- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

- Finance & Accounting / MBA EMBA Resources

Next Case Study Solutions

- Buenos Aires Embotelladora S.A. (BAESA): A South American Restructuring Case Study Solution

- This Bud's for Who? The Battle for Anheuser-Busch Case Study Solution

- Eskimo Pie Corp. (Abridged) Case Study Solution

- PepsiCo's Bid for Quaker Oats (A) Case Study Solution

- Flowers Industries, Inc. (Abridged) Case Study Solution

Previous Case Solutions

- Daniel Dobbins Distillery, Inc., Spanish Version Case Study Solution

- The Farm Winery Case Study Solution

- General Mills, Inc.: Appendix of Comparable Company Data Case Study Solution

- Deutsche Brauerei (v. 1.2) Case Study Solution

- Charley's Family Steak House (C) Case Study Solution

Predictive Analytics

April 6, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Diageo plc description.

A major U.K.-based multinational is reevaluating its leverage policy as it restructures its business. The treasury team models the tradeoffs between the benefits and costs of debt financing, using Monte Carlo simulation to estimate the savings from the interest tax shields and expected financial distress costs under several sets of leverage policies. The group treasurer (CFO) must decide whether and how the simulation results should be incorporated into a recommendation to the board of directors and, more generally, what recommendation to make regarding the firm's leverage policy.

Case Description Diageo plc

Strategic managment tools used in case study analysis of diageo plc, step 1. problem identification in diageo plc case study, step 2. external environment analysis - pestel / pest / step analysis of diageo plc case study, step 3. industry specific / porter five forces analysis of diageo plc case study, step 4. evaluating alternatives / swot analysis of diageo plc case study, step 5. porter value chain analysis / vrio / vrin analysis diageo plc case study, step 6. recommendations diageo plc case study, step 7. basis of recommendations for diageo plc case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Diageo plc

Diageo plc is a Harvard Business (HBR) Case Study on Finance & Accounting , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Diageo plc is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Diageo plc case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Diageo plc will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Diageo plc case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Finance & Accounting, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Diageo plc, is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Diageo plc case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Finance & Accounting Solutions

In the Texas Business School, Diageo plc case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Diageo plc

Step 1 – Problem Identification of Diageo plc - Harvard Business School Case Study

The first step to solve HBR Diageo plc case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Leverage Simulation is facing right now. Even though the problem statement is essentially – “Finance & Accounting” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Leverage Simulation, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Diageo plc. The external environment analysis of Diageo plc will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

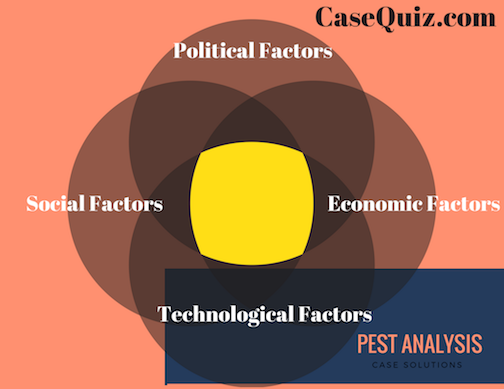

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Diageo plc case study. PESTEL analysis of " Diageo plc" can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Diageo plc macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Diageo plc

To do comprehensive PESTEL analysis of case study – Diageo plc , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Diageo plc

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Diageo plc ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Leverage Simulation is operating, firms are required to store customer data within the premises of the country. Leverage Simulation needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Diageo plc has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Leverage Simulation in case study Diageo plc" should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Leverage Simulation in case study “ Diageo plc ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Leverage Simulation in case study “ Diageo plc ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Diageo plc ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Leverage Simulation can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Diageo plc case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Leverage Simulation needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Diageo plc

Social factors that impact diageo plc, technological factors that impact diageo plc, environmental factors that impact diageo plc, legal factors that impact diageo plc, step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: diageo plc case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

- Harvard Case Studies

Diageo plc Case Study Solution & Analysis

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Diageo plc Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Diageo plc:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Diageo plc and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Diageo plc HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Diageo plc is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Diageo plc.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

STEP 5: PESTEL/ PEST Analysis of Diageo plc Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Diageo plc.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

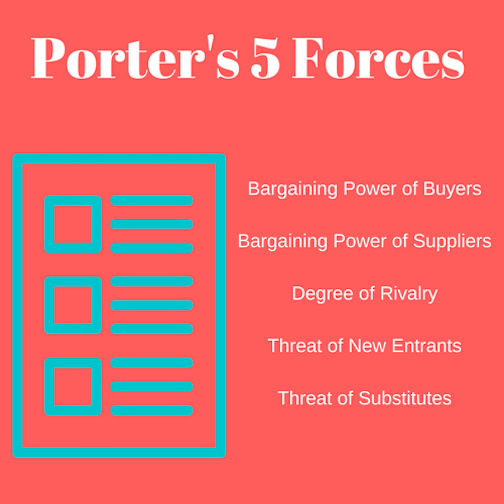

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Diageo plc Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Diageo plc:

Vrio analysis for Diageo plc case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Diageo plc company’s activities and resources values. RARE: the resources of the Diageo plc company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE : the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE : resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Diageo plc) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Diageo plc Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Diageo plc Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Diageo plc Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Diageo plc Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

Fern Fort University

Diageo plc case study analysis & solution, harvard business case studies solutions - assignment help.

