. Case Study on Dosa Plaza:

Mr. Ganapathy smiles and says it was an accidental business. He basically hails from a small village called Naglapuram from Tamil Nadu. He came to Mumbai in 1990 in search of livelihood with a great ambition and dream along with his basic educational background. He passed out of 10 th standard and migrated to Mumbai with the help of his friend.

He applied for a job at different places but was denied a job for not having a good education background or knowing English. Then he worked in a bakery at Bandra making pav vada and pavs are the favourite dish of Mumbaikars. Mr. Ganapathy worked at many small places and restaurants. He was not satisfied with his job and shifted his base to new Mumbai.

He started a career with a restaurant in Vashi called Prem Sagar as a service boy. Later, his passion for cooking led to a business opportunity when he started selling dosas.

Having seen a dosa stall on the roadside in sector 12 at Vashi along with his brother, he decided to start a business in dosa. He was running a business almost for five years in the same area and offered as many as 15 varieties of dosas. During this period he created a customer base and learned new varieties of dosas.

Along with his dosa outlet he tried his luck by investing in a Chinese restaurant in which he incurred a loss. But he tried Chinese cuisine in his dosas which worked very well. He got passionate and invented variety of dosas in Chinese style like American chopsuey, schezwan dosa, paneer chilly, spring roll dosa etc. By the year end, Dosa Plaza had fashioned 20-25 original varieties of dosas.

During this time he learnt about the computers and the use of internet from a friend. He had a vision to make dosa an international cuisine. Late in the evening, he used to browse the internet to broaden his skills and convert his vision into a reality. He made his dosas popular by serving them complimentary to his customers. The tremendous response that he received from his customers inspired him to fashion many more original one-of-their-kind recipes.

Dosa Plaza had already made its presence felt in the hearts of the food lovers. By 1998, Dosa Plaza had 104 delicious varieties of dosas in its list. He started his first shop at the Vashi Railway station. He earned a good name and credibility through the Vashi store. The response to his dosas kept growing, so he stayed on for a whole year. He bought his vegetables from APMC Vashi market at a wholesale price every morning and made basic recipes at home with his brother.

Dosa plaza came to his mind as both the words have “AA” in the end which make it sound better and Plaza means open corner space and his new outlet was also in an open corner. Dosa Plaza is affixed with Prem Sagar as he worked in Prem Sagar. Before which, he never got such an opportunity to work.

Earlier he was always instructed by his employer to work in a kitchen. It was the Prem Sagar restaurant which gave him an opportunity to interact with customers and showcase his talent. According to Mr. Ganapathy, the market is kaleidoscopic. When he started, customers used to come because of the owner’s name and the personal relationship. Gradually customers shifted to food taste. Brand had a major role in customer preferences. Now customers come for brand. Service, location and ambience play an important role on a customer’s mind.

Competition:

Dosa Plaza doesn’t have any big competition as everybody operates in their own way. The major organized player has also entered into this business with a strong financial support and brand name. Dosa Diner is the first restaurant in Mumbai to transform traditional Udipi food into non-vegetarian fare.

This attempt is to capture the mid-market family dining segment. The restaurant effectively mixes bright colors and ethnic materials to produce a warm ambience. The restaurant offers various types of dosas with choice of fillings ranging from prawns, lamb and chicken to mushrooms and cottage cheese.

Dr. Dosa had a clear cision for his success. He’s been interested in food — preparing it, serving it and seeing people enjoy it. Though never formally trained in the dosa preparation, he learned to cook. He did R&D in dosa and created more varieties. Now 27 dosas are trademarked and the number is still increasing. He opted to spend his time learning how to prepare dosas for his family, customers and always found the experience tremendously satisfying. Even today he hasn’t lost his enthusiasm for well-prepared food.

Mr. Ganapathy learnt business in Mumbai. His personality shows a great impact of family tradition, values and ethics. He firmly believes in himself and believes in moving ahead at every stage of life. He does not believe in looking back. Past experience as employee of many small restaurants helped him to understand the business in a broader perspective.

He personally believes dosa is a purely vegetarian food and doesn’t believe adding non-vegetarian varieties in his menu. Instead of that he brought different veg concepts in his menu and added more varieties. He is the first person in India who offered idly with Manchurian at a premium price.

Future Expansion:

Presently Dosa Plaza has 35 outlets spread across in nine different states in India. Mr. Ganapathy is not targeting all shopping malls but only a few quality malls. Prime target is highways. He is planning to launch 6-8 outlets in Chennai in the next one year.

