- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

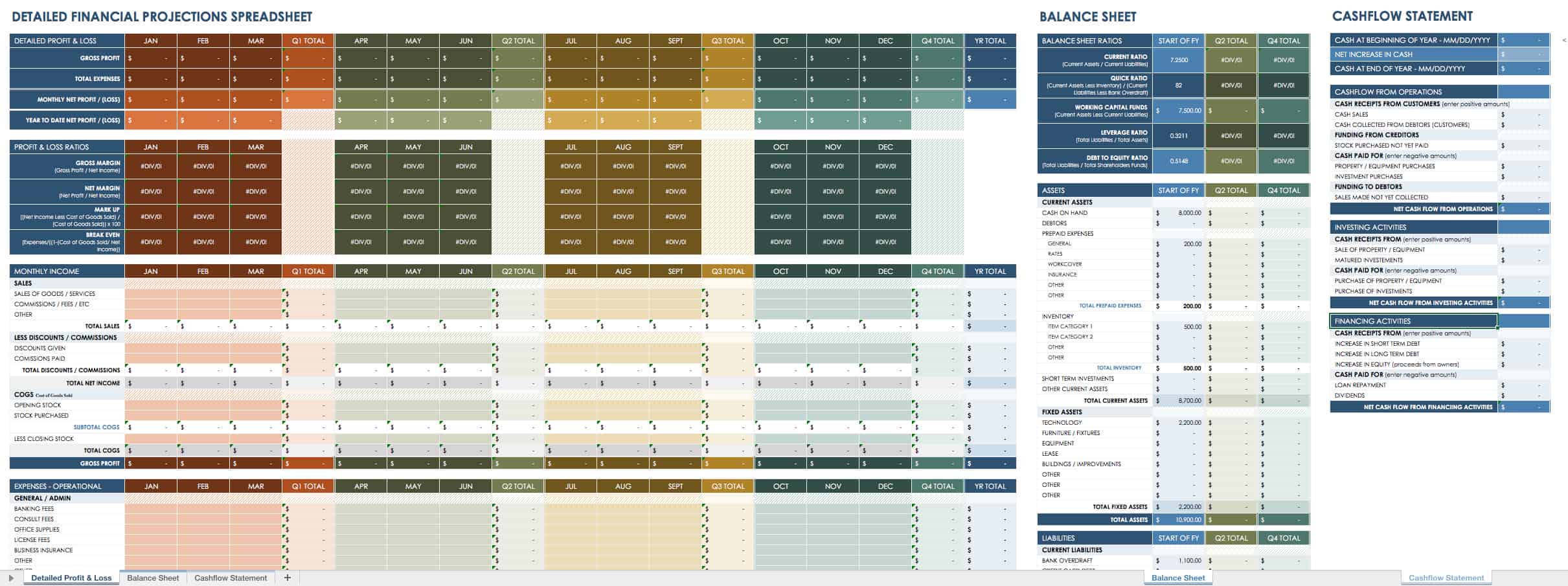

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

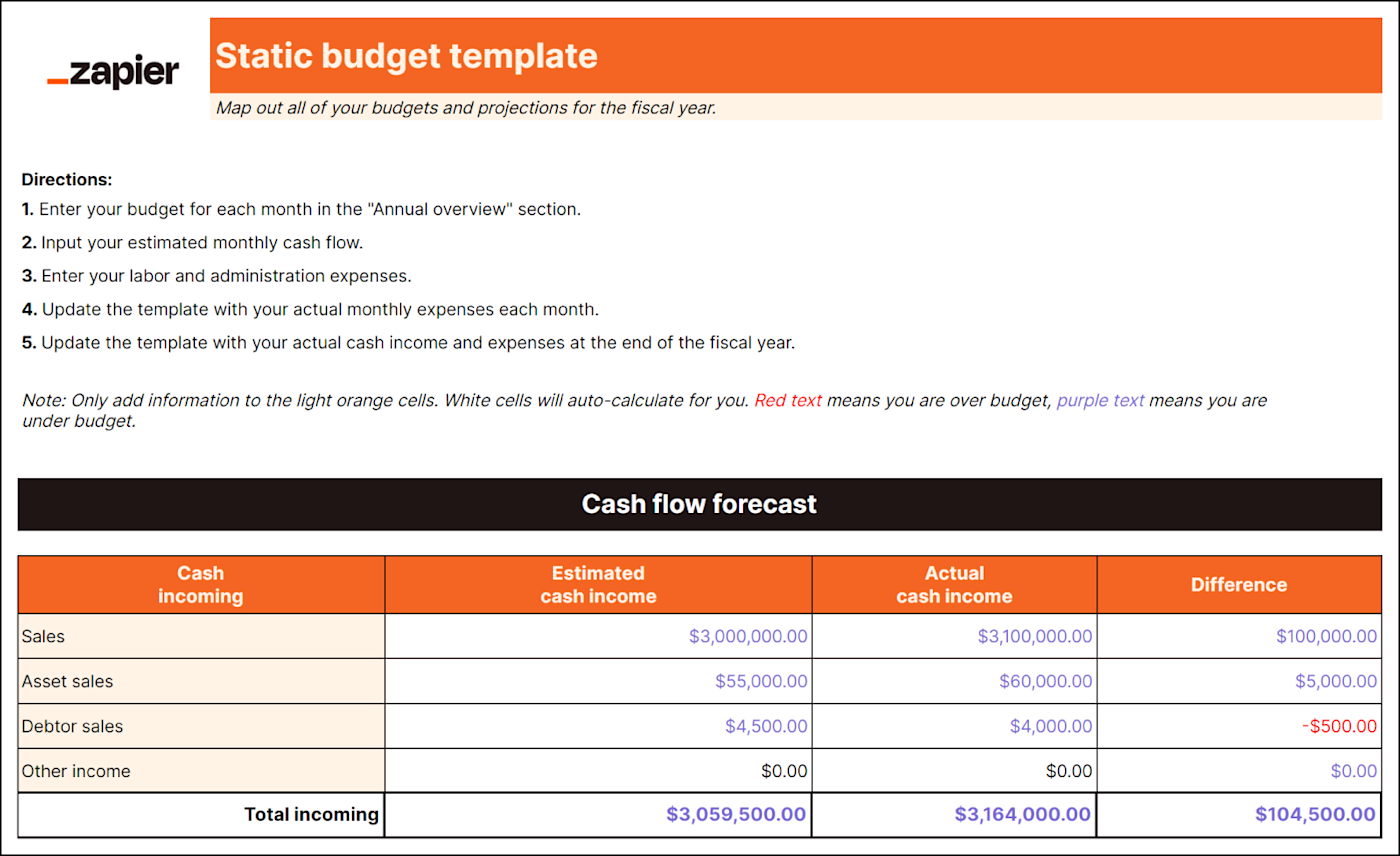

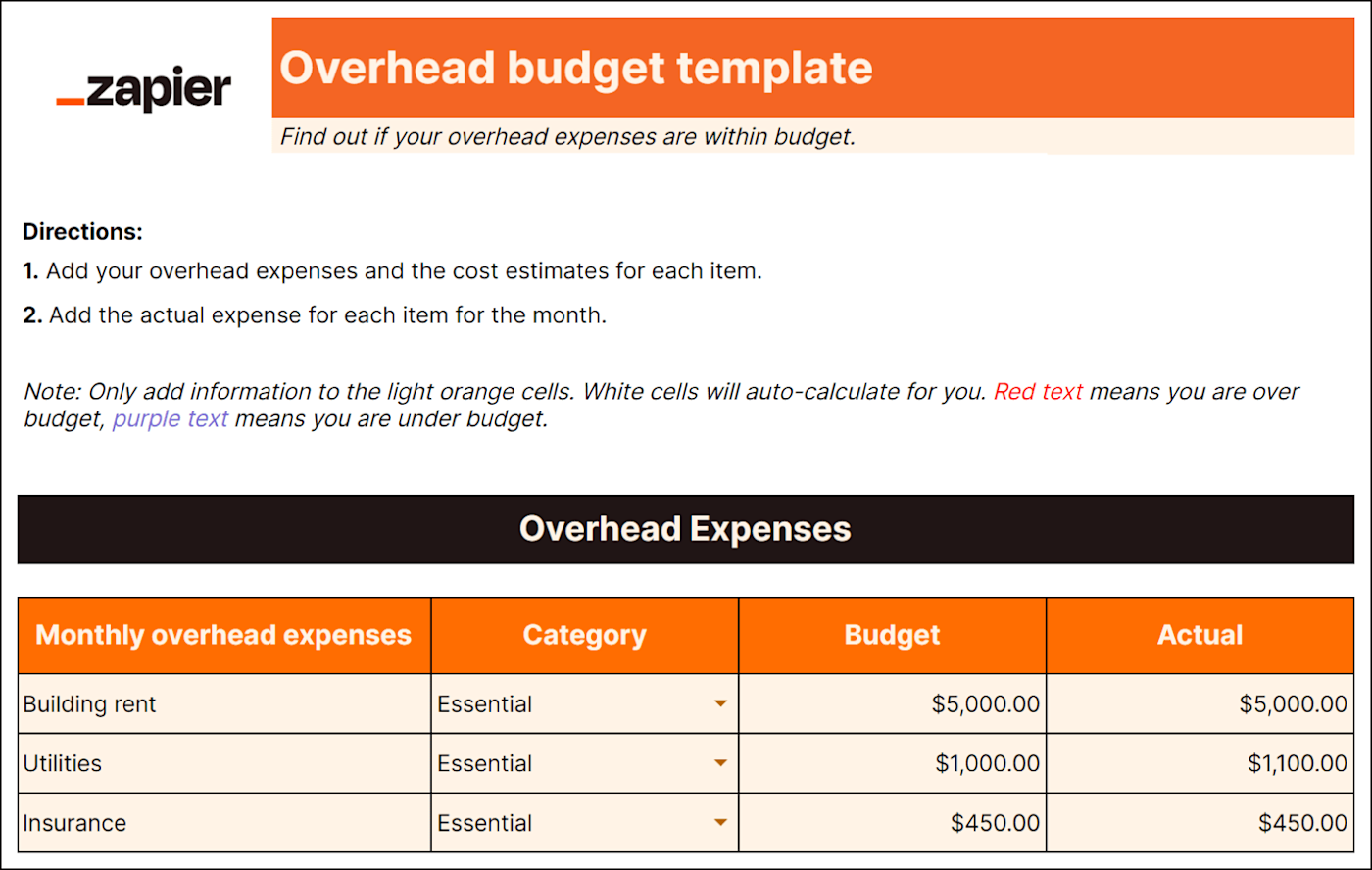

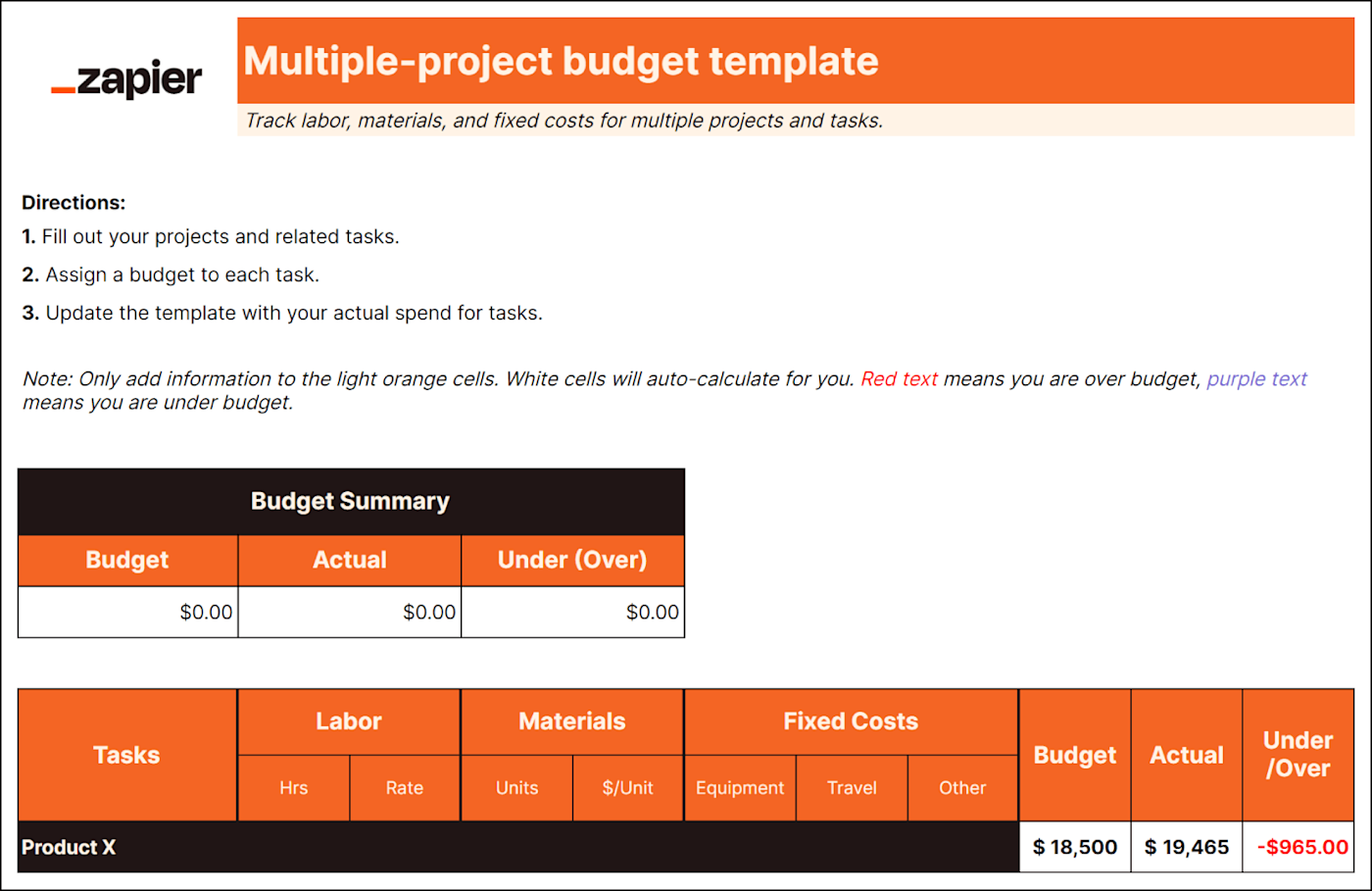

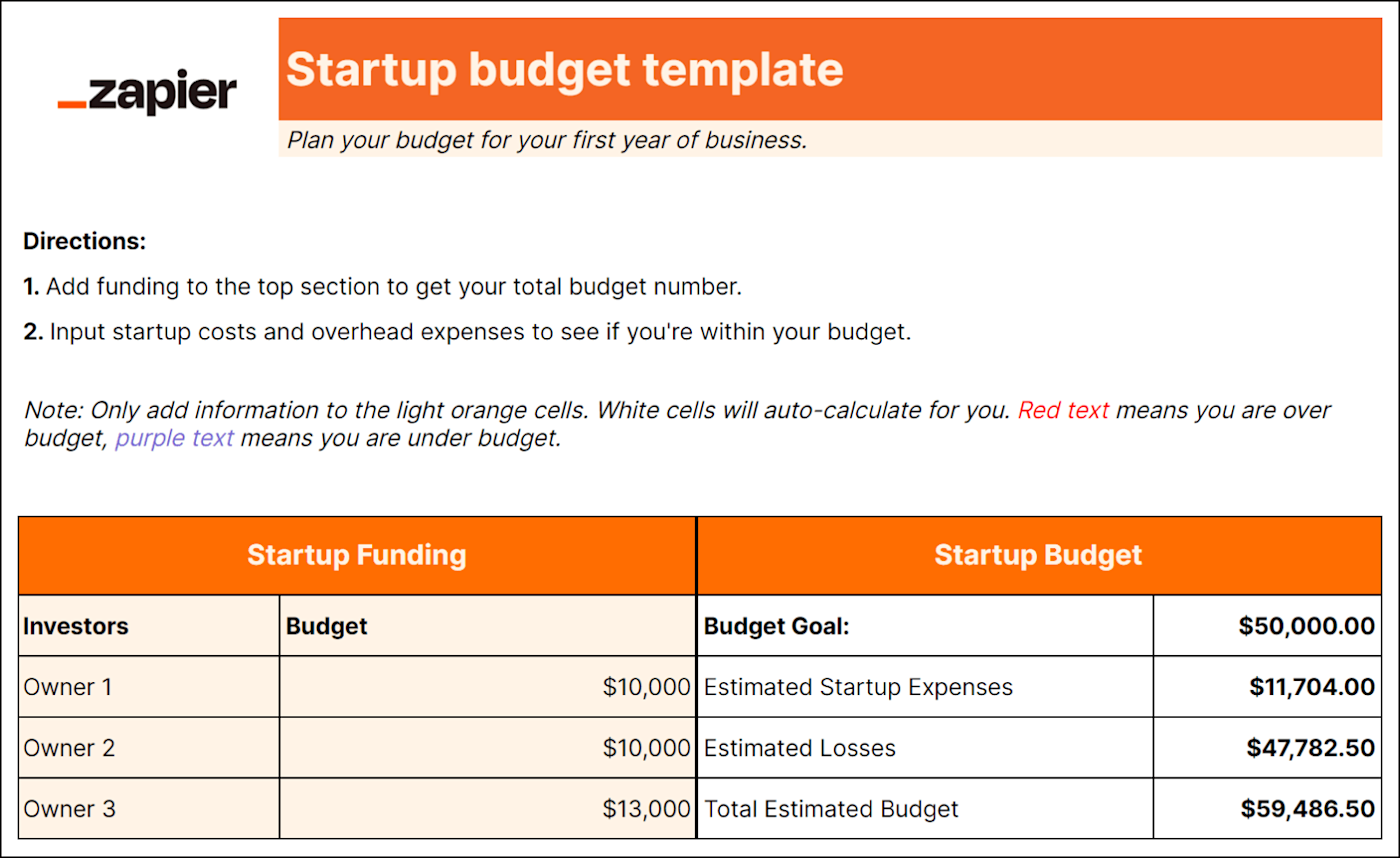

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

