Perfect Markets in General Essay

Perfect market is a situational market that is rare in real life (Rittenberg & Tregarthen, 2011). Perfect competition in the market occurs in a way that it is difficult for any stakeholder to influence the price of commodities. In this case, automobile, beer and corn markets are examples of perfect market models.

A perfect competition market is, therefore, an imaginary situation that is characterized by large number of buyers and sellers. The buyers and sellers are many, but their individual consumer behavior has no impact on the market (Rittenberg & Tregarthen, 2011).

Similarly, the demand of one buyer is so insignificant compared to the total demand in the market and, therefore, no individual behavior can influence the prices. There are few competitive perfect markets in existence where the conditions of the perfect market are strict. (Salemi, & Hansen, 2005, p.29)

In this case, the automobile, beer and corn industries have influenced the buyer selection in their products so that products can be bought at different prices. A good example of perfect competitive market is where many farmers are producing corn.

Moreover, in the automobile industry, many dealers sell similar models of cars that one can barely differentiate. “The firms in these markets are price takers and are characterized by perfect knowledge, freedom of entry and exit of the market” (Salemi, & Hansen, 2005, p.29). There is also non-governmental interference in their activities, lack of excess supply and demand, and less transport costs.

In the beer and automobile industries, the seller has perfect knowledge about the market. Therefore, no one would conduct business at their preferred price other than the equilibrium price. For example, today a person could be assembling cars and then he or she can decide to clear the stock and start something else.

In these market models, all buyers are identical in the eyes of sellers. There are also no advantages of selling products to particular buyers (Salemi, & Hansen, 2005). The beer and the automobile companies have no personal recognition or preference of their buyers.

The prices in these markets are determined strictly by the interplay demand and supply. There is no government intervention in the form of taxes or subsidies, quotas, price controls among other regulations (Salemi, & Hansen, 2005). This factor makes the automobile and beer industries sell all what they supply in the market.

The buyers are able to buy all what they require because there is no deficit in supply. The other conditions that place these products under perfect mobility are factors of production. All factors of production including land, capital, labor, and entrepreneurship can be easily switched from one use to another. In beer, automobile, and corn market, factors of production are assumed to be perfectly mobile.

Further, it is assumed that buyers and sellers are located in one area. As such, they do not incur any costs in transporting their goods. The sellers in these markets cannot, therefore, charge higher prices to cover the cost of transport.

In the perfect markets, the buyers have perfect knowledge of the prices offered by different firms on certain products. The products sold have homogeneity. Perfect competition is advantageous to the society because the price equals the marginal cost of production in each firm. The price offered is reasonable and no single firm monopolizes the market.

Rittenberg, L., & Tregarthen, T. (2011). Principles of economics . Irvington, NY: Flat World Knowledge.

Salemi, M. K., & Hansen, W. L. (2005). Discussing economics: A classroom guide to preparing discussion questions and leading discussion . Cheltenham: Edward Elgar.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, August 6). Perfect Markets in General. https://ivypanda.com/essays/perfect-markets/

"Perfect Markets in General." IvyPanda , 6 Aug. 2019, ivypanda.com/essays/perfect-markets/.

IvyPanda . (2019) 'Perfect Markets in General'. 6 August.

IvyPanda . 2019. "Perfect Markets in General." August 6, 2019. https://ivypanda.com/essays/perfect-markets/.

1. IvyPanda . "Perfect Markets in General." August 6, 2019. https://ivypanda.com/essays/perfect-markets/.

Bibliography

IvyPanda . "Perfect Markets in General." August 6, 2019. https://ivypanda.com/essays/perfect-markets/.

- The Global Standardization Strategy

- On Owning a Business Producing Price-Elastic Goods

- Price Takers vs. Price Makers

- Guidelines Regarding Negotiating with Hostage Takers

- New Product: Laptop Assembling Machinery Nokia Corporation

- Globalisation and Cultural Homogeneity

- The Canadian English Language: Autonomy and Homogeneity

- Assembling the Dubai Government Excellence Program

- Supply and Demand Elasticity and Global Price of Corn

- The Omnivore’s Dilemma: Corn Production

- The Wine Market in the United States

- United Arab Emirates: Achieving High Development

- Dubai Aluminum: Opening a Branch in Saudi Arabia

- Food and Well Being

- Rice Production in China

Perfect competition

Perfect competition is a market structure where many firms offer a homogeneous product. Because there is freedom of entry and exit and perfect information, firms will make normal profits and prices will be kept low by competitive pressures.

Features of perfect competition

- Many firms.

- Freedom of entry and exit; this will require low sunk costs.

- All firms produce an identical or homogeneous product.

- All firms are price takers, therefore the firm’s demand curve is perfectly elastic.

- There is perfect information and knowledge.

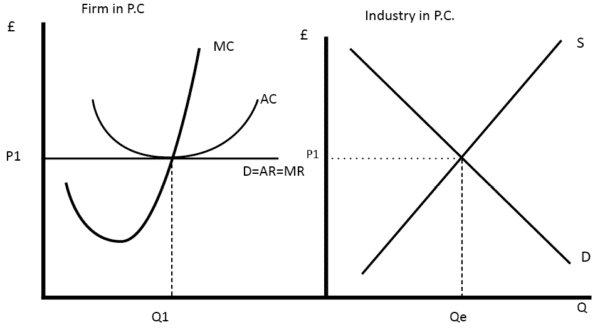

Diagram for perfect competition

- The industry price is determined by the interaction of Supply and Demand, leading to a price of Pe.

- The individual firm will maximise output where MR = MC at Q1

- In the long run firms will make normal profits.

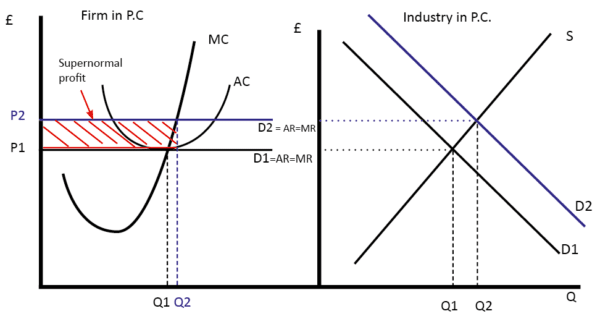

What happens if supernormal profits are made?

If supernormal profits are made new firms will be attracted into the industry causing prices to fall. If firms are making a loss then firms will leave the industry causing price to rise

The features of perfect competition are very rare in the real world. However perfect competition is as important economic model to compare other models. It is often argued that competitive markets have many benefits which stem from this theoretical model.

Changes in long run equilibrium

1. The effect of an increase in demand for the industry.

If there is an increase in demand there will be an increase in price Therefore the demand curve and hence AR will shift upwards. This will cause firms to make supernormal profits.

This will attract new firms into the market causing price to fall back to the equilibrium of Pe

2. An increase in firms costs

- The AC curve will increase therefore AR< AC

- Firms will now start making a loss and therefore firms will go out of business. This will cause supply to fall causing prices to increase.

Efficiency of perfect competition

- Firms will be allocatively efficient P=MC

- Firms will be productively efficient . Lowest point on AC curve.

- Firms have to remain efficient otherwise they will go out of business. ( X-efficiency )

- Firms are unlikely to be dynamically efficient because they have no profits to invest in research and development.

- If there are high fixed costs , firms will not benefit from efficiencies of scale.