Diageo plc is a Harvard Business (HBR) Case Study on Finance & Accounting , Fern Fort University provides HBR case study assignment help for just $11. Our case solution is based on Case Study Method expertise & our global insights.

Finance & Accounting Case Study | Authors :: George Chacko, Peter Tufano, Joshua Musher

Case study description.

A major U.K.-based multinational is reevaluating its leverage policy as it restructures its business. The treasury team models the tradeoffs between the benefits and costs of debt financing, using Monte Carlo simulation to estimate the savings from the interest tax shields and expected financial distress costs under several sets of leverage policies. The group treasurer (CFO) must decide whether and how the simulation results should be incorporated into a recommendation to the board of directors and, more generally, what recommendation to make regarding the firm's leverage policy.

Order a Finance & Accounting case study solution now

To Search More HBR Case Studies Solution Go to Fern Fort University Search Page

[10 Steps] Case Study Analysis & Solution

Step 1 - reading up harvard business review fundamentals on the finance & accounting.

Even before you start reading a business case study just make sure that you have brushed up the Harvard Business Review (HBR) fundamentals on the Finance & Accounting. Brushing up HBR fundamentals will provide a strong base for investigative reading. Often readers scan through the business case study without having a clear map in mind. This leads to unstructured learning process resulting in missed details and at worse wrong conclusions. Reading up the HBR fundamentals helps in sketching out business case study analysis and solution roadmap even before you start reading the case study. It also provides starting ideas as fundamentals often provide insight into some of the aspects that may not be covered in the business case study itself.

Step 2 - Reading the Diageo plc HBR Case Study

To write an emphatic case study analysis and provide pragmatic and actionable solutions, you must have a strong grasps of the facts and the central problem of the HBR case study. Begin slowly - underline the details and sketch out the business case study description map. In some cases you will able to find the central problem in the beginning itself while in others it may be in the end in form of questions. Business case study paragraph by paragraph mapping will help you in organizing the information correctly and provide a clear guide to go back to the case study if you need further information. My case study strategy involves -

- Marking out the protagonist and key players in the case study from the very start.

- Drawing a motivation chart of the key players and their priorities from the case study description.

- Refine the central problem the protagonist is facing in the case and how it relates to the HBR fundamentals on the topic.

- Evaluate each detail in the case study in light of the HBR case study analysis core ideas.

Step 3 - Diageo plc Case Study Analysis

Once you are comfortable with the details and objective of the business case study proceed forward to put some details into the analysis template. You can do business case study analysis by following Fern Fort University step by step instructions -

- Company history is provided in the first half of the case. You can use this history to draw a growth path and illustrate vision, mission and strategic objectives of the organization. Often history is provided in the case not only to provide a background to the problem but also provide the scope of the solution that you can write for the case study.

- HBR case studies provide anecdotal instances from managers and employees in the organization to give a feel of real situation on the ground. Use these instances and opinions to mark out the organization's culture, its people priorities & inhibitions.

- Make a time line of the events and issues in the case study. Time line can provide the clue for the next step in organization's journey. Time line also provides an insight into the progressive challenges the company is facing in the case study.

Step 4 - SWOT Analysis of Diageo plc

Once you finished the case analysis, time line of the events and other critical details. Focus on the following -

- Zero down on the central problem and two to five related problems in the case study.

- Do the SWOT analysis of the Diageo plc . SWOT analysis is a strategic tool to map out the strengths, weakness, opportunities and threats that a firm is facing.

- SWOT analysis and SWOT Matrix will help you to clearly mark out - Strengths Weakness Opportunities & Threats that the organization or manager is facing in the Diageo plc

- SWOT analysis will also provide a priority list of problem to be solved.

- You can also do a weighted SWOT analysis of Diageo plc HBR case study.

Step 5 - Porter 5 Forces / Strategic Analysis of Industry Analysis Diageo plc

In our live classes we often come across business managers who pinpoint one problem in the case and build a case study analysis and solution around that singular point. Business environments are often complex and require holistic solutions. You should try to understand not only the organization but also the industry which the business operates in. Porter Five Forces is a strategic analysis tool that will help you in understanding the relative powers of the key players in the business case study and what sort of pragmatic and actionable case study solution is viable in the light of given facts.

Step 6 - PESTEL, PEST / STEP Analysis of Diageo plc

Another way of understanding the external environment of the firm in Diageo plc is to do a PESTEL - Political, Economic, Social, Technological, Environmental & Legal analysis of the environment the firm operates in. You should make a list of factors that have significant impact on the organization and factors that drive growth in the industry. You can even identify the source of firm's competitive advantage based on PESTEL analysis and Organization's Core Competencies.

Step 7 - Organizing & Prioritizing the Analysis into Diageo plc Case Study Solution

Once you have developed multipronged approach and work out various suggestions based on the strategic tools. The next step is organizing the solution based on the requirement of the case. You can use the following strategy to organize the findings and suggestions.

- Build a corporate level strategy - organizing your findings and recommendations in a way to answer the larger strategic objective of the firm. It include using the analysis to answer the company's vision, mission and key objectives , and how your suggestions will take the company to next level in achieving those goals.

