14 Reasons Why You Need a Business Plan

10 min. read

Updated April 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

12 Min. Read

Do You Need a Business Plan? Scientific Research Says Yes

6 Min. Read

Business Plan vs Business Model Canvas Explained

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

10 Min. Read

When Should You Write a Business Plan?

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

6 Reasons You Really Need to Write A Business Plan

Published: October 14, 2020

Starting a busine ss can be a daunting task, especially if you’re starting from square one.

It’s easy to feel stuck in the whirlwind of things you’ll need to do, like registering your company, building a team, advertising, the list goes on. Not to mention, a business idea with no foundation can make the process seem incredibly intimidating.

Thankfully, business plans are an antidote for the new business woes that many entrepreneurs feel. Some may shy away from the idea, as they are lengthy documents that require a significant amount of attention and care.

However, there’s a reason why those who take the time to write out a business plan are 16% more likely to be successful than those who don’t. In other words, business plans work.

What is a business plan, and why does it matter?

In brief, a business plan is a roadmap to success. It's a blueprint for entrepreneurs to follow that helps them outline, understand, and cohesively achieve their goals.

Writing a business plan involves defining critical aspects of your business, like brand messaging, conducting market research, and creating pricing strategies — all before starting the company.

A business plan can also increase your confidence. You’ll get a holistic view of your idea and understand whether it's worth pursuing.

So, why not take the time to create a blueprint that will make your job easier? Let’s take a look at six reasons why you should write a business plan before doing anything else.

Six Reasons You Really Need To Write a Business Plan

- Legitimize your business idea.

- Give your business a foundation for success.

- Obtain funding and investments.

- Hire the right people.

- Communicate your needs.

- It makes it easier to sell your business.

1. Legitimize your business idea.

Pursuing business ideas that stem from passions you’ve had for years can be exciting, but that doesn’t necessarily mean it’s a sound venture.

One of the first things a business plan requires you to do is research your target market. You’ll gain a nuanced understanding of industry trends and what your competitors have done, or not, to succeed. You may find that the idea you have when you start is not likely to be successful.

That may feel disheartening, but you can always modify your original idea to better fit market needs. The more you understand about the industry, your future competitors, and your prospective customers, the greater the likelihood of success. If you identify issues early on, you can develop strategies to deal with them rather than troubleshooting as they happen.

It’s better to know sooner rather than later if your business will be successful before investing time and money.

2. Give your business a foundation for success.

Let's say you’re looking to start a clean beauty company. There are thousands of directions you can go in, so just saying, “I’m starting a clean beauty company!” isn’t enough.

You need to know what specific products you want to make, and why you’re deciding to create them. The Pricing and Product Line style="color: #33475b;"> section of a business plan requires you to identify these elements, making it easier to plan for other components of your business strategy.

You’ll also use your initial market research to outline financial projections, goals, objectives, and operational needs. Identifying these factors ahead of time creates a strong foundation, as you’ll be making critical business decisions early on.

You can refer back to the goals you’ve set within your business plan to track your progress over time and prioritize areas that need extra attention.

All in all, every section of your business plan requires you to go in-depth into your future business strategy before even acting on any of those plans. Having a plan at the ready gives your business a solid foundation for growth.

When you start your company, and your product reaches the market, you’ll spend less time troubleshooting and more time focusing on your target audiences and generating revenue.

3. Obtain funding and investments.

Every new business needs capital to get off the ground. Although it would be nice, banks won’t finance loans just because you request one. They want to know what the money is for, where it’s going, and if you’ll eventually be able to pay it back.

If you want investors to be part of your financing plan, they’ll have questions about your business’ pricing strategies and revenue models. Investors can also back out if they feel like their money isn’t put to fair use. They’ll want something to refer back to track your progress over time and understand if you’re meeting the goals you told them you’d meet. They want to know if their investment was worthwhile.

The Financial Considerations section of a business plan will prompt you to estimate costs ahead of time and establish revenue objectives before applying for loans or speaking to investors.

You’ll secure and finalize your strategy in advance to avoid showing up unprepared for meetings with potential investors.

4. Hire the right people.

After you’ve completed your business plan and you have a clear view of your strategies, goals, and financial needs, there may be milestones you need to meet that require skills you don’t yet have. You may need to hire new people to fill in the gaps.

Having a strategic plan to share with prospective partners and employees can prove that they aren’t signing on to a sinking ship.

If your plans are summarized and feasible, they’ll understand why you want them on your team, and why they should agree to work with you.

5. Communicate your needs.

If you don’t understand how your business will run, it’ll be hard to communicate your business’s legitimacy to all involved parties.

Your plan will give you a well-rounded view of how your business will work, and make it easier for you to communicate this to others.

You may have already secured financing from banks and made deals with investors, but a business’ needs are always changing. While your business grows, you’ll likely need more financial support, more partners, or just expand your services and product offers. Using your business plan as a measure of how you’ve met your goals can make it easier to bring people onto your team at all stages of the process.

6. It makes it easier to sell your business.

A buyer won’t want to purchase a business that will run into the ground after signing the papers. They want a successful, established company.

A business plan that details milestones you can prove you’ve already met can be used to show prospective buyers how you’ve generated success within your market. You can use your accomplishments to negotiate higher price points aligned with your business’ value.

A Business Plan Is Essential

Ultimately, having a business plan can increase your confidence in your new venture. You’ll understand what your business needs to succeed, and outline the tactics you’ll use to achieve those goals.