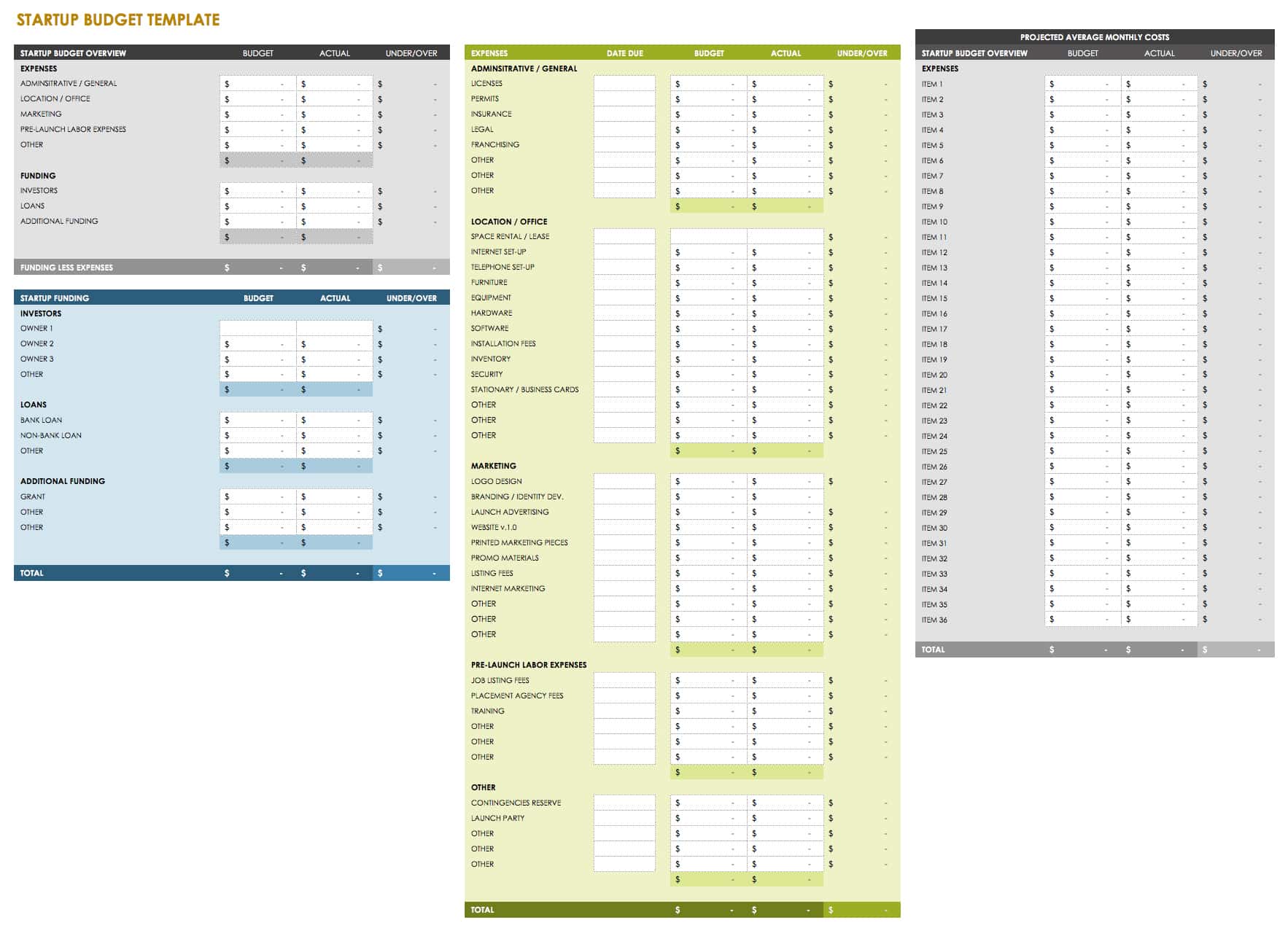

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

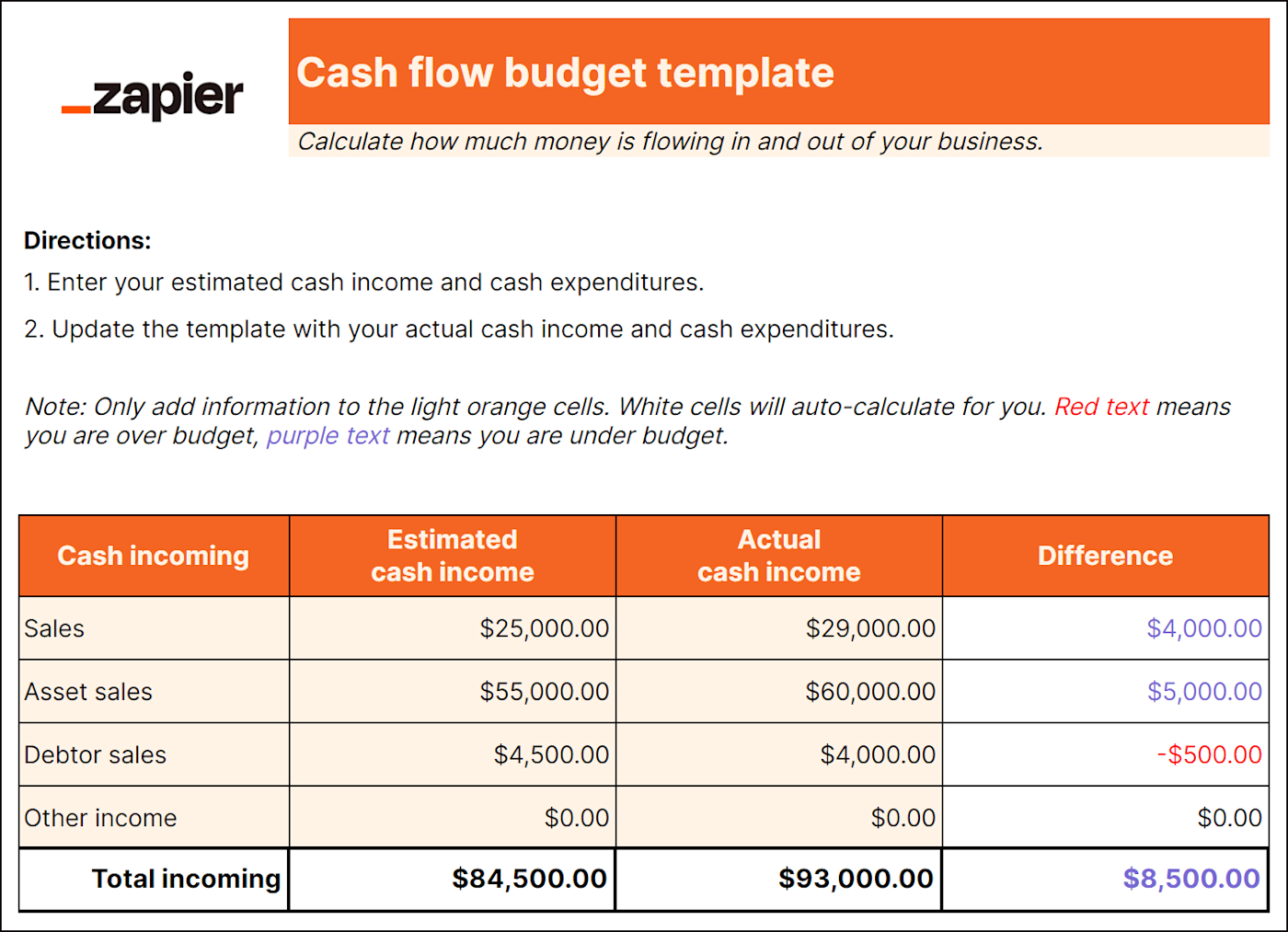

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

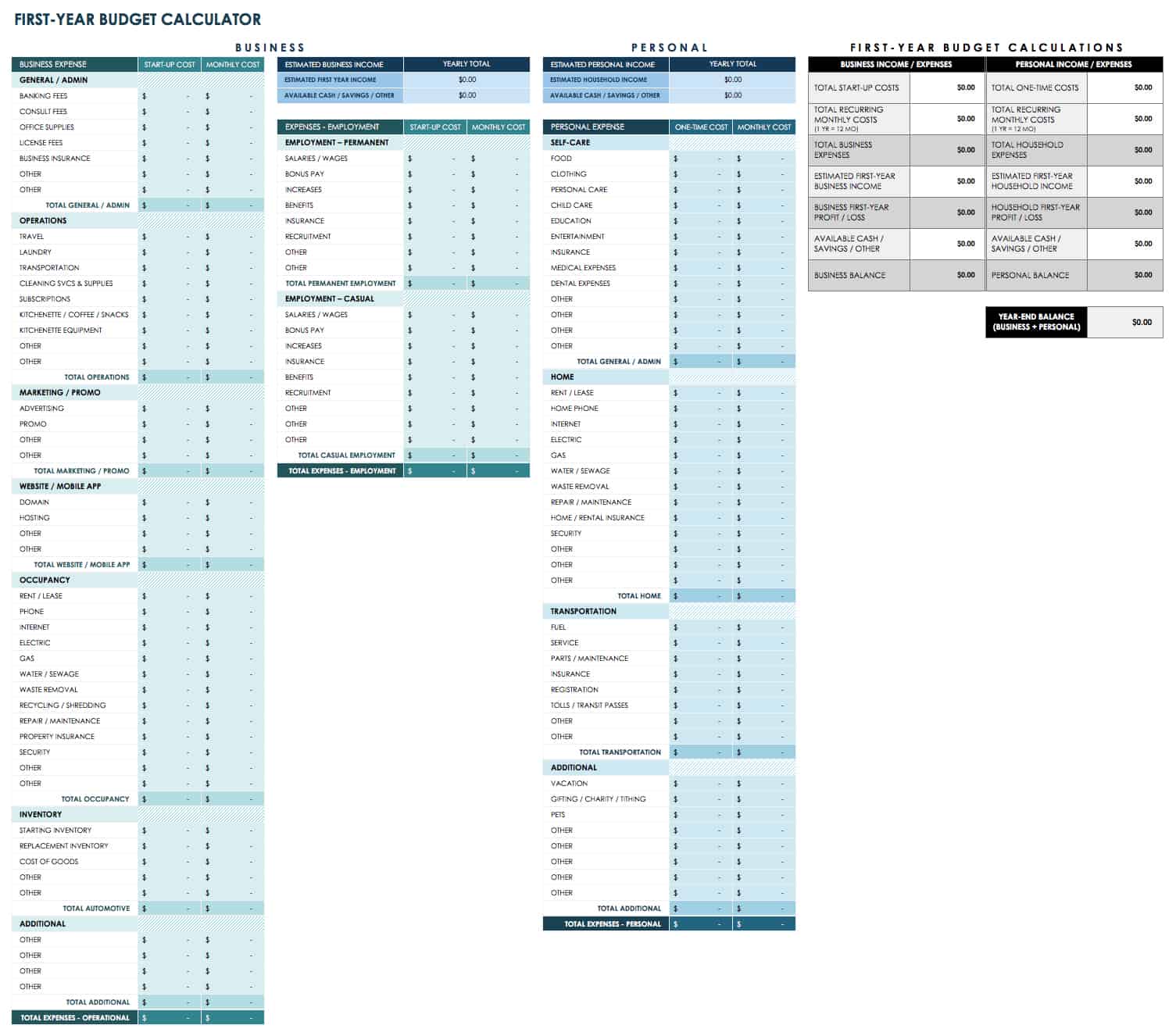

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

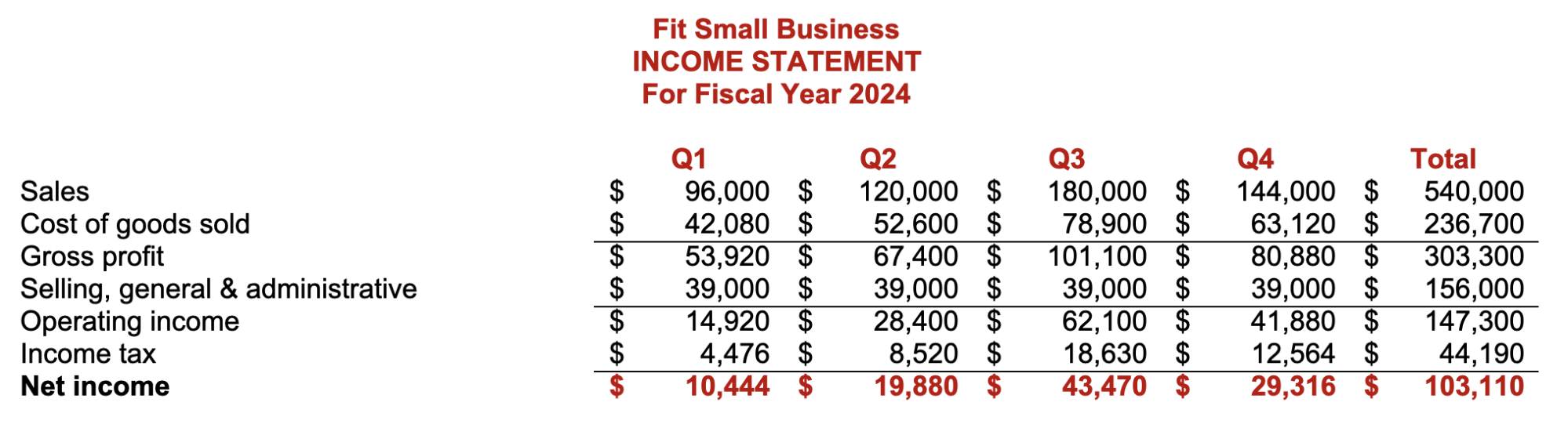

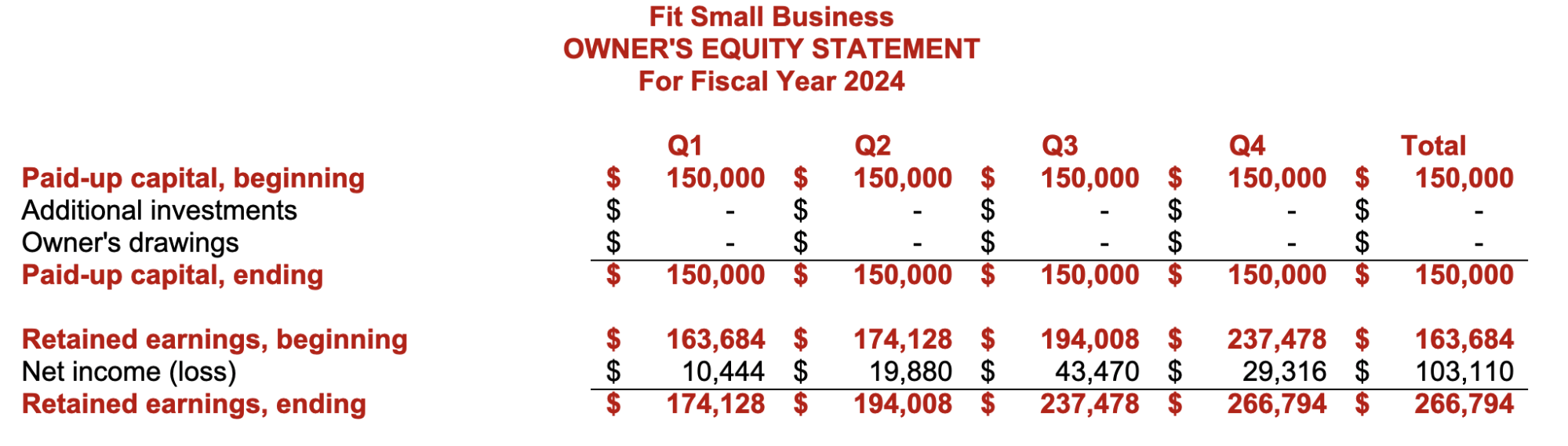

