Loan Participation Vs Assignment

- No Comments

Sub-participation

Sub-participation is a form of loan participation in which a lender shares its risk with a second party. This type of loan participation does not change the documentation of the loan. This type of loan participation can also include future amounts for loans that have not yet been fully disbursed, such as a revolving credit facility.

The legality of sub-participation is dependent on the conditions of the loan agreement. In general, a loan participant cannot enforce the loan or proceed against the collateral on their own. Furthermore, the borrower may not even be aware that the loan participant is involved. However, the seller of the participation retains the right to enforce or compromise the loan, as well as to amend it without the consent of the participant.

As for drafting sub-participation agreements, there are many ways to do so. But it is important to include at least the following provisions: The term of the agreement, the rate of interest, and the repurchase provisions. These provisions should be included in the sub-participation or assignment agreement.

Assignment and sub-participation are standard terms in inter-bank transactions. We will examine the purposes of the loan participation and assignment agreements, as well as the terms of the transaction. While they are essentially interchangeable, they are fundamentally different.

Loan participation and assignment are both ways to transfer ownership of a loan. Assigning a loan to a third party or sub-assigning it to yourself is a common way to transfer the loan.

The terms “loan participation” and “assignment” are often used in the banking industry. Both terms refer to the transfer of a loan’s rights and payments between two financial institutions. We’ll look at what each term means and how they differ from each other.

Loan participation has long been a common form of loan transfer. Its advantages over other loan transfer methods include the ability to diversify a portfolio and limit risk. It also eliminates the need for loan servicing. However, this option can be problematic when it differs from underlying loans. For this reason, it’s important to structure loan participation carefully.

Whether a loan is a participation or an assignment depends on a variety of factors. The percentage of loan ownership, relationship with the other financial institution, and confidence in the other party are all important considerations. However, the basic difference between participation and assignment is that the former involves the original lender continuing to manage the loan while the latter takes on the responsibility of doing so.

As a rule, loan participation is a good option if the original lender does not want to keep the title of the loan. It allows the borrower to avoid the costs associated with the loan and is more attractive for borrowers. In addition, loan participation arrangements can be more flexible than outright assignments. However, it’s important to make sure that the arrangement you enter into is formal. This will prevent any confusion or conflict down the road.

Syndication

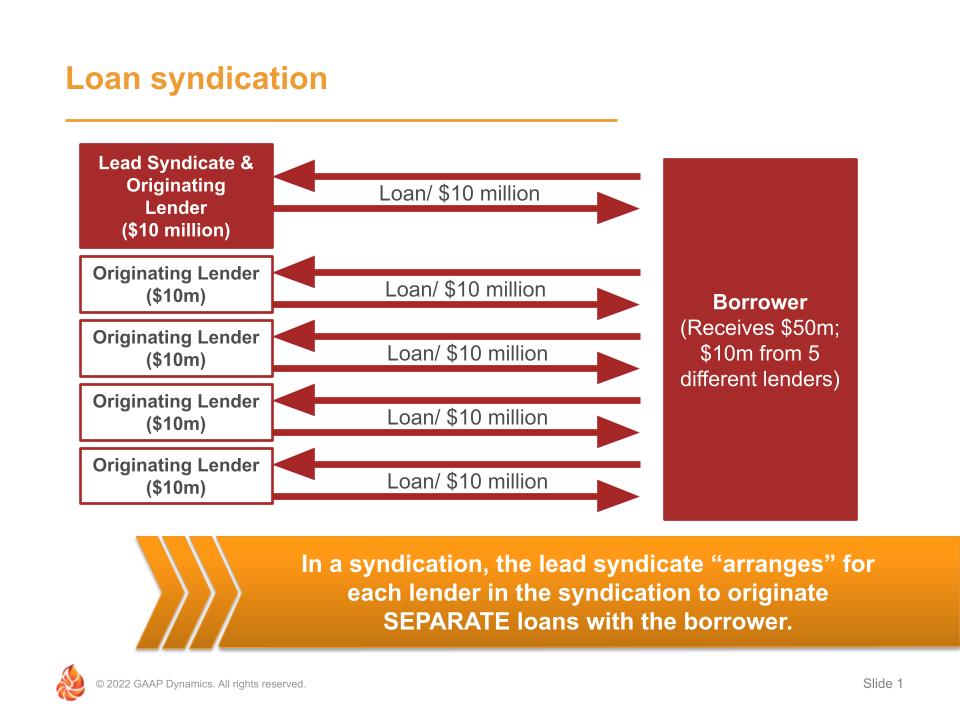

Understanding the differences between loan participation and syndication is important for lenders. Understanding these two options can help them find the best solutions for their lending needs. Syndication is a common type of lending program where lenders pool their loans together to reduce the risks of defaults. Loan participation programs can be more complex and require due diligence to be effective.

Syndicated lending allows lenders to access the expertise and business relationships of their fellow lenders while maximizing their exposure to deal flow. However, lenders who join a syndicated lending arrangement often give up some of their independence and flexibility to take unilateral action. In addition, these arrangements often involve the involvement of legal counsel, which can also be important.

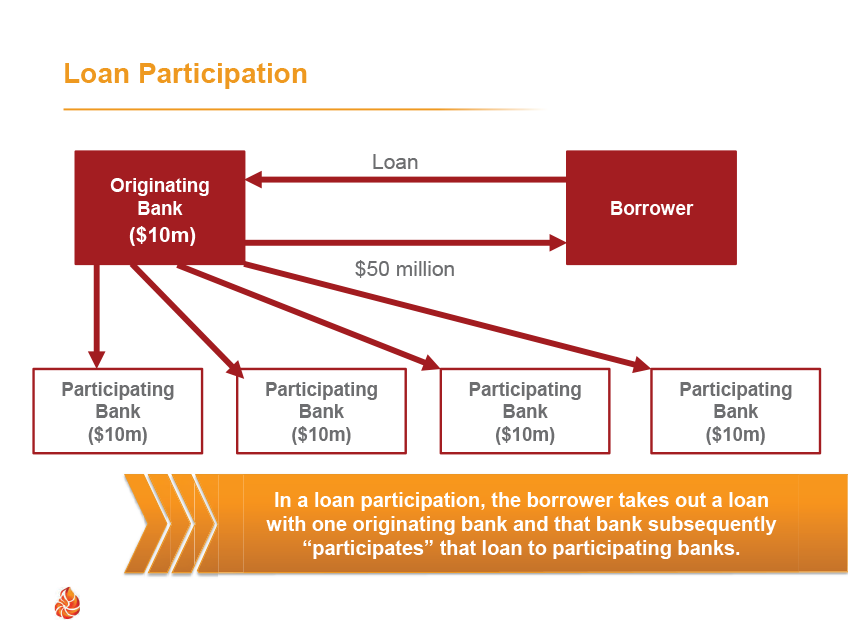

A loan participation arrangement is a group of lenders coming together to fund a large loan. A lead bank underwrites the loan and sells portions of it to other financial institutions. Loan syndication, on the other hand, is an arrangement whereby multiple financial institutions pool their money together and make one large loan. In this type of arrangement, the original lender transfers the rights and obligations to the purchasing financial institution. The risk is then shared among the participating lenders, allowing them to share in the interest and the risks of the loan’s default.