Two new restaurant formats, “Mumbai Spices” and “Chop king” have been introduced. Food trial is on for these restaurants. He is also planning to open kiosks opposite to the railway stations in Mumbai and the plan is to have centralized kitchen in Mumbai, which will be the supplier so as to optimize the entire process.

For the international operations he already had a strategic tie-up with landmark group which is one of the leading retail groups in the world. He started his first outlet in Sharjah international airport in the New Zealand outlet.

This outlet in New Zealand is the first Dosa outlet. Prior to this, there wasn’t any vegetarian outlet of this scale in close proximity. Foreigners and NRIs come from 100 km range. Mr. Ganapathy believes that customers come to his outlet as the rates are reasonable. He is also planning to enter into Canada and US market soon.

Mode of Operation:

Dosa Plaza operates on three business models i.e. company owned, joint venture and franchise. At an initial stage the stores were expanded by the method of franchising. At the growth stage, few of the stores did not perform well. The store which was there is Ghatkopar was closed because of the franchisees.

It’s difficult to control over the franchisees which is the major drawback of this particular model. Ganapathy prefers joint venture rather than having franchise outlets especially in overseas operations as joint ventures allow more control over the business.

4. Case Study on Multiplexes:

“There’s no business like show business”.

The above truism comes to life when we consider the amount of turnover churned by the multiplexes that have mushroomed up in the past decade. Predominantly single-screen theaters ruled the roost when it came to movie theaters but with changing times the era of multiplexes was ushered in with cinema halls being converted into the ultimate weekend getaway for the thronging millions.

With around 11,500 active screens, India is under screened. China, which produces far lesser films than India has 65,000 screens while the US has 36,000. India’s screen density stands low at 12 screens per million populations. There is a need of at least 20,000 screens as against the current 11,500. This gives multiplex operators enough room to grow as the traditional single-screen theatres do not have the financial wherewithal nor do they enjoy tax incentives.

Over the last few years, multiplexes have emerged as a trend in urban India. Multiplexes are essentially cinemas with three or more screens. They provide a quality viewing experience and are generally located around shopping malls to increase footfalls in these malls.

Each screen in a multiplex has a small seating capacity in the range of 150-300 seats as compared to single screen cinemas which have capacities in the range of 800-1,200 seats.

The multiplexes are ensuring everyone is taken care of as movie theatres have been amalgamated with retail outlets, shopping malls, bowling alleys and food courts etc. The multiplex players are bending over each other to cater to the needs of the customer and make it a family experience.

This is only the icing on the multiplex owner’s cake and this icing only gets thicker with time as millions of revenue is on stake with the loyal customers coming to get a good deal. The heavyweights in this arena are PVR cinemas, Big Cinemas (owner ADAG group), Inox and Fun Cinemas.

1. BIG Movies:

In June 2005, the Anil Dhirubhai Ambani Group (ADAG) acquired majority of the shares of the cinema screening business of the Manmohan Shetty owned Adlabs. The phenomenal growth story of 20 screens in 2005 to 186 screens today with a seating capacity of 71,000 followed this acquisition.

The success mantras driving the story are — expansion, scale-up and acquisition. The jump to Rs.365 crores in 2007 was termed as a three-fold growth which jumped again to about Rs.520 crores in 2008.

ADAG bought nearly 200 cinema houses pan America in cities as New York and Chicago and 51 theatres in Malaysia and six in Mauritius, which increased their presence overseas. Moreover they have focused on acquiring and renovating old movie houses in tier II and tier III cities.

Thus you would find a big cinema presence in cities like Lucknow, Hyderabad and Ghaziabad. Big Cinemas has opted for organic and inorganic growth strategy and if we look at the turnovers, this seems to be paying off.

According to the Adlabs spokesperson, they have 70 movies in the pipeline. The acquisition of N.D. studios in Karjat raised many eyebrows as they seem to be going into risky ventures in an over-zealous attempt to aim for the stars. They also plan to launch 52 satellite channels and are targeting the TV audience.

One of the most innovative concepts brought in is the d-technology which would entail production, distribution and screening of the movies via digital cables. This technology reduces the risk of piracy and also makes it much simpler for cutting costs.

Reliance Adlabs is one of the firms that are planning a double-digit number of screens in one of its megaplexes. The firm is investing Rs.30 crore on what will be India’s largest megaplex. It will have 15-16 screens, including an IMAX 3D-digital screen, food and beverage lounges, special screens for kids and sports screens.

Adlabs is also opening a nine-screen multiplex at Ghatkopar and PVR is coming up with eight screens. Adlabs has tied up with Kingfisher airlines where if you travel by airlines, you accumulate points on which you can get a free ticket in Adlabs after you have reached a specific number of points.