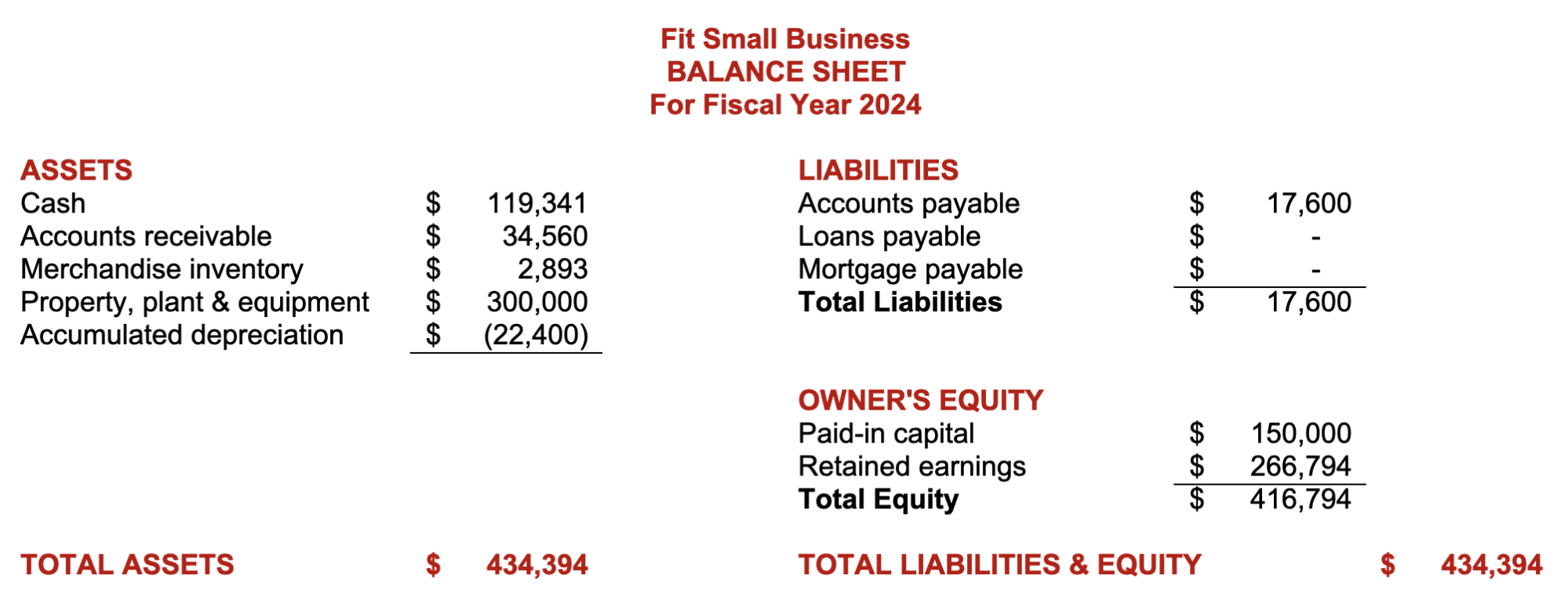

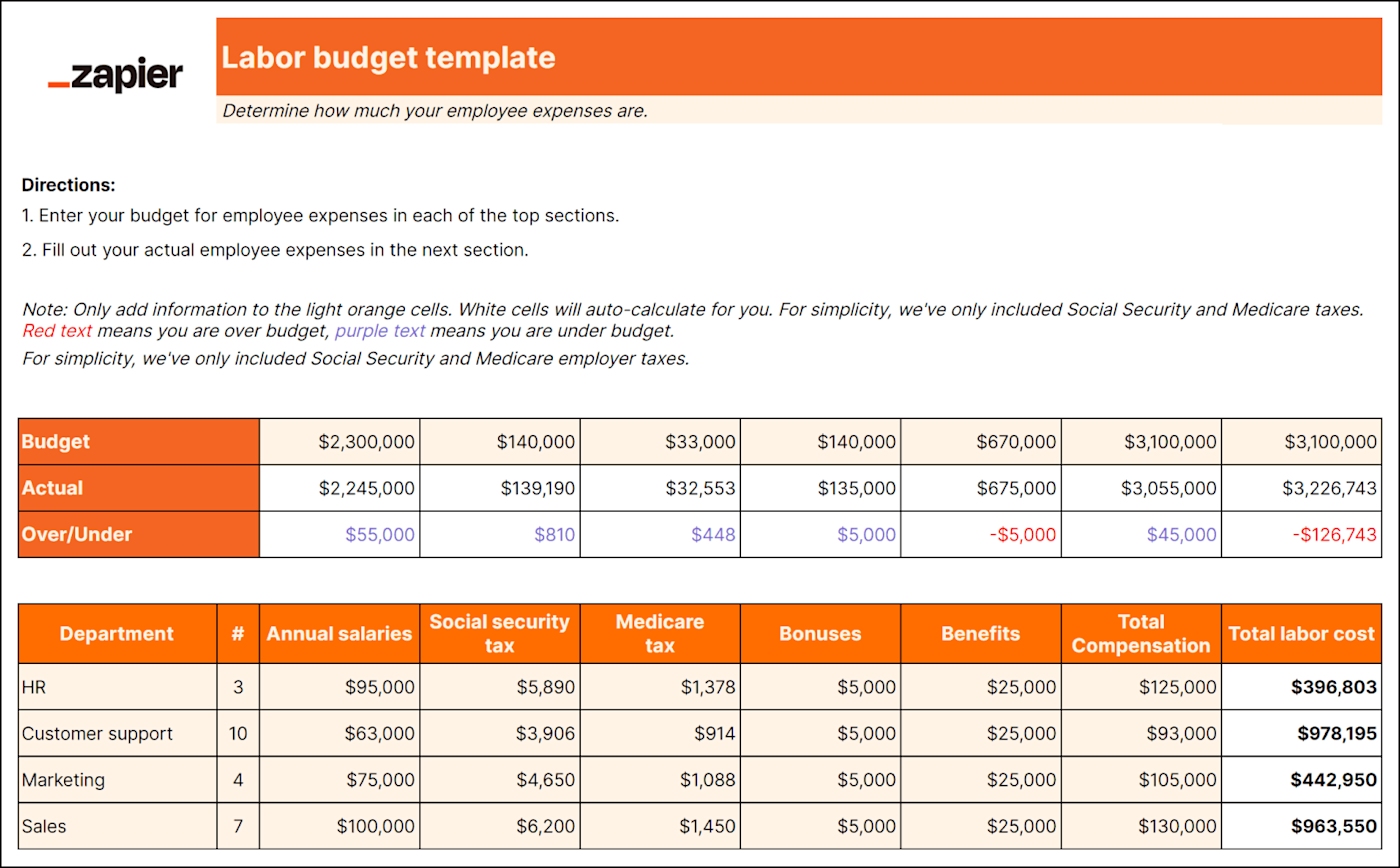

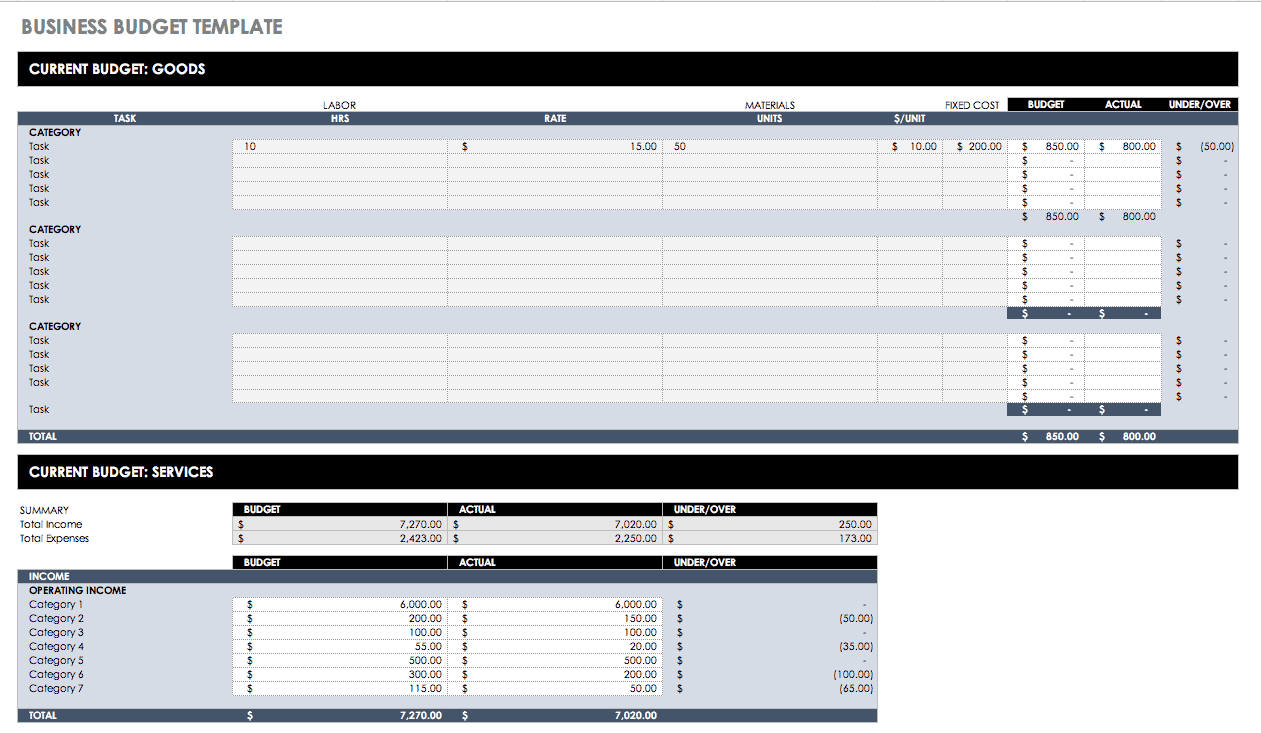

See the sample below.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

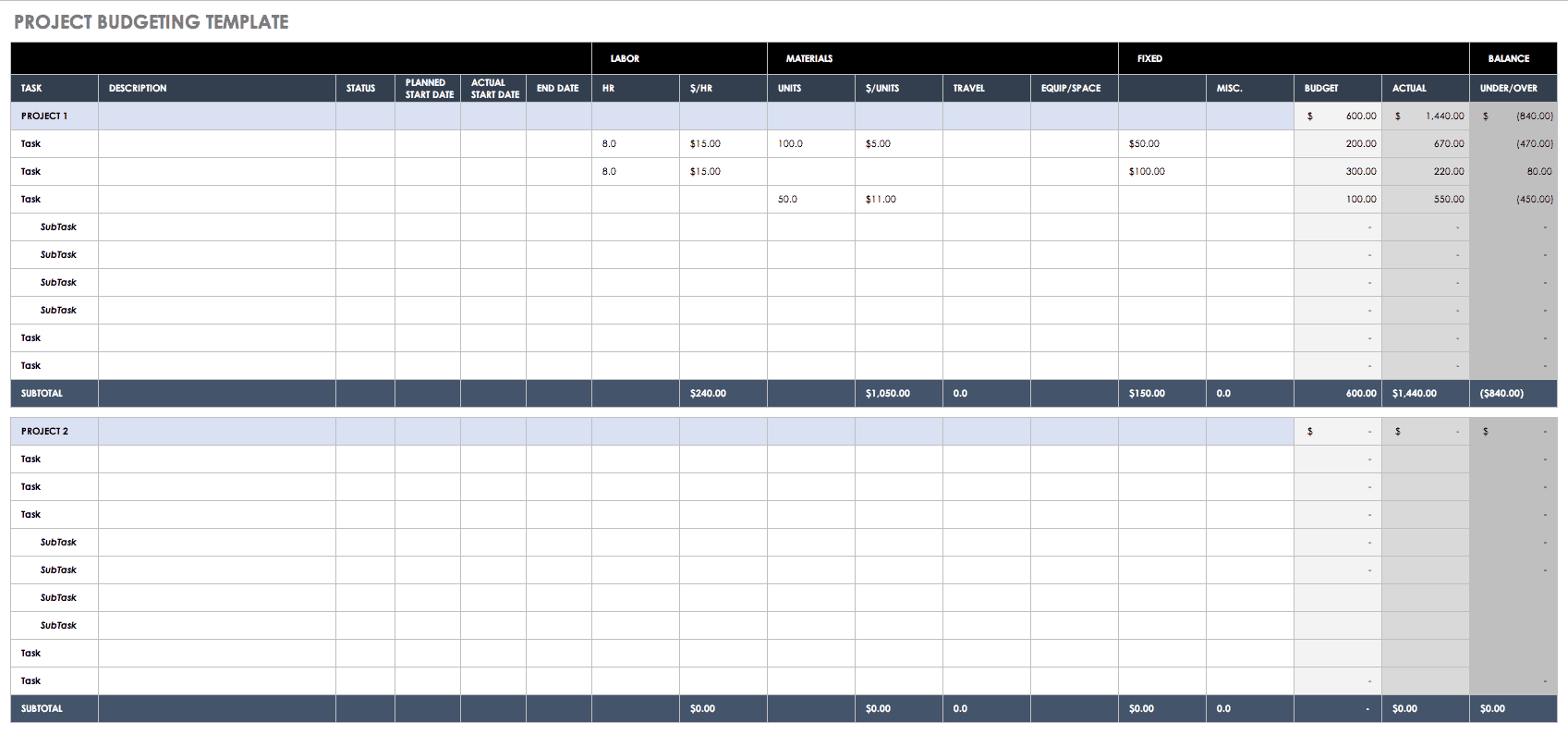

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

Small business budgeting templates

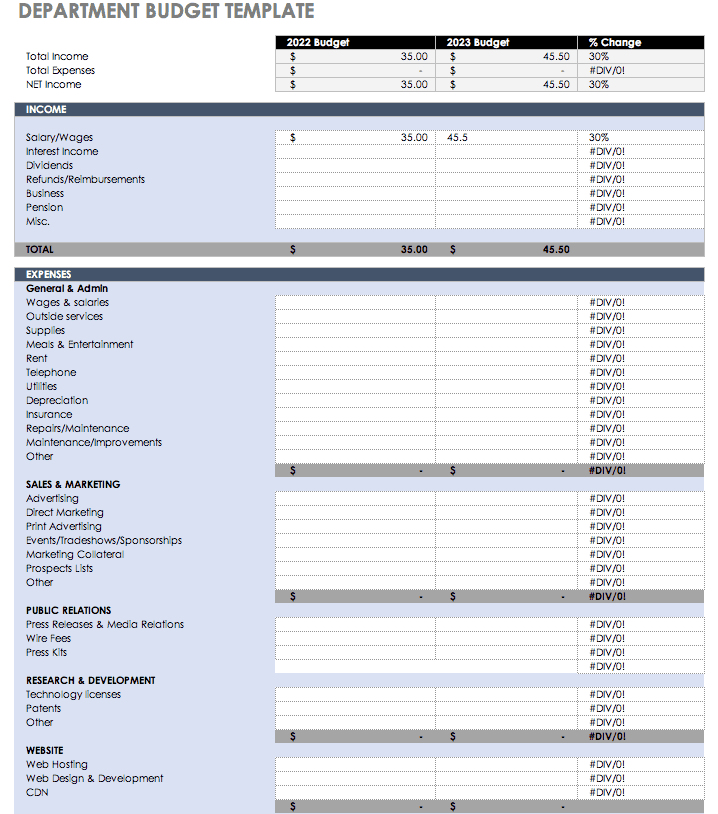