A syndication contract can be structured in as many tranches as necessary to meet the borrowing needs of a customer. The underlying contract will contain a commitment contract that specifies the ratio of participation among the participants. Each tranche will have a borrower, which will be a common participant or may be different. The contract will require that each participant fulfill their commitments before the scheduled due dates.

Loan participation and assignment are standard transactions between banks. They are similar in some respects but have different purposes.

There are many types of loan participation agreements. Some involve a full assignment, while others are a sub-participation. If you are involved in loan participation or assignment, you need to understand which type of agreement applies to your situation. There are several types of loan participation agreements, including sub-participation agreements, undisclosed agencies, and assignments.

Sub-participation agreements are typically used to assign part of the loan amount to a new lender, and the loan documentation remains unchanged. In addition, these types of agreements include future amounts, which may be provided as part of a revolving credit facility or a portion of a loan that hasn’t been fully disbursed.

Loan participation is a popular option for lenders to limit their exposure to borrowers. Lenders may sell a portion of the loan to an investor or sell a portion of their interest to another party. While the transfer of a loan portion does not always require the consent of the transferor, lenders must consider participating interest guidelines and the applicable rules.

How Do Variables Affect Bank Loan Sales?

Comments are closed.

- Participate

SALES [email protected] 501-246-5148

SUPPORT [email protected] 501-313-3414

Get ahead of the competition.

Demos of our products take only 30 minutes and we offer a free trial.

Schedule Your Demo Today

Schedule a Demo

All Rights Reserved.

- Schedule A Demo

Trending News

Related Practices & Jurisdictions

- Corporate & Business Organizations

- Financial Institutions & Banking

- All Federal

As the secondaries market continues to grow and increase in complexity, we have noticed an uptick in interest among our clients in selling (and buying) loan participations. Participation arrangements can be a powerful tool for institutions on either side of the transaction – sellers can free up capital on their balance sheet, pare back funding obligations and reduce exposure to certain borrowers or industries, and buyers can get the economic benefit of a loan without having to manage a direct relationship with the borrower or comply with (typically more stringent) restrictions and consent requirements for direct assignments. Plus, while the transaction is undoubtedly complex, both parties can leverage the Loan Syndications and Trading Association’s form documentation to keep attention focused on those provisions most important to their institution and the specific transaction. Done right, a bespoke participation arrangement lets everyone leave the field a winner (trophies optional).

Below we discuss broadly the participation structure and its benefits, typical principal documentation and some key considerations and commonly-negotiated provisions.

Participation Structure and Its Benefits

For the uninitiated, a participation is best understood in contrast with an assignment. Both are mechanisms by which a lender of record under a loan agreement ( i.e. , the entity that is actually party to the contract as a lender) can transfer all or part of its interest in a funded or unfunded loan to a third party. However, unlike with an assignment (where the assignee steps fully into the shoes of the assignor as lender of record, and assumes direct contractual privity with the borrower and legal and beneficial ownership of the loan), the seller of a participation interest retains title to the loan and direct contractual privity with the borrower ( i.e. , the participant does not become a lender of record under the loan agreement) along with certain rights and obligations, and the buyer of a participation interest assumes the economic benefits and risks. The contractual relationship for a participation is just between the seller and buyer – the borrower is not typically involved, and indeed is often not even aware of the transaction.

Among the benefits to sellers of loan participations, perhaps the most obvious is the cash received from the buyer upon settlement. Loan participations in the non-distressed secondaries space are often purchased for prices at or near par ( i.e. , 100% of the principal amount of the debt participated), and that cash lands immediately on the seller’s balance sheet. For unfunded loans, because the participation agreement obligates the participant to fund (or reimburse, depending on timing) future draws through the seller, a seller also benefits by shifting much of the responsibility to fund future draws to the participant (noting, of course, that this introduces new credit risk with respect to the buyer). In addition, regulated lenders are not typically required to hold capital against participated loans. Sellers can also realize value by retaining some of the economics of the loan they’re selling a participation interest in. We see many participations where sellers retain some or all upfront fees paid by the borrower in respect of the loan, and a number where the buyer takes a haircut on the interest payments that are passed through to them, with the seller retaining the difference (noting that, if a seller is not passing along all or substantially all of the rights and obligations under the loan, the parties should carefully consider with counsel whether the sale would still be considered a true participation under New York law – if it wouldn’t, buyer may be at risk of being considered a mere contractual counterparty of seller subject to seller’s credit risk). Taken together, sellers can use participation arrangements to put cash on their balance sheets, reduce exposure to certain borrowers or industries and decrease regulatory capital obligations in compliance with internal or external requirements.

On the buyer’s side of the transaction, buyers benefit from being able to realize some or all of the economic benefits of a loan without incurring origination expenses, the bulk of ongoing administration expenses or the legal expense associated with preparing the underlying loan documentation (subject, of course, to indemnities, etc., that can flow through to a participant, e.g. , agent expenses). From a credit perspective, depending on buyer’s internal comfort level, a buyer can draft to varying degrees behind the seller’s credit analysis and diligence of the borrower. In addition, since participants are typically not disclosed to a borrower, a buyer can generally keep its status as participant confidential.

Buyers and sellers alike benefit from not needing to seek consents and pay assignment or other fees that might be required in the case of a direct assignment.

Typical Principal Documentation

Sellers and their counsel typically hold the pen when documenting participation arrangements. While drafting parties can and do use their own forms, it often makes sense to leverage the Loan Syndication and Trading Association’s (LSTA) standard form participation agreement for par/near-par ( i.e. , non-distressed) trades as a starting point – even for bespoke, heavily-negotiated participations. The LSTA’s form participation agreement was developed to facilitate efficient documentation of transactions in the high-volume secondary market (where participations are often used as a backup settlement option for debt trades that can’t settle by assignment), and accordingly generally tracks market-standard terms and mechanics for participation arrangements. The LSTA form splits the participation agreement into two documents: (i) a longer set of standard terms and conditions (often referred to as STCs, and available here for LSTA members), which contains a baseline set of market-standard provisions, and (ii) a relatively short form agreement setting forth the transaction-specific terms of the participation (often referred to as the TSTs, and available here for LSTA members), which incorporates the STCs by reference and lets parties toggle on or off (often via checkbox), or otherwise supplement or modify, the various provisions of the STCs. The LSTA’s bifurcated documentation pulls all the transaction-specific information, business terms and frequently negotiated provisions into a more manageable document.