- Business Unit Level Solution - The case study may put you in a position of a marketing manager of a small brand. So instead of providing recommendations for overall company you need to specify the marketing objectives of that particular brand. You have to recommend business unit level recommendations. The scope of the recommendations will be limited to the particular unit but you have to take care of the fact that your recommendations are don't directly contradict the company's overall strategy. For example you can recommend a low cost strategy but the company core competency is design differentiation.

- Case study solutions can also provide recommendation for the business manager or leader described in the business case study.

Step 8 -Implementation Framework

The goal of the business case study is not only to identify problems and recommend solutions but also to provide a framework to implement those case study solutions. Implementation framework differentiates good case study solutions from great case study solutions. If you able to provide a detailed implementation framework then you have successfully achieved the following objectives -

- Detailed understanding of the case,

- Clarity of HBR case study fundamentals,

- Analyzed case details based on those fundamentals and

- Developed an ability to prioritize recommendations based on probability of their successful implementation.

Implementation framework helps in weeding out non actionable recommendations, resulting in awesome Diageo plc case study solution.

Step 9 - Take a Break

Once you finished the case study implementation framework. Take a small break, grab a cup of coffee or whatever you like, go for a walk or just shoot some hoops.

Step 10 - Critically Examine Diageo plc case study solution

After refreshing your mind, read your case study solution critically. When we are writing case study solution we often have details on our screen as well as in our head. This leads to either missing details or poor sentence structures. Once refreshed go through the case solution again - improve sentence structures and grammar, double check the numbers provided in your analysis and question your recommendations. Be very slow with this process as rushing through it leads to missing key details. Once done it is time to hit the attach button.

Previous 5 HBR Case Study Solution

- Daniel Dobbins Distillery, Inc., Spanish Version Case Study Solution

- The Farm Winery Case Study Solution

- General Mills, Inc.: Appendix of Comparable Company Data Case Study Solution

- Deutsche Brauerei (v. 1.2) Case Study Solution

- Charley's Family Steak House (C) Case Study Solution

Next 5 HBR Case Study Solution

- Buenos Aires Embotelladora S.A. (BAESA): A South American Restructuring Case Study Solution

- This Bud's for Who? The Battle for Anheuser-Busch Case Study Solution

- Eskimo Pie Corp. (Abridged) Case Study Solution

- PepsiCo's Bid for Quaker Oats (A) Case Study Solution

- Flowers Industries, Inc. (Abridged) Case Study Solution

Special Offers

Order custom Harvard Business Case Study Analysis & Solution. Starting just $19

Amazing Business Data Maps. Send your data or let us do the research. We make the greatest data maps.

We make beautiful, dynamic charts, heatmaps, co-relation plots, 3D plots & more.

Buy Professional PPT templates to impress your boss

Nobody get fired for buying our Business Reports Templates. They are just awesome.

- More Services

Feel free to drop us an email

- fernfortuniversity[@]gmail.com

- (000) 000-0000

- Harvard Business School →

- Faculty & Research →

- January 2001 (Revised August 2003)

- HBS Case Collection

- Format: Print

- | Pages: 16

More from the Author

- Journal of Finance

The Price of Immediacy

- Faculty Research

Pricing Liquidity: The Quantity Structure of Immediacy Prices

- May 2005 (Revised February 2006)

Introduction to Interest Rate Options

- The Price of Immediacy By: George Chacko, Jakub W. Jurek and Erik Stafford

- Pricing Liquidity: The Quantity Structure of Immediacy Prices By: George Chacko, Jakub W. Jurek and Erik Stafford

- Introduction to Interest Rate Options

Marketing Process Analysis

Segmentation, targeting, positioning, marketing strategic planning, marketing 5 concepts analysis, swot analysis & matrix, porter five forces analysis, pestel / pest / step analysis, cage distance analysis international marketing analysis leadership, organizational resilience analysis, bcg matrix / growth share matrix analysis, block chain supply chain management, paei management roles, leadership with empathy & compassion, triple bottom line analysis, mckinsey 7s analysis, smart analysis, vuca analysis ai ethics analysis analytics, diageo plc case study solution & analysis / mba resources.

- Finance & Accounting / MBA Resources

Introduction to case study solution

EMBA Pro case study solution for Diageo plc case study

At EMBA PRO , we provide corporate level professional case study solution. Diageo plc case study is a Harvard Business School (HBR) case study written by George Chacko, Peter Tufano, Joshua Musher. The Diageo plc (referred as “Leverage Simulation” from here on) case study provides evaluation & decision scenario in field of Finance & Accounting. It also touches upon business topics such as - Value proposition, Costs. Our immersive learning methodology from – case study discussions to simulations tools help MBA and EMBA professionals to - gain new insight, deepen their knowledge of the Finance & Accounting field, and broaden their skill set.

Urgent - 12Hr

- 100% Plagiarism Free

- On Time Delivery | 27x7

- PayPal Secure

- 300 Words / Page

Case Description of Diageo plc Case Study

A major U.K.-based multinational is reevaluating its leverage policy as it restructures its business. The treasury team models the tradeoffs between the benefits and costs of debt financing, using Monte Carlo simulation to estimate the savings from the interest tax shields and expected financial distress costs under several sets of leverage policies. The group treasurer (CFO) must decide whether and how the simulation results should be incorporated into a recommendation to the board of directors and, more generally, what recommendation to make regarding the firm's leverage policy.