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

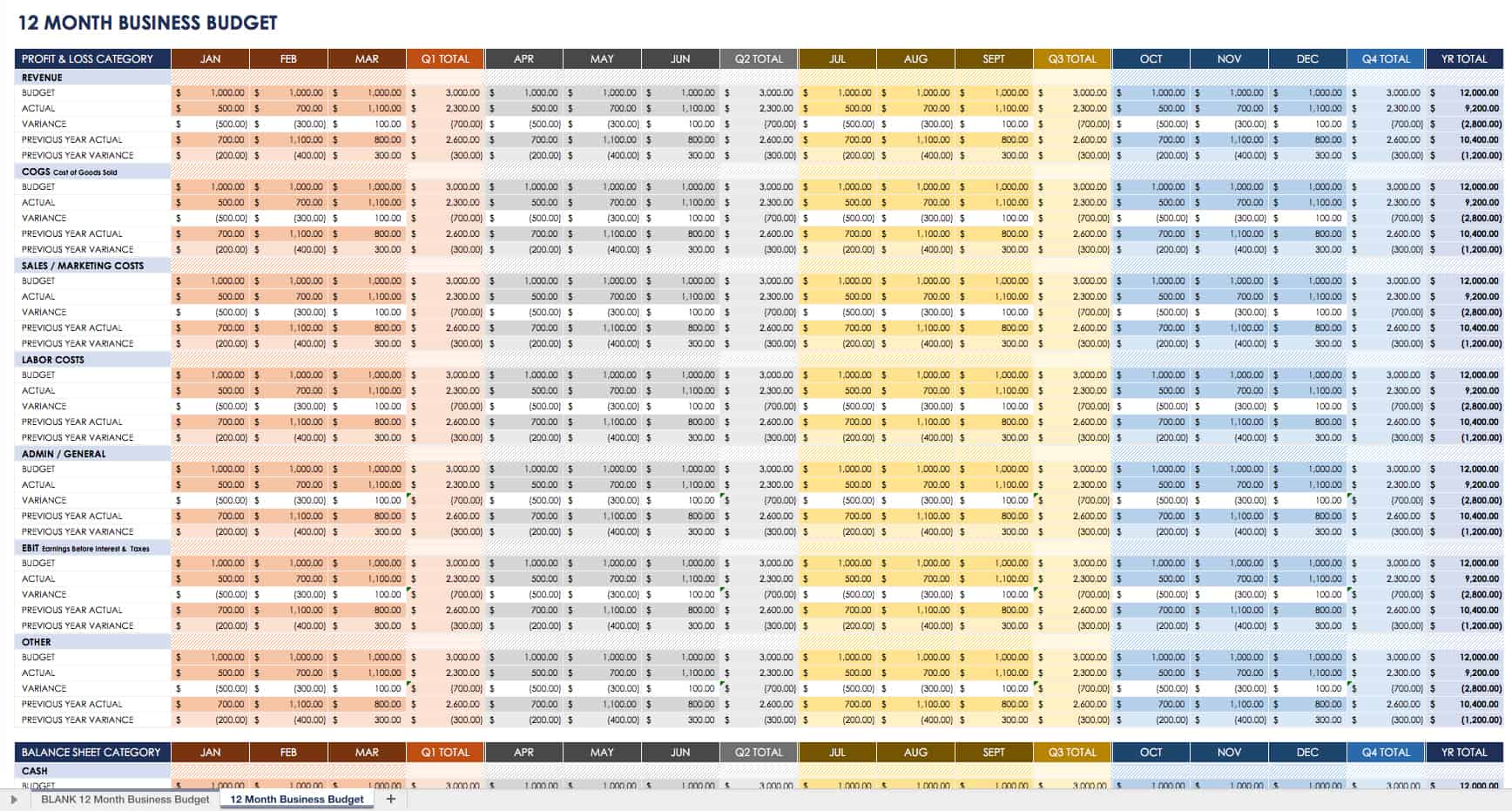

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

How to Pay Off Your Business Debt, Fast

Buried in small business debt? Follow this plan to dig yourself out.

.png)

How to Calculate (And Interpret) The Current Ratio

Trying to measure liquidity? Here’s how to calculate the current ratio, a financial metric that measures your company’s ability to pay off its short-term debts.

The Basics of Small Business Accounting: A How-to

New to business? Learn the fundamentals of small business accounting, and set your financials up for success.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Please note that the contents of this site are not being updated since October 1, 2023.