Some people have a lifetime goal of turning their passions into successful business ventures, and a well-crafted business plan can make those dreams come true.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![why is the model of business planning necessary How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

What is a Business Plan? Definition, Tips, and Templates

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![why is the model of business planning necessary 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![why is the model of business planning necessary The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Why Is a Business Plan Important? (+ How to Create One)

June 21st, 2022 | Small Business Resources

A business plan is not something you create just for the sake of creating it—it’s a key factor in your company’s success. According to a SCORE survey , the next biggest source of support for small business owners just starting out—behind their friends and family—is having a solid business plan in place.

Aside box: What is a business plan?

A business plan is a written document that outlines what your business objectives are and how you will go about achieving them. Refresh your business plan regularly to reflect with your evolving business objectives.

Business plans can be both internal and external documents. If you’re looking to secure funding from an investor or get a loan from a bank, they will certainly want to evaluate your business plan first.

Why is this plan so important? Because entrepreneurship without a business plan is like traveling without a roadmap. You might reach your destination eventually without it, but the journey will be tough, if not impossible.

Know the location of your destination and what roads you’ll need to travel, and you’ll significantly increase your chances of success.

12 reasons why having a business plan is important

The process of creating your business plan encourages you to take a deep dive into every aspect of your company—helping you spot flaws and take steps to improve.

Beyond highlighting weaknesses, a strong business plan positively shapes a company’s reputation. It shows investors, partners, and even potential hires that your business is working toward clear objectives and is on a reliable growth path.

1. It helps confirm the viability of your business idea

The research that goes into creating your business plan will help you gauge whether your idea is a viable one. You’ll learn the size of your potential market, who your competitors are, who your target customers are, and what problem you’re solving for them.

With this information, you can evaluate your chances of creating a profitable and sustainable business.

2. It helps you make financial projections

According to CB Insights , almost 40% of startups ran out of cash or failed to raise new capital. Business plans require you to evaluate your current financials and projects in detail, so you can steer clear of draining your bank account.

3. It helps you protect your business from common risks

Very few companies and individuals are willing to work in any capacity with businesses that don’t protect their partners with professional liability policies. To form your business plan, you’ll need to learn about the business risks your company faces and put together an insurance plan that helps mitigate them.

4. It helps you form partnerships

Regardless of the type of partners you have—contractors, freelancers, vendors, manufacturers—you need to establish trust. Partners want to know the specifics of your proposed cooperation before they commit.

Successful partnerships depend on well-defined roles and responsibilities and clearly specified incentives and key performance indicators (KPIs).

Business plans clearly define what cooperation and success look like for partnerships, so external parties feel comfortable working with your company.

5. It helps you hire and retain top talent

You can’t hire good people if they don’t believe your business is viable. A business plan shows top talent that your company has potential and is a good place to work.

A clear business plan is also helpful when you’re seeking hiring advice from more experienced peers. Approaching them with a business plan in hand makes that process easier as well.

“Merely telling a friend or potential business mentor you’re aiming to start with ten employees, for example, is not an exceptionally detailed statement,” said Admir Salcinovic, co-founder and marketing manager of PriceListo . “Showing a business plan that outlines the exact duties, salaries, and expectations you have for employees gives far more information for people to provide advice about.”

6. It provides you with competitor analysis

Market analysis is one of the cornerstones of a business plan. This process involves identifying and researching your main competitors and their business models. This data can provide insights into how you should position your business on the market in order to be competitive and carve out a market share for yourself.

7. It helps you understand customer pain points

Along with highlighting competitors, your market research helps you pin down the problem you’re solving for customers and how you plan on helping them. This research often involves surveying customers to understand their pain points.

8. It helps you assemble the right executive team

According to CB Insights , 15% of new businesses failed because the team they had in place wasn’t right. A strong and experienced leadership team can help navigate the many bumps in the road that new business experience, like structural and personal problem solving, risk assessment, and dips in team morale.

Business plans must include a detailed analysis of your management—who they are, and what they bring to the table to evaluate your leadership internally and externally. Startups also commonly dedicate a section of their business plans to the type of culture they are looking to build.

9. It makes you more attractive to lenders/investors

Real talk—most investors and banks won’t even talk to you if you don’t have a business plan. Harvard Business Review research from 2017 showed that writing a business plan increases the chances of your team receiving funding, noting that having a business plan “builds legitimacy and confidence among investors that the entrepreneur is serious.” “When I went to banks to ask for loans, every one of them asked for my business plan,” said Marina Vaamonde, owner and founder of off-market house marketplace HouseCashin . “If I didn’t have mine ready at the time, I would have wasted time during a crucial growth phase of my business when I needed employees.”

Investors and banks will use your business plan to understand your revenue model, cash flow, and, most importantly, how you plan on using funding.

“No matter how great your idea, angel investors won’t invest without a formal business plan,” said Calloway Cook, president of Illuminate Labs . “It doesn’t need to be 50-pages long, but they want to see that you’ve done the work to validate your concept, both informally with customer interviews and formally with market research.”

Cook, whose team was able to raise a pre-seed round of slightly over $100,000, also recommends including directly sourced customer data in your business plan to attract investors.

“Get feedback from real users. This is what sways the minds of investors,” said Cook. “Anyone can create a hypothetical profitable scenario using market size and demographic information, but if investors can see real people interested in your product or service, they’ll be more likely to invest.”

10. It helps you create a marketing strategy

To form a business plan, you’ll need to research on customer demographics and preferences. This data can inform and strengthen your marketing and branding strategies—helping you target your ideal customer.

New companies often have a limited budget to work with and need to adopt strategies that can spark greater growth and cost less than traditional marketing channels. The market research you’re doing for your business plan makes it a perfect starting point for developing these strategies.