Of course, there are a number of points in the LSTA forms that counsel will typically want to smooth out when using them outside of the more commoditized secondary loan trading market ( e.g. , the need for trade confirmations and funding memoranda, delayed compensation, etc.). Nevertheless, starting with LSTA forms helps both buyer and seller cut down on legal expense, and focuses attention on the terms and provisions that are of particular importance to the parties and the specific deal. These efficiencies can also facilitate innovation.

Key Considerations and Commonly-Negotiated Provisions

Elevation . Buyer’s rights to request “elevation” of its participation ( i.e. , to seek to become a direct lender under the loan agreement) is often the subject of negotiation. Under the STCs, a buyer can always elevate if seller goes into bankruptcy. Otherwise, it’s up to the parties – in some transactions buyers are free to elevate at any time. In others, elevations triggers are heavily tailored, and can include conditions tied to seller’s credit rating, the amount of seller’s loans or commitments under the facility, disputes over collateral value (particularly for participations in NAV loans) or the occurrence of certain events (or failures by seller to take certain actions) under the loan documents.

Voting . The voting provisions in the participation agreement govern whether, when and to what extent, the buyer can direct seller’s votes as a lender under the loan documents. Participation provisions in loan agreements will sometimes limit a seller’s ability to grant voting control to a participant beyond the typical suite of “sacred” provisions ( e.g. , facility size, interest rates, payment dates, term, etc.). Otherwise, the parties can and do tailor the allocation of control to their liking – from no buyer voting rights at all to full buyer voting rights and everything in between. Buyers will often push for control over at least the “sacred” provisions in the loan documents. Sometimes buyers request decision-making power over waivers of certain events of default, facility subordination or other provisions important to the buyer’s credit analysis or institutional concerns. If the underlying loan agreement does include limitations on the seller’s ability to grant voting control, parties will typically clarify in the participation agreement that any voting rights allocated to buyer are allocated only to the extent it would not violate the loan agreement.

Sub-participations . One standard provision of the STCs we frequently see negotiated is the requirement that seller consent to a requested sub-participation by buyer “not be unreasonably withheld or delayed.” Often, sellers will request that that language be deleted. Buyers, in turn, will request some exceptions ( e.g. , permitting sub-participations to affiliates, if seller’s hold on the facility drops below some specified amount, etc.).

Loan agreement diligence . Buyers and sellers should take care to consider the terms of the underlying loan documentation when documenting participation arrangements. Loan agreements in the secondaries market do not always include the detailed assignment and participation provisions lenders might expect in a loan agreement drafted with an eye towards syndication – indeed, it’s not infrequent that we see loan agreements that are silent on the subject. Sometimes there will be credit agreement provisions that necessitate representations from buyer or seller ( e.g. , a representation that buyer is not an affiliate of the borrower, not on a disqualified institution list or not otherwise an ineligible buyer) or explicitly require that seller maintain a participant register for tax purposes. While uncommon, credit agreements occasionally include borrower or other consent requirements for lender participations (and often the consequence for failing to obtain that consent is that the transaction is void). Additional complexities are introduced when participating in a bilateral loan – in the event a buyer wants to elevate its participation interest, significant revisions to the loan documents may be required to accommodate a multi-lender structure. Often specifically tailored provisions are required in the participation agreement to address a given loan agreement.

The above is just a sampling of bespoke provisions.

Current Legal Analysis

More from cadwalader, wickersham & taft llp, upcoming legal education events.

Sign Up for e-NewsBulletins

- Online Courses

Loan participations vs. syndications: What’s the deal?

Posted on Jun 29, 2021 by Bob Laffler, CPA | Tags: Accounting , Auditing

Loan participations and loan syndications are terms often interchanged to describe a lending arrangement involving more than one lender; however, for accounting and reporting purposes, these are two different types of transactions with unique considerations and issues. We often get questions from participants in our classroom Banking Industry Fundamentals training programs and have dedicated time to this subject in our eLearning series available on the Revolution, our online learning platform.

While both loan participations and syndications involve multiple lenders, the way each is structured results in different accounting issues, including derecognition under ASC 860 and recognition of fees under ASC 606 and/or ASC 310.

Loan Participations:

In a loan participation, the originating bank enters into several lending arrangements. The first transaction is the loan origination to the borrower. This transaction will follow the normal accounting for loans under ASC 310. The unloading of a portion of the loan to participating banks represents a “transfer of a financial asset” (i.e. the loan, or a portion of the loan) and must be assessed for derecognition under ASC 860. This analysis involves determining if the participating loan represents a “participating interest” under ASC 860 and further whether control over the participating loan has been relinquished by the originating bank.

Loan Syndications:

In a loan syndication, the bank with the “relationship” with the borrower likely does not want to assume the risk of issuing such a large loan. As a result, rather than underwrite the entire loan and look to participate it out to other banks, the lead bank acts as a “syndicate”, matching the borrower up with multiple lenders, each of which underwrites and originates its own loan to the borrower. As a result, there are multiple loans issued by numerous banks to the one borrower.

Loan syndications do not involve any “transfers of financial assets” as each loan in a syndication is between a respective originating bank and the borrower. As a result, ASC 860 and the analysis of derecognition is not an issue. However, there are some issues for the lead syndicate bank involving revenue recognition related to the fees it collects from the borrower. Some of these fees may represent “syndication fees” for arranging the deal, as well as typical lenders fees for the loan it has underwritten itself. Also, these arrangements may involve the lead syndicate servicing the series of loans on behalf of the syndicate banks. For these loans, other than its own originated loan, the lead syndicate will need to recognize a servicing asset (or liability) in accordance with ASC 860.

How do you tell the difference?

As it is illustrated above, these two arrangements (a loan participation and syndication) have unique terms even though they achieve the same economic result. Therefore, the only way to know whether you are dealing with a participation or syndication is the READ the loan agreements! Careful consideration should be given to the legal underwriters and parties to the contract, contractual terms of the instruments, and other conditions to make a final analysis.

Often it is a legal determination that will dictate whether it is a loan participation or syndication. Once this determination is made, it’s on to the accounting analysis!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.

Comments (0)

Add a comment.

Allowed tags: <b><i><br> Add a new comment:

Ready To Make a Change?

Cookies on the GAAP Dynamics website

- Publications

" * " indicates required fields

Assignment, novation or sub-participation of loans

Transfers of loan portfolios between lending institutions have always been commonplace in the financial market. A number of factors may come into play – some lenders may wish to lower their risks and proportion of bad debts in their balance sheets; some may undergo restructuring or divest their investment portfolios elsewhere, to name a few. The real estate market in particular has been affected by the announcement of the “three red lines” policy by the People’s Bank of China in 2020 which led to a surge of transfers, or attempted transfers, of non-performing loans. Other contributing factors include the continuous effects of the Sino-US trade war and the Covid-19 pandemic.