- see more: efficiency of perfect competition

Examples of perfect competition

In the real world, it is hard to find examples of industries which fit all the criteria of ‘perfect knowledge’ and ‘perfect information’. However, some industries are close.

- Foreign exchange markets . Here currency is all homogeneous. Also, traders will have access to many different buyers and sellers. There will be good information about relative prices. When buying currency it is easy to compare prices

- Agricultural markets . In some cases, there are several farmers selling identical products to the market, and many buyers. At the market, it is easy to compare prices. Therefore, agricultural markets often get close to perfect competition.

- Internet related industries . The internet has made many markets closer to perfect competition because the internet has made it very easy to compare prices, quickly and efficiently (perfect information). Also, the internet has made barriers to entry lower. For example, selling a popular good on the internet through a service like e-bay is close to perfect competition. It is easy to compare the prices of books and buy from the cheapest. The internet has enabled the price of many books to fall in price so that firms selling books on the internet are only making normal profits.

Related pages

- eBay and perfect competition

- Different types of market structure

1 thought on “Perfect competition”

- Pingback: The problem of rejected / misshaped vegetables | Economics Help

Comments are closed.

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

Microeconomics

Course: microeconomics > unit 7.

- Introduction to perfect competition

Perfect competition and why it matters

- Economic profit for firms in perfectly competitive markets

- How perfectly competitive firms make output decisions

- Efficiency in perfectly competitive markets

- Perfect competition foundational concepts

- Long-run economic profit for perfectly competitive firms

- Long-run supply curve in constant cost perfectly competitive markets

- Long run supply when industry costs aren't constant

- Free response question (FRQ) on perfect competition

- Perfect competition in the short run and long run

- Increasing, decreasing, and constant cost industries

- Efficiency and perfect competition

- A perfectly competitive firm is a price taker , which means that it must accept the equilibrium price at which it sells goods. If a perfectly competitive firm attempts to charge even a tiny amount more than the market price, it will be unable to make any sales.

- Perfect competition occurs when there are many sellers, there is easy entry and exiting of firms, products are identical from one seller to another, and sellers are price takers.

- The market structure is the conditions in an industry, such as number of sellers, how easy or difficult it is for a new firm to enter, and the type of products that are sold.

- Many firms produce identical products.

- Many buyers are available to buy the product, and many sellers are available to sell the product.

- Sellers and buyers have all relevant information to make rational decisions about the product being bought and sold.

- Firms can enter and leave the market without any restrictions—in other words, there is free entry and exit into and out of the market.

Self-check questions

Review questions.

- A single firm in a perfectly competitive market is relatively small compared to the rest of the market. What does this mean? How small is small?

- What are the four basic assumptions of perfect competition? Explain what they imply for a perfectly competitive firm.

- What is a price taker firm?

Critical-thinking questions

- Finding a life partner is a complicated process that may take many years. It is hard to think of this process as being part of a very complex market with a demand and a supply for partners. Think about how this market works and some of its characteristics, such as search costs. Would you consider it a perfectly competitive market?

- Can you name five examples of perfectly competitive markets? Why or why not?

Attribution

Want to join the conversation.

- Upvote Button navigates to signup page

- Downvote Button navigates to signup page

- Flag Button navigates to signup page

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

10.9: Introduction to Perfect Competition

- Last updated

- Save as PDF

- Page ID 48412

What you’ll learn to do: describe the characteristics of perfect competition and calculate costs, including fixed, variable, average, marginal, and total costs

Imagine the 7-year old you had a lemonade stand. It was one of several on the street. Your neighbor, Julie, also had a lemonade stand and she typically sold her lemonade for 25 cents. You figured that in order to make more money, you would charge 50 cents and steal all her customers. Sadly, everyone bought from Julie and you had no customers at all.

Welcome to the world of perfect competition. You will see in this section that because your lemonade stands were essentially identical, in order to remain in business and make any profit, you needed to be a price-taker instead of a price-maker.

Contributors and Attributions

- Introduction to Perfect Competition. Authored by : Steven Greenlaw and Lumen Learning. License : CC BY: Attribution

- lemonade stand. Authored by : ErikaWittlieb. Provided by : Pixabay. Located at : https://pixabay.com/en/lemonade-stand-lemonade-summer-2483297/ . License : CC0: No Rights Reserved

Perfect competition

Key characteristics.

- There is perfect knowledge, with no information failure or time lags in the flow of information. Knowledge is freely available to all participants, which means that risk-taking is minimal and the role of the entrepreneur is limited.

- Given that producers and consumers have perfect knowledge, it is assumed that they make rational decisions to maximise their self interest - consumers look to maximise their utility, and producers look to maximise their profits.

- There are no barriers to entry into or exit out of the market.

- Firms produce homogeneous, identical, units of output that are not branded.

- Each unit of input, such as units of labour, are also homogeneous.

- No single firm can influence the market price, or market conditions. The single firm is said to be a price taker , taking its price from the whole industry. The single firm will not increase its price independently given that it will not sell any goods at all. Neither will the rational producer lower price below the market price given that it can sell all it produces at the market price.

- There are very many firms in the market - too many to measure. This is a result of having no barreirs to entry.

- There is no need for government regulation, except to make markets more competitive.

- There are assumed to be no externalities , that is no external costs or benefits to third parties not invlolved in the transaction.

- Firms can only make normal profits in the long run, although they can make abnormal (super-normal) profits in the short run.

The firm as price taker

Equilibrium in perfect competition, in the short run, in the long run, the benefits.

- Because there is perfect knowledge, there is no information failure and knowledge is shared evenly between all participants.

- There are no barriers to entry, so existing firms cannot derive any monopoly power .

- Only normal profits made, so producers just cover their opportunity cost.

- There is no need to spend money on advertising, because there is perfect knowledge and firms can sell all they can produce. In addition, selling unbranded goods makes it hard to construct an effective advertising campaign.

- There is maximum possible: Consumer surplus Economic welfare

- There is maximum allocative and productive efficiency: Equilibrium will occur where P = MC, hence allocative efficiency. In the long run equilibrium will occur at output where MC = ATC, which is productive efficiency.

- There is also maximum choice for consumers.

How realistic is the model?

Test your knowledge with a quiz, press next to launch the quiz, you are allowed two attempts - feedback is provided after each question is attempted..

Monopolistic competition

Market structures

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

8.2: Perfect Competition and Why It Matters

- Last updated

- Save as PDF

- Page ID 181355

Learning Objectives

- Explain the characteristics of a perfectly competitive market

- Discuss how perfectly competitive firms react in the short run and in the long run

Firms are in perfect competition when the following conditions occur: (1) many firms produce identical products; (2) many buyers are available to buy the product, and many sellers are available to sell the product; (3) sellers and buyers have all relevant information to make rational decisions about the product that they are buying and selling; and (4) firms can enter and leave the market without any restrictions—in other words, there is free entry and exit into and out of the market.

A perfectly competitive firm is known as a price taker , because the pressure of competing firms forces it to accept the prevailing equilibrium price in the market. If a firm in a perfectly competitive market raises the price of its product by so much as a penny, it will lose all of its sales to competitors. When a wheat grower, as we discussed in the Bring It Home feature, wants to know the going price of wheat, they have to check on the computer or listen to the radio. Supply and demand in the entire market solely determine the market price, not the individual farmer. A perfectly competitive firm must be a very small player in the overall market, so that it can increase or decrease output without noticeably affecting the overall quantity supplied and price in the market.