11. It helps you set your pricing

The market analysis you perform while writing your business plan will inform how you set your pricing. Your competitor pricing models, your cost of goods sold , and your break-even point are some of the valuable data points you’ll need to acquire to start shaping your pricing model and your sales strategy.

12. It helps you establish the right KPIs

You can’t report on the progress of your business without first establishing what metrics are important to track.

Business plans show what metrics are important to track, given your financial projections, sales goals, marketing plans, and budgets. When you know which metrics to track, everyone in your organization can report on the progress of your business.

KPIs are not just financial goals. They can include trackable data like customer count, the quality of customer service (first response time, customer service satisfaction), and staff-related data like attendance, quality of work, retention, and satisfaction levels.

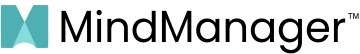

How to write a business plan: What are the core components?

To provide a big-picture view of vital company insights that gives both your team and third parties an easy way to gauge your financial health and projected growth, a good business plan must include the following components:

Executive summary

The executive summary serves as a high-level synopsis of your business plan—like the Cliff Notes for a book. It gives a general overview of the topics that your business plan will cover.

An executive summary should always be fairly brief. But when presenting your plan to third parties, it’s also important to write a summary that’s compelling enough to intrigue them and make them want to read on.

Even though this summary appears first in a business plan, we recommend writing this section last. That way, you’ll be familiar enough with all of the business plan’s main sections to be able to write a concise and accurate summary to kick it off.

Business summary

The business summary covers how the products and services your company offers serve the market. This section of your business plan should focus on your value proposition—defining what pain points you solve for your customers and how.

Explain what differentiates your brand from competitors by showing customer reviews and listing success stories and accomplishments. Readers of the business summary should come away from it convinced that your business is a viable one.

It’s also a good idea to wait until you’ve written the market analysis section before writing this section. Your business summary should consist of condensed takeaways sourced from market research.

Market analysis

This component of your business plan answers questions about the market in which your company is competing, such as:

- How big are your target market segments?

- Where does your business fit within these segments?

- Who are the main competitors?

- Who are your customers?

Performing market research is difficult work, especially for less experienced business owners. If you have the funds to do so, hiring a market research/competitive analysis agency to perform the analysis for you is definitely worth it.

The good news is that there are plenty of available resources for those who want to perform their own research, especially online, such as:

- U.S. census data tools : These tools and free industry research reports can help you determine your market size and gain insight into potential customer demographics data.

- Statista : One of the best research data websites, Statista covers hundreds of industries, constantly performing market research and providing hard business data. The website also uses graphs and charts to make their data more understandable for those who might be new to market research.

- Google Trends : Google Trends can help you understand what potential customers are most interested in, allowing you to see into the minds of consumers and audiences. The tool offers robust filter options to create detailed reports about what the trending stories and most searched terms are in a particular demographic.

If you’d rather find mentors and learn about your market through personal interactions, you can look to join local business organizations such as your local chamber of commerce , the National Federation of Independent Business (NFIB) , or Business Network International (BNI) .

Your market research helps you nail down your ideal customer segments. Uncover key customer demographics: where they live, how much money they make, how old they are, what their level of education is, what their buying habits look like, and more.

Market analysis will help you uncover who your direct competitors are, what their strengths and weakness are, and how your offer differs from theirs.

“Going in blind, without understanding who my competitors were, as well as their core strengths and weaknesses, would have decimated any chances of me establishing a worthwhile competitive strategy,” said Lisa Richards, CEO of the health website the Candida Diet . “Knowing who my competition was made it possible for me to develop a differentiation strategy that set me apart from them in terms of brand perception, allowing me to capture a large share of the market from the very beginning,” she added.

Marketing and sales plan

Along with identifying your target market, a business plan should outline how you plan on reaching this audience and selling your product or service to them.

This section of your business plan should detail your branding and marketing strategy. You should also cover any promotional strategies you plan to implement and a description of the current and future strategic partnerships you plan on installing. For example, if your business sells homemade soap, you could list the brick-and-mortar and online shops you plan on partnering with to increase the reach of your sales.

It should also include pricing strategy—the methodology and process behind how you plan on setting prices for your product or services. Set your prices too low, and you could struggle to turn a profit. Set the price too high, and customers could turn to your more affordable competition.

“After creating our initial business plan, we immediately saw how our business is not profitable enough given the current pricing ranges we have and the target market,” said Sherry Morgan, founder of animal content hub Petsolino . “After further investigation, we found out the holes in our initial plan. From there, we adjusted our pricing and selling strategies.”

The management-related part of your business plan should explain your company hierarchy and introduce your business’s leaders by providing information about their professional backgrounds, education, and achievements.

If you’ve received funding, be sure to highlight your investors, shareholders, and any professional advisors. If you have imminent hiring needs within management, detail them in this section.

Financial plan

The three statements that are integral to your financial plan section are your cash flow statement, income statement, and balance sheet. You should include a short explanation or analysis of all three in your business plan. Don’t hesitate to ask for expert help here, especially if you don’t currently have an in-house accountant.

This section of your business plan is particularly important if you’re looking to attract potential investors or you want to take out a business loan. If that’s the case, in addition to the three mandatory financial statements, you must also provide a detailed list of what you need the money for (marketing, equipment, labor expenses, insurance costs, rent, etc.).

As you grow, your financial plan will help you develop a model for tracking your income and expenses that will enable you to allocate your resources more effectively.

Revisit and revise your business plan regularly

Business plans are never set in stone. They must evolve and change as your business grows and reaches new milestones. Set a regular review schedule to revisit your business plan and tweak it when necessary.