T +852 2905 5760 E [email protected]

Transferability of Loans

The legal analysis regarding the transferability of loans can be complex. The loan agreement should be examined with a view to identifying any restrictions on transferability of the loan between lenders, such as prior consent of the debtor and, in some cases, whether such consent may be withheld. Other general restrictions may apply given that most banks have internal confidentiality rules and data protection requirements, the latter of which may also be subject to governmental regulations. Certain jurisdictions may restrict the transfer of loans relating to specific types of receivables – mortgage or consumer loans being prime examples. It is imperative to conduct proper due diligence on the documentation and underlying assets in order to be satisfied with the transferability of the relevant loans. This may be complicated further if there are multiple projects, facility lines or debtors. It is indeed common to see a partial transfer of loans to an incoming lender or groups of lenders.

Methods of Transfer

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor’s rights, such as the right to receive payment of principal and interest on the loan. The assignor is still required to perform any obligations under the loan documentation. Therefore, there is no need to terminate the loan documentation and, unless the loan documentation stipulates otherwise, there is no need to obtain the debtor’s consent, but notice of the assignment must be served on the debtor. However, many debtors are in fact involved in the negotiation stage, where the parties would also take the opportunity to vary the terms of the facility and security arrangement.

Novation of a loan requires that the debtor, the existing lender (transferor) and the incoming lender (transferee) enter into new documentation which provides that the rights and obligations of the transferor will be novated to the transferee. The transferee replaces the transferor in the loan facility and the transferor is completely discharged from all of its rights and obligations. This method of transfer does require the prior consent of the relevant debtor.

Sub-participation is often used where a lender, whilst wishing to share the risks of certain loans, nonetheless prefers to maintain the status quo. There is no change to the loan documentation – the lender simply sells all or part of the loan portfolio to another lender or lenders. From the debtor’s perspective, nothing has changed and, in principle, there is no need to obtain the debtor’s consent or serve notice on the debtor. This method of transfer is sometimes preferred if the existing lender is keen to maintain a business relationship with the debtor, or where seeking consent from the debtor or notifying the debtor of any transfer is not feasible or desirable. In any case, there would be no change to the balance sheet treatment of the existing lender.

Offshore Security Arrangements

The transfer of a loan in a cross-border transaction often involves an offshore security package. A potential purchaser will need to conduct due diligence on the risks relating to such security. From a legal perspective, the security documents require close scrutiny to confirm their legality, validity and enforceability, including the nature and status of the assets involved. Apart from transferability generally, the documents would reveal whether any consent is required. A lender should seek full analysis on the risks relating to enforcement of security, which may well be complicated by the involvement of various jurisdictions for potential enforcement actions.

A key aspect to the enforcement consideration is whether a particular jurisdiction requires that any particular steps be taken to perfect a security interest relating to the loan portfolio (if the concept of perfection applies at all) and, if so, whether any applicable filing or registration has been made to perfect the security interest and, more importantly, whether there exists any prior or subsequent competing security interest over all or part of the same assets. For example, security interests may be registered in public records of the security provider maintained by the companies registry in Bermuda or the British Virgin Islands for the purpose of obtaining priority over competing interests under the applicable law. The internal register of charges of the security provider registered in the Cayman Islands, Bermuda or the British Virgin Islands should also be examined as part of the due diligence process. Particular care should be taken where the relevant assets require additional filings under the laws of the relevant jurisdictions, notable examples of such assets being real property, vessels and aircraft. Suites of documents held in escrow pending a potential default under the loan documentation should also be checked as they would be used by the lender or security agent to facilitate enforcement of security when the debtor defaults on the loan.

Due Diligence and Beyond

Legal due diligence on the loan documentation and security package is an integral part of the assessment undertaken by a lender of the risks of purchasing certain loan portfolios, regardless of whether the transfer is to be made by way of an assignment, novation or sub-participation. Whilst the choice of method of transfer is often a commercial decision, enforceability of security interests over underlying assets is the primary consideration in reviewing sufficiency of the security package in any proposed loan transfer.

Hong Kong , Shanghai , British Virgin Islands , Cayman Islands , Bermuda

Banking & Asset Finance , Corporate

Banking & Financial Services

A Bird’s-eye View of Some Key Restructuring Options and Processes in Bermuda, the British Virgin Islands and the Cayman Islands

This article focuses on restructuring options and processes only, and will merely touch on formal in...

Similar but Different

While the basic features of the trust remain, there are some notable differences in how trusts can b...

Material adverse change clauses in light of the Covid-19 pandemic

Experts from each of our key global offices provide jurisdiction specific advice and answer question...

Managing the court process

Economic Substance update Q4 2020

The facilitation of cross border restructurings in Bermuda, the British Virgin Islands and the Cayman Islands

In this update, we consider the powers and discretion of the domestic courts in Bermuda, the BVI and...

Economic Substance update Q1 2020

On 18 February 2020, the Economic and Financial Affairs Council (ECOFIN) announced that Bermuda and ...

Offshore listing Vehicles to benefit from the Shanghai - London stock connect

Offshore deal value through June 2018 nearly matches 2017 total

Snapshot Petitions Report 2017

- Select your option

- find a lawyer

- find an office

- contact you

Worldwide: Assignment, Novation Or Sub-Participation Of Loans

Transfers of loan portfolios between lending institutions have always been commonplace in the financial market. A number of factors may come into play – some lenders may wish to lower their risks and proportion of bad debts in their balance sheets; some may undergo restructuring or divest their investment portfolios elsewhere, to name a few. The real estate market in particular has been affected by the announcement of the "three red lines" policy by the People's Bank of China in 2020 which led to a surge of transfers, or attempted transfers, of non-performing loans. Other contributing factors include the continuous effects of the Sino-US trade war and the Covid-19 pandemic.

TRANSFERABILITY OF LOANS

The legal analysis regarding the transferability of loans can be complex. The loan agreement should be examined with a view to identifying any restrictions on transferability of the loan between lenders, such as prior consent of the debtor and, in some cases, whether such consent may be withheld. Other general restrictions may apply given that most banks have internal confidentiality rules and data protection requirements, the latter of which may also be subject to governmental regulations. Certain jurisdictions may restrict the transfer of loans relating to specific types of receivables – mortgage or consumer loans being prime examples. It is imperative to conduct proper due diligence on the documentation and underlying assets in order to be satisfied with the transferability of the relevant loans. This may be complicated further if there are multiple projects, facility lines or debtors. It is indeed common to see a partial transfer of loans to an incoming lender or groups of lenders.

METHODS OF TRANSFER

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor's rights, such as the right to receive payment of principal and interest on the loan. The assignor is still required to perform any obligations under the loan documentation. Therefore, there is no need to terminate the loan documentation and, unless the loan documentation stipulates otherwise, there is no need to obtain the debtor's consent, but notice of the assignment must be served on the debtor. However, many debtors are in fact involved in the negotiation stage, where the parties would also take the opportunity to vary the terms of the facility and security arrangement.