A perfectly competitive market is a hypothetical extreme; however, producers in a number of industries do face many competitor firms selling highly similar goods, in which case they must often act as price takers. Economists often use agricultural markets as an example. The same crops that different farmers grow are largely interchangeable. According to the United States Department of Agriculture monthly reports, in December 2021, U.S. corn farmers received an average of $5.47 per bushel. A corn farmer who attempted to sell at $6.00 per bushel would not have found any buyers. A perfectly competitive firm will not sell below the equilibrium price either. Why should they when they can sell all they want at the higher price? Other examples of agricultural markets that operate in close to perfectly competitive markets are small roadside produce markets and small organic farmers.

Visit this website that reveals the current value of various commodities.

This chapter examines how profit-seeking firms decide how much to produce in perfectly competitive markets. Such firms will analyze their costs as we discussed in the chapter on Production, Costs and Industry Structure. In the short run, the perfectly competitive firm will seek the quantity of output where profits are highest or, if profits are not possible, where losses are lowest.

In the long run, positive economic profits will attract competition as other firms enter the market. Economic losses will cause firms to exit the market. Ultimately, perfectly competitive markets will attain long-run equilibrium when no new firms want to enter the market and existing firms do not want to leave the market, as economic profits have been driven down to zero.

- WordPress.org

- Documentation

- Learn WordPress

- View AMP version

Check the PageSpeed score

PageSpeed score is an essential attribute to your website’s performance. It affects both the user experience and SEO rankings.

You can hide this element from the settings

Checking...

We are checking the PageSpeed score of your Characteristics Of Perfect And Imperfect Markets page.

Characteristics Of Perfect And Imperfect Markets

Market is a place where the buyers and sellers make transactions regarding goods and services. Depending on time, competition and extent of area, markets are classified into several types. On the basis of competition markets are classified into perfect markets and imperfect markets.

Perfectly competitive Markets:

Perfectly competitive market is one which consists of large number of buyers and sellers, uniform price and homogeneous commodities. No single buyer or seller is able to exercise control over the price of a commodity. The price of a commodity is same throughout the market. The following are the characteristics of perfect markets or perfectly competitive markets.

Characteristics of perfect markets:

1) There exists a large number of buyers and sellers. Each buyer buys a main portion of the whole stock of commodities. Similarity each seller sells a negligible portion of the whole stock of commodities. They have no influence over the determination of the price.

2) There prevails homogeneous commodities. The quantity and quality of commodities available in the market are the same. No differences are observed in the size, quality, taste of the Commodities.

3) Both the buyers and sellers will know the prices prevalent in the market. Neither of them can increase or decrease the price of a commodity. So the price line of a perfectly competitive market runs parallel to OX axis.

4) There exists no obstacles for the firms to enter or leave the industry. New firms enter the industry when there are huge profits. Old firms leave the industry when there are huge losses.

5) There exists no transport costs. As a result the price of the commodity is same at any place in the market.

6) Factors of production are freely mobile. They move from one industry to the other until they get higher remunerative prices for their services.

Distinction between pure competition and perfect competition:

‘Pure’ competition is a word introduced by Prof. Chamberlain. Pure competition is said to prevail when there exists large number of buyers and sellers, homogeneous commodities and freedom of admission into and exit of firms from an industry. In addition to these features perfect competition includes perfect knowledge of prices, free mobility of factors of production, absence of transport costs and uniform price as its features.

Both pure and perfect competitions are the two ideal concepts which can’t be found in real world. What we observe in reality is the prevalence of imperfect competition.

Imperfect Competition:

Imperfect competition consists of the features which are opposite to perfect competition. It has some special features.

Characteristics of imperfect markets:

1) There exists a small number of sellers in ‘this market. This enables the sellers to charge the prices as they like.

2) The number of buyers is also small. But its does not mean that buyers are few. The buyers in this market system are divided into several groups. Each group buys goods and services from different sellers.

3) The commodities bought and sold in this market are heterogeneous. They differ in their size, quality, appearance, tastes and durability.

4) The sellers adopt product differentiation and price discrimination. They collect different prices for the same commodity from different buyers.

5) There exists transport costs and selling costs in this market.

6) The consumers may not know the prevailing prices of the commodities in the market.

7) The factors of production are not freely mobile.

8) There prevails different prices for the same commodity in the same region.

Thus, imperfect competition consists of the features which are quite opposite to the perfect competition.

Knowledgiate Team

Understanding the cobb-douglas production function: a key concept in economics, new de dollarisation: understanding its impact on economies, de-dollarisation: understanding the shift away from the u.s. dollar, maximum social welfare and perfect competition (analysis with indifference curves), relationship between efficiency pareto efficiency and perfect competition, welfare economics: underlying concepts and thoughts, market failure and externalities in environmental economics, trophic levels and ecological pyramids, dynamics of ecosystems : productivity and energy flow, master piece: types and characteristics of biotic community, subscribe to our mailing list to get the new articles, factors affecting the size of a market, law of supply: determinants, assumptions, exceptions and limitations, related articles.