Case Authors : George Chacko, Peter Tufano, Joshua Musher

Topic : finance & accounting, related areas : costs, what is the case study method how can you use it to write case solution for diageo plc case study.

Almost all of the case studies contain well defined situations. MBA and EMBA professional can take advantage of these situations to - apply theoretical framework, recommend new processes, and use quantitative methods to suggest course of action. Awareness of the common situations can help MBA & EMBA professionals read the case study more efficiently, discuss it more effectively among the team members, narrow down the options, and write cogently.

Case Study Solution Approaches

Three Step Approach to Diageo plc Case Study Solution

The three step case study solution approach comprises – Conclusions – MBA & EMBA professionals should state their conclusions at the very start. It helps in communicating the points directly and the direction one took. Reasons – At the second stage provide the reasons for the conclusions. Why you choose one course of action over the other. For example why the change effort failed in the case and what can be done to rectify it. Or how the marketing budget can be better spent using social media rather than traditional media. Evidences – Finally you should provide evidences to support your reasons. It has to come from the data provided within the case study rather than data from outside world. Evidences should be both compelling and consistent. In case study method there is ‘no right’ answer, just how effectively you analyzed the situation based on incomplete information and multiple scenarios.

Case Study Solution of Diageo plc

We write Diageo plc case study solution using Harvard Business Review case writing framework & HBR Finance & Accounting learning notes. We try to cover all the bases in the field of Finance & Accounting, Costs and other related areas.

Objectives of using various frameworks in Diageo plc case study solution

By using the above frameworks for Diageo plc case study solutions, you can clearly draw conclusions on the following areas – What are the strength and weaknesses of Leverage Simulation (SWOT Analysis) What are external factors that are impacting the business environment (PESTEL Analysis) Should Leverage Simulation enter new market or launch new product (Opportunities & Threats from SWOT Analysis) What will be the expected profitability of the new products or services (Porter Five Forces Analysis) How it can improve the profitability in a given industry (Porter Value Chain Analysis) What are the resources needed to increase profitability (VRIO Analysis) Finally which business to continue, where to invest further and from which to get out (BCG Growth Share Analysis)

SWOT Analysis of Diageo plc

SWOT analysis stands for – Strengths, Weaknesses, Opportunities and Threats. Strengths and Weaknesses are result of Leverage Simulation internal factors, while opportunities and threats arise from developments in external environment in which Leverage Simulation operates. SWOT analysis will help us in not only getting a better insight into Leverage Simulation present competitive advantage but also help us in how things have to evolve to maintain and consolidate the competitive advantage.

- High customer loyalty & repeat purchase among existing customers – Leverage Simulation old customers are still loyal to the firm even though it has limited success with millennial. I believe that Leverage Simulation can make a transition even by keeping these people on board.

- Experienced and successful leadership team – Leverage Simulation management team has been a success over last decade by successfully predicting trends in the industry.

- Little experience of international market – Even though it is a major player in local market, Leverage Simulation has little experience in international market. According to George Chacko, Peter Tufano, Joshua Musher , Leverage Simulation needs international talent to penetrate into developing markets.

- Leverage Simulation business model can be easily replicated by competitors – According to George Chacko, Peter Tufano, Joshua Musher , the business model of Leverage Simulation can be easily replicated by players in the industry.

Opportunities

- E-Commerce and Social Media Oriented Business Models – E-commerce business model can help Leverage Simulation to tie up with local suppliers and logistics provider in international market. Social media growth can help Leverage Simulation to reduce the cost of entering new market and reaching to customers at a significantly lower marketing budget.

- Lucrative Opportunities in International Markets – Globalization has led to opportunities in the international market. Leverage Simulation is in prime position to tap on those opportunities and grow the market share.

- Growing dominance of digital players such as Amazon, Google, Microsoft etc can reduce the manoeuvring space for Leverage Simulation and put upward pressure on marketing budget.

- Customers are moving toward mobile first environment which can hamper the growth as Leverage Simulation still hasn’t got a comprehensive mobile strategy.

Once all the factors mentioned in the Diageo plc case study are organized based on SWOT analysis, just remove the non essential factors. This will help you in building a weighted SWOT analysis which reflects the real importance of factors rather than just tabulation of all the factors mentioned in the case.

What is PESTEL Analysis

PESTEL /PEST / STEP Analysis of Diageo plc Case Study

PESTEL stands for – Political, Economic, Social, Technological, Environmental, and Legal factors that impact the macro environment in which Leverage Simulation operates in. George Chacko, Peter Tufano, Joshua Musher provides extensive information about PESTEL factors in Diageo plc case study.

Political Factors

- Political consensus among various parties regarding taxation rate and investment policies. Over the years the country has progressively worked to lower the entry of barrier and streamline the tax structure.

- Political and Legal Structure – The political system seems stable and there is consistency in both economic policies and foreign policies.

Economic Factors

- According to George Chacko, Peter Tufano, Joshua Musher . Leverage Simulation should closely monitor consumer disposable income level, household debt level, and level of efficiency of local financial markets.

- Inflation rate is one of the key criteria to consider for Leverage Simulation before entering into a new market.

Social Factors

- Leisure activities, social attitudes & power structures in society - are needed to be analyzed by Leverage Simulation before launching any new products as they will impact the demand of the products.

- Demographic shifts in the economy are also a good social indicator for Leverage Simulation to predict not only overall trend in market but also demand for Leverage Simulation product among its core customer segments.