As of October 2, 2023, Acclr Business Information Services (Info entrepreneurs) will be delivered directly by CED’s Business Information Services . To find out more about CCMM’s other Acclr services, please visit this page: Acclr – Business Services | CCMM.

- Advice and guidance

- Starting a business

- Personalized Guidance

- Seminars on Business Opportunities

- Certification of Export Documents

- Market Studies

- Export Financing

- International Trade Training

- Connection with the World Bank

- Trade Missions

- SME Passport

- Export Resources

- Import Resources

- Networking Activities

- Networking Training

- CCMM Member Directory

- Market Studies and Research Services

- Business plan

- Registration and legal structures

- Guidance for Drafting a Business Plan

- Help in Seeking Funding

- News, Grants, and Competitions

- Funding Meet-and-Greet

- Resources for Drafting a Business Plan

- Regulations / Permits / Licences

- Personalized Market Information Research

- Personalized Meetings with Guest Experts

- Government Subsidies and Programs

- Training for your employees

- Employee Management

- Interconnection Program

- Wage Subsidies

- French courses

- Merchant-Student Pairing

- Intellectual property

- Marketing and sales

- Operations management

- Hiring and managing human resources

- Growth and innovation

- Importing and exporting

- Calls for tenders

- Support organizations

- Sale / Closure / Bankruptcy

- Business intelligence

- Business lists and profiles

- Market data

- Market trends

- Business advice

- Business plan management consultant

- Legal structures consultant

- Accounting consultant

- Legal consultant

- Export certification

- Resource centre

Budgeting and business planning

Once your business is operational, it's essential to plan and tightly manage its financial performance. Creating a budgeting process is the most effective way to keep your business - and its finances - on track.

This guide outlines the advantages of business planning and budgeting and explains how to go about it. It suggests action points to help you manage your business' financial position more effectively and ensure your plans are practical.

Planning for business success

The benefits, what to include in your annual plan, a typical business planning cycle, budgets and business planning, benefits of a business budget, creating a budget, key steps in drawing up a budget, what your budget should cover, what your budget will need to include, use your budget to measure performance, review your budget regularly.

When you're running a business, it's easy to get bogged down in day-to-day problems and forget the bigger picture. However, successful businesses invest time to create and manage budgets, prepare and review business plans and regularly monitor finance and performance.

Structured planning can make all the difference to the growth of your business. It will enable you to concentrate resources on improving profits, reducing costs and increasing returns on investment.

In fact, even without a formal process, many businesses carry out the majority of the activities associated with business planning, such as thinking about growth areas, competitors, cashflow and profit.

Converting this into a cohesive process to manage your business' development doesn't have to be difficult or time-consuming. The most important thing is that plans are made, they are dynamic and are communicated to everyone involved. See the page in this guide on what to include in your annual plan.

The key benefit of business planning is that it allows you to create a focus for the direction of your business and provides targets that will help your business grow. It will also give you the opportunity to stand back and review your performance and the factors affecting your business. Business planning can give you:

- a greater ability to make continuous improvements and anticipate problems

- sound financial information on which to base decisions

- improved clarity and focus

- a greater confidence in your decision-making

The main aim of your annual business plan is to set out the strategy and action plan for your business. This should include a clear financial picture of where you stand - and expect to stand - over the coming year. Your annual business plan should include:

- an outline of changes that you want to make to your business

- potential changes to your market, customers and competition

- your objectives and goals for the year

- your key performance indicators

- any issues or problems

- any operational changes

- information about your management and people

- your financial performance and forecasts

- details of investment in the business

Business planning is most effective when it's an ongoing process. This allows you to act quickly where necessary, rather than simply reacting to events after they've happened.

- Review your current performance against last year/current year targets.

- Work out your opportunities and threats.

- Analyse your successes and failures during the previous year.

- Look at your key objectives for the coming year and change or re-establish your longer-term planning.

- Identify and refine the resource implications of your review and build a budget.

- Define the new financial year's profit-and-loss and balance-sheet targets.

- Conclude the plan.

- Review it regularly - for example, on a monthly basis - by monitoring performance, reviewing progress and achieving objectives.

- Go back to 1.

New small business owners may run their businesses in a relaxed way and may not see the need to budget. However, if you are planning for your business' future, you will need to fund your plans. Budgeting is the most effective way to control your cashflow, allowing you to invest in new opportunities at the appropriate time.

If your business is growing, you may not always be able to be hands-on with every part of it. You may have to split your budget up between different areas such as sales, production, marketing etc. You'll find that money starts to move in many different directions through your organisation - budgets are a vital tool in ensuring that you stay in control of expenditure.

A budget is a plan to:

- control your finances

- ensure you can continue to fund your current commitments

- enable you to make confident financial decisions and meet your objectives

- ensure you have enough money for your future projects

It outlines what you will spend your money on and how that spending will be financed. However, it is not a forecast. A forecast is a prediction of the future whereas a budget is a planned outcome of the future - defined by your plan that your business wants to achieve.

There are a number of benefits of drawing up a business budget, including being better able to:

- manage your money effectively

- allocate appropriate resources to projects

- monitor performance

- meet your objectives

- improve decision-making

- identify problems before they occur - such as the need to raise finance or cash flow difficulties

- plan for the future

- increase staff motivation

Creating, monitoring and managing a budget is key to business success. It should help you allocate resources where they are needed, so that your business remains profitable and successful. It need not be complicated. You simply need to work out what you are likely to earn and spend in the budget period.

Begin by asking these questions:

- What are the projected sales for the budget period? Be realistic - if you overestimate, it will cause you problems in the future.

- What are the direct costs of sales – i.e. costs of materials, components or subcontractors to make the product or supply the service?

- What are the fixed costs or overheads?

You should break down the fixed costs and overheads by type, e.g.:

- cost of premises, including rent, municipal taxes and service charges

- staff costs –e.g. wages, benefits, Québec Parental Insurance Plan (QPIP) premiums, contributions to the Québec Pension Plan (QPP) and to the financing of the Commission des normes du travail (CNT)

- utilities – e.g. heating, lighting, telephone

- printing, postage and stationery

- vehicle expenses

- equipment costs

- advertising and promotion

- travel and subsistence expenses

- legal and professional costs, including insurance

Your business may have different types of expenses, and you may need to divide up the budget by department. Don't forget to add in how much you need to pay yourself, and include an allowance for tax.

Your business plan should help in establishing projected sales, cost of sales, fixed costs and overheads, so it would be worthwhile preparing this first. See the page in this guide on planning for business success.

Once you've got figures for income and expenditure, you can work out how much money you're making. You can look at costs and work out ways to reduce them. You can see if you are likely to have cash flow problems, giving yourself time to do something about them.

When you've made a budget, you should stick to it as far as possible, but review and revise it as needed. Successful businesses often have a rolling budget, so that they are continually budgeting, e.g. for a year in advance.

There are a number of key steps you should follow to make sure your budgets and plans are as realistic and useful as possible.

Make time for budgeting

If you invest some time in creating a comprehensive and realistic budget, it will be easier to manage and ultimately more effective.

Use last year's figures - but only as a guide

Collect historical information on sales and costs if they are available - these could give you a good indication of likely sales and costs. But it's also essential to consider what your sales plans are, how your sales resources will be used and any changes in the competitive environment.

Create realistic budgets

Use historical information, your business plan and any changes in operations or priorities to budget for overheads and other fixed costs.

It's useful to work out the relationship between variable costs and sales and then use your sales forecast to project variable costs. For example, if your unit costs reduce by 10 per cent for each additional 20 per cent of sales, how much will your unit costs decrease if you have a 33 per cent rise in sales?

Make sure your budgets contain enough information for you to easily monitor the key drivers of your business such as sales, costs and working capital. Accounting software can help you manage your accounts.

Involve the right people

It's best to ask staff with financial responsibilities to provide you with estimates of figures for your budget - for example, sales targets, production costs or specific project control. If you balance their estimates against your own, you will achieve a more realistic budget. This involvement will also give them greater commitment to meeting the budget.

Decide how many budgets you really need. Many small businesses have one overall operating budget which sets out how much money is needed to run the business over the coming period - usually a year. As your business grows, your total operating budget is likely to be made up of several individual budgets such as your marketing or sales budgets.

Projected cash flow -your cash budget projects your future cash position on a month-by-month basis. Budgeting in this way is vital for small businesses as it can pinpoint any difficulties you might be having. It should be reviewed at least monthly.

Costs - typically, your business will have three kinds of costs:

- fixed costs - items such as rent, salaries and financing costs

- variable costs - including raw materials and overtime

- one-off capital costs - purchases of computer equipment or premises, for example

To forecast your costs, it can help to look at last year's records and contact your suppliers for quotes.

Revenues - sales or revenue forecasts are typically based on a combination of your sales history and how effective you expect your future efforts to be.

Using your sales and expenditure forecasts, you can prepare projected profits for the next 12 months. This will enable you to analyse your margins and other key ratios such as your return on investment.

If you base your budget on your business plan, you will be creating a financial action plan. This can serve several useful functions, particularly if you review your budgets regularly as part of your annual planning cycle.

Your budget can serve as:

- an indicator of the costs and revenues linked to each of your activities

- a way of providing information and supporting management decisions throughout the year

- a means of monitoring and controlling your business, particularly if you analyse the differences between your actual and budgeted income

Benchmarking performance

Comparing your budget year on year can be an excellent way of benchmarking your business' performance - you can compare your projected figures, for example, with previous years to measure your performance.

You can also compare your figures for projected margins and growth with those of other companies in the same sector, or across different parts of your business.

Key performance indicators

To boost your business' performance you need to understand and monitor the key "drivers" of your business - a driver is something that has a major impact on your business. There are many factors affecting every business' performance, so it is vital to focus on a handful of these and monitor them carefully.

The three key drivers for most businesses are:

- working capital

Any trends towards cash flow problems or falling profitability will show up in these figures when measured against your budgets and forecasts. They can help you spot problems early on if they are calculated on a consistent basis.

To use your budgets effectively, you will need to review and revise them frequently. This is particularly true if your business is growing and you are planning to move into new areas.

Using up to date budgets enables you to be flexible and also lets you manage your cash flow and identify what needs to be achieved in the next budgeting period.

Two main areas to consider

Your actual income - each month compare your actual income with your sales budget, by:

- analysing the reasons for any shortfall - for example lower sales volumes, flat markets, underperforming products

- considering the reasons for a particularly high turnover - for example whether your targets were too low

- comparing the timing of your income with your projections and checking that they fit

Analysing these variations will help you to set future budgets more accurately and also allow you to take action where needed.