Organization, Structure and Dynamics of the Ecosystem

Ecology and Ecosystem : Clearly Explained

10 Steps in Demand Forecasting Process

Essentials of a Good Forecasting System

akun pro kamboja

slot thailand

mahjong ways

https://hoerakinderschoenen.nl/

https://bergeijk-centraal.nl/wp-includes/slot-deposit-gopay/

slot mahjong ways

https://www.job-source.fr/wp-content/slot-singapore/

https://tentangkitacokelat.com/wp-includes/slot-deposit-gopay/

slot server thailand

akun pro myanmar

slot garansi kekalahan

slot deposit dana

https://slot-myanmar.deparmotor.com/

https://slotserverluarnegeri.deparmotor.com/

https://slot777.devtmp.focim.edu.mx/

https://bet-200.devtmp.focim.edu.mx/

https://slot-thailand.devtmp.focim.edu.mx/

Slot Server Thailand

https://buggybrolly.com/wp-includes/idn-poker/

https://www.donchuystacoshoputah.com/

https://orderzenseafoodsushigrill.com/

https://www.saltedsalad.com/

https://tastebakerycafe.com/

https://www.order369ramenpokechinesefood.com/

https://www.suiviesante.fr/wp-content/slot-malaysia/

https://www.smokepitgrill.com/

https://www.ilovesushiindy.com/

https://yakikojapanesegrill.com/

https://www.themixxgrill.com/

https://chilangosbargrill.com/

https://tentangkitacokelat.com/wp-content/slot-pulsa/

https://winkelstueck-reparatur.de/wp-includes/slot-pulsa/

https://slot-pulsa.devtmp.focim.edu.mx/

https://kayanscarf.com/

https://www.garage-aymard.fr/wp-includes/slot-qris/

https://nexttech-tt.com/

https://dotnetinstitute.co.in/wp-includes/slot-deposit-gopay/

https://www.yg-moto.com/wp-includes/sbobet/

https://bergeijk-centraal.nl/wp-content/slot777/

https://www.anticaukuleleria.com/slot-myanmar/

https://bergeijk-centraal.nl/wp-includes/slot-bonus-new-member/

https://houseofgabriel.com/wp-includes/slot-bonus/

jurassic kingdom

https://houseofgabriel.com/wp-includes/pomo/slot-petir-merah/

https://houseofgabriel.com/wp-includes/pomo/slot-garansi-kekalahan-100/

https://lajme.org/wp-content/sbobet/

https://houseofgabriel.com/wp-includes/pomo/slot777/

https://houseofgabriel.com/wp-includes/pomo/mahjong-ways/

https://houseofgabriel.com/wp-includes/pomo/bca-slot/

https://houseofgabriel.com/

https://www.job-source.fr/wp-content/sugar-rush/

https://repairkaro.com/pragmatic-play/

pragmatic play

https://idn-poker.zapatapremium.com.br/

https://sbobet.albedonekretnine.hr/

https://mahjong-ways.zapatapremium.com.br/

https://slot777.zapatapremium.com.br/

https://baksobakarmantap.com/slot777/

https://www.entrealgodones.es/wp-includes/slot-pulsa/

https://slot88.zapatapremium.com.br/

https://slot-pulsa.zapatapremium.com.br/

https://hollyorchards.com/wp-content/pyramid-bonanza/

https://slot777.jikuangola.org/

https://slot777.nwbc.com.au/

http://wp.aicallcenter.ai/wp-includes/widgets/slot-deposit-pulsa/

https://choviettrantran.com/wp-includes/slot-deposit-pulsa/

https://kreativszepsegszalon.hu/wp-includes/slot-deposit-pulsa/

https://www.muaythaionline.org/wp-includes/slot-deposit-pulsa/

https://pgdownloads.enterprisedb.com/slot-deposit-pulsa/

https://ebook.franchise.7-eleven.com/slot-pulsa/

https://llohan.hollywood.com/slot-pulsa/

https://transition.site5.com/slot-pulsa/

https://fan.iitb.ac.in/slot-pulsa/

slot server myanmar

https://podcast.peugeot.fr/slot-pulsa/

https://mahjong-ways.softcia.com.br/

https://le-fief-fleuri.fr/core/wp-includes/sbobet/

https://le-fief-fleuri.fr/core/wp-includes/idn-poker/

slot myanmar

slot kamboja

slot bonus new member

bonus new member

https://ratlscontracting.com/wp-includes/sweet-bonanza/

https://quickdaan.com/wp-includes/slot-thailand/

https://summervoyages.com/wp-includes/slot-thailand/

https://aws-klinkier.pl/wp-content/idn-poker/

https://thewolfiscoming.com/wp-includes/slot-bonus/

https://www.handwerksform.de/wp-includes/slot777/

https://www.nikeartfoundation.com/wp-includes/slot-deposit-pulsa/

https://lepremier.miami/wp-content/slot-bonus/

https://www.anticaukuleleria.com/wp-content/cmd368/

https://candyhush.com/wp-content/slot-bonus/

https://showersealed.com.au/wp-content/sabasport/

https://tdapelsin.ru/wp-includes/slot-bonus/

https://kreativszepsegszalon.hu/wp-content/slot-bonus/

https://jakartaaids.org/wp-content/sbobet88/

https://ratlscontracting.com/wp-includes/ubobet/

situs slot nexus

slot bet kecil

slot gacor deposit 10 ribu

slot joker123

slot bet 100

slot deposit 10 ribu

big bass crash slot

spaceman slot

wishdom of athena

slot bonanza

slot spaceman

Rujak Bonanza

Candy Village

Gates of Gatotkaca

Adblock Detected

- Search Search Please fill out this field.

Monopolistic Markets

Perfect competition, special considerations.

- Government & Policy

Monopolistic Market vs. Perfect Competition: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-d90f2cc61d274246a2be03cdd144f699.jpeg)

Monopolistic Market vs. Perfect Competition: An Overview

A monopolistic market and a perfectly competitive market are two market structures that have several key distinctions in terms of market share , price control, and barriers to entry . In a monopolistic market, there is only one firm that dictates the price and supply levels of goods and services, and that firm has total market control. In contrast to a monopolistic market, a perfectly competitive market is composed of many firms, where no one firm has market control.

Monopolistic and perfectly competitive markets affect supply, demand, and prices in different ways. In the real world, no market is purely monopolistic or perfectly competitive. Every real-world market combines elements of both of these market types.

Key Takeaways:

- In a monopolistic market, there is only one firm that dictates the price and supply levels of goods and services.

- A perfectly competitive market is composed of many firms, where no one firm has market control.

- In the real world, no market is purely monopolistic or perfectly competitive.

- In between a monopolistic market and perfect competition lies monopolistic competition or imperfect competition.

- In monopolistic competition, there are many producers and consumers in the marketplace, and all firms only have a degree of market control.

In a monopolistic market , firms are price makers because they control the prices of goods and services. In this type of market, prices are generally high for goods and services because firms have total control of the market. Firms have total market share, which creates difficult entry and exit points. Since barriers to entry in a monopolistic market are high, firms that manage to enter the market are still often dominated by one bigger firm.

A monopolistic market generally involves a single seller, and buyers do not have a choice concerning where to purchase their goods or services.

Purely monopolistic markets are extremely rare and perhaps even impossible in the absence of absolute barriers to entry, such as a ban on competition or sole possession of all natural resources. Sometimes, however, a government will establish a monopolistic market to ensure national interests or maintain critical infrastructure. For instance, many utilities such as power companies or water authorities may be granted a monopoly status for a certain area.

In the absence of such permission, governments often have laws and enforcement mechanisms to promote competition by preventing or breaking up monopolies. This is because a monopolistic market can often become inefficient, charge customers higher prices than would otherwise be available, and can prevent newcomers from entering the market. Thus, there are various antitrust regulations that keep monopolies at bay.

A monopoly is when there is only one seller in the market. A monopsony , on the other hand, is when there is only one buyer in a market.

In a market that experiences perfect competition , prices are dictated by supply and demand. Firms in a perfectly competitive market are all price takers because no one firm has enough market control. Unlike a monopolistic market, firms in a perfectly competitive market have a small market share. Barriers to entry are relatively low, and firms can enter and exit the market easily. Contrary to a monopolistic market, a perfectly competitive market has many buyers and sellers, and consumers can choose where they buy their goods and services.

Companies earn just enough profit to stay in business and no more. If they were to earn excess profits, other companies would enter the market and drive profits down. As mentioned earlier, perfect competition is a theoretical construct. As such, it is difficult to find real-life examples of perfect competition.

Pricing in perfect competition is based on supply and demand while pricing in monopolistic competition is set by the seller.

According to economic theory, when there is perfect competition, the prices of goods will approach their marginal cost of production (i.e., the cost to produce one more unit). This is because any firm that tries to sell at a higher price in an attempt to earn excess profits will be undercut by a competitor seeking to grab market share. This also promotes a sort of technological arms race in order to reduce the costs of production so that competitors can undercut one another and still earn a profit. Over time, however, as technology diffuses through to all producers, the effect is to lower consumer prices even further (as well as erode profits for producers).

In between a monopolistic market and perfect competition lies monopolistic competition . In monopolistic competition, there are many producers and consumers in the marketplace, and all firms only have a degree of market control. In contrast, whereas a monopolist in a monopolistic market has total control of the market, monopolistic competition offers very few barriers to entry. All firms are able to enter into a market if they feel the profits are attractive enough. This makes monopolistic competition similar to perfect competition.

However, in a monopolist competitive market, there is product differentiation . Products in monopolistic competition are close substitutes; the products have distinct features, such as branding or quality. This is unlike both a monopolistic market, where there are no substitutes for products, and perfect competition, where the products are identical.

In reality, all markets will display some form of imperfect competition. That is because there will always be some barriers to entry, some information asymmetries , larger and smaller competitors, and small differences in product differentiation.

What Are the Differences Between Monopolistic Markets and Perfect Competition?