“Creating and evaluating your business plan on a regular basis is a wonderful approach to identify weaknesses, gaps, and assumptions you’ve made to establish contingency plans,” said Matthew Paxton, founder and owner of gaming website Hypernia .

As you make adjustments, don’t hesitate to pick the brains of more experienced business people and mentors to gain different perspectives on areas of improvement for your business plan.

Share This Article

April 12th, 2022

March 31st, 2022

March 9th, 2022

June 26th, 2020

July 15th, 2020

This website uses cookies to improve your experience. By continuing to browse the site, you are agreeing to our use of cookies. Review our Privacy Policy for more details.

- Entrepreneurship

- Starting a Business

- My #1 Online Biz

- Business Planning

- Advertising

- Content Marketing

- Digital Marketing

- Public Relations

- Business Model

- Financial Forecasting

- Market Research

- Risk Management

- Business Plan

- Conferences

- Online Communities

- Professional Associations

- Social Media

- Human Resource

- Productivity

- Legal Requirements

- Business Structure

- Mission Statement

- Financial Plan

- Market Analysis

- Operational Plan

- SWOT Analysis

- Target Market

- Competitor Analysis

- Customer Profiling

- Market Trends

- Pricing Strategies

- Sole Proprietorship

- Partnership

- Cooperative

- Corporation

- Limited Liability

The Importance Of Business Planning: A Beginner’s Guide

by Mike Vestil

Business planning is the process of determining the goals and objectives of a business and developing a roadmap to achieve them.

It involves the analysis of current and future market conditions, operational capabilities, financial resources, and other factors that impact business success.

Effective business planning helps entrepreneurs and organizations navigate the complexities of the market and make strategic decisions that increase profitability and longevity.

Whether you are starting a new business or looking to expand an existing one, a well-crafted business plan is critical to your success.

In this article, we will explore the key components of business planning and provide insights on how to create a plan that meets your specific needs.

Introduction To Business Planning

What is business planning.

A business plan can be described as a document that outlines and describes the goals of a business and the strategies that will be employed to achieve these goals.

It typically includes detailed information about the company, such as the products, services, and customers that it intends to target, as well as an analysis of the market and the competition.

A business plan also describes the financial projections and resources needed to achieve these goals, such as the amount of money that will be invested, the sales projections, and the operational costs.

The purpose of a business plan is to provide a roadmap for the business owner and all stakeholders, including investors, employees, and management teams.

The importance of a business plan cannot be overstated as it serves as a guide to identify and address potential challenges that a business owner may encounter along the way.

Starting and running a business can be a daunting task, but having a well-crafted business plan can help alleviate some of the stress associated with the unknowns of business ownership.

A business plan helps to define and communicate the vision of the business, which can be invaluable to gaining traction with potential investors or partners who can assist in the growth and development of the company.

It also serves as a tool for measuring success as it provides specific goals and objectives that can be compared to actual results.

In conclusion, a well-written business plan is essential to the overall success of a business.

It provides a clear road map of what the business hopes to achieve and how it intends to do so. It serves as a guide for all stakeholders and helps to communicate the vision of the business to potential investors, employees, and partners.

Ultimately, a business plan helps to mitigate potential risks and set the business up for success.

Importance Of Business Planning

Business planning is an essential activity that every organization must engage in irrespective of its nature or size. It helps organizations in setting goals, staying focused, and measuring progress.

There are several reasons why business planning is of great importance, such as guiding decision-making, allocating resources, and identifying potential risks and opportunities.

First and foremost, business planning helps organizations in setting realistic goals and determining the best strategies to achieve them. It provides a roadmap for the future that enables executives and managers to make informed decisions based on available data and market trends.

Additionally, business planning is a critical tool for allocating resources and ensuring that they are used efficiently.

By analyzing financial data and identifying areas of potential wastage, organizations can reduce costs and increase profitability.

Furthermore, business planning is an effective means of identifying potential risks and opportunities that an organization may face.

By conducting a thorough analysis of internal and external factors that may impact the business, organizations can develop contingency plans to mitigate risks and capitalize on opportunities.

Another essential aspect of business planning is that it enables organizations to monitor and measure their progress.

Through the use of key performance indicators (KPIs), organizations can track their performance against set objectives and make adjustments where necessary.

This helps to ensure that the organization is on track towards achieving its goals and that everyone within the organization is working towards the same objectives.

Moreover, business planning is a critical tool for securing external funding. Investors and lenders are more likely to invest in organizations that have a well-defined strategy and a clear understanding of their market and industry.

In conclusion, business planning is a critical activity for any organization that wants to thrive in a competitive marketplace.

It provides a framework for decision-making, resource allocation, risk management, and measuring progress. Without a solid business plan, organizations are likely to struggle to achieve their goals, make efficient use of their resources, and identify potential risks and opportunities.

Therefore, it is crucial for organizations to invest time and resources into developing a comprehensive and realistic business plan that reflects their unique strengths, weaknesses, and objectives.

Purpose Of Business Planning

Business planning is a critical aspect of establishing a successful business. The purpose of business planning is to outline the objectives, strategies, and steps necessary to achieve those objectives.

This process involves creating a roadmap for the future of the business, identifying potential obstacles and opportunities, and developing tactics to overcome or leverage them.

Business planning is essential for potential investors, as it provides an overview of the company’s goals and how they plan to achieve them. It also allows for more effective decision-making, as it provides a framework for assessing whether or not certain decisions align with the company’s overall goals.