It is one of the leading multiplex chains in India with 101 screens under operation in 14 cities at present. PVR has been successful in building a lifestyle entertainment brand because of its focus on customer service and quality of experience.

The company has been able to establish itself as one of the premier entertainment destinations, which has resulted in the highest occupancies, footfalls and spend per head as compared to all of the other multiplex operators.

It attracted 18 million patrons with an occupancy ratio of 41% in FY08, both the highest numbers among all the multiplex players. Today, it contributes 10% plus to the total domestic box office collections in the country, showing a clear dominance.

It has shown impressive operational performance, delivering a 65% CAGR in top line in the past five years. The company has shown remarkable pace of expansion in the last 3-4 years with commendable speed and quality of execution.

Inox has more than 50% of its screenings the tier I and II cities, which has rewarded the company very well in the past. It plans to add more than 100 screens in the coming two years, 70% of which will come up in select tier I and II cities. They believe that the move will create value for the company as these locations are comparable to metros level.

Inox has ramped up its presence to 84 screens in 24 locations at present. While registering a strong capacity growth in the past four years, the company has also been very successful in building a strong entertainment brand for its cinemas. Operating in an industry marked by execution delays, both the speed and the quality of expansion are commendable considering that the promoters didn’t have prior exposure to the exhibition industry.

4. Shringar Films Pvt. Ltd.:

It was founded in 1975, with the distribution of Bollywood films as the company’s core area of operation. Operating the chain of Fame cinemas, the company gave Mumbai its first five-screen multiplex and its first IMAX theatre. Today it has a total of 30 screens in seven complexes. By 2009 the chain aimed to targets a sprawling presence with approximately 52,000 seats.

Risks and Concerns Related to Multiplexes :

Multiplexes thrive on rising footfalls which in turn depend on the better supply of films from producers. Hence, any disruption on the supply side will definitely have a negative impact on a multiplex players’ growth. Movies compete for customer attention with other forms of entertainment viz. DVDs, TV, cricket, festivals etc. An increased acceptability of these avenues will divert footfalls away from the multiplexes.

However, there is enough room for all to exist and grow simultaneously. A case in point is the US, where almost all forms of entertainment are present and have been well received by the consumers. Even then, footfall growth hasn’t halted over there.

Moreover, there might be possible synergies among these formats which might benefit multiplexes, e.g. showing of IPL matches on cinema screens. Supply of quality real estate has been a problem in the past for multiplex players. Mall delays due to various reasons will hurt expansion plans of the companies.

Entertainment tax in India is among the highest in the world leading to a much higher occupancy levels required for breakeven of multiplexes. Even though state governments have announced tax free windows for these players, uncertainty looms over the viability of multiplexes after the window expires. The level entertainment tax should come down in the future; otherwise any increase will be passed on to the consumer to a large extent like it is being done at present.

The whole footfall growth story depends on rising prosperity in the country leading to higher discretionary consumer spends. If the economic environment starts worsening for a prolonged period, it will affect patronage levels, negatively pulling down top line growths. Hopefully there is enough space for more multiplex projects given the quantum of demand and lack of supply in the sector.

Preliminary analysis suggests that at national level and considering only the urban population demand in the age group of 15-60 years, 662 multiplexes with three screens per property i.e. 2,000 screens can operate at 35% capacity. All of the multiplex players combined are operating only 500 screens at present.

Related Articles:

- Retail Management Case Study: Top 3 Case Studies

- Case Studies on Retail Sectors: Top 3 Case Studies | India

- Retail Management Case Studies

- Retail Management Case Studies (With Conclusion)

We use cookies

Privacy overview.

Two Global Brand Digital Retail Transformation Case Studies: Lessons & Challenges

Digital retail transformation case studies almost always focus on customer experiences (for example, providing iPads for in-store eCommerce, using augmented reality for product demos, etc.) but in this article we’re going to dive into the other — and equally important — side of digital retail transformation: the employee experience.

In our experience, when employees have access to updated digital tools and training techniques, retail organizations and customers both benefit. Specifically:

- Quicker Onboarding: Employees are onboarded more quickly and retain more information, so training costs decrease.

- Better Training: Employees can look up answers to detailed questions or help customers find products in real time which improves the customer experience.

- Better Customer Experience: Customers are more satisfied and buy more because their questions are answered quickly and accurately.

- More Insights: Retail leaders get more insight into what training or policies are working the best across an entire organization.

Below, we’ll show you exactly what this transformation was like for two multinational retail brands — each with tens of thousands of store employees.

(Details have been anonymized for confidentiality reasons.)