In a monopolistic market, there is only one seller or producer of a good. Because there is no competition, this seller can charge any price they want (subject to buyers' demand) and establish barriers to entry to keep new companies out. On the other hand, perfectly competitive markets have several firms each competing with one another to sell their goods to buyers. In this case, prices are kept low through competition, and barriers to entry are low.

What Is the Difference Between a Monopoly and a Monopolistic Market?

A monopoly refers to a single producer or seller of a good or service. A monopolistic market is the scope of that monopoly. For instance, XYZ Co. may be a monopoly producer of widgets. It can control a monopolistic market over all the widgets sold in the United States whereby nobody else sells widgets.

What Are the Main Characteristics of Perfect Competition?

In a perfectly competitive market: all firms sell an identical product; all firms are price-takers ; all firms have a relatively small market share; buyers know the nature of the product being sold and the prices charged by each firm; the industry is characterized by freedom of entry and exit. In reality, some or all of these features are not present or are influenced in some way, leading to imperfect competition .

Federal Trade Commission. " The Antitrust Laws ."

- Antitrust Laws: What They Are, How They Work, Major Examples 1 of 24

- Understanding Antitrust Laws 2 of 24

- Federal Trade Commission (FTC): What It Is and What It Does 3 of 24

- Clayton Antitrust Act of 1914: History, Amendments, Significance 4 of 24

- Sherman Antitrust Act: Definition, History, and What It Does 5 of 24

- Robinson-Patman Act Definition and Criticisms 6 of 24

- How and Why Companies Become Monopolies 7 of 24

- Discriminating Monopoly: Definition, How It Works, and Example 8 of 24

- What Is Price Discrimination, and How Does It Work? 9 of 24

- Predatory Pricing: Definition, Example, and Why It's Used 10 of 24

- Bid Rigging: Examples and FAQs About the Illegal Practice 11 of 24

- Price Maker: Overview, Examples, Laws Governing and FAQ 12 of 24

- What Is a Cartel? Definition, Examples, and Legality 13 of 24

- Monopolistic Markets: Characteristics, History, and Effects 14 of 24

- Monopolistic Competition: Definition, How it Works, Pros and Cons 15 of 24

- What Are the Characteristics of a Monopolistic Market? 16 of 24

- Monopolistic Market vs. Perfect Competition: What's the Difference? 17 of 24

- What are Some Examples of Monopolistic Markets? 18 of 24

- A History of U.S. Monopolies 19 of 24

- What Are the Most Famous Monopolies? 20 of 24

- Monopoly vs. Oligopoly: What's the Difference? 21 of 24

- Oligopoly: Meaning and Characteristics in a Market 22 of 24

- Duopoly: Definition in Economics, Types, and Examples 23 of 24

- Oligopolies: Some Current Examples 24 of 24

:max_bytes(150000):strip_icc():format(webp)/Term-Definitions_monopoly-fa34a19571eb4168876f3a6947aa1a6f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Essay on Markets: Top 4 Essays | Economics

In this essay we will discuss about:- 1. Meaning of Markets 2. Features of the Markets 3. Elements 4. Performance.

Essay on Markets

Essay # 1. meaning of markets :.

The term market structure refers to the type constituents and nature of an industry. It includes the relative and absolute size of firms, active in industry, easiness in the entry into business, the demand curve of the firm products etc.

There are two extremities of the market structure on this basis, on one end there is a market of perfect competition and on the other perfect monopoly market. In between these two extremities there are monopolistic competition, oligopoly, duopoly etc.

ADVERTISEMENTS:

In common usage the word market designates a place where certain things are bought and sold. But when we talk about the word market in economics, we extend our concept of market well beyond the idea of single place to which the householder goes to buy something. For our present purpose, we define a market as an area over which buyers and sellers negotiate the exchange of a well- defined commodity. For a single market to exist, it must be possible for buyers and sellers to communicate with each other and to make meaningful deals over the whole market.

Several economists have attempted to define the term market as used in economics.

Some of them are as under:

According to Curnot, “Economists understand by the term market not any particular market-place in which things are bought and sold, but the whole of any region in which buyers and sellers are in such free intercourse with one another that the price of the same goods tends to equality easily and quickly.”

In the eyes of Prof. Chapman, “The term market refers not necessarily to a place but always to a commodity and the buyers and sellers who are to direct competition with one another”.

In simple words, the term market refers to a structure in which the buyers and sellers of the commodity remain in close contact.

Essay # 2. Features of the Markets:

On the basis above-mentioned definitions we can mention following main features of the market:

(i) Commodity:

For the existence of market, a commodity- essential this is to be bought and sold. There cannot be a market without commodity.

(ii) Buyers and Sellers:

Buyers and sellers are also essential for market. Without buyers and sellers the sale-purchase activity cannot be conducted which is essential part of a market.

(iii) Area:

There should be an area in which buyers and sellers of the commodity live in. It is not essential that the buyers and sellers should come to a particular place to transact the business.

(iv) Close Contact:

There should be close contact and communication between, buyers and sellers. This communication may be established by any method. For example, in olden days this contact and communication was possible only when the buyers and sellers of a particular commodity could come at a particular place.

But now with the developed means of communication physical presence of buyers and sellers at one particular place is not essential. They can contact with, each other through letters, telegrams, telephones, etc. In the boundary of a market we include only those buyers and sellers who can maintain regular close contacts.

For instance, India’s farmers (or sellers of grains) have no close contacts with the consumers (or buyers) of England, hence though they are the buyers and sellers of grains yet do not come under the purview of a market.

(v) Competition:

There should be some competition among buyers and sellers of the commodity in a market.

Essay # 3. Elements of Market Conduct:

(a) seller and buyer concentration:.

Here, seller concentration means in certain industry the number of active firms is very limited and these few firms produce a large part of the total supply. In other words, there firms possess the market power in a sense that any one of these firms can affect the market price by making change in the quantity of its product.

In full competition, each firm produces a very small part of the total production. Hence, it cannot affect the market price. In this type of market, the seller concentration is zero. So, as we move from the perfect competitive market towards pure monopolist market, the quantity of seller concentration increases.

(b) Market Power:

Every competitive firm attempts to get market power by making difference in the product. From economic point of view difference in the product or product heterogeneousness affects the market, structure significantly. In the position of homogeneous product when a seller makes even a slight change in the price of product the consumers begin to purchase the product sold by other producers.

In other words the firm producing homogeneous product has to face the perfectly elastic demand curve. On the contrary in the position of heterogeneous products any single firm can increase some price without being affected due to the preferences of the consumer.

(c) Product Differentiation:

In the perfect competition market all firms sell the same or homogeneous product. But in the market, in reality a single product is sold by the different producers, claiming that all products (such as toothpaste) are not same. The producers bring variety by means of brand name, packaging, size, colour, taste, weight etc. In spite of no locational differences, variety is seen by means of retailer service, home delivery, credit facility etc.

(d) Barriers in Entry:

Seller’s concentration indicates that how some firms acquire dominance in an industry, consequently the real competition between the firms is lessened or limited. If there are some barriers in the entry of new firms, then the prospective competition is also limited.

The types of such barriers are as follows:

(i) Cost profit to the present firm which is not available to the new firms.

(ii) Legal barriers in entry.

(iii) Product difference and advertisement etc. cause the presence of strong preference among consumers for the products sold by the established firms.