Similarly, business planning is critical for internal stakeholders, as it helps to establish a shared vision and objective for the company, as well as the roadmap for achieving it.

Ultimately, business planning is a vital tool for any business owner or entrepreneur looking to establish a thriving enterprise in today’s complex and competitive market.

Key Elements Of Business Planning

Executive summary.

The executive summary is a critical component of any business plan, providing a concise yet comprehensive summary of the key elements of the plan.

It should provide a clear and compelling overview of the business, highlighting its unique value proposition, target market, competitive advantages, and key strategies for success.

Key financial projections should also be included, providing investors and other stakeholders with a clear understanding of the anticipated risks and rewards associated with the venture.

The executive summary should be written in a clear and concise manner, using language that is both easy to understand and engaging to the reader.

It should be designed to capture the attention of potential investors, lenders, or other stakeholders, providing them with a clear understanding of the business and its potential for success.

Market Analysis Of Business Planning

The Market Analysis section of a business plan is a crucial component that provides a thorough analysis of the target market, industry trends, competition, and customer base.

This subsection should focus on the target market’s size, demographics, and psychographics, including their purchasing habits, preferences, and behaviors.

The assessment of industry trends involves investigating the direction of the market, identifying opportunities, and assessing the impact of external factors such as economic conditions and government regulations.

The section on competition analysis must provide a detailed analysis of direct and indirect competitors, including their strengths, weaknesses, and market share.

This information can be obtained through the use of surveys, online research, and networking. The subsection should also assess the customer base, including market segmentation, potential growth, and loyalty.

Moreover, the subsection should include a SWOT analysis that examines the strengths, weaknesses, opportunities, and threats of the company.

The analysis should focus on the potential challenges faced by the company as well as the opportunities that can be leveraged to achieve success.

This analysis provides an insight into the company’s competitive position and helps identify areas where the company can improve.

Overall, the Market Analysis section is critical for any business plan as it provides a well-rounded understanding of the target market, industry trends, and competitive landscape.

The information provided in this section can be used to develop a sound business strategy and make informed decisions that drive the company’s success.

Company Description Of A Business Plan

The Company Description subsection of a business plan provides an overview of the company and its history, current status, and future prospects.

It should detail what the company does, what sets it apart from competitors, and how it intends to achieve success. A well-crafted company description should also communicate the company’s core values, mission statement, and vision for the future.

It is important to include any relevant company history and milestones as well as any notable achievements, partnerships, or industry awards.

Additionally, a clear explanation of the management team’s experience and qualifications, including their education, certifications, and industry experience, is essential to demonstrate the company’s capacity to succeed.

Furthermore, the products or services offered by the company and how they meet the needs and desires of customers should also be emphasized.

Overall, a concise and compelling company description sets the foundation for the rest of the business plan and conveys a sense of confidence and expertise to potential investors and stakeholders.

Organization And Management

The Organization and Management subsection is crucial in any business plan as it highlights the structure, roles, and responsibilities of the key personnel who will be at the helm of the organization.

The success of any business is largely dependent on the capabilities of the people managing it.

Therefore, it is essential to outline the experience and expertise of each member of the management team. This subsection should also provide clear information on the ownership structure of the organization, including the distribution of shares or ownership percentages.

It is important to highlight any legal or regulatory requirements that the management needs to fulfill to operate the business effectively.

Additionally, the subsection should explain the key operational and administrative functions, as well as any external professional services that will be necessary to ensure the smooth running of the business.

Service Or Product Line

Service or Product Line is a crucial section of a business plan that outlines the products or services a company intends to offer.

This section must describe the key attributes of the product or service, including its unique features, the target market, and what sets it apart from competitors.

Additionally, this section must touch on the production process and costs, as well as the pricing strategy the company will use to ensure that the product or service is profitable.

A successful business plan must ensure that its offerings add value to the target market and adapt accordingly by conducting market research, understanding the competition, and leveraging innovation to create new and improved products.

Marketing And Sales Of A Business Plan

The Marketing and Sales subsection of a business planning document is designed to outline the strategies that will be used to promote and sell a company’s product or service.

This section should include a market analysis and an explanation of how the company plans to differentiate itself from competitors. The marketing plan should identify target customers, their needs, and the benefits that the product or service will provide.

The sales plan should identify the distribution channels that will be used, as well as the pricing model and the sales team structure.

Additionally, this section should identify any marketing and sales metrics that will be used to measure success, such as conversion rates and lead generation.

It is crucial for companies to have a comprehensive marketing and sales plan in place to ensure that they are able to effectively reach their target audience and drive revenue growth.

Funding Request Of A Business Plan

The Funding Request subsection of a business plan is where the entrepreneur explains their financial needs to potential investors or lenders. This section starts with the amount of money required and how it will be utilized, such as for inventory, facilities, or equipment.

The business owner must provide an accurate estimate of the total costs involved, including monthly expenses and projected revenues.

It is also essential to explain how the funding request will affect the company’s financial position and how it will help achieve the specified goals.

Sometimes, entrepreneurs may need to explain their willingness to give up a portion of their company’s ownership to secure financing.

The funding request should be provided with detailed financial statements and projections to support the proposal.

Moreover, entrepreneurs should also specify the repayment schedule and interest rates if they are looking for loans.

The objective is to persuade potential investors or lenders that the proposed investment is feasible, and the revenue from the company is likely to provide a satisfactory return on investment within an acceptable time frame.

A well-written and researched funding request inspires confidence in potential investors or lenders and increases the entrepreneur’s chance of securing the necessary funds.

Importance Of Financial Projections In Business Plan

The subsection Financial Projections is a crucial aspect of any business plan. It entails forecasting the financial outcomes of the proposed business operations.