Technological Factors

- Artificial intelligence and machine learning will give rise to importance of speed over planning. Leverage Simulation needs to build strategies to operate in such an environment.

- 5G has potential to transform the business environment especially in terms of marketing and promotion for Leverage Simulation.

Environmental Factors

- Environmental regulations can impact the cost structure of Leverage Simulation. It can further impact the cost of doing business in certain markets.

- Consumer activism is significantly impacting Leverage Simulation branding, marketing and corporate social responsibility (CSR) initiatives.

Legal Factors

- Intellectual property rights are one area where Leverage Simulation can face legal threats in some of the markets it is operating in.

- Health and safety norms in number of markets that Leverage Simulation operates in are lax thus impact the competition playing field.

What are Porter Five Forces

Porter Five Forces Analysis of Diageo plc

Competition among existing players, bargaining power of suppliers, bargaining power of buyers, threat of new entrants, and threat of substitutes.

What is VRIO Analysis

VRIO Analysis of Diageo plc

VRIO stands for – Value of the resource that Leverage Simulation possess, Rareness of those resource, Imitation Risk that competitors pose, and Organizational Competence of Leverage Simulation. VRIO and VRIN analysis can help the firm.

What is Porter Value Chain

Porter Value Chain Analysis of Diageo plc

As the name suggests Value Chain framework is developed by Michael Porter in 1980’s and it is primarily used for analyzing Leverage Simulation relative cost and value structure. Managers can use Porter Value Chain framework to disaggregate various processes and their relative costs in the Leverage Simulation. This will help in answering – the related costs and various sources of competitive advantages of Leverage Simulation in the markets it operates in. The process can also be done to competitors to understand their competitive advantages and competitive strategies. According to Michael Porter – Competitive Advantage is a relative term and has to be understood in the context of rivalry within an industry. So Value Chain competitive benchmarking should be done based on industry structure and bottlenecks.

What is BCG Growth Share Matrix

BCG Growth Share Matrix of Diageo plc

BCG Growth Share Matrix is very valuable tool to analyze Leverage Simulation strategic positioning in various sectors that it operates in and strategic options that are available to it. Product Market segmentation in BCG Growth Share matrix should be done with great care as there can be a scenario where Leverage Simulation can be market leader in the industry without being a dominant player or segment leader in any of the segment. BCG analysis should comprise not only growth share of industry & Leverage Simulation business unit but also Leverage Simulation - overall profitability, level of debt, debt paying capacity, growth potential, expansion expertise, dividend requirements from shareholders, and overall competitive strength. Two key considerations while using BCG Growth Share Matrix for Diageo plc case study solution - How to calculate Weighted Average Market Share using BCG Growth Share Matrix Relative Weighted Average Market Share Vs Largest Competitor

5C Marketing Analysis of Diageo plc

4p marketing analysis of diageo plc, porter five forces analysis and solution of diageo plc, porter value chain analysis and solution of diageo plc, case memo & recommendation memo of diageo plc, blue ocean analysis and solution of diageo plc, marketing strategy and analysis diageo plc, vrio /vrin analysis & solution of diageo plc, pestel / step / pest analysis of diageo plc, swot analysis and solution of diageo plc, references & further readings.

George Chacko, Peter Tufano, Joshua Musher (2018) , "Diageo plc Harvard Business Review Case Study. Published by HBR Publications.

Case Study Solution & Analysis

- Buenos Aires Embotelladora S.A. (BAESA): A South American Restructuring Case Study Solution & Analysis

- This Bud's for Who? The Battle for Anheuser-Busch Case Study Solution & Analysis

- Eskimo Pie Corp. (Abridged) Case Study Solution & Analysis

- PepsiCo's Bid for Quaker Oats (A) Case Study Solution & Analysis

- Flowers Industries, Inc. (Abridged) Case Study Solution & Analysis

- Daniel Dobbins Distillery, Inc., Spanish Version Case Study Solution & Analysis

- The Farm Winery Case Study Solution & Analysis

- General Mills, Inc.: Appendix of Comparable Company Data Case Study Solution & Analysis

- Deutsche Brauerei (v. 1.2) Case Study Solution & Analysis

- Charley's Family Steak House (C) Case Study Solution & Analysis

Explore More

Feel free to connect with us if you need business research.

You can download Excel Template of Case Study Solution & Analysis of Diageo plc

Brought to you by:

By: George Chacko, Peter Tufano, Joshua Musher

A major U.K.-based multinational is reevaluating its leverage policy as it restructures its business. The treasury team models the tradeoffs between the benefits and costs of debt financing, using…

- Length: 16 page(s)

- Publication Date: Jan 29, 2001

- Discipline: Finance

- Product #: 201033-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

- Supplements

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

A major U.K.-based multinational is reevaluating its leverage policy as it restructures its business. The treasury team models the tradeoffs between the benefits and costs of debt financing, using Monte Carlo simulation to estimate the savings from the interest tax shields and expected financial distress costs under several sets of leverage policies. The group treasurer (CFO) must decide whether and how the simulation results should be incorporated into a recommendation to the board of directors and, more generally, what recommendation to make regarding the firm's leverage policy.

Learning Objectives

To introduce the static-tradeoff theory of capital structure, as actually implemented in a major firm. Also to introduce the use of simulation to capture the impact of different business policies under uncertainty.