Your actual expenditure - regularly review your actual expenditure against your budget. This will help you to predict future costs with better reliability. You should:

- look at how your fixed costs differed from your budget

- check that your variable costs were in line with your budget - normally variable costs adjust in line with your sales volume

- analyse any reasons for changes in the relationship between costs and turnover

- analyse any differences in the timing of your expenditure, for example by checking suppliers' payment terms

Original document, Budgeting and business planning , © Crown copyright 2009 Source: Business Link UK (now GOV.UK/Business ) Adapted for Québec by Info entrepreneurs

Our information is provided free of charge and is intended to be helpful to a large range of UK-based (gov.uk/business) and Québec-based (infoentrepreneurs.org) businesses. Because of its general nature the information cannot be taken as comprehensive and should never be used as a substitute for legal or professional advice. We cannot guarantee that the information applies to the individual circumstances of your business. Despite our best efforts it is possible that some information may be out of date.

- The websites operators cannot take any responsibility for the consequences of errors or omissions.

- You should always follow the links to more detailed information from the relevant government department or agency.

- Any reliance you place on our information or linked to on other websites will be at your own risk. You should consider seeking the advice of independent advisors, and should always check your decisions against your normal business methods and best practice in your field of business.

- The websites operators, their agents and employees, are not liable for any losses or damages arising from your use of our websites, other than in respect of death or personal injury caused by their negligence or in respect of fraud.

Need help? Our qualified agents can help you. Contact us!

- Create my account

The address of this page is: https://www.infoentrepreneurs.org/en/guides/budgeting-and-business-planning/

INFO ENTREPRENEURS

380 St-Antoine West Suite W204 (mezzanine level) Montréal, Québec, Canada H2Y 3X7

www.infoentrepreneurs.org

514-496-4636 | 888-576-4444 [email protected]

Consent to Cookies

This website uses necessary cookies to ensure its proper functioning and security. Other cookies and optional technologies make it possible to facilitate, improve or personalize your navigation on our website. If you click "Refuse", some portions of our website may not function properly. Learn more about our privacy policy.

Click on one of the two buttons to access the content you wish to view.

Solving your most complex planning challenges

Explore Industry Research

What do Gartner, Forrester, and IDC have in common? They all named Anaplan a planning leader.

Your success is the heart of our success

Hear from our customers at Anaplan Connect 2024

Join us for a day of connected inspiration from your industry-leading peers who have found the answer in agile, connected enterprise planning.

Transform how you see, plan and lead your business

Get started today.

Explore on-demand demos to discover how our modeling and planning capabilities are designed to meet the specific and unique needs of your business.

Transform how you see, plan, and lead your business

We’d love to find out how we can help you

Events, training, and content for your planning journey

Visit our blog and newsroom

Your hub for Anaplan updates, insights, perspectives, and innovations.

Powerful partnerships to drive your digital transformation and deliver game-changing strategies.

Solutions for your business, your industry, from the world’s leading alliances.

- wrappers --> Finance

Annual Budgeting Process, Planning and Best Practices

- Share on Twitter

- Share on Facebook

- Share on LinkedIn

Conor Donohoe

FP&A Specialist

Effective annual budgets aren’t just top-down initiatives to allot spending and set production targets. Done right, they can embody corporate priorities and spur growth.

All companies have to prepare annual budgets, but many don’t understand the real purpose behind the exercise. If a budget fails to influence and promote behavioral change across an organization, it remains a work of fiction, imposed from above and adopted with varying degrees of resignation or cynicism.

The budget is a blend of art and science. It needs to tell a compelling story for people to believe in it and reflect that with their behavior. During budget season, the finance team’s efforts quickly get stuck in the weeds of spreadsheet overload, and the real story is lost.

There is a better way of building a budget to reflect the company’s priorities, stimulate growth, and encourage employee engagement. That’s what we’re offering here: the opportunity to get back to basics and rethink budgeting (as well as other fundamental financial processes we’ll discuss over the following weeks).

Giving more responsibility, getting more accountability

The most effective annual budgets are both operational and financial, rather than an arbitrary, top-down, purely finance-driven exercise. They make the budget process transparent and accessible to all involved. This organizational alignment ensures that departmental leaders have ownership of their segment of the plan, know how the overall budget affects them, and, as a result, gain a clearer vision of both tactical and larger strategic goals.

The results of getting the budgeting approach right are that businesses become more efficient, waste less time on spreadsheet manipulation, and operate more cost-effectively. When the budgeting process transitions from overly focusing on the accounting perspective to being about the real drivers behind the business, then the departmental heads feel more inherent responsibility and ownership toward the numbers. And beyond these intangible benefits to morale, people who feel more like owners will show more accountability to deliver on those numbers.

For management, mastering the basics of budgeting will better position them to make decisions that can increase revenue, decrease costs, and improve free cash flow and working capital.

Bring your lines of business into the budget process early

A former boss of mine liked to say, “nobody went to budgeting school.” Below, Nadine Pichelot, VP of Finance, EMEA at Anaplan, shares her perspective on how to get the most out of the budgeting process. Pichelot previously spent more than 20 years as a finance leader and CFO at several companies. She has managed teams using budgeting methodologies of all types, including zero-based , top-down, and bottom-up budgeting.

Pichelot observes that the best budgeting processes start at the top, with business leaders thinking through the commercial and operational drivers that influence their financial plans. Key considerations include market size, projected growth or decline in market share, demand shifts, cost inputs (raw materials, employee costs, transportation, advertising, and more), competitive pressures, and the regulatory environment. You also build in the company’s high-level goals for the year (and looking ahead to future years ).

It’s important to reach out to the operational departments and regions to find out their budget expectations for the coming year, and balance those bottom-up projections against the top-down goals. Bring the departments into the budgeting process as early as possible, Pichelot says: “Finance should take the lead, but finance needs the operational departments involved… or you have only a partial process.”

Of course, even in prosperous times, no budget can satisfy everyone’s hopes. You can’t blithely assume that, say, the manufacturing output will go up 10% across the board without buying replacements for outdated equipment. Or that every project on R&D’s wish list will get funded. Involving the leaders from these operational departments gives everyone more perspective. Executives gain more realistic expectations in relation to the productivity of their workforce. Line-of-business heads get a better sense of how much (or little) new funding is up for grabs. Those operational managers know they’ll have to make trade-offs, but they’ll be more accepting of the results when they see the assumptions that went into them and have a voice in how they are shaped.

Make smart trade-offs

This kind of collaboratively validated budget process relies on everyone working off a single set of numbers and expectations. “If you don’t have a budget process that makes sure you start out with shared assumptions, working from a single source of the truth, it ends up wasting a lot of time,” Pichelot cautions. “You spend a lot of time chasing down facts or settling misunderstandings. And then you’re not really spending the time where you should be, which is working with your functional leads.

“For example, my chief development officer should only be focused on questions like, ‘How do I get the budget to cover my new R&D projects and my product development?’ And all my sales director should be worried about is ‘How will you fund my sales force? How will you make me more productive?’” A transparent, efficient budget process will let these executives make their cases for funding, or else accept prudent trade-offs. Discussing how to allot your resources is worthwhile when it keeps you aligned to larger corporate priorities, Pichelot explains.

“[With an inefficient budget process,] you’re spending all your time reconciling data – saying things like, ‘Oh, by the way, I need to take away half a million here to fill a hole of half a million in another department,’ which shouldn’t be the case. You end up doing stupid trade-offs.”

Spreadsheet chaos versus a single source of the truth

This brings us to the biggest hindrance in annual budgeting: manual, spreadsheet-driven processes. Some of the world’s largest, most successful companies still rely on sending around copies of spreadsheets for lines of business to fill out and the finance team to reconcile. That’s a huge waste of time, Pichelot says.

“Spending hours and hours reconciling numbers in leadership meetings – that has happened to me! Someone will say, ‘I entered that number, so I know it’s right.’ And someone else will reply, “Oh, no. You’re working off the wrong assumptions. Which cells did you change?’ Sometimes they won’t even remember what figures they changed.”

In fact, each spreadsheet is a potential point of failure. Over weeks and months, errors accumulate. Links break. Version control issues increase with time. There’s no real-time visibility into performance against objectives. By the time information is communicated across the business, it’s out of date.

No wonder the annual budgeting process can take three or four months, sometimes even five, to complete, when it’s hampered by outdated technology.

“When I joined Anaplan, of course we used our own software platform for our internal financial planning processes. I saw how much faster and more efficient it is when everyone has access to the same set of data, on a shared platform,” Pichelot says. “For example, there’s a built-in audit trail, so you’re not spending time tracking down which figures got changed. And you can easily view all the KPIs – not just financial ones but operational indicators like contract renewal rates or staff hiring and attrition rates.”

This offers benefits beyond making the process faster and more accurate, she points out: It helps the budget better reflect the company’s overall strategy. “Even if you have an efficient budgeting process, it can defeat its own purpose if you haven’t listened to your operational leaders and assigned the right funding priorities to the various functions. Finance shouldn’t be acting in a vacuum. It plays a role in gathering information and setting the cadence, of course. But it should also be fostering a more thoughtful budget process across each department.”

A budget built to support business growth

Part of that more thoughtful process, Pichelot adds, is offering the flexibility to reflect changes during the budgeting cycle, whether due to executive priority shifts or the external shocks that came all too often in 2020. Even a final, approved annual budget isn’t meant to be a pair of handcuffs. Rather, it should point out a clear direction of travel for the next 12 months, ensuring that employees are accountable to the plan and motivated to deliver on its objectives.

With that kind of process in place, the annual budget becomes less “spreadsheet fantasy” and more a realistic foundation for business growth.

Read our eBook for a step-by-step guide to improving your yearly budget process and reinventing how your business makes plans for the future.

How to Create a Profitable Annual Business Plan [+Free Template]

Published: February 09, 2023

The beginning of a new quarter is the perfect time to start planning the next year for your business. Start the next year or quarter off on the right foot by creating an annual business plan for your company.

Q4 often brings a flurry of business-related activity. And while all this activity helps fill the pipeline, it can distract you from reflecting on past performance and preparing for the year or quarter ahead.

Fortunately, you can write an annual business plan at any time of the year. Start your plan now to set your team up for success.

What is an annual business plan?

An annual business plan is just that — a plan for you and your employees to help achieve the company’s goals for the year. Think of an annual business plan as the guide to complete all of your company’s overall goals outlined in your initial business plan.

The first business plan you wrote for your business is the blueprint and the annual business plan is the detailed instructions to keep your business running long-term.

Usually, an annual business plan contains a short description of your company, a marketing analysis, and a sales/marketing plan.

Because an annual business plan is for the year, you’ll want to review your business at the end of four consecutive quarters and revise your plan for the next four quarters.

Why is annual business planning important?

Even though the fourth quarter might be a busy time of year, don’t put off creating an annual business plan.

Not only will your annual business plan keep you on track, it will also help you map out a strategy to keep your employees accountable. You can then more easily achieve the overall goals of your business.

Here are some reasons why it’s well worth creating an annual business plan for your company.

You can measure your success.

An annual business plan is the best way to measure your success. And I’m referring to the collective “you” here because it takes the entire company or all of your employees to make new business efforts effective.