You’ll learn the real-world details of how we did it and the key insights and lessons that any retail brand should heed:

- The legacy retail training and communication problems these two brands were dealing with (and many others still are).

- A case study of a global sportswear brand’s digital transformation odyssey, including details on why generic digital solutions simply wouldn’t work for their business model.

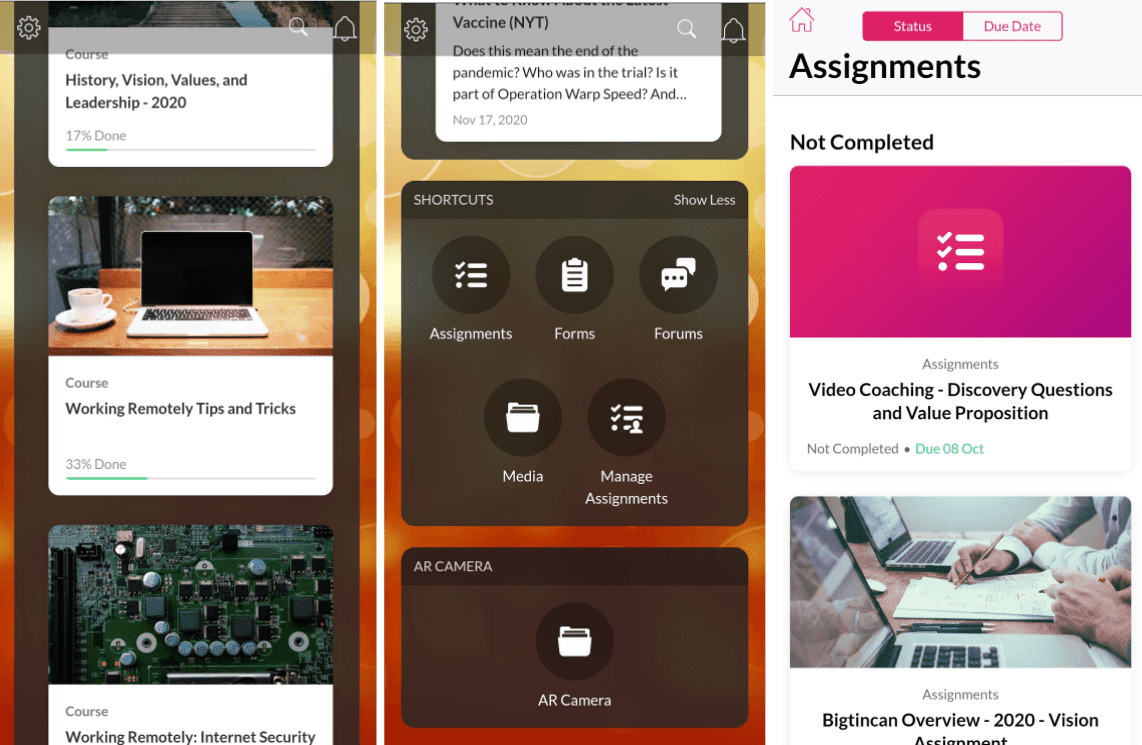

- How Bigtincan’s custom-tailored digital training solution helped a multinational beauty retailer overcome a bottleneck for growth and sales productivity.

- The themes that emerge from our experience solving training and communication problems for big players on the retail stage.

First, let’s start with a closer look at the why , by examining some challenges and pain points that have plagued corporate-retail relations for decades.