Financial projections encompass several critical elements, including income statements, cash flow statements, and balance sheets.

Accurately projecting financial outcomes is vital for securing funding from investors and financial institutions.

Furthermore, it is a critical tool for managing resources, making critical financial decisions, and monitoring day-to-day financial activities.

When preparing financial projections, it is essential to consider various factors that might influence the outcomes, such as market trends, competition, industry regulations, and other economic indicators.

One critical element that should not be overlooked is setting realistic goals and timelines for achieving the forecasted outcomes.

Additionally, it is essential to prepare alternative scenarios to gauge the impact of unforeseen events on the business’s financial health.

Overall, the Financial Projection subsection provides insights into the potential financial performance of the business and enables entrepreneurs to develop a well-informed roadmap for success.

Appendix Section In A Business Plan

The Appendix section is an optional section that can be included in a business plan. This section provides space to include any additional information that investors or lenders may find useful in evaluating the business plan.

The Appendix can be used to include resumes of key personnel, product or service brochures, legal documents, and any other relevant information that supports the business plan.

It is important to remember that the Appendix should not be used to include information that should be in other sections, but rather to include supplementary information that adds value to the overall plan.

Steps In Business Planning

Step 1: research and analysis.

A crucial step in creating a successful business plan is conducting thorough research and analysis. This step involves collecting and analyzing relevant data from various sources, such as industry reports, customer surveys, and competitor analysis.

The purpose of this research is to gain a deep understanding of the market, identify potential customers, and evaluate market trends and changes.

Analyzing the data collected enables entrepreneurs to identify opportunities and potential threats that their business may face.

Additionally, this step involves evaluating the resources required to establish and run the business, including understanding the costs associated with acquiring and retaining customers, product development, and distribution.

One of the essential factors to consider during the research and analysis stage is the target market. It is important to identify the audience who would be interested in the product or service offered by the business.

Identifying the target market helps entrepreneurs to evaluate the size of the market, the preferences of their potential customers, and the most effective marketing strategies.

Moreover, research provides entrepreneurs with an understanding of customer spending habits and the overall demand for the product.

This knowledge enables entrepreneurs to tailor their business plan to meet the needs of the target market and increase the likelihood of success.

Another critical aspect of the research and analysis stage is evaluating the competition. An analysis of the existing businesses in the industry helps entrepreneurs identify potential rivals.

It also provides insights into the strengths and weaknesses of competitors, their marketing strategies, and the types of products or services they offer.

This information empowers entrepreneurs to develop unique value propositions and competitive advantages that will differentiate their business from others in the market.In summary, research and analysis are the foundation of a successful business plan.

It provides entrepreneurs with a clear understanding of the market, target audience, and competition.

This information enables entrepreneurs to create a comprehensive plan that outlines the steps required to establish and run a profitable business.

Conducting thorough research and analysis is essential to increase the chances of success and minimize the risks associated with starting a new business.

Step 2: Develop A Strategic Plan

The second step in the business planning process is to develop a strategic plan. This is a critical step that involves identifying goals and objectives for the company, as well as the strategies and tactics that will be used to achieve them.

A strategic plan should include a detailed analysis of the company’s strengths, weaknesses, opportunities, and threats. This information can be obtained through market research, customer surveys, and other methods.

Once this analysis is complete, the company can begin to develop a plan for achieving its goals. This should include a detailed description of the company’s products or services, its target market, and its competitors.

It should also include a plan for marketing and sales, as well as financial projections for the next few years.

An important component of the strategic plan is the identification of key performance indicators (KPIs) that will be used to measure the success of the plan.

These KPIs should be specific and measurable, and should be reviewed regularly to ensure that the plan is on track.

The strategic plan should also consider the company’s resources, including its human capital, financial resources, and technological infrastructure. It should identify any gaps in these resources and make recommendations for how they can be filled.

Ultimately, the strategic plan should be a living document that is reviewed and updated regularly. As the company grows and changes, the plan should be adjusted accordingly to ensure that it remains relevant and effective.

Step 3: Create A Business Plan

Step 4: implement the plan.

The actual implementation of a business plan involves executing each step of the strategy. The effectiveness of the plan heavily relies on the satisfaction of the plan’s objectives, the use of realistic timelines, and the deployment of adequate resources.

The business’ management will need to generate functional plans to ensure that resources are allocated optimally. Timelines must also be established for every step of the process to monitor progress and adjust the plan if necessary.

Good communication with all stakeholders is essential to successful implementation. The plan must be communicated to all employees, contractors, and vendors.

The resources, including personnel and funding, must be aligned with the plan. Efficient coordination is necessary to ensure that everyone is working towards the same end goal.

Performance measurement is crucial, as adjustment to the plan may be necessary to achieve the intended outcomes.

Technology and software may also be necessary in executing specific strategies, which should be included in the plan.

Addressing challenges and roadblocks along the way may also require flexible thinking and adapting the plan accordingly.

Therefore, the process of implementing a business plan involves evaluating the plan’s success and adaption of the plan to current business operations.

By successfully implementing the plan, the business can achieve its desired outcome and ultimately achieve its end goal.

Step 5: Monitor And Review

After implementing a business plan, monitoring and reviewing are crucial steps to ensure success. This stage is vital because it allows a business owner to determine if their strategies are working effectively or if changes need to be made.

It is an opportunity to observe the strengths and weaknesses of a business, discover any financial or operational problems, and measure progress toward established goals.

Monitoring includes tracking financial performance, sales figures, production levels, and customer satisfaction rates.