Jan 29, 2001 (Revised: Aug 6, 2003)

Discipline:

Geographies:

United Kingdom

Industries:

Food industry, Retail trade

Harvard Business School

201033-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Work & Careers

- Life & Arts

Case study: Diageo

- Case study: Diageo on x (opens in a new window)

- Case study: Diageo on facebook (opens in a new window)

- Case study: Diageo on linkedin (opens in a new window)

- Case study: Diageo on whatsapp (opens in a new window)

By Abby Ghobadian

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

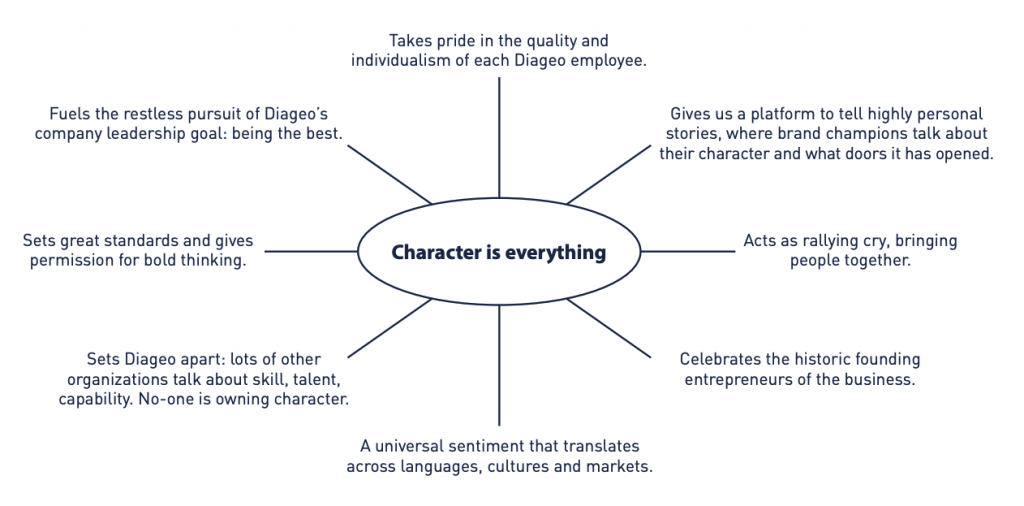

The story: After a series of mergers, demergers and acquisitions, the management of Diageo, the conglomerate formed by the 1997 merger of Guinness and Grand Met, made a strategic decision to focus on premium alcohol drinks. Diageo was in charge of an expanding and wide-ranging collection of brands, some of which had broad appeal across many countries while others had more regional appeal, sometimes limited to just a few markets.

The challenge: After both organic growth and acquisitions, three key dilemmas emerged by 2002. First, how to manage brands with significantly different appeal, such as Guinness, a brand with strong Irish roots but huge global appeal, or Buchanan’s, the leading Scotch whisky in Latin America. Second, how to rejuvenate tired brands and third, how to improve the market share of the most successful brands, such as Captain Morgan, J & B, Smirnoff and Johnnie Walker.

The initial strategy: To help managers maintain focus and allocate resources, Diageo developed three brand classifications: global priority, local priority and category.

The global priority brands were the big sellers that were popular across a number of important markets and received the lion’s share of promotional resources and attention; by 2010, this figure was £1.3bn. Each of these brands was marketed consistently across all relevant markets and under the direction of a global brand team.

Local priority brands were those popular in specific geographic areas. They were managed at the regional level, with executives adapting the marketing to suit local needs.

Category brands played specific roles within a sector; they might be aimed at a particular type of consumer or at a particular price point. Promotion and positioning decisions were made by local executives.

What happened next: The three groupings were flexible enough to change: global priority brands become “strategic brands”, changing to reflect the fact that while all key brands were not necessarily global, they were very much international. This group increased from eight to 14, with brands such as Crown Royal, Windsor and Buchanan’s migrating into this new category to reflect their increasing stature.

In addition, Diageo developed ways to deepen its understanding of consumers, including in emerging markets. When sales of whisky brands declined because Scotch’s image failed to appeal to younger people, the brands were rejuvenated by replacing Scottish cues, such as tartan and bagpipes, with contemporary images more in tune with the lifestyle of consumers in the developing countries. Hence, the move to link Johnnie Walker to Formula One racing.

Diageo also strengthened its focus on the consumer, including putting significant resources including in-house specialists into consumer planning globally.

One result of this planning capability was Cîroc, a grape-based vodka launched in 2003 and aimed at affluent drinkers with buying power and a taste for premium brands.

Meanwhile, emerging markets offer new growth opportunities for Diageo, thanks to increases in both adult populations and an awareness of international spirits brands. This provides opportunities to promote brands in all categories.

In addition, consumers are increasingly willing to switch from illicit alcohol to legal, branded versions. Diageo’s strategic response has often been to promote the safety and legal nature of branded alcohol and to develop a better supply network.

The results: Diageo has become the world’s leading premium drinks business by volume, net sales and operating profit. It makes and markets eight of the world’s 20 best-selling spirits brands.

Key lessons: Having inherited or acquired a large number of disparate brands, Diageo solved the marketer’s global vs local dilemma by segmenting its brands in a way that helped the business prioritise its resources effectively at a crucial stage of its evolution.