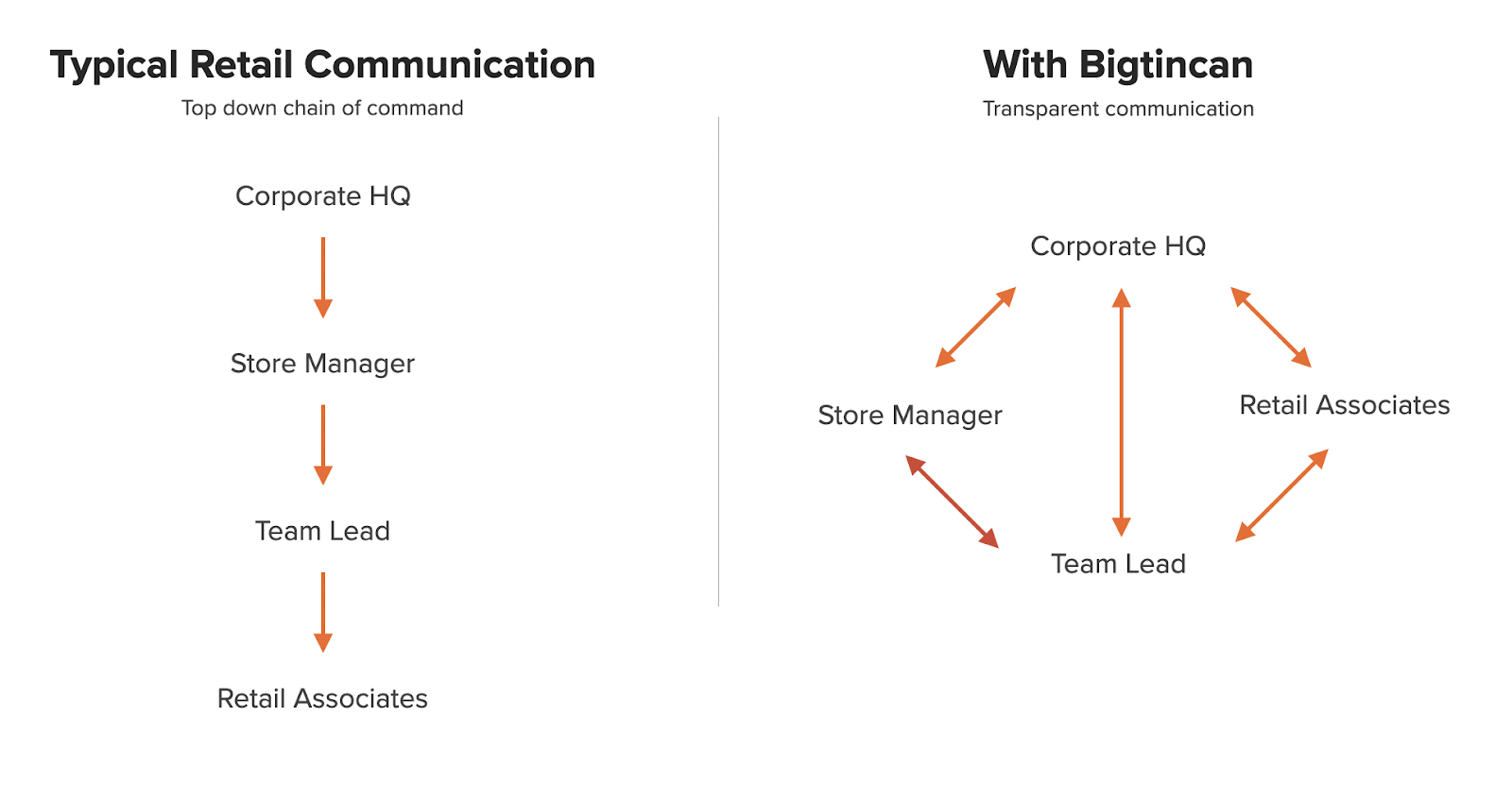

An Overview of Legacy Retail Training and Communication Problems

Retail employee training procedures and headquarters-to-store communications have always had more than their share of inefficiencies.

Associate training at many retail stores, including (until recently) those of the major brands we cover in this article, commonly involves posting updates on a corkboard at the back of the store and reliance on weekly “team meetings.”

But this standard system doesn’t typically work well.

Just think about it: how many employees ignore the corkboard, skip the meetings, or just zone out?

Scale those scenarios up to hundreds or thousands of individual retail locations and consider the impact of subpar training methodologies on liability, product messaging, customer experience, and sales productivity, and you have a significant set of inefficiencies that are hurting profitability.

Or, for another example, think about retail training in a store with extremely high employee turnover.

One of the brands we’ll discuss shortly has an average annual attrition or turnover rate around 40% at the store level (largely due to their employee demographics). This is common in the retail industry, and some stores are even higher.

The quality of employee training tends to decrease in proportion to the number of new employees being onboarded, the other obligations of managers on duty, and during the times of year when customer demand is highest.

In other words, the times when employees should be performing at their peak are when they’re least likely to get the quality training they need to succeed.

Most of these problems with retail communication and training have existed for decades (or longer) because no one knew how to fix them.

Companies may have accepted these inefficiencies as unavoidable for a long time, but that's no longer the case.

However, what’s not necessarily obvious is that basic digital solutions like computer-based training software, cloud-based file-sharing, and email, are inadequate to address these decades-old problems. We’ll explain why that is in a moment, in the first case study.

These case studies are anonymized for nondisclosure reasons, but still contain plenty of details to teach you how we approach and solve training and communication problems at scale.

Case Study #1: Global Sportswear Apparel and Lifestyle Brand

This sportswear apparel company has over a thousand brick and mortar physical stores worldwide and tens of thousands of retail workers.

The vast majority of their store employees are young, high school age to early 20s, which helps account for the average annual employee turnover rate of 40% we alluded to in the previous section.