Reviewing involves analyzing the data gathered from monitoring activities and implementing changes to improve the business.

Monitoring and reviewing also help with business planning, providing entrepreneurs with a basis for decision-making.

Ongoing tracking and analysis can identify potential areas of growth, new opportunities, and potential risks.

Keeping current with industry trends, competitive analysis, and customer feedback can be included in the monitoring and review process.

By identifying and addressing challenges, a business can stay ahead of the competition and improve operations, products, and services.

Regular reviews act as a preventative measure for changes in the market or industry. Real-time optimization can be applied to marketing campaigns, cost structures, sales techniques, and more.

By consistently monitoring and reviewing, a business owner can take immediate corrective action instead of waiting until it’s too late.

Additionally, reviewing allows for continual improvement by providing insight into potential opportunities for growth and increased profitability.

A monitoring and review system should be established as part of the overall plan. This should include setting benchmarks and metrics, as well as scheduling regular reviews of progress toward established goals.

Once the system is in place, the focus should shift towards utilizing data gathered from monitoring and review activities.

This data should be analyzed, identifying areas that require changes and taking action to implement those changes.

In conclusion, monitoring and reviewing are important elements to ensure the continued success of a business.

Through monitoring and reviewing activities, entrepreneurs can gain a better understanding of their business operations and optimize accordingly.

By utilizing data and implementing changes, businesses can ensure long-term profitability and sustainable growth.

Types Of Business Plans

Startup business plan.

A startup business plan is an essential document that outlines the road map for a new business venture.

It is a comprehensive document that typically includes an executive summary, market analysis, company description, product or service offerings, marketing and sales strategies, financials, and a timeline.

The purpose of the business plan is to help entrepreneurs map out their goals and objectives, identify potential roadblocks, and develop strategies to overcome them.

By creating a startup business plan, entrepreneurs can gain a better understanding of their customers, competitors, and market trends.

In addition, they can use the plan to secure funding from investors or financial institutions, to communicate their vision to potential employees, and to develop a clear and concise strategy for scaling the business.

A well-crafted startup business plan is a crucial component of launching a successful new business venture.

Internal Business Plan

The Internal Business Plan is a critical component of the overall business plan. It outlines the internal strategies and tactics that a company will use to achieve its objectives.

This plan is developed by the management team and guides the day-to-day operations of the company. The Internal Business Plan addresses the company’s marketing, operations, financial, and human resources objectives.

A key part of the plan is developing a clear understanding of the company’s competitive advantage and how it will use this advantage to successfully compete within the marketplace.

The Internal Business Plan is also used to assess the company’s progress toward its goals and to make adjustments to the plan as needed.

This plan is different from the Strategic Business Plan which addresses the direction and overall vision of the company, while the Internal Business Plan is focused on the day-to-day operations.

A successful Internal Business Plan is critical to any start-up business as it provides a roadmap for the company to follow and helps create a culture of accountability and focus on achieving the company’s objectives.

Strategic Business Plan

A strategic business plan is a vital component of any successful business. It outlines a company’s overall direction, goals, and objectives over the long term.

A strategic business plan is not just a document, but rather a roadmap that guides a company’s decision-making processes.

It involves conducting a thorough analysis of a company’s market, competition, resources, and capabilities to create a unique value proposition.

The strategic business plan enables a company to position itself in the market and differentiate itself from competitors. The plan should also outline specific actions that need to be taken to achieve the desired objectives.

The strategic business plan typically includes the mission statement, which defines the company’s purpose, values, and culture.

It should also identify the target market and customer segments, as well as the channels and strategies used to reach them.

The plan should also analyze the competitive landscape, identifying strengths, weaknesses, opportunities, and threats (SWOT) to the business.

One of the critical components of a strategic business plan is setting clear and measurable goals and objectives over the long term.

These should be specific, measurable, achievable, relevant, and time-bound (SMART). The goals and objectives should align with the company’s mission statement and vision, and support the overall strategy.

The strategic plan should also outline the tactics and actions that will be taken to achieve these goals, as well as the timeline and resources required.

Another important element of a strategic business plan is the financial plan. This should include a detailed budget, sales forecast, cost of goods sold, cash flow projection, and profit and loss statement.

The financial plan should also consider contingencies and risk management strategies.

A well-executed strategic business plan can significantly benefit a company’s growth and success.

It provides a clear roadmap for decision-making, enabling a company to make informed and strategic choices.

It also helps to align all stakeholders around a common vision and direction, which can improve employee engagement and motivation.

Finally, a strategic business plan enhances a company’s credibility and reputation, which can attract investors, customers, and partners.

Operations Business Plan

The Operations Business Plan is a crucial component of any business plan, as it details the necessary steps to achieve operational efficiency and success.

This subsection focuses on the day-to-day running of the business, outlining the processes and procedures that will be followed, including production, logistics, inventory management, customer service, and more.

A well-crafted Operations Business Plan should provide clear guidance on how the company will meet its goals, reduce costs, and optimize processes.

One of the key elements of an Operations Business Plan is the production plan, which outlines the processes and resources needed to manufacture products or deliver services to customers.

This plan should include production schedules, quality control measures, and contingency plans in case of unexpected delays or problems.

Additionally, inventory management is crucial to ensure that the business has the appropriate amount of goods on hand, minimizing waste and avoiding shortages.

Another important aspect of an Operations Business Plan is logistics, covering the transport of goods and services from the company to the customers.

Logistics might include shipping, delivery, or other transportation-related activities that can affect the efficiency and effectiveness of the business.