An annual plan not only sets expectations for you but also for others within your company who need to contribute to the business’s success.

You can reflect on the past and plan ahead.

Creating an annual business plan allows you to reflect on the past 12 months.

As you reflect on the previous year, you’ll be able to get a good idea of what your business is capable of doing and set accurate, attainable projections based on previous numbers.

You’ll define your business goals.

Your annual business plan will shed some light on what the heck you do at your company. For those who are not routinely involved in new business, it can seem like a black hole of mystery.

Sharing your plan — whether to an executive committee, department heads, or even the entire staff — adds clarity and gives everyone something to aim for.

You can impress your boss.

If you head a department that could benefit from an annual business plan, don’t wait to be asked before you start writing. Get on your CEO’s schedule to review your outline and discuss your intentions for putting this plan together.

Sometimes the hardest part is getting started. You can get the ball rolling with the basic template that follows.

Annual Business Plan Template

Each section of your annual business plan will help tell the story of your company and clearly define your company’s goals for the year.

Let’s take a look at each section of the annual business plan template .

Executive Summary

Don't forget to share this post!

Related articles.

How to Perform an Agency Brand Audit to Improve Your New Business Results

27 Interesting Marketing Charts Every Client Needs to See

The Ruthless Pursuit of “No” and Other Rules of New Business

8 Best Practices of Agencies That Win More New Business

How to Develop a Quick Win Approach for New Client Relationships

How to Stay In Touch With Prospects Who Aren’t Ready for a New Agency

How to Sell Your Ideas to Questioning Clients

How to Create an Ideal Client Profile

Why Big Brands Hire Small Agencies

8 Types of Clients Who Can Derail the New Business Process

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.

You’ll also want to think about anything that might slow your growth. Many businesses experience seasonal fluctuations, which can impact your budget if you don’t plan for it. To account for these changes, list the minimum expenses required to keep your business running. Use your financial statements to understand these costs, and consider averaging out irregular expenses over the year to avoid surprises.

Ideally, your business should build a cash reserve during profitable periods to cover expenses during slower seasons. If necessary, consider various financing options, such as a business credit card or line of credit, that you can draw from to manage cash flow during peak or off times.

4. Calculate your profits

The next step in creating a business budget is to calculate your business profits. You can look at your total profits by calculating revenue minus expenses. That way, you see how much money you have to work with, called your working capital .

You should also understand your profit margins for each of your products and services, which can help you set prices or decide whether to offer a new product or service.

How to calculate your profit margins

To find out your gross profit margin, you’ll first need to calculate the gross profit. To calculate your business’s gross profit, subtract the cost of goods sold (COGS) from your total revenue. COGS includes all the expenses related to producing your products and services.

Once you have the gross profit, use the gross profit margin formula: (Revenue – COGS) / Revenue x 100. This will give you a percentage that shows how much profit you gain from that particular product after accounting for the product’s costs.

5. Make a strategy for your working capital

Knowing what to do with extra revenue, which is your working capital, is crucial for managing your business finances and growth. Here’s how to get started with a financial strategy that propels your business goals forward:

- Set spending limits for different categories in your budget. When listing your expenses, you should have set a dollar amount for each category. You can estimate this by a monthly average or a general forecasted amount.

- Set realistic short- and long-term goals. These goals will motivate you to stick to your budget and guide your spending decisions.

- Compare your actual spending with your net income and priorities. Look at the areas you’re spending and consider whether you need to reallocate money to different categories. Consider separating expenses into business needs and extras.

- Adjust your budget and actual spending. Adjust your spending to ensure you do not overspend and can allocate money towards your goals. If you need to cut spending, consider the categories that are extras, such as types of marketing that you don’t know will generate a return on investment.

6. Review your budget and forecasts regularly

Finally, review your budget regularly. By frequently checking in on your budget, you can identify any discrepancies between your planned and actual expenses and adjust accordingly. This allows you to proactively handle any financial issues that may arise rather than reacting to them after they’ve become a problem.

Regular reviews also allow you to refine your budgeting process and improve its accuracy over time. Keep in mind that your budget is not set in stone but rather a tool to guide your financial decisions and help you achieve your business goals.

What to do if you have a deficit in your business budget

Finding a deficit in your small business budget can be alarming, but there are several strategies you can employ to handle this situation.

- Do a cash flow analysis. Begin by doing a cash flow analysis to review what your business is earning and spending money on. Identify potential problems and adjust the budget as needed to prevent overspending.

- Cut nonessential business costs. Cutting spending may involve eliminating nonessential costs and transferring funds from other categories to overspent categories. Your goal is a balanced or profitable budget.

- Negotiate with suppliers. Be transparent in your communications with suppliers and explain your quality standards and why you’re seeking cost reduction. Explore options for cost reduction that do not compromise quality, such as process improvements or ordering in larger quantities.

- Create a lean business model. By removing anything that doesn’t benefit your customer, your business can potentially save time and resources. Lean business models focus on continually improving processes and customer experience without adding additional resources, time or funds.

- Add revenue and diversify revenue streams. Raising revenue requires a realistic plan with measurable goals to increase sales and overall business income. You can also consider other products and services you could offer that would make your business profitable.

- Use financing to cover temporary gaps. Applying for a small business loan can help pay bills during an unplanned shortfall. Since this will add an expense to your budget, make sure you can handle the loan repayments and your regular expenses.

- Plan for a deficit. In some cases, a planned budget deficit might be a strategic decision, such as investing in new opportunities that promise long-term benefits.

Bottom line

Having a well-developed business budget is crucial for making informed decisions. You can effectively manage your small business’s finances by tracking and analyzing your business’s inflows and outflows, forecasting your expected revenue and adjusting your budget to stay balanced.

Even in the face of a budget deficit, there are various strategies you can use to keep your business profitable, including negotiating costs with your suppliers, assessing your business operations and offering new products and services.

With a solid business budget in place, you can confidently navigate financial challenges and drive long-term success for your small business.

Frequently asked questions

What are the benefits of a business budget, what are the components of a business budget, how do you calculate fixed and variable costs in a business budget.

Related Articles

How to finance a small business for the holidays

Average cost of starting a small business

How to bootstrap your small business

How to start a small business

Get expert advice delivered straight to your inbox.

How to Create a Basic Business Budget

8 Min Read | Mar 13, 2024

You’d never intentionally set your business up to fail, right? But if you don’t know your numbers and how to make a business budget, that’s exactly what you’re doing. Money problems and bad accounting are two reasons why many small businesses don’t make it past their first five years. 1

Talking about budgets can feel overwhelming. We get it. For a lot of business leaders, it’s a lot more comfortable dreaming up big ideas and getting stuff done than digging into numbers. But you can’t set yourself up for steady growth until you have a handle on the money flowing in and out of your company. You also can’t enjoy financial peace in your business.

Not a numbers person? That’s okay. Follow the simple steps below to learn how to create a budget for a business and manage your finances with confidence. We’ll even give you a link to an easy-to-use small-business budget template in the EntreLeader’s Guide to Business Finances .

But before we get to that, let’s unpack what a budget is and why you need one.

Don't Let Your Numbers Intimidate You

With the EntreLeader’s Guide to Business Finances, you can grow your profits without debt—even if numbers aren’t your thing. Plus, get a free business budget template as part of the guide!

What Is a Business Budget?

A business budget is a plan for how you’ll use the money your business generates every month, quarter and year. It’s like looking through a windshield to see the expenses, revenue and profit coming down the road. Your business budget helps you decide what to do with business profit, when and where to cut spending and grow revenue, and how to invest for growth when the time comes. Leadership expert John Maxwell sums it up: “A budget is telling your money where to go instead of wondering where it went.”

But here’s what a business budget is not: a profit and loss (P&L) report you read at the end of the month. Your P&L is like a rearview mirror—it lets you look backward at what’s already happened. Your P&L statement and budget are meant to work together so you can see your financial problems and opportunities and use those findings to forecast your future, set educated goals, and stay on track.

Why Do I Need to Budget for My Business?

Creating a budget should be your very first accounting task because your business won’t survive without it. Sound dramatic? Check this out: There are 33.2 million small businesses in the United States. Out of the small businesses that opened from 1994 to 2020, 67.7% survived at least two years. But less than half survived past five years. 2 The top reasons these businesses went under? They hit a wall with cash-flow problems, faced pricing and cost issues, and failed to plan strategically . 3

As a business owner, one of the worst feelings in the world is wondering whether you’ll be able to make payroll and keep your doors open. That’s why we can’t say it enough: Make a business budget to stay more in control and have more financial peace in running your business.

A budget won’t help you earn more money, but it will help you:

- Maximize the money you’ve got

- Manage your cash flow

- Spend less than your business earns

- Stay on top of tax payments and other bills

- Know if you’re hitting your numbers so you can move at the true speed of cash

How to Create a Budget for a Business

Your ultimate goal is to create a 12–18-month business budget—and you will get there! But start by building out your first month. Don’t even worry about using a fancy accounting program yet. Good ol’ pen and paper or a simple computer document is fine. Just start! Plus, setting up a monthly budget could become a keystone habit that helps kick-start other smart business habits.

Here’s how to create your first budget for business:

1. Write down your revenue streams.

Your revenue is the money you earn in exchange for your products or services. You’ll start your small- business budget by listing all the ways you make money. Look at last month’s P&L—or even just your checking account statement—to help you account for all your revenue streams. You’re not filling in numbers yet. Just list what brings in revenue.

For example, if you run an HVAC business, your revenue streams could be:

- Maintenance service calls

- Repair services and sales

- New unit installation

- Insulation installation

- Air duct cleaning

2. Write down the cost of goods sold (if you have them).

Cost of goods is also called inventory. These expenses are directly related to producing your product or service. In the HVAC example, your cost of goods would be the price you pay for each furnace and air conditioning unit you sell and install. It could also include the cost of thermostats, insulation and new ductwork.

3. List your expense categories.

It’s crazy how much money can slip through the cracks when we’re not careful about putting it in the budget. Think through all your business expenses—down to the last shoe cover your technicians wear to protect your customers’ flooring during house calls. Here’s a list of common business budget categories for expenses to get you started:

- Office supplies and equipment

- Technology services

- Training and education

Related articles : Product Launch: 10 Questions to Ask Before You Launch a New Product New Product Launch: Your 10-Step Checklist

4. Fill in your own numbers.

Now that you have a solid list of revenue and expense categories, plug in your real (or projected) numbers associated with them. It’s okay if you’re not sure how much you’ll sell just yet or exactly how much you’ll spend. Make an educated guess if you’re just starting out. If your business has been earning money for a while, use past P&L statements to guide what you expect to bring in. Your first budget is about combining thoughtful guesswork with history and then getting a more realistic picture month over month.

5. Calculate your expected profit (or loss).

Now, number nerds and number haters alike—buckle in. We’re about to do some basic accounting so you know whether you have a profit or loss. This is your chance to figure out exactly how much you’re spending and making in your business.