A subsequent focus on understanding consumer lifestyles, increasingly in emerging markets, has helped the company’s growth, whether in adjusting established brands or acquiring new ones.

The writer is professor of organisational performance at Henley Business School and co-editor of the Journal of Strategy and Management

Promoted Content

Follow the topics in this article.

- UK companies Add to myFT

- Work & Careers Add to myFT

- Mergers & Acquisitions Add to myFT

- Companies Add to myFT

- Food & Beverage Add to myFT

Comments have not been enabled for this article.

International Edition

How Diageo Became One Of The World's Largest Alcohol Producers

Table of contents.

Diageo's story did not begin until 1997 when Guinness merged with food and beverage wholesaler Grand Metropolitan PLC. The $15.8 billion deal went smoothly and the two companies merged under the Diageo name.

The two companies had already brought dozens of brands under one umbrella with the merger, but launching additional brands, especially beverages, has become one of the company's key missions. The Diageo Group includes global brands such as Johnny Walker whiskey, Guinness beer, Ciroc vodka, Captain Morgan rum, and Aviation Gin.

A few key facts about Diageo:

- Diageo employs 28,025 people around the world.

- Diageo generated net sales of GBP 12.733 billion in 2021.

- The company sold more than 4 million units of product .

- The group’s reported profit was uplifted by 6% .

- Diageo is present in 180 countries through its brands.

- The company holds more than 200 different brands.

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

A History Of Two Brands

Diageo's history goes back much further than the company's founding in 1997 when the Guinness brand merged with Grand Metropolitan PLC.

Guinness Brewery

The father of Arthur Guinness, born in 1725, was a brewer. He learned the trade from him and established his brewery in Celbridge. In 1759, he leased an acre and a half of land near St. James's Gate on River Liffey in Dublin for 9,000 years. Pale and ale beers were not very popular in Ireland; whiskey and gin were, on the other hand, much more common, so he decided to make black beer. He created his black beer using secret ingredients, and it was a huge success. By 1769, the beer was exported to Great Britain. In 1775, the town council accused him of using more water than allowed for brewing. But Guinness would do anything to defend his brewery and fought back. After his death, his successors continued to run the business, and the brand has since become a symbol of Ireland.

Throughout its history, the beer has been produced in only three varieties: Porter or Single, Double or Extra, and Foreign Stout, which was destined for export.

In 1868, it was among the first three major breweries, with more than 350,000 barrels. By 1876, it had produced nearly 780,000 barrels. In October 1886, Guinness became a public company with average sales of over one million barrels per year. All this was achieved without advertising or discounts. The company was worth £6 million at the time, and the shares were oversubscribed by twenty times the issue price so that the share price immediately rose by 60% on the first day of trading.

Over the years, numerous quality control procedures were introduced, including those pioneered by William Sealy Gosset - under the pseudonym Student - in 1899, which later became known as the Student t-distribution and Student t-test. At the same time, the company was generous to its employees, distributing one-fifth of its total income to its 5,000 employees in 1907.

By 1914, the company had sold over 2.5 million barrels of beer, representing 10% of the British market at the time. In 1930, it was one of the seven largest companies in the world. In the early 1960s, the company switched from wooden to aluminum kegs. Sales declined in the 1970s, so the original recipe was changed to use pale malt and the process was refined with isomerized hop extracts. In 1986, the company was renamed Distillers Company, which also made it a controlling body in the United Kingdom.

In 1997, Guinness merged with Grand Metropolitan and continued production under the Diageo name, although it remained a separate entity and retained all rights and trademarks for its products.

In 2005, the London brewery closed and all production and distribution were moved to Dublin. Today it is distributed in over 120 countries.

Grand Metropolitan PLC

MRMA Ltd (short for Mount Royal Metropolitan Association) was founded in 1934 as a hotel business. Maxwell Joseph founded Grand Hotels (Mayfair) Ltd. after World War II and MRMA merged with the company in 1957, the merged company group grew rapidly. A public offering of the company was completed in 1961.

From the accommodation market, it was a natural step forward to open toward catering. By 1967, it acquired Bateman Catering and by 1968, Midland Catering. The company then purchased Express Dairies in 1969, Berni Inns, and Mecca bingo halls in the next year.

Following this, it entered the brewing business by purchasing Truman, Hanbury & Buxton in 1972 and Watney Mann in 1973. Through these new acquisitions, the group held onto quite a few alcoholic beverage brands, including J&B whisky, Baileys Irish Cream, Gilbey's gin, Piat wine, and Croft sherry, and Smirnoff vodka. To reflect the change in direction and the rapid expansion of the company, it was renamed Grand Metropolitan in 1973.

MRMA Ltd (short for Mount Royal Metropolitan Association) was founded in 1934 as a hotel company. Maxwell Joseph established Grand Hotels (Mayfair) Ltd after World War II and MRMA merged with it in 1957, the merged group of companies grew rapidly. Grand Metropolitan Hotel Limited was listed on London Stock Exchange in 1961 and changed its name to Grand Metropolitan Hotel Ltd. in 1962.

From the accommodation market, it was a natural step to turn to the hospitality industry. By 1967, the company acquired Bateman Catering and in 1968 Midland Catering. The company bought Express Dairies, Berni Inns in 1969, and Mecca's bingo halls the following year.