(e) Other Elements:

Apart from these main elements, there are some other elements to be considered. One of them is the growth rate of market demand. In this situation the firms are somewhat idle. On the contrary in a rapidly growing industry the firms also become more competitive. In the growing market every firm is struggling and striving for more demand.

If there is more elasticity of the price demand of a product, the firm will be motivated to lessen the price in order to increase ones portion in the total sale. In the condition of oligopoly when a firm decreases price other firms also do the same. Then all firms derive benefit in the condition of more elastic demand. If the product demand is inelastic no firm will tend to change price.

Essay # 4. Market Performance:

Market performance means the evaluation of the derivation of the behaviour of any industry when it behaves differently than the established superior laws of the market. It is assumed that in the position of the perfect competition only an industry can perform well. But when the market is derivated from the condition of perfect competition, then the market behaviour also changes. Now the question arises, as to how a market performance can be evaluated in any industry?

Certain acceptable indicators are as follows:

1. Profitability:

All firms have an objective like profitability, profit maximisation or satisfactory level of profit. But profitability in any industry does not depend only upon the performance of the firm. It also depends upon monopolist power, product diversity, or inefficient use of resources etc. Economists have used the hypothesis of normal profit. It is the rate of profit which makes the firm not to leave the industry. The performance level affects the quantity of profit significantly.

2. Productivity:

It is an index of production of per unit input used, if more production is possible by the same units then there is growth in productivity. Growth in production is an indicator of efficient performance of an industry.

But this index is also not without practical shortcomings. Till we cannot keep the other factors stable, it is difficult to measure productivity of certain means/ inputs, like labour on capital. Besides this the units of labour, capital, or land are heterogeneous, so when a change occurs in the quantity of an input, there is also a change in its quality. For example when we recruit more workers, first we recruit more skilled ones and then the less skilled.

Information about the performance of an industry can be derived from its growth rate also. The measure of growth rate of an industry can be known from the product, employment and wealth creation. But every index creates problems in measuring the performance.

For example, it is possible that in an industry more and more people get employment, or there is a rapid rate of wealth accumulation. But it is also possible that the resources are not efficiently used. Likewise when the growth rate is high we do not have information of production cost, whether it is more or less.

4. Effect on Index:

Now the question arises whether the market structure affects the indexes of market performance. Profitability is one of the many indicators of performance. For example in perfect competition, a firm earns normal profit in long term while in monopoly or market having monopolist power, the firm earns extra-normal profit in long term also.

Excessive seller concentration, barriers in entry and product difference can make firm earn more profit in long term also. Likewise we take growth index. Both in monopoly and oligopoly markets firm produces less than its capacity or there is a position of extra capacity.

5. Ill Effects on Firm Growth:

Thus, the growth of the firm is affected adversely. Productivity and efficiency are associated with each other. In the position of monopoly and oligopoly a firm has extra capacity which means inefficient use of resources and low level of productivity. Lastly, the social performance of a firm is also affected by market structure. In monopoly and perfect competition, consumer and labour, both are exploited. Growth in competition decreases the power of exploitation of the producers.

6. Social Performance:

The performance level of an industry can be evaluated in the item of many social bases. These social bases can be income redistribution or other indicators of social welfare. For example the social performance of the medicine industry can be measured by the decrease in the illness period or death rate.

If the expansion/growth of any industry results in decrease of present inequalities of income in society, or it helps in reducing poverty or unemployment then the performance level of the industry can be called high.

Market Structure Conduct Performance Interrelations:

In micro economics the equilibrium of the firm and industry is studied. On the contrary industrial economics is more related to change in market structure, resulting in the changes of market behaviour or firm’s behaviour, which ultimately affect their market performance. So, industrial economics can be studied with the help of structure conduct performance approach or model.

Complexity of Interrelations:

According to the economists, the interrelations between the structures, conduct performance are sufficiently complex. To conclude it can be said that market structure affects the behaviour of a firm and behaviour of a firm affects its performance (profitability) in the market.

Related Articles:

- Markets under Monopolistic Competition | Markets

- Monopoly and Perfect Competition | Markets | Economics

- Characteristics of a Perfect Competition | Market | Economics

- Aspects of Monopolistic Competition | Markets

THE DYNAMICS OF IMPERFECT MARKETS GRADE 12 NOTES - ECONOMICS STUDY GUIDES

- Key concepts

- Output profit and loss

- Oligopolies

- Monopolistic competition

- Summary of market structures

There are a number of different types of imperfect markets, e.g. monopolies, oligopolies and monopolistic competition. An imperfect market is characterised by imperfect competition. Some participants have earlier or exclusive access to information that benefits them in the marketplace at the expense of their competitors. Certain participants will be able to access the market more easily than other participants, i.e. the supply of and demand for products will not be equal, and the matching of buyers to sellers will not be immediate. Overview

7.1 Key concepts

These definitions will help you understand the meaning of key Economics concepts that are used in this study guide. Understand these concepts well.

Use mobile notes to help you learn these key concepts. See page xiv in the introduction for more.

7.2 Monopolies

A monopoly exists when there is one seller of a good or service for which there is no close substitute. 7.2.1 Characterictics of monopolies

- There is only one seller of the product

- There are barriers to entry. These are caused by patents and other forms of intellectual property rights, control over resources, government regulations and decreasing costs.

- The monopolist is regarded as a price maker since it is able to influence the market price through changing the quantity it supplies to the market.

- The are no close substitutes. The product cannot be easily replaced. Consumers have no choice in price and quality of the product.

- There is no competition. One business in the market will control the supply of goods and services.

- Products are differentiated and unique. Monopolies manufacture a variety of products which are difficult for other companies to copy.

- Large amounts of starting capital are required. Large industries like Eskom and SASOL require millions of starting capital.

- Monopolies have legal considerations. New inventions are protected by patent rights. Services, like the Post Office are protected by law and other businesses are prohibited from entering the market.

- It is also possible for the monopolist to make an economic profit in the long run. This is because it faces no competition from new entrants as a result of the barriers to entry.

Monopolies can be classified as two main groups due to barriers that exist Natural monopolies: High development costs prevent others from entering the market and therefore the government supplies the product. E.g. Electricity in South Africa is provided by the government enterprise, Eskom. It costs billions of rands to build and maintain power stations and therefore there are no other suppliers. Artificial monopolies : Here the barriers to entry are not economic in nature. An example of a barrier is a patent. A patent is a legal and exclusive right to manufacture a product, e.g. Denel Land Systems manufacturing Casspirs. 7.2.2 The demand curve of the monopolist

- Under perfect competition the individual producer faces a horizontal demand curve where D = MR = AR, since it is a price taker.

- By contrast, the monopolist faces a normal market demand curve which slopes downwards from left to right. Here D = AR.

- It is also the market (or industry’s) demand curve, since the monopolist is responsible for the entire output of the industry.

7.2.3 The marginal revenue curve of a monopolist

- Since a monopolist faces a downward sloping demand curve, its marginal revenue curve and its demand curve are not the same curve as is the case with an individual producer under perfect competition.

- Under perfect competition, the individual producer is a price taker and can sell any quantity at the market price and therefore faces a horizontal demand curve, which is also its marginal revenue curve.

- The demand curve for a monopolist, which is downward sloping, implies that, if it wishes to increase its sales by an additional unit, it must decrease the price of the product.

- The lower price applies to all its customers. Its marginal revenue - that is the amount by which total revenue increases if it sells an additional unit – will therefore be less than the price.

- The marginal revenue curve and the demand curve are therefore not the same curve. The Marginal revenue curve will be lower than the demand curve.