Novation of a loan requires that the debtor, the existing lender (transferor) and the incoming lender (transferee) enter into new documentation which provides that the rights and obligations of the transferor will be novated to the transferee. The transferee replaces the transferor in the loan facility and the transferor is completely discharged from all of its rights and obligations. This method of transfer does require the prior consent of the relevant debtor.

Sub-participation is often used where a lender, whilst wishing to share the risks of certain loans, nonetheless prefers to maintain the status quo. There is no change to the loan documentation – the lender simply sells all or part of the loan portfolio to another lender or lenders. From the debtor's perspective, nothing has changed and, in principle, there is no need to obtain the debtor's consent or serve notice on the debtor. This method of transfer is sometimes preferred if the existing lender is keen to maintain a business relationship with the debtor, or where seeking consent from the debtor or notifying the debtor of any transfer is not feasible or desirable. In any case, there would be no change to the balance sheet treatment of the existing lender.

OFFSHORE SECURITY ARRANGEMENTS

The transfer of a loan in a cross-border transaction often involves an offshore security package. A potential purchaser will need to conduct due diligence on the risks relating to such security. From a legal perspective, the security documents require close scrutiny to confirm their legality, validity and enforceability, including the nature and status of the assets involved. Apart from transferability generally, the documents would reveal whether any consent is required. A lender should seek full analysis on the risks relating to enforcement of security, which may well be complicated by the involvement of various jurisdictions for potential enforcement actions.

A key aspect to the enforcement consideration is whether a particular jurisdiction requires that any particular steps be taken to perfect a security interest relating to the loan portfolio (if the concept of perfection applies at all) and, if so, whether any applicable filing or registration has been made to perfect the security interest and, more importantly, whether there exists any prior or subsequent competing security interest over all or part of the same assets. For example, security interests may be registered in public records of the security provider maintained by the companies registry in Bermuda or the British Virgin Islands for the purpose of obtaining priority over competing interests under the applicable law. The internal register of charges of the security provider registered in the Cayman Islands, Bermuda or the British Virgin Islands should also be examined as part of the due diligence process. Particular care should be taken where the relevant assets require additional filings under the laws of the relevant jurisdictions, notable examples of such assets being real property, vessels and aircraft. Suites of documents held in escrow pending a potential default under the loan documentation should also be checked as they would be used by the lender or security agent to facilitate enforcement of security when the debtor defaults on the loan.

DUE DILIGENCE AND BEYOND

Legal due diligence on the loan documentation and security package is an integral part of the assessment undertaken by a lender of the risks of purchasing certain loan portfolios, regardless of whether the transfer is to be made by way of an assignment, novation or sub-participation. Whilst the choice of method of transfer is often a commercial decision, enforceability of security interests over underlying assets is the primary consideration in reviewing sufficiency of the security package in any proposed loan transfer.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

- Practical Law

Assignments and Participations of Loans

Practical law practice note 8-381-8532 (approx. 22 pages).

- United States

- 14985 60th Street North Stillwater, MN 55082

- Phone (651) 439-2951

- Fax (651) 439-1417

MBA Article – Dos and Don’ts of Loan Participations

Loan participations have been a valuable tool in commercial lending for years. This is true primarily because they allow banks to participate in transactions that would otherwise present too much risk for them alone, or allow them to purchase or sell an interest in a transaction necessary to comply with their legal lending limit. Loan participations also allow banks the opportunity to diversify their loan portfolio with transactions, or within lending markets, in which they have minimal experience or expertise.

Prior to late 2007, when the most recent recession began, loan participations were used regularly. However, since that time, and continuing with the adoption of FASB 140, which took effect as of November 15, 2009, many banks have shied away from using loan participations. Properly managed, loan participations still have value in today’s lending marketplace and appear to be regaining popularity. With that in mind, it is important to understand not only what banks cannot do within the scope of a loan participation, but also understand what they should do to protect their interests.

THE DON’Ts OF LOAN PARTICIPATIONS

Although FASB 140, as amended by FASB 166, is merely an accounting standard, its adoption has had the largest impact on what banks can no longer do with respect to loan participations. Specifically, FASB 140, as amended by FASB 166, requires loan participations to (i) be based on a pro-rata ownership interest in the loan; (ii) require all cash derived from the loan to be shared based on pro-rata ownership, except for cash stemming from services rendered (i.e. an origination fee or a servicing fee); and, (iii) be non-recourse. In the event a loan participation fails to meet these requirements, it may not invalidate the participation agreement; however, the participation likely will not be treated as a sale of a portion of the loan. Rather it will most likely be treated as a direct loan from the participating bank to the borrower. In such case, certain unintended consequences such as exceeding a bank’s legal lending limit and other regulatory compliance violations may occur.

Loan participations prior to 2009 commonly included Last-In-First-Out (LIFO), First-In-Last-Out (FILO), or other accounting variations which were loan participation structures utilized by lead banks to facilitate the sale of loan participations. However, those types of accounting variations and structures do not comply with the current requirement that loan participation ownership be structured on a pro-rata basis.

Additionally, prior to 2009, loan participations also regularly allowed the lead bank to retain non-service based fees, such as non-usage fees on revolving lines of credit, pre-payment penalties and late fees, just to name a few. Retention of those types of fees clearly violates the current requirement that all cash derived from the participated loan be shared based on pro-rata ownership. It is important to note that service based fees need not be shared based on pro-rata ownership. Thus, the lead bank may still retain service based fees, such as loan origination fees, loan renewal fees and loan servicing fees.

Lastly, some loan participation agreements previously contained mandatory sale or buy-back provisions in favor of participant banks. These provisions ranged from mandatory buy-out of a participant by the lead bank upon the occurrence of an event of default by the borrower, to at-will repurchase. Depending on the specific language, these types of provisions allowed lead lenders better control of the particular lending relationship with the borrower or were an incentive for a participant bank purchasing an interest in a loan. These types of provisions are now contrary to the requirement that sales of participating interests be non-recourse and a true sale. Although, it is important to recognize that a lead lender may still buy back a participating interest from a participant bank, they just cannot have a required sale/buy-back in the loan participation agreement.

THE DOs OF LOAN PARTICIPATIONS

In addition to the issues that lenders should avoid in loan participations as noted above, which are primarily driven by the changes to the applicable FASB standards, lenders should ensure that the terms and conditions of their loan participation agreements guard against the unfortunate consequences experienced by both lead and participant banks during the most recent recession.

First, many lead banks and participant banks alike experienced a great deal of frustration with loans participated to more multiple participants. Previously, many lead banks used the same form of participation agreement to govern loans participated to multiple participants as they did for loans participated to a single participant. Unfortunately, loans participated to multiple parties present their own unique issues and should be documented accordingly. Specifically, many loan participation agreement forms allow the lead bank to take certain actions without the consent of participants and require participant consent for other actions. Although these types of consent provisions were sufficient for loans participated to a singular participant, they proved problematic for multi-participant loans because, when read together, such consent provisions are sometimes interpreted as requiring unanimous approval by all participants. This type of unintended interpretation allowed participants owning just a small percentage of a loan to veto any action decisions by the remainder of the lending group. For this reason, it is strongly recommended that when contemplating a loan to be participated by multiple parties, a master loan participation agreement is utilized, rather than individual loan participation agreements for each participant to ensure proper and unambiguous voting requirements for any given loan administration or collection action.