It then entered the brewing business, acquiring Truman, Hanbury & Buxton in 1972 and Watney Mann in 1973. Through these new acquisitions, the group held on to a number of alcoholic beverage brands, including J&B Whisky, Baileys Irish Cream, Gilbey's Gin, Piat Wine, and Croft Sherry, and Smirnoff Vodka. To reflect the company's change in direction and rapid expansion, it was renamed Grand Metropolitan in 1973.

The 80s was heavy in M&A and company selling activities for Grand Met:

- In 1980, it acquired US tobacco and drinks company Liggett Group, which was later sold to Bennett S. Lebow.

- Warner Holidays and Intercontinental Hotels Corporation were bought by the company in 1981.

- As a result of the 1987 acquisition of Heublein wines and spirits from RJR Nabisco, Grand Met became one of the largest producers of wine and spirits in the world and became the owner of the Smirnoff brand.

- Also in 1987 the company withdrew from catering when it disposed of its catering division by way of a management buyout, creating Compass Group. In late 1988 more than 700 pubs, owned by Grand Met at the time, were sold to different professional investors and operator companies. As the next step in updating the company’s portfolio of products and services, Intercontinental Hotels were sold to Saison Group.

- By selling these assets, it was able to expand into the betting market by purchasing one of the most well-known brands, William Hill.

- Through the buyout of the Pillsbury Company and its Burger King chain in 1988, Grand Metropolitan entered the fast food industry, later acquiring the Wimpy chain.

- In 1990 the company sold the brewers Samuel Webster's and Ushers of Trowbridge in 1991.

In the following years, the company slowly closed down its pub operating division, selling more than 20,000 pubs it owned and operated through its previously acquired businesses.

The largest merger at the time

Even though the companies, Guinness and Grand Metropolitan were rivals for years, it was the friendship of their leaders that made the idea for the merger possible. $15.8 billion was a record amount at the time, making the company the seventh-largest drinks and food holding organization globally.

In addition to Burger King and Pillsbury Co., Grand Met also brought Smirnoff vodka and J&B whiskey in the combined company, while Guinness brought its stout, Johnnie Walker whiskey, and Gordon's gin under the umbrella. Haagen-Dazs ice cream and Green Giant vegetables were also part of Grand Metropolitan.

Analysts see synergies between the two companies' products and geographic scope, as well as the potential for other mergers among large food and liquor producers. As investors rejoiced over the news, their stocks rose. In London, Grand Met shares rose by $1.23 to $9.57, while Guinness’s share price increased by $1.39 to $9.75.

With the proposed stock swap, Grand Met shareholders gained control over 52.7% of the new company, while Guinness shareholders had the rest. Shareholders also received cash payments of $3.9billion along with shares in the new company.

Four divisions have been created in the new company:

- United Distillers and Vintners, combining the liquor and wine operations

- Burger King

- Guinness Brewing Worldwide

There were about 2,000 layoffs among the 20,000 jobs at the companies' liquor businesses. Total employment for the two firms in 1997 was 85,000.

Cleaning up the portfolio

In 2002, Diageo sold one of the companies brought in the holding by Grand Metropolitan - Burger King. The consortium of Texas Pacific Group, Bain Capital Partners, and Goldman Sachs Capital Partners signed the acquisition deal, which cost them $1.5 billion. Approximately $86 million was paid in assumed debt, while $212.5 million was settled by subordinated debt - both in cash. Since 2000, Digieo had been trying to sell Burger King to rid itself of a struggling business so it could concentrate on its core beverage business.

A previous agreement between Diageo and the buyout firms included specific performance targets for Burger King. McDonald's largest rival failed to meet these objectives and potential buyers pulled out.

Key takeaways

The two companies that make up Diageo, Guinness and Grand Metropolitan, built more than just a well-known brand. Both were holding companies that effectively developed brands in different and overlapping markets.

Guinness focused exclusively on alcoholic beverages and, in addition to its brewery, repeatedly acquired beverage companies that complemented its existing portfolio.

The Grand Metropolitan took a different approach, initially offering accommodation services before entering the food and beverage business. However, both markets have complimented the hotel's product range very well.

While the merger was possible because of the friendly relationship between the managers, it was a very deliberate move by the two companies. After all, in the food and beverage market, a larger portfolio also means faster and easier sales, making it much easier for the new Diageo company to get onto the shelves of stores, restaurants, and hotels.

The period that followed was one of product streamlining, as the merged network of companies owned hotels and food organizations such as Burger King. To take full advantage of product synergies, the company had to sell the "redundant" parts of its business. The refreshed portfolio performed much better.

Acquisition Strategy

As we showed in the first chapter, the two giant companies that formed the holding company did not come empty-handed, but Diageo has accelerated the pace of acquisitions since the merger.

Since the early 2000s, Diago has been especially active in acquiring established and new businesses on the beverages market. A list of its M&A activity:

- Seagram's spirits and wine businesses were acquired by Diageo in 2001.

- For $100 million, Diageo purchased fifty percent of the Don Julio Tequila brand from Jose Cuervo during 2003.

- A deal worth US$2.1 billion was reached in February 2011 for Diageo to acquire Mey Icki, a Turkish liquor company.

- Diageo acquired Ypióca, Brazil's largest selling premium cachaça brand, for £ 300 million in May 2012.