Customer service is also a critical component, ensuring that customers feel valued and satisfied with their interactions with the company.

Efficient operation requires effective management, and an Operations Business Plan should outline the organizational structure of the company, including roles and responsibilities of staff members.

Clear communication and collaboration among team members are essential to ensuring that the business runs smoothly and effectively.

Overall, a well-conceived Operations Business Plan is a fundamental component of an effective business plan.

By addressing the day-to-day operations and processes needed for a business to function, this plan helps ensure that the company can operate effectively, minimize waste, and achieve its goals.

Feasibility Business Plan

One of the most critical components of a successful business launch is creating a feasibility business plan.

This type of plan focuses on determining whether a business idea is practical and worth pursuing.

At its core, a feasibility plan looks at the market demand for a product or service, analyzes the competition, examines potential revenue streams, and evaluates the resources required to bring the idea to fruition.

The plan should also outline the risks and challenges associated with the business, as well as any legal and regulatory considerations that may impact its viability.

During the feasibility analysis, entrepreneurs should identify their target audience and understand their behavior and needs.

This analysis is crucial in determining the market demand for the product or service. At the same time, businesses must determine how they will differentiate themselves from the competition.

It’s important to analyze your competition’s strengths and weaknesses, identify opportunities, and determine how to leverage them to create a competitive advantage.

Another critical aspect of the feasibility analysis is identifying potential revenue streams. Businesses need to consider the various ways they can generate income and determine which ones are the most viable.

They should also consider potential expenses, such as marketing and advertising, rent, utilities, and employee salaries.

Once revenue and expenses have been identified, businesses can create financial projections to determine their profitability and whether their business idea is economically sound.

Resource allocation is another essential consideration in a feasibility business plan. Entrepreneurs need to determine what resources they will require to launch and sustain their business.

This includes financial resources, such as startup capital and ongoing funding, as well as human resources, such as employees and contractors.

Businesses must also consider the resources required for production, such as equipment, raw materials, and supplies.

Finally, it’s essential to identify and understand the risks and challenges associated with launching and running a business.

This includes legal and regulatory concerns, such as permits and licenses, as well as other challenges, such as technological advancements or changes in the market.

By identifying and evaluating these risks, businesses can create contingency plans and ensure they have the resources and expertise needed to overcome potential obstacles.

In conclusion, creating a feasibility business plan is an essential first step in launching a successful business.

It provides a comprehensive overview of the business idea, evaluating its potential and risks, and determines whether it is a sound investment.

By conducting a thorough analysis of the market demand, competition, potential revenue streams, resource allocation, and risk and challenges, entrepreneurs can make an informed decision and pursue their business idea with a greater level of confidence and success.

Growth Business Plan

Growth Business Plan is a vital component for businesses that have survived their initial stages and are looking to scale up their operations.

This type of plan focuses on strategies that can be implemented to facilitate growth and increased profitability.

One of the primary concerns of a Growth Business Plan is identifying new areas for expansion, such as new products, markets, or services.

It also involves assessing current operations to determine how they can be optimized and scaled efficiently.

The first step to creating a Growth Business Plan is conducting a market analysis to gain a comprehensive understanding of industry trends, consumer demands, and emerging opportunities.

This involves collecting and analyzing data from various sources such as industry reports, competitor analysis, and consumer feedback.

The goal is to identify untapped markets, potential partnerships, and new revenue streams that can be leveraged to facilitate growth.

The second step is to assess the existing organizational structure to determine if changes need to be made to support growth.

This includes hiring additional staff, expanding the physical infrastructure, or investing in new technology.

A comprehensive growth strategy must also address potential risks and challenges that may arise during the scaling process, such as changes in consumer behavior, supply chain disruptions, or regulatory changes.

Another critical aspect of a Growth Business Plan is financial planning. This involves conducting a financial analysis of the company’s operations to identify areas where cost savings can be realized and new revenue streams can be generated.

The plan must also include a detailed financial forecast that outlines revenue projections, cash flow forecasts, and budgets for capital expenditures.

Ultimately, a successful Growth Business Plan must articulate a clear and comprehensive strategy that establishes a roadmap for scaling up operations while maintaining profitability.

The plan must be flexible enough to adapt to changes in the market, consumer behavior, or the regulatory environment while also being prudent in managing risks associated with growth.

Clear communication of the plan to all the stakeholders of the business is necessary for flawless execution of the expansion efforts.

Exit Business Plan

One important aspect of business planning that is often overlooked is the Exit Business Plan. This subsection of a business plan outlines the steps that the company will take in the event that it needs to close down or be sold.

This can be an important consideration for investors and stakeholders, as it can help them understand the potential risks and rewards associated with their investment.

The Exit Business Plan should include a thorough analysis of the company’s financials, including any outstanding debts or liabilities, as well as projections for future revenue and expenses.

It should also outline the company’s strategy for selling its assets or winding down its operations, including any legal or regulatory considerations that may come into play.

Another important aspect of the Exit Business Plan is succession planning. This involves identifying key personnel who will be responsible for ensuring a smooth transition in the event of an exit, and outlining their roles and responsibilities.

It may also involve identifying potential buyers or partners who could take over the company, and developing a strategy for negotiating a sale or merger.

Ultimately, the purpose of the Exit Business Plan is to minimize risk and maximize value for all stakeholders involved.

By planning for the possibility of an exit from the outset, companies can be better prepared to handle unforeseen circumstances and minimize the potential impact on their investors and employees.

Summary Of Business Planning

Business planning is an essential component of any successful enterprise. It serves as a roadmap for achieving business objectives, providing a framework for decision-making, and establishing accountability.