Second, as recently experienced by many lenders, the dynamics of loan participations change significantly when either the lead lender or a participant has been closed by the FDIC, and the applicable interest in the participated loan is assigned to an acquiring bank. The insertion of a participant bank with loss-share remedies with the FDIC substantially alters how that party may act within the scope of the loan participation. Particularly troubling for the other parties to the participated loan were collateral liquidation scenarios that were favorable for all of the parties without loss-share, but not deemed as favorable to a party with loss-share. With respect to this issue, there are a few noteworthy considerations. A loan participation agreement cannot divest a lead lender or a participant of its ownership because of a FDIC take-over. Such a provision would violate the requirement that loan participations be sold without recourse. However a provision can be included in the participation agreement to contemplate that the servicing responsibilities are to be transferred to one of the participant banks upon the closure of the lead bank by the FDIC. New ownership of the lead bank’s rights may have a different servicing philosophy. Common differences of opinion among the lead banks and participants involve issues such as what constitutes an event of default, when to call an event of default, enforcement of non-monetary loan covenants, whether to utilize a loan workout or forbearance agreement, collateral liquidation strategies, and an assortment of other issues. These are just a few of the many issues that should be carefully considered by the lead bank and participants when the parties are negotiating the participation agreement. Participation agreements are not “one size fits all” documents. In fact, the majority of participation agreements should be customized to fit the transaction and the specific lead and participant banks.

Another issue that arose frequently during the recession involved the ownership of foreclosed or surrendered collateral which caused lead, and participant, banks to ask how such collateral should be carried by the banks following liquidation or surrender in light of the fact the “loan” no longer exists. In reality, such collateral should be treated as OREO or OPPO. Depending on the nature of the asset, a limited liability company is the most favored ownership entity structure for this scenario and will continue to be, especially with the changes to the limited liability company rules set to take effect as of August 1, 2015. Placing OREO or OPPO participated assets into a limited liability company can significantly limit both the lead and participant banks’ exposure to non-contractual liability, with the banks each obtaining an ownership interest in the entity equal to their pro-rata share in the participated loan. This is particularly important where the assets involve businesses which are, and will continue to be, open to the public after the asset foreclosed or surrendered. It is important to note that lead and participant Minnesota banking corporations must obtain approval from the Minnesota Department of Commerce prior to the formation of such entities. The participation agreement should include a provision that contemplates the formation of such an entity and, to the extent possible, proposed drafts the entity’s formation documents should be negotiated and prepared simultaneously with the participation agreement.

In the last decade, there have been significant changes to both the relationship of parties to a participated loan and the language of loan participation agreements. Although significant, these changes have not altered the fact that banks can continue to utilize participated loans as a valuable part of their businesses, but doing so within the parameters of today’s requirements and in light of prior experiences.

Published by:

Related Articles

- Jellum Law Announces a New Partner January 13, 2023

- Happy Holidays from Jellum Law December 21, 2022

- Continuing Resolution Extended and Prime Rate Notice December 16, 2022

- Celebrating Jellum Law Staff November 22, 2022

- Jellum Law Adds New Team Member to the Litigation Team November 8, 2022

- About Jellum Law

Jellum Law 651-439-2951 [email protected] 7616 Currell Blvd, Suite 245 - Woodbury, MN 55125

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt , and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/concernedman-ba55c714fbc94fc28f7fd6b7c7723894.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Loan Agreement: Assignment and Participation Clauses | Practical Law

Loan Agreement: Assignment and Participation Clauses

Practical law standard clauses 8-383-3066 (approx. 39 pages).

Loan Participation vs. Syndication: What's the Difference

- April 29, 2021

Understanding the difference between loan participation vs. syndication is critically important when fulfilling your borrowing needs. Lenders seeking to generate new avenues of income or meet the local community’s borrowing needs should begin by examining each process. By immersing yourself in the details of loan participation programs and loan syndication programs, you can find a solution that aligns with your needs.

Here is what to understand about loan participation vs. loan syndication, with a special focus on the importance of loan participation programs to the modern financial marketplace.

Loan Participation vs. Syndication: What to Know

What is loan participation.

Loan participation entails a lender selling portions of an outstanding loan to buyers who may subsequently collect interest and principal payments from that loan. Most loan participation occurs between two or more financial institutions, allowing multiple banks or credit unions to effectively share ownership (and collectively reap the dividends of) any given loan. Loan participation programs can allow all lending participants to share the risks associated with the loan equally, or they can be structured on a senior/subordinate basis to differentially distribute both the risks and rewards associated with the loan to the various lenders managing it.

Banks aren’t the only ones who partake in loan participation programs; credit union service organizations or CUSOs frequently band together to share the ownership of loans in as efficient a manner as possible. A credit union may use a CUSO to engage in loan participation to avoid exceeding regulatory limitations placed upon it by laws such as the Credit Union Membership Access Act . Alternatively, a credit union that holds a risky loan may sell portions of that loan to a CUSO to minimize its exposure to financial risks.

What is Loan Syndication?

Loan syndication entails multiple lenders coming together to fund a large loan for a single borrower. If a would-be borrower needs access to a huge sum of money that an individual lender may not be able to provide by itself, loan syndication can be formed to meet the demand for a hefty loan by pooling the resources of multiple lenders together. Thus, loan syndication allows lenders to collectively issue a massive loan to a needy borrower without individually exposing themselves to the risk of that borrower defaulting on a particularly large loan.

Loan syndications are incredibly important when it comes to financing immense projects that no individual lender may view as safe enough to finance by themselves. It allows bold marketplace actors to embark upon lengthy, risky projects that would likely never materialize if they had to rely on a single cautious lender. If an important client has credit needs that surpass a lender’s established credit exposure limits, loan syndication can allow a bank or CUSO to partially participate in the loan with limited exposure to risks.

Differences Between Loan Participation vs. Syndication

The most critical difference between loan participation vs. syndication is that all lenders partaking in loan syndication will both be involved in the origination and servicing of a loan. On the other hand, in a loan participation program, not all lenders involved will have joint involvement in the origination and servicing of a loan. Many loan participation programs involve an original (or senior) lender who holds onto the original loan documentation and services the loan, while also including a secondary (or subordinate) lender who holds a smaller portion of the loan and is only paid if there are enough funds remaining after the senior lender is paid.

Borrowers themselves may not even know their loan has been participated out by the original lender. In a loan syndicate, however, borrowers will understand from the start that their loan is being sourced from multiple different lenders at once to mitigate financial risks associated with defaulting on a loan. The significant difference between loan participation vs. syndication is thus the role of the lenders themselves. According to the Credit Union Times , CUSOs now play a more important role in loan participation than they did just a few years ago due to heightened demand.

