- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Market Analysis Section of a Business Plan

Alyssa Gregory is an entrepreneur, writer, and marketer with 20 years of experience in the business world. She is the founder of the Small Business Bonfire, a community for entrepreneurs, and has authored more than 2,500 articles for The Balance and other popular small business websites.

:max_bytes(150000):strip_icc():format(webp)/alyssa-headshot-2018-5b73ee0046e0fb002531cb50.png)

The market analysis section of your business plan comes after the products or services section and should provide a detailed overview of the industry you intend to sell your product or service in, including statistics to support your claims.

In general, the market analysis section should include information about the industry, your target market, your competition, and how you intend to make a place for your own product and service. Extensive data for this section should be added to the end of the business plan as appendices, with only the most important statistics included in the market analysis section itself.

What Should a Market Analysis Include?

The market analysis section of your small business plan should include the following:

- Industry Description and Outlook : Describe your industry both qualitatively and quantitatively by laying out the factors that make your industry an attractive place to start and grow a business. Be sure to include detailed statistics that define the industry including size, growth rate , trends, and outlook.

- Target Market : Who is your ideal client/customer? This data should include demographics on the group you are targeting including age, gender, income level, and lifestyle preferences. This section should also include data on the size of the target market, the purchase potential and motivations of the audience, and how you intend to reach the market.

- Market Test Results : This is where you include the results of the market research you conducted as part of your initial investigation into the market. Details about your testing process and supporting statistics should be included in the appendix.

- Lead Time : Lead time is the amount of time it takes for an order to be fulfilled once a customer makes a purchase. This is where you provide information on the research you've completed on how long it will take to handle individual orders and large volume purchases, if applicable.

- Competitive Analysis : Who is your competition? What are the strengths and weaknesses of the competition? What are the potential roadblocks preventing you from entering the market?

7 Tips for Writing a Market Analysis

Here is a collection of tips to help you write an effective and well-rounded market analysis for your small business plan.

- Use the Internet : Since much of the market analysis section relies on raw data, the Internet is a great place to start. Demographic data can be gathered from the U.S. Census Bureau. A series of searches can uncover information on your competition, and you can conduct a portion of your market research online.

- Be the Customer : One of the most effective ways to gauge opportunity among your target market is to look at your products and services through the eyes of a purchaser. What is the problem that needs to be solved? How does the competition solve that problem? How will you solve the problem better or differently?

- Cut to the Chase : It can be helpful to your business plan audience if you include a summary of the market analysis section before diving into the details. This gives the reader an idea about what's to come and helps them zero in on the most important details quickly.

- Conduct Thorough Market Research : Put in the necessary time during the initial exploration phase to research the market and gather as much information as you can. Send out surveys, conduct focus groups, and ask for feedback when you have an opportunity. Then use the data gathered as supporting materials for your market analysis.

- Use Visual Aids : Information that is highly number-driven, such as statistics and metrics included in the market analysis, is typically easier to grasp when it's presented visually. Use charts and graphs to illustrate the most important numbers.

- Be Concise : In most cases, those reading your business plan already have some understanding of the market. Include the most important data and results in the market analysis section and move the support documentation and statistics to the appendix.

- Relate Back to Your Business : All of the statistics and data you incorporate in your market analysis should be related back to your company and your products and services. When you outline the target market's needs, put the focus on how you are uniquely positioned to fulfill those needs.

Analyze your market like a pro with this step-by-step guide + insider tips

Don’t fall into the trap of assuming that you already know enough about your market.

No matter how fantastic your product or service is, your business cannot succeed without sufficient market demand .

You need a clear understanding of who will buy your product or service and why .

You want to know if there is a clear market gap and a market large enough to support the survival and growth of your business.

Industry research and market analysis will help make sure that you are on the right track .

It takes time , but it is time well spent . Thank me later.

WHAT is Market Analysis?

The Market Analysis section of a business plan is also sometimes called:

- Market Demand, Market Trends, Target Market, The Market

- Industry Analysis & Trends, Industry & Market Analysis, Industry and Market Research

WHY Should You Do Market Analysis?

First and foremost, you need to demonstrate beyond any reasonable doubt that there is real need and sufficient demand for your product or service in the market, now and going forward.

- What makes you think that people will buy your products or services?

- Can you prove it?

Your due diligence on the market opportunity and validating the problem and solution described in the Product and Service section of your business plan are crucial for the success of your venture.

Also, no company operates in a vacuum. Every business is part of a larger overall industry, the forces that affect your industry as a whole will inevitably affect your business as well.

Evaluating your industry and market increases your own knowledge of the factors that contribute to your company’s success and shows the readers of your business plan that you understand the external business conditions.

External Support

In fact, if you are seeking outside financing, potential backers will most definitely be interested in industry and market conditions and trends.

You will make a positive impression and have a better chance of getting their support if you show market analysis that strengthens your business case, combining relevant and reliable data with sound judgement.

Let’s break down how to do exactly that, step by step:

HOW To Do Market Analysis: Step-by-Step

So, let’s break up how market analysis is done into three steps:

- Industry: the total market

- Target Market: specific segments of the industry that you will target

- Target Customer: characteristics of the customers that you will focus on

Step 1: Industry Analysis

How do you define an industry.

For example, the fashion industry includes fabric suppliers, designers, companies making finished clothing, distributors, sales representatives, trade publications, retail outlets online and on the high street.

How Do You Analyze an Industry?