Activity 1 Use the table below of a typical monopolist and plot the revenue curves on the same set of axes. Notice the position of the Marginal revenue curve in relation to the Demand curve.

7.3 Output profit and loss

7.3.1 Revenue

- The demand curve for a monopolist is the market demand curve and slopes downwards from left to right (DD/AR). See the top graph in Figure 7.1.

- Any point on the curve is an indication of the quantity of the product to be sold and the price at which trade takes place.

- Any price-quantity combination on the demand curve is also its average revenue (AR) curve.

- The average revenue from each product is calculated by dividing the total revenue by the quantity = the price. See the bottom graph in Figure 7.1 (left).

- The marginal revenue (MR) curve runs below the demand curve (AR) – it always intersects the horizontal axis at a point halfway between the origin and the point of intersection of the demand curve (AR).

- The cost structure of the monopoly is the same as that of competitive businesses.

- Determine the point where MC = MR, the point where the production cost of the last unit is equal to the revenue it earns (point e) – profitmaximising production quantity of Q1 on the horizontal axis.

- To determine the price at which Q1 is sold, move vertically upwards from e to L on the demand curve. The market price is therefore determined at P.

- Total revenue is greater than the short-term total costs. The monopolist makes a profit (due to demand and cost of production).

7.3.3 Economic loss in the short term When you draw the economic loss for the monopolist, the graph stays the same, EXCEPT the AC curve moves to the right - up, and totally misses the AR (demand) curve (see Figure 7.7).

- The monopoly suffers short-term losses when the AC curve lies above the demand curve (DD).

- Equilibrium is reached where MR = MC (a loss-minimising situation).

- The monopoly will produce a quantity Q and sell at price P. The total costs are the area OCLQ; the total revenue is the area OPNQ. The loss will be that part that is shaded (the area PCLN).

7.3.4 Comparison of a monopoly and a perfect market

Loss Some people argue that a monopolist always makes an economic profit. This is not the case. Profitability of a monopolist depends on the demand for the product as well as the cost of production.

7.4 Oligopolies

An oligopoly exists when a small number of large companies are able to influence the supply of a product or service to a market. By controlling the supply of the product or service on the market, oligopolies aim to keep its prices and profits high. Oil companies are one of the best examples of an oligopoly. A special type of this market form is a duopoly – an industry with only two producers. 7.4.1 Characteristics of oligopolies

- There is limited competition. Only a few suppliers manufacture the same product.

- Products may be homogenous or differentiated.

- This market is characterised by mutual dependence. The decision of one company will influence and will be influenced by the decisions of the other companies.

- Oligopolies can frequently change their prices in order to increase their market share. However this can result in a price war.

- Extensive use is made non-price measures to increase market share e.g. advertising, efficient service or product differentiation.

- Producers have considerable control over the price of their products although not as much as in a monopoly.

- If oligopolies operate as a cartel, firms have an absolute cost advantage over the rest of the competitors in the industry. Abnormal high profits may be a result of joint decisions in an oligopoly.

- Entry is not easy in an oligopolistic market. This is due to brand loyalty and it also requires a large capital outlay.

7.4.2 Kinked demand curve for the oligopolist

- One theory devised by an American economist, Paul Sweezy, can be used to determine the oligopolist’s demand curve.

- An oligopolist faces a kinked demand curve. This demand curve consists of two sections.

- The top section, the section that relates to high prices is a very elastic slope (i.e. demand is very sensitive to a price change.)

- The bottom section, the section that relates to lower prices is very inelastic (i.e. demand is not sensitive to a price change).

- Suppose the oligopolist is selling at the original/present price of R10 and 9 units of output are sold. Total revenue is R10 × 9 = R90

- If the firm tries to increase profit by increasing the price by R2 to R12, quantity demanded would fall to 2 units and total revenue would decrease to R24 (R12 × 2).

- If the firm tries to increase profit by reducing the price by R2 to R8 and increasing its total sales, total revenue would be R80.

- The oligopolist is therefore faced with a difficult decision because in both instances it will not benefit.

- Increasing the price of goods or reducing the price to increase sales will not lead to greater revenue earned.

7.4.3 Non-price competition

- Oligopoly firms are reluctant to change prices because a price war will drive prices down and profits will be eliminated.

- They make use of non-price measures to attract customers and increase their market share.

- An important aspect of non-price competition is to build brand loyalty, product recognition and product differentiation.

- This is done by means of advertising and marketing. As a result, oligopoly firms tend to spend a substantial amount of money on this.

Other forms of non-price competition include:

- extended shopping and business hours

- doing business over the internet

- after-sales services

- offering additional services

- loyalty rewards for customers

- door-to-door deliveries

Examples of firms that use kinds of non-price strategies are those in petrol retailing such as Shell, BP and Caltex and in the banking sector such as ABSA, FNB etc. 7.4.4 Collusion Collusion takes place when rival firms cooperate by raising prices and by restricting production in order to maximise their profits. When there is a formal agreement between firms to collude it is called a cartel. A cartel is a group of producers whose goal is to form a collective monopoly in order to fix prices and limit supply and competition. In general, cartels are economically unstable because there is a great incentive for members not to stick to the agreement, to cheat by cutting prices illegally and to sell more than the quotas set by the cartel. Although there is an incentive to collude there is also an incentive to compete. This has caused many cartels to be unsuccessful in the long term. Some well known cartels are the Organisation of Petroleum Exporting Countries(OPEC) and De Beers diamonds in South Africa. Overt/Formal collusion e.g. cartels are generally forbidden by law in most countries. However, they continue to exist nationally and internationally. Sometimes in an oligopoly market, a dominant firm will increase the price of a product in the hope that its rivals will see this as a signal to do the same. This is referred to as price leadership and is an example of a tacit collusion.

7.5 Monopolistic competition

7.5.1 Characteristics of monopolistic competition

- The products are differentiated. Products are similar but not identical. The are similar in that they satisfy the same need of the consumer. There may be differences in packaging but the product is the same. e.g. sugar and salt.

- Differentiated products create opportunities for non-price competition e.g. advertising.

- Monopolistic competition displays a hybrid structure. It is a combination of competition and a monopoly.

- There are many sellers.This indicates the element of competition.

- Entry into the market is easy.

- Businesses have little control over the price of the product. Each business sells at its own price since a single price cannot be determined for the differentiated product because a range of prices could apply.

- Information for buyers and sellers is incomplete.

- Collusion is not possible under monopolistic competition.

- Restaurants, plumbers, lawyers, insurance brokers, hairdressers, funeral parlours and estate agents are all examples of monopolistic competitors.

See nonprice competition for oligopolies on page 109. Some forms are similar for monopolistic competition. Make sure you can draw the graphs for the monopolistic competitor. 7.5.2 Non-price competition

- Differentiated products create opportunities for non-price competition i.e. competition is not based on prices but rather on factors relating to the product’s uniqueness.

- Advertising campaigns and further product differentiation are powerful forms of non-price competition.

- The greater the product differentiation the less price elastic the demand for the product will be.

- Large sums of money are spent on research, development and advertising to build a loyal consumer group.

- Therefore brands play a significant role in determining customer loyalty where a consumer may choose one producer over another. Large chain stores e.g. Checkers, Spar etc. have their own brands for some products. Most of these products are exactly the same as known brands.

7.5.3 Prices and production levels in the short-term and long-term

- The demand curve for a monopolistic competitor is similar that of a monopolist.