Loan Participation vs. Syndication: Which is Best For Me?

Loan syndication is preferable in expensive cases that may require multiple lenders to finance a single borrower’s loan. Loan participation programs, on the other hand, allow banks and credit unions to mitigate their exposure to risks by distributing portions of their existing loans out to other lenders. Contacting the experts at Extensia Financial can help connect commercial real estate brokers with credit unions interested in participating in lending programs.

The financial professionals at Extensia can explain the fine differences between loan participation vs. syndication while also illustrating which option is the most reliable for any given commercial scenario.

Let’s work together to find a solution

Rely on AVANA Capital to help preserve your wealth and create growth for your business.

Setup Menus in Admin Panel

Sharing the Knowledge!™

- Knowledge Point

How are assignment and participation treated?

An “ assignment ” under New York law is the legal term used to refer to the transfer of rights, such as the right to receive payments on a loan , while “delegation” is the legal term used to refer to the transfer of obligations, such as the obligation to make loans . However, “assignment” as commonly used in the US refers to the transfer of both rights and obligations of the assignor/ seller under a credit agreement, such that the assignee/buyer comes into privity of contract with the borrower .

An “ assignment ” as used under English law is the transfer from a lender to another party of the rights to interest and principal – not any obligations – for amounts already drawn down and owing to the lender. Only the benefit of an agreement may be assigned, with any commitment to provide funds to the borrower remaining with the existing lender. The transferee (buyer) assumes the rights of the transferor (seller) and enters into a direct relationship with the parties to the loan agreement – the borrower, the agent and the other lenders .

Where a US participation transfers the beneficial and economic ownership of a loan, under English law the loan remains with the originating lender and an unsecured debtor-creditor relationship is created between the participants and the grantor. Therefore, a US participation is effectively a true sale , where an LMA-style participation if refinancing for the loan originator and grantor. However, both US and UK participations create a new contract between the original lender and the loan buyer, while leaving the contract between the borrower and the original lender unchanged.

Related Items

- What is loan sales?

- What are borrower concerns with loan sales?

- What is loan novation?

- When do loans trade?

- Privacy Policy

- Terms of Use

- Please note that the information you provide us now will serve as the basis of our offer. In the event we require more information or clarification, we will contact you.

Identification

- Name * First Last

- Business Name *

- Email * Enter Email Confirm Email

Content Details

- Course Title

- Subject Area & Topics

- Course Objective

- Estimated Total Number of Hours of Courseware Use * 4 8 12 16 20 More than 20

- Estimated Number of Courseware Users per Course * 4 8 12 16 20 More than 20

- Blended (Original + Pecunica)

- Content Specifications *

- Glossary Examples Drop files here or

User Information

- Type of Courseware User Industry Professional Graduate Student Tertiary-Level Undergraduate Upper Secondary-Level Student Other

- Course Creation Consultation

- Subject Matter Expert

- General Course Administration

- Text-to-Speech Rendering

- You have not selected any Learning Management Services.

- Brand for White-Labeling

- Special Requirements

- Phone This field is for validation purposes and should be left unchanged.

- Kindly use this form to contact us only if you are not provided an appropriate form (e.g., a service-specific request form) for the purpose.

- Subject * General Enquiry Course Enquiry Collaboration with Pecunica Request for Support Courseware Evaluation Request Request Corporate Discount

- I understand and accept the Nondisclosure Agreement

Privacy Statement

Any information obtained from Users of this Website at the time of any communication with us (the "Company") or otherwise is stored by the Company. This information is collected solely for the purposes of communicating with the User, processing registrations, creating and maintaining user records, keeping Users informed of upcoming events and products, and assisting the Company in improving services. Under no circumstances shall this confidential information be passed by the Company to a third party, except with the explicit approval of the User or as may be required by law, court order or governmental regulation or if such disclosure is otherwise necessary in support of any criminal or other legal investigation or proceeding.

- Email This field is for validation purposes and should be left unchanged.

- Use this form for submitting links to content, such as guidance, reports, images, suggesting edits to the text, and to report errors. Topic: How are assignment and participation treated?

- Comment Suggestion Report Error

Only fill in if you are not human

- What is Rimon?

- Awards and Recognitions

- Representative Clients

- Streamlined Structure

- Our Principles

- Recent Firm News

- Diversity, Equity, and Inclusion

- All-Star Team

Search our capabilities across practice areas, industries and regions

Search the rimon team.

- Industry-Specific Blogs

After London and Paris, Rimon Set on Further International Expansion, Law360 Reports

Rimon Partner Rodrigo Castillo Cottin Highly Recommended by Leaders League for Wealth Management

Global Law Firm Rimon PC expands international reach with opening of new London office

- Asia Pacific

- Latin America

- Middle East

- North America

Regional Practices

- Albuquerque

- Kansas City

- Los Angeles

- Minneapolis

- Northern Virginia

- Philadelphia

- Research Triangle, North Carolina

- San Francisco

- Santa Barbara

- Silicon Valley

- St. Petersburg

- Washington, D.C.

- Join Our Team Open Positions Lateral Partners

- Client Portal

Insights & Analysis

Top ten issues to consider when dealing with loan participations, insights douglas j. schneller · john j. hanley · july 24, 2018.

Rimon Partners, John Hanley and Douglas Schneller , have an important update titled “Top Ten Issues to Consider When Dealing with Loan Participations”.

Loan participations can be an effective way for lenders to reduce their exposure to a borrower’s credit and manage their loan portfolios and liquidity, and for investors to acquire an interest in a loan without becoming a lender of record under the loan agreement. Although loan participations are customarily used in the loan market, they differ from assignments (i.e. outright sales) in several important ways.

Before delving into the issues, what do we mean by a participation interest in a loan? Although discussed in more detail below, generally a participation refers to a situation in which the lender of record, or Grantor, retains legal (or nominal) title to the loan while simultaneously conveying to the investor, or Participant, the economic interest in the underlying loan.

There can be several reasons why parties might use a participation arrangement rather than an outright assignment. From the Participant’s perspective, it may not satisfy requirements under the Loan Agreement to become a lender of record. In certain jurisdictions there can be licensing requirements to engage in lending activities, which the Grantor may satisfy but the Participant might not. Sometimes the Participant may want its investment to be confidential and unknown to the Borrower, Administrative Agent or other parties in the credit facility. And, finally, the Grantor may wish to remain nominally a lender under the Loan Agreement – for example, to continue to receive syndicate information – while offloading some or all of its credit exposure.

Click here to view the full article.

John J. Hanley focuses his practice on first and second lien financings; private placements of debt and equity securities; and the purchase and sale of loans, securities, trade claims and other illiquid assets. His clients include business development companies, specialty lenders, investment banks, hedge funds, actively managed CLOs, special purpose vehicles, and other financial institutions.