Briefly describe your industry, including the following considerations:

1.1. Economic Conditions

Outline the current and projected economic conditions that influence the industry your business operates in, such as:

- Official economic indicators like GDP or inflation

- Labour market statistics

- Foreign trade (e.g., import and export statistics)

1.2. Industry Description

Highlight the distinct characteristic of your industry, including:

- Market leaders , major customer groups and customer loyalty

- Supply chain and distribution channels

- Profitability (e.g., pricing, cost structure, margins), financials

- Key success factors

- Barriers to entry preventing new companies from competing in the industry

1.3. Industry Size and Growth

Estimate the size of your industry and analyze how industry growth affects your company’s prospects:

- Current size (e.g., revenues, units sold, employment)

- Historic and projected industry growth rate (low/medium/high)

- Life-cycle stage /maturity (emerging/expanding/ mature/declining)

1.4. Industry Trends

- Industry Trends: Describe the key industry trends and evaluate the potential impact of PESTEL (political / economic / social / technological / environmental / legal) changes on the industry, including the level of sensitivity to:

- Seasonality

- Economic cycles

- Government regulation (e.g. environment, health and safety, international trade, performance standards, licensing/certification/fair trade/deregulation, product claims) Technological change

- Global Trends: Outline global trends affecting your industry

- Identify global industry concerns and opportunities

- International markets that could help to grow your business

- Strategic Opportunity: Highlight the strategic opportunities that exist in your industry

Step 2: Target Customer Identification

Who is a target customer.

One business can have–and often does have–more than one target customer group.

The success of your business depends on your ability to meet the needs and wants of your customers. So, in a business plan, your aim is to assure readers that:

- Your customers actually exist

- You know exactly who they are and what they want

- They are ready for what you have to offer and are likely to actually buy

How Do You Identify an Ideal Target Customer?

2.1. target customer.

- Identify the customer, remembering that the decision-maker who makes the purchase can be a different person or entity than the end-user.

2.2. Demographics

- For consumers ( demographics ): Age, gender, income, occupation, education, family status, home ownership, lifestyle (e.g., work and leisure activities)

- For businesses ( firmographic ): Industry, sector, years in business, ownership, size (e.g., sales, revenues, budget, employees, branches, sq footage)

2.3. Geographic Location

- Where are your customers based, where do they buy their products/services and where do they actually use them

2.4 Purchasing Patterns

- Identify customer behaviors, i.e., what actions they take

- how frequently

- and how quickly they buy

2.5. Psychographics

- Identify customer attitudes, i.e., how they think or feel

- Urgency, price, quality, reputation, image, convenience, availability, features, brand, customer service, return policy, sustainability, eco-friendliness, supporting local business

- Necessity/luxury, high involvement bit ticket item / low involvement consumable

Step 3: Target Market Analysis

What is a target market.

Target market, or 'target audience', is a group of people that a business has identified as the most likely to purchase its offering, defined by demographic, psychographic, geographic and other characteristics. Target market may be broken down to target customers to customize marketing efforts.

How Do You Analyze a Target Market?

So, how many people are likely to become your customers?

To get an answer to this questions, narrow the industry into your target market with a manageable size, and identify its key characteristics, size and trends:

3.1. Target Market Description

Define your target market by:

- Type: B2C, B2B, government, non-profits

- Geographic reach: Specify the geographic location and reach of your target market

3.2. Market Size and Share

Estimate how large is the market for your product or service (e.g., number of customers, annual purchases in sales units and $ revenues). Explain the logic behind your calculation:

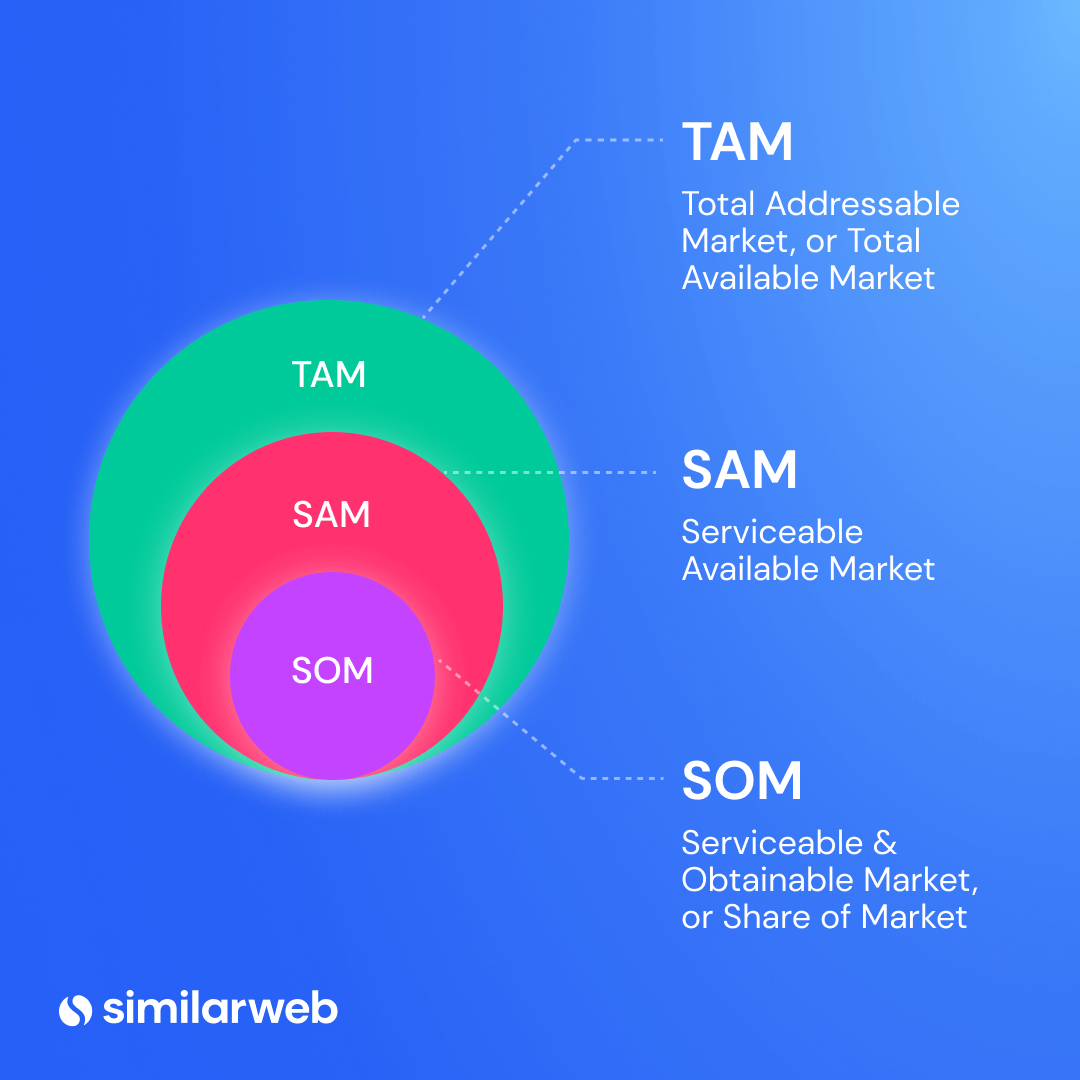

- TAM (Total Available/Addressable/Attainable Market) is the total maximum demand for a product or service that could theoretically be generated by selling to everyone in the world who could possibly buy from you, regardless of competition and any other considerations and restrictions.

- SAM (Serviceable Available Market) is the portion of the TAM that you could potentially address in a specific market. For example, if your product/service is only available in one country or language.

- SOM (Service Obtainable Market / Share of Market) is the share of the SAM that you can realistically carve out for your product or service. This the target market that you will be going after and can reasonably expect to convert into a customer base.

3.3. Market Trends

Illustrate the most important themes, changes and developments happening in your market. Explain the reasons behind these trends and how they will favor your business.

3.4. Demand Growth Opportunity

Estimate future demand for your offering by translating past, current and future market demand trends and drivers into forecasts:

- Historic growth: Check how your target market has grown in the past.

- Drivers past: Identify what has been driving that growth in the past.

- Drivers future: Assess whether there will be any change in influence of these and other drivers in the future.

How Big Should My Target Market Be?

Well, if the market opportunity is small, it will limit how big and successful your business can become. In fact, it may even be too small to support a successful business at all.

On the other hand, many businesses make the mistake of trying to appeal to too many target markets, which also limits their success by distracting their focus.

What If My Stats Look Bad?

Large and growing market suggests promising demand for your offering now and into the future. Nevertheless, your business can still thrive in a smaller or contracting market.

Instead of hiding from unfavorable stats, acknowledge that you are swimming against the tide and devise strategies to cope with whatever lies ahead.

Step 4: Industry and Market Analysis Research

The market analysis section of your business plan should illustrate your own industry and market knowledge as well as the key findings and conclusions from your research.

Back up your findings with external research sources (= secondary research) and results of internal market research and testing (= primary research).

What is Primary and Secondary Market Research?

Yes, there are two main types of market research – primary and secondary – and you should do both to adequately cover the market analysis section of your business plan:

- Primary market research is original data you gather yourself, for example in the form of active fieldwork collecting specific information in your market.

- Secondary market research involves collating information from existing data, which has been researched and shared by reliable outside sources . This is essentially passive desk research of information already published .

Unless you are working for a corporation, this exercise is not about your ability to do professional-level market research.

Instead, you just need to demonstrate fundamental understanding of your business environment and where you fit in within the market and broader industry.

Why Do You Need To Do Primary & Secondary Market Research?

There are countless ways you could go collecting industry and market research data, depending on the type of your business, what your business plan is for, and what your needs, resources and circumstances are.

For tried and tested tips on how to properly conduct your market research, read the next section of this guide that is dedicated to primary and secondary market research methods.

In any case, tell the reader how you carried out your market research. Prove what the facts are and where you got your data. Be as specific as possible. Provide statistics, numbers, and sources.

When doing secondary research, always make sure that all stats, facts and figures are from reputable sources and properly referenced in both the main text and the Appendix of your business plan. This gives more credibility to your business case as the reader has more confidence in the information provided.

Go to the Primary and Secondary Market Research post for my best tips on industry, market and competitor research.

7 TOP TIPS For Writing Market Analysis

1. realistic projections.

Above all, make sure that you are realistic in your projections about how your product or service is going to be accepted in the market, otherwise you are going to seriously undermine the credibility of your entire business case.

2. Laser Focus

Discuss only characteristic of your target market and customers that are observable, factual and meaningful, i.e. directly relate to your customers’ decision to purchase.

Always relate the data back to your business. Market statistics are meaningless until you explain where and how your company fits in.

For example, as you write about the market gap and the needs of your target customers, highlight how you are uniquely positioned to fill them.

In other words, your goal is to:

- Present your data

- Analyze the data

- Tie the data back to how your business can thrive within your target market

3. Target Audience

On a similar note, tailor the market analysis to your target audience and the specific purpose at hand.

For example, if your business plan is for internal use, you may not have to go into as much detail about the market as you would have for external financiers, since your team is likely already very familiar with the business environment your company operates in.

4. Story Time

Make sure that there is a compelling storyline and logical flow to the market information presented.

The saying “a picture is worth a thousand words” certainly applies here. Industry and market statistics are easier to understand and more impactful if presented as a chart or graph.

6. Information Overload

Keep your market analysis concise by only including pertinent information. No fluff, no repetition, no drowning the reader in a sea of redundant facts.

While you should not assume that the reader knows anything about your market, do not elaborate on unnecessary basic facts either.

Do not overload the reader in the main body of the business plan. Move everything that is not essential to telling the story into the Appendix. For example, summarize the results of market testing survey in the main body of the business plan document, but move the list of the actual survey questions into the appendix.

7. Marketing Plan

Note that market analysis and marketing plan are two different things, with two distinct chapters in a business plan.

As the name suggests, market analysis examines where you fit in within your desired industry and market. As you work thorugh this section, jot down your ideas for the marketing and strategy section of your business plan.

Final Thoughts

Remember that the very act of doing the research and analysis is a great opportunity to learn things that affect your business that you did not know before, so take your time doing the work.

Related Questions

What is the purpose of industry & market research and analysis.

The purpose of industry and market research and analysis is to qualitatively and quantitatively assess the environment of a business and to confirm that the market opportunity is sufficient for sustainable success of that business.

Why are Industry & Market Research and Analysis IMPORTANT?

Industry and market research and analysis are important because they allow you to gain knowledge of the industry, the target market you are planning to sell to, and your competition, so you can make informed strategic decisions on how to make your business succeed.

How Can Industry & Market Research and Analysis BENEFIT a Business?

Industry and market research and analysis benefit a business by uncovering opportunities and threats within its environment, including attainable market size, ideal target customers, competition and any potential difficulties on the company’s journey to success.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

Market Research for a Business Plan: How to Do It in a Day

Whether it’s your first time using market research for a business plan or this isn’t exactly your first rodeo: a quick refresh on the topic can do no harm.

If anything, it’s the smart route to take. Particularly when you consider modern-day market research data can be obtained quicker than ever – when the right tools are used.

Today, I’m going to explain exactly how to conduct market research for a business plan, and how to access that key data and juicy intel without hassle.

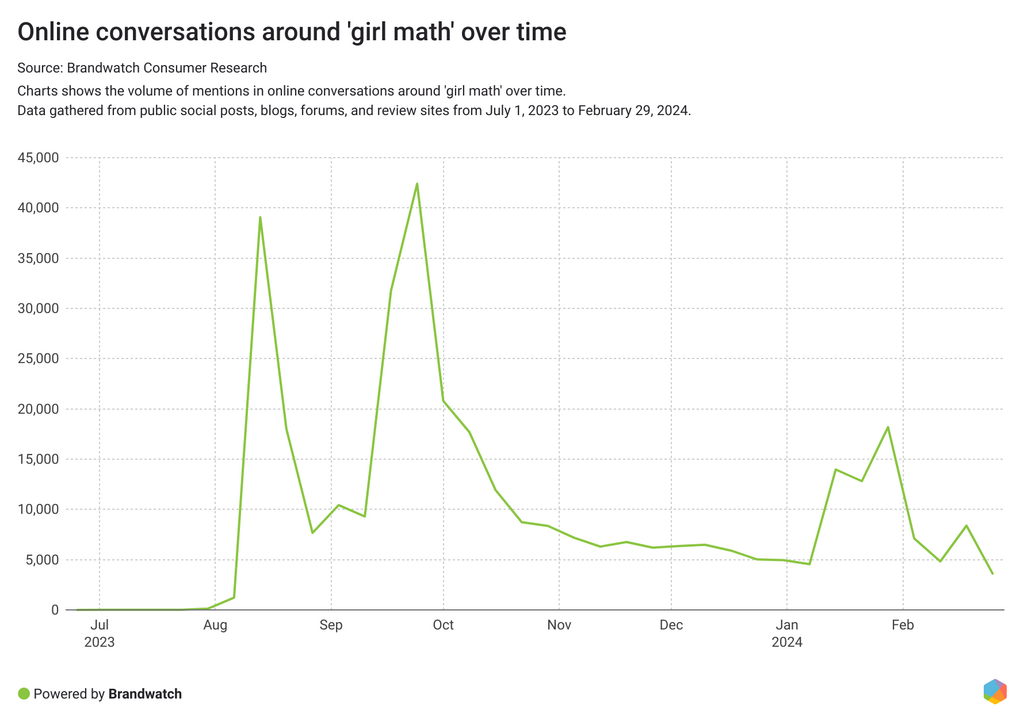

The importance of market research in business planning

They say knowledge is power, and where your rivals and your market are concerned, there’s nothing quite like it. By looking at things like consumer behavior, the competitive landscape , market size, and the digital strategies of others; companies at any stage in their lifecycle can stay relevant, maintain a competitive edge, set strategic direction, and experience growth. Doing periodic market research also helps businesses develop a deeper, more informed understanding of a market, its audience, and key players. If you’re seeking financial backing, doing market research is essential to show credibility and build confidence in your plans.

How to conduct market research for a business plan

Good market research for a business plan should be contextualized with information about your company, its goals, products, pricing, and financials. Sounds like a lot of work, right? Read on to learn how to conduct all the market research for a business plan you’re going to need – quickly, using the most up-to-date data there is. I’ll show you how to:

- Understand your audience

- Identify target personas

- Size your market

- Research the competition

- Discover your unique sales proposition

- Define marketing priorities

Before you start, make sure your business planning document includes the following 10 headings:

This format is considered best practice, so I’ve indicated the specific sections that each element of your market research fits into.

Sound good? Then let’s get started.

1. Understand your audience

What it is – A target audience is a social segment of people who are likely to be interested in your products or services. It’s a snapshot of your target customer base, sorted by certain characteristics. It’s also known as audience demographics and can contain data like age, gender, location, values, attitudes, behaviors, and more.

Where to use this market research in a business plan – Demographical data can help determine the size of your market, which slots into the executive summary, marketing plan, market sizing, and financial sections of the plan. What’s more, when you use it to identify groups of people to target, it can also be used in the products and services, competitive research tools , and SWOT analysis sections.

Bonus: Audience demographics can also help you develop stronger branding by choosing imagery that appeals most to your ideal customers.

How to do a quick audience analysis

Similarweb Research Intelligence gives you the ability to view almost any industry in a few seconds; you can also create a custom industry based on specific players in your market. Here’s how to see relevant audience demographics in a market. For this example, I chose the airline industry.

View typical audience relevant to your sector with gender and age distribution, along with geographical data . You can see which companies are experiencing growth and at what rate. Audience loyalty is also key to understanding how people behave, if they tend to shop around and what search terms they use to discover sites in any niche.

Read more: Learn more about how to do a demographic analysis of your market’s audience .

2. Identify target personas

What it is – An audience or target persona is a typical customer profile. It starts with audience demographics, and then zooms into a much deeper level. Most organizations develop multiple target personas, based on things like pain points, location, gender, background, occupation, influential factors, decision-making, likes, dislikes, goals, ideals, and more.

Pro Tip: If you’re in B2B, your target personas are based on the people who make purchasing decisions, not the business itself.

Where to use this market research in a business plan – Creating target personas for your business shows you know whom you’re targeting, and how to market to them. This information will help you complete market sizing, product or service overview, marketing plan, and could fit into the competitive research section too.

How to create a buyer persona in five steps

Guesswork does not equal less work – there’s no place for shortcuts here. Your success depends on developing the most accurate representation of who your customers are, and what they care about.

1. Research: If you’re already in business, use market research surveys as a tool to collect information about your customers. If you’re a startup or pre-startup, you can use a platform like Similarweb to establish a typical customer profile for your market. Don’t forget to use mobile app intelligence and website analytics in tandem to build a complete picture of your audience.

Pro Tip: Secondary market research is another good source of intel for startups. You might be able to find published surveys that relate to your products or market to learn more.

2. Analysis: Here, you’re looking to answer key questions to fill in the blanks and build a complete picture of your ideal customer. Tools like Similarweb Digital Research Intelligence, Google Analytics, and competitors’ social media channels can help you find this out. Typical questions include:

- Where is your audience coming from?

- What channels do they use to find your site?

- Do they favor access via mobile site, app, or desktop?

- What are their demographics? Think age, job, salary, location, and gender.

3. Competitive market research: This shows you what marketing channels, referral partners, and keywords are sending traffic to businesses similar to yours When you combine this data with what you learned in sections 1 + 2, you are ready to build your personas.

4. Fill in a buyer persona template: We’ve done the hard work for you. Download a pre-made template below .

Further reading: The complete guide to creating buyer personas

3. Size your market

What it is – Market sizing is a way to determine the potential size of a target market using informed estimation. This is how you find out the potential revenue and market volume applicable to your business . There are three key metrics: total addressable market (TAM), service addressable market (SAM), and service obtainable market (SOM).

Where to use this market research in a business plan – Knowing how big the slice of the pie you’re going after is crucial. It can inform any goal setting and help with forecasting too. This data can be used in your executive summary, marketing plan, competitive research, SWOT analysis, market sizing, operations, and financial sections.

Further reading: How to do market sizing shows you how to calculate the TAM, SAM, and SOM for your business.

4. Research the competition

What it is – Competitive landscaping shows who you’re up against and how your offering stacks up vs others in your space. By evaluating rivals in-depth and looking at things like features, pricing, support, content, and additional products, you can form a detailed picture of the competition.

Where to use this market research in a business plan – The information you gain from performing a competitive analysis can transform what you offer and how you go to market. In business planning, this market research supports the executive summary, product or service overview, marketing plan, competitive research, SWOT analysis, and operation sections.

How to do competitive landscaping

Using the industry overview section of Similarweb Digital Research Intelligence, competitor research is made quick and easy. Access key metrics on an industry or specific players, then download raw data in a workable excel file or get a PNG image of charts in an instant. Most data can be downloaded via excel or as an image and included in the resource section of your plan.

Here, you can see a summary of a market, yearly growth, and top sites. A quick click to industry leaders shows you market leaders and rising stars. Select any name for a complete picture of their digital presence – use this to spot potential opportunities to gain a competitive advantage.

Read more: See how to do a competitive analysis and get a free template to help you get started.

5. Discover your unique sales proposition

What it is – Not all businesses have them, and that’s OK. A unique selling proposition (USP) is something distinctive your business offers but your rivals don’t . It can be anything that’s unique to a product, service, pricing model, or other.

Why it’s useful – Having a compelling USP helps your company stand out in a market. It can make your business more valuable to a customer vs the competition, and ultimately help you win and retain more customers.

Where to use this market research in a business plan – Your USP should be highlighted in the executive summary, the product and service overview, and the SWOT analysis.

How to find your USP

Unless you’ve developed a unique product or service, or you’re planning to sell to the market at a lower-than-average price point, you’re going to have to look for some kind of service differentiator that’ll help you stand out. In my experience, the quickest way to discover this is through competitive benchmarking. Here, I’m talking about evaluating your closest rivals to uncover things they’re not doing, or looking for gaps that your business can capitalize on.

A competitive review of their site should look at things like:

- Customer support: do they have live chat, email support, telephone support, etc.?

- Content: do they produce additional content that offers value, free resources, etc.?

- Offers: what promotions or offers do they run?

- Loyalty or referral programs: do they reward loyalty or referrals?

- Service level agreements: what commitments do they make to their customers?

- Operations: consider delivery methods, lead times, returns policy etc.

- Price promises: what satisfaction or price promises do they offer, if at all?

Go easy on yourself and create a basic template that details each point. Once complete, look for opportunities to provide something unique that nobody else currently offers.

6. Define marketing priorities

What it is – A detailed plan showing how you position and market your products or service. It should define realistic, clear, and measurable goals that articulate tactics, customer profiles, and the position of your products in the market.

Where to use this market research in a business plan – Relevant intel you uncover should inform the marketing plan first and foremost. However, it can also be used in the SWOT analysis, operation, and financial sections.

How to do it – with a market research example

Using the marketing channels within Similarweb Digital Research Intelligence, you can short-cut the lengthy (and often costly) process of trial and error when trying to decide which channels and activities work best.

Let me show you how.

Using Similarweb Digital Research Intelligence, I can hone in on any site I like, and look at key marketing intel to uncover the strategies they’re using, along with insights into what’s driving traffic, and traffic opportunities.

In less than 60 seconds, I can see easyJet’s complete online presence; its marketing and social channels, and a snapshot of every metric that matters, like referrals, organic and paid ads, keywords, and more. Expand any section to get granular data, and view insights that show exactly where key losses, gains, and opportunities exist.

You can take this a step further and add other sites into the mix. Compare sites side-by-side to see who is winning, and how they’re doing it. While this snapshot shows a comparison of a single competitor, you can compare five at any one time. What’s more, I can see industry leaders, rising players, and any relevant mobile app intelligence stats, should a company or its rivals have an app as part of their offering.

Best practice for market research data in business plans

When doing any type of market research , it’s important to use the most up-to-date data you can get your hands on. There are two key factors for data are timeliness and trustworthiness.

For any market, look for data that applies to any period over the last 12 months. With how fast markets evolve and how quickly consumer behaviors change, being able to view dynamic data is key. What’s more, the source of any data matters just as much as its age.

To emphasize the importance of using the right type of data in a business plan, here’s some timely advice from SBA commercial lending expert and VP of Commerce National Bank and Trust, Steve Fulmer. As someone who, in the past 15 years, has approved approximately $150 million in loans to SMBs; his advice is worth paying attention to.

“ For anybody doing market research for a business plan, they must cite sources. Most new or small businesses lack historical performance data, which removes substantial confidence in their plans. As a lender, we cannot support assumptions in their business plan or their projections if their data hasn’t come from a trustworthy source.”

Wrapping up…

Now you know the six ways to do market research for a business plan, it’s time to knuckle down and get started. With Similarweb, you’ve got access to all the market intel you’re going to need to conduct timely, accurate, and reliable market research. What’s more, you can return to the platform anytime to benchmark your performance , get fresh insights, and adapt your strategies to focus on growth – helping you build a sustainable business that can withstand the test of time.

How do I do market research for a business plan?

By using Digital Research Intelligence tools like Similarweb, you can quickly conduct audience research, company research, market analysis, and benchmarking from a single place. Another method is secondary market research, but this takes more time and data isn’t always up to date.

Why does a business plan need market research?

Doing market research for a business plan is the quickest and easiest way to validate a business idea and establish a clear view of the market and competitive landscape. When done right, it can show you opportunities for growth, strategies to avoid, and effective ways to market your business.

What is market research in a business plan?

Market research in business planning is one of the most powerful tools you can use to flesh out and validate your company or its products. It can tell you whether there’s a market for your product, and how big that market is – it also helps you discover industry trends, and examine the strategies of the rising stars and industry leaders in detail.

Related Posts

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

From AI to Buy: The Role of Artificial Intelligence in Retail

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Industry Research: The Data-Backed Approach

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

How to Write and Conduct a Market Analysis

3 min. read

Updated January 3, 2024

A market is the total sum of prospective buyers, individuals, or organizations that are willing and able to purchase a business’s potential offering. A market analysis is a detailed assessment of the market you intend to enter. It provides insight into the size and value of the market, potential customer segments, and their buying patterns.

In this section, we’ll be covering what information to include in your business plan after completing your research. If you’re struggling with the research itself, you should check out our market research resources for step-by-step guidance.

- How to write your market analysis

The information featured in your market analysis should focus on firmly defining who your customers are. Here are the two steps you need to take:

Define your target market

Finding your target market requires segmentation based on demographic and psychographic information until you reach the ideal customer. You need to address who they are and how you identified them.

Target market examples

A target market analysis is a key part of any business plan. Let’s walk you through some examples.

Determine your market size

Identifying your potential customers isn’t enough. You also need to prove that the size of the market can support your business. To do this, it’s helpful to define what’s available, serviceable, and can be obtained.

Optional information to include

The main purpose of the market analysis is to show who your customers are. While defining your target market may be enough, it can be helpful to include some of the following supporting details.

Show that you know your industry

Before starting a business, you should know the state of your industry and where it’s headed. This includes industry metrics you’ve collected, any barriers to entry, emerging trends, or common success factors.

Write a customer analysis

Conducting a customer analysis provides additional depth to your target audience. You’ll know them better and go beyond just segmentation.

Use a customer persona to describe your customers

It can be difficult for you, your employees, and potential investors to visualize who your customers are based solely on data. Creating a customer persona can bring them to life and support your target market choice.

- Why conduct a market analysis?

Conducting any sort of in-depth research can be a time-intensive process. However, the benefits far outweigh the investment—so much so that it’s recommended that you revisit your market analysis at least once a year in order to stay on top of emerging trends or changes in the market.

As part of your business plan, it demonstrates that you have a firm understanding of your customers. Here are the other benefits gained by completing a market analysis:

Reduce risk

If you really understand your potential customers and market conditions, you’ll have a better chance of developing a viable product or service. It also helps you explore if your idea will work or not. If you determine that the market size can’t sustain your business, there are too many barriers, high starting costs, intense competition, or some other factor that would lead to a higher chance of failure—you can pivot and avoid wasting your hard-earned time and money.

Better position your business

Researching the market landscape will help you strategically position your business. This may be done through pricing, specific features, production/distribution, or any other method to differentiate your business and make it more attractive to your target audience.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Verify product/market fit

Part of positioning your business is determining if there is a sustainable market for your business. This starts with segmenting and identifying your ideal customers. It then involves a process of gathering feedback, gauging interest, and finding any sort of demonstrable traction. To learn more about finding product market fit, check out the market research section of our Starting a Business Guide.

Inform investors

Research is not only valuable for informing you as a business owner but in convincing investors and lenders that your idea is worth funding. In many ways, the fact that you spent time pulling together viable information is just as important as the information itself. It shows that you care about finding success as a business owner and are willing to put in the work, even at this early stage.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- Optional information

Related Articles

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

How to Write the Company Overview for a Business Plan

How to Set and Use Milestones in Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Skip to main content

- Skip to secondary menu

- Skip to footer

Market Analysis

Connecting the Dots, Quantifying Technology Trends & Measuring Disruption

How to do a market analysis for a business plan

A market analysis is an important part of a business plan because it helps you understand the market in which your business will operate. It involves researching and analyzing the target market, competitors, and industry trends in order to identify opportunities and challenges. Here are the steps you can follow to do a market analysis for a business plan:

Define your target market: The first step in a market analysis is to identify the specific group of customers that you will be targeting with your products or services. This may include demographics (age, gender, income, education level, etc.), geographic location, and other characteristics that are relevant to your business.

Research the market size: Next, you’ll need to determine the size of the market you are targeting. This will help you understand the potential demand for your products or services and determine whether the market is large enough to support your business. You can use various sources of data, such as industry reports and government statistics, to estimate the size of the market.

Analyze competitors: It’s important to understand who your competitors are and what they are offering. This will help you identify unique selling points for your business and determine how you can differentiate yourself from your competitors. You can research your competitors online, ask customers about their preferences, and even visit their stores or websites to get a sense of their product offerings and pricing.

Assess industry trends: Understanding industry trends can help you anticipate changes in the market and position your business to take advantage of them. Look for trends in areas such as technology, consumer behavior, and regulatory changes that may affect your business.

Determine your target market’s needs and preferences: To effectively market your products or services, you need to understand what your target customers need and want. You can gather this information through customer surveys, focus groups, and other market research methods.

Determine your target market’s purchasing power: It’s important to understand how much your target customers are willing and able to pay for your products or services. This will help you determine your pricing strategy and determine whether there is enough demand at your target price point.

Analyze your target market’s attitudes and behaviors: Understanding your target customers’ attitudes and behaviors can help you tailor your marketing efforts to their preferences. For example, if your target market values sustainability, you may want to highlight the eco-friendliness of your products in your marketing materials.

By conducting a thorough market analysis, you can gain a better understanding of the market in which your business will operate and make informed decisions about your marketing, pricing, and product development strategies.

Recent Posts

- Impact of Electric Vehicles on Independent Repair Shops

- RISC-V and Open POWER Instruction Set Architecture (ISA) Fortunes are Rising, Market Analysis

- Resilient Workforce Stokes Inflation Fears: Fed Likely to Keep Foot on the Gas Pedal

- The AI Boom That Propelled the 2023 Market

- Electric Car Industry Charges Ahead: Hong Kong’s Financial Hub Beckons for Expansion

- Fund Managers Exercise Caution Amidst European Stock Market Challenges

- Kenya’s Economic Landscape: Balancing Declining Inflation and Aggressive Interest Rate Hike

- Fueling China’s Coffee Craze: Emerging Markets and the Growing Demand for Beans

- AI reality vs. myth: predictions for 2024

- Cloudflare is introducing the concept of the “connectivity cloud”

Market Research Media

- High Energy Military Laser Market Forecast

- U.S. Federal Cybersecurity Market Forecast

- Adapting to Survive: Analyzing the Evolution of the Social Media Industry Amidst Technological, Regulatory, and User-Driven Shifts

- Social Media Monitoring in PR and Communication

- The Rise of Federation in Social Media

- Navigating the Regulatory Landscape: Deepfakes and Altered Media

- Embracing Universal Benefits: A Case for Fair and Inclusive Welfare Systems

- Beyond Fairytales: The Billion-Dollar Legacy of Disney’s Public Domain Adaptations

- Text-to-Image AI Generators and their Impact on Media Markets

- The Evolution of RSS Feeds: A Media Analyst’s Perspective

Media Partners

- Technology Conferences

- Event Sharing Network

- Defense Market

- Cybersecurity Events

- Event Calendar

- Calendarial

- Venture Capital

- Exclusive Domains

Privacy Overview

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![market research and analysis in business plan → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

![market research and analysis in business plan SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![market research and analysis in business plan How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research and analysis in business plan 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![market research and analysis in business plan 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

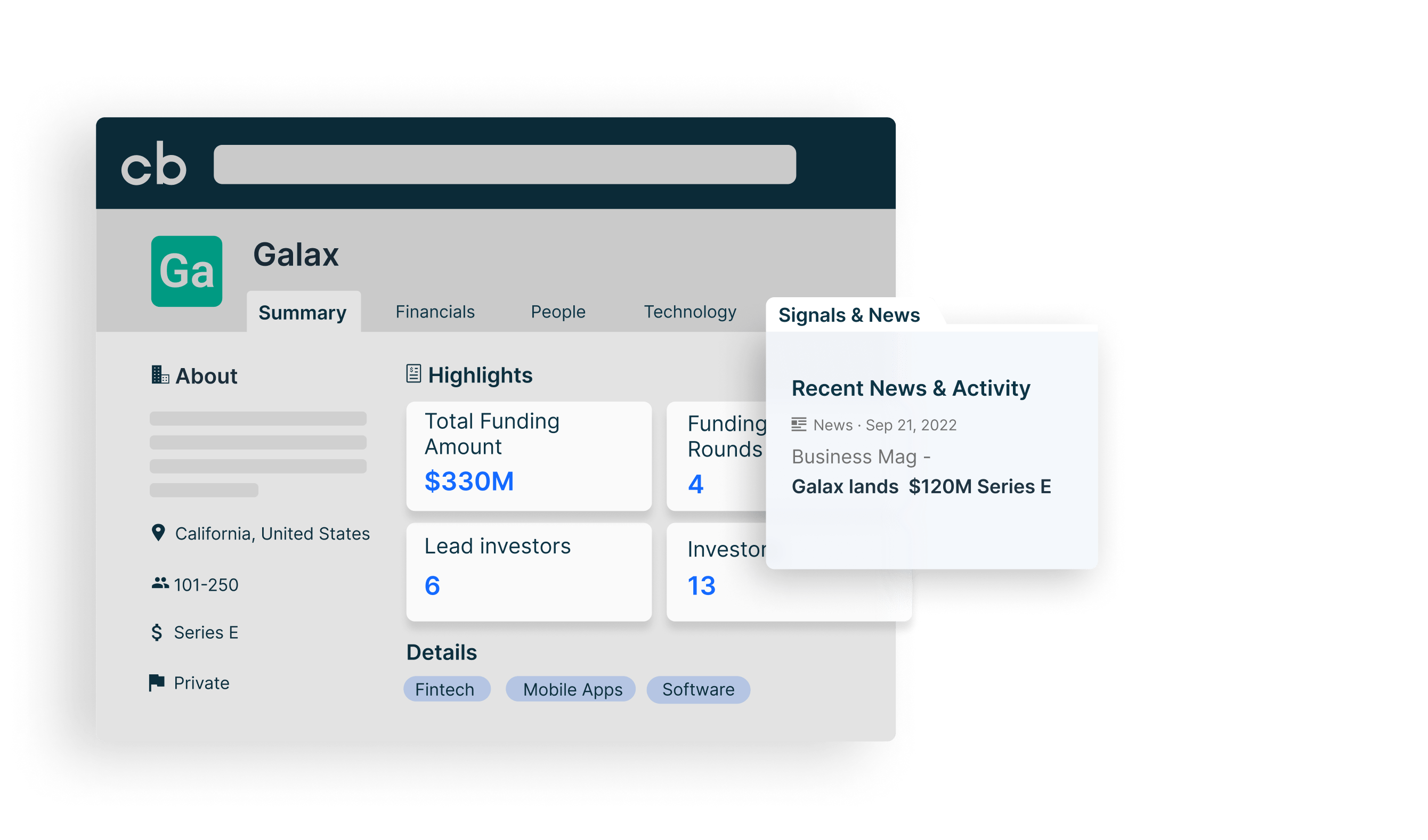

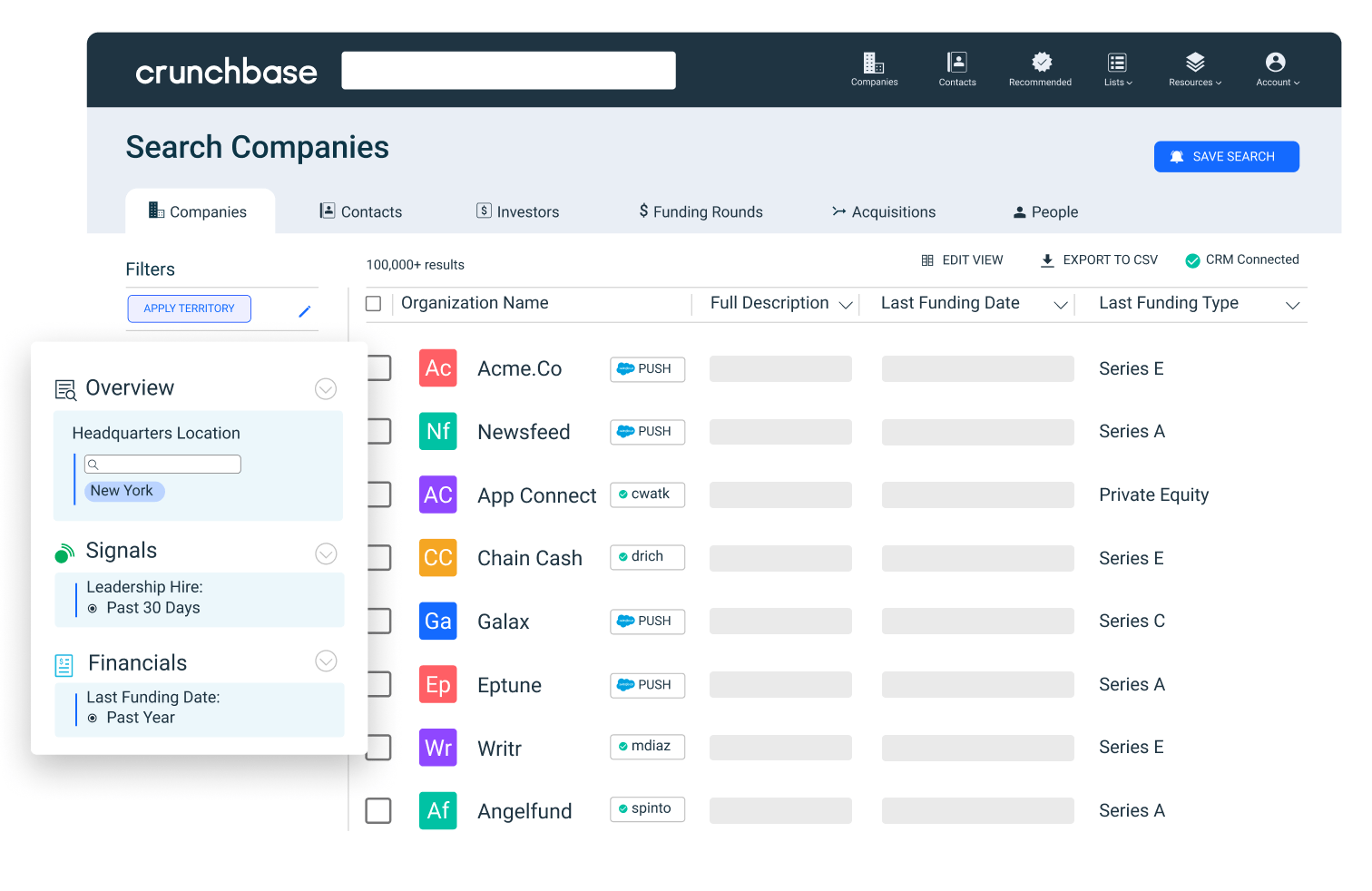

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research