- Short term equilibrium (economic profit and economic loss) corresponds with a monopoly, but the demand curve is more price elastic (flatter) due to good substitutes.

- Long-term equilibrium is characterised by normal profit, due to the ease of entry and exit into the market (similar to a perfect market). The economic profit made in the short-term attracts more businesses to enter the market.

7.5.4 Comparison of monopolistic competition with perfect competition

- Both firms make normal profit in the long run. Therefore there is no difference in the long-run between the perfect market and the monopolistic market as far as profit is concerned.

- The equilibrium price is higher than in a perfect market. The consumer therefore pays less in the perfect market and more in the monopolistic market.

- The monopolistic competitor does not produce at the minimum of the LAC whereas the perfect competitor does. He is less efficient.

- The perfect competitor produces more at a lower price while the monopolistic competitor produces less at a higher price.

7.6 Summary of market structures

Activity 2 Complete the following table by filling in the missing information:

[20] Answer to activity 2

[20] Activity 3 Study the following graph and answer the questions that follow:

- Define the term imperfect market. (2)

- Motivate why the above graph indicates short-term equilibrium. (4)

- Which point on the graph indicates profit maximisation? (2)

- Calculate the economic profit. (6) [14]

Related items

- Mathematics Grade 12 Investigation 2023 Term 1

- TECHNICAL SCIENCES PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

- TECHNICAL SCIENCES PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

- MATHEMATICS LITERACY PAPER 2 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS JUNE 2022

- MATHEMATICS LITERACY PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

IMAGES

VIDEO

COMMENTS

Perfect Markets in General Essay. Perfect market is a situational market that is rare in real life (Rittenberg & Tregarthen, 2011). Perfect competition in the market occurs in a way that it is difficult for any stakeholder to influence the price of commodities. In this case, automobile, beer and corn markets are examples of perfect market models.

The characteristics are: 1. A Large Number of Buyers and Sellers 2. An Identical or a Homogeneous Product 3. No Individual Control Over the Market Supply and Price 4. No Buyers' Preferences 5. Perfect Knowledge 6. Perfect Mobility of Factors 7. Free Entry and Free Exit of Firms and few others. Characteristic # 1.

Perfect competition is a market structure where many firms offer a homogeneous product. Because there is freedom of entry and exit and perfect information, firms will make normal profits and prices will be kept low by competitive pressures. Features of perfect competition. Many firms. Freedom of entry and exit; this will require low sunk costs.

Examine the characteristics of a perfect market in detail; Compare the individual businesses to the industry in detail; The examination of individual business and industry should be accompanied by an analysis of tables and graphs; HOT QUESTION: Explain why the individual maize, wheat or milk farmer does not have an influence on the price

What are the 5 characteristics of perfect competition? There are five characteristics that have to exist in order for a market to be considered perfectly competitive. The characteristics are ...

Perfect competition is a market structure in which the following five criteria are met: 1) All firms sell an identical product; 2) All firms are price takers - they cannot control the market price ...

Allocative efficiency means that among the points on the production possibility frontier, the point that is chosen is socially preferred—at least in a particular and specific sense. In a perfectly competitive market, price is equal to the marginal cost of production. Think about the price that is paid for a good as a measure of the social benefit received for that good; after all ...

Key points. A perfectly competitive firm is a price taker, which means that it must accept the equilibrium price at which it sells goods. If a perfectly competitive firm attempts to charge even a tiny amount more than the market price, it will be unable to make any sales. Perfect competition occurs when there are many sellers, there is easy ...

What you'll learn to do: describe the characteristics of perfect competition and calculate costs, including fixed, variable, average, marginal, and total costs. Imagine the 7-year old you had a lemonade stand. It was one of several on the street. Your neighbor, Julie, also had a lemonade stand and she typically sold her lemonade for 25 cents.

Perfect competition. EconomicsOnline • January 17, 2020 • 4 min read. A perfectly competitive market is a hypothetical market where competition is at its greatest possible level. Neo-classical economists argued that perfect competition would produce the best possible outcomes for consumers, and society.

Discuss how perfectly competitive firms react in the short run and in the long run. Firms are in perfect competition when the following conditions occur: (1) many firms produce identical products; (2) many buyers are available to buy the product, and many sellers are available to sell the product; (3) sellers and buyers have all relevant ...

Perfect competition assumes that there are many buyers, many sellers, and identical products. Market forces drive supply and demand, and every company has equal market share. It is purely ...

Discuss in detail the various equilibrium positions with the aid of graphs-PERFECT MARKET (Perfect Market) INTRODUCTION A perfect market is a market structure which has a large number of buyers and sellers. OR The market price is determined by the industry (demand and supply curves). OR

Characteristics of imperfect markets: 1) There exists a small number of sellers in 'this market. This enables the sellers to charge the prices as they like. 2) The number of buyers is also small. But its does not mean that buyers are few. The buyers in this market system are divided into several groups. Each group buys goods and services from ...

Features of a Perfect Market: A perfect market has the following conditions: 1. Free and Perfect Competition: In a perfect market, there are no checks either on the buyers or sellers. They are free to buy or to sell to any person. It means there are no monopolies. 2. Cheap and Efficient Transport and Communication: Uniform price for the commodity would not be possible if the changes in the ...

In between a monopolistic market and perfect competition lies monopolistic competition. In monopolistic competition, there are many producers and consumers in the marketplace, and all firms only ...

Perfect markets 3 RECAP: Cost and Revenue tables and curves 3 6.1 Perfect Competition 16 6.2 Individual business and industry 19 6.3 Market structure 27 6.4 Output, profits, losses and supply 28 Individual business & an industry 28 6.5 Competition Policies 41 7. References 47

In this essay we will discuss about:- 1. Meaning of Markets 2. Features of the Markets 3. Elements 4. Performance. Essay on Markets Essay # 1. Meaning of Markets: The term market structure refers to the type constituents and nature of an industry. It includes the relative and absolute size of firms, active in industry, easiness in the entry into business, the demand curve of the firm products ...

2. Discuss in detail the characteristics of perfect markets and monopoly. 3. Discuss in detail the price elasticity of demand (PED) (with / without the aid of graphs). Contemporary economic issues. 1. Examine in detail the causes and consequences of globalisation. 2. Examine in detail the state of environment / problems threatening the environment.

Discuss in detail the characteristics of a perfect market. (26) List and explain any FIVE factors that influence individual. (10) [40] INTRODUCTION The markets are important because they distribute goods and services for the production and make them available to consumers. There are two main types of markets, namely perfect and imperfect.

Long-term equilibrium is characterised by normal profit, due to the ease of entry and exit into the market (similar to a perfect market). The economic profit made in the short-term attracts more businesses to enter the market. 7.5.4 Comparison of monopolistic competition with perfect competition. Both firms make normal profit in the long run.

Perfect market (1) 2 What is being depicted in the by the shaded area in the graph above? ... SECTION C Essay question (40) Introduction (2) (The introduction is a moderate to difficult lower order response, a candidate can use a accepted Description or an appropriate explanation of the topic under discussion as an introduction) Allocation of ...

Market structure essays. Subject. Economics. 625 Documents. Students shared 625 documents in this course. Degree FET. School High School - South Africa. Academic year: 2020/2021. Uploaded by: Nuha Alli. University of Johannesburg. 4 followers. 130 Uploads. 999+ upvotes. Follow. Recommended for you. 33. 2021-2023 GR12 Economics P1 Essays Final.