Douglas Schneller handles a broad range of complex transactional matters involving bank finance and lending; restructuring, bankruptcy and insolvency; inter-creditor and subordination arrangements, including for mezzanine, leveraged, multi-lien and unitranche financings; claims analysis and reconciliation; and purchases and sales of par and distressed assets such as bank loans, notes, accounts receivable, trade claims, bankruptcy claims, and equity interests.

Insights April 23, 2024

Insights april 22, 2024, insights april 18, 2024, insights april 17, 2024, insights april 4, 2024, insights april 2, 2024.

- Join Our Team

- Privacy Policy

- ATTORNEY ADVERTISING/NOTICES

- ATTORNEY LOGIN

© 2024 Rimon, P.C. - San Francisco, CA. All Rights Reserved.

- Disclaimers

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages. Adroll is used for marketing purposes.

Keeping these cookies enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Conventus Law

More results...

Hong Kong – Assignment, Novation Or Sub-Participation Of Loans.

April 28, 2022 by Balaram Adhikari

TRANSFERABILITY OF LOANS

The legal analysis regarding the transferability of loans can be complex. The loan agreement should be examined with a view to identifying any restrictions on transferability of the loan between lenders, such as prior consent of the debtor and, in some cases, whether such consent may be withheld. Other general restrictions may apply given that most banks have internal confidentiality rules and data protection requirements, the latter of which may also be subject to governmental regulations. Certain jurisdictions may restrict the transfer of loans relating to specific types of receivables – mortgage or consumer loans being prime examples. It is imperative to conduct proper due diligence on the documentation and underlying assets in order to be satisfied with the transferability of the relevant loans. This may be complicated further if there are multiple projects, facility lines or debtors. It is indeed common to see a partial transfer of loans to an incoming lender or groups of lenders.

METHODS OF TRANSFER

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor’s rights, such as the right to receive payment of principal and interest on the loan. The assignor is still required to perform any obligations under the loan documentation. Therefore, there is no need to terminate the loan documentation and, unless the loan documentation stipulates otherwise, there is no need to obtain the debtor’s consent, but notice of the assignment must be served on the debtor. However, many debtors are in fact involved in the negotiation stage, where the parties would also take the opportunity to vary the terms of the facility and security arrangement.

Novation of a loan requires that the debtor, the existing lender (transferor) and the incoming lender (transferee) enter into new documentation which provides that the rights and obligations of the transferor will be novated to the transferee. The transferee replaces the transferor in the loan facility and the transferor is completely discharged from all of its rights and obligations. This method of transfer does require the prior consent of the relevant debtor.

Sub-participation is often used where a lender, whilst wishing to share the risks of certain loans, nonetheless prefers to maintain the status quo. There is no change to the loan documentation – the lender simply sells all or part of the loan portfolio to another lender or lenders. From the debtor’s perspective, nothing has changed and, in principle, there is no need to obtain the debtor’s consent or serve notice on the debtor. This method of transfer is sometimes preferred if the existing lender is keen to maintain a business relationship with the debtor, or where seeking consent from the debtor or notifying the debtor of any transfer is not feasible or desirable. In any case, there would be no change to the balance sheet treatment of the existing lender.

OFFSHORE SECURITY ARRANGEMENTS

The transfer of a loan in a cross-border transaction often involves an offshore security package. A potential purchaser will need to conduct due diligence on the risks relating to such security. From a legal perspective, the security documents require close scrutiny to confirm their legality, validity and enforceability, including the nature and status of the assets involved. Apart from transferability generally, the documents would reveal whether any consent is required. A lender should seek full analysis on the risks relating to enforcement of security, which may well be complicated by the involvement of various jurisdictions for potential enforcement actions.

A key aspect to the enforcement consideration is whether a particular jurisdiction requires that any particular steps be taken to perfect a security interest relating to the loan portfolio (if the concept of perfection applies at all) and, if so, whether any applicable filing or registration has been made to perfect the security interest and, more importantly, whether there exists any prior or subsequent competing security interest over all or part of the same assets. For example, security interests may be registered in public records of the security provider maintained by the companies registry in Bermuda or the British Virgin Islands for the purpose of obtaining priority over competing interests under the applicable law. The internal register of charges of the security provider registered in the Cayman Islands, Bermuda or the British Virgin Islands should also be examined as part of the due diligence process. Particular care should be taken where the relevant assets require additional filings under the laws of the relevant jurisdictions, notable examples of such assets being real property, vessels and aircraft. Suites of documents held in escrow pending a potential default under the loan documentation should also be checked as they would be used by the lender or security agent to facilitate enforcement of security when the debtor defaults on the loan.

DUE DILIGENCE AND BEYOND

Legal due diligence on the loan documentation and security package is an integral part of the assessment undertaken by a lender of the risks of purchasing certain loan portfolios, regardless of whether the transfer is to be made by way of an assignment, novation or sub-participation. Whilst the choice of method of transfer is often a commercial decision, enforceability of security interests over underlying assets is the primary consideration in reviewing sufficiency of the security package in any proposed loan transfer.

For further information, please contact:

Fiona Chan , Partner, Appleby

Register for your monthly Asia legal updates from Conventus Law

Error: Contact form not found.

Malaysia – A Brief Overview Of Labuan Business Essentials.

Electrifying The Road Ahead: A Comprehensive Guide To EV Charging Guidelines In Malaysia.

- richard wee - managing partner, richard wee chambers.

EU – Green Claims Directive: Update On Recent Developments.

CONVENTUS LAW

CONVENTUS DOCS CONVENTUS PEOPLE

3/f, Chinachem Tower 34-37 Connaught Road Central, Central, Hong Kong

IMAGES

VIDEO

COMMENTS

However, the basic difference between participation and assignment is that the former involves the original lender continuing to manage the loan while the latter takes on the responsibility of doing so. As a rule, loan participation is a good option if the original lender does not want to keep the title of the loan.

Participation Structure and Its Benefits. For the uninitiated, a participation is best understood in contrast with an assignment. Both are mechanisms by which a lender of record under a loan ...

Most participations are non-recourse to the bank selling the participation, which makes it all the more important for a would-be participant to conduct due diligence on the borrower and the loan (see Standard Document, Participation Agreement: Drafting Note, Non-recourse Participation).In practice, however, a participant may carry out less extensive due diligence than the originating lender.

Loan Syndications: In a loan syndication, the bank with the "relationship" with the borrower likely does not want to assume the risk of issuing such a large loan. As a result, rather than underwrite the entire loan and look to participate it out to other banks, the lead bank acts as a "syndicate", matching the borrower up with multiple ...

This would typically be by legal transfer (i.e., novation or assignment) under the LMA, or assignment under the LSTA, in each case using the form of transfer document prescribed in the underlying credit agreement or, in some cases, by participation using either the LMA or LSTA standardised form.

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation. A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor's rights, such